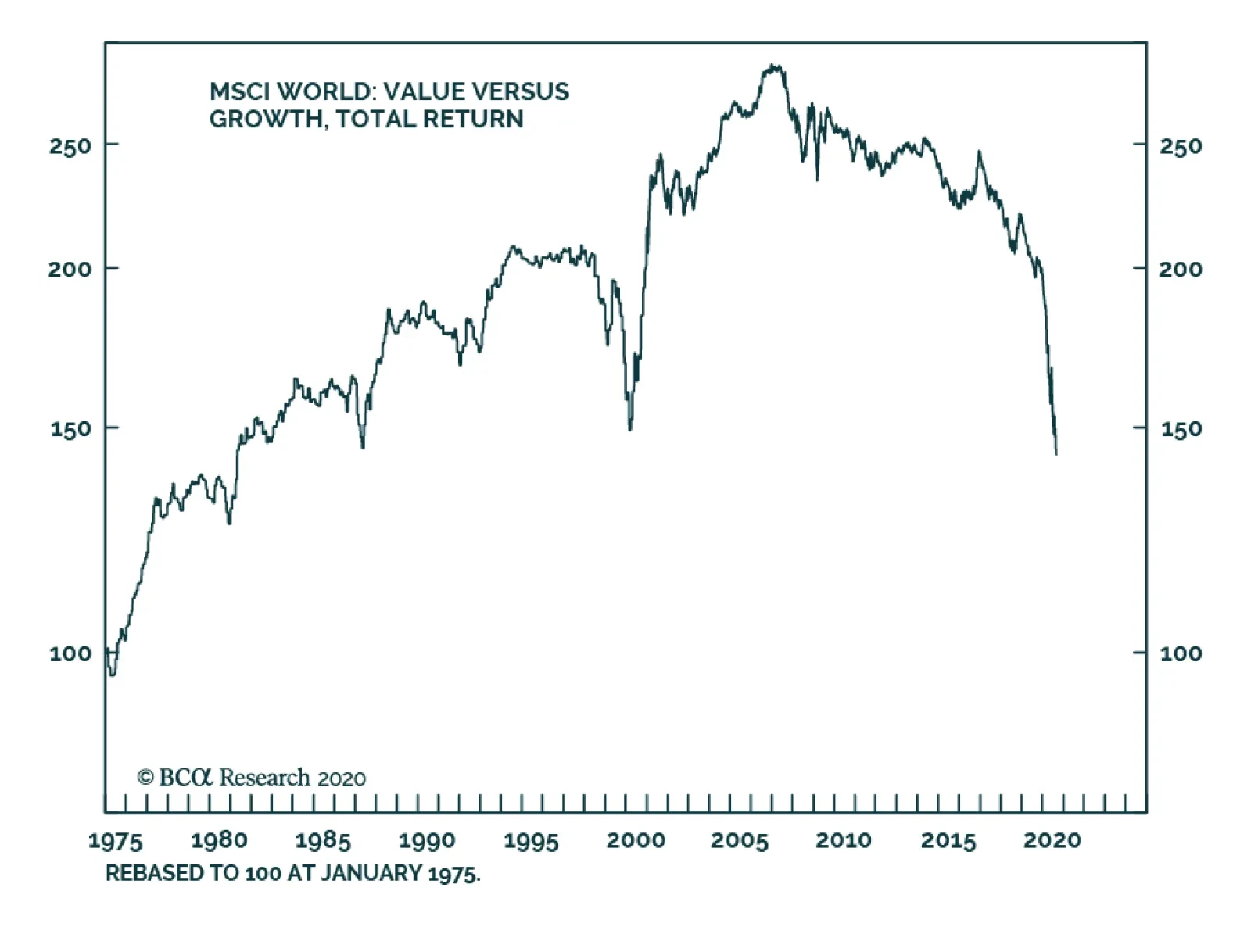

In the 34 years through 1975-2008, value stocks trebled relative to growth stocks albeit, with the occasional vicious countertrend move, such as the dot com bubble. But in the 2009-2020 interval, the tables turned. For…

Highlights ‘Value’ sector profits are in terminal decline. Bank profits are in terminal decline, because private sector credit is now ‘maxed out’, and the intermediation between borrowers and savers can be done…

Dear Client, I will be on vacation next week. Instead of our regular report, we will be sending you a Special Report from my colleague Jonathan LaBerge. Jonathan will explore the risks posed to commercial real estate and the banking…

Dear Client, In lieu of our regular report next week, we will be sending you a Special Report from my colleague Garry Evans, Chief Global Asset Allocation Strategist. Garry will be discussing the social and industrial changes that will…

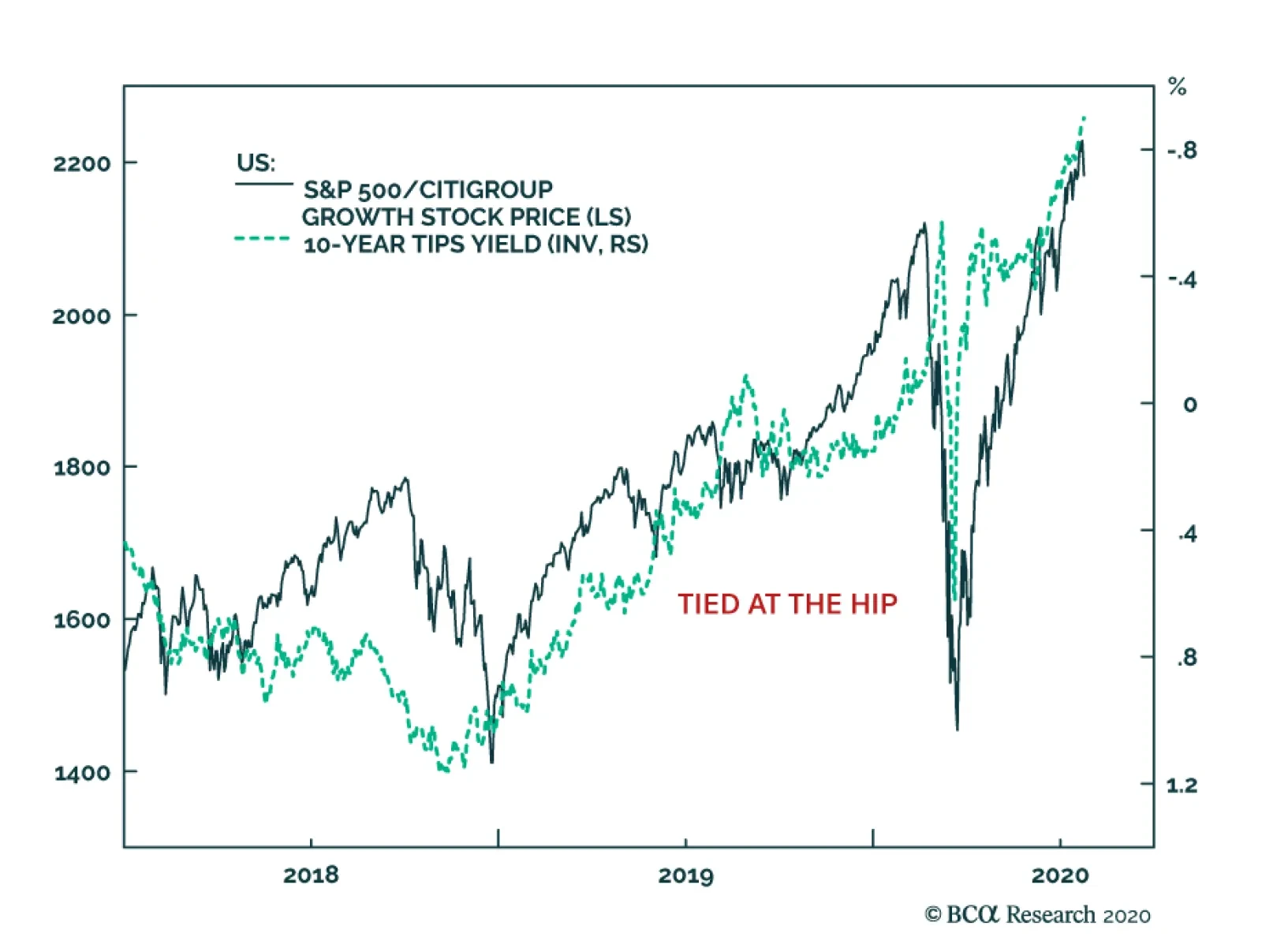

For the past two and a half years, the performance of US growth stocks versus the S&P 500 has closely tracked the inverse of real yields. Historically. Real yields also correlate closely with the expected growth rate of long-…

Highlights The economic performance of Sweden, which did not have a lockdown, has been almost as bad as Denmark, which did have a lockdown. This proves that the current recession is not ‘man-made’, it is ‘pandemic-…

Despite the strong rally in stocks since mid-March and a looming second wave of the pandemic, we continue to recommend that investors overweight equities on a 12-month horizon. Needless to say, this view has raised some eyebrows. With…

In a webcast this Friday I will be joined by our Chief US Equity Strategist, Anastasios Avgeriou to debate ‘Sectors To Own, And Sectors To Avoid In The Post-Covid World’. Today’s report preludes five of the points…