Recent economic data have been reasonably firm. We will cut our 12-month US recession probability to 40% from 50% if the Supreme Court strikes down President Trump’s tariffs. This would take our scenario-weighted year-end 2026…

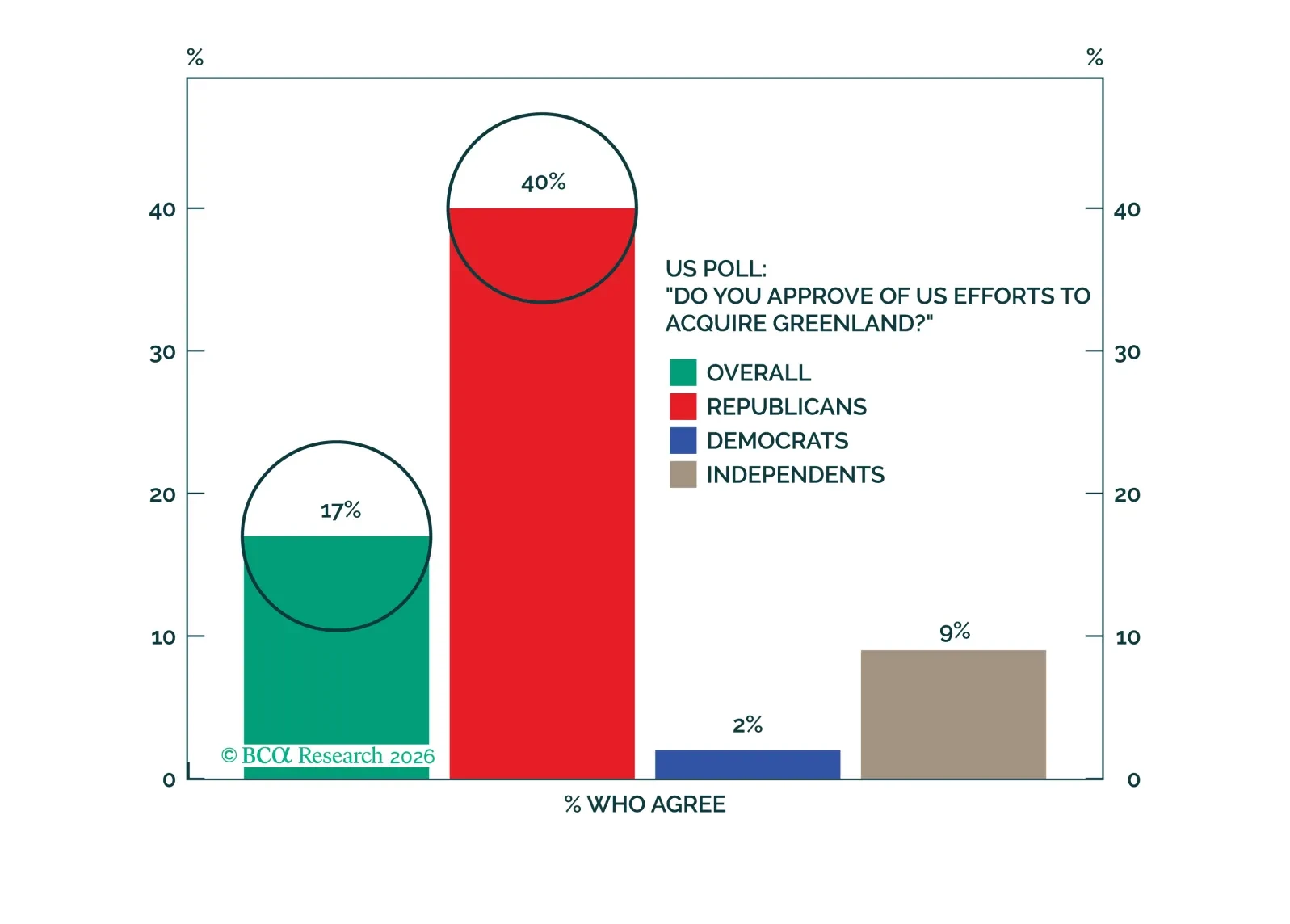

Investors should bet against the US seizing Greenland by force and collapsing NATO. But stay tactically defensive anyway.

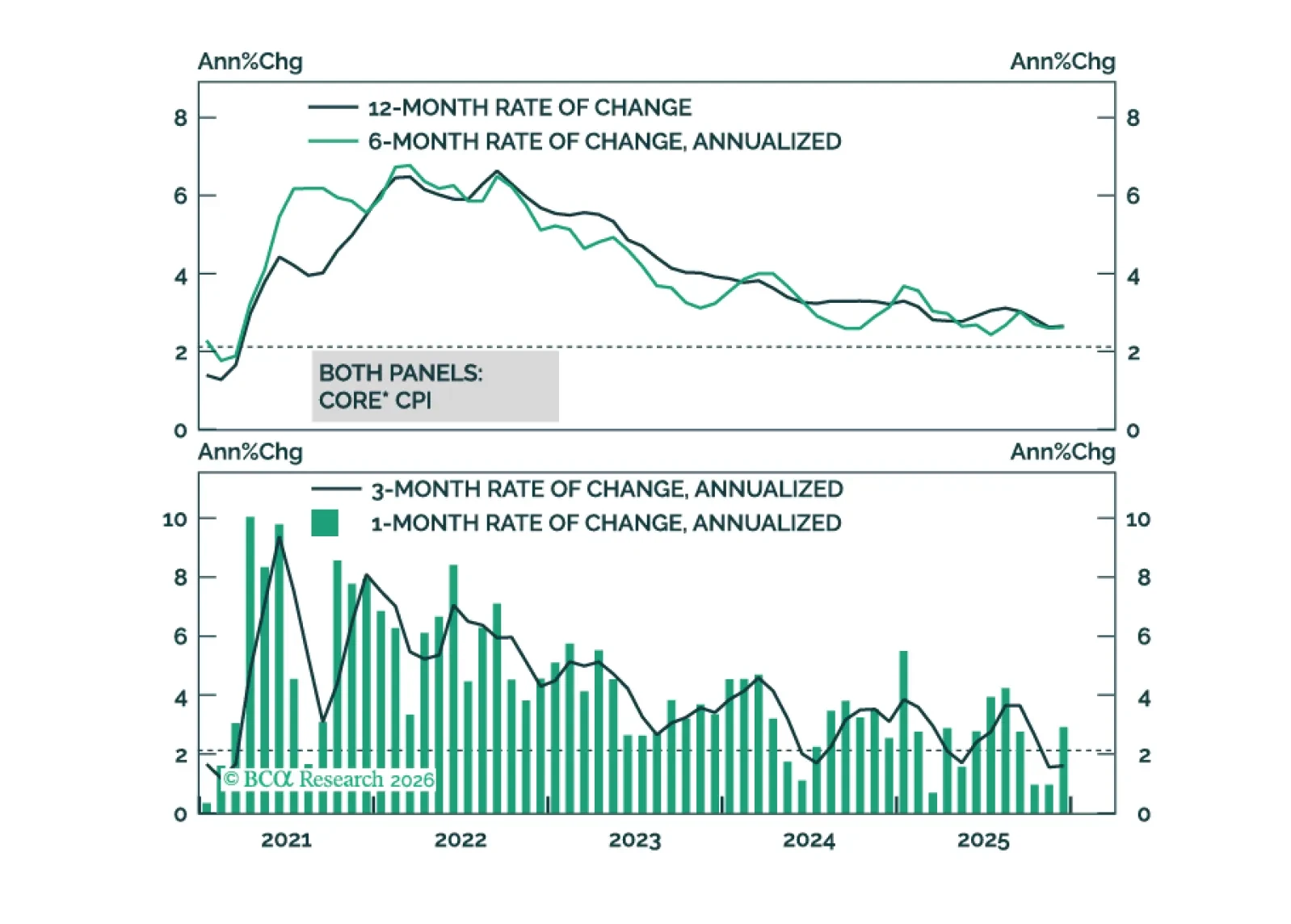

This morning’s CPI report signals that the worst of the tariff impact on inflation may already be in the rearview mirror.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

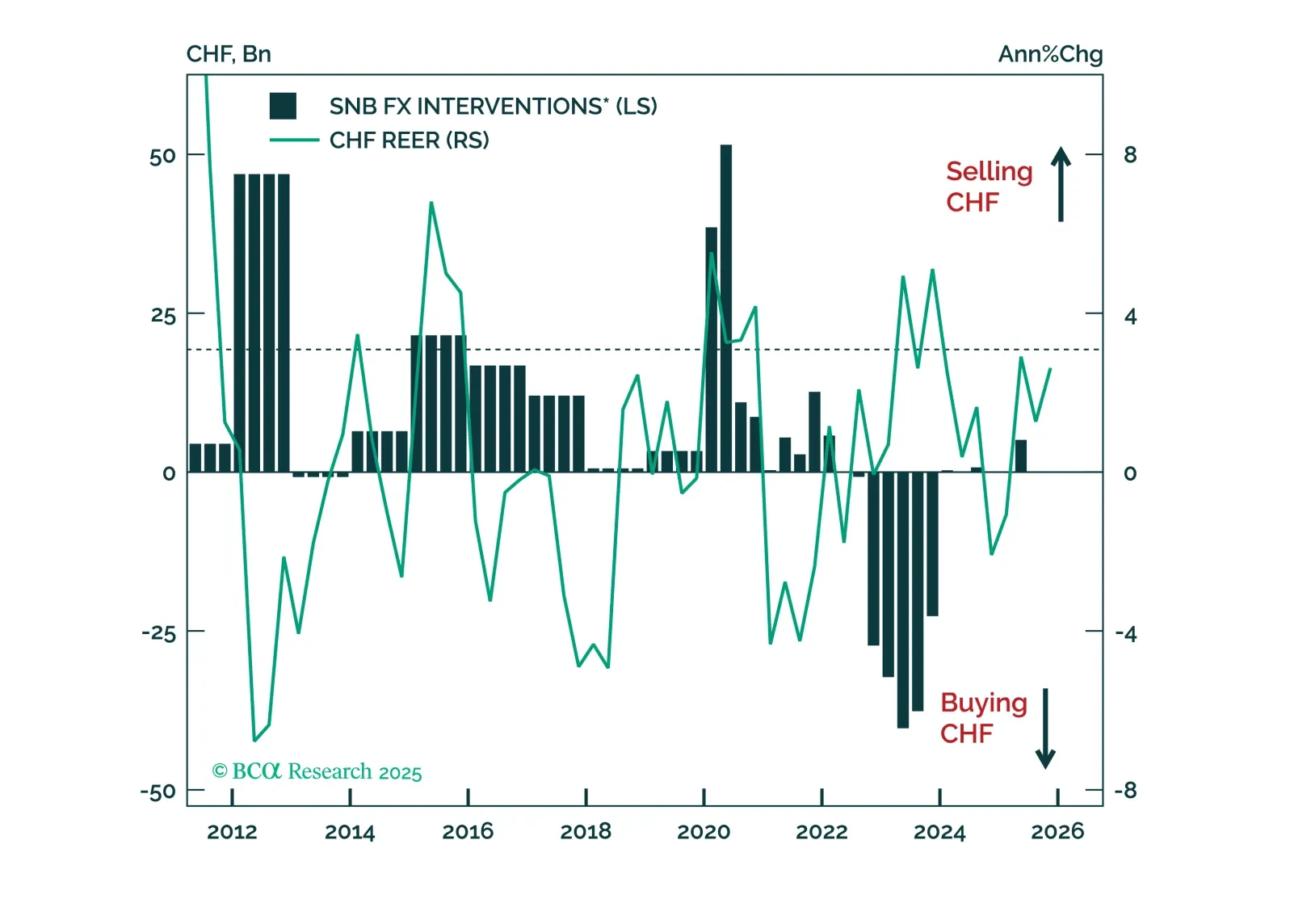

The SNB remains on hold, but the bar for further easing is falling quickly – even as Switzerland secures a breakthrough trade deal with the US. With CHF now pressing against a policy ceiling, the franc looks increasingly attractive…

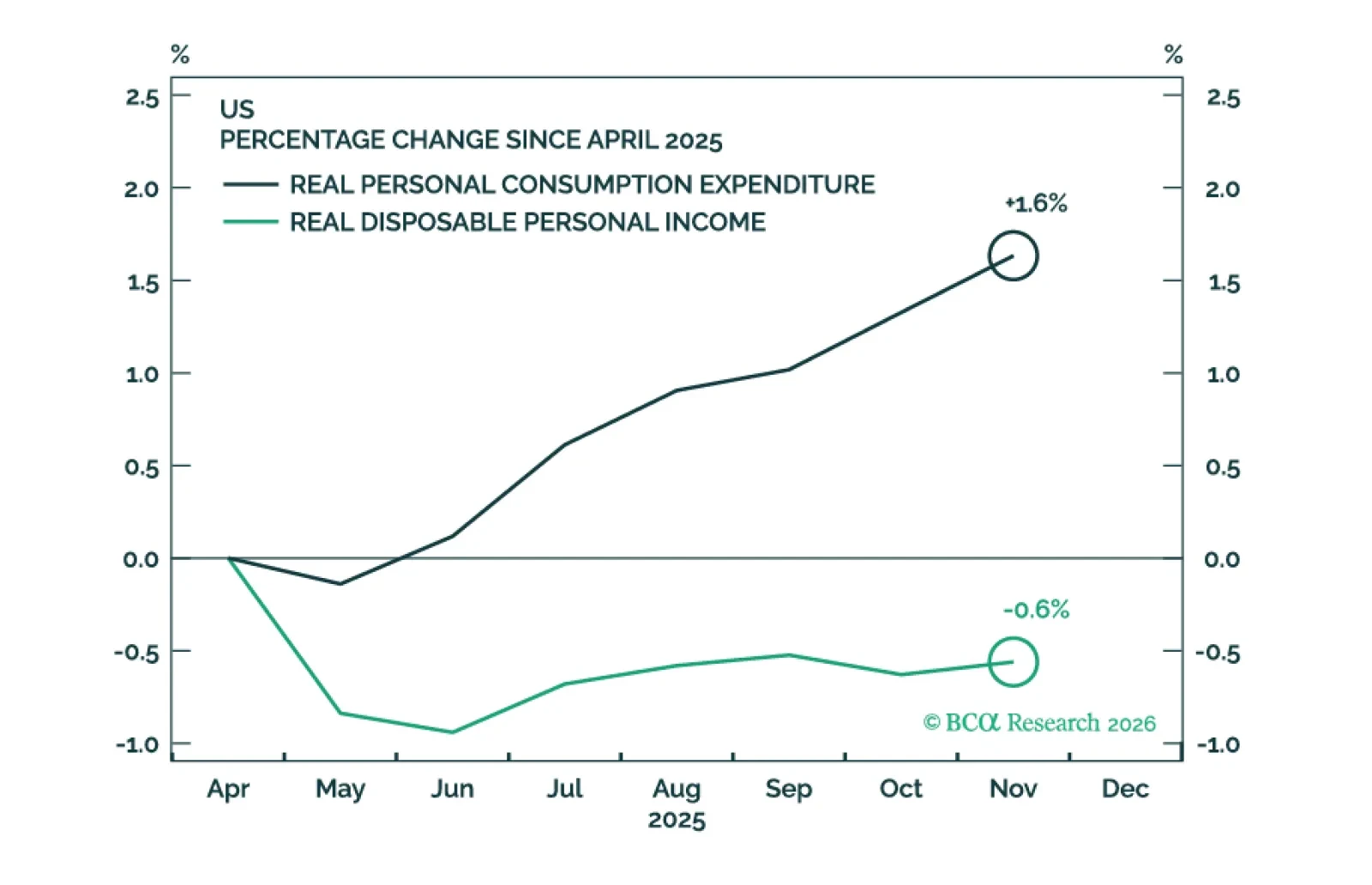

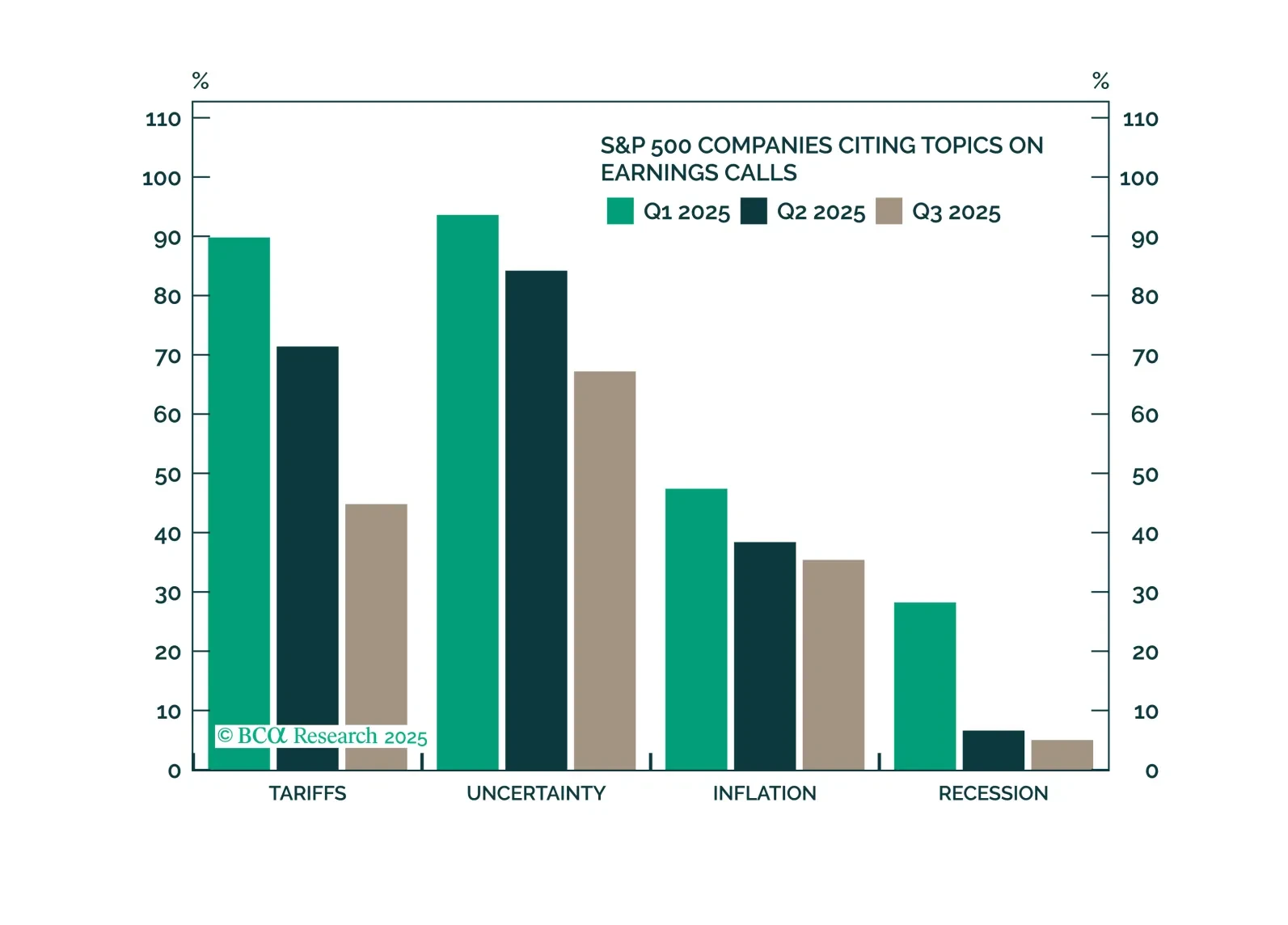

Tariffs are fading in importance as companies successfully mitigate cost pressures and preserve profitability. The recent wave of high-profile layoffs is more concerning, but there does not appear to be a systemic reason behind the…

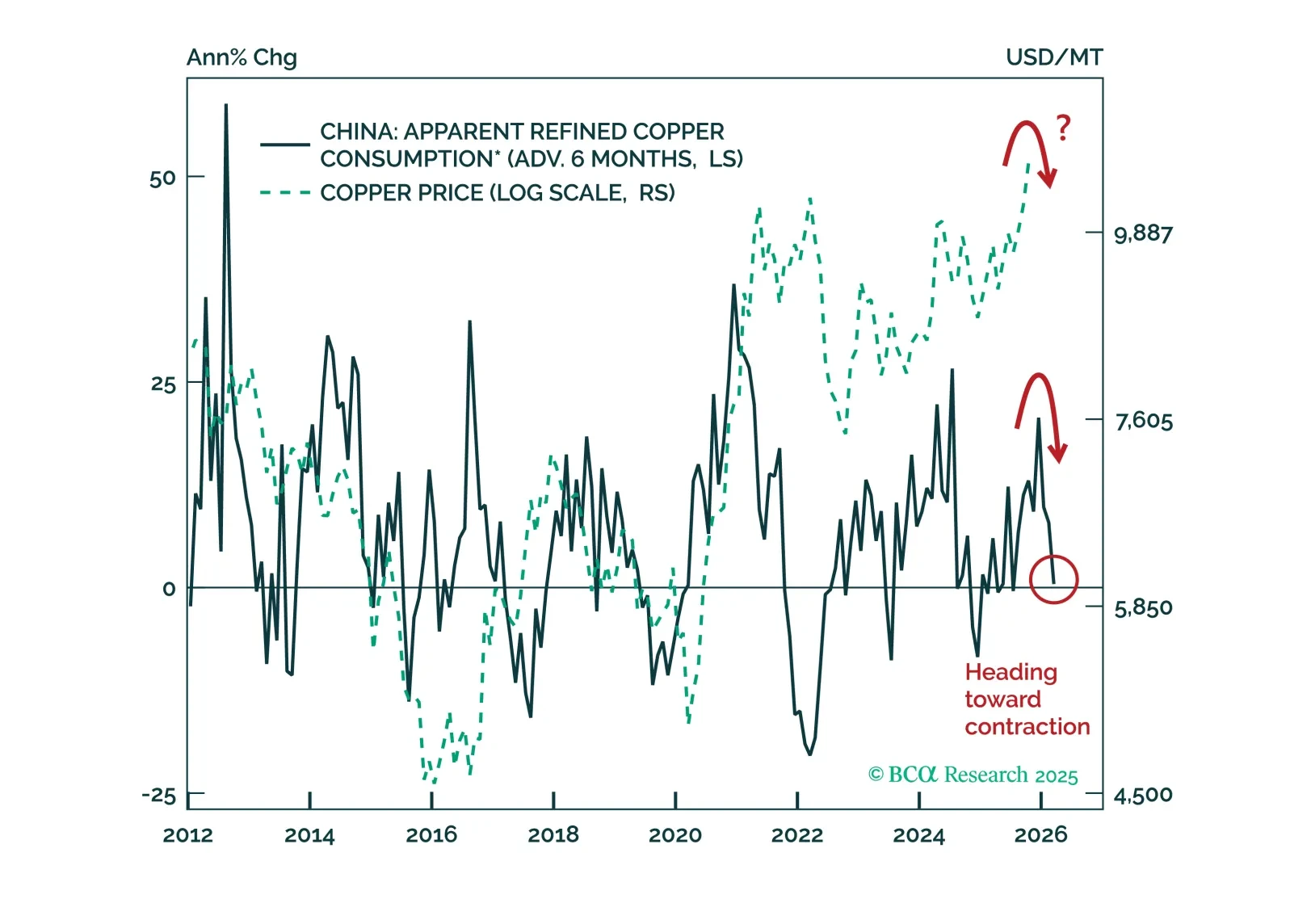

Should investors chase the copper rally or use the latest bout of strength as an opportunity to sell?We warn that weakening Chinese demand and shrinking global manufacturing will weigh on the metal’s price over a cyclical timeframe…

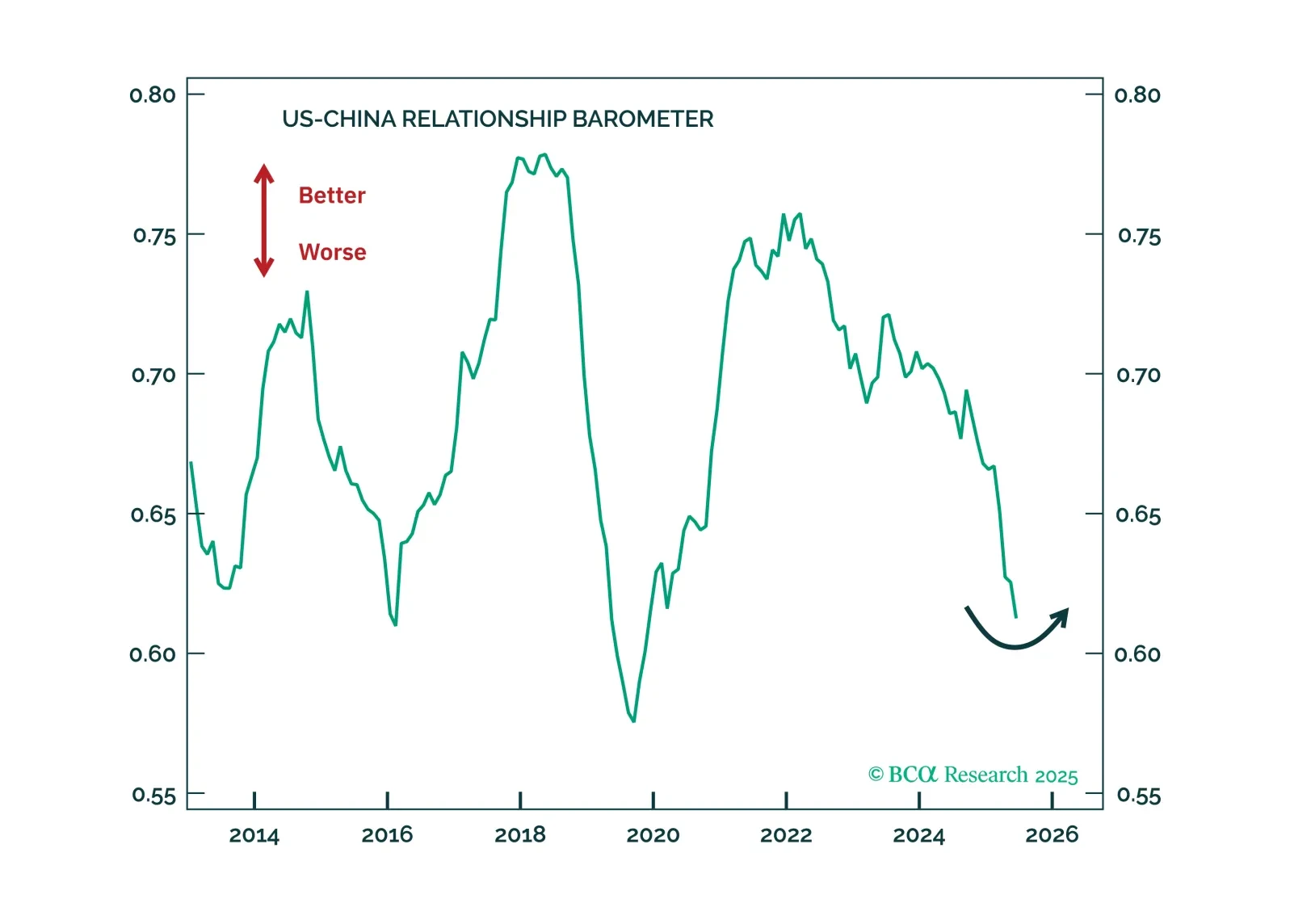

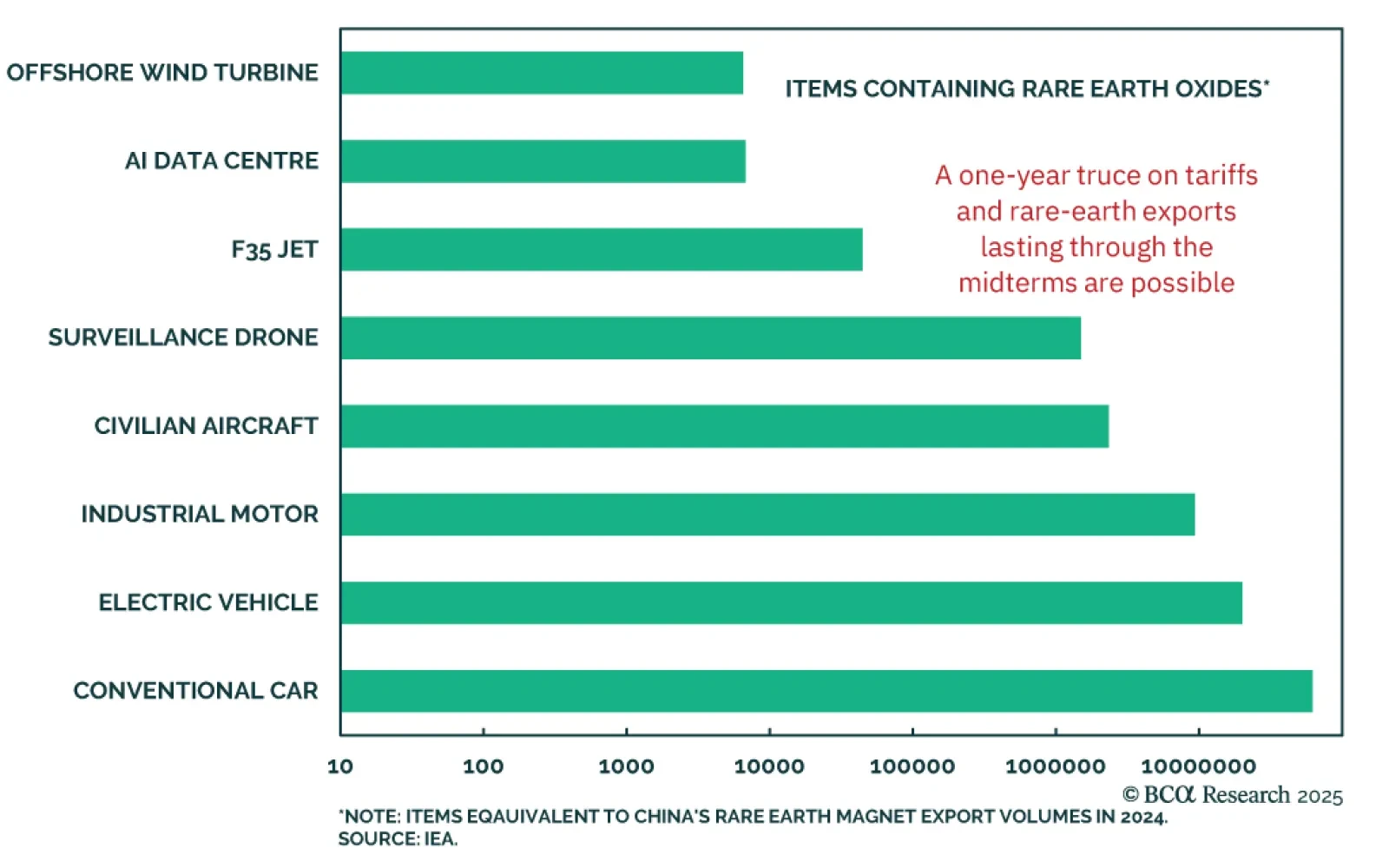

The Trump-Xi summit continued the trade truce and tentatively created a framework to contain tensions over 2026. That is not a trade deal but it is good enough for global financial markets, especially Chinese assets.

The US and China appear to be moving toward a trade deal, though it remains unclear whether the goal is simply damage control or a genuine expansion of market access. Presidents Trump and Xi are scheduled to meet on October 30 in…

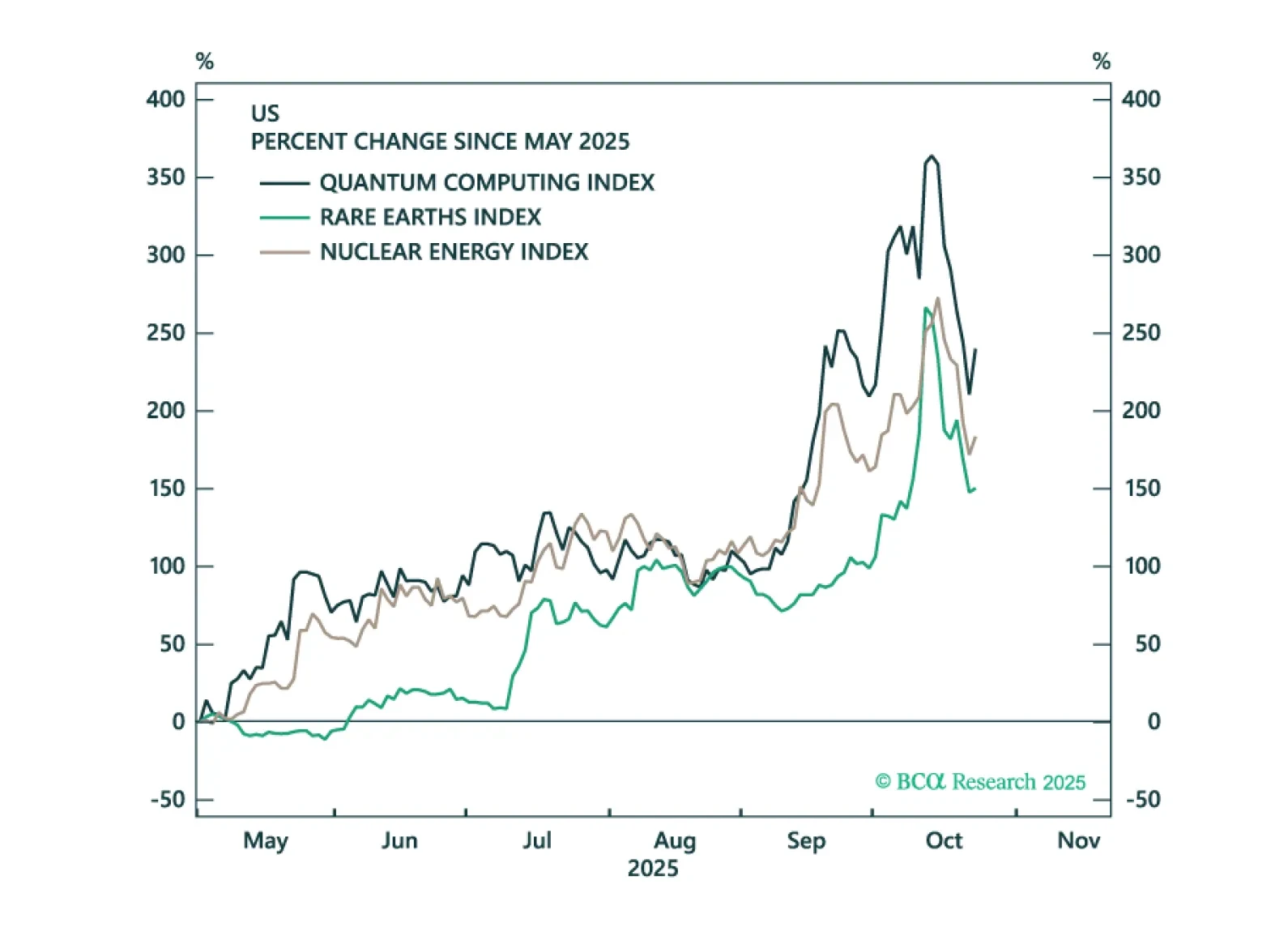

Precious metals, corporate credit, and tech stocks are all showing signs of late-cycle euphoria. We identify various trigger points that investors should monitor to turn more bearish.