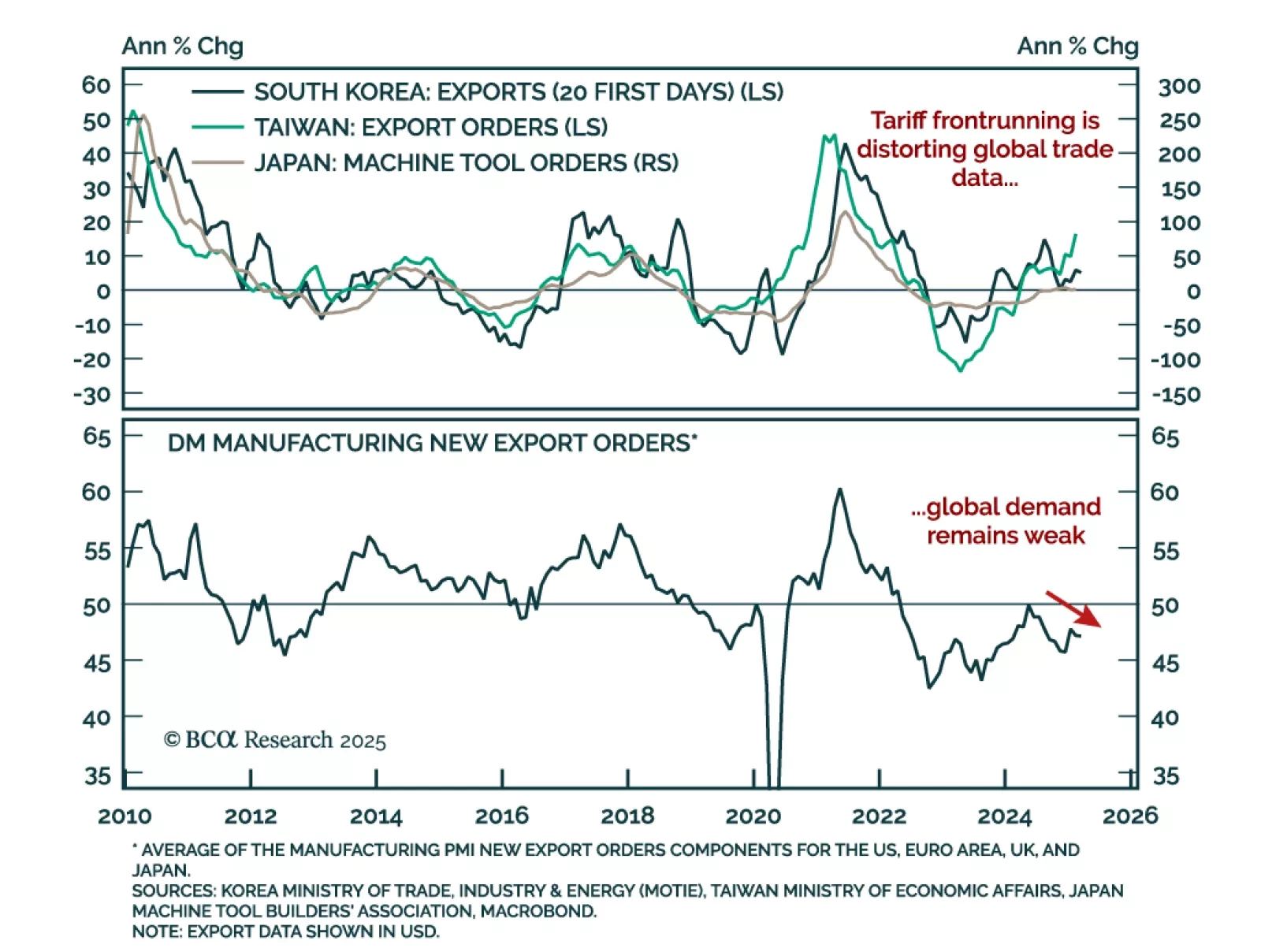

East Asian trade data has been disappointing. Preliminary February data for Japanese machine tool orders showed a slowdown to 3.5% y/y from 4.7% in January. Broader machinery orders were down 3.5% m/m in January. Taiwanese exports…

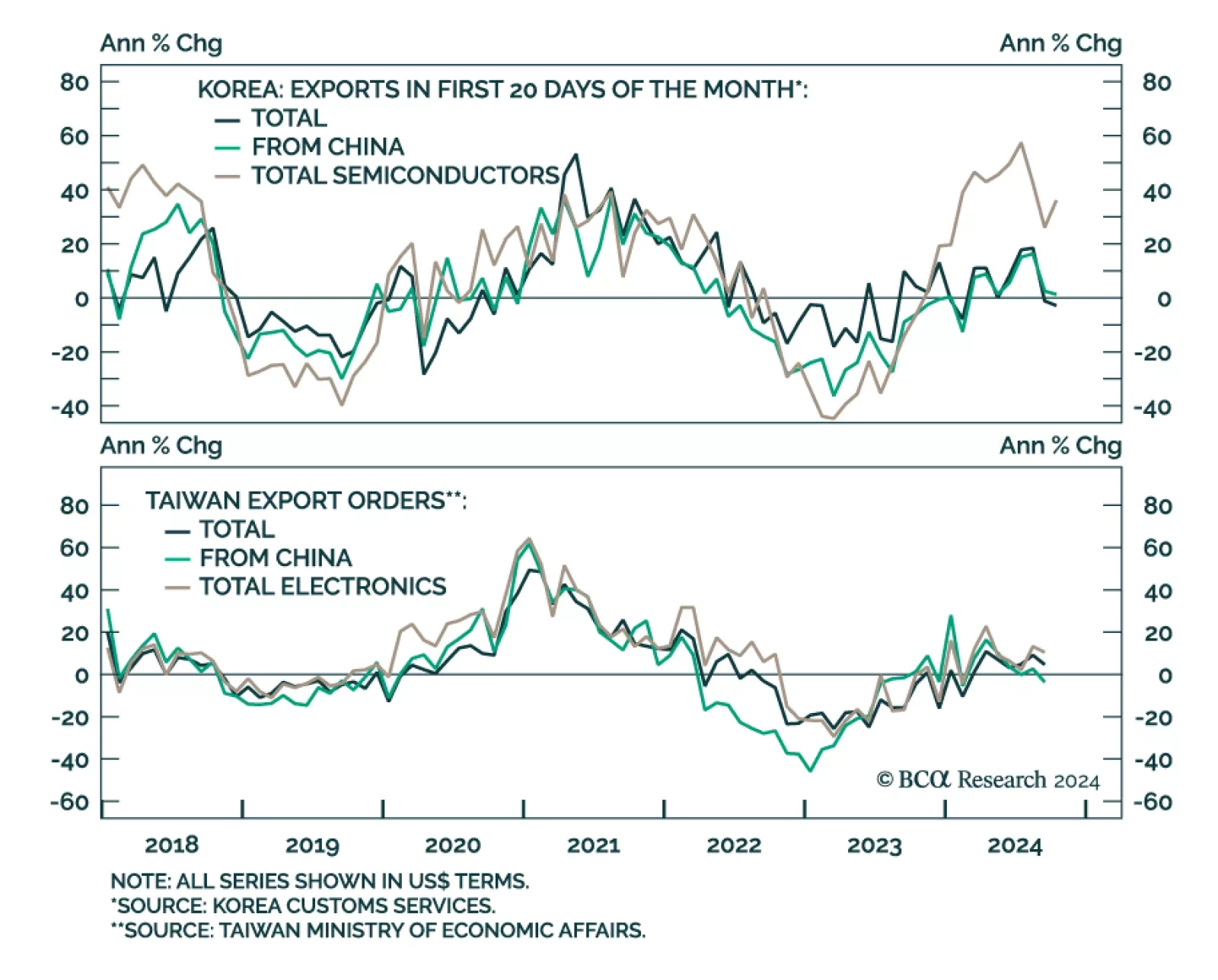

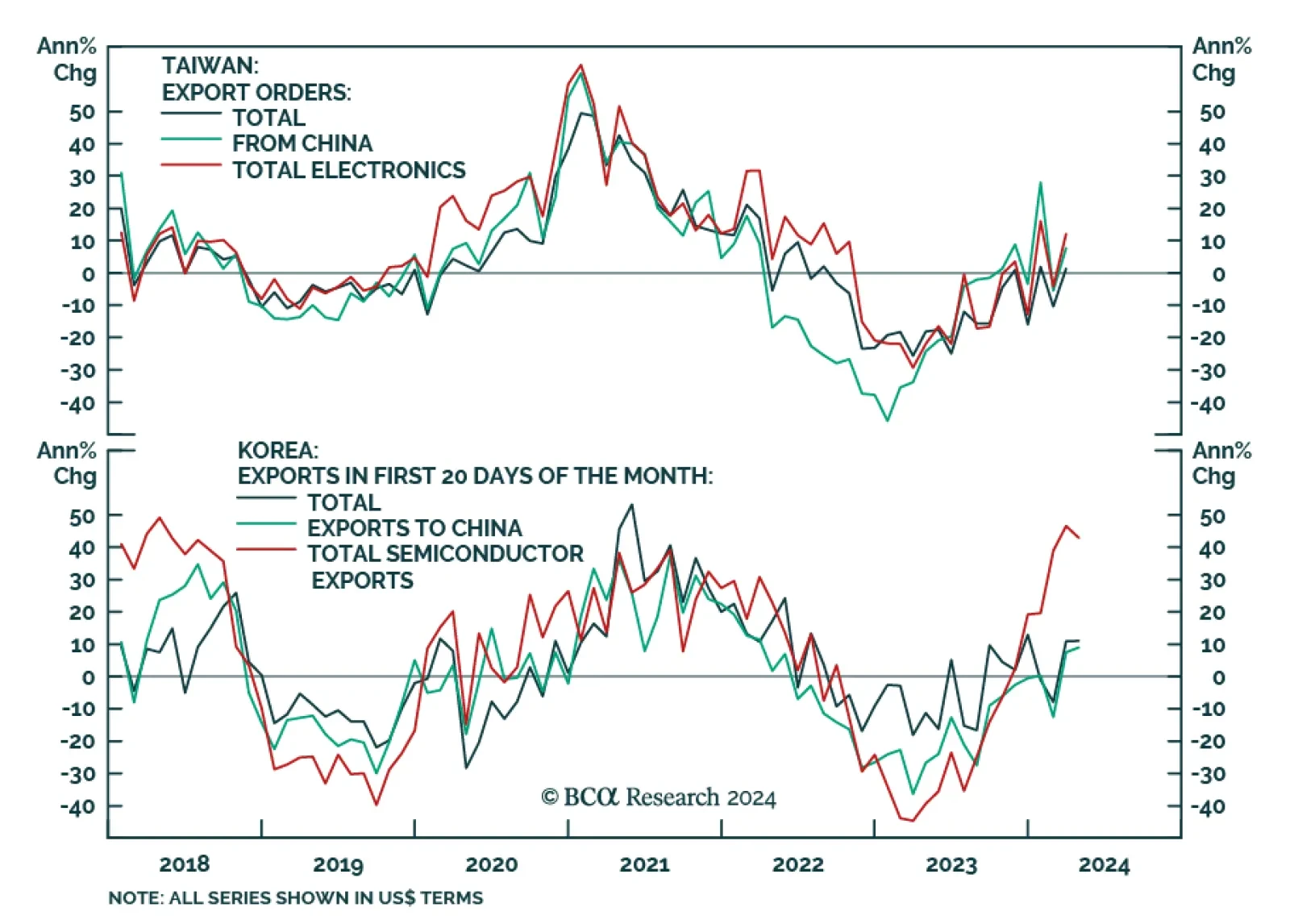

East Asian trade data was mixed in December and January. Taiwanese export orders for December were stronger than expected, rebounding to 20.8% y/y from 3.3% in November. On the other hand, Korean exports for the first 20 days of…

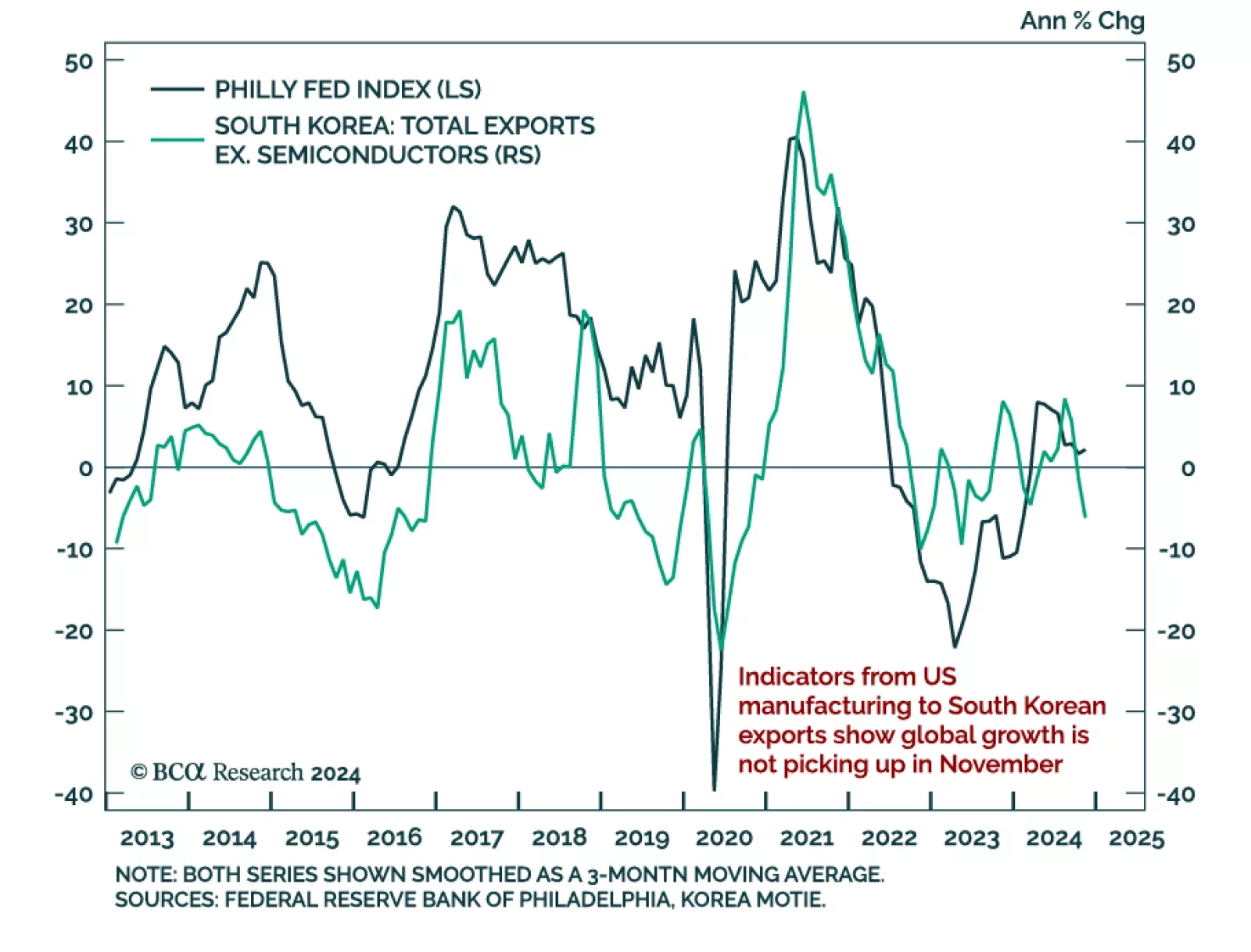

The November Philly Fed manufacturing survey missed expectations and fell to -5.5 vs. 10.3 in October. New orders and shipments softened although they still indicate growth. Most indicators of current activity decreased, while…

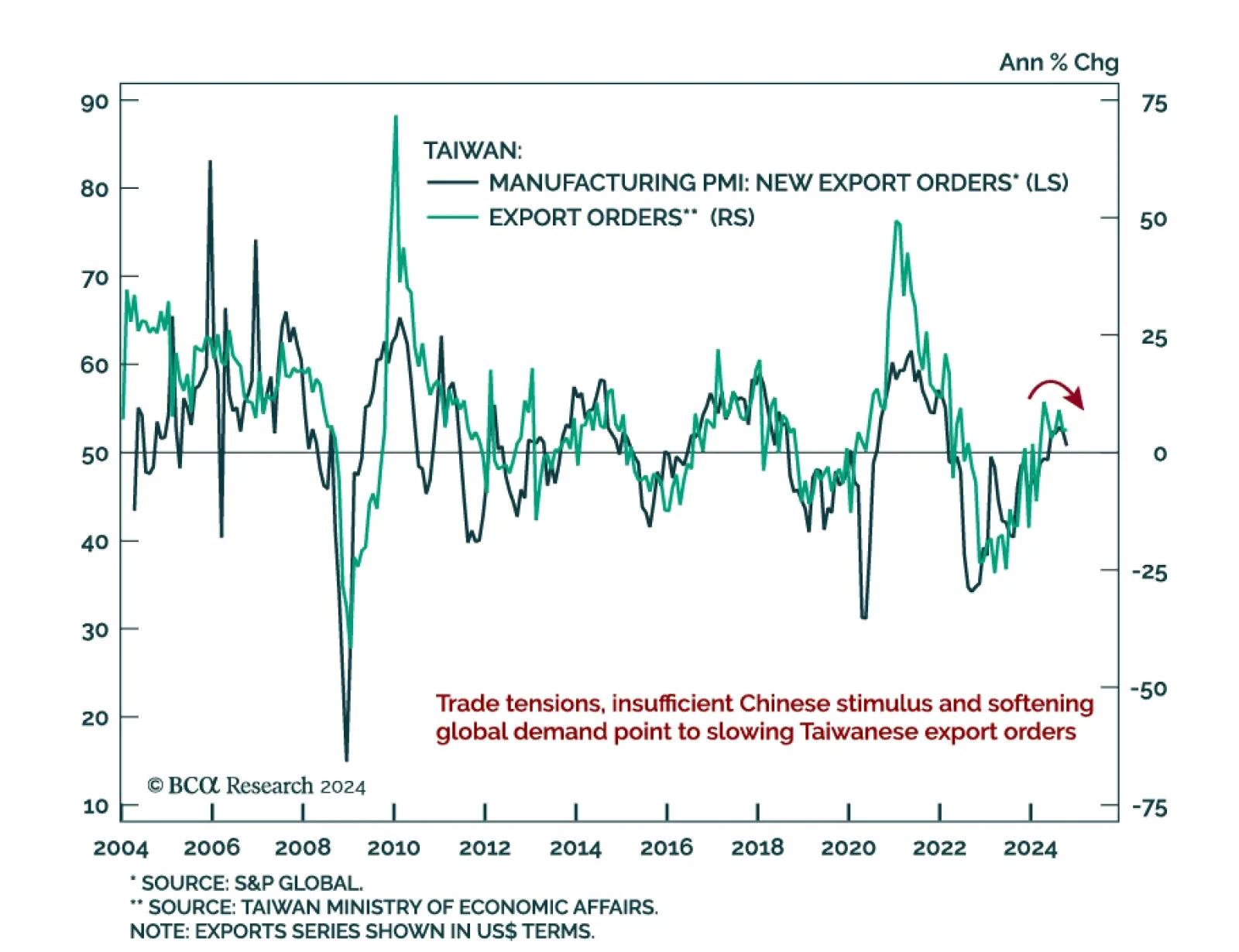

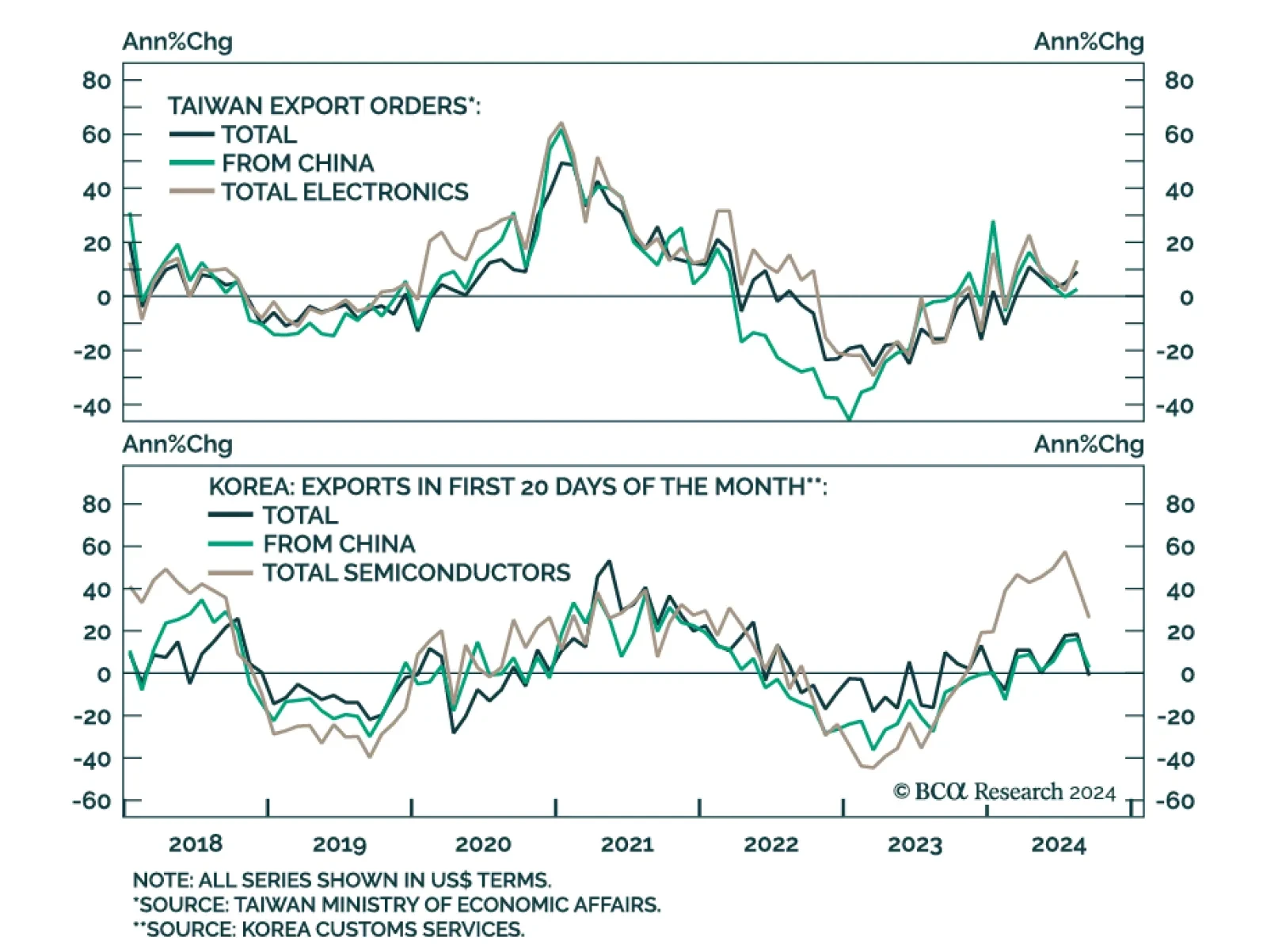

Taiwanese export orders surprised positively when a deceleration was expected, printing at 4.9% y/y, up from 4.6% in September. The increase was spread across most categories, with exports of electronic products accelerating to…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

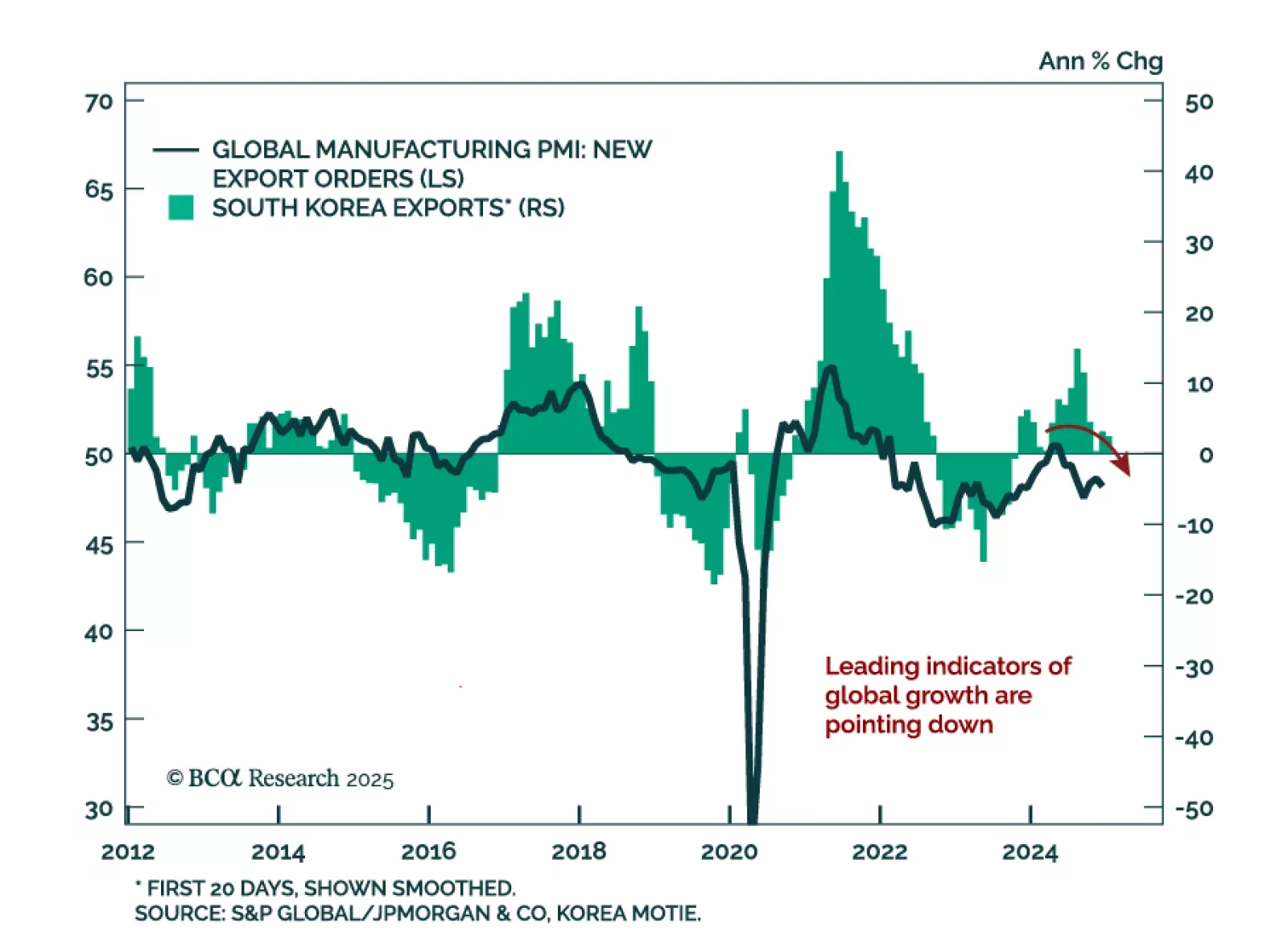

The recent slump in globally- and tech-sensitive East Asian trade shows no respite, with advanced October Korean exports and September Taiwanese export orders data disappointing. Korean exports for the first 20 days of October…

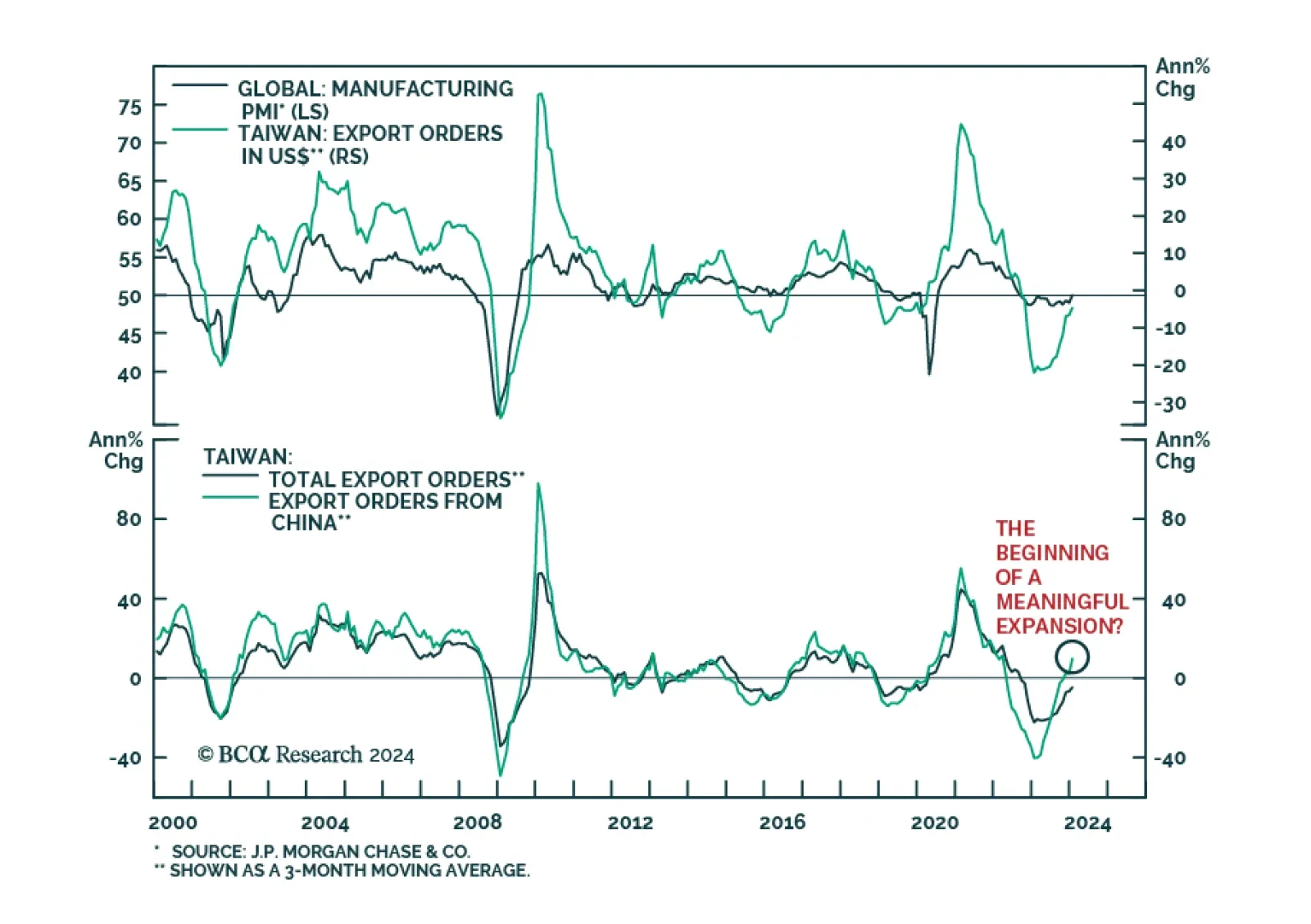

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders accelerated from 4.8% y/y to a faster-than-anticipated 9.1% in August. The faster pace of growth was also broad…

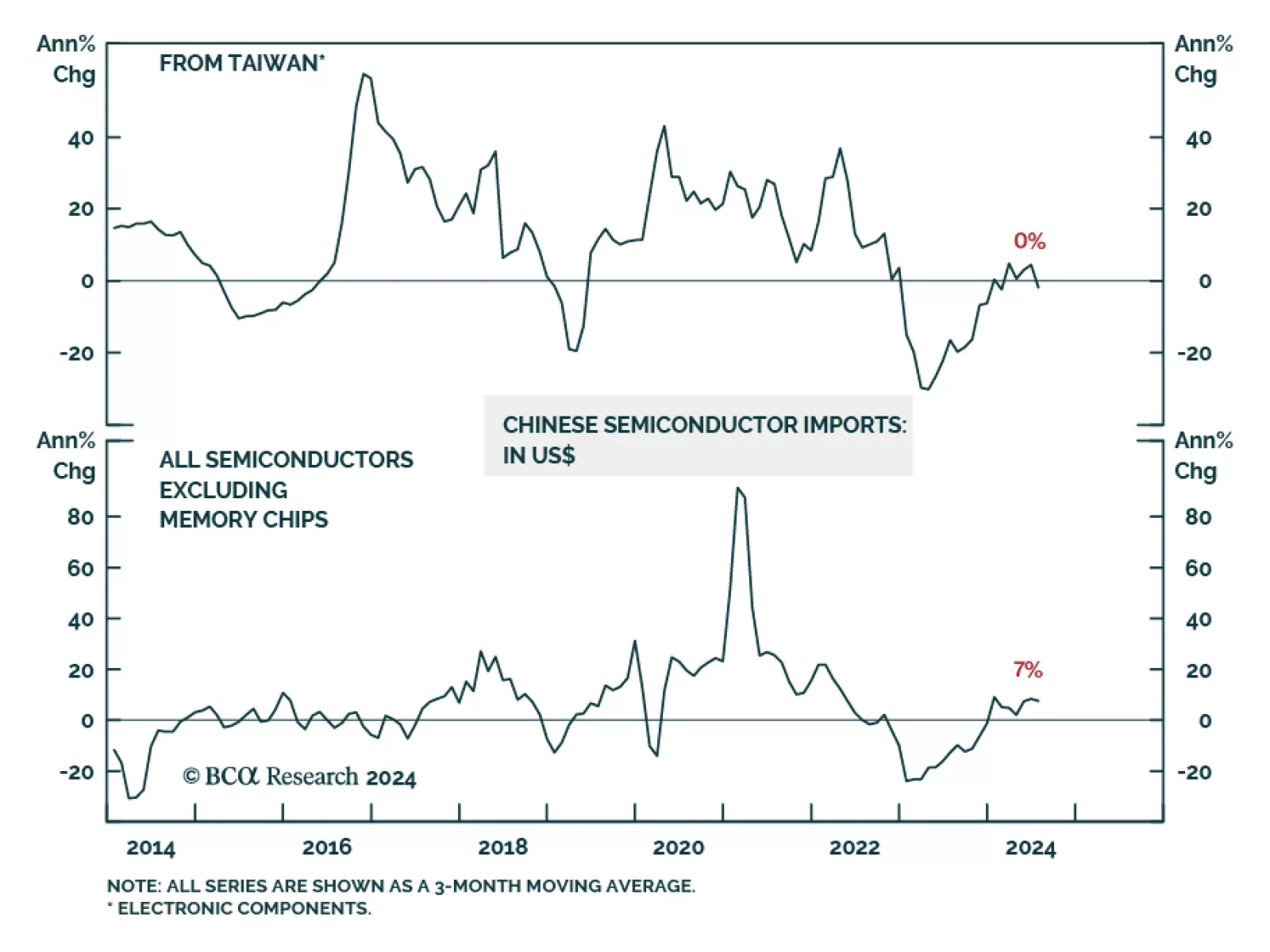

According to BCA Research’s Emerging Markets Strategy Service, China has been accumulating high-value memory semiconductors in anticipation of further US restrictions. Since October 2022, the US has been tightening rules…

Export dynamics of small open economies are a bellwether for global growth. The latest Taiwanese and Korean export numbers are consistent with a revival in global trade. Taiwanese export orders grew by 1.2% y/y in March…

On the surface, the latest Taiwanese export orders release delivered a positive signal on the global trade cycle. The 1.9% y/y expansion in January marks a significant improvement from the 16.0% contraction in December. Moreover…