Investors remain cautious about the US economy and still have significant cash that needs to be put to work which could extend the rally further. Earnings rebound later in the year will be supported by rising sales growth and surging…

In Section I, we audit the market’s “soft landing” narrative in response to a meaningful challenge to our cautious stance from recent financial market developments. We acknowledge that US economic growth was stronger in the first…

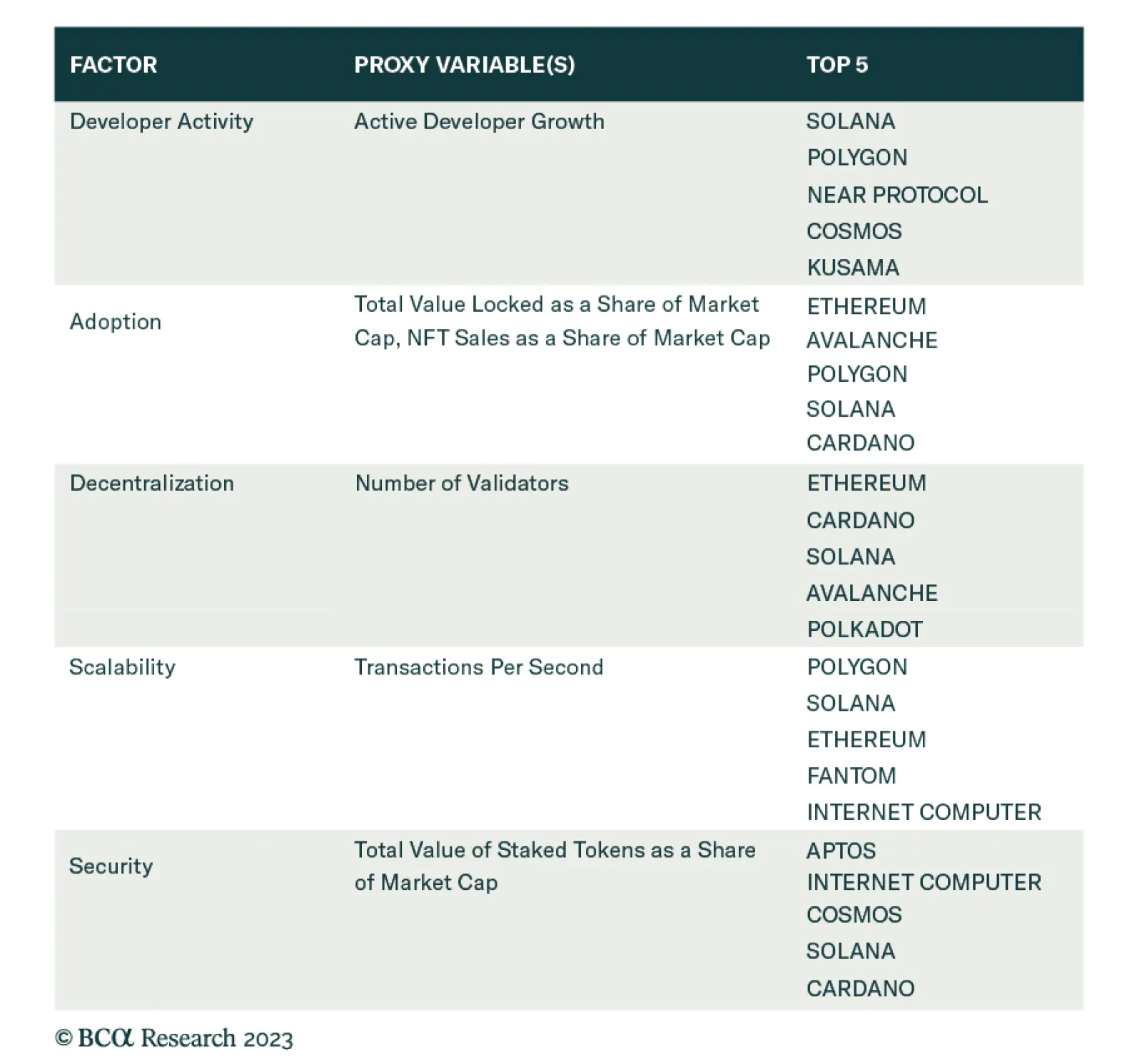

According to BCA Research’s Counterpoint service, the top five blockchains are Solana (SOL), Ethereum (ETH), Polygon (MATIC), Cardano (ADA), and Avalanche (AVAX). Investors should have a small (up to 5 percent)…

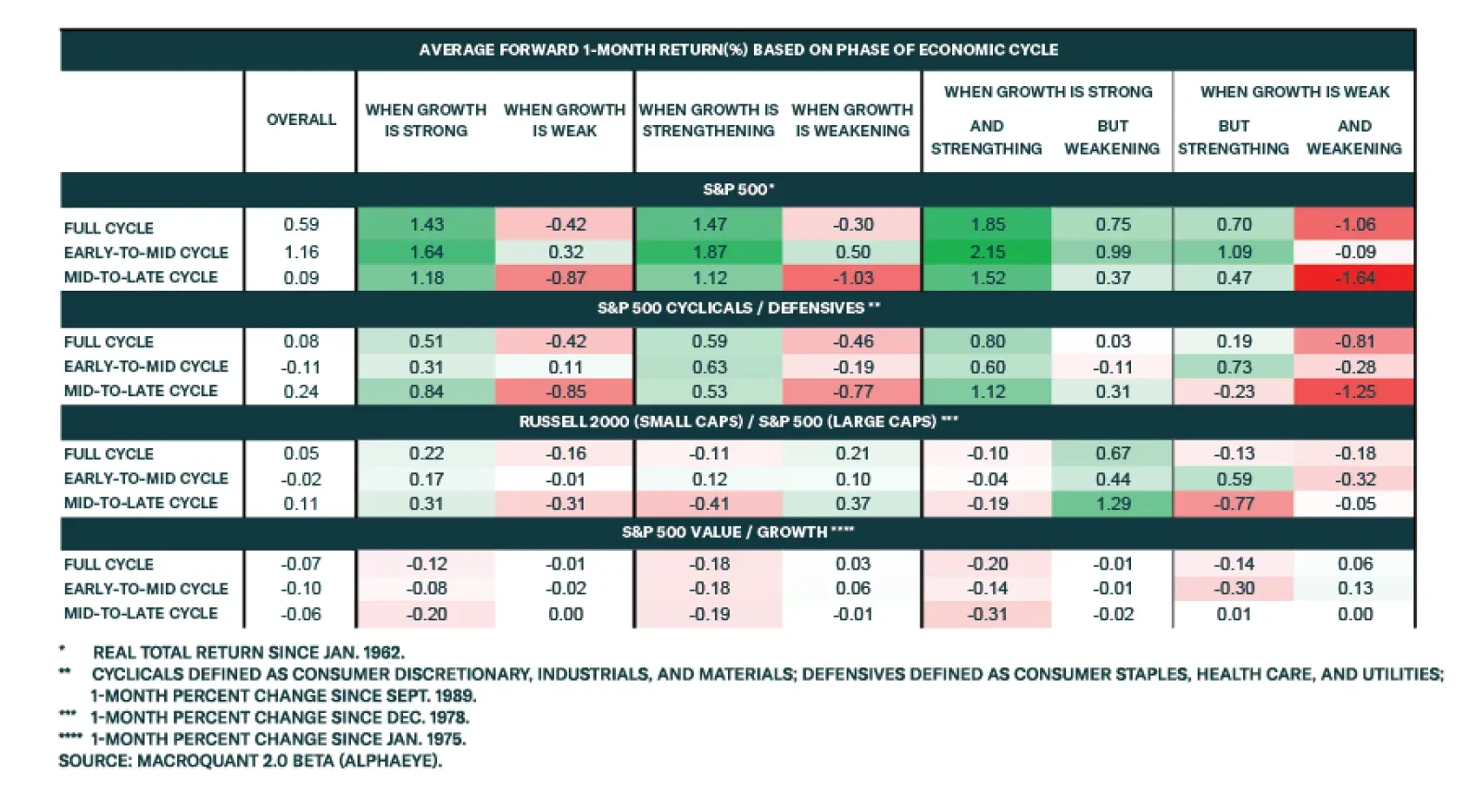

According to BCA Research’s Global Investment Strategy service, stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. In classical physics, the trajectory of an object…

Stocks fare best when there is plenty of slack in the economy and growth is strong and getting stronger. The good news is that the economic growth score for the US in our MacroQuant model is above its historic average. The bad news…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

The S&P 500 performance was flat in May if not for the strong performance of a small cohort of mega-caps, aided by exposure to AI. Earnings and sales growth are contracting but analysts expect a rebound into a yearend, which is…

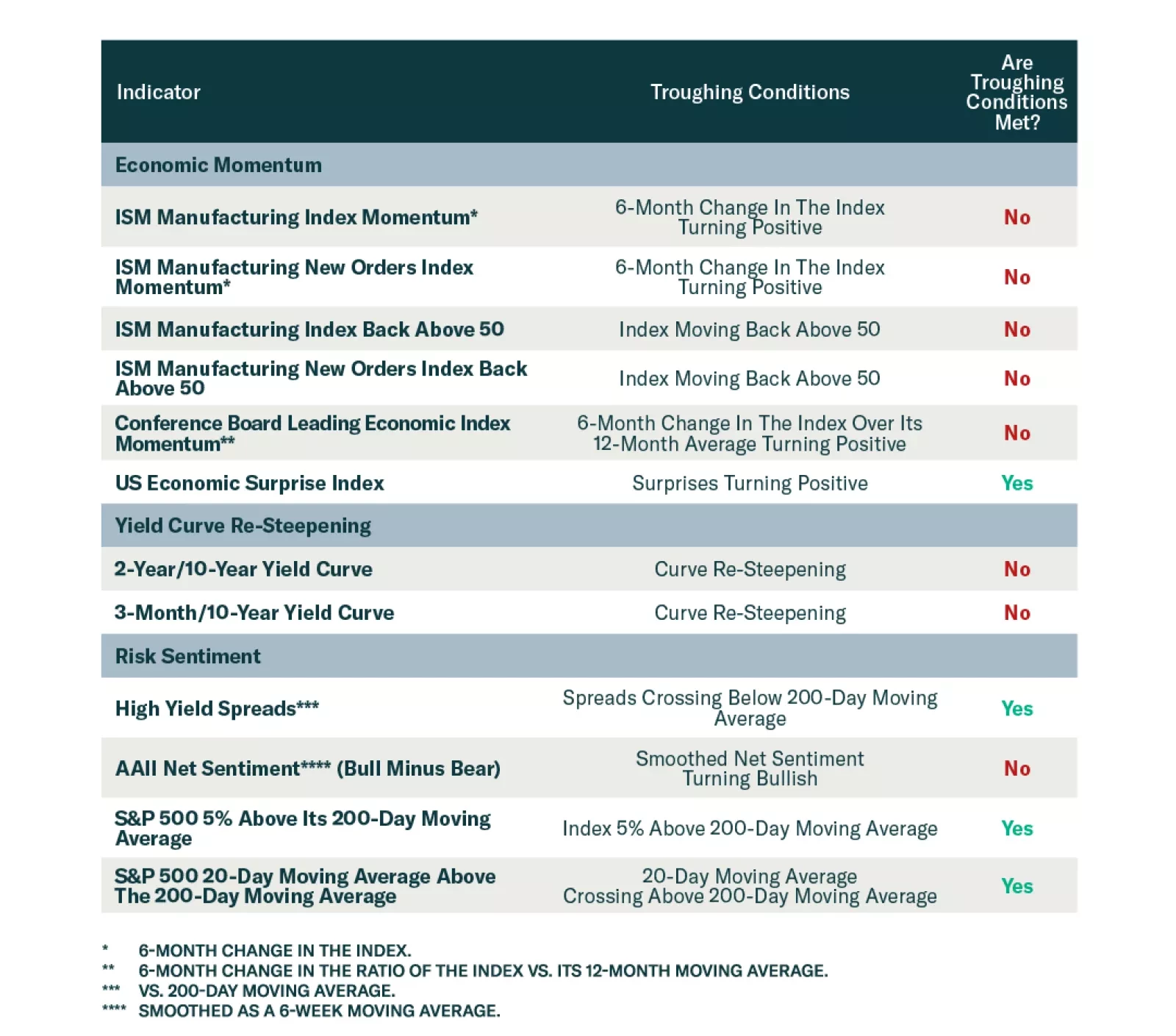

BCA Research’s Global Asset Allocation service continues to recommend an overweight on government bonds, neutral on cash, and underweight on equities and credit. Market technicals do not suggest this is a robust…