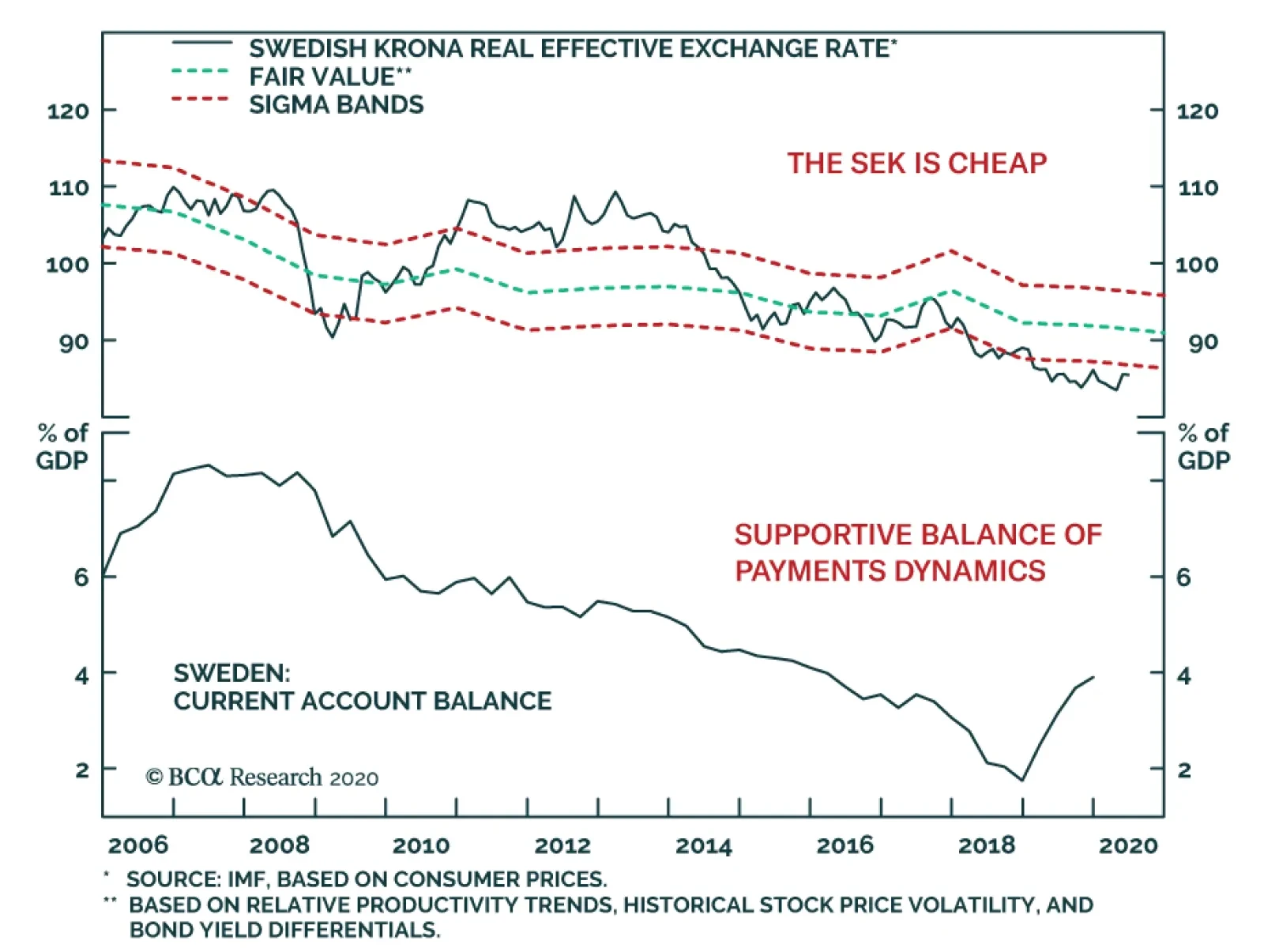

The Swedish krona remains one of our Foreign Exchange Strategy team’s preferred G-10 currencies. The real trade-weighted SEK stands well below its long-term fair value model. Moreover, the SEK trades 13.4% and 36.3%…

Highlights In this Weekly Report, we present our semi-annual chartbook of the BCA Central Bank Monitors. All of the Monitors are now below the zero line, indicating the need for continued easy global monetary policy to help mitigate the…

Dear client, In lieu of our regular weekly report next week, we will hold a webcast on Thursday at 10:00 am ET discussing both tactical and strategic currency considerations. The format will be a short presentation, followed by a Q&…

Highlights Competitive devaluation will remain the dominant policy landscape in the near term. This means that paradoxically, currencies with high and/or positive long-term interest rates remain at risk. The CAD may be the next shoe…

Highlights The pillars of dollar support continue to fall, but the missing catalyst is visibility on the trajectory of global growth. For now, we remain constructive on the DXY short term, but bearish longer term. Market internals…

Highlights The path of least resistance for the DXY remains up. The internal dynamics of financial markets remain constructive for the DXY. We explore more key indicators to complement the analysis in our February 28 report. Our…

Highlights The latest interest rate cuts by central banks confirms the narrative that the authorities view economic risks as asymmetrical to the downside. This all but assures that competitive devaluation will become the dominant…

Highlights For stock markets, the best inoculation against Covid-19 is ultra-low bond yields. Our tactical underweight to equities versus bonds achieved its 5 percent profit target and is now closed. We are now awaiting the fractal…