Taiwanese exports unexpectedly grew for the first time in just over a year in September – sending a positive signal about the global manufacturing cycle. The 3.4% y/y increase surprised anticipations of a moderation in the…

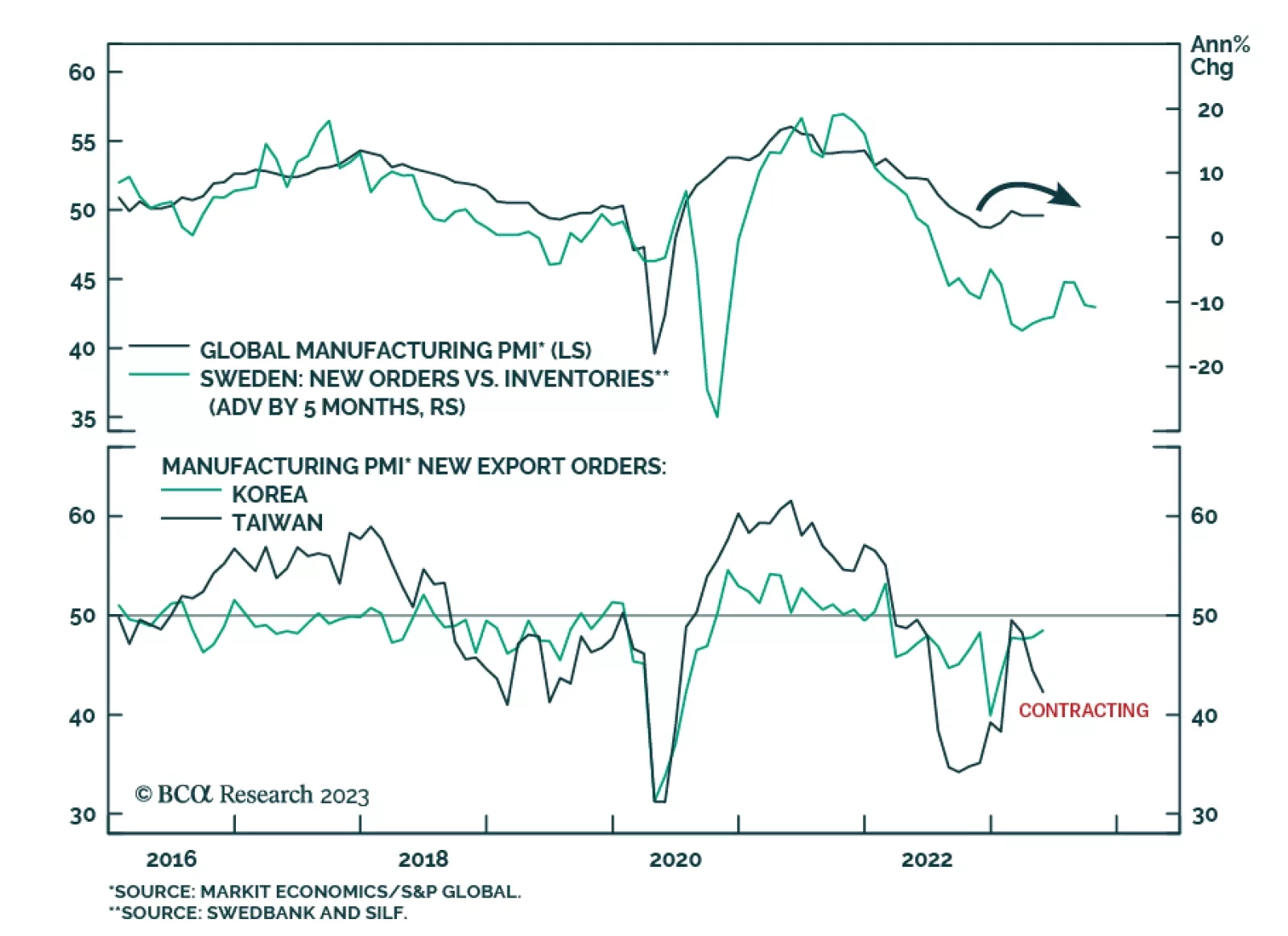

Taiwanese export orders sent a disappointing signal about global manufacturing conditions on Wednesday, corroborating the message from Singapore’s NODX release earlier this week. The pace of decline in export orders…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

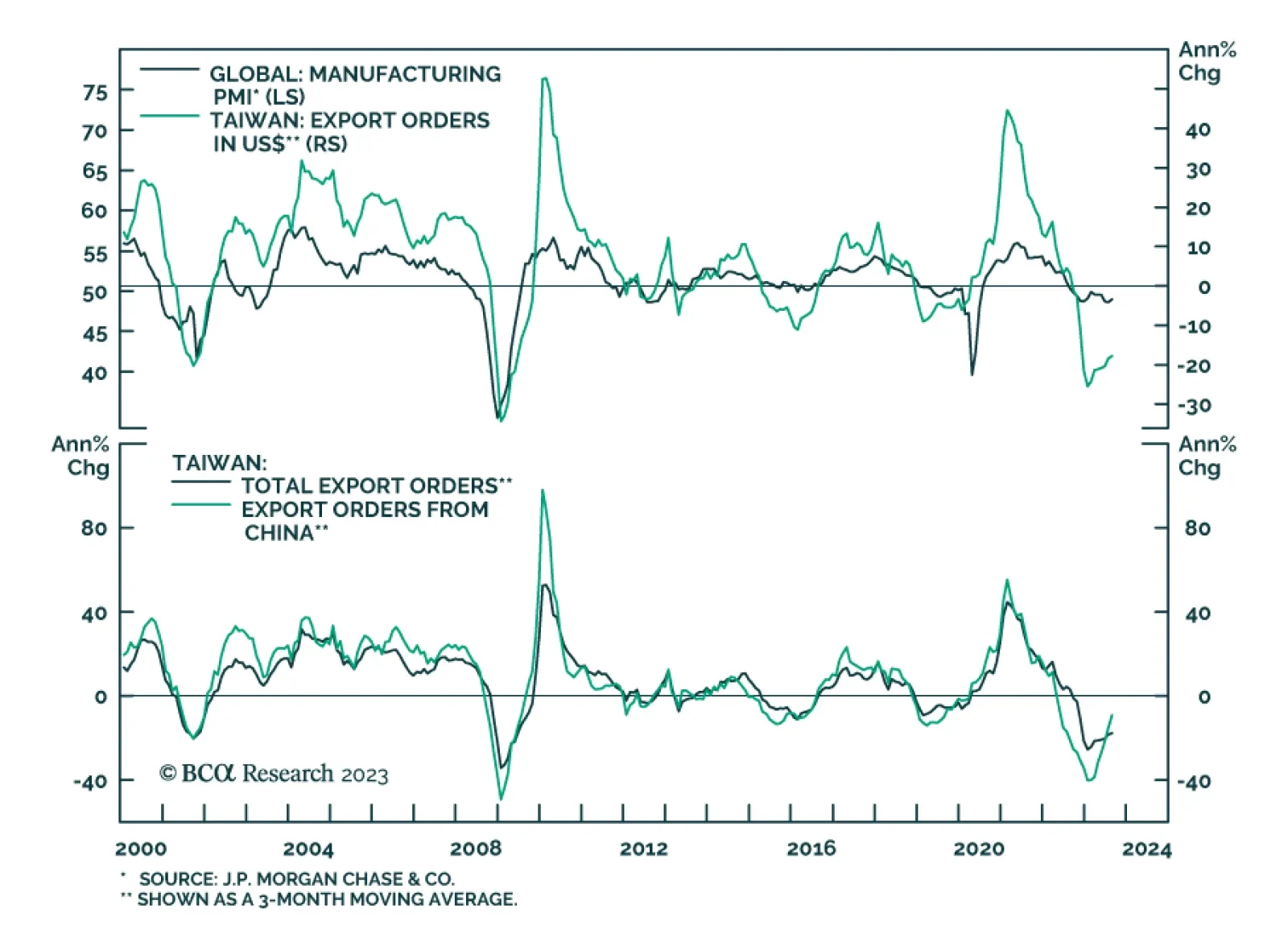

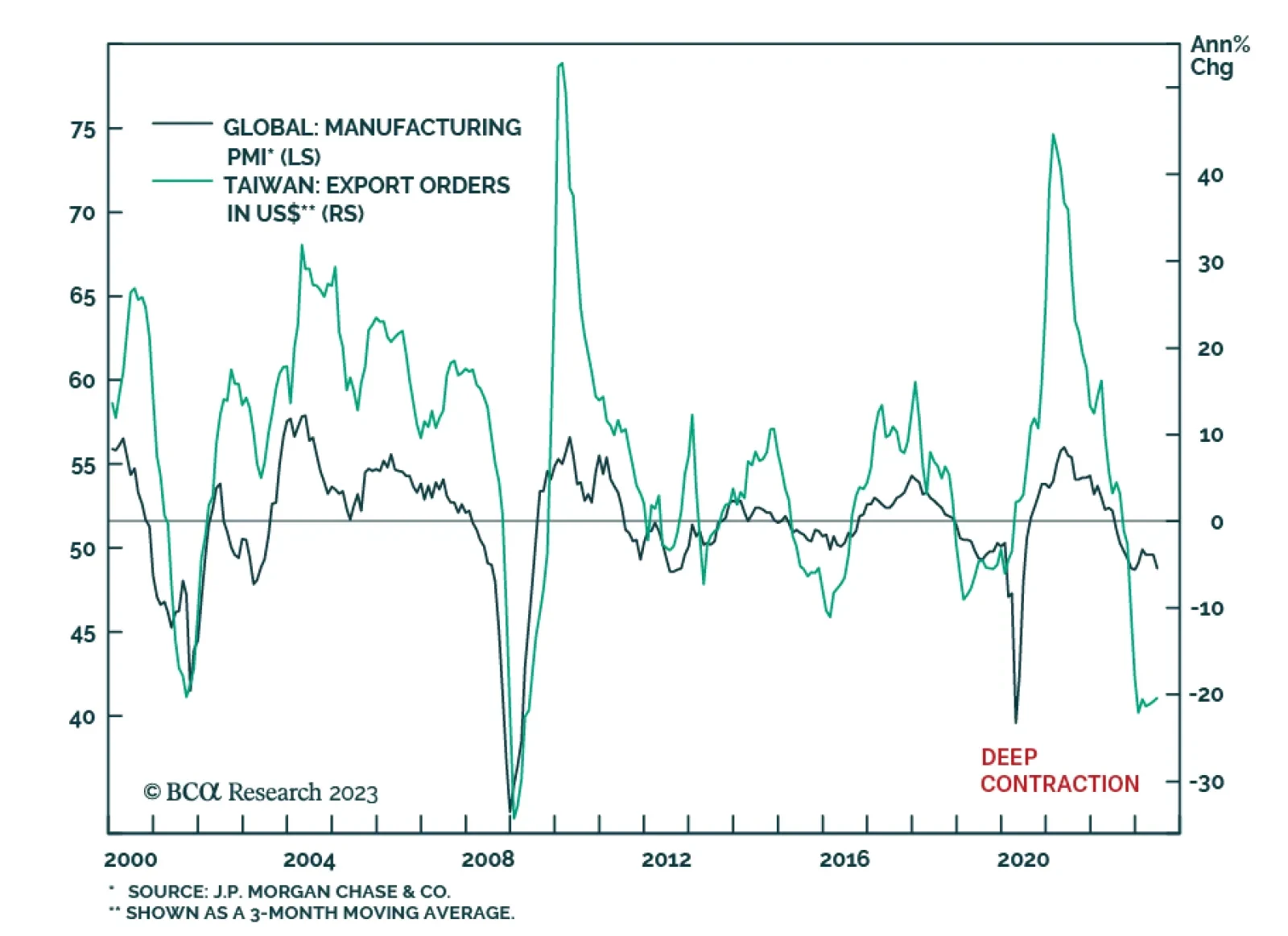

Taiwanese export orders sent a pessimistic signal about the global trade cycle. The contraction deepened in June from -17.6% y/y to -24.9% y/y – delivering a downside surprise to expectations of a 20.3% y/y decline. The…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

The Global Manufacturing PMI was unchanged at 49.6 in May – below the 50 boom-bust line for the ninth consecutive month. The details of the release were mixed. On the one hand, the Production sub-component rose to an 11-…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.