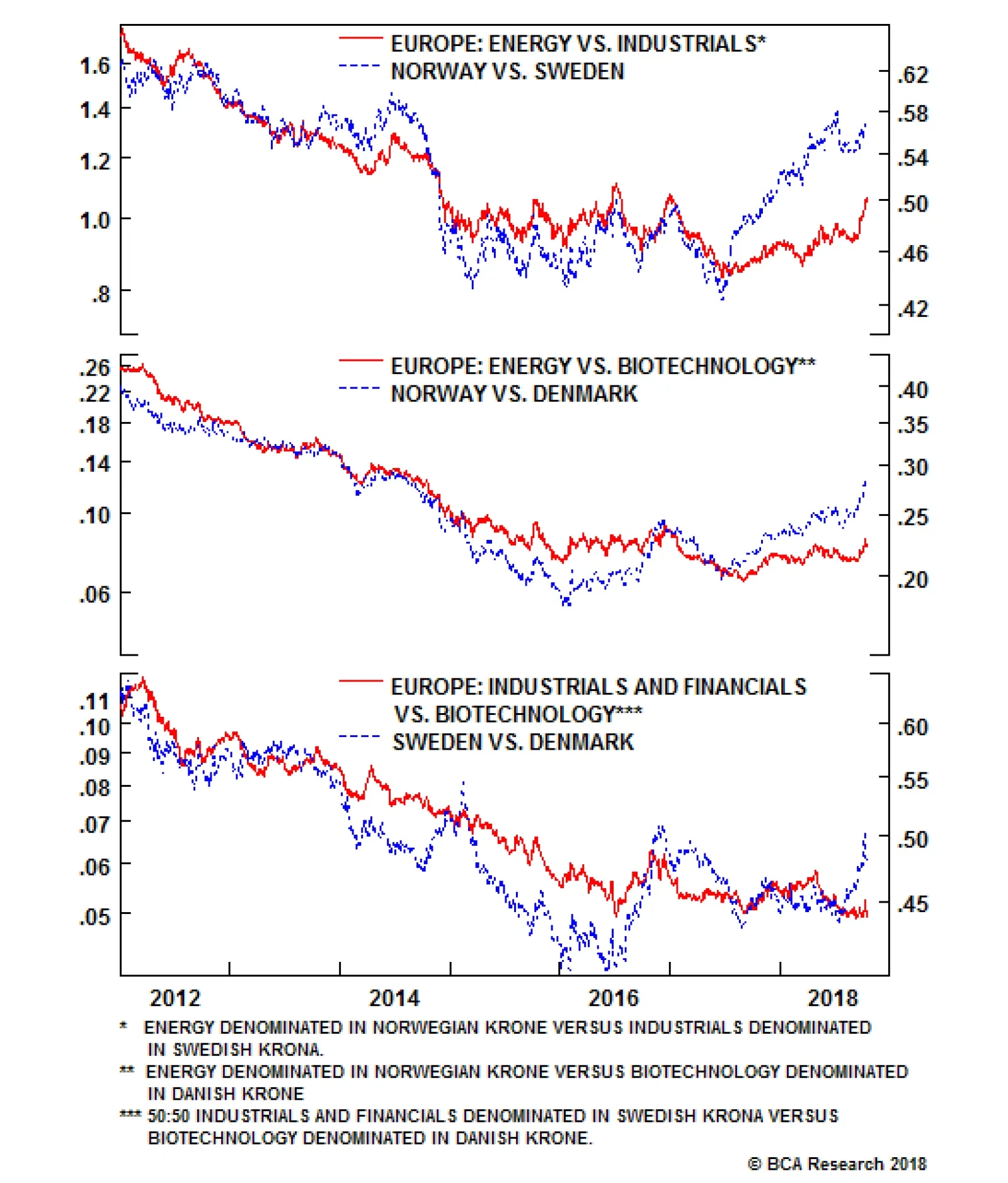

Looking at these three bourses, each has a defining dominant sector (or sectors) whose market weighting swamps all others. In Norway, oil and gas accounts for over 40 percent of the market; in Sweden, industrials accounts for 30…

Highlights The long term direction for the pound is higher... ...but as the EU withdrawal bill passes through the U.K. parliament, expect a very hairy ride. The stock markets in Norway, Sweden and Denmark are driven by energy,…

Highlights The U.S. dollar is likely to correct further over the coming weeks. The CAD should benefit as it is cheap and oversold, and the inflationary back-drop warrants tighter monetary conditions. This will be a bear market rally,…

Highlights German real estate and real estate equities remain a worthwhile multi-year position, especially in relative terms. The dominant stocks are Vonovia, Deutsche Wohnen, LEG, and GSW. Swedish real estate and real estate equities…

Highlights The real culprit for the mushrooming U.S./euro area trade imbalance is the ECB, and specifically its post-2014 experiment with ultra-loose monetary policy. There could be a major sea-change in ECB policy after November 2019…

Highlights Global Inflation has upside on a cyclical basis, but this narrative is well known and investors have already placed their bets accordingly, buying inflation protection in a wide swath of markets. However, global growth has…

Highlights The following four investment themes are likely to play out over the next couple of years: The yield shortfall on German long-dated bunds versus the equivalent U.S. T-bonds and U.K. gilts will narrow, one way or the other…

Highlights In this Weekly Report, we review all of the individual trades in our Tactical Overlay portfolio. These are positions that are intended to complement our strategic Model Bond Portfolio, typically with shorter holding periods…