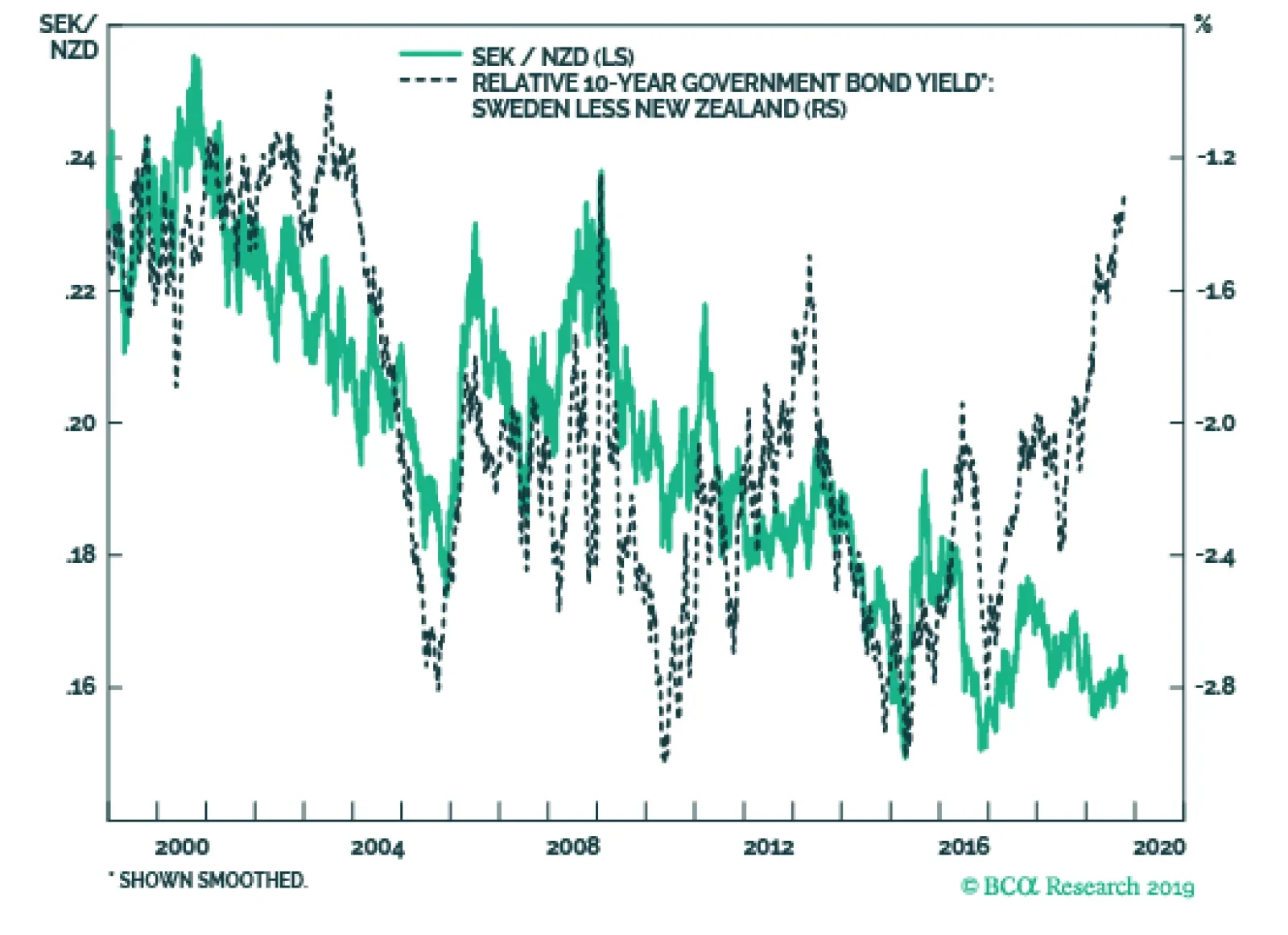

Selling NZD/SEK is the optimal vehicle to play any Swedish krona rebound. USD/SEK and NZD/SEK are often highly correlated; since the SEK has a higher beta to global growth than the kiwi (Sweden exports 45% of its GDP versus 27%…

Highlights The currency market is bifurcated in terms of shorter-term expectations versus longer-term factors. The Swedish krona, Norwegian krone, and British pound are solid long-term buys, but could remain very volatile in the short…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating a growing need to ease global monetary policy (Chart of the Week).…

Highlights Currency markets continue to fight a tug-of-war between deteriorating global growth and easing global financial conditions. Such an environment is typically fertile ground for a dollar bull market, yet the trade-weighted…

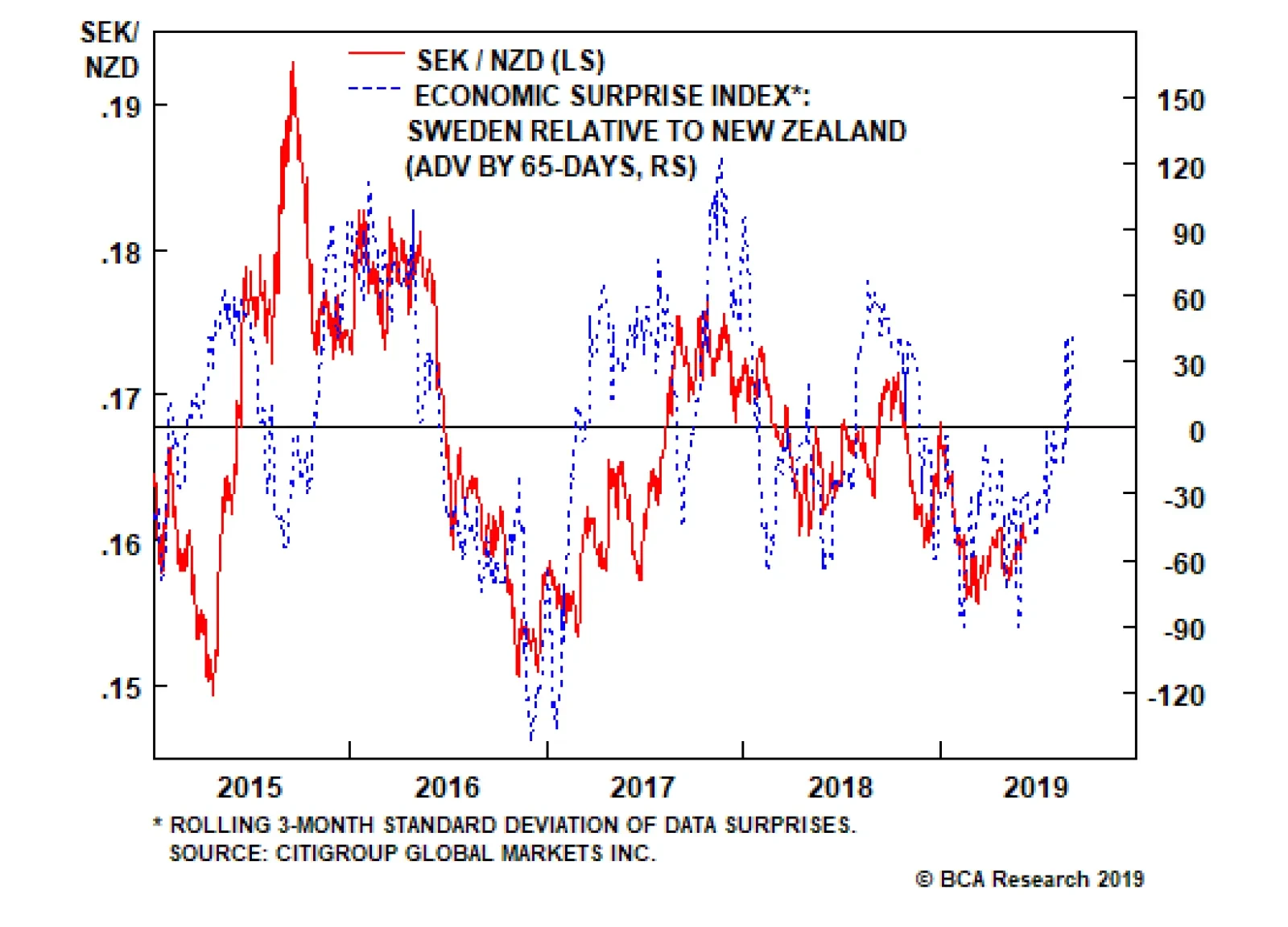

Since 2015, the cross has been trading into the apex of a tight wedge formation, defined by higher lows and lower highs. From a technical standpoint, the break above the 50-day moving average is bullish, suggesting the cross…

Highlights It remains too early to put on fresh pro-cyclical trades, but the Federal Reserve’s dovish shift is a positive development at the margin. As the market fights a tug of war between weak fundamentals and easier monetary…

Highlights U.S.: The Fed remains decidedly neutral, despite market expectations (and White House pressure) for lower U.S. interest rates. Treasury yields are mispriced and should grind higher over the next 6-12 months, led first by…

Highlights Recent data suggest central bankers remain behind the curve in boosting inflation expectations. Ergo, expect a dovish bias to persist over the next few months. Our thesis remains that global growth is in a volatile…