Dear Client, In addition to this short weekly report, you will also receive our 2020 outlook, published by the Bank Credit Analyst. Next week, I will be on the road visiting clients in South Africa. I hope to report my discussions and…

Highlights On a tactical horizon, underweight bonds versus cash, especially those bonds with deeply negative yields… …and underweight bonds versus equities. On a strategic horizon, remain overweight a 50:50 combination…

Highlights New structural recommendation: long GBP/USD. The substantial Brexit discount in the pound makes it a long-term buy for investors who can tolerate near-term volatility. The most powerful equity play on a fading Brexit…

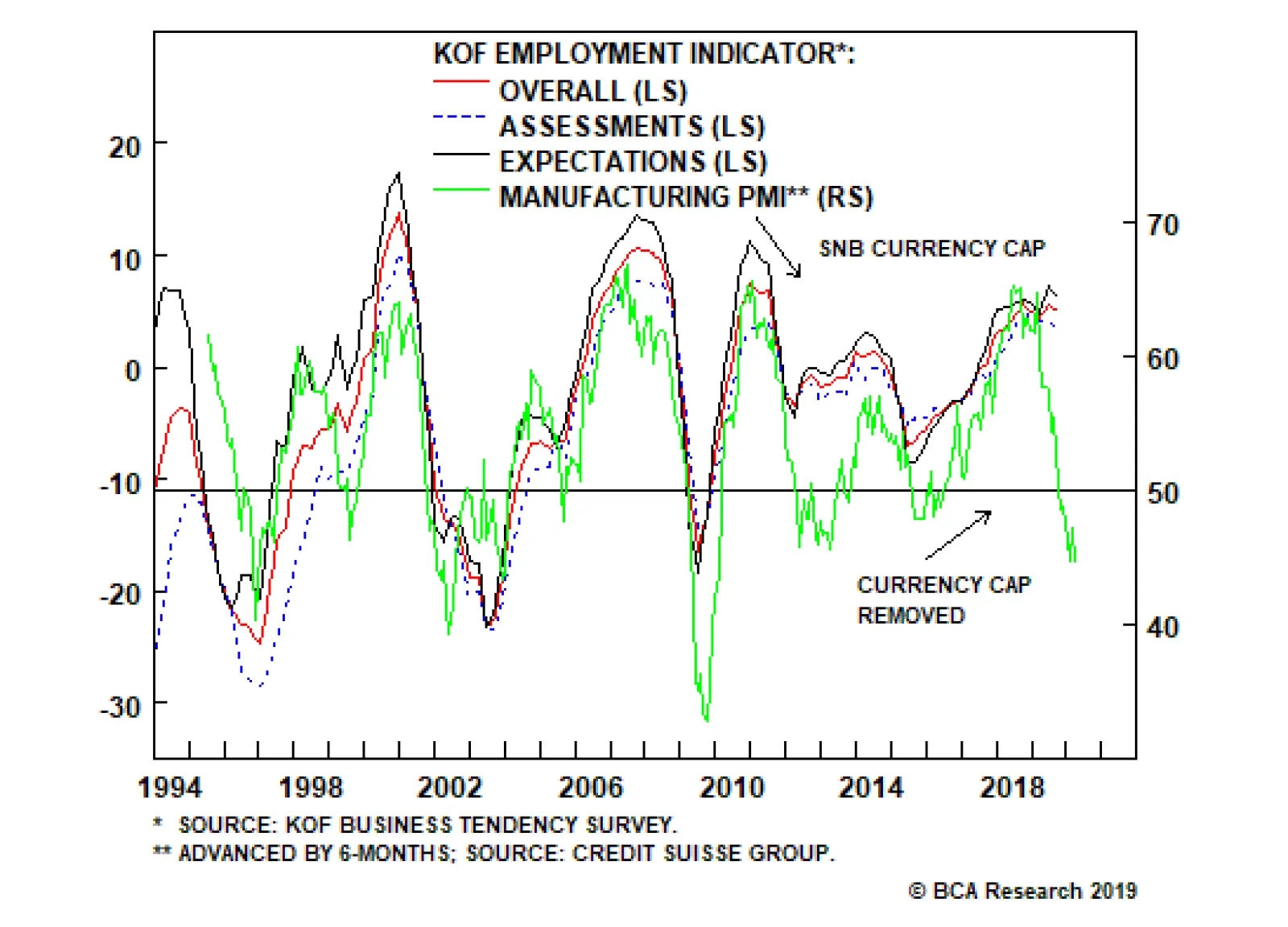

Domestically, the Swiss economy is holding up well, but how much longer will it defy a slowing external sector. The KOF employment indicator is at its highest level since 2010, and the expectations component continues to exceed…

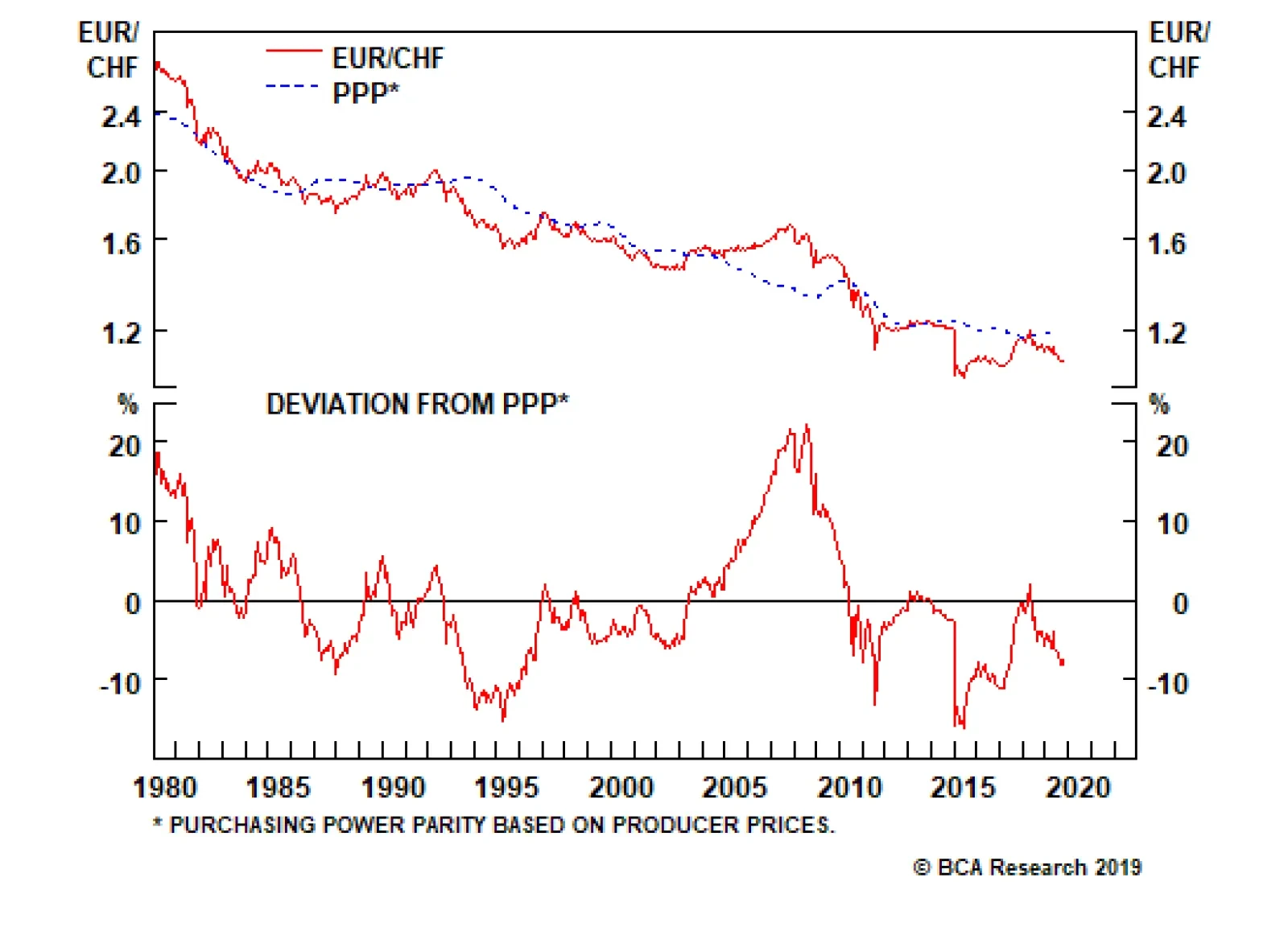

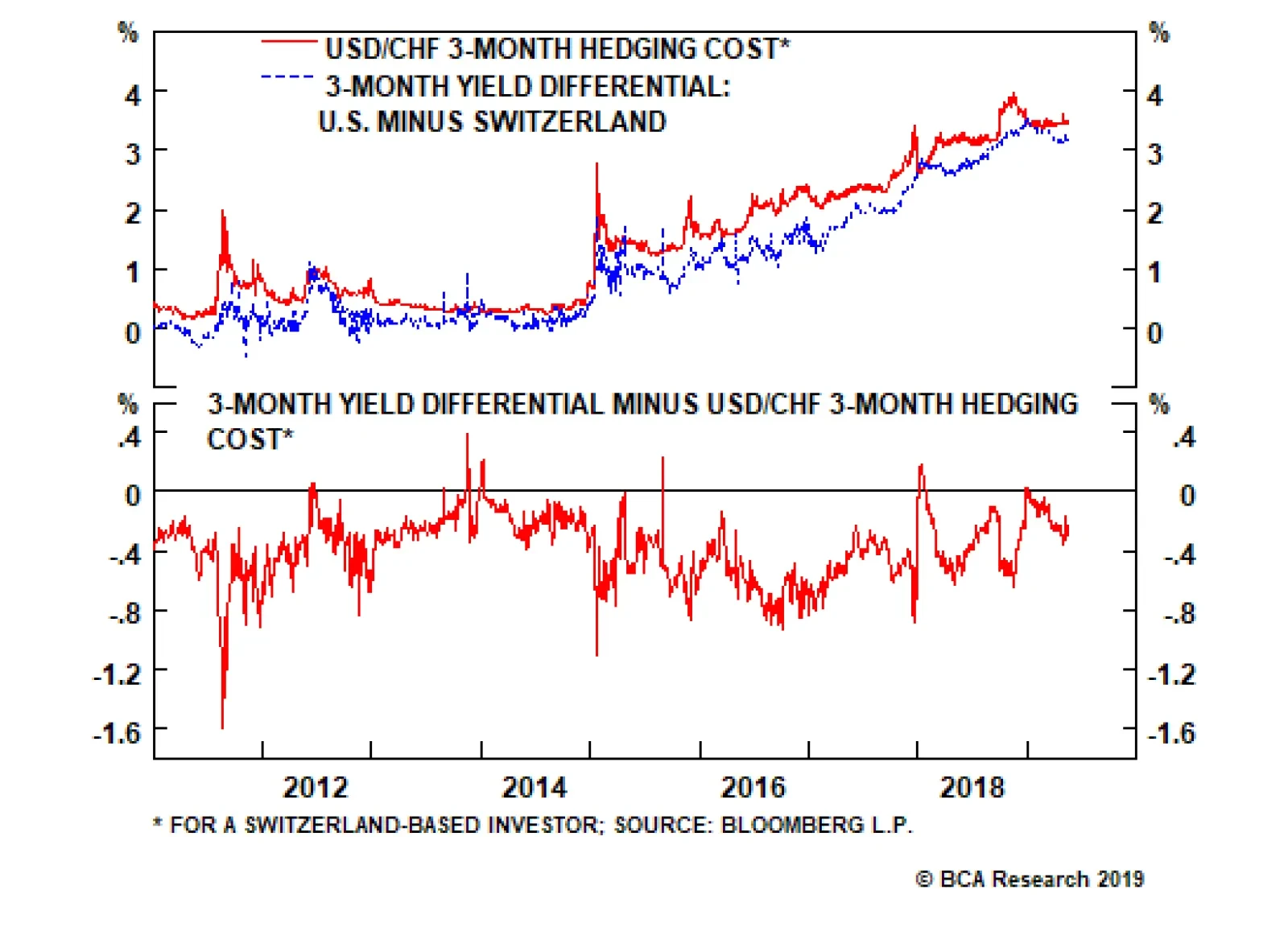

The four key factors that suggest the Swiss economy needs a weaker currency, especially versus the euro are: The Swiss trade balance has held up well in the face of the global slowdown, but this has been largely driven by…

Highlights The slowdown in the U.S. manufacturing sector is at risk of becoming deeper than elsewhere. This is not bearish for the U.S. dollar, given that it is a countercyclical currency, but it is not a constructive development,…

Switzerland ticks off all the characteristics of a safe-haven currency. Its large net international investment position of 125% of GDP generates huge income inflows. Meanwhile, rising productivity over the years has led to a…