The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

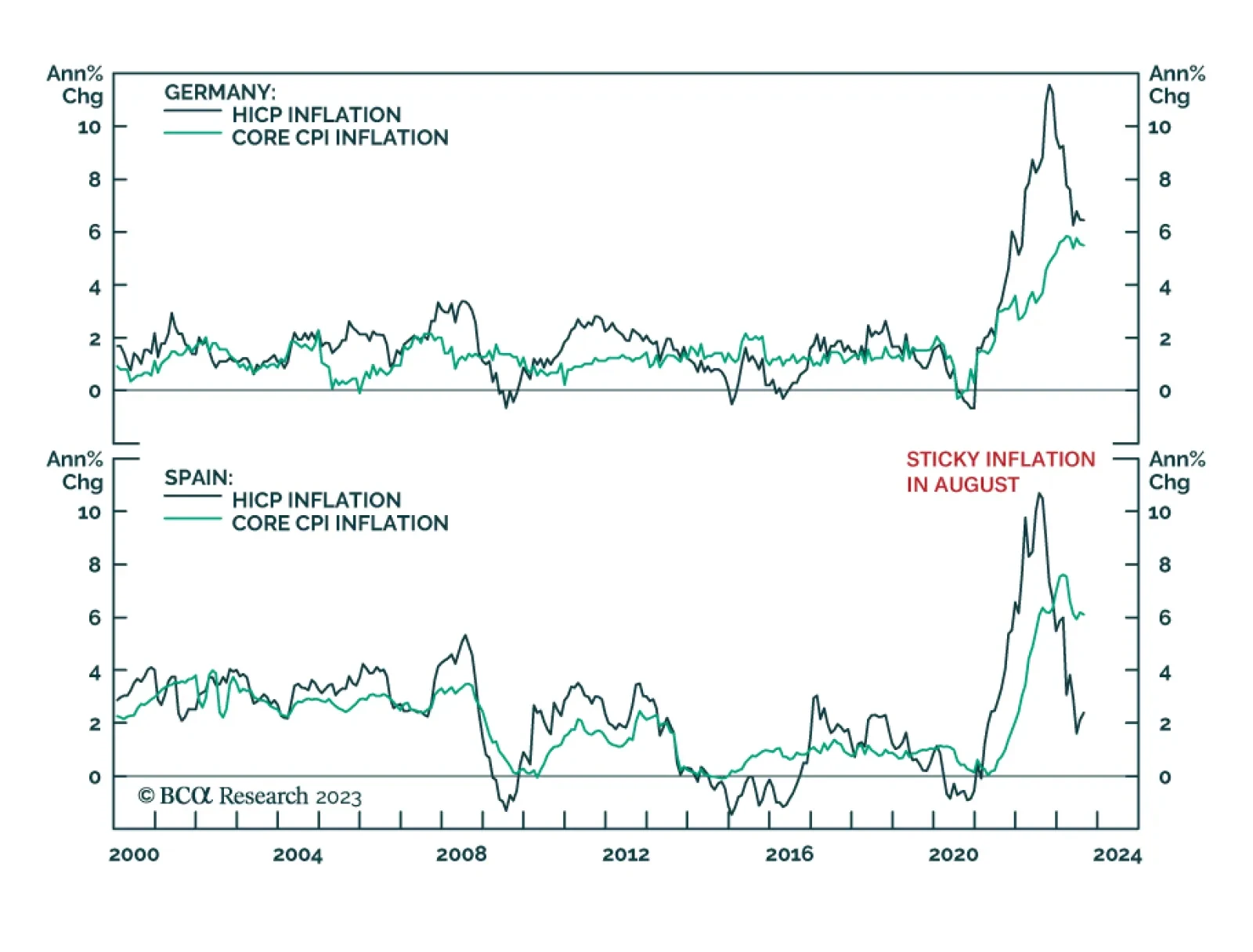

Euro Area inflation data surprised to the upside on Wednesday. According to preliminary data, although Germany’s harmonized headline CPI inflation rate fell from 6.5% y/y to 6.4% y/y in August, it nevertheless came in…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

The snap election which took place on Sunday resulted in a political deadlock in Spain. No single party has won enough seats to form a government. More importantly, both the left-wing bloc and the right-bloc fell short of the 176-…

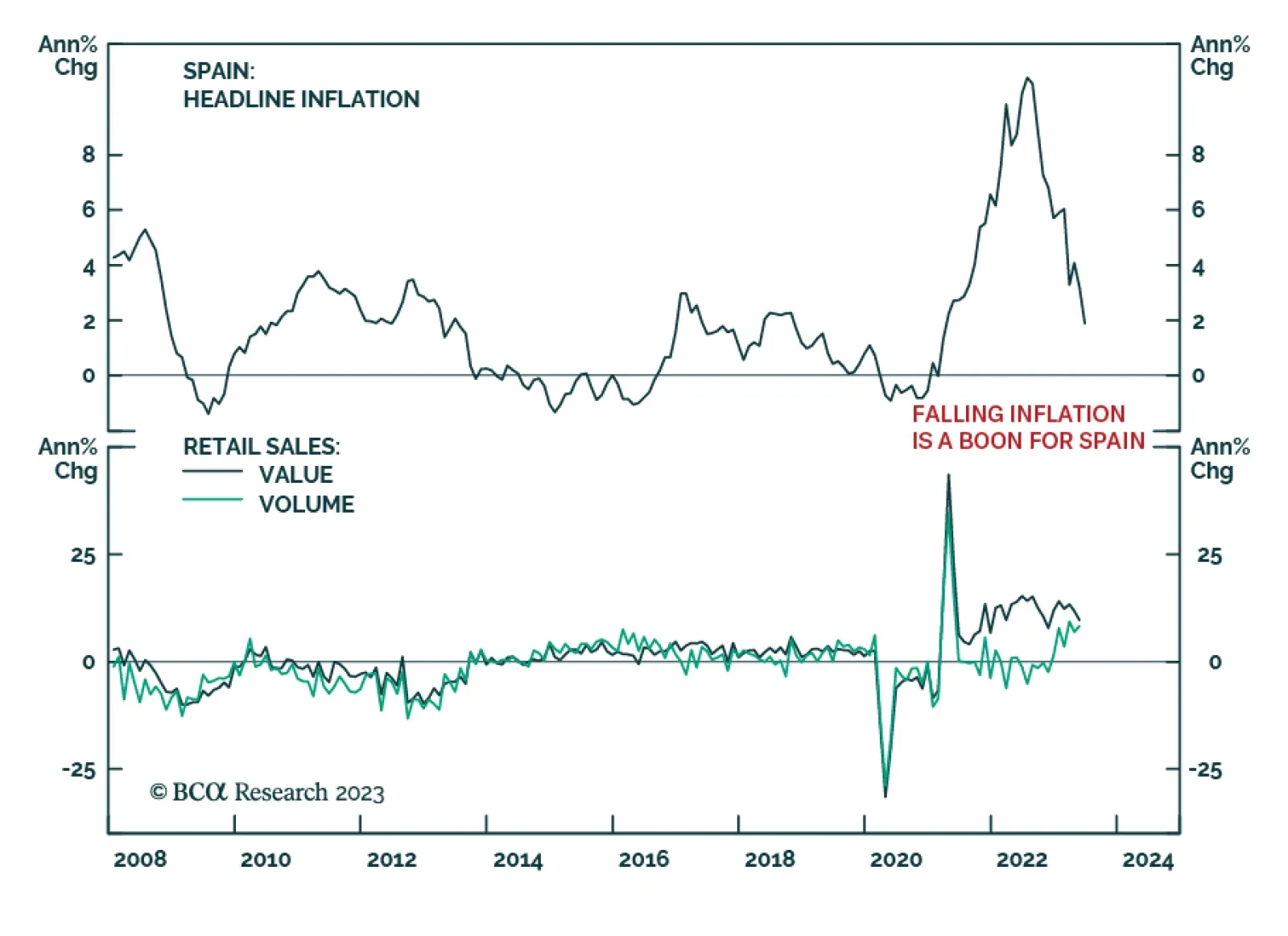

According to BCA Research’s Geopolitical Strategy and European Investment Strategy services, Spain’s economy is outperforming that of the Eurozone thanks to lower inflation and exploding tourism activity. These trends…

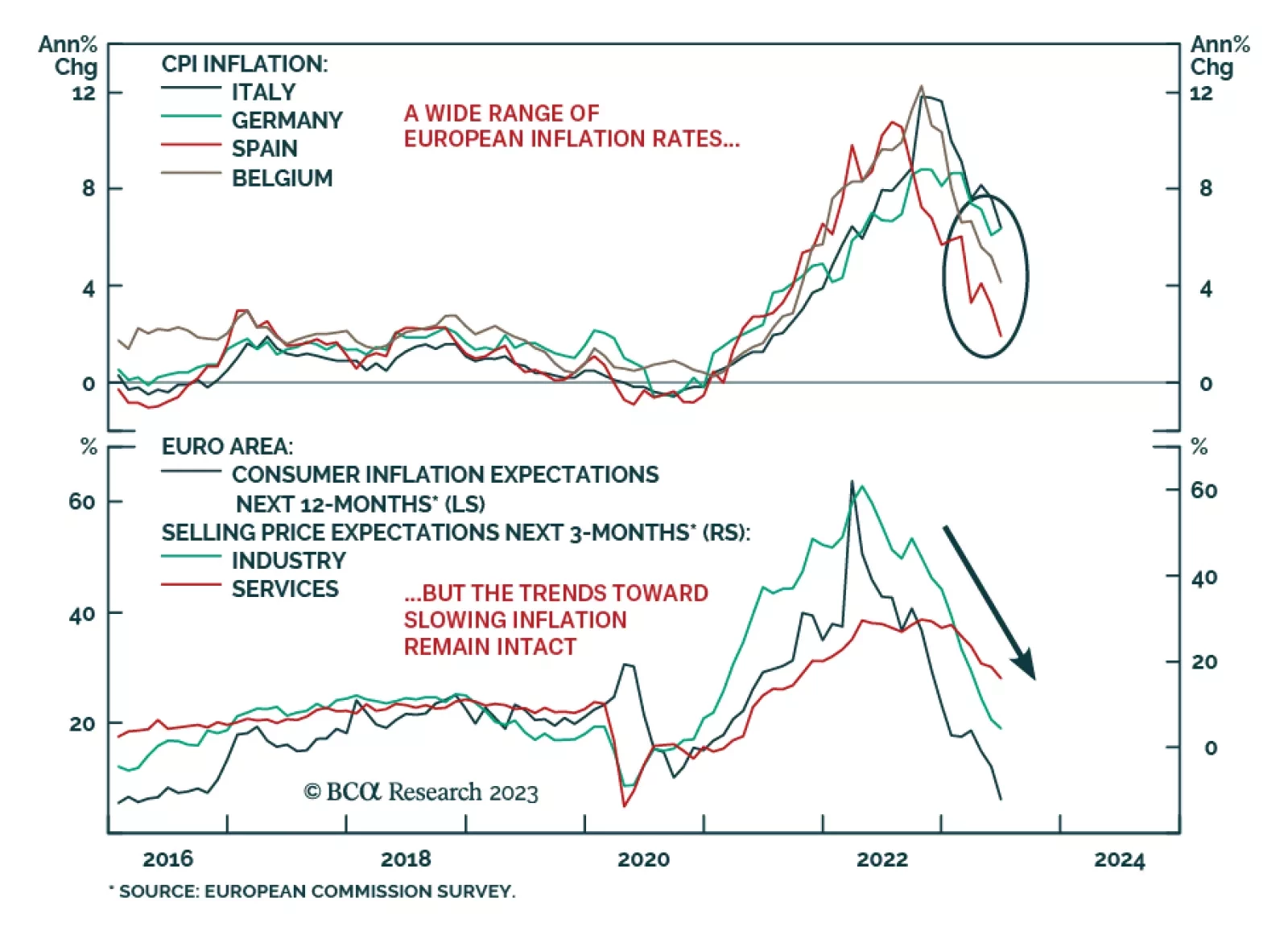

The preliminary inflation prints for June in the major euro area economies highlight a growing divergence in inflation outcomes. There was good news: headline CPI inflation in Italy fell to 6.7% in June from 8.0% in May, while…

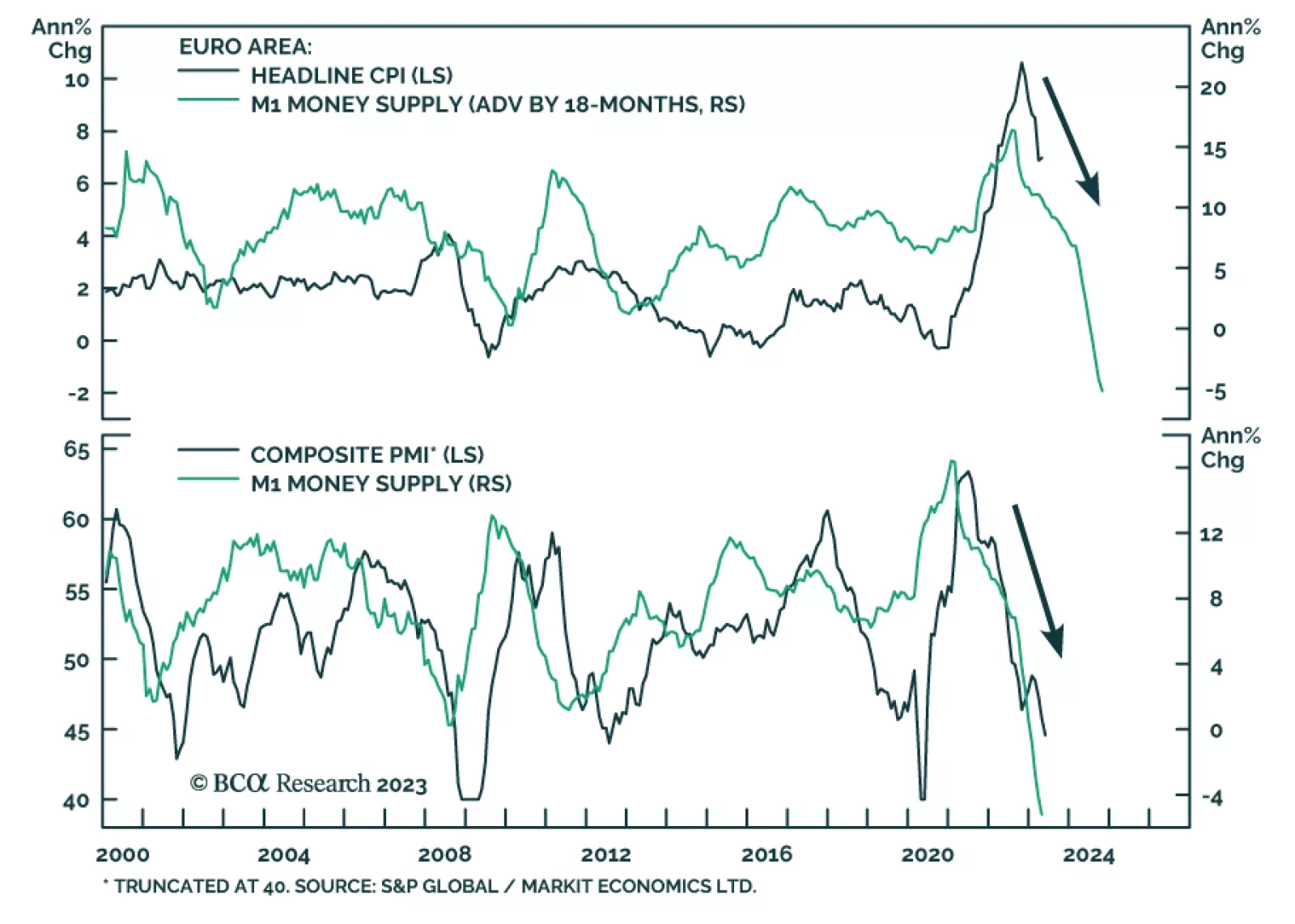

The latest Eurozone data releases show the impact of the ECB’s aggressive monetary tightening cycle. The contraction in M1 money supply – which includes currency in circulation and overnight deposits –…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.