The Global Manufacturing PMI remained unchanged at 48.7 in July, indicating that the pace of decline steadied at the start of the third quarter. The details of the release show accelerating rates of decline in production, new…

The DXY will continue to have near-term upside, as economic growth holds up in the US, while it deteriorates in other parts of the world. Remain constructive on the DXY at current levels, but pivot to a short position on evidence US…

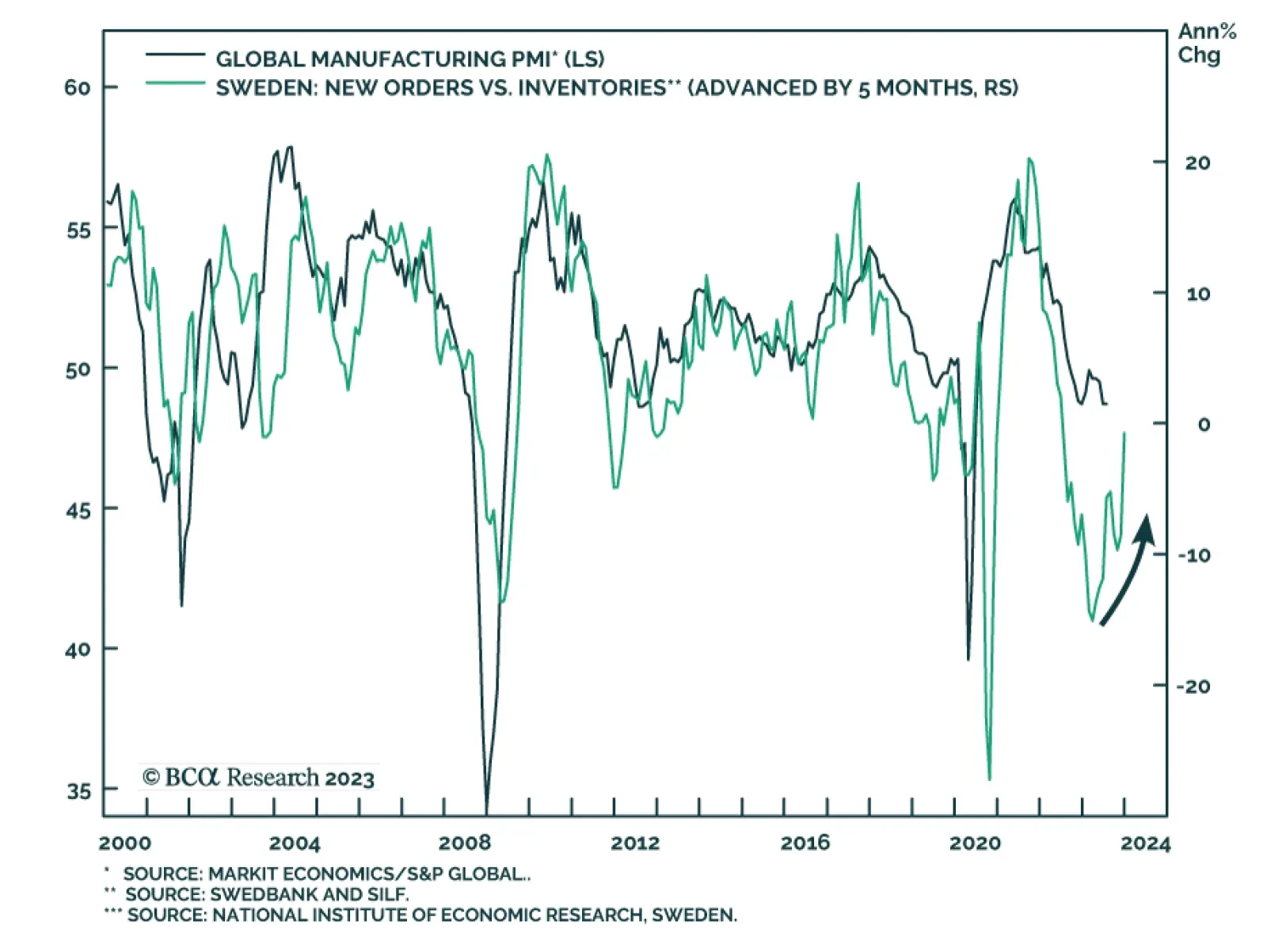

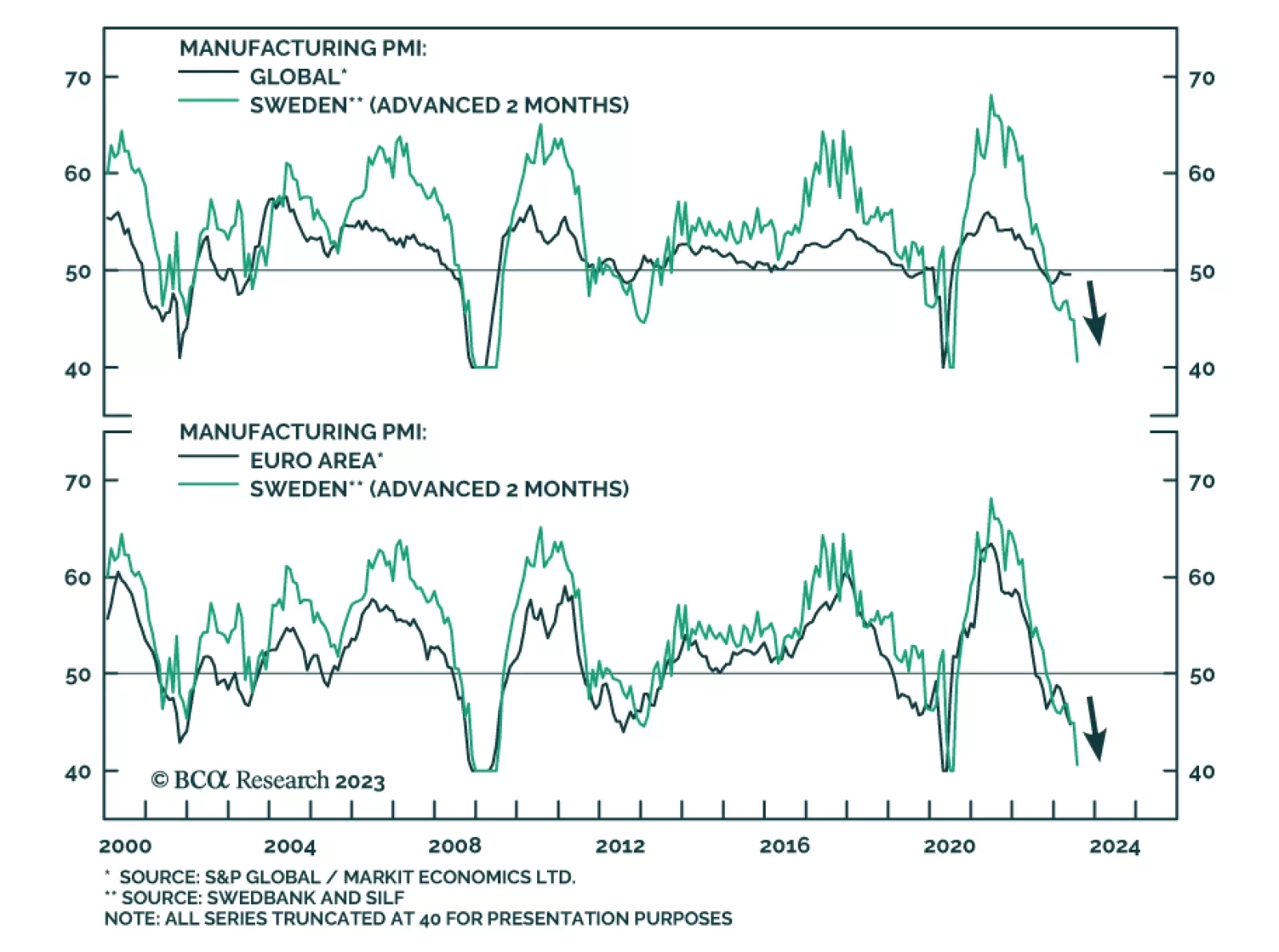

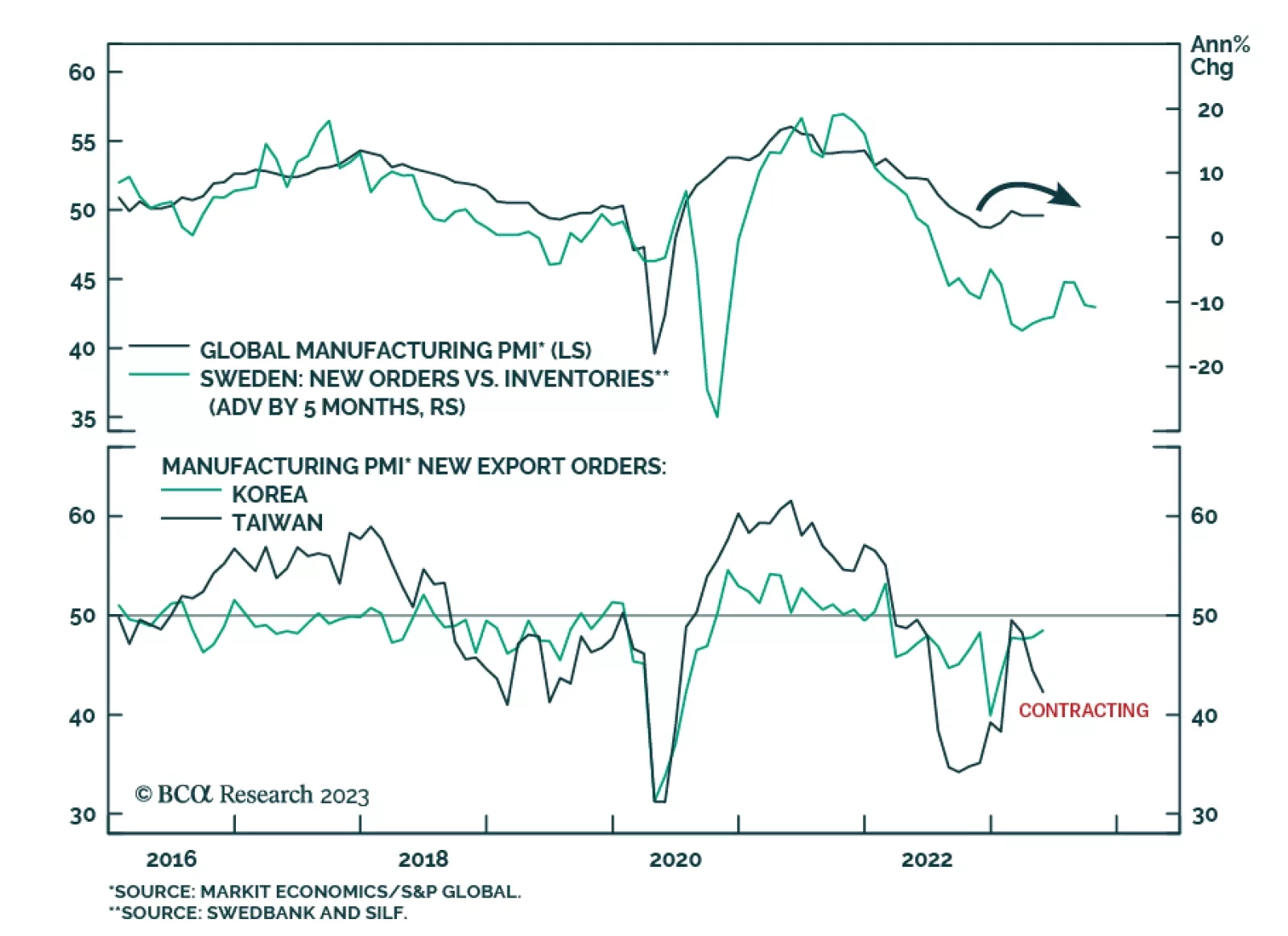

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…

The Global Manufacturing PMI was unchanged at 49.6 in May – below the 50 boom-bust line for the ninth consecutive month. The details of the release were mixed. On the one hand, the Production sub-component rose to an 11-…

In this Month-In-Review report, we go over the latest G10 data releases and rank currencies’ fundamental standing based on our updated macroeconomic model.

Our Central Bank Monitors support the recent shift in tone from central bankers in Europe. Find out what it means for European fixed-income portfolio allocation.

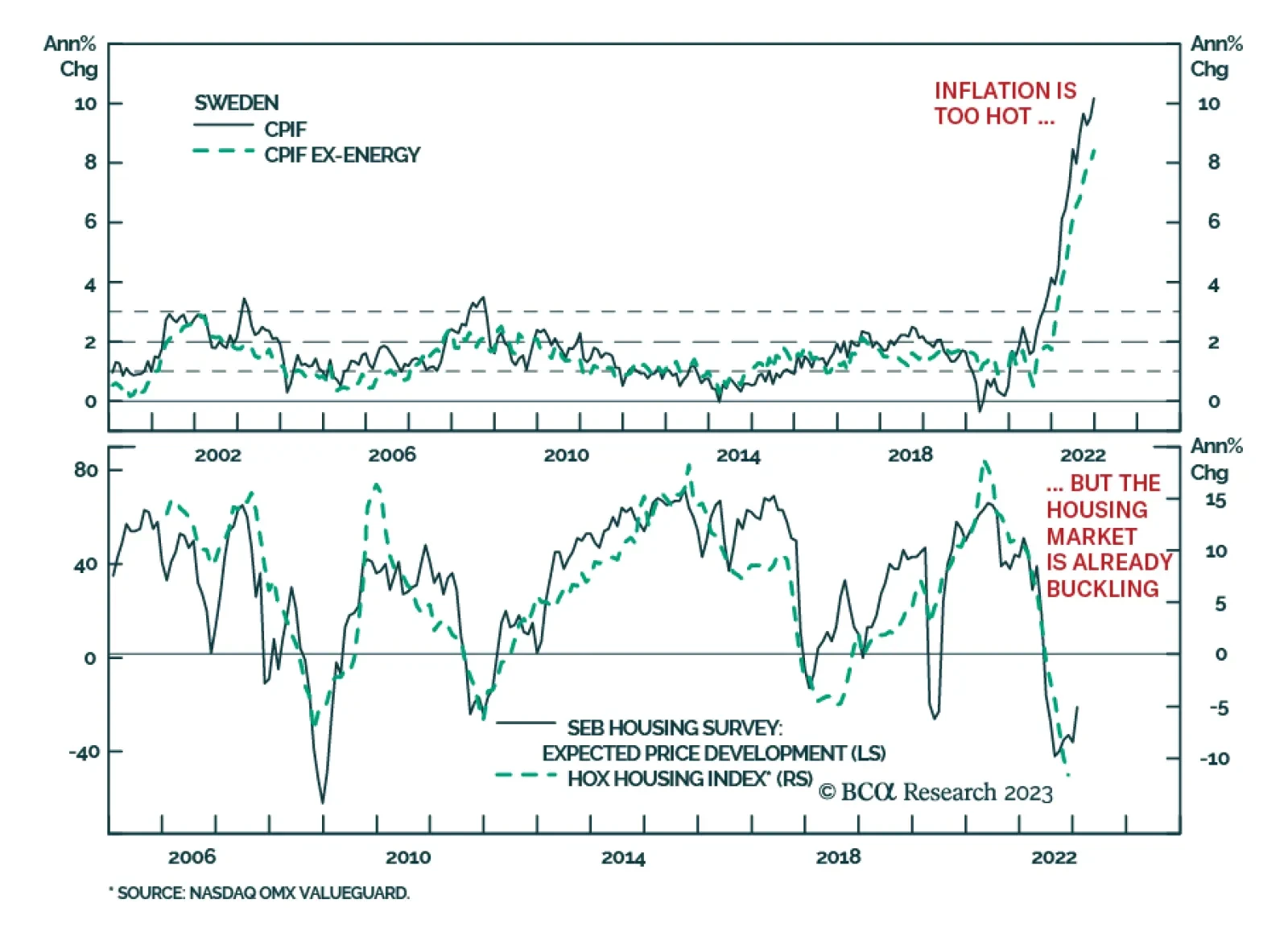

As expected, Sweden’s Riksbank delivered a 50 bp rate hike at its meeting on Thursday, bringing the policy rate to 3.0%. and signaled that further hikes are likely. Moreover, it announced that beginning in April it will…

European inflation will decline through 2023, which will greatly help households and consumption. But can European inflation remain low after that?