Highlights Demand in the major economies remains well below its pre-pandemic trend. Meaning that relative to potential output, demand is lukewarm, at best. Inflation is hot, not because of strong overall demand, but because of the…

Dear Client, Thank you for your continued readership and support this year. This is the last European Investment Strategy report for 2021. In this piece, we review ten charts covering important aspects of the European economy and…

Highlights 2022 will be a year of economic normalization. We hope that even if we can’t leave COVID behind, we will learn to live with it. Economic growth will remain strong, but it will be trending down towards its long-term…

Highlights Our theme for the year, “No Return To Normalcy,” is largely vindicated. Inflation is back! The geopolitical method still points to three long-term strategic themes: multipolarity, hypo-globalization, and populism…

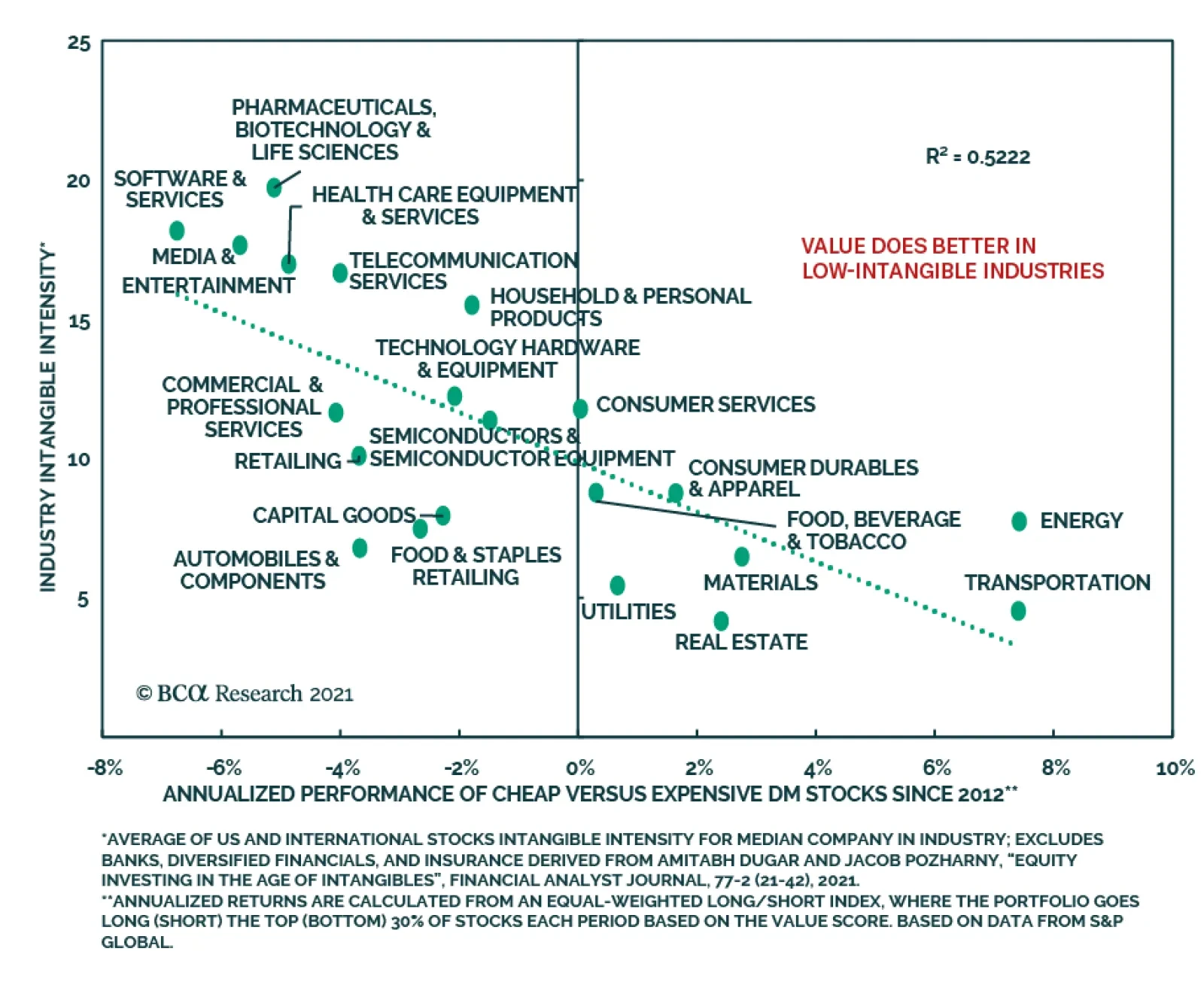

BCA Research’s Global Asset Allocation and Equity Analyzer services conclude that traditional valuation metrics may no longer be an accurate measure of intrinsic value in intangible-heavy companies or industries.…

Highlights US growth will slow next year, not because demand will falter, but because supply-side constraints will prevent the economy from producing as much output as households and businesses want to buy. If aggregate demand…

Highlights Rate Hikes Are Coming – O/W Banks And Small Caps: Rampant inflation is changing investor expectations on the timing and speed of rate hikes. At present, the market is pricing in three rate hikes in 2022. Overweight…