Executive Summary Macron Still Favored, But Le Pen Cannot Be Ruled Out Macron is still favored to win the French election but Le Pen’s odds are 45%. Le Pen would halt France’s neoliberal structural reforms,…

Executive Summary The Dollar Has Broken Above Overhead Resistance Most central banks continue to dial up their hawkish rhetoric, led by the Fed. This is putting upward pressure on the dollar (Feature Chart). The big…

Executive Summary Ebbing Stagflation Fear Will Prompt Rerating European inflation will rise further before peaking this summer. Core CPI will reach between 2.8% and 3.2% by year-end before receding. The combination of…

Dear client, In addition to this weekly report, we sent you a Special Report from our Geopolitical Strategy service, highlighting the risk from the Russo-Ukrainian conflict. Kind regards, Chester Executive Summary The Ukraine…

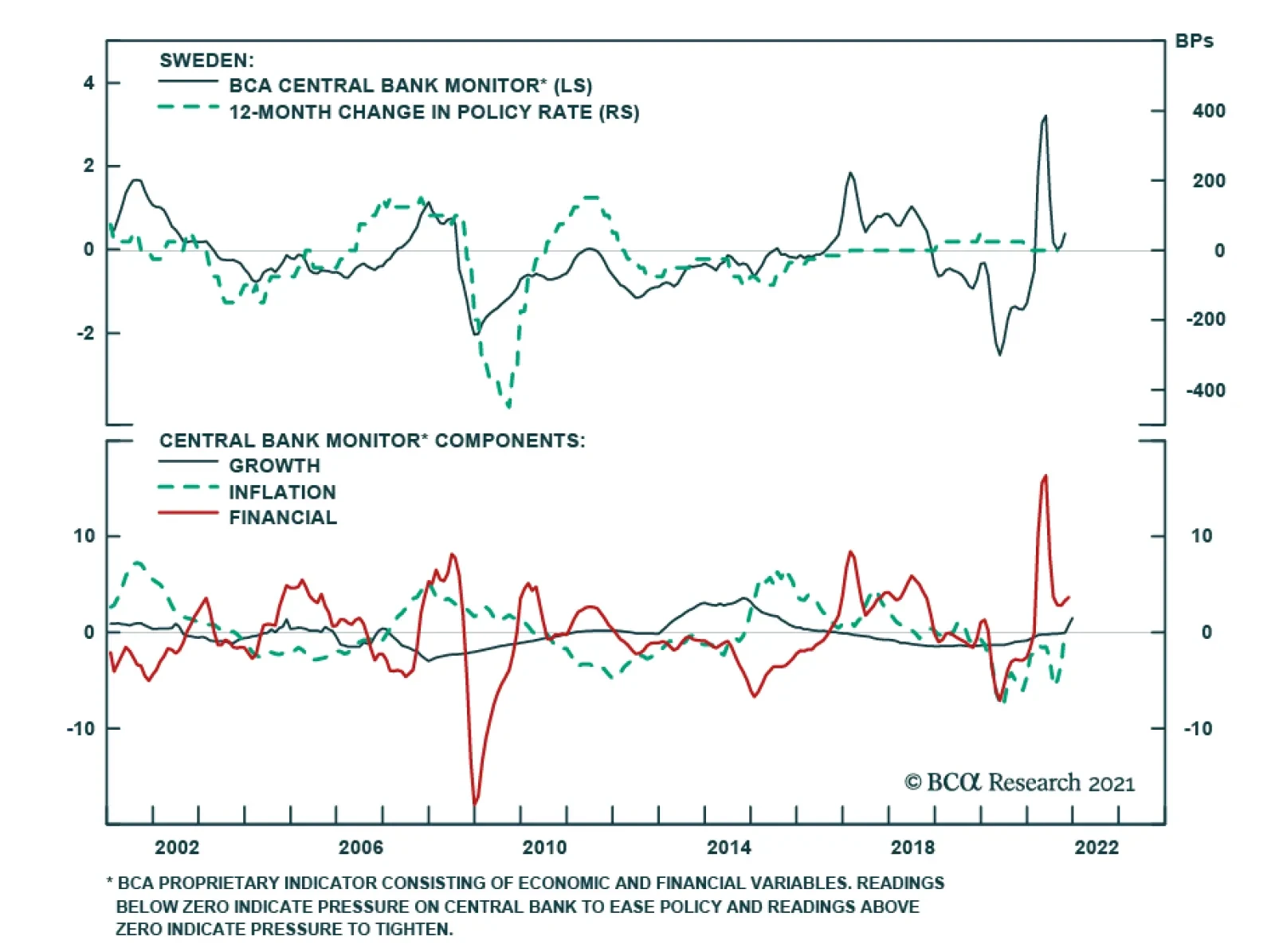

BCA Research’s European Investment Strategy & Global Fixed Income Strategy services conclude that Swedish sovereign debt is not an attractive underweight candidate in global government bond portfolios. Their Riksbank…

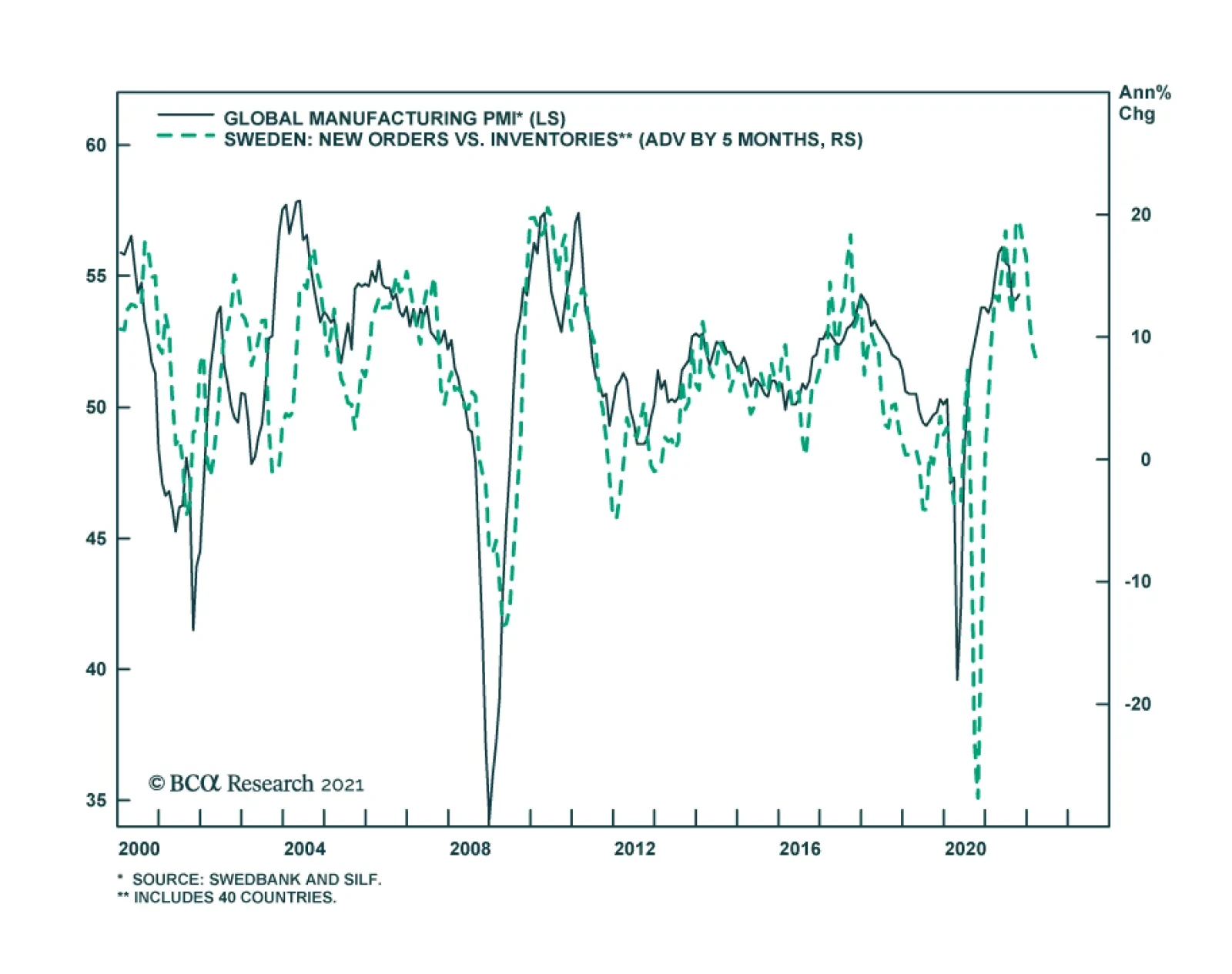

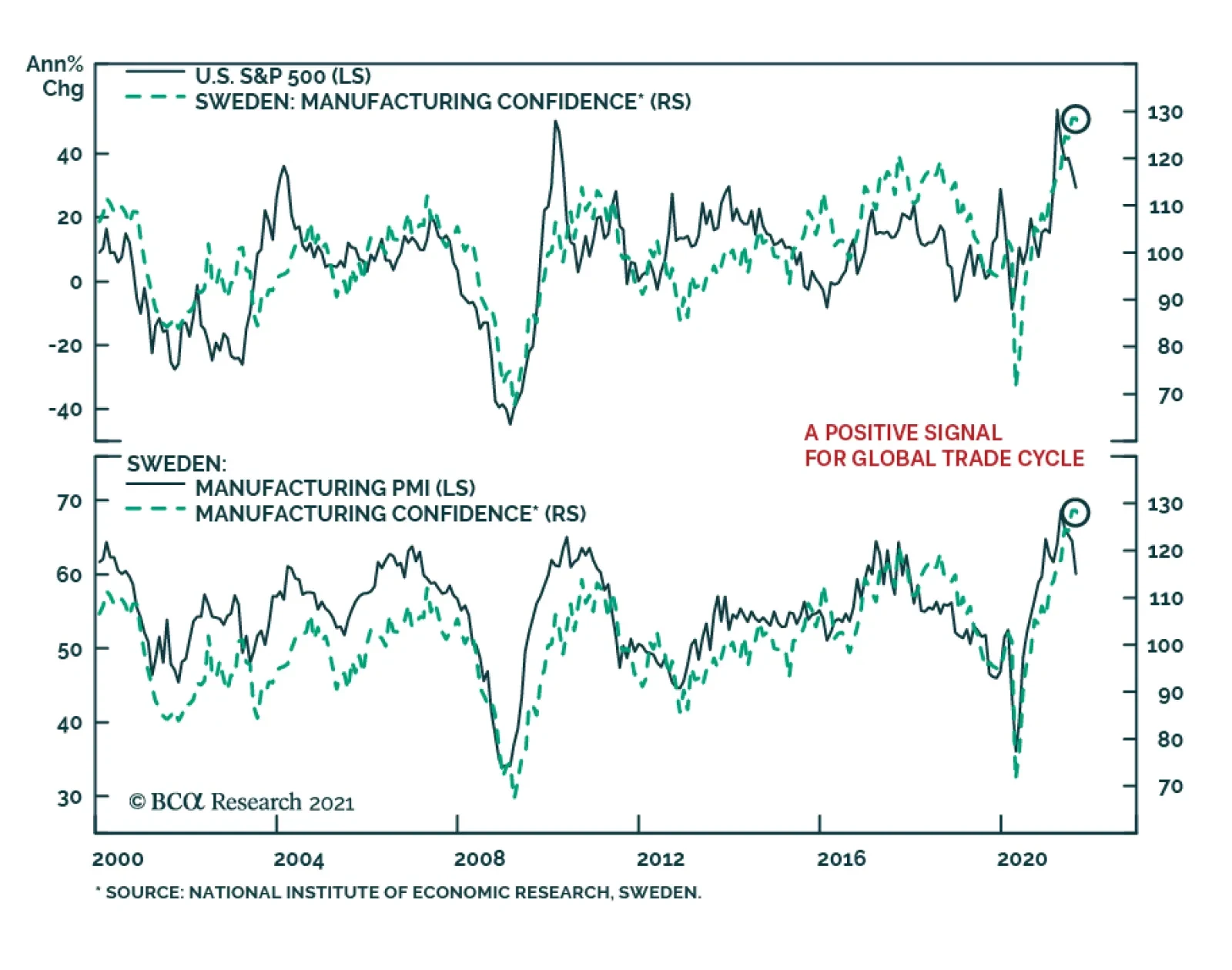

The Swedish new-orders-to-inventories ratio is a leading indicator of the global manufacturing cycle. Sweden is a small open economy that is very sensitive to global growth dynamics. Moreover, Swedish exports are weighted towards…

Results from Sweden’s September Economic Tendency survey were a minor disappointment. The headline indicator slipped 0.7 points to 119.9. The confidence indicators for both the manufacturing industry and consumer declined…

Highlights Monetary Policy: Last week’s numerous central bank meetings across the world confirmed that the overall direction for global monetary policy is shifting in a more hawkish direction. The main reason: growing fears that…

Highlights The Evergrande crisis is not China’s Lehman moment. Nonetheless, Chinese construction activity will decelerate further in response to this shock. Global equities are frothy enough that a weaker-than-expected Chinese…