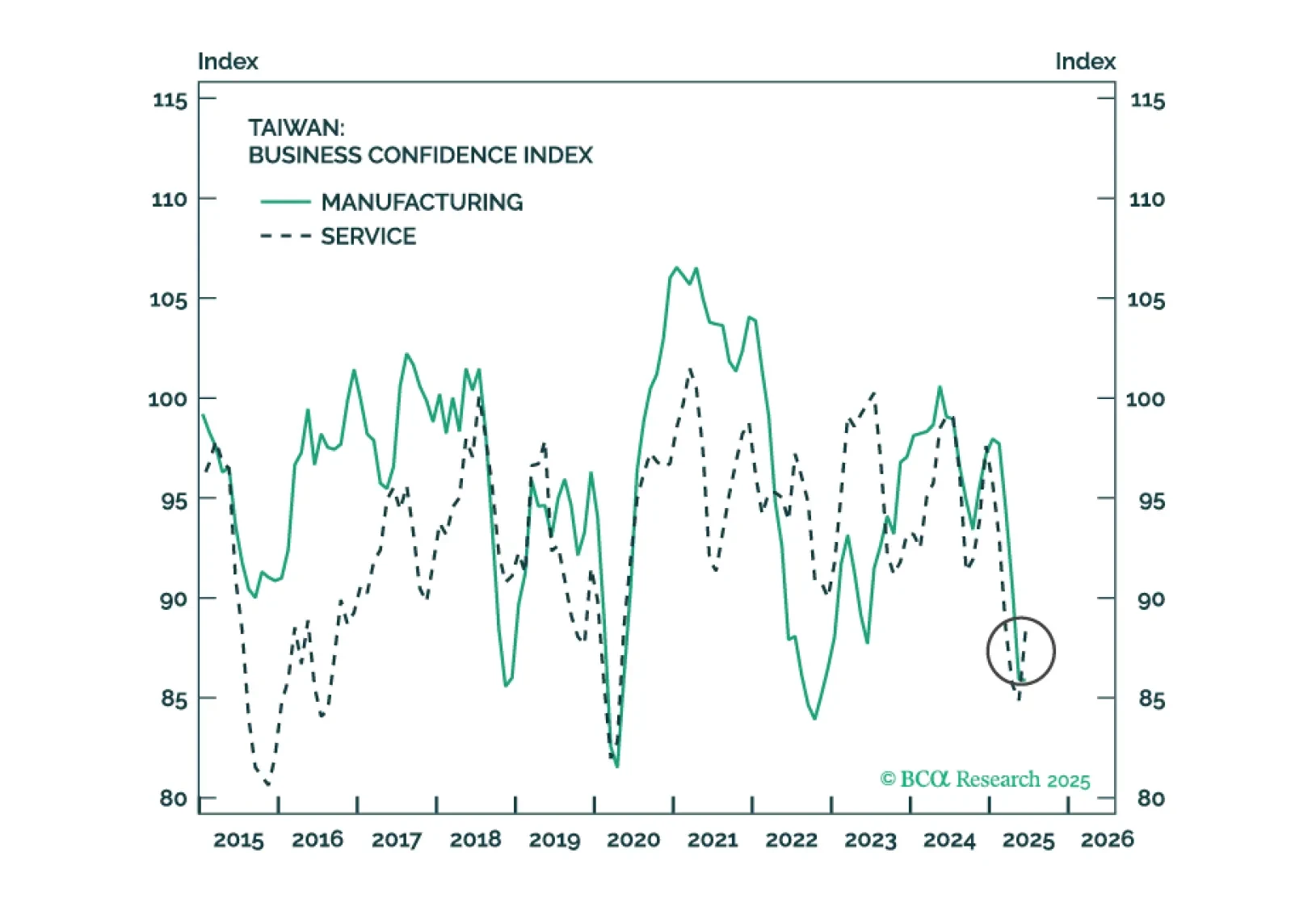

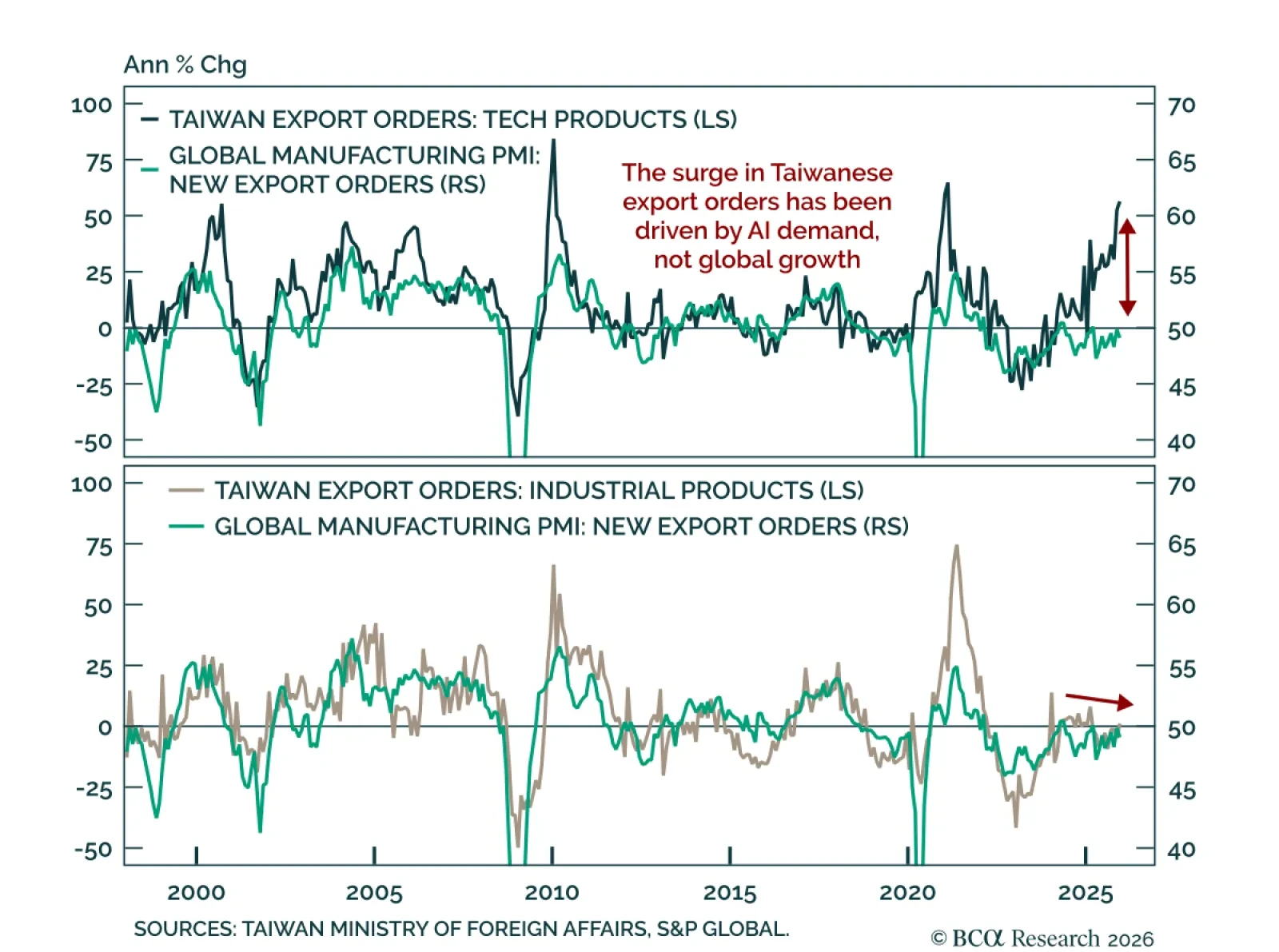

Strong Taiwanese export orders reflect AI demand rather than a pickup in global growth momentum. Taiwanese export orders reached a record high in December, rising 43.8% y/y and accelerating from 39.5% the prior month. The increase…

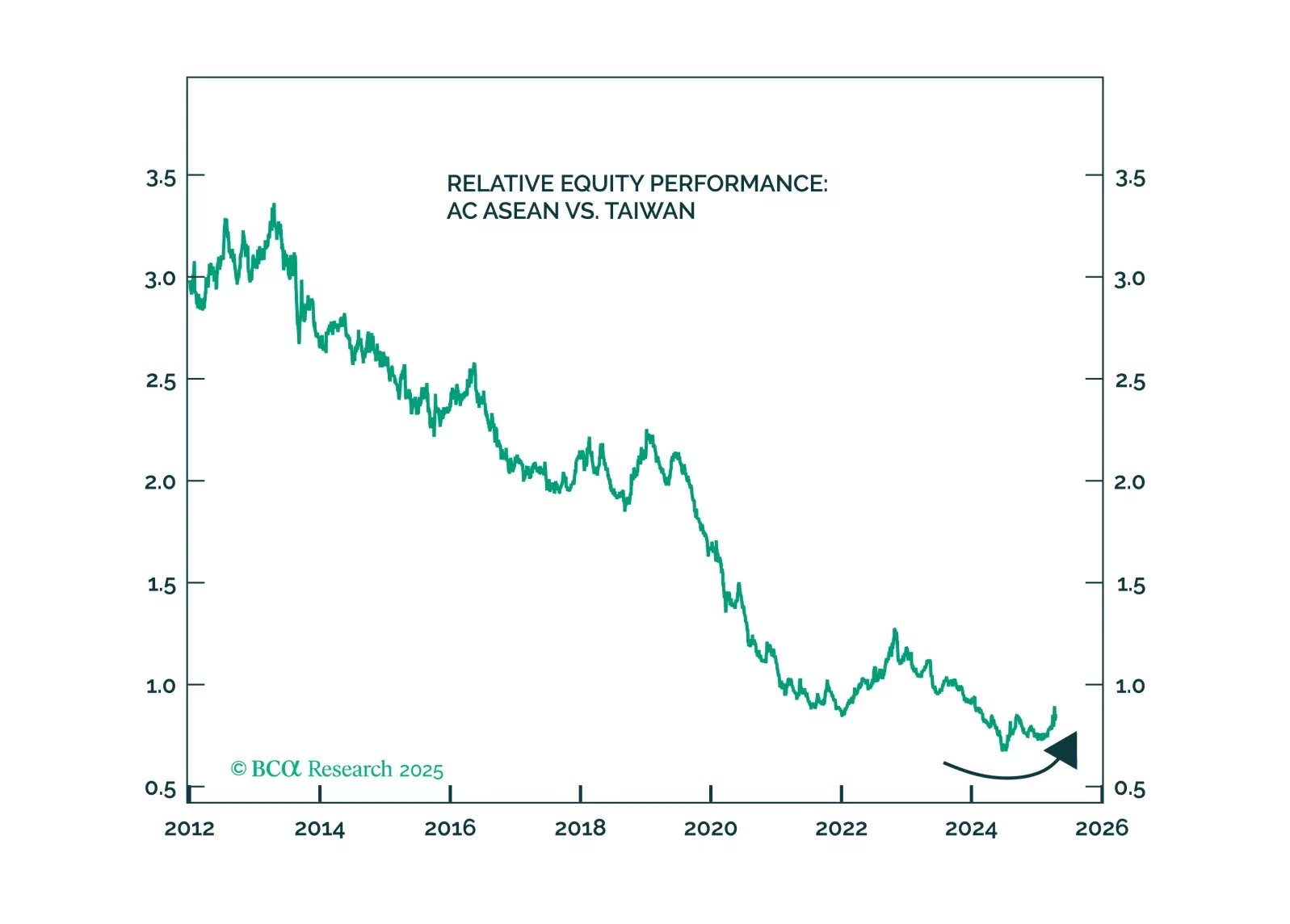

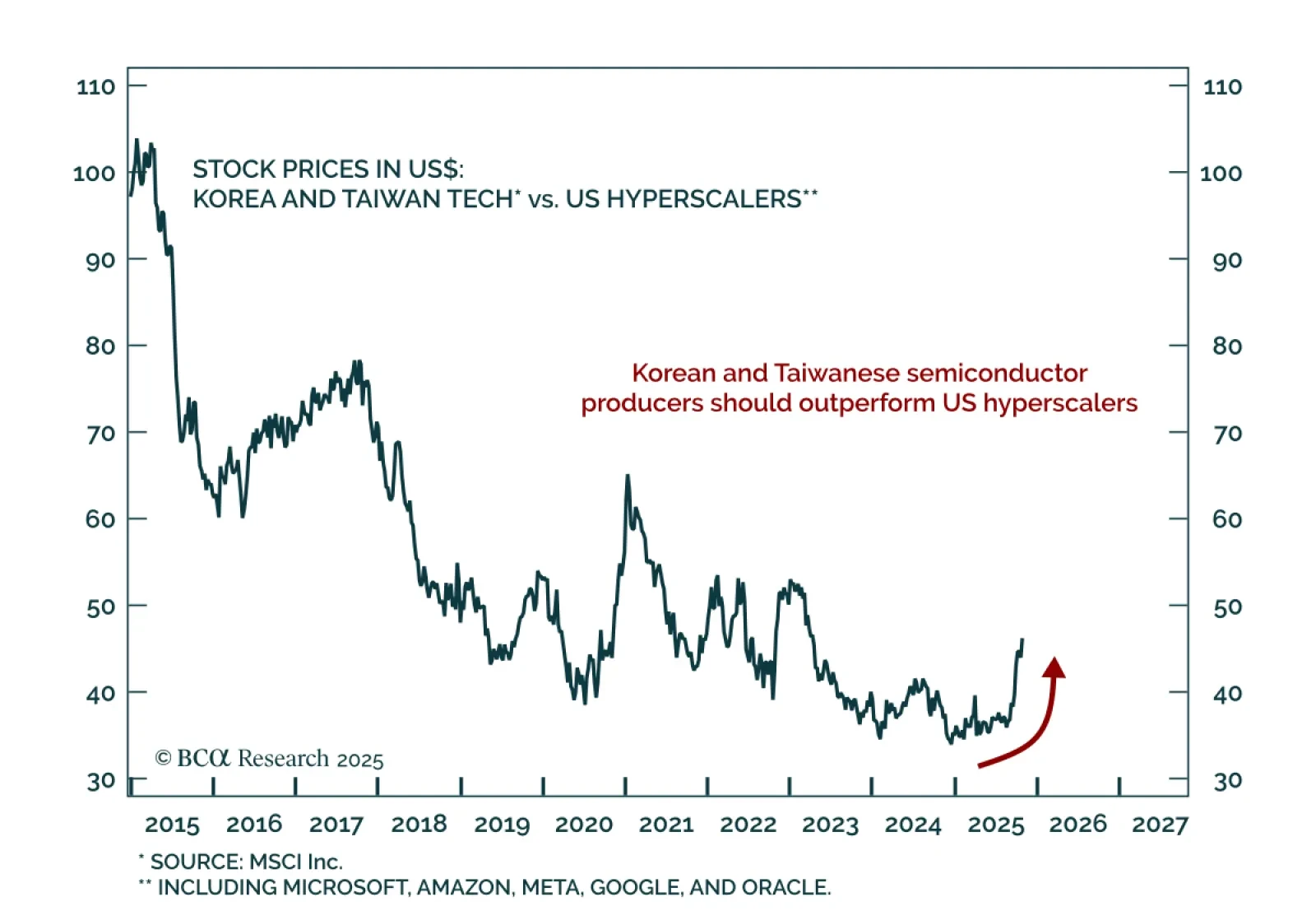

Our Emerging Markets strategists recommend a long Asian semiconductor stocks / short US hyperscalers trade over the next 6–12 months, with a positive return profile in both bullish and bearish AI scenarios. Korean and Taiwanese…

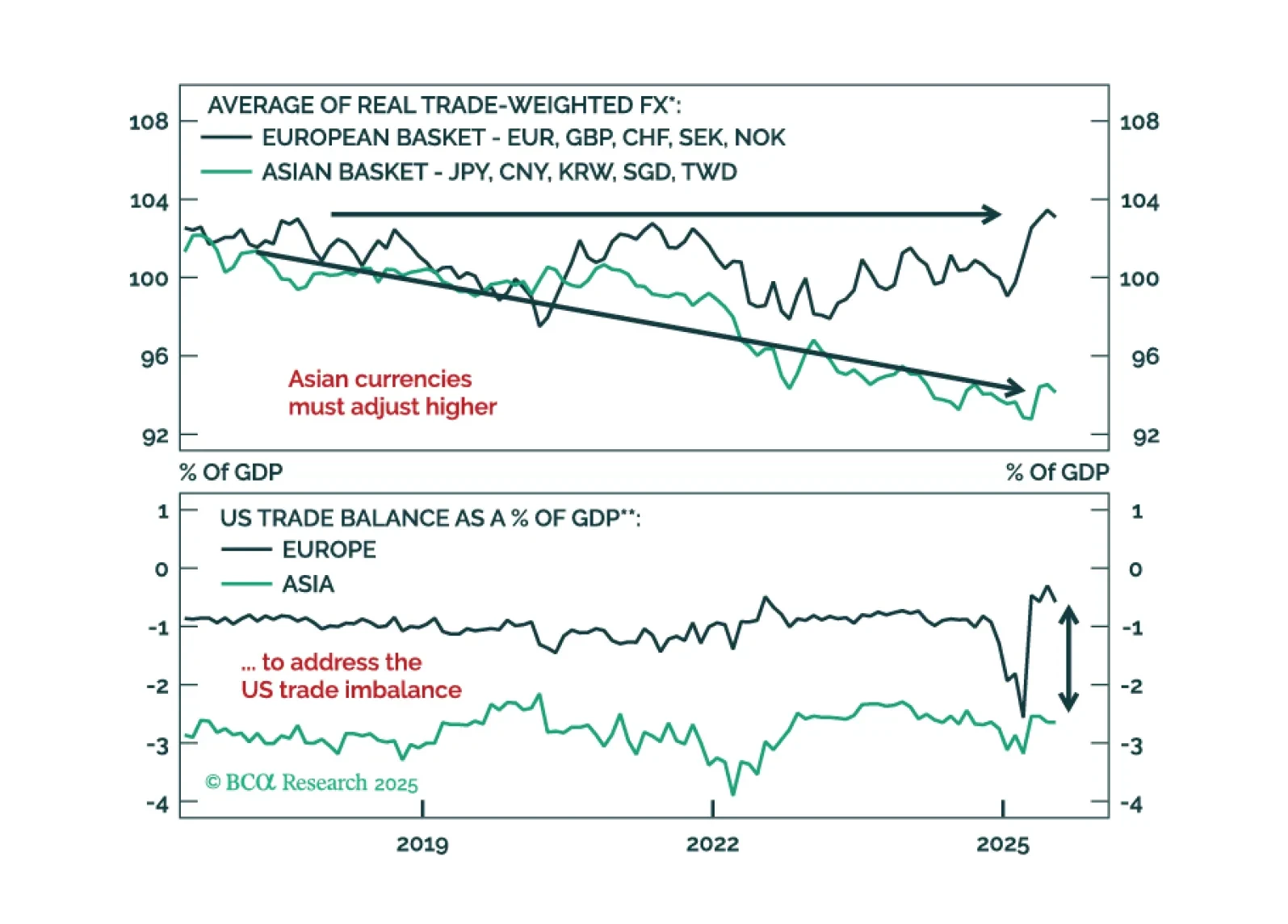

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

Taiwan’s failed recall election reduces 12-month geopolitical risk for Taiwanese and Chinese equities on the margin. We are reviewing our long European industrials / short Chinese industrials trade.

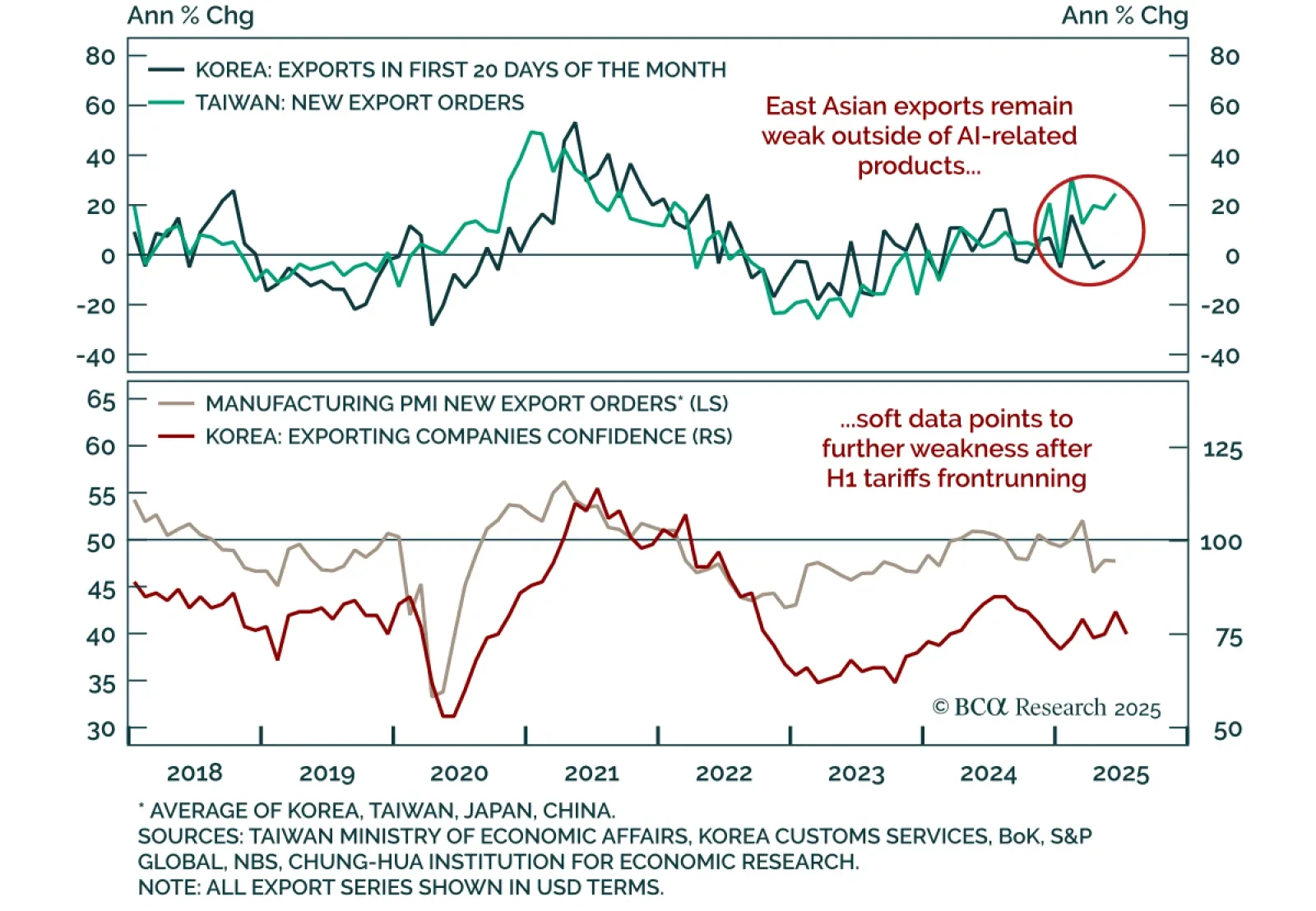

June Taiwanese export orders surprised to the upside, but weakness in non-tech trade and in broader East Asian exports underscores the narrowness of the global recovery. Orders rose 24.6% y/y, accelerating from 18.5% in May, though m…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

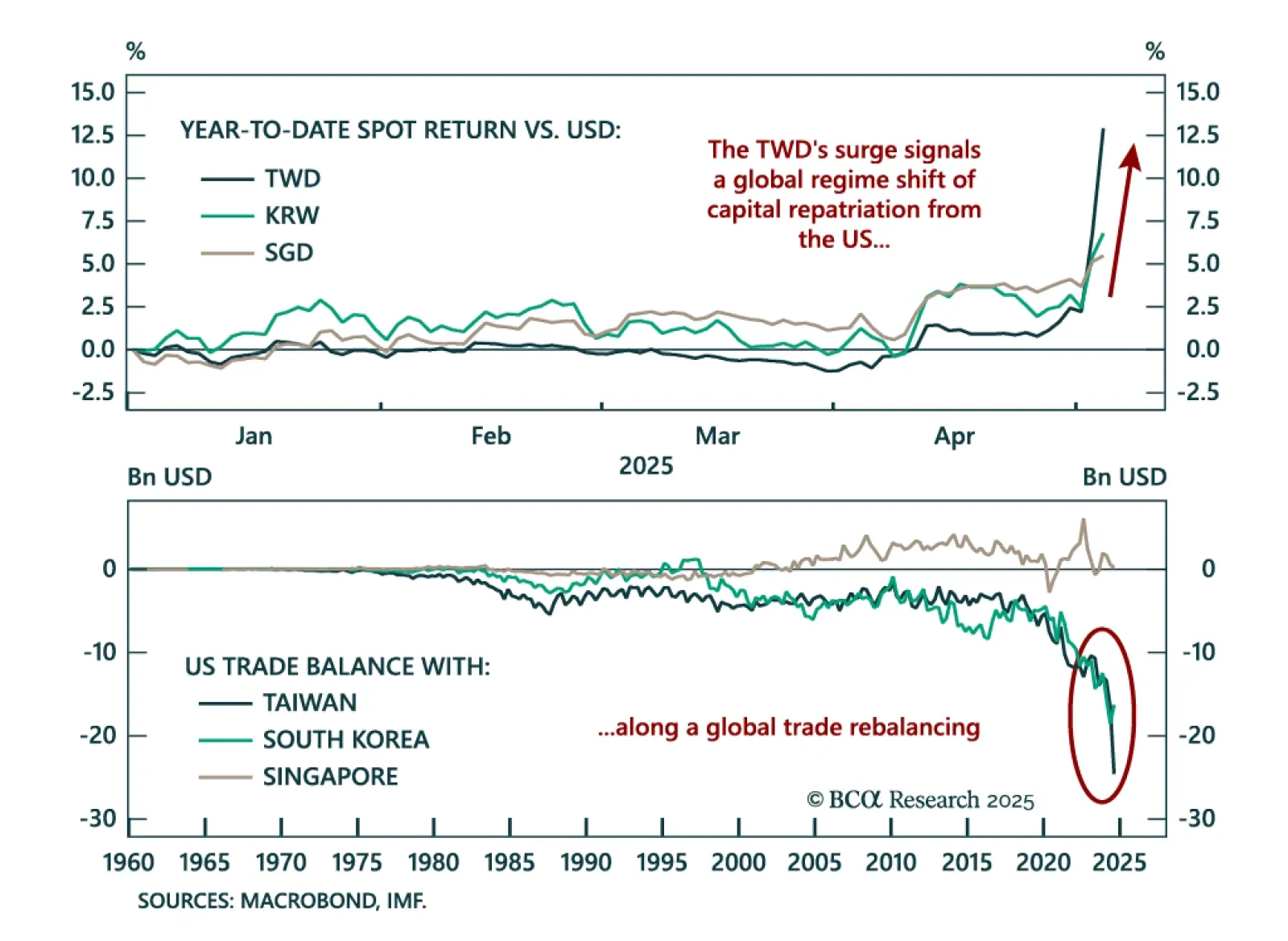

The TWD’s surge reflects a regime shift in global capital flows that supports EM Asia government bonds. Alongside other Asian currencies, the TWD has rallied sharply against the USD since late last week. While the first wave of…

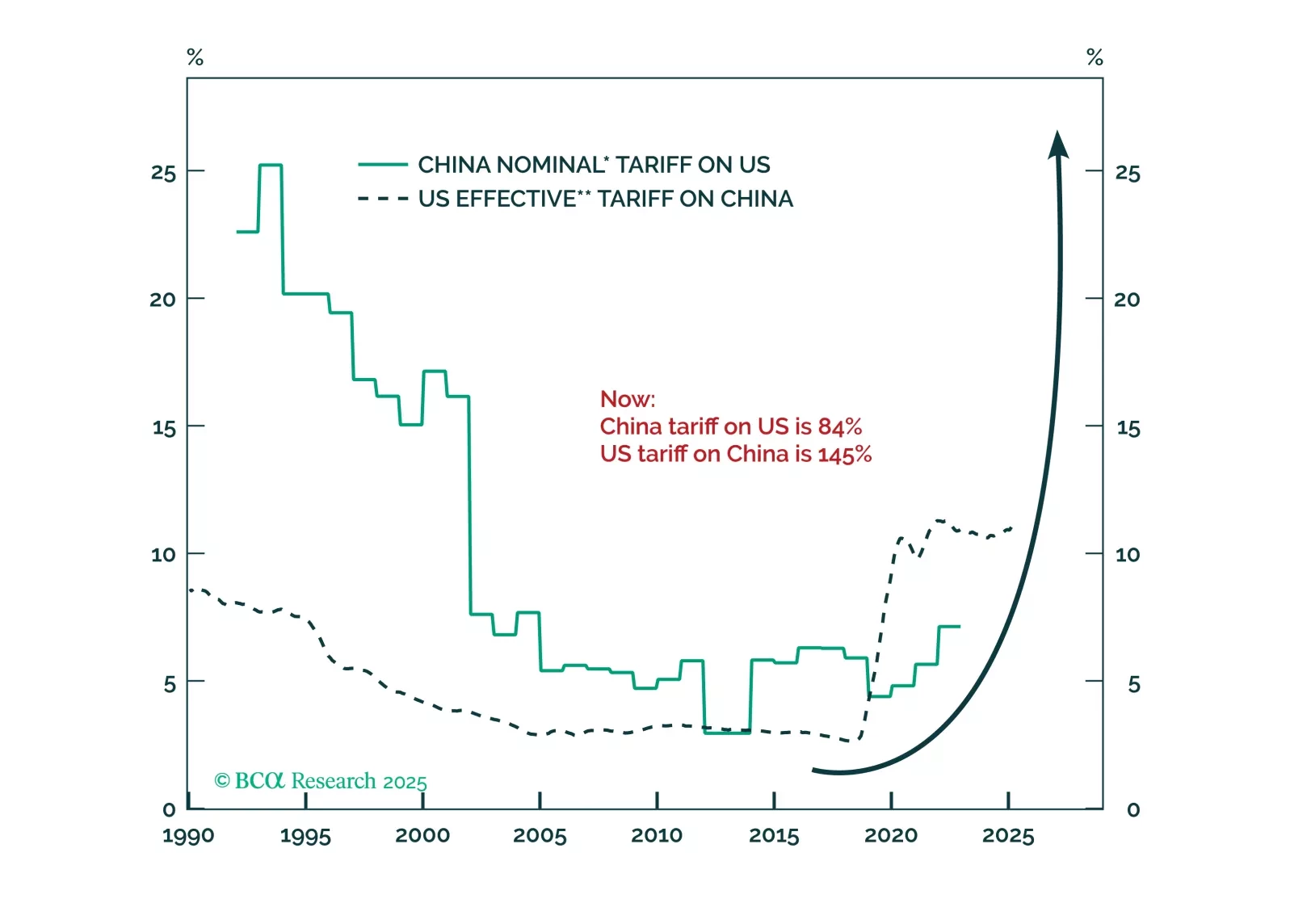

China’s aggressive retaliation against U.S. tariffs will enable President Trump to shift from punishing allies and redirect the trade war toward China. If Beijing does not react to the latest tariffs by doubling its fiscal stimulus,…