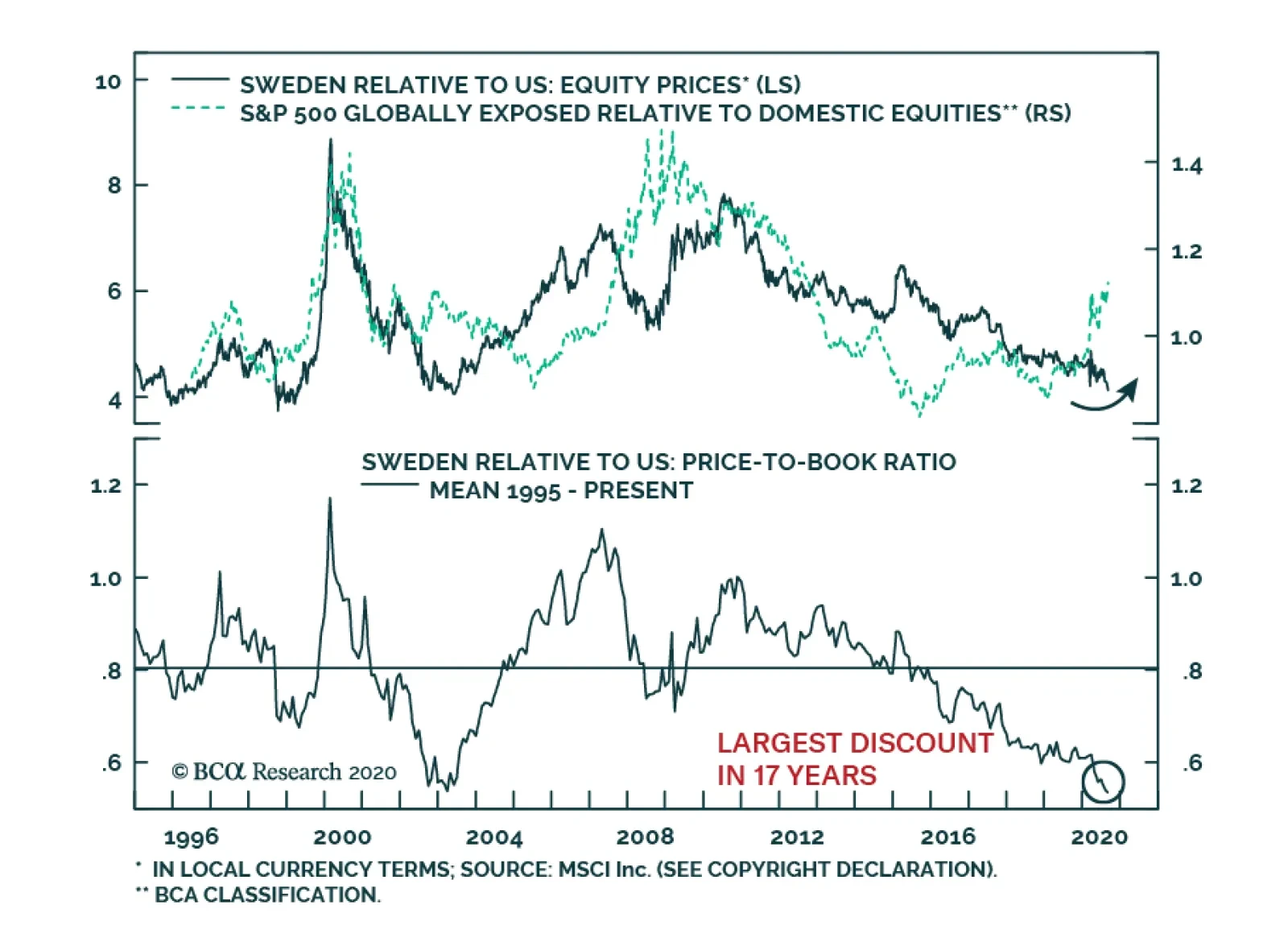

Over the coming 12 to 18 months, investors should overweight Swedish equities relative to US ones. Swedish equities overweight value stocks and cyclical sectors. This characteristic means that an acceleration in global…

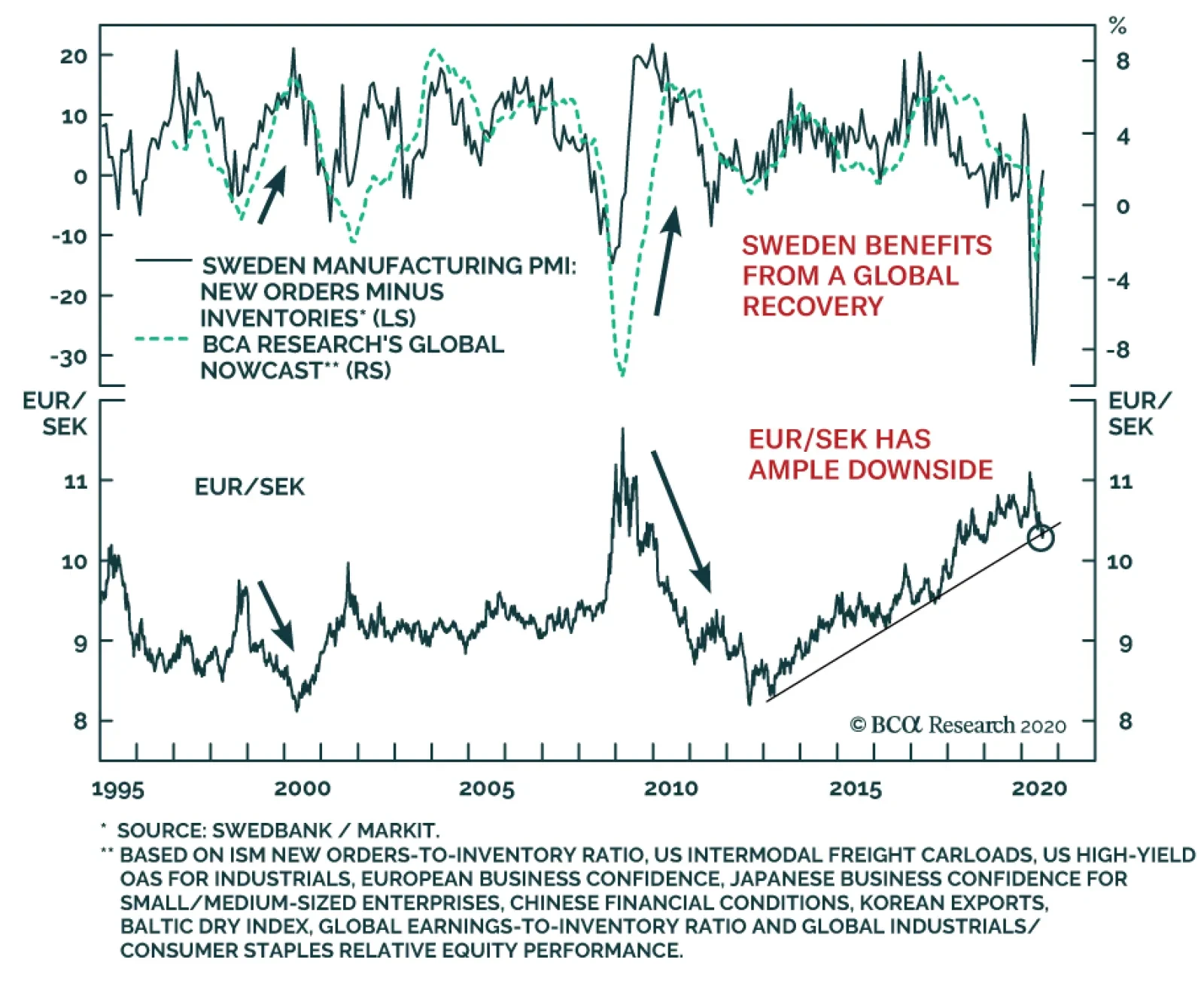

BCA Research's Foreign Exchange Strategy service estimates that Scandinavian currencies (NOK and SEK) are the best way to express its bearish dollar view over the coming 12 months. Both Norway and Sweden are well poised to…

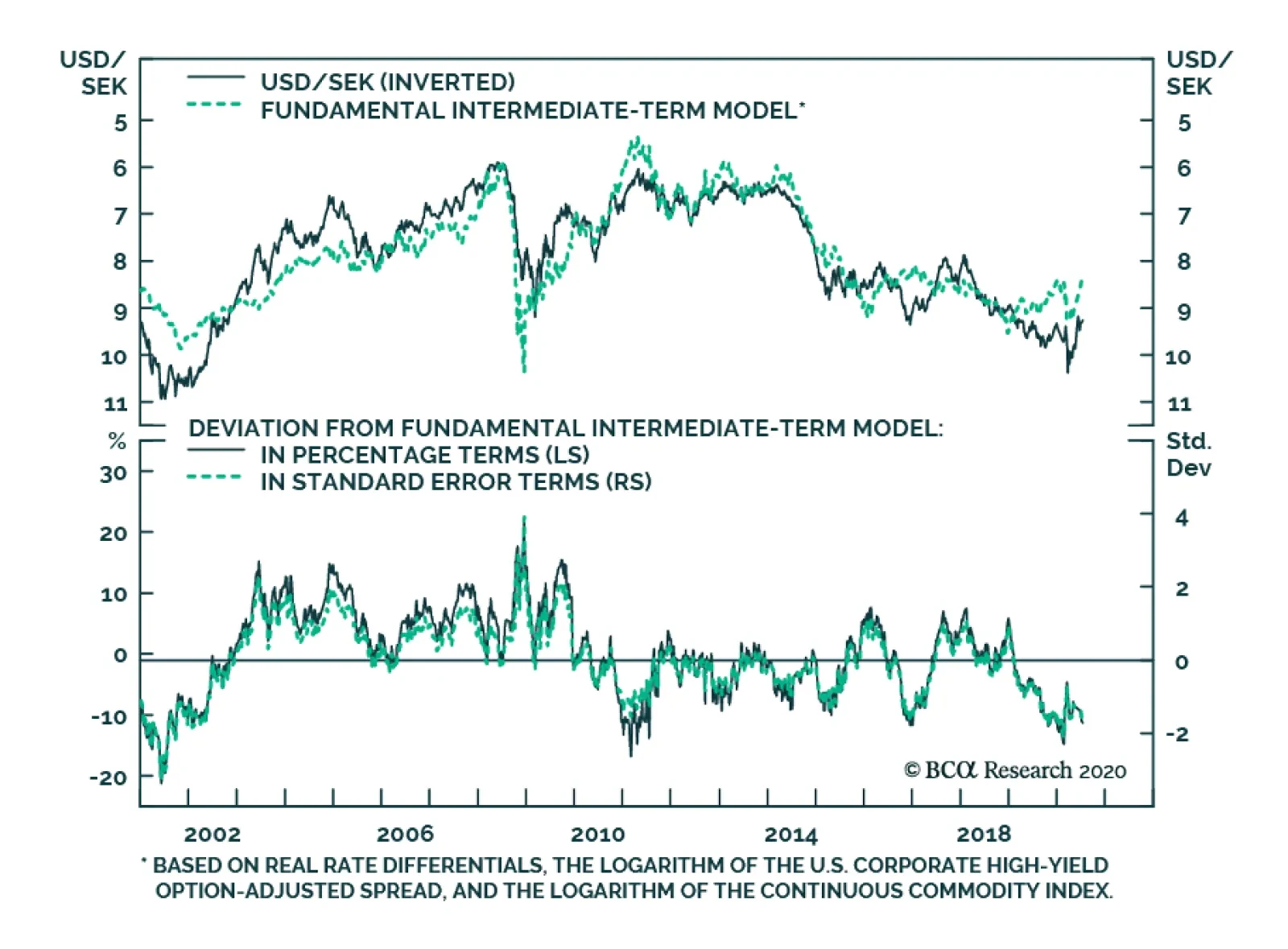

Highlights We remain bearish on the US dollar over the next 12 months. The best vehicle to express this view continues to be the Scandinavian currencies (NOK and SEK). Precious metals remain a buy so long as the dollar faces downside…

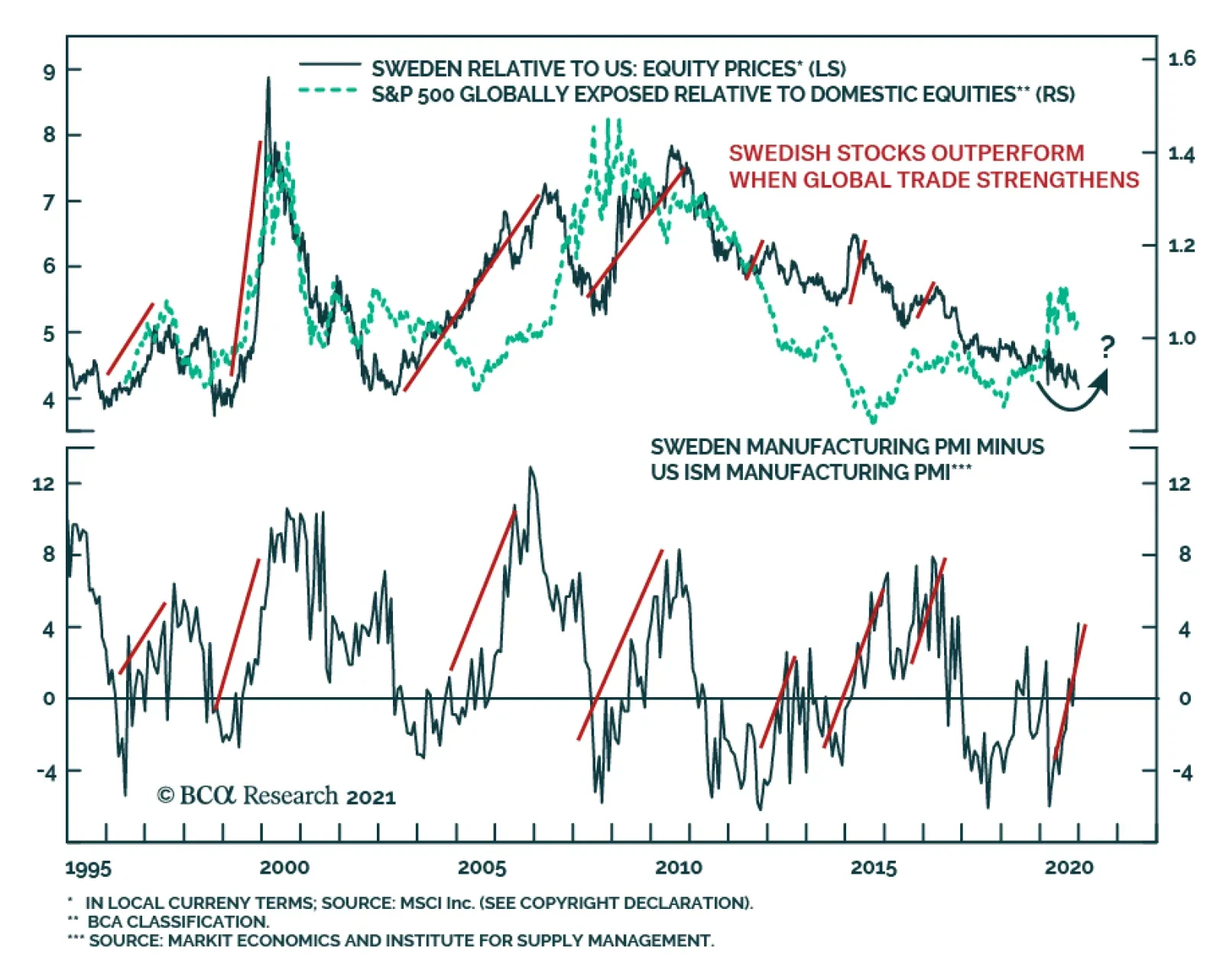

The 10-year underperformance of Swedish equities relative to US ones is advanced and the Swedish stock market should generate a strong outperformance over the coming years. Swedish equities are extremely pro-cyclical, and the…

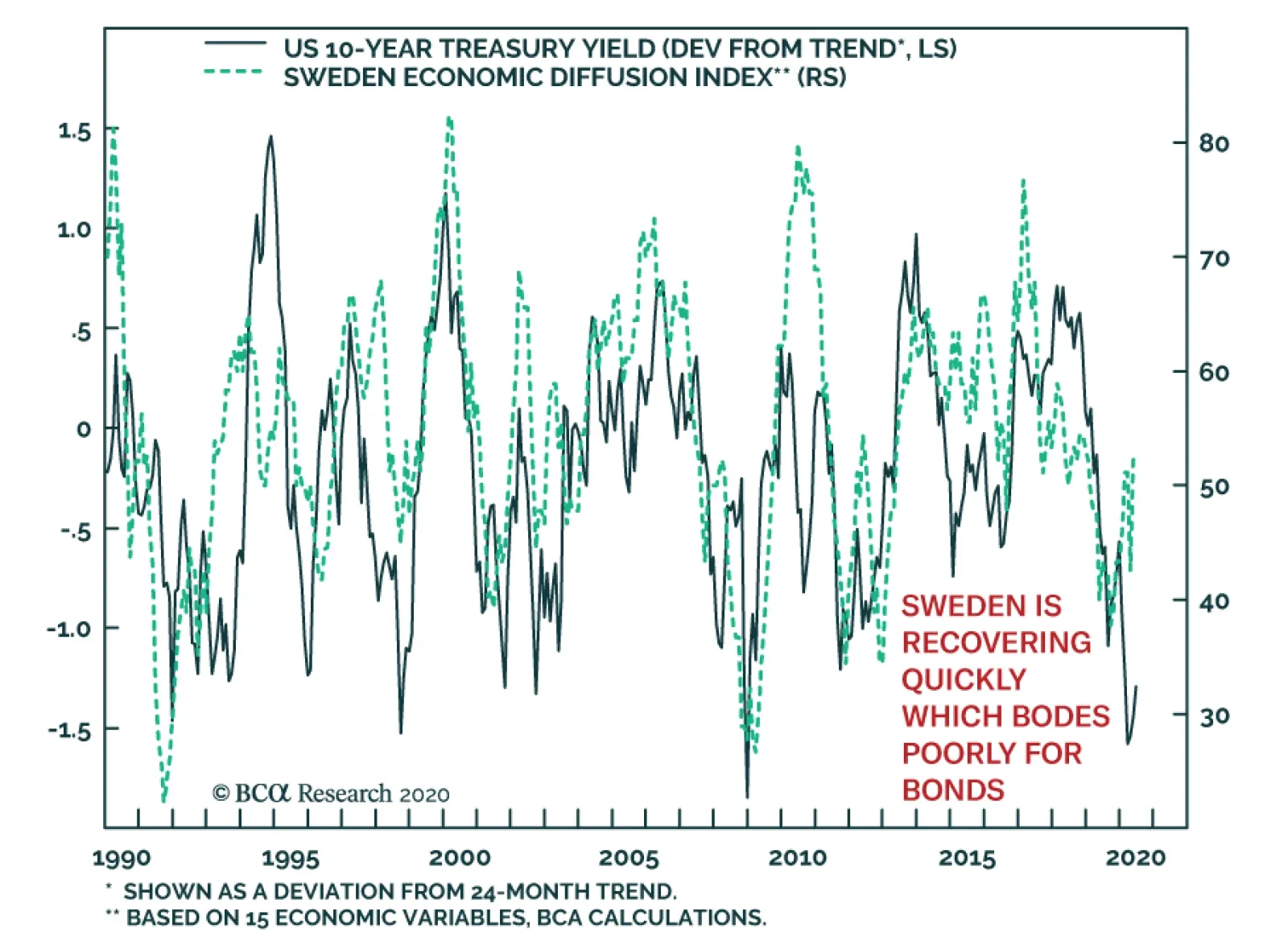

The Swedish Manufacturing PMI also continues its rebound, which is a direct consequence of the pick-up in the global PMI. Sweden possesses a small and very open economy where trade accounts for 90% of GDP. Moreover, Sweden…

BCA Research's Foreign Exchange Strategy service's intermediate-term model shows that the Swedish krona is now quite cheap. As such, it is one of their favorite longs. Meanwhile, since the Fed extended its USD swap lines…

Highlights Our intermediate-term timing models suggest the US dollar is broadly overvalued. We are maintaining a modest procyclical currency stance (long NOK, GBP and SEK), but also have a portfolio hedge (short USD/JPY). Go…

Highlights The economic performance of Sweden, which did not have a lockdown, has been almost as bad as Denmark, which did have a lockdown. This proves that the current recession is not ‘man-made’, it is ‘pandemic-…

Sweden’s strategy to deal with the COVID-19 crisis has been controversial. While many dispute its health implication, its impact on the Swedish economy has been positive. Despite the profound pro-cyclicality of Sweden…