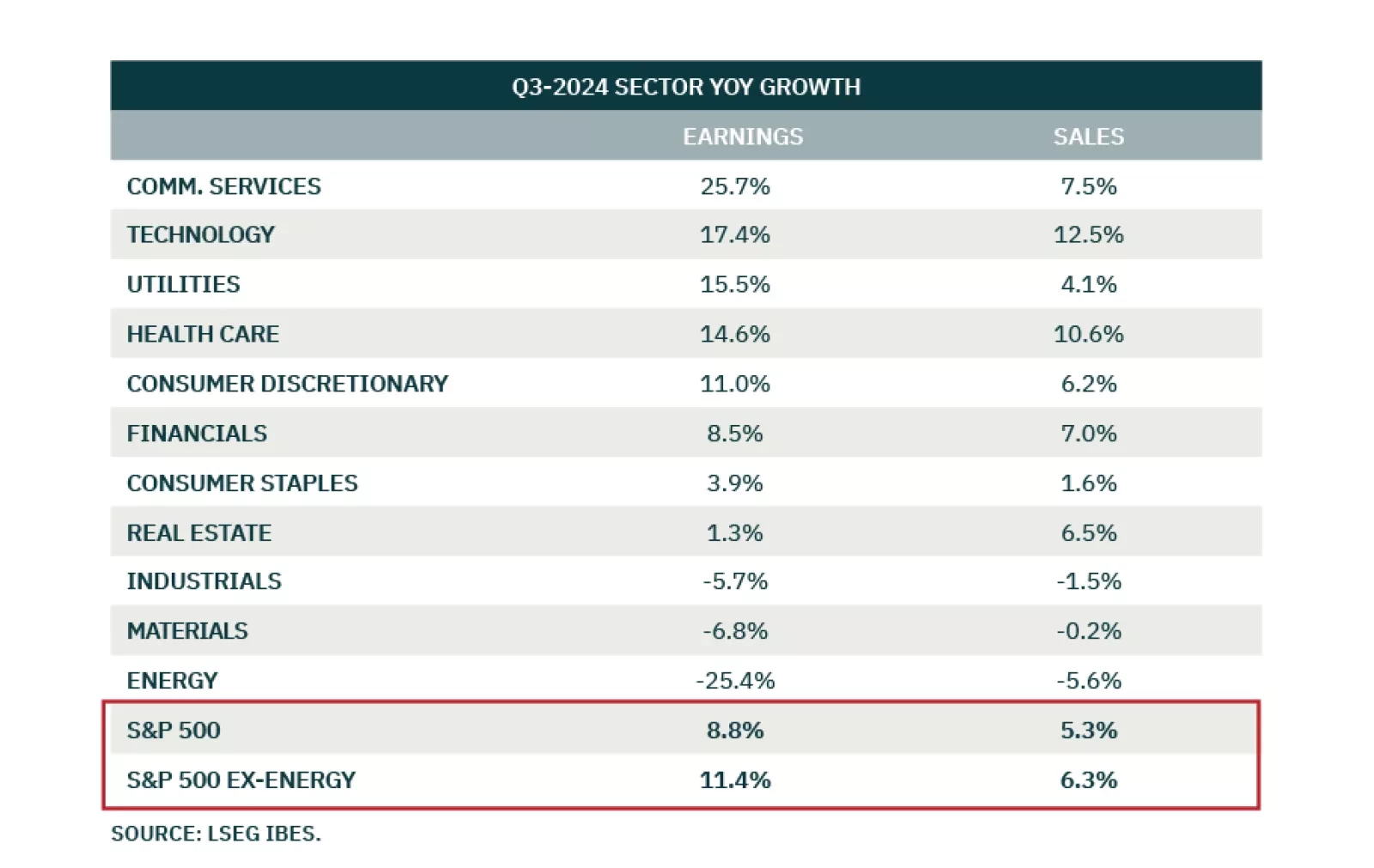

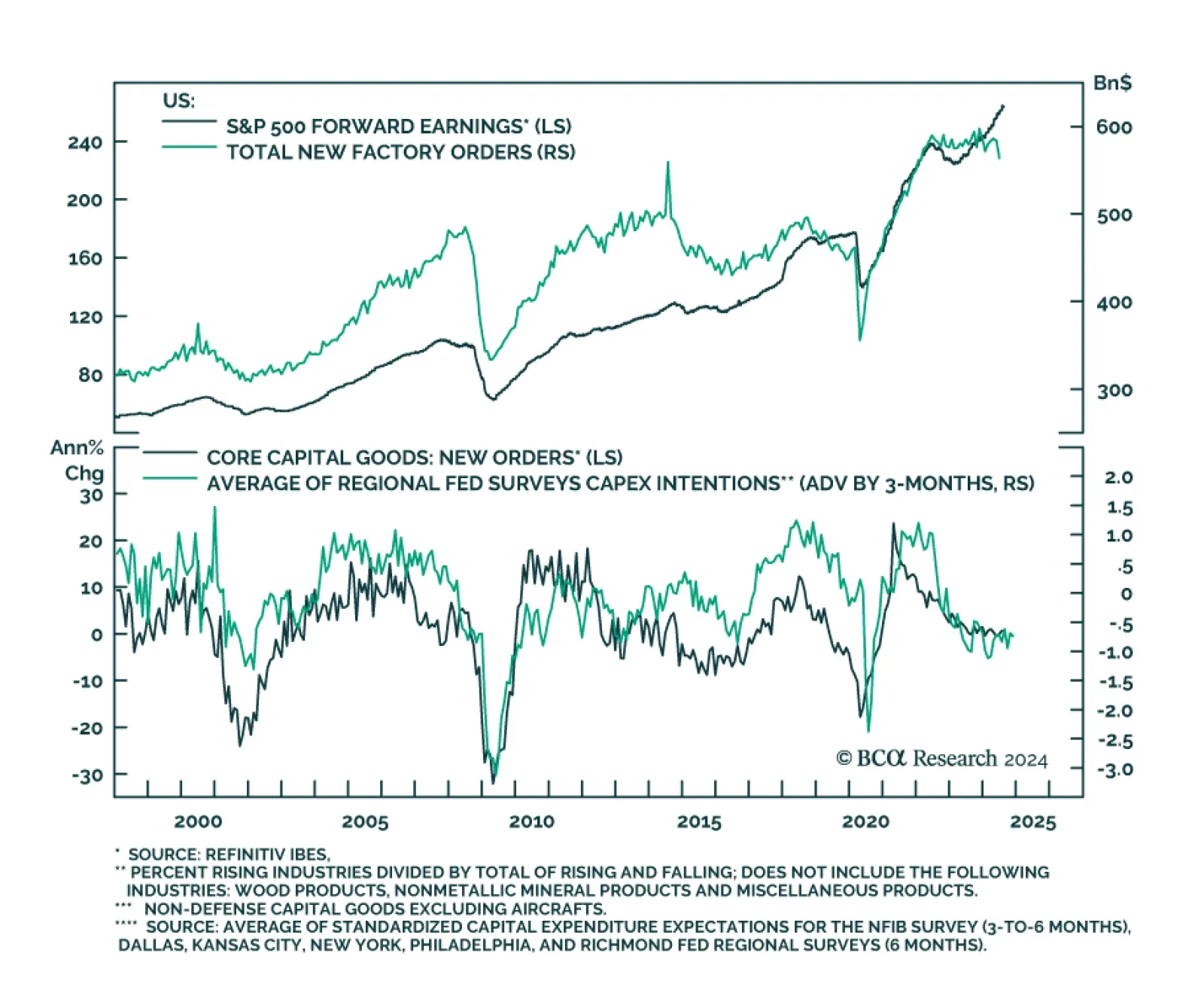

Prior to Nvidia reporting, 76% of S&P 500 companies beat earnings expectations while 61% beat on sales. Nvidia beat earnings expectations, but the magnitude by which guidance beats the most optimistic analyst expectations is…

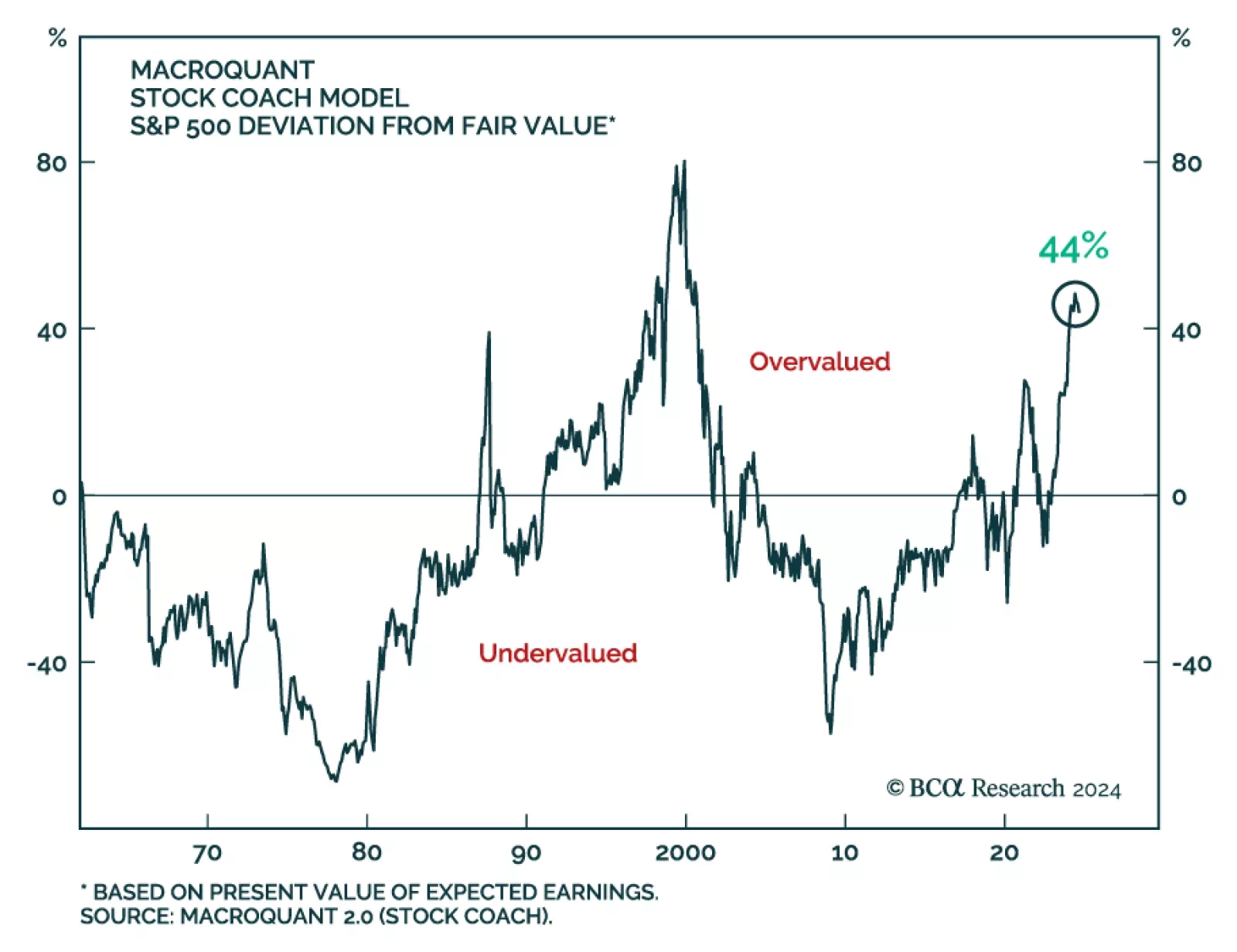

According to BCA Research’s Global Investment Strategy service, the imbalances in the US economy are sizeable enough to generate a mild recession. Unfortunately for equity investors, a mild recession would not preclude a…

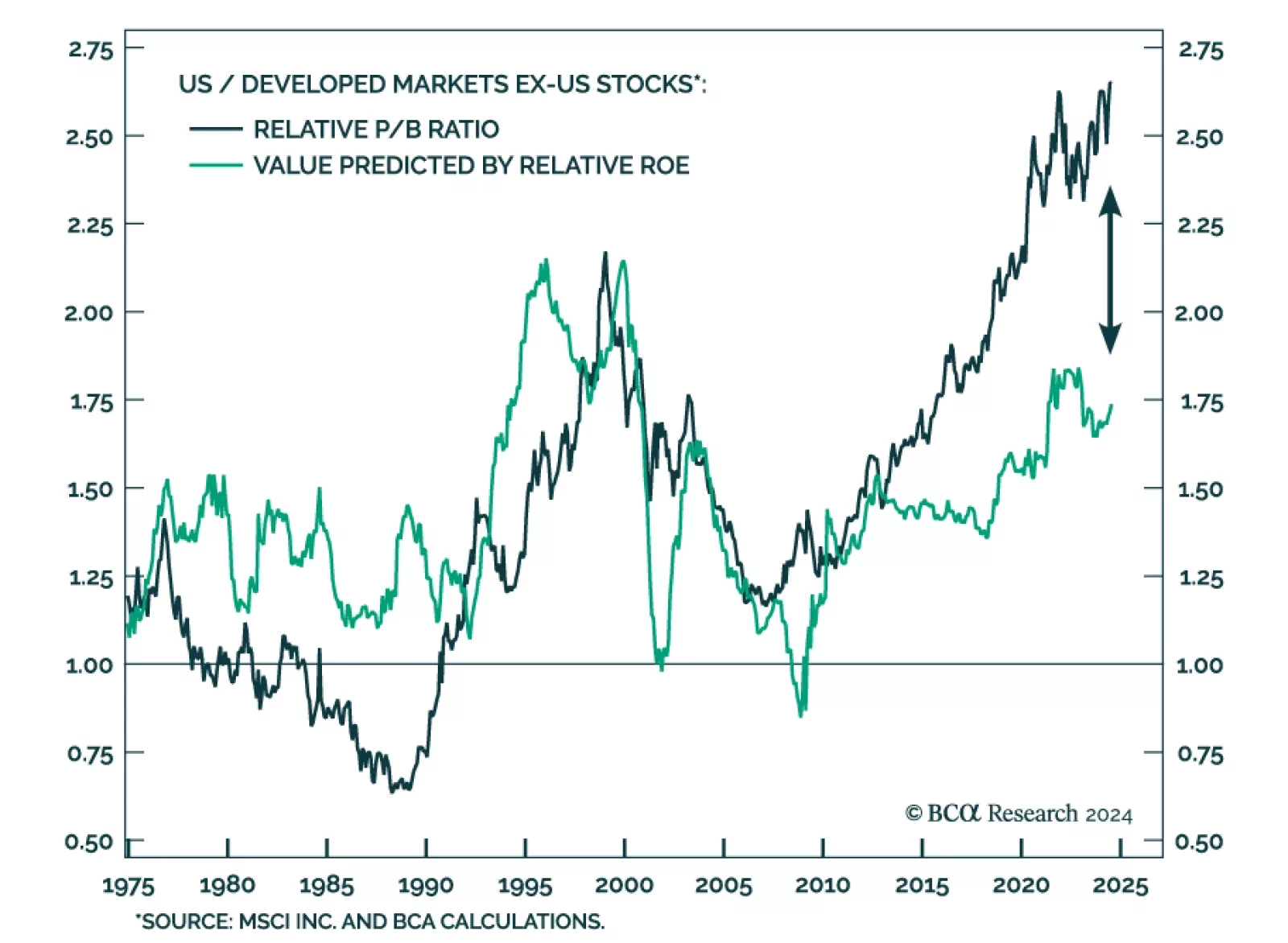

According to our Bank Credit Analyst service, an inflection point in the relative performance of US stocks is not likely to occur over the coming 6-12 months. A recession favors US equities in common currency terms barring…

Preliminary estimates suggest that US durable goods orders growth rebounded sharply from a 6.9% m/m contraction to 9.9% growth in July, upending expectations of a more muted 5.0% monthly increase. However, a 34.8% m/m rise in…

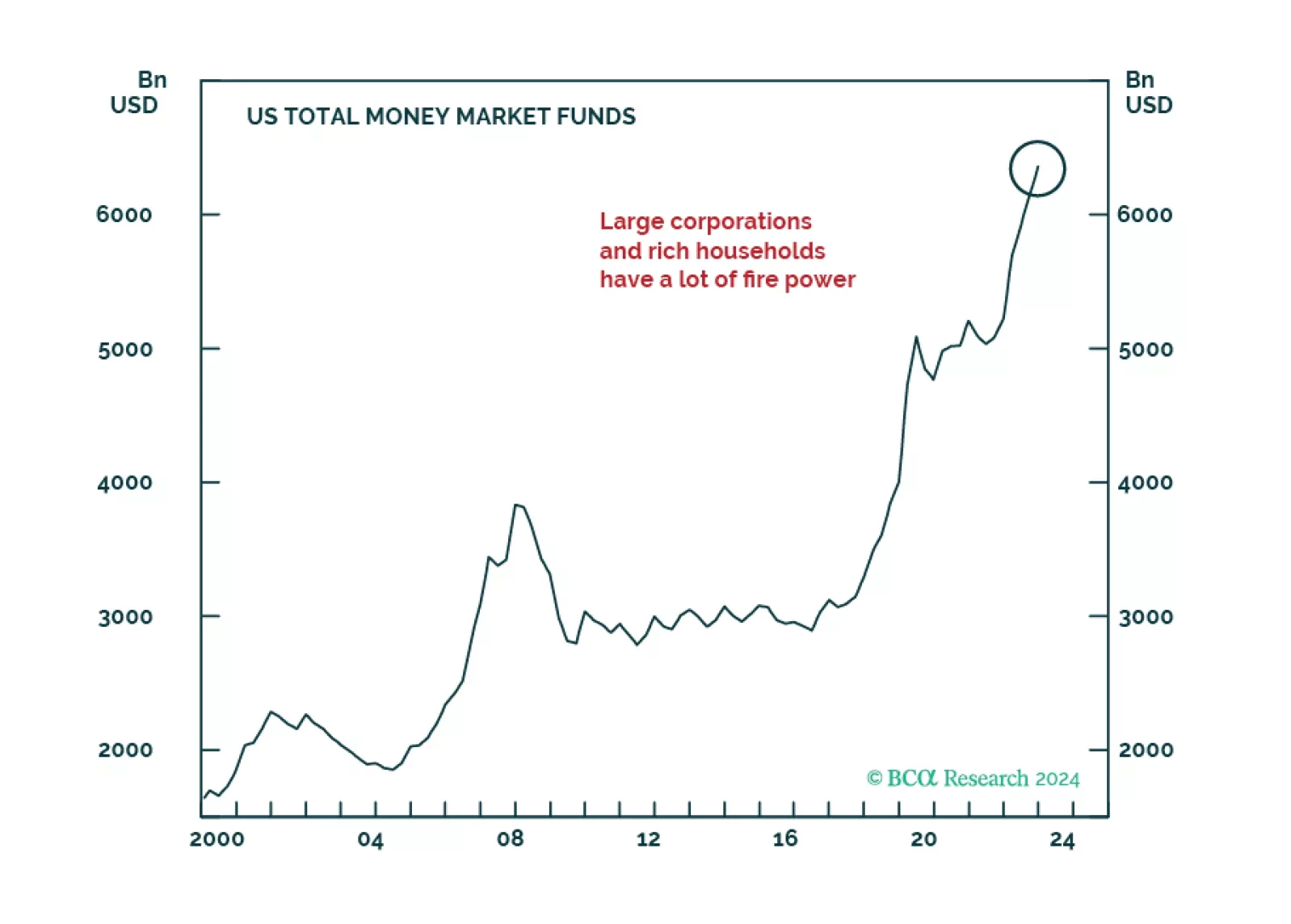

Generative AI-related rally resumed in May. Much of the recent market gains are down to excess liquidity that was begotten by the massive pandemic stimulus, creating a dichotomy between multiple economic challenges and exuberant…

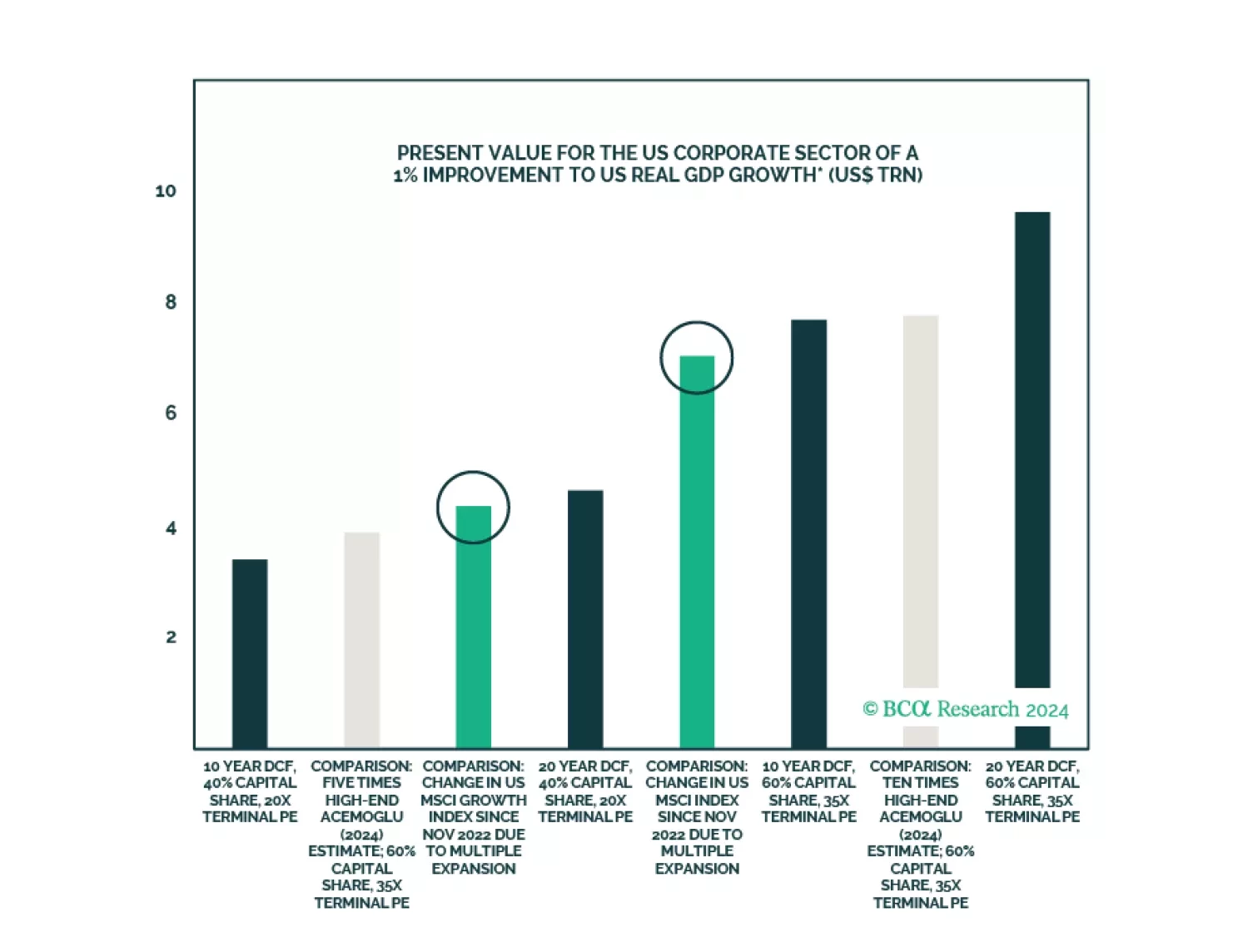

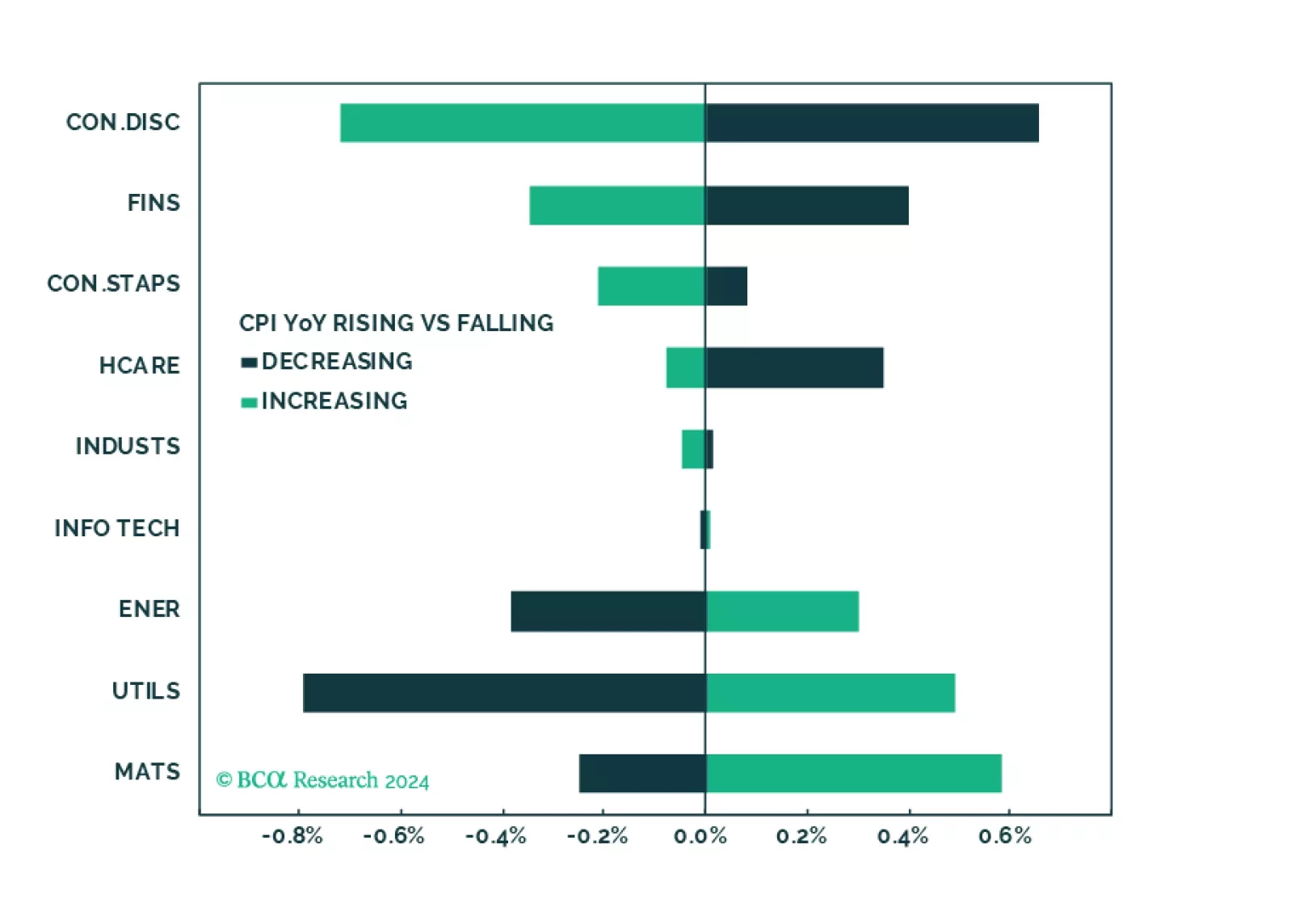

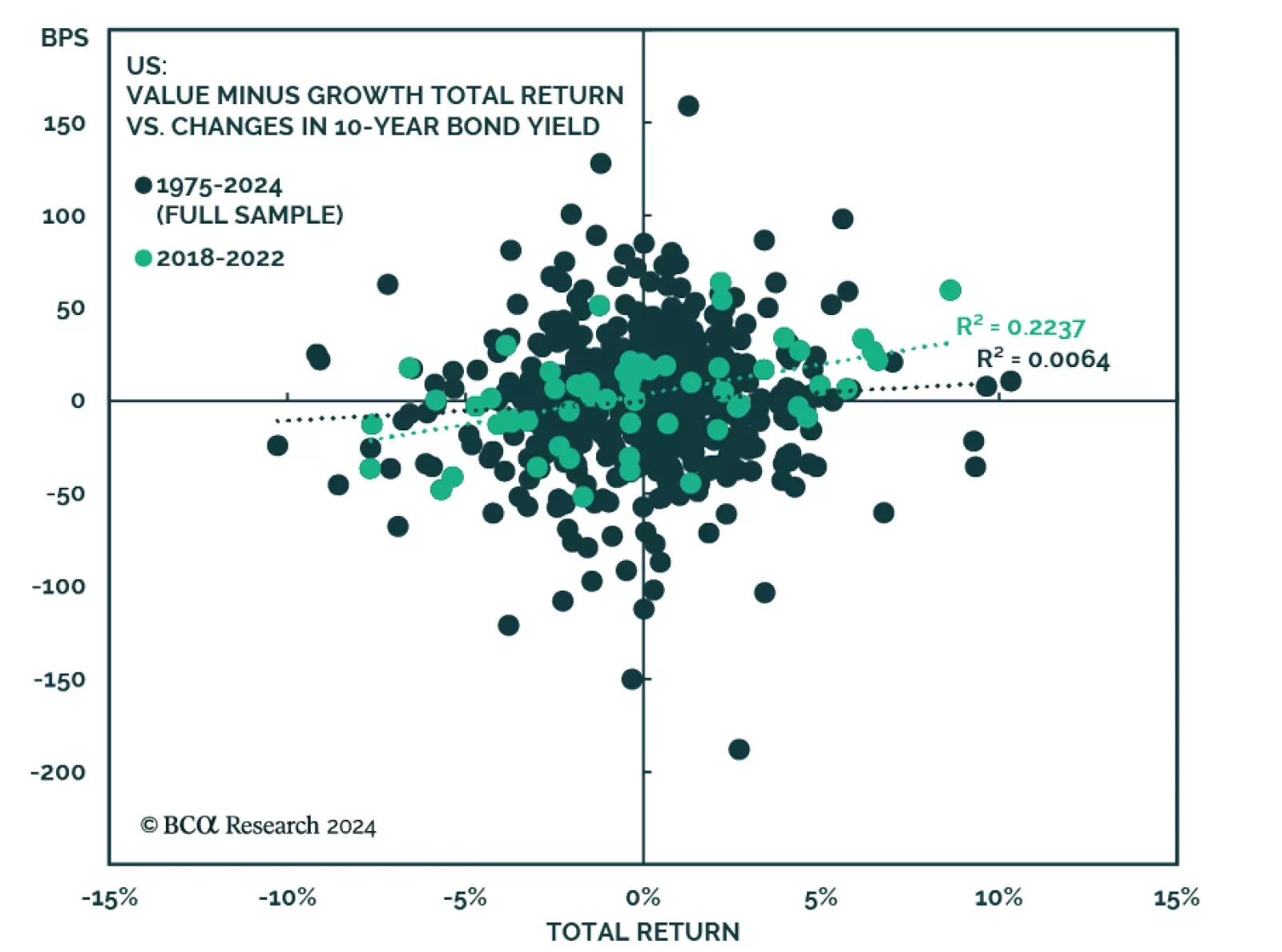

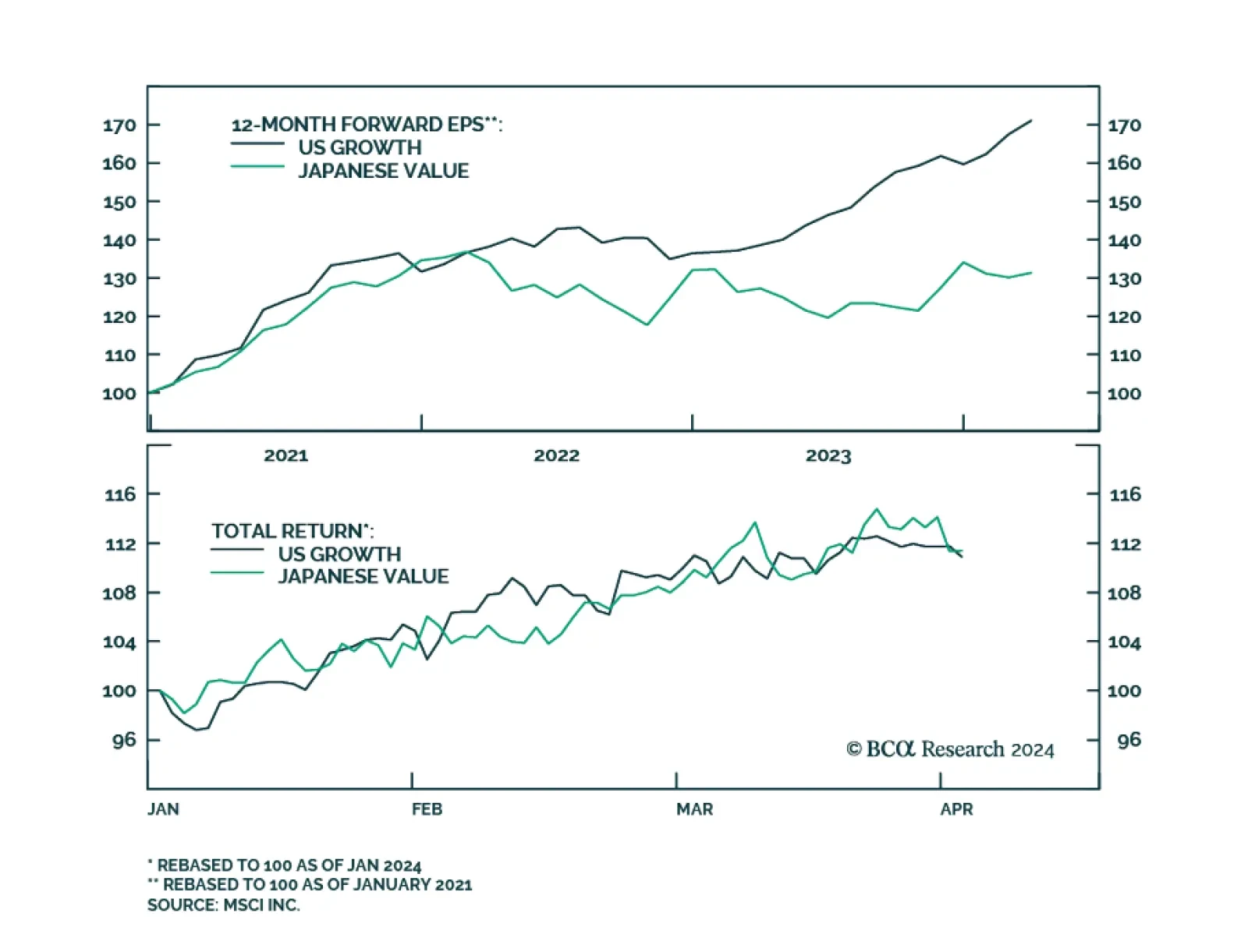

The idea that rising interest rates benefit value at the expense of growth has become consensus amongst market participants. The rationale is simple: Most of the cashflow that shareholders will receive from growth stocks are…

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

The extraordinary performance of AI companies has pushed US growth stocks to new highs. So far, the MSCI US Growth Index has returned almost 11% since the start of the year, outperforming global stocks by over 3%. No growth index…