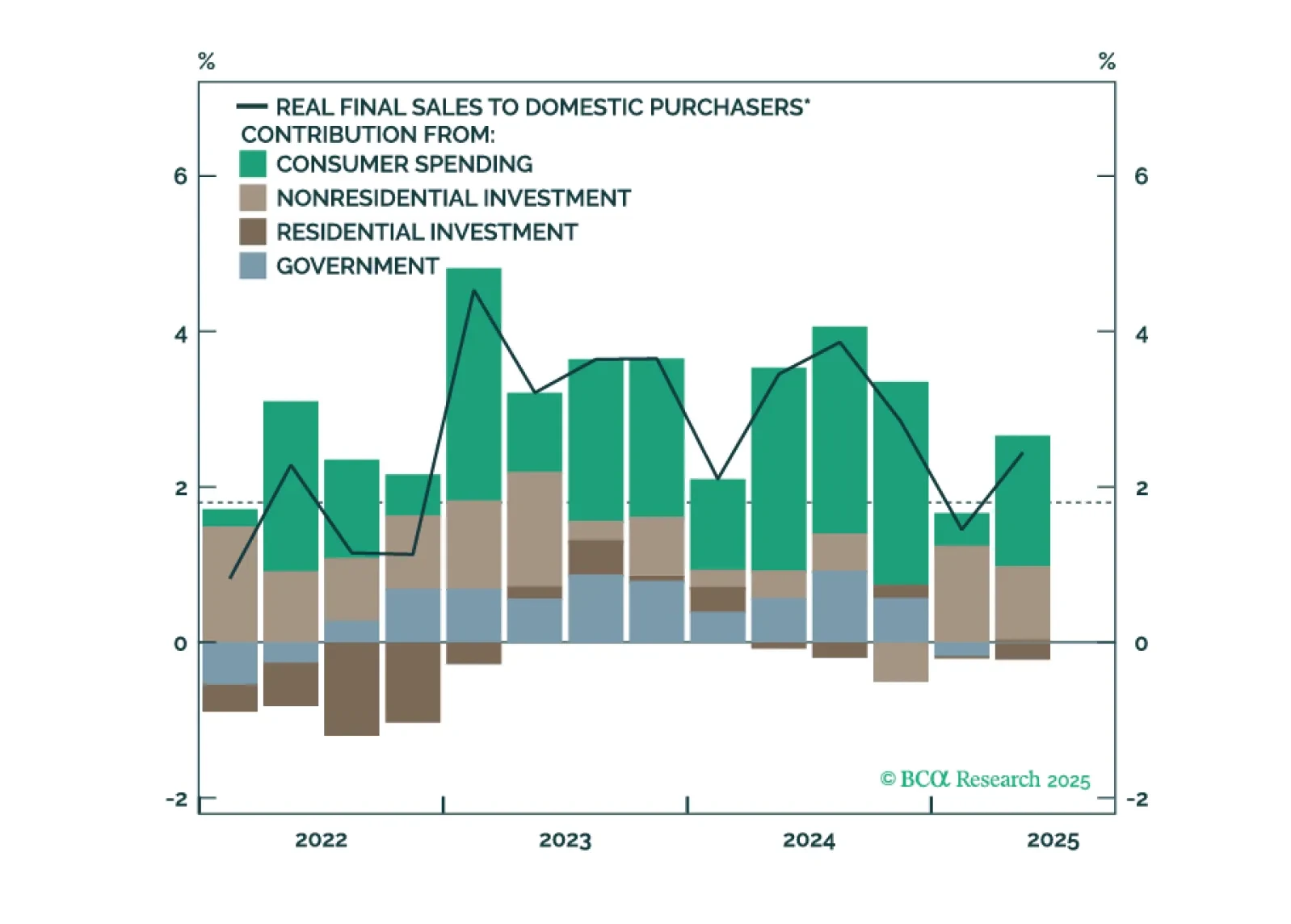

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.

We remain bullish both bonds and equities, but conviction is falling. We are Luddites when it comes to the AI theme, but we have followed it regardless. A bubble is a bubble, not to be shorted. Yet Europe’s weak AI returns reveal…

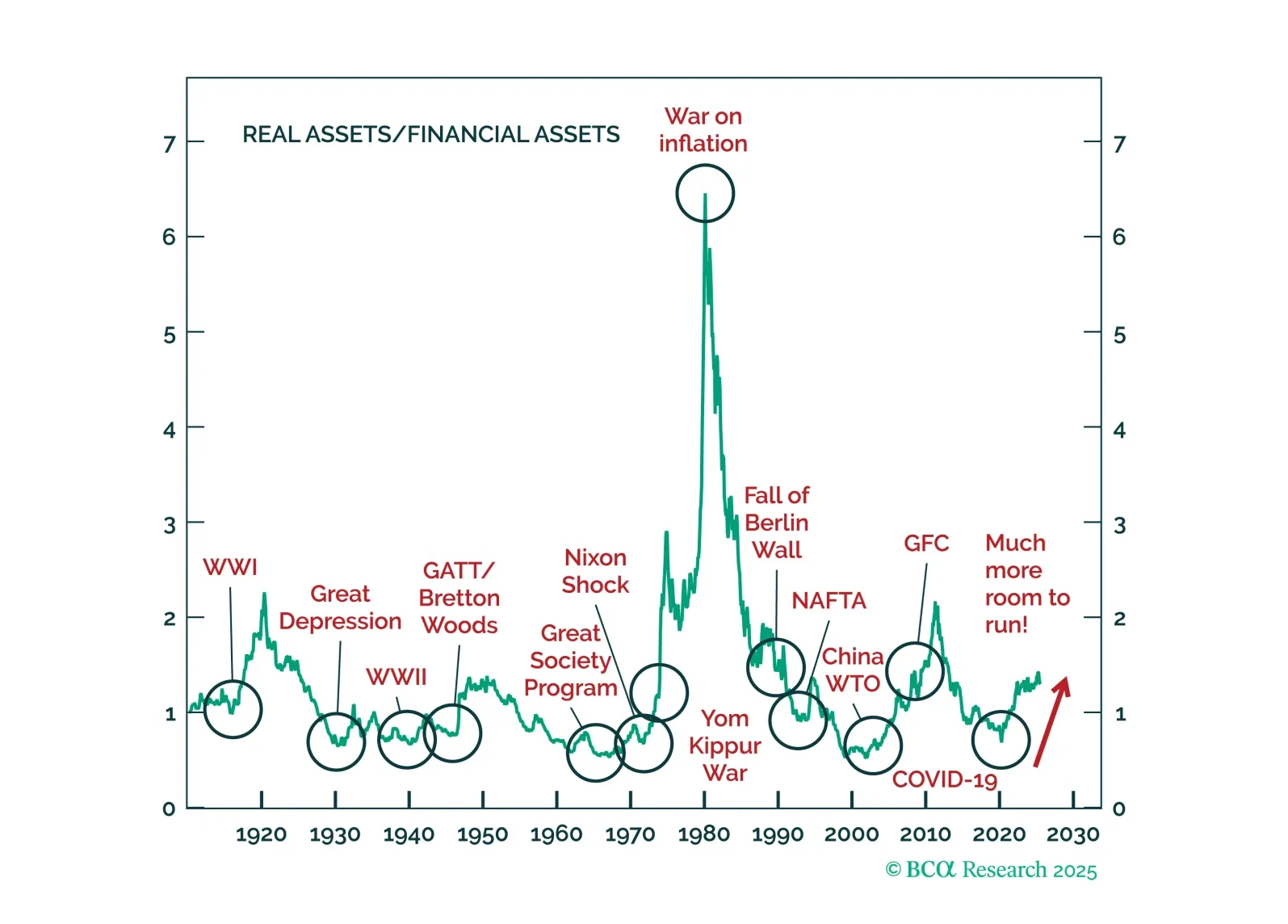

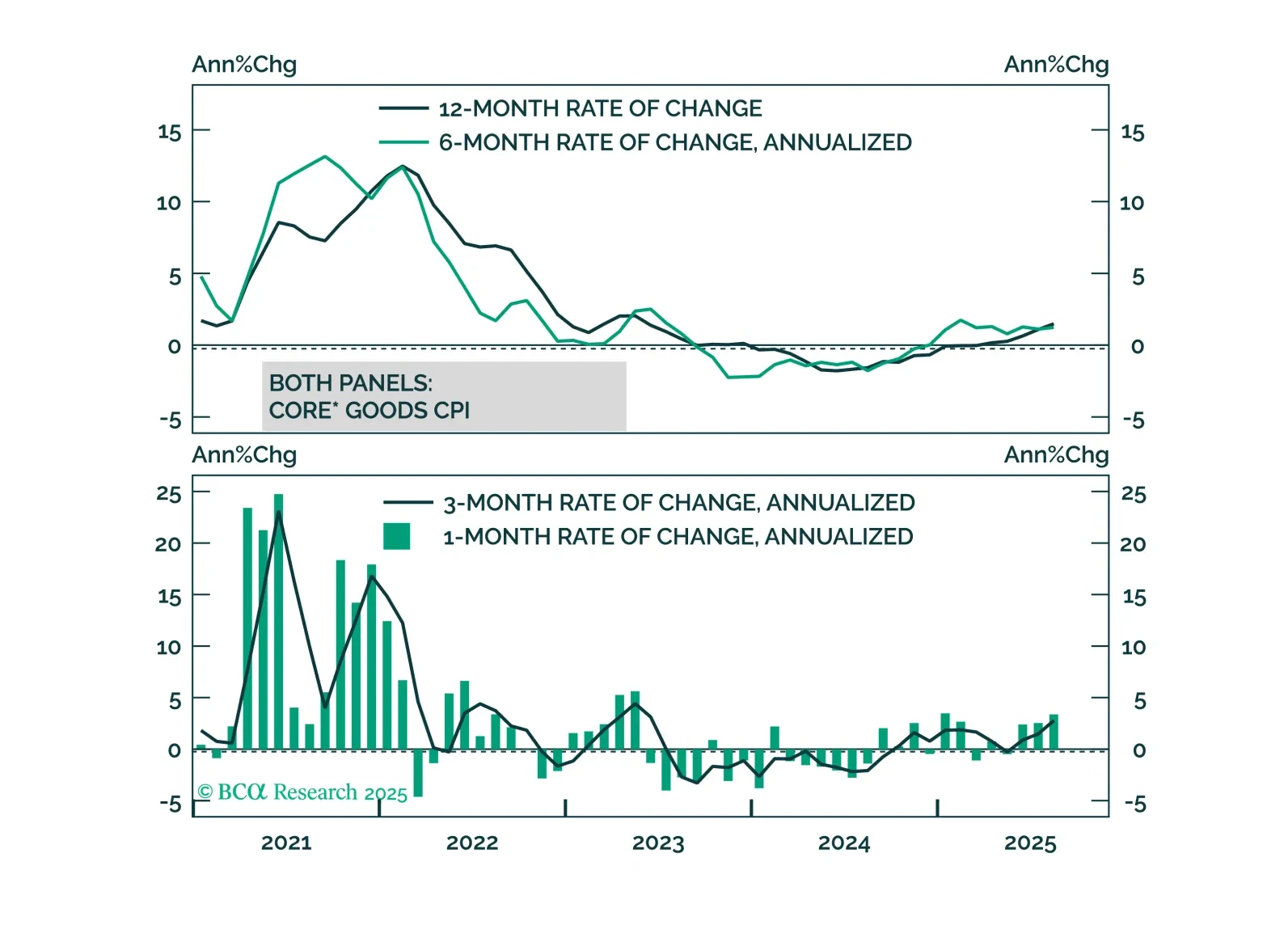

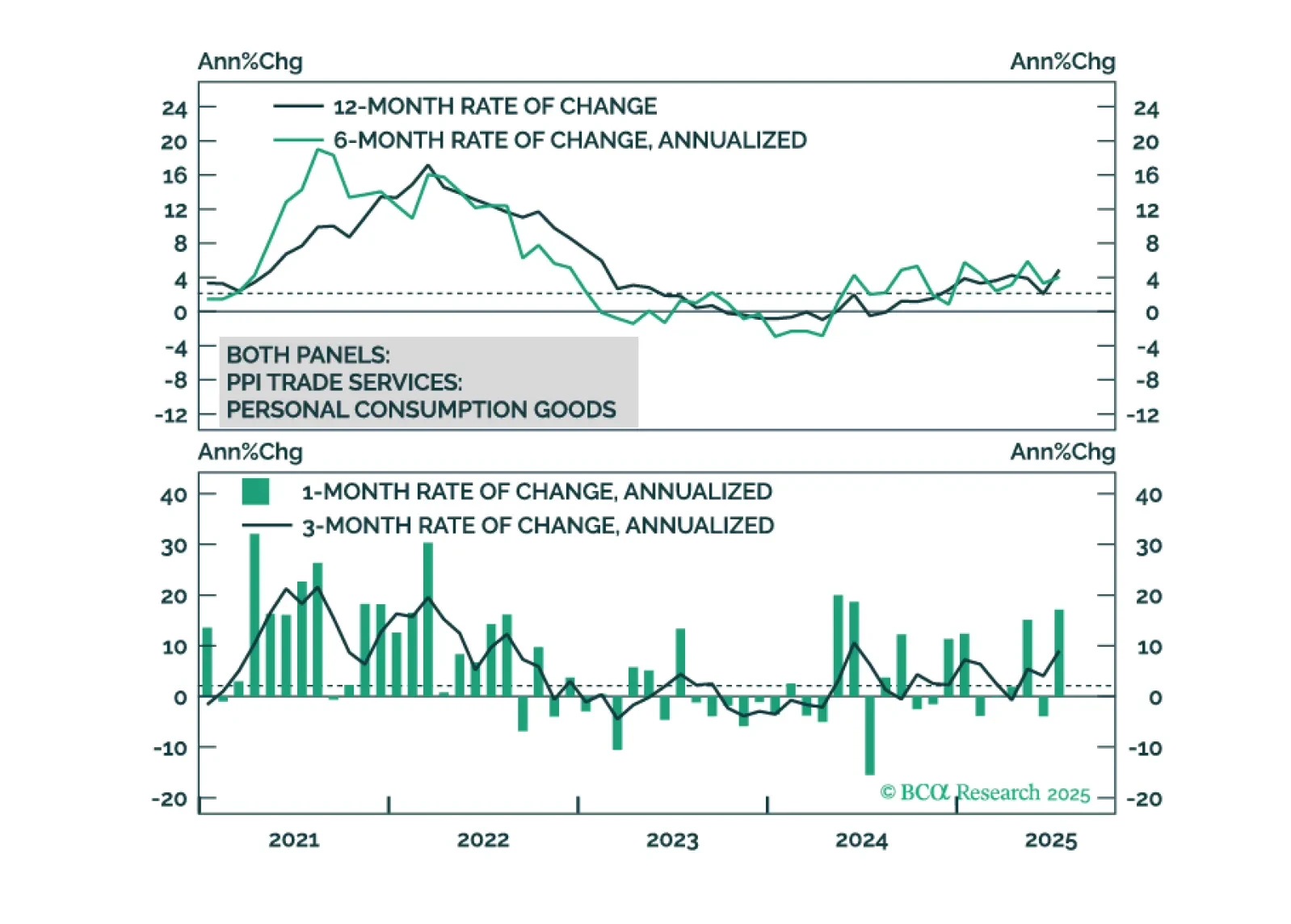

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.

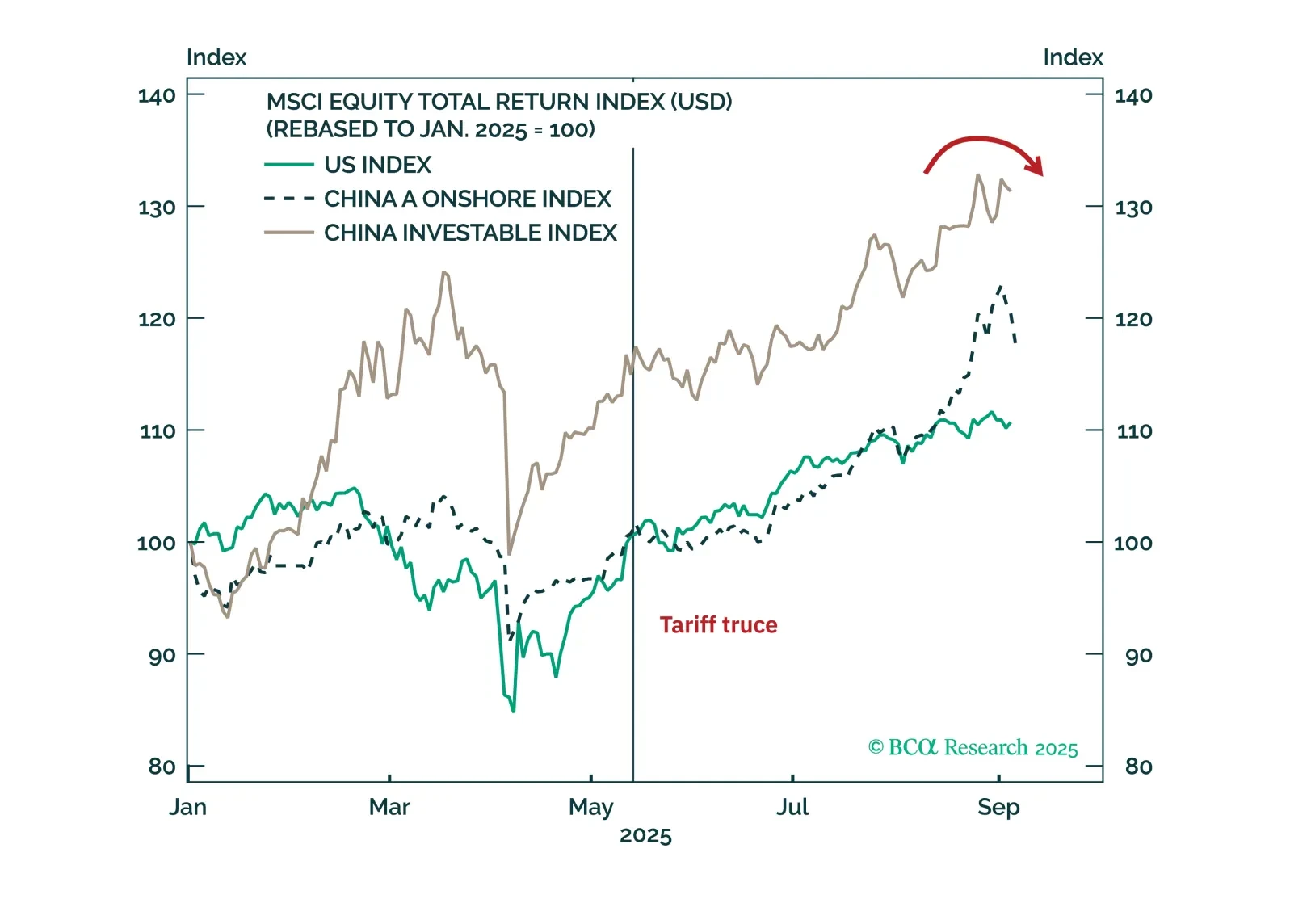

Investors will be disappointed if they buy into the China rally and then Russia escalates the war in Ukraine.

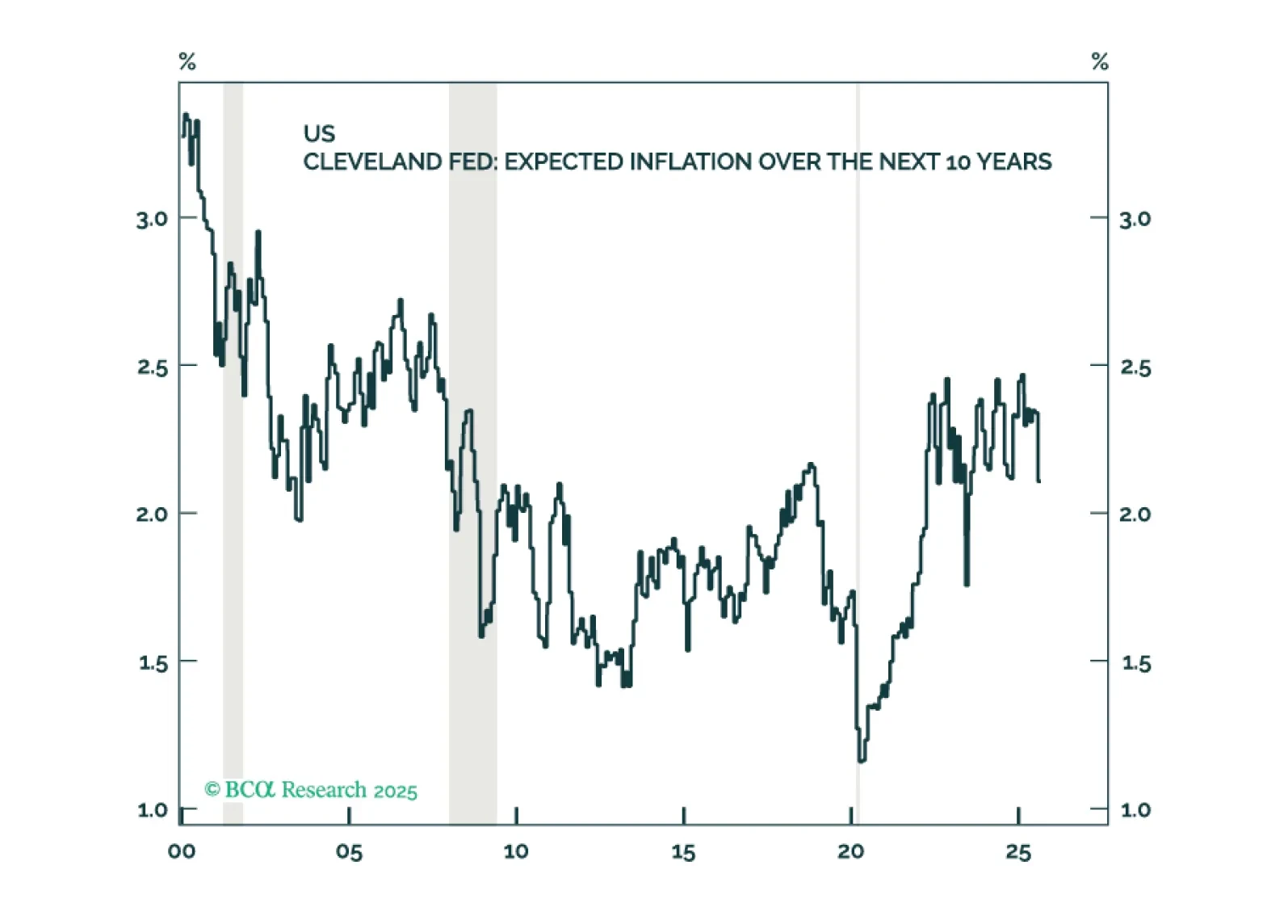

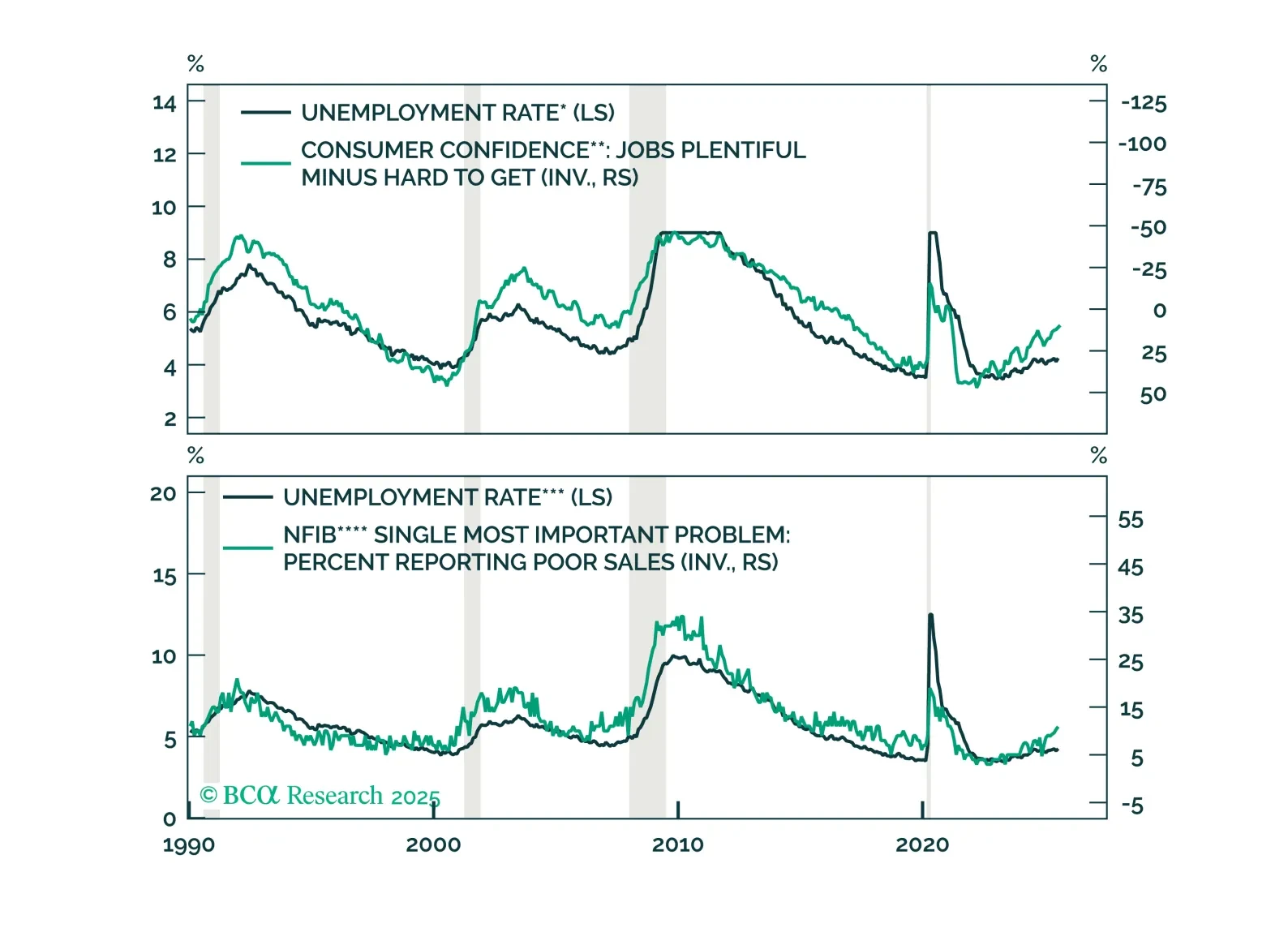

Inflation expectations in the US remain reasonably well anchored and there are few signs of a brewing wage-price spiral. Thus, the near-term risks to growth outweigh the risks of higher inflation. Looking beyond the next year or two…

Our Portfolio Allocation Summary for September 2025.

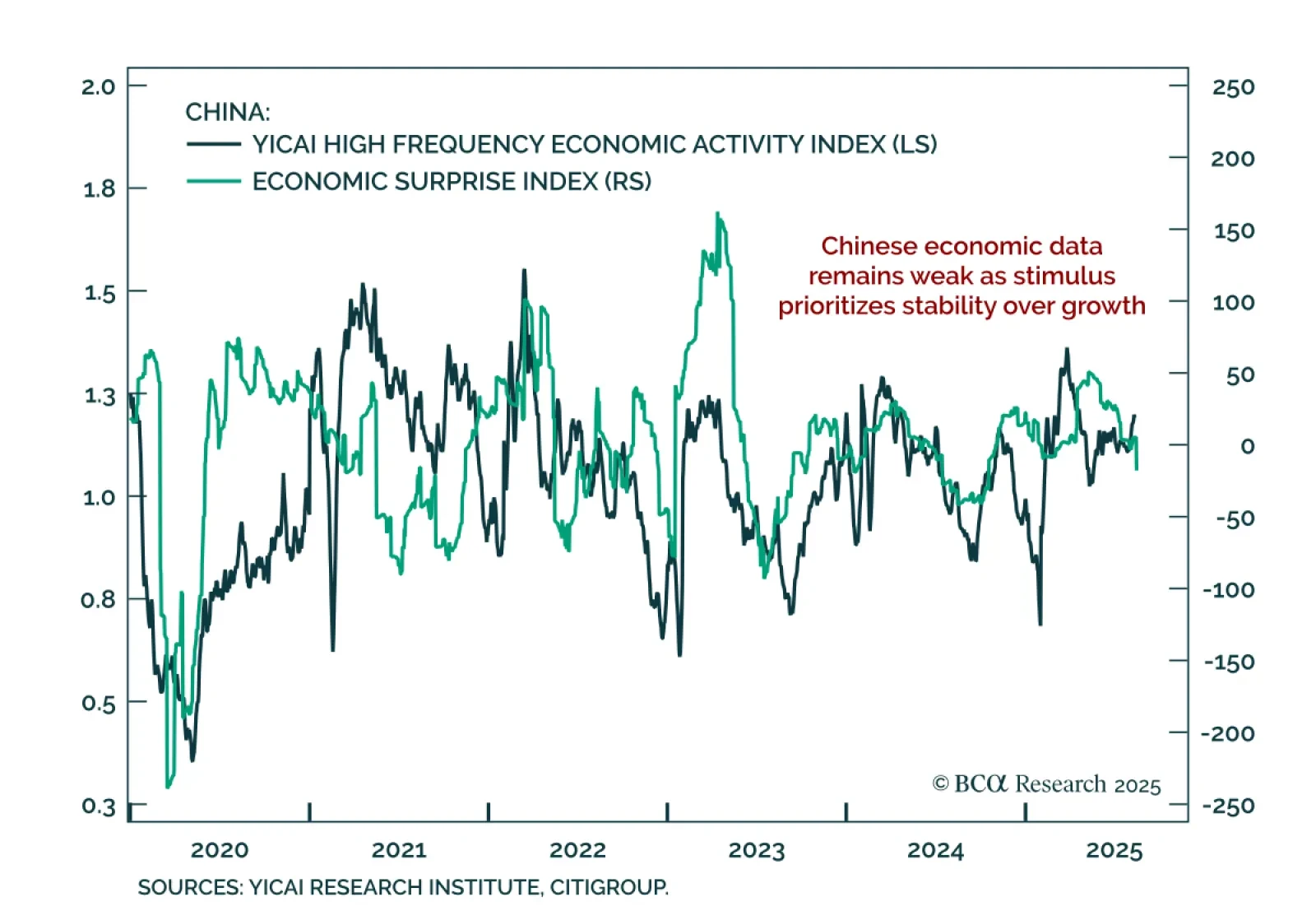

July data confirm China’s weak growth, with no near-term shift toward meaningful stimulus. New home prices fell 0.31% m/m, retail sales slowed to 3.7% y/y from 4.8%, and industrial production eased. Flooding in July disrupted…

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.

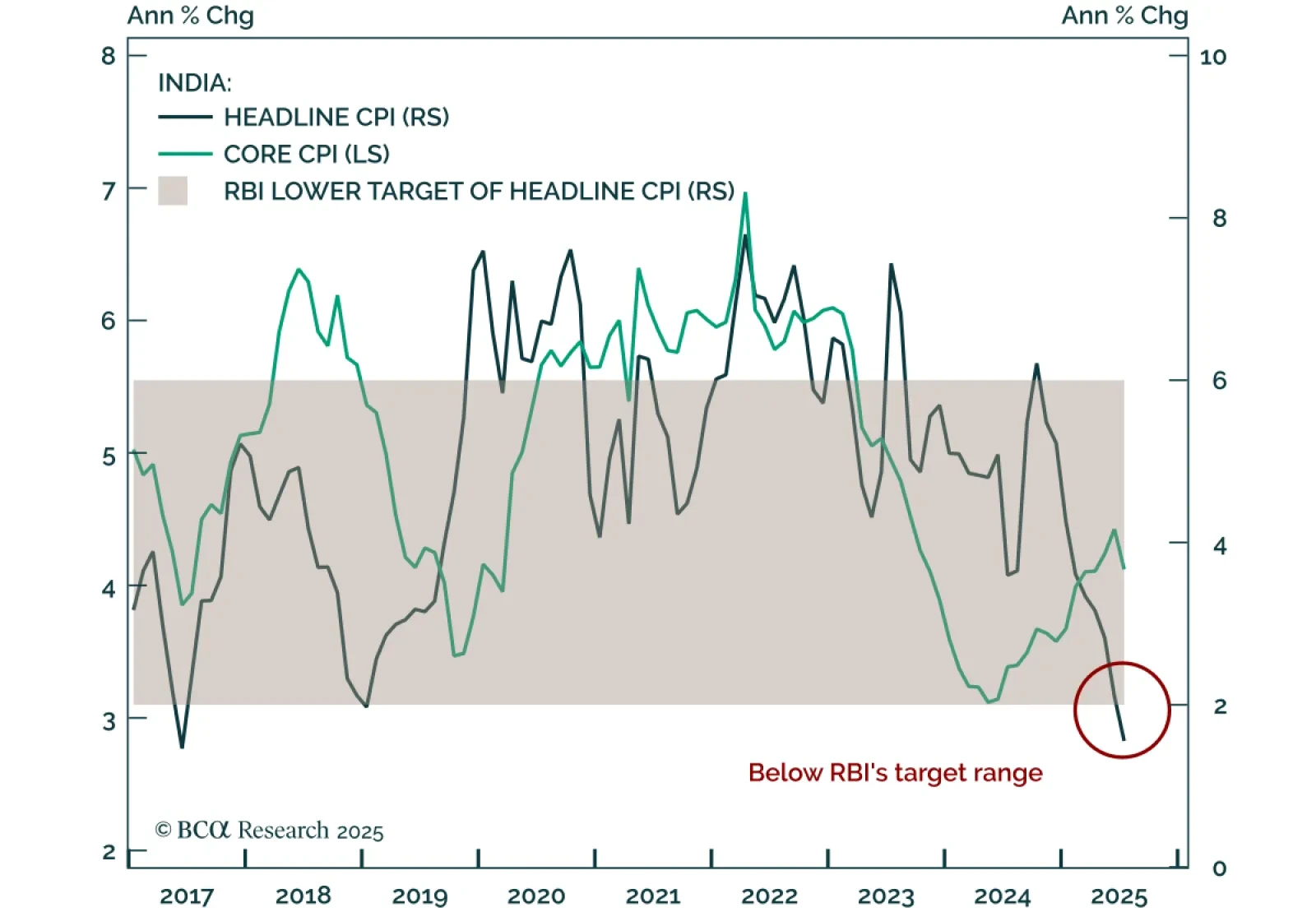

India’s sharp CPI undershoot will bring forward rate cuts, supporting a long on local bonds. Headline CPI fell to 1.55%, well below the RBI’s 2-6% target range, pointing to earlier and deeper easing than markets price. Our…

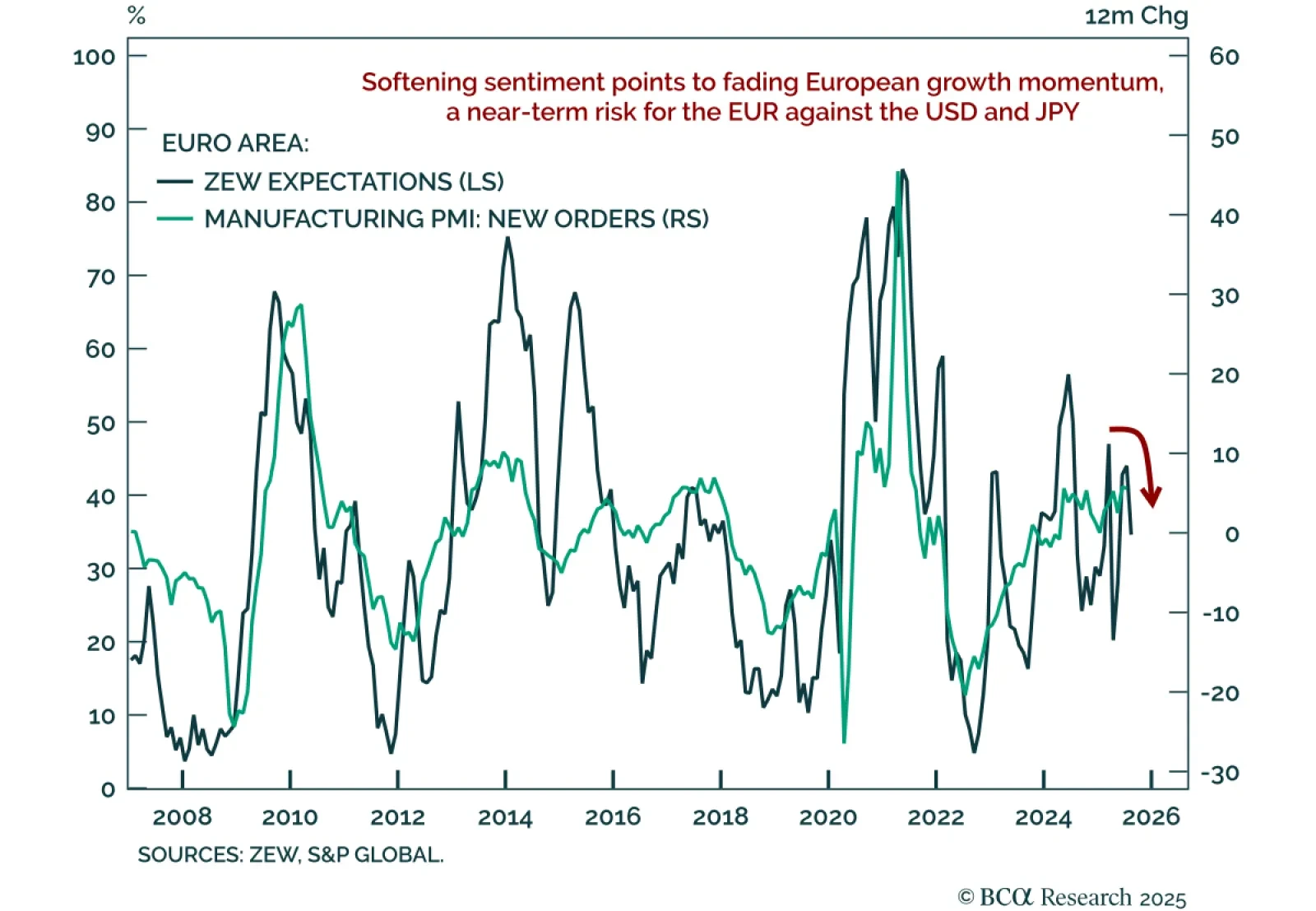

European sentiment has moderated, pointing to near-term downside risk for a technically-stretched Euro. The August Eurozone ZEW Expectations index fell to 25.1 from 36.1, with Germany’s reading missing estimates, dropping sharply to…