The equity rally extended into March as hard landing outcome was priced out. It has broadened, as money flowed into less over-loved pockets of the market. Our models signal that margins are about to stabilize, and earnings growth…

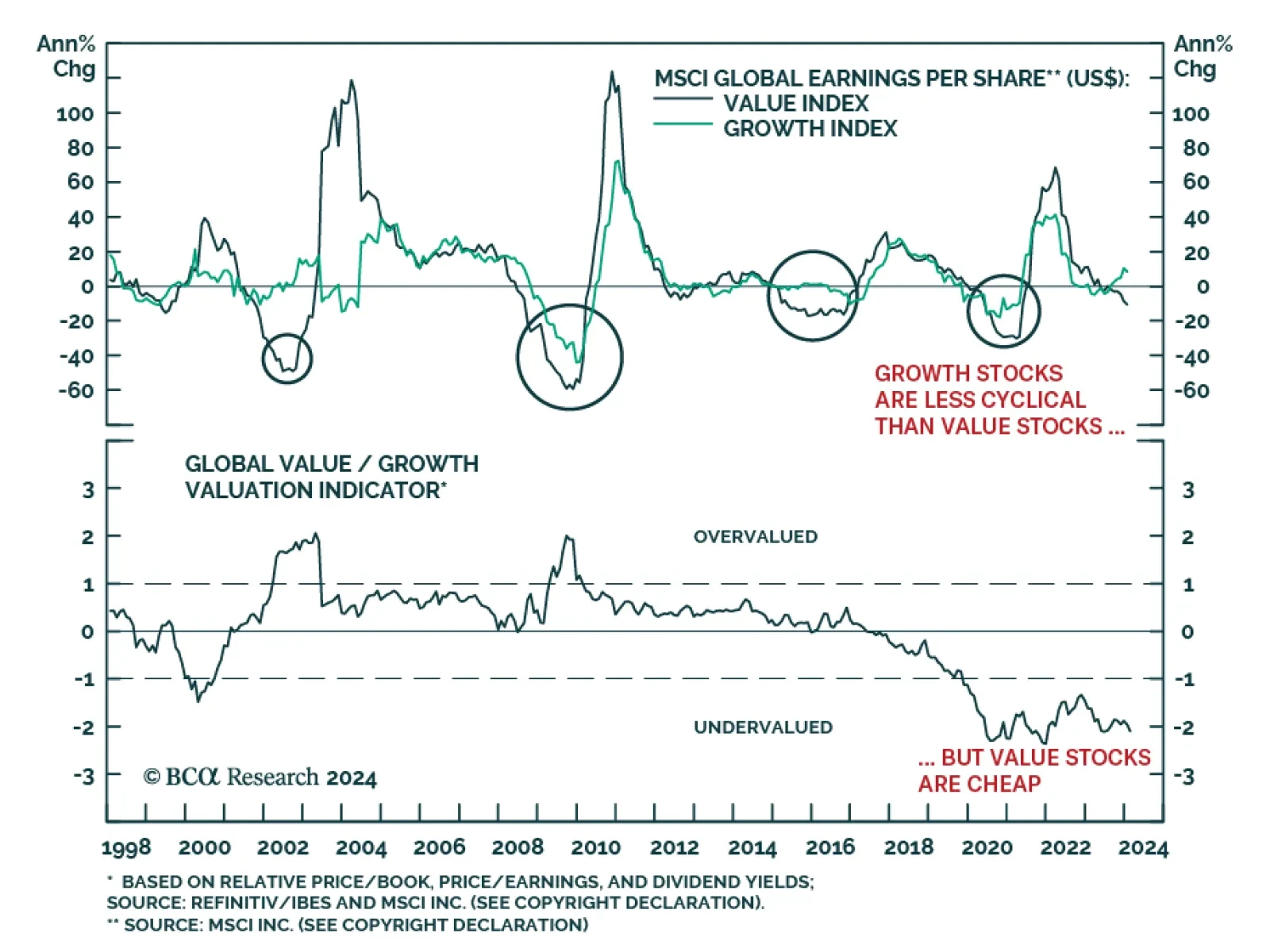

The MSCI ACW Growth index continues to strengthen vis-à-vis the Value index, outperforming the latter by 4.7 percentage points year-to-date, following 23.3 percentage points in 2023. Given that the IT, Consumer…

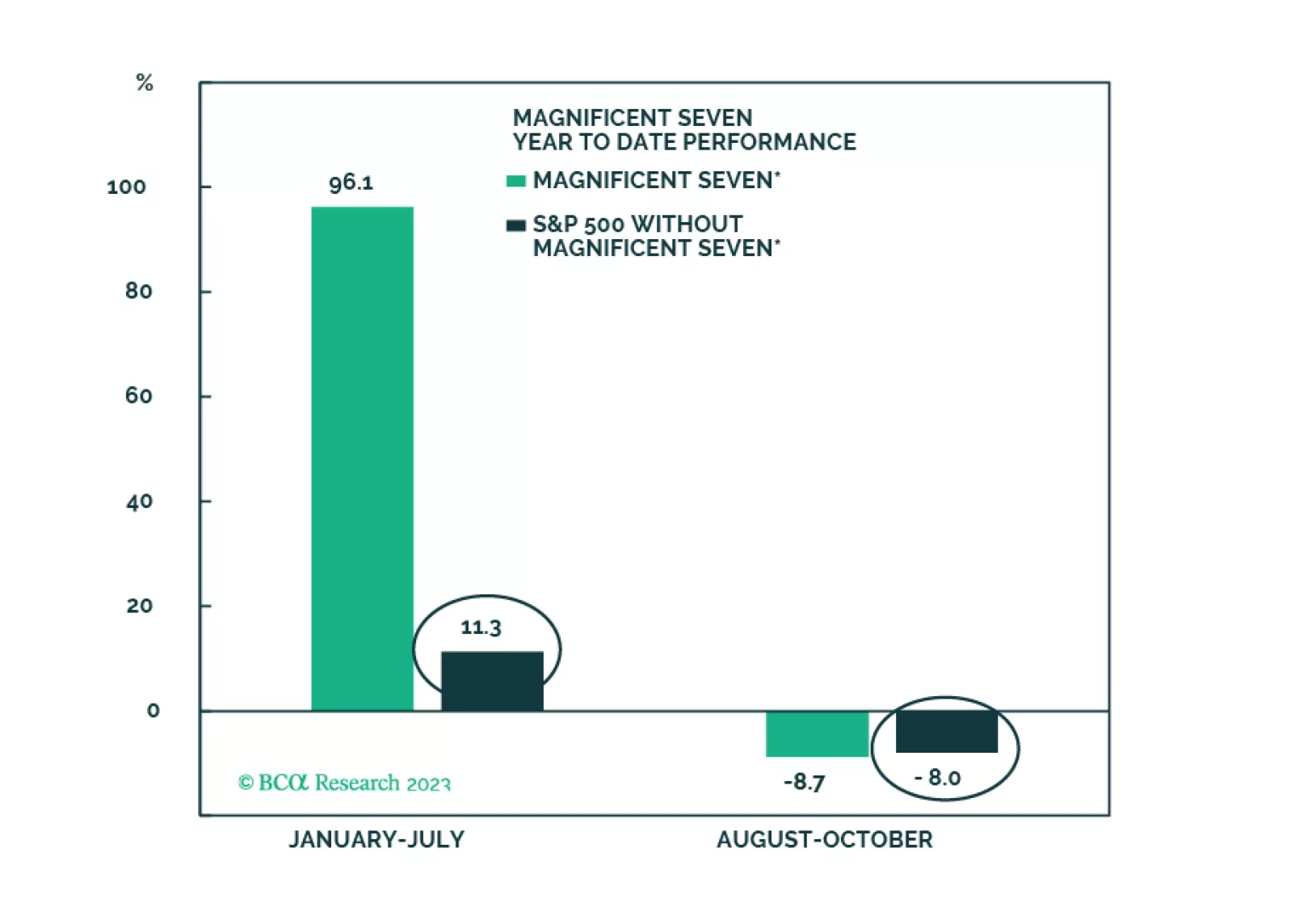

The dominance of large tech companies in the S&P 500 has caused concern amongst investors. The Magnificent Seven now represent 30% of the index. These companies have more than doubled in value over the past year, in contrast…

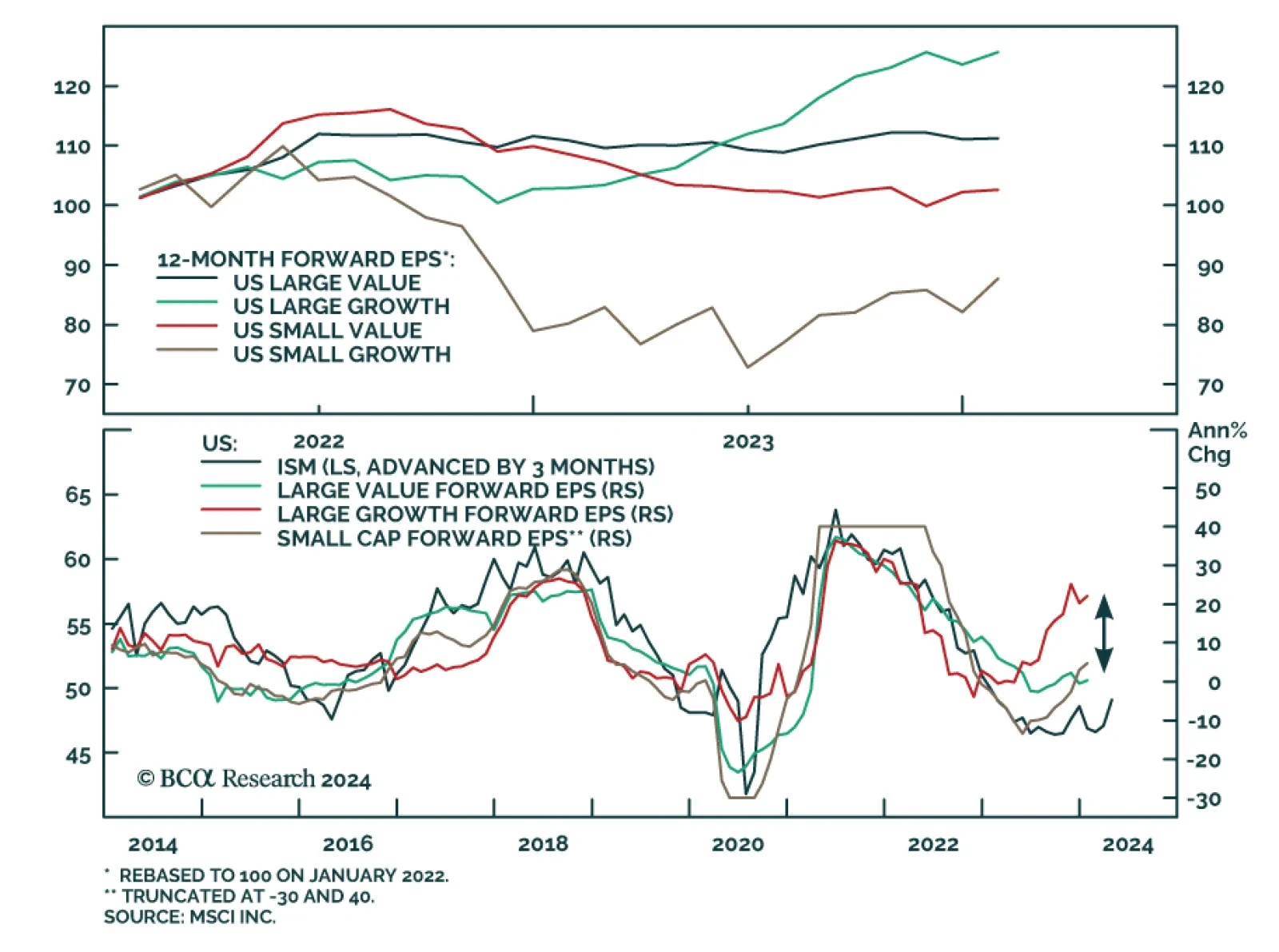

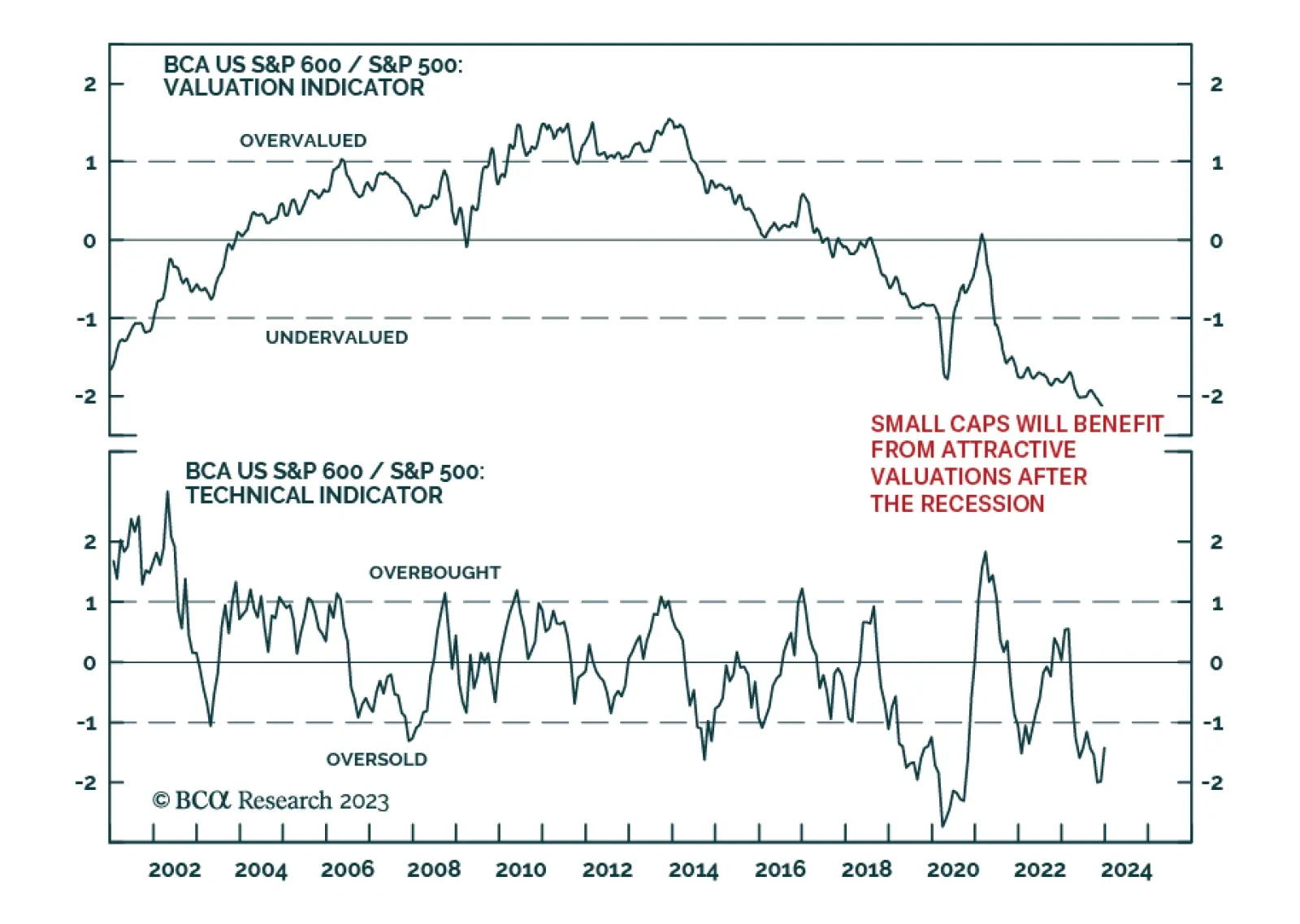

US small-cap stocks have benefitted from the recent improvement in risk sentiment. The S&P 600 is up 10% over the past month – exceeding the S&P 500’s gains by 5.4 percentage points after having underperformed…

The Vicious Troika remains a long-term threat, but over the short term, rates will likely have another leg down on growth concerns, offering support to equities, which are now fairly valued and are no longer overbought. Longer-term…

Downside risks to equities are building. Rates, the dollar, and energy prices will remain elevated into yearend. This trifecta makes a soft landing less likely than before and hurts corporate profits and multiples. However, high cash…

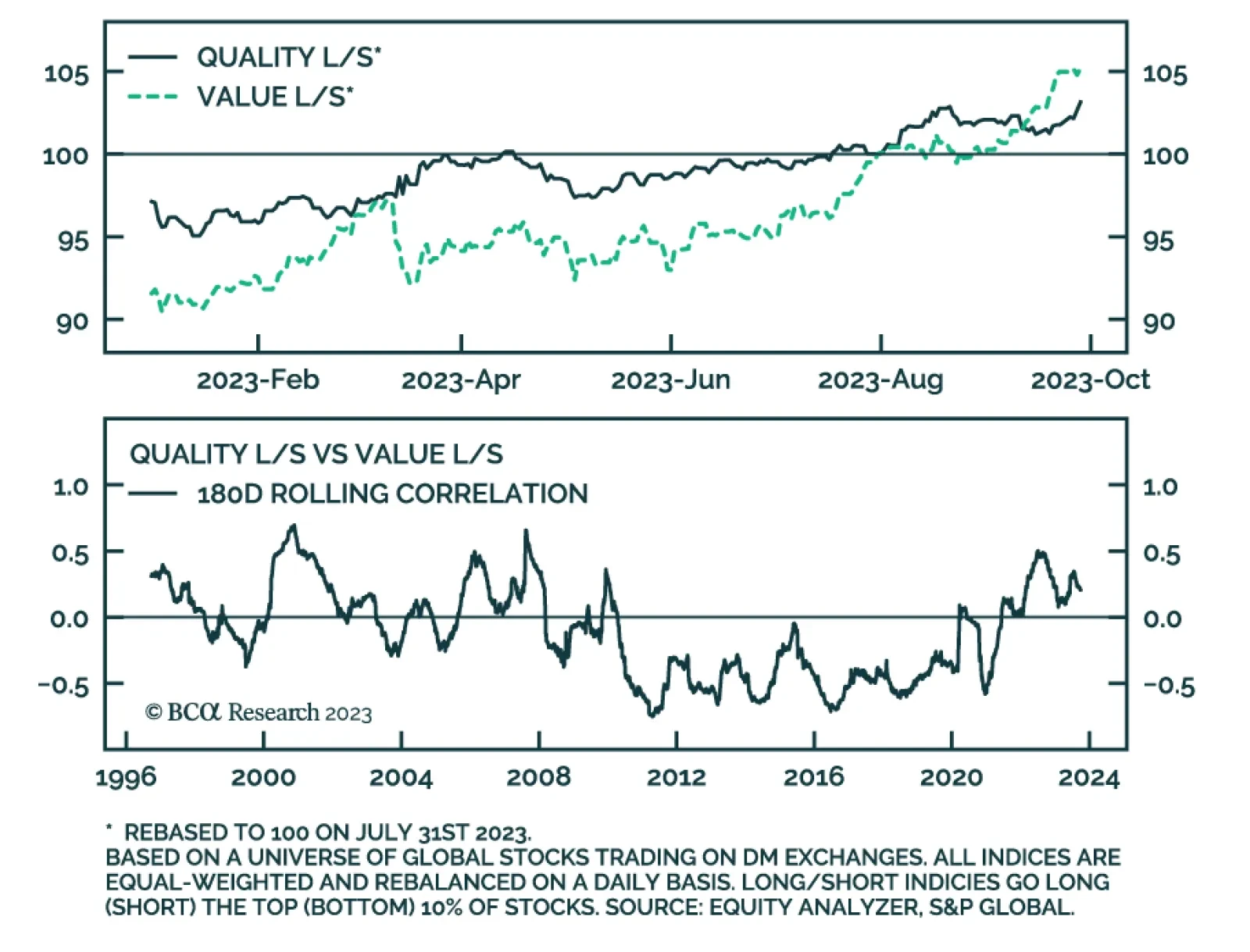

Our Equity Analyzer service is a stock selection platform powered by the BCA Score, a 30-factor stock ranking system. The model tends to benefit from periods of uncertainty due to its high-quality and low volatility tilt. The…

Nvidia’s stock price hit a fresh all-time high on Thursday after its blockbuster Q2 earnings call. The company reported it generated $13.51 billion in revenue last month (above expectations of $11.2 billion) and forecasted…

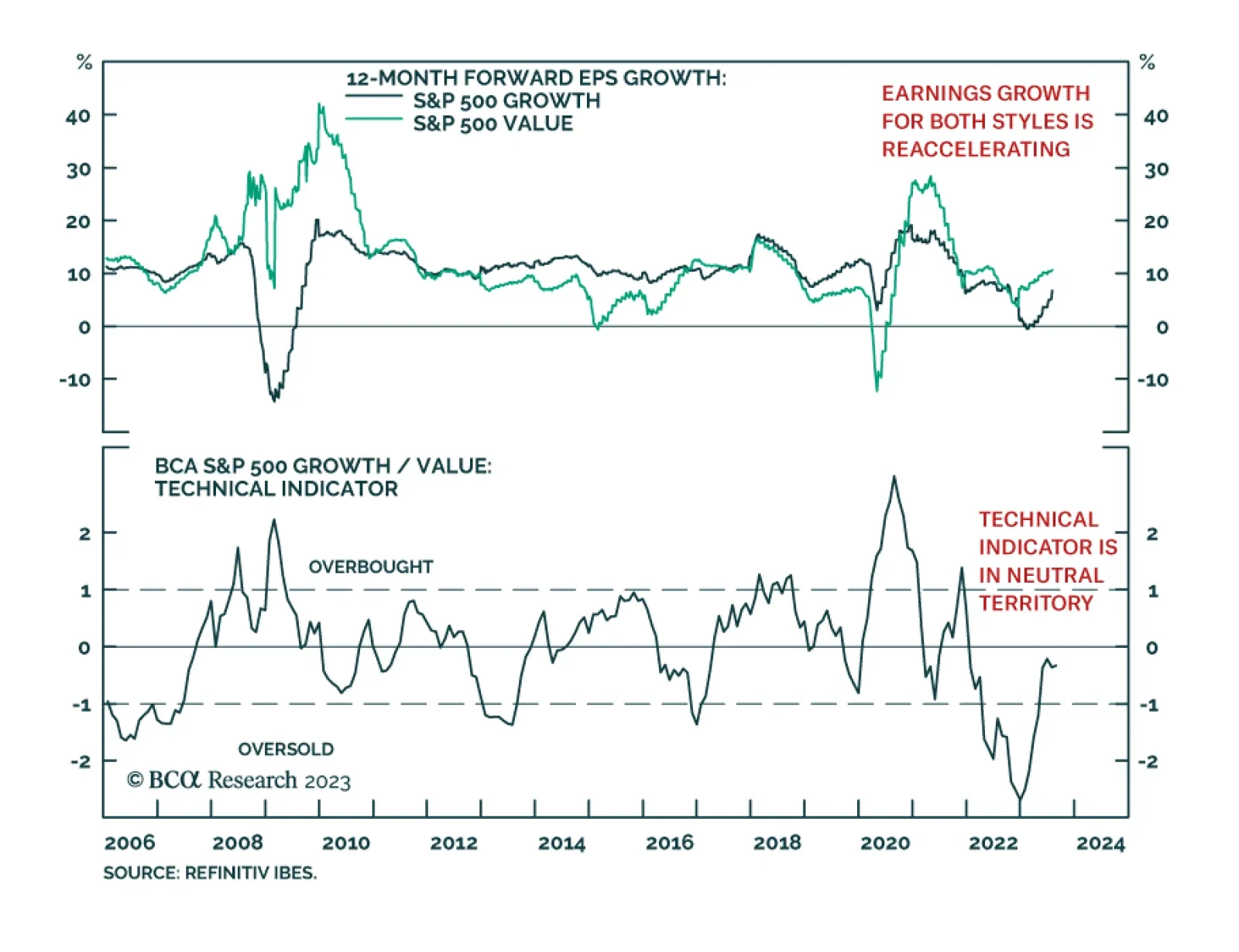

According to BCA Research’s US Equity Strategy service, the outperformance of Growth sectors most likely has run its course. The team has opened an overweight in Growth vs. Value in April. Since then, the trade is…

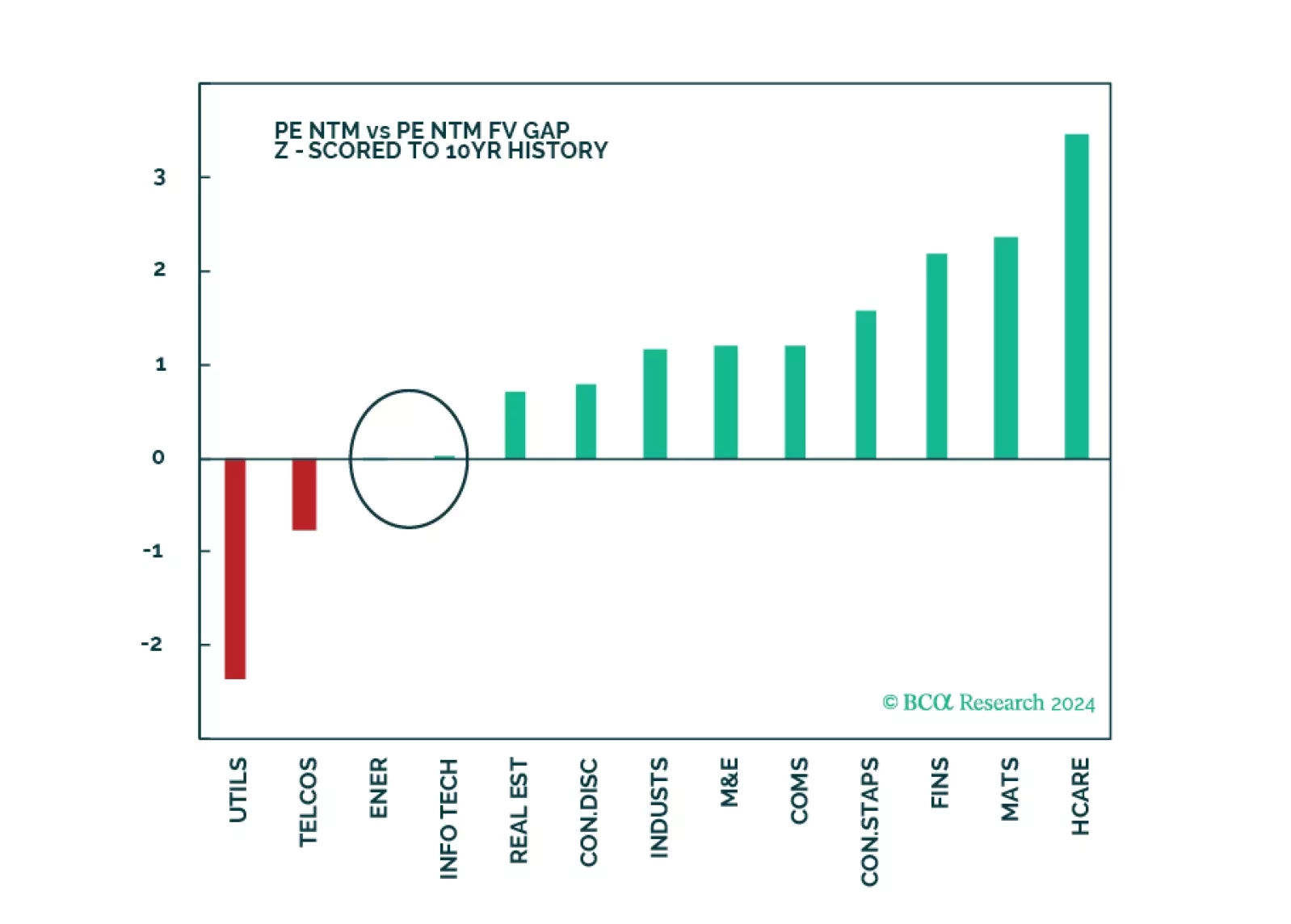

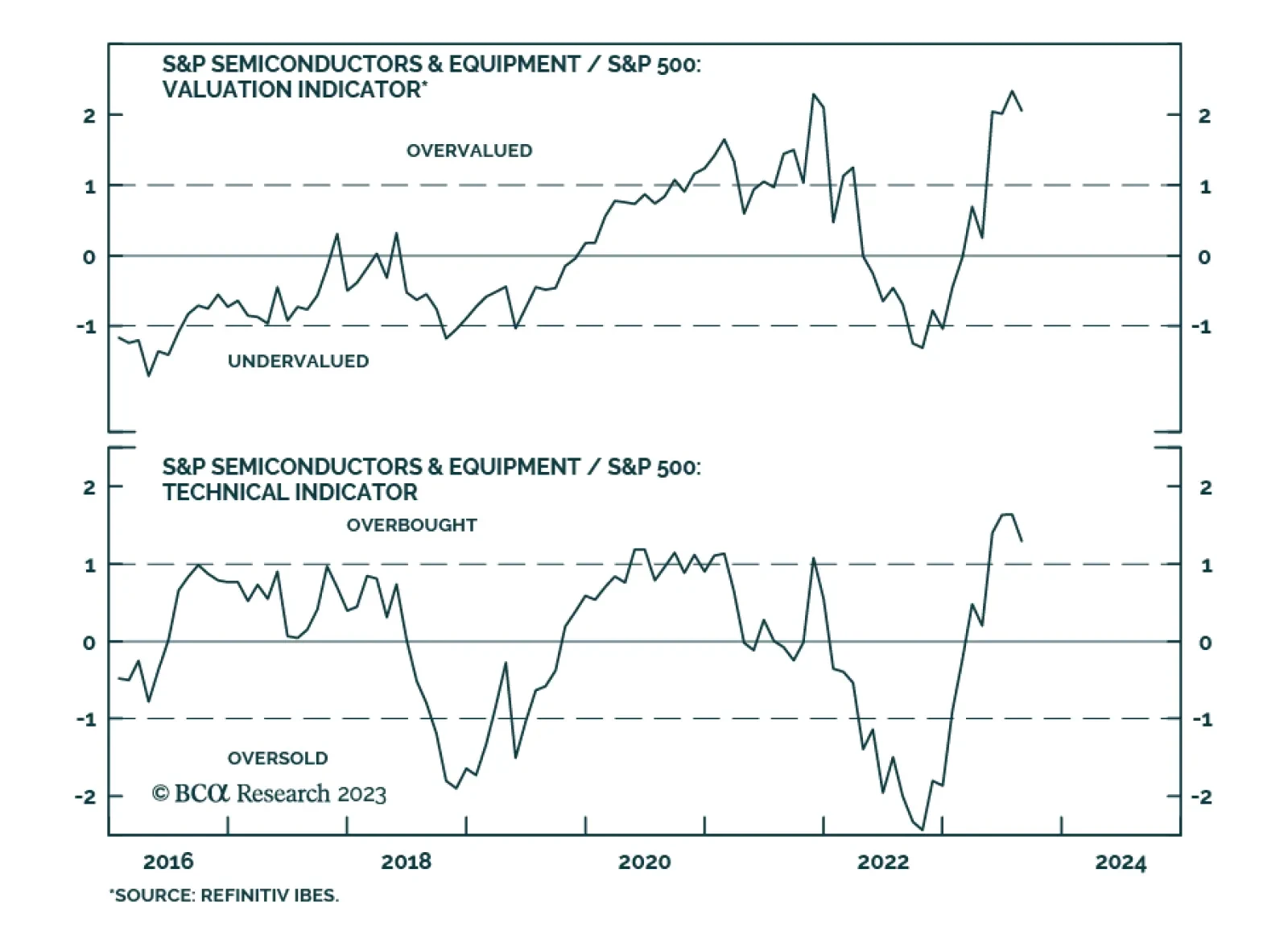

Outperformance of Growth sectors most likely has run its course. It is time to shift Growth vs. Value allocation to neutral, downgrade Semis, and upgrade Energy to overweight.