Highlights U.S. growth remains robust, despite some temporary softness in recent months. Ex U.S., growth continues to fall but, with China probably now ramping up monetary stimulus, should bottom in the second half. Central banks…

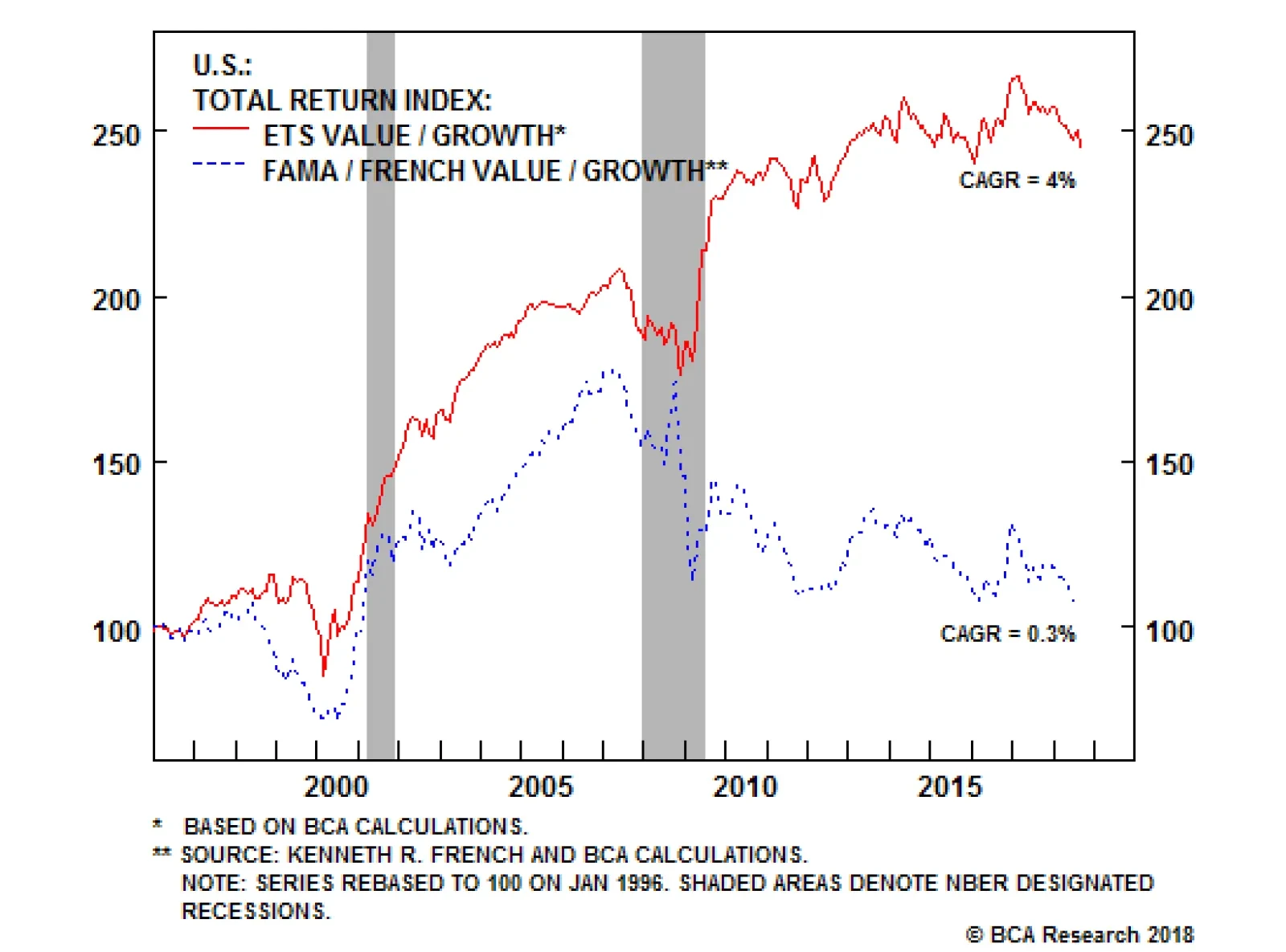

To develop our custom value index, we use five valuation measures in the ETS database: trailing P/E, forward P/E, price-to-tangible-book value, price-to-sales and price-to-cash flow. Every quarter we rank the stocks within each…

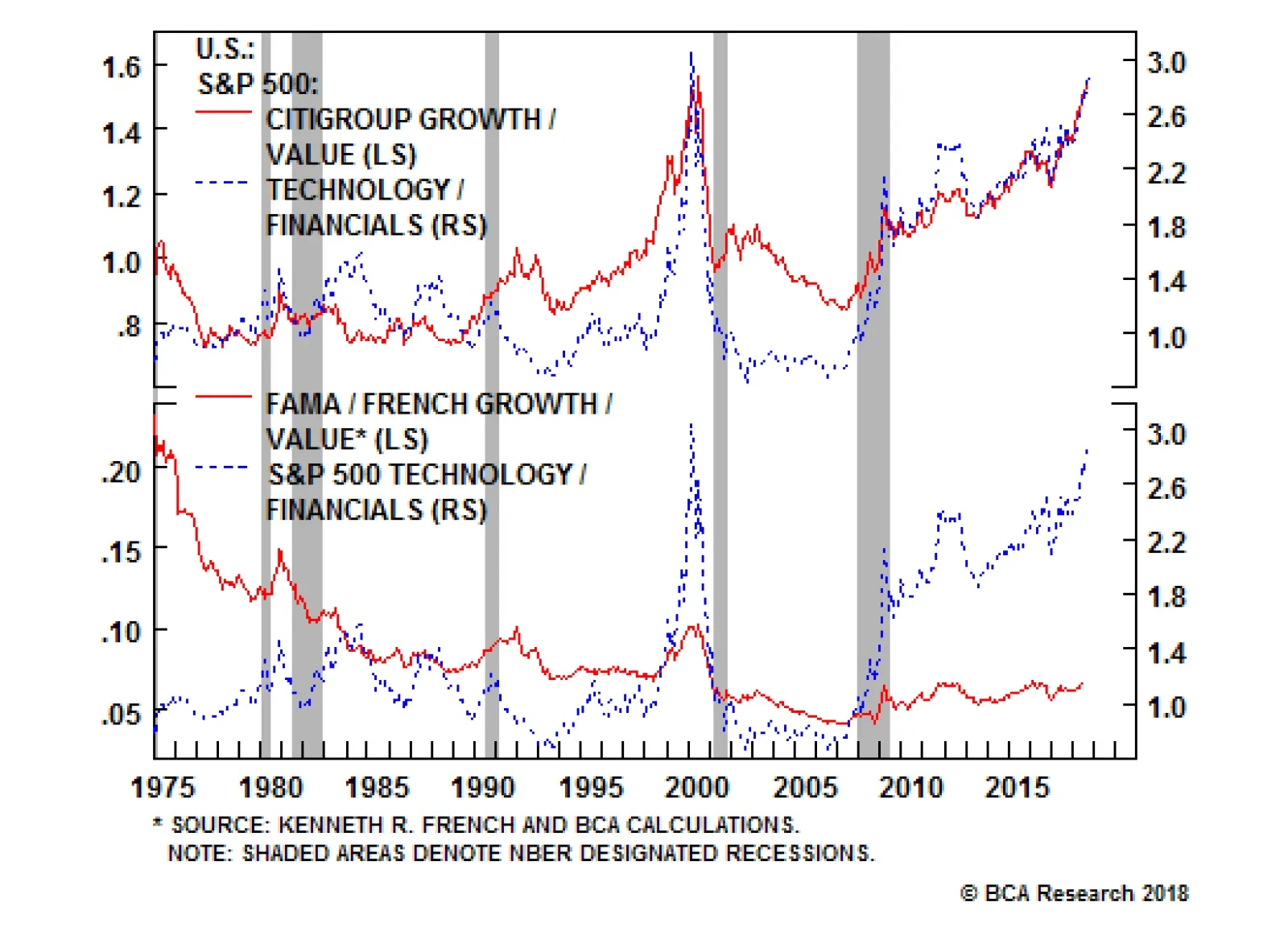

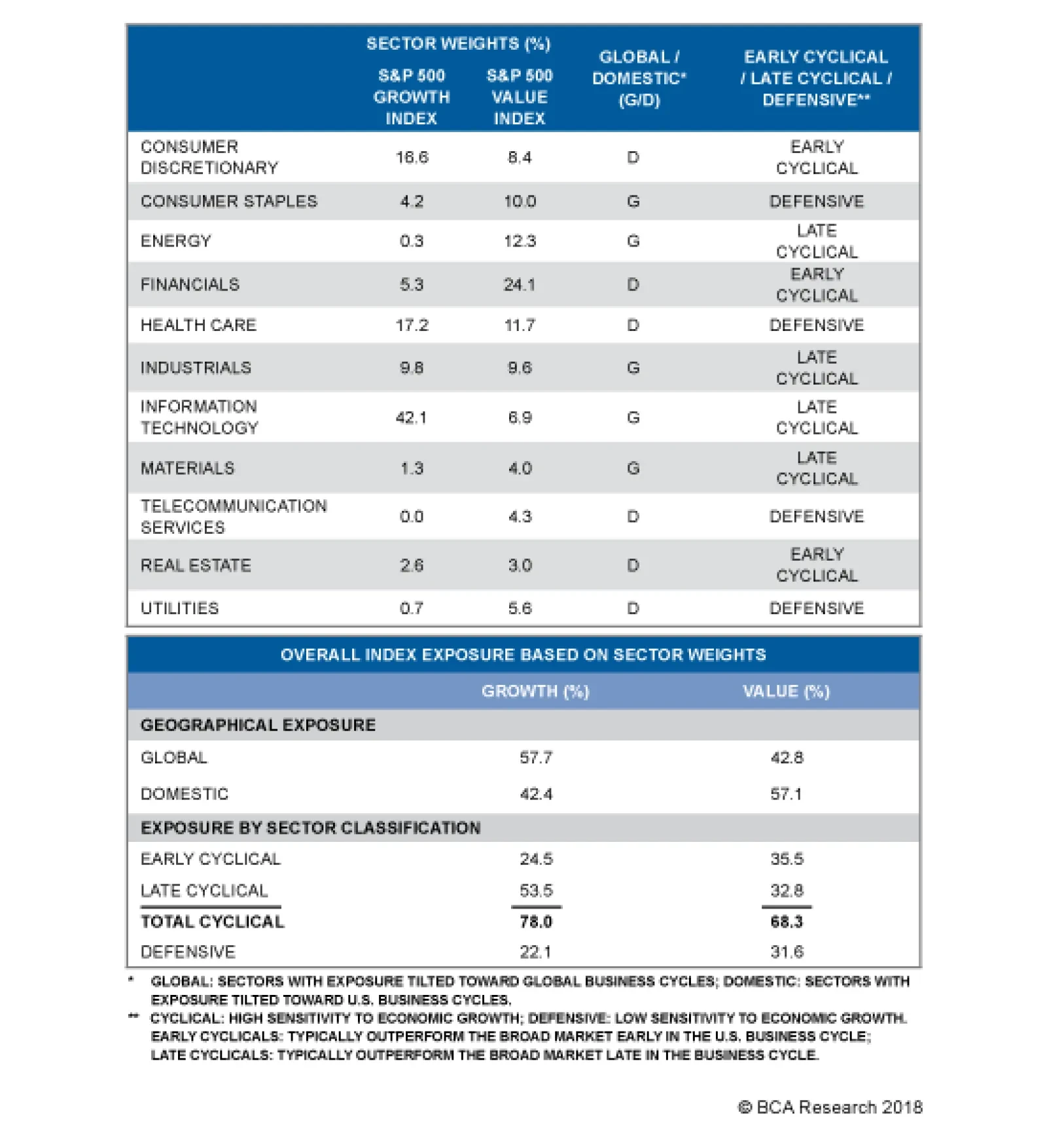

The higher debt load of Financials and the low-margin operations of banks depress their multiples relative to nonfinancial firms. Thus, Financials hold permanent residency in the off-the-shelf value indexes. Conversely, Tech…

The headline S&P 500 indexes currently differentiate between growth and value stocks using the following metrics: 3-year growth rates in EPS, 3-year growth rates in sales-per-share, and 12-month price momentum; along with…

Highlights Macro outlook: Global growth will continue to decelerate into early next year on the back of brewing EM stresses and an underwhelming policy response from China. Equities: Stay neutral for now, while underweighting EM…

Please note that our next publication will be a joint special report with BCA’s Geopolitical Service that will be published on Wednesday, August 1st instead of our usual Monday publishing schedule. Further, there will be no…