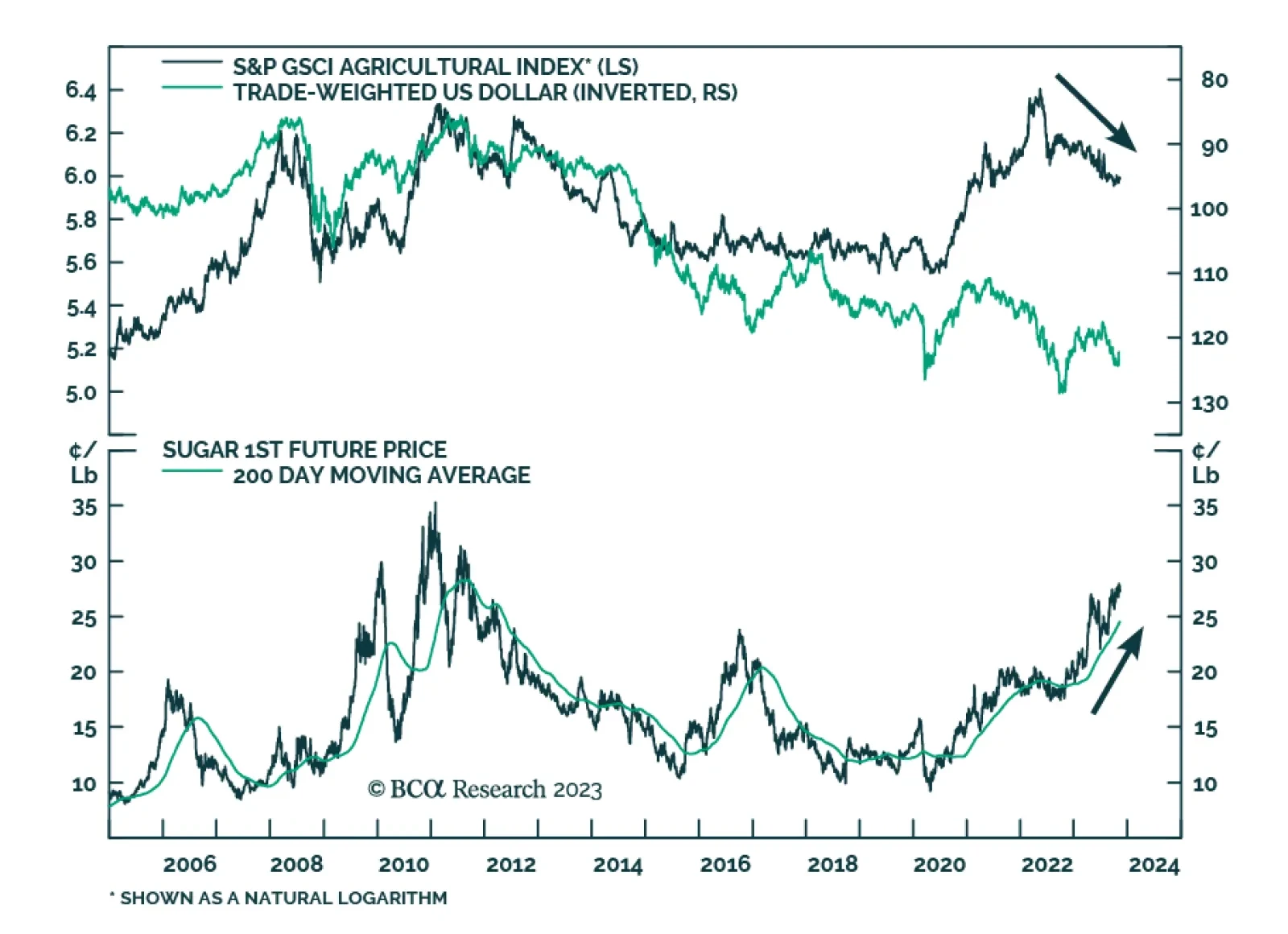

Agriculture commodity prices have been on a steady decline for over a year. Since peaking in mid-May 2022, the GSCI Agriculture index has dropped by 34% -- nearly half of which occurred in 2023. The weakness is generally broad-…

Highlights The tactical environment is dynamic, chaotic and unpredictable. ...Chaos also brings opportunity. We must recognize and exploit opportunities when chance presents them. Look for recurring patterns to exploit.1 Feature…

Dear Client, We are pleased to present our 2017 Outlook for Grains & Softs, covering corn, wheat, soybeans and rice in the grain markets, and cotton and sugar. This is our last regular Weekly Report for the year. You should have…

Highlights By now, the Kingdom of Saudi Arabia (KSA) and Russia have figured out that if each cuts 500k b/d of production, the revenue enhancement for both will be well worth the foregone volumes. Even without additional cuts from other…

If the Fed convinces markets it is on track to lift rates this year and a couple of times next year, we expect a 10% appreciation of the USD over the next 12 months. This would be extremely bearish for commodities.

Clearing the refined-product overhang in the global storage markets is not as straightforward as it used to be: The Kingdom of Saudi Arabia (KSA), China, and India all are making concerted efforts to boost refining capacity, which is…

Global oil demand will continue to surprise to the upside over the balance of the year - growing at a rate of 1.6 MMb/d - following an unexpected surge over the first five months of 2016.

Gold will remain well bid over the short term. The surge in demand that pushed prices up by 20% ytd (Chart of the Week) will continue to dominate supply growth.