Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

Highlights German bunds and Swiss bonds are no longer haven assets. The haven assets are the Swiss franc, Japanese yen, and US T-bonds. Gold is less effective as a haven asset. During this year’s coronavirus crash, the gold…

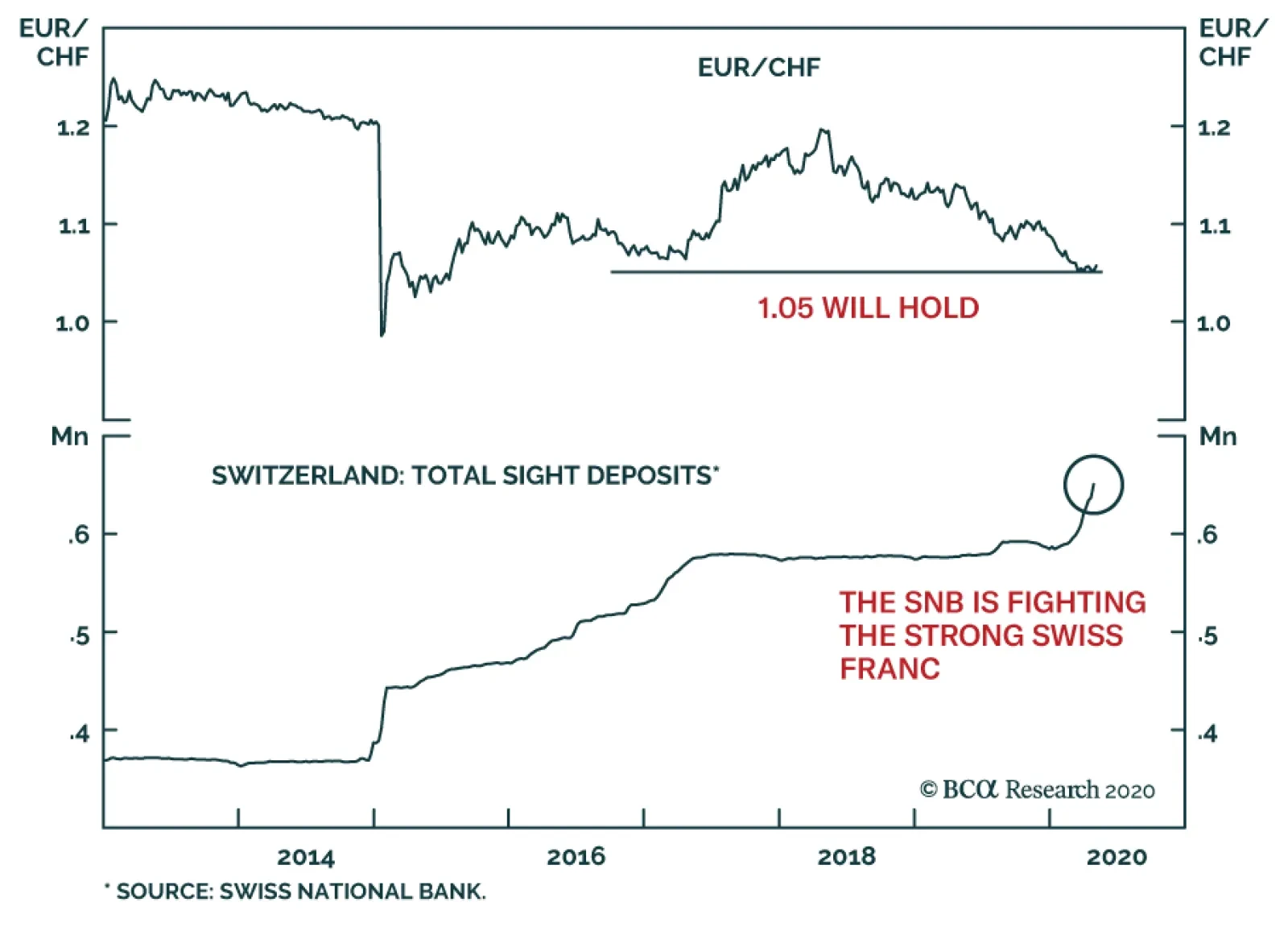

The Swiss National Bank has once again been pushed into a corner. The rise in economic stress and risk aversion caused by the COVID-19 shock has created a sea of inflows into Switzerland out of the euro area. As a result, the…

Highlights The pillars of dollar support continue to fall, but the missing catalyst is visibility on the trajectory of global growth. For now, we remain constructive on the DXY short term, but bearish longer term. Market internals…

On a happy personal note, I will be away on paternity leave for a short time, reacquainting myself with nappies. As such, there will be no Weekly Reports for the next two weeks, but you will receive two excellent Special Reports penned…

Highlights The breakout in the DXY indicates the investment universe could become precarious. The euro could fall to 1.04 on such an outcome. The yen and Swiss franc should outperform in this environment, barring recent weakness in…

Highlights Most central banks still consider economic risks asymmetrical to the downside. This means that even if global growth rebounds in earnest, policy is likely to stay pat over the next three to six months. The conclusion is…