Highlights The elevated uncertainty about global growth stemming from the COVID-19 virus in China has not only made investors more anxious, but central bankers as well. This means that, only six weeks into the year, policymakers may…

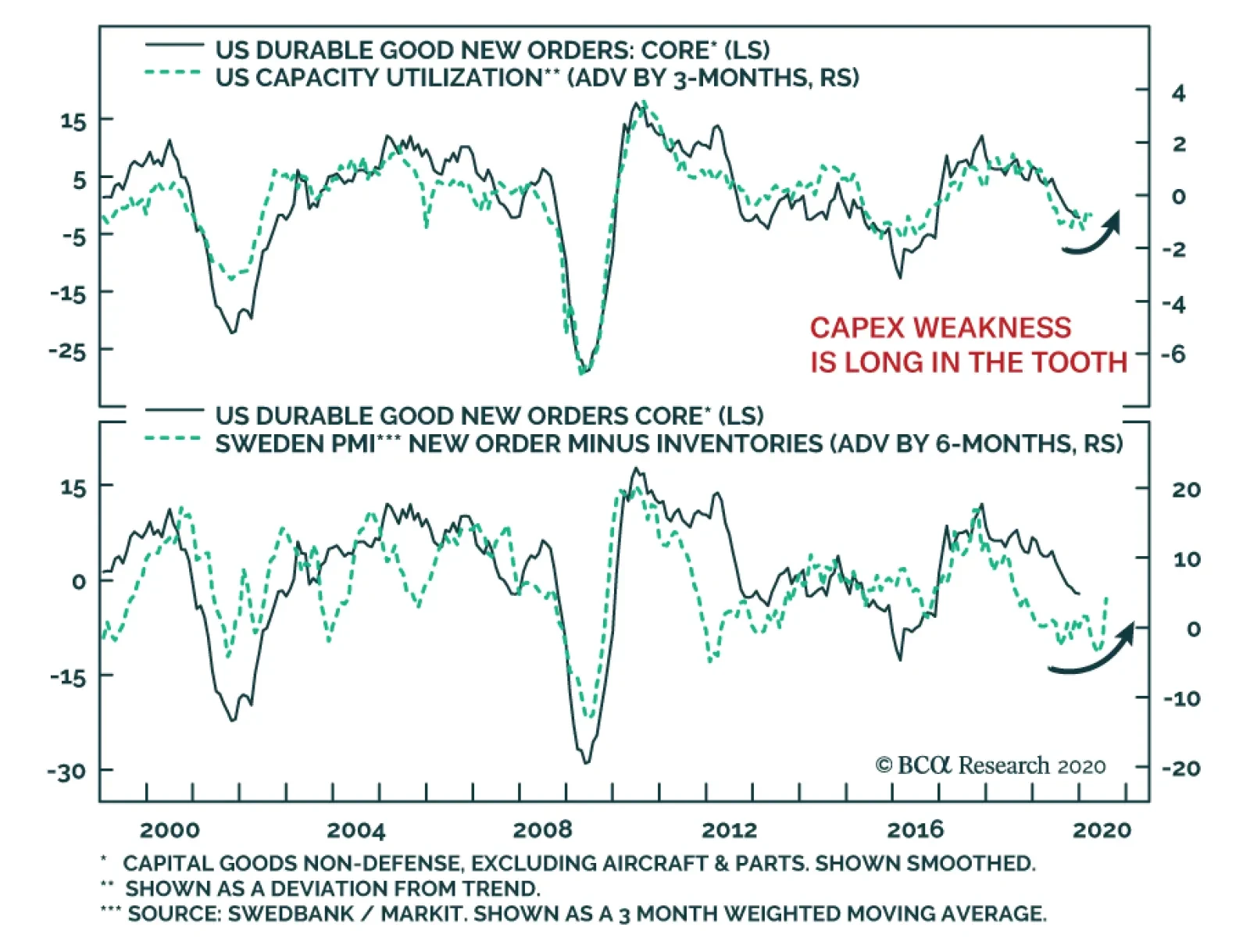

US core capital goods new orders, which excluding defense and aircraft & parts, have been weak, which suggests that the capex deterioration is intact. However, signs are accumulating that this decline is long in the tooth…

Highlights Most central banks still consider economic risks asymmetrical to the downside. This means that even if global growth rebounds in earnest, policy is likely to stay pat over the next three to six months. The conclusion is…

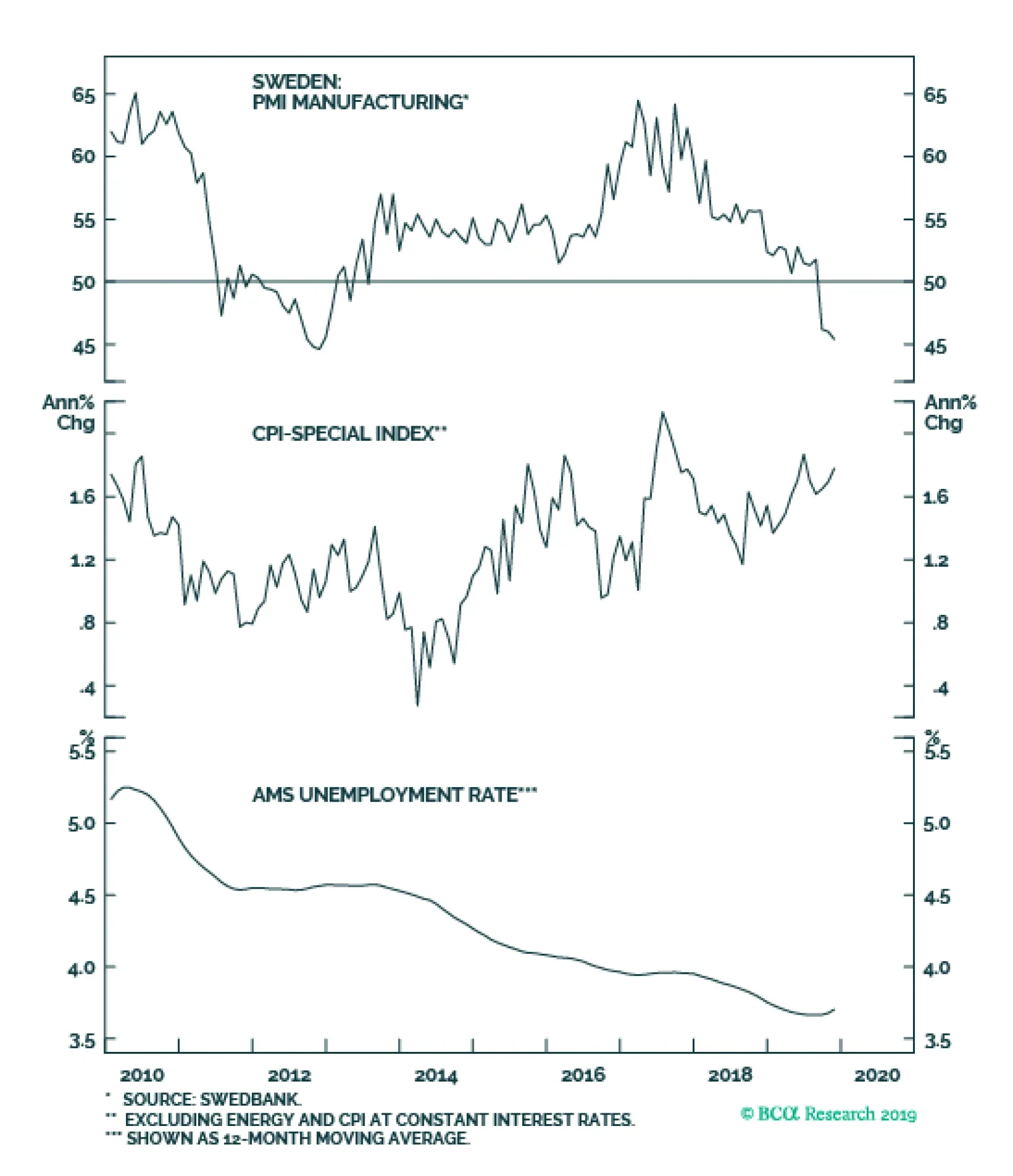

The Riskbank finally did it. In an environment where major central banks are cutting interest rates, the Swedish central bank went against the flow and lifted the repo rate by 25bps to zero. At first glance, this seems…

Dear Client, In addition to this short weekly report, you will also receive our 2020 outlook, published by the Bank Credit Analyst. Next week, I will be on the road visiting clients in South Africa. I hope to report my discussions and…

In lieu of the next weekly report I will be presenting the quarterly webcast ‘The Japanification Of Europe: Should We Fear It, Or Celebrate It?’ on Monday 4 November at 10.00AM EST, 3.00PM GMT, 4.00PM CET, 11.00PM HKT. As…

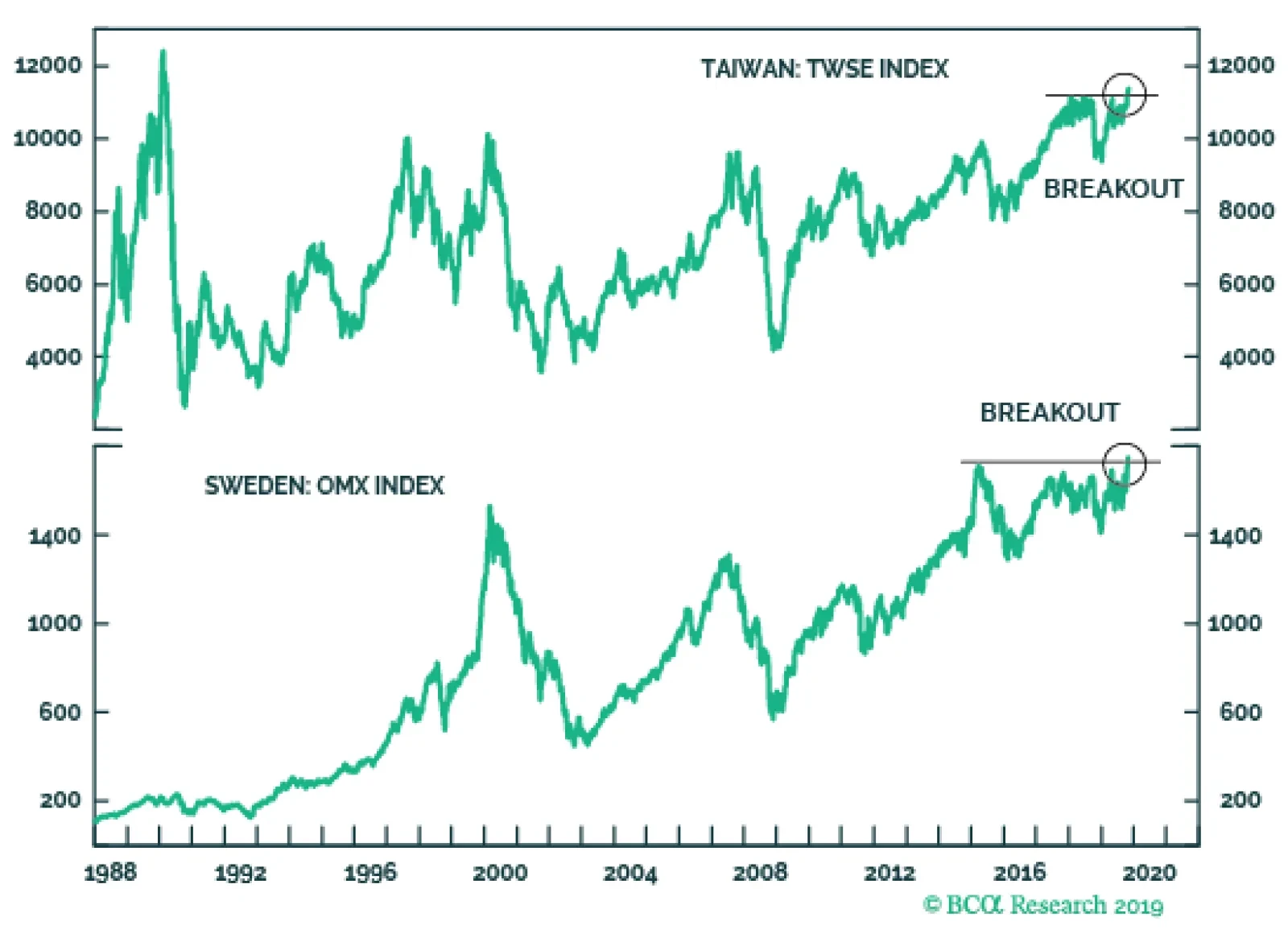

A variety of pro-cyclical financial variables are pointing toward an improving global growth outlook. The AUD/JPY has clearly bottomed, the USD/KRW is weakening, and the silver to gold ratio has been strengthening. The most…

Highlights On a tactical horizon, underweight bonds versus cash, especially those bonds with deeply negative yields… …and underweight bonds versus equities. On a strategic horizon, remain overweight a 50:50 combination…