As expected, Sweden’s central bank maintained a dovish tone and kept policy unchanged following its meeting on Tuesday. The Riksbank acknowledged that Swedish inflation surprised to the upside relative to its July forecast. As…

Highlights The dollar is fighting a tug of war between two diverging forces: an economic slowdown around the world but plunging real interest rates in the US. The litmus test for determining which force will gain the upper hand is if…

The Swedish retail sales are growing smartly. After a 0.4% contraction in April, they expanded 2.3% in May and annual growth accelerated from 7% to 10.3%. House prices are rising at a double digit pace, which historically leads…

Highlights Important leading indicators of Eurozone activity point to record growth in the coming quarters. Progress on the vaccination front, global pent-up demand, and easing fiscal policy will fuel the Euro Area recovery. Consensus…

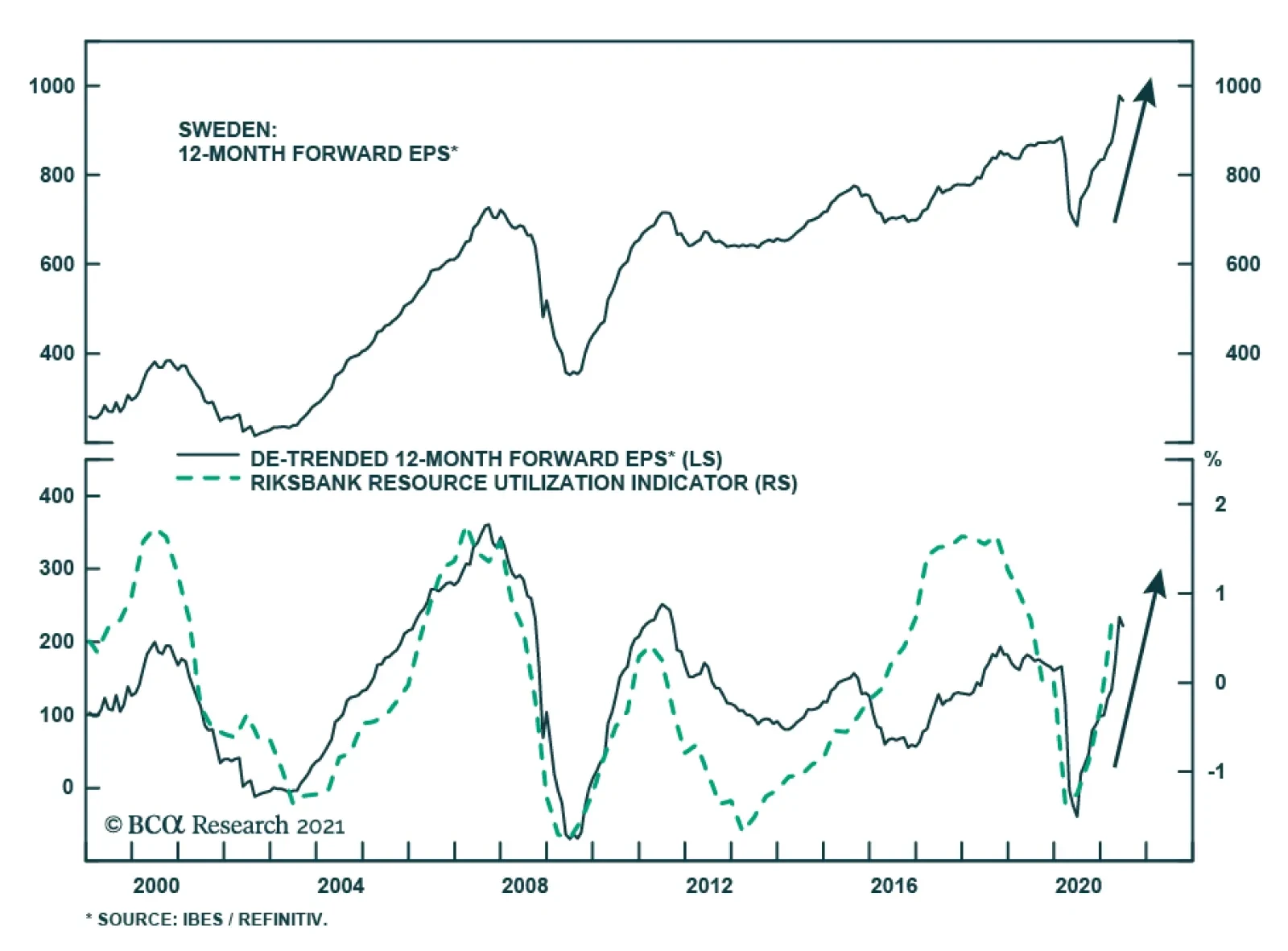

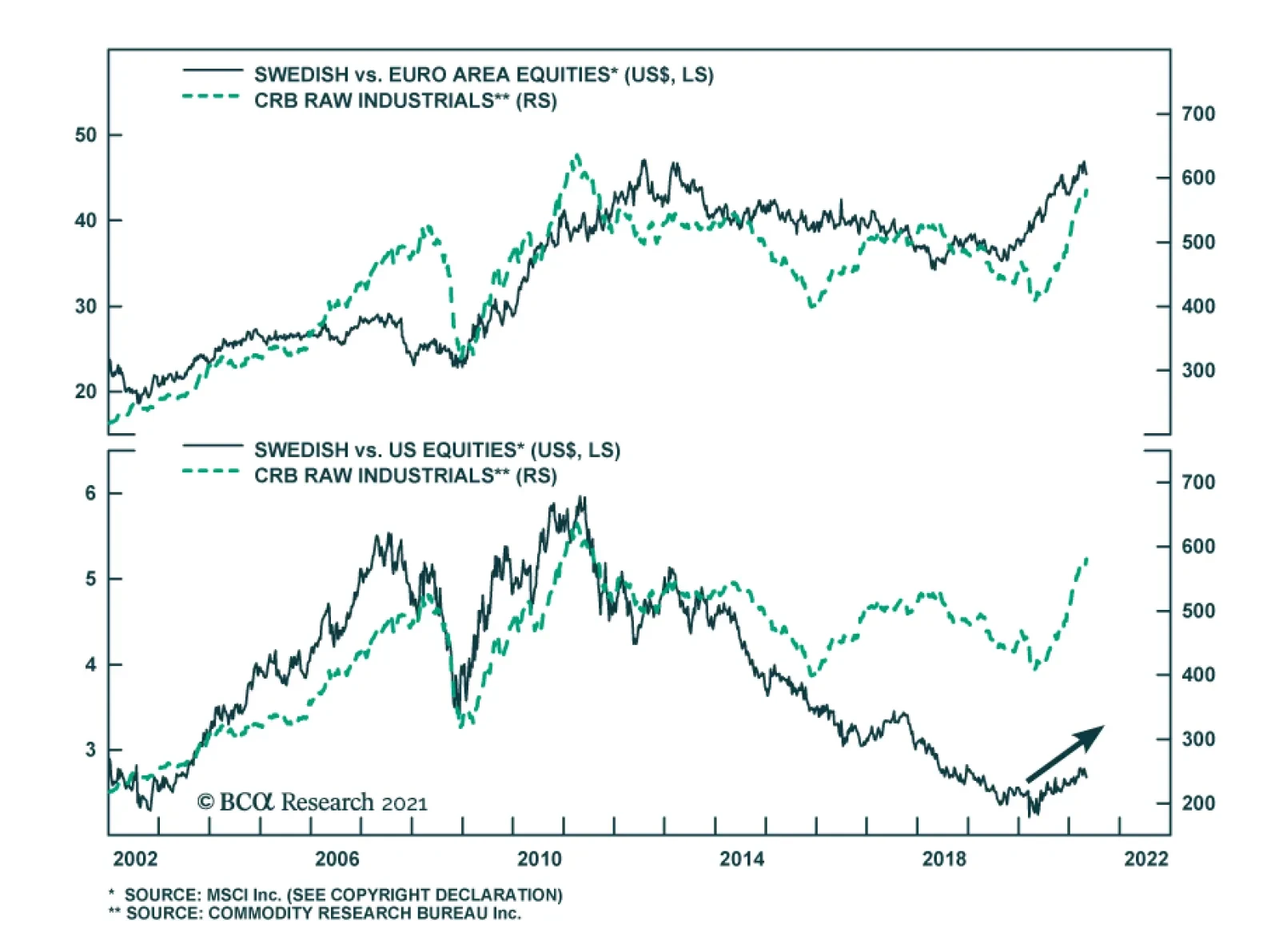

BCA Research’s European Investment Strategy service concludes that Swedish stocks possess significantly more upside against both Eurozone and US equities over the remainder of the cycle. The industrial sector is a…

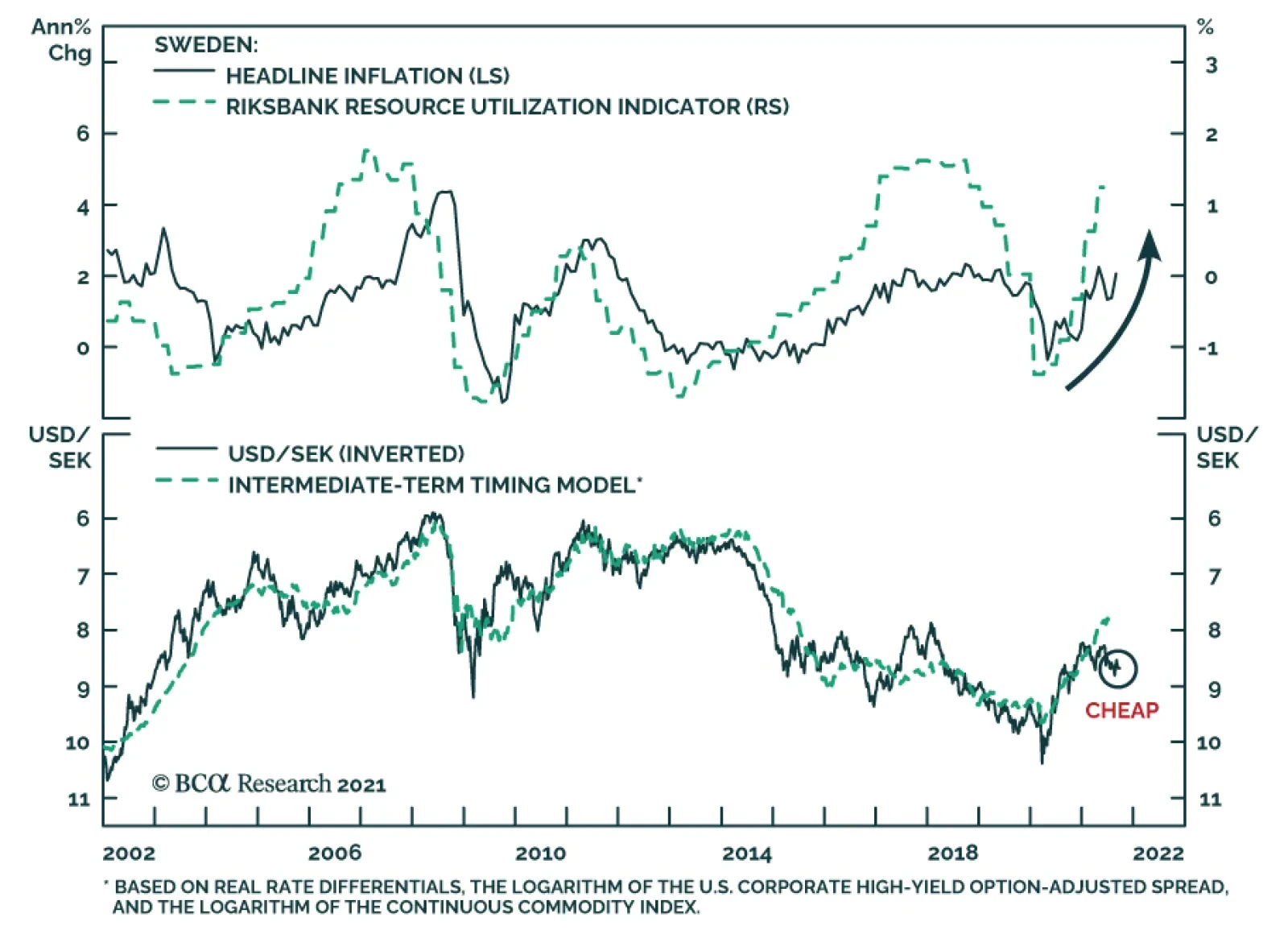

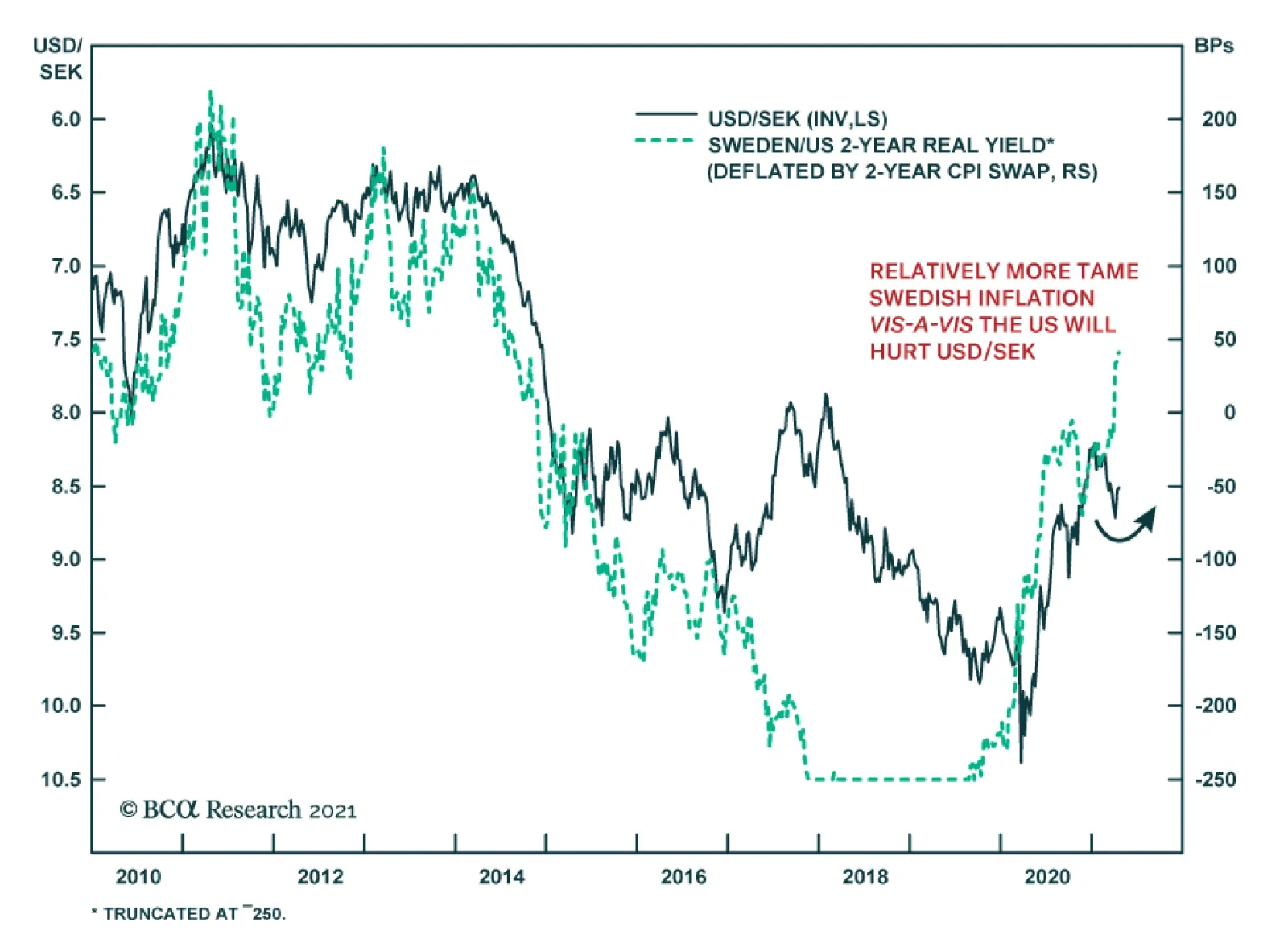

Highlights Sweden’s economic recovery is robust and will deepen. Policy is accommodative. Very few advanced economies will benefit as much from the global economic rebound. The labor market will tighten, capacity utilization…

Swedish inflation accelerated in March, beating expectations of a more muted pick up. The CPIF measure favored by the Riksbank came in at 1.9% y/y, higher than the 1.5% reading in February and just shy of the central bank’s…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…