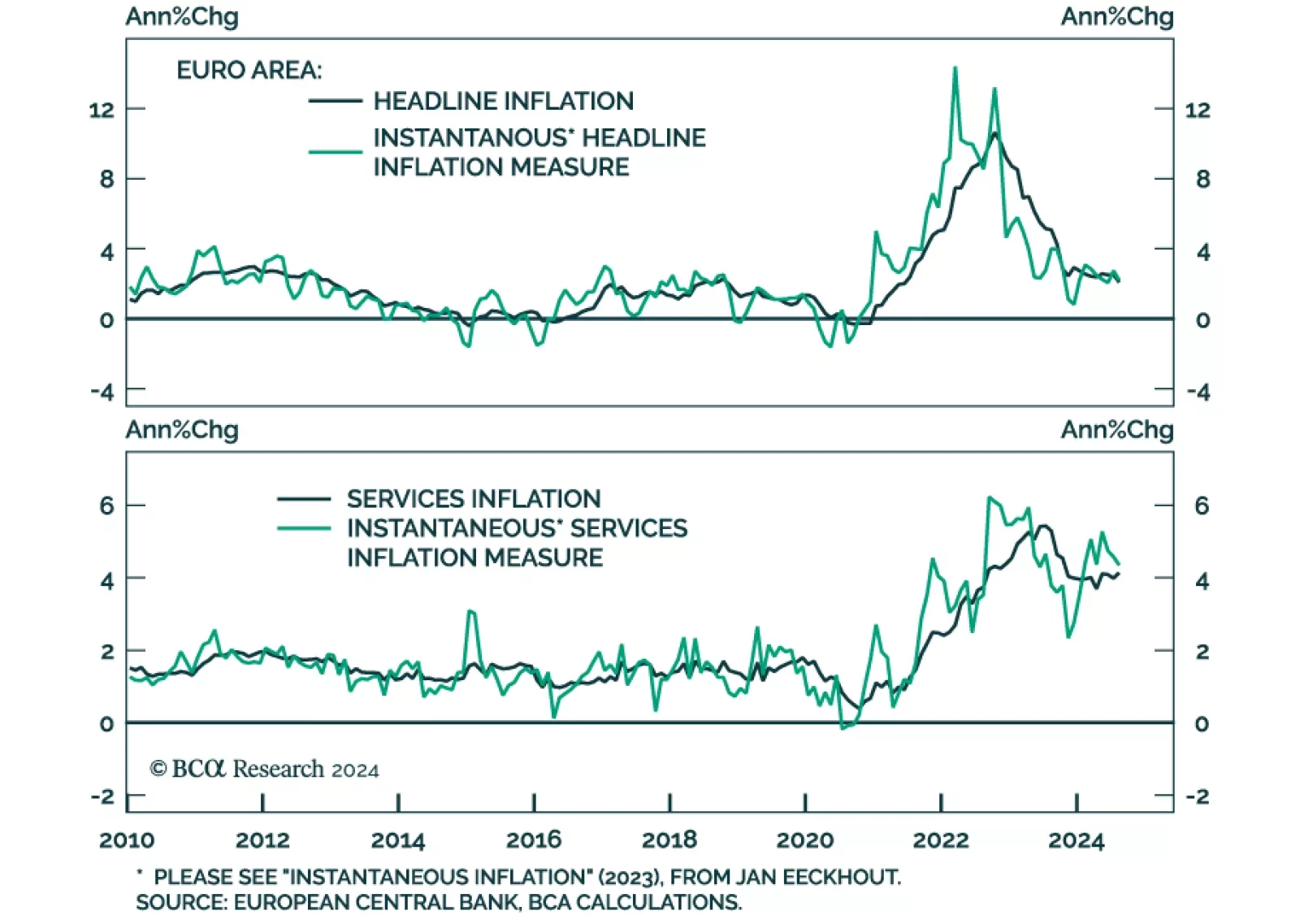

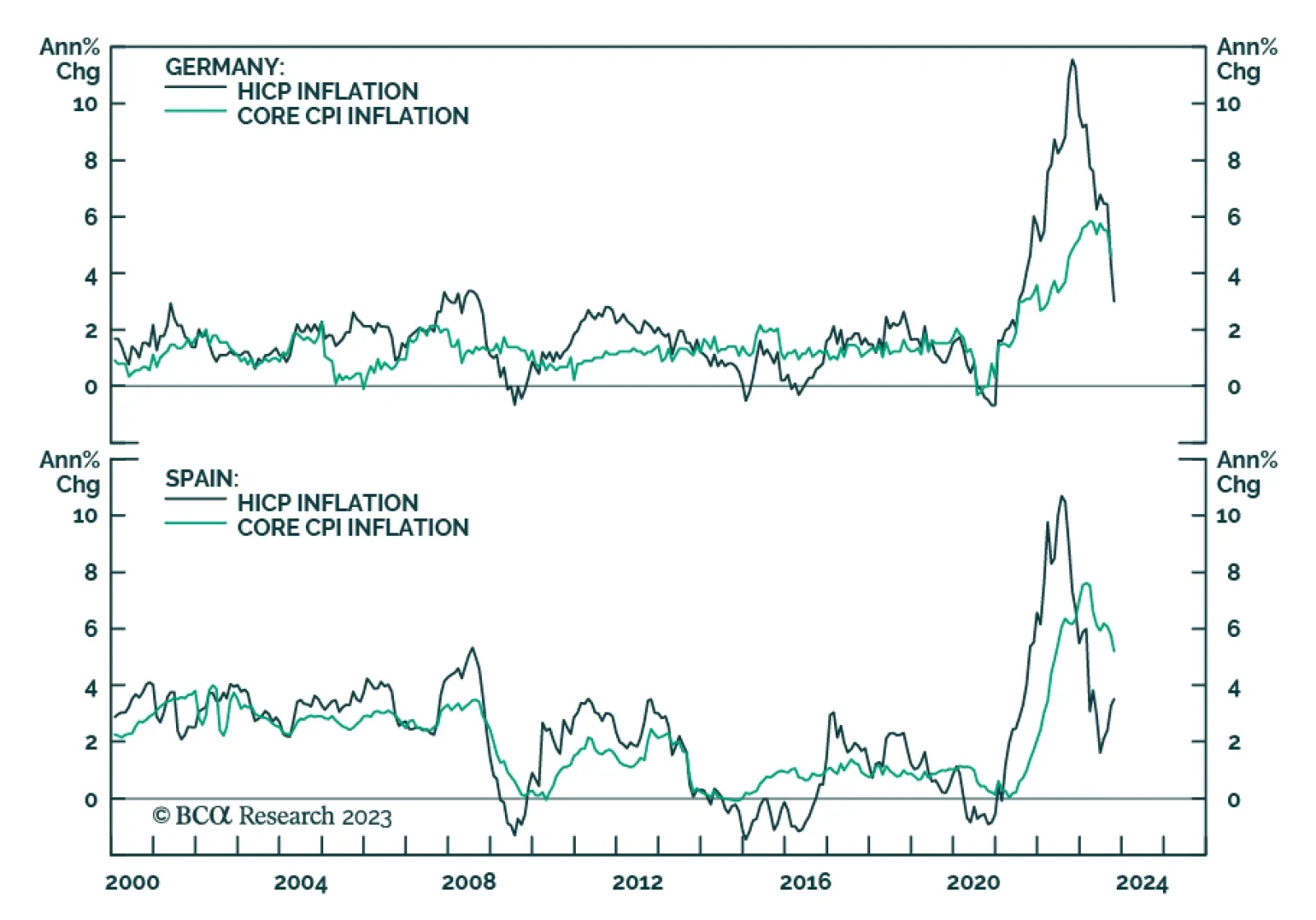

France’s and Spain’s preliminary September CPI readings declined on a month-on-month basis, clocking in at 1.5% and 1.7% y/y respectively, and undershooting consensus expectations. Germany’s and Italy’s…

Eurozone GDP surprised to the upside in Q2, growing by 0.3% q/q annualized against expectations of 0.2%. Stronger-than-expected expansions in France (0.3% q/q vs 0.2%) and Spain (0.8% q/q vs 0.5%), as well as steady growth in…

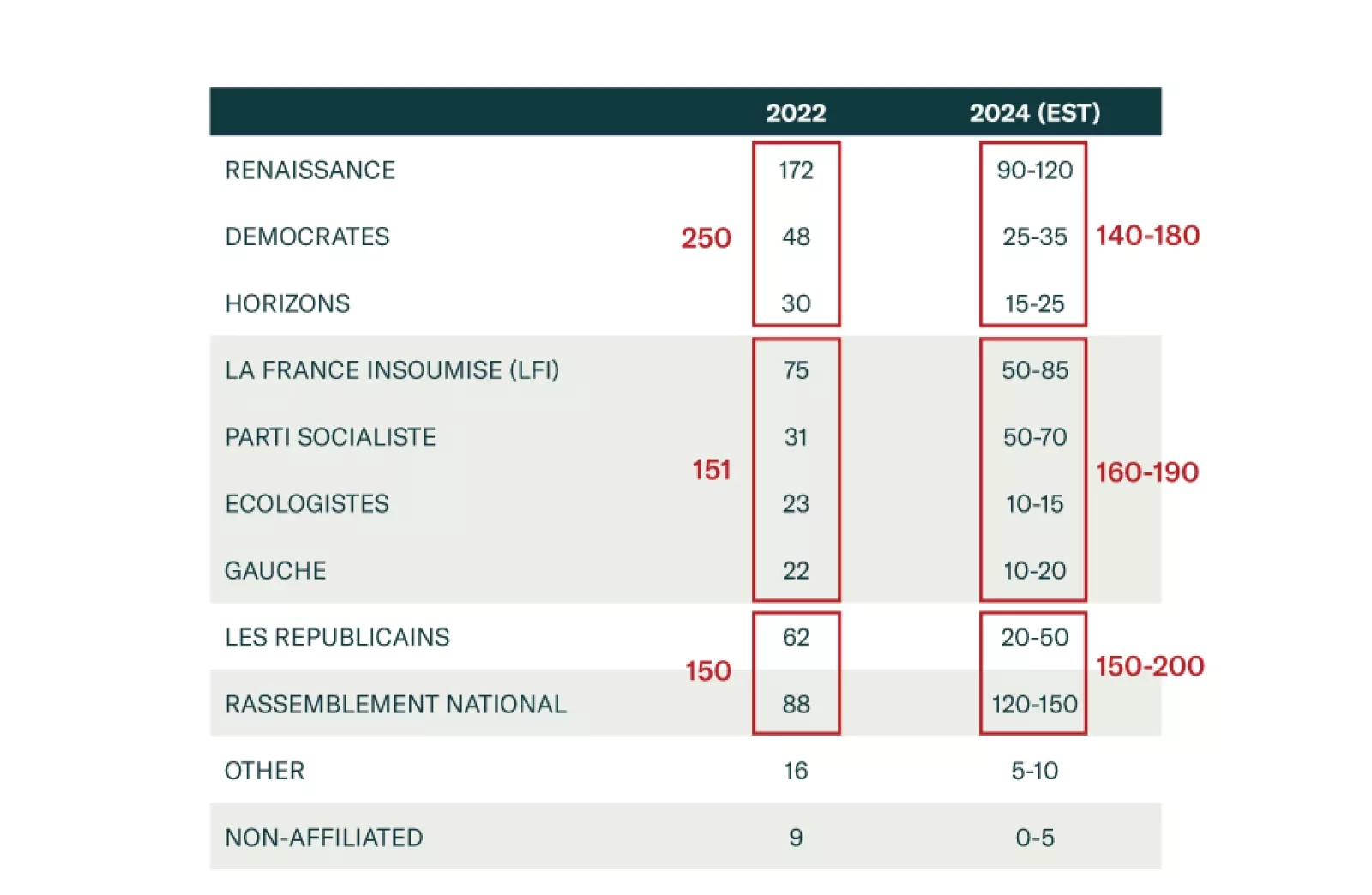

European assets are selling off as investors panic about the upcoming French election. Is this panic justified, and if so, for how long?

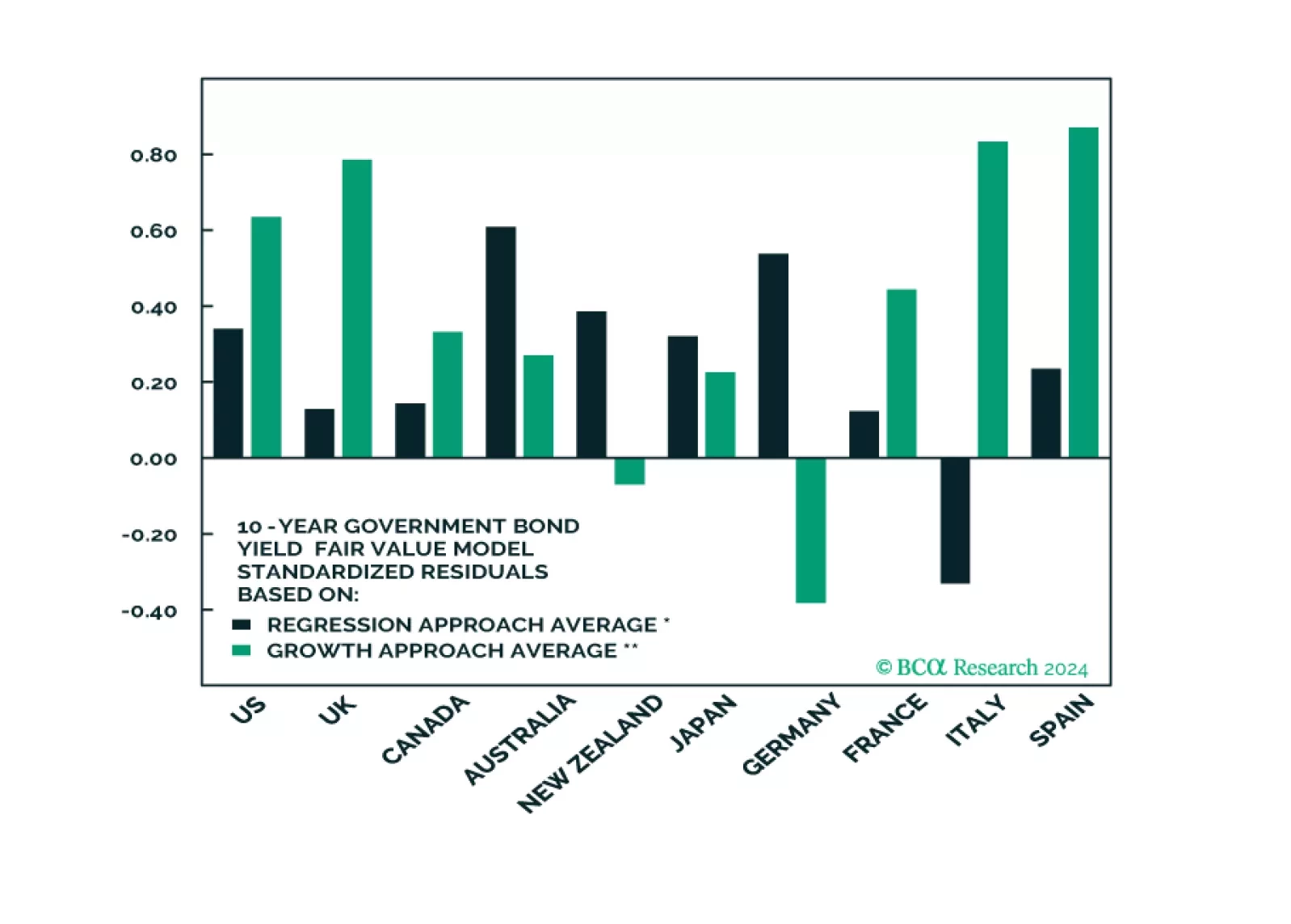

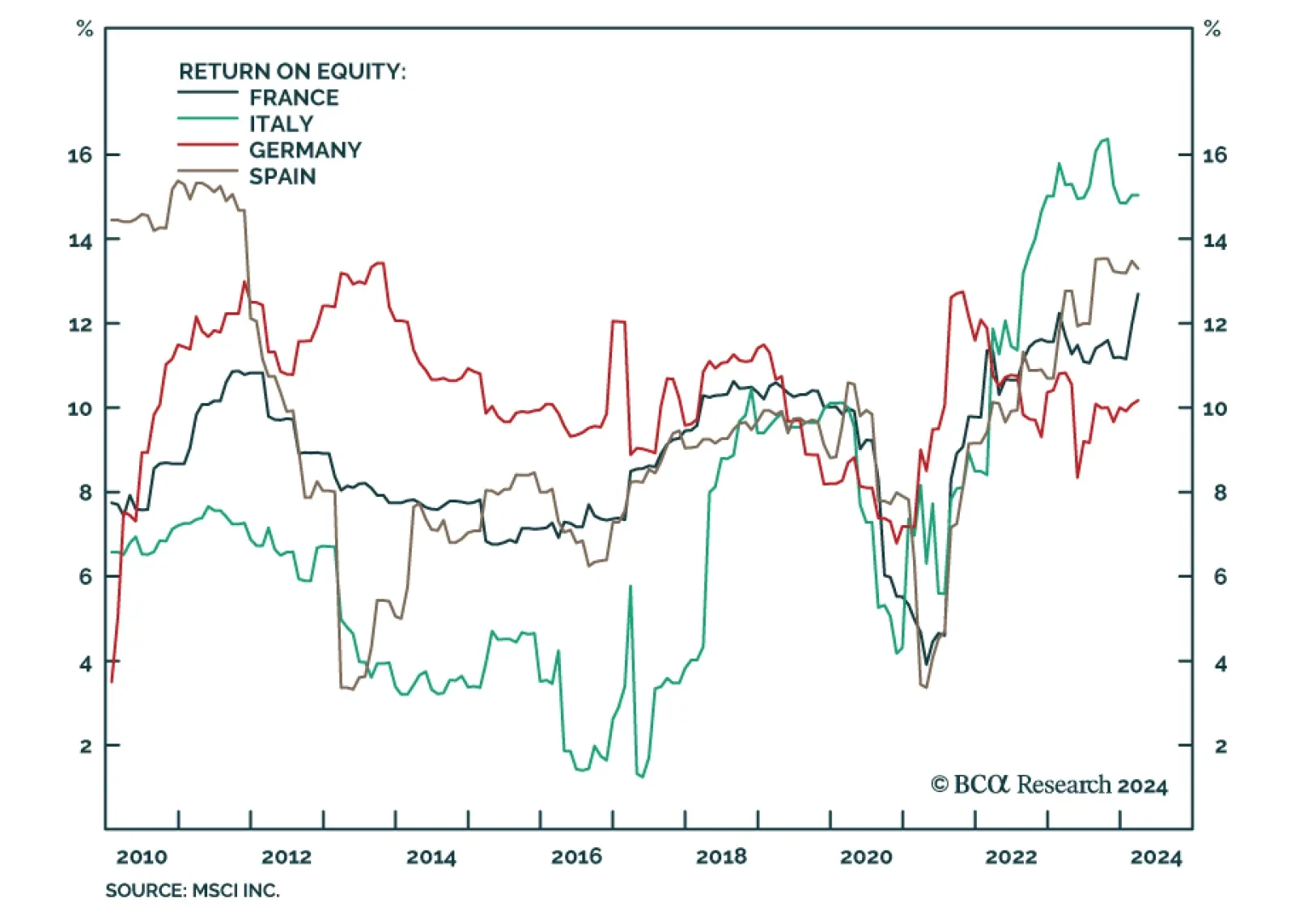

Italy and Spain have a poor reputation when it comes to their economies. The European debt crisis affected them more than other Euro Area countries. Their housing markets collapsed and debt cost soared. France and Germany, while…

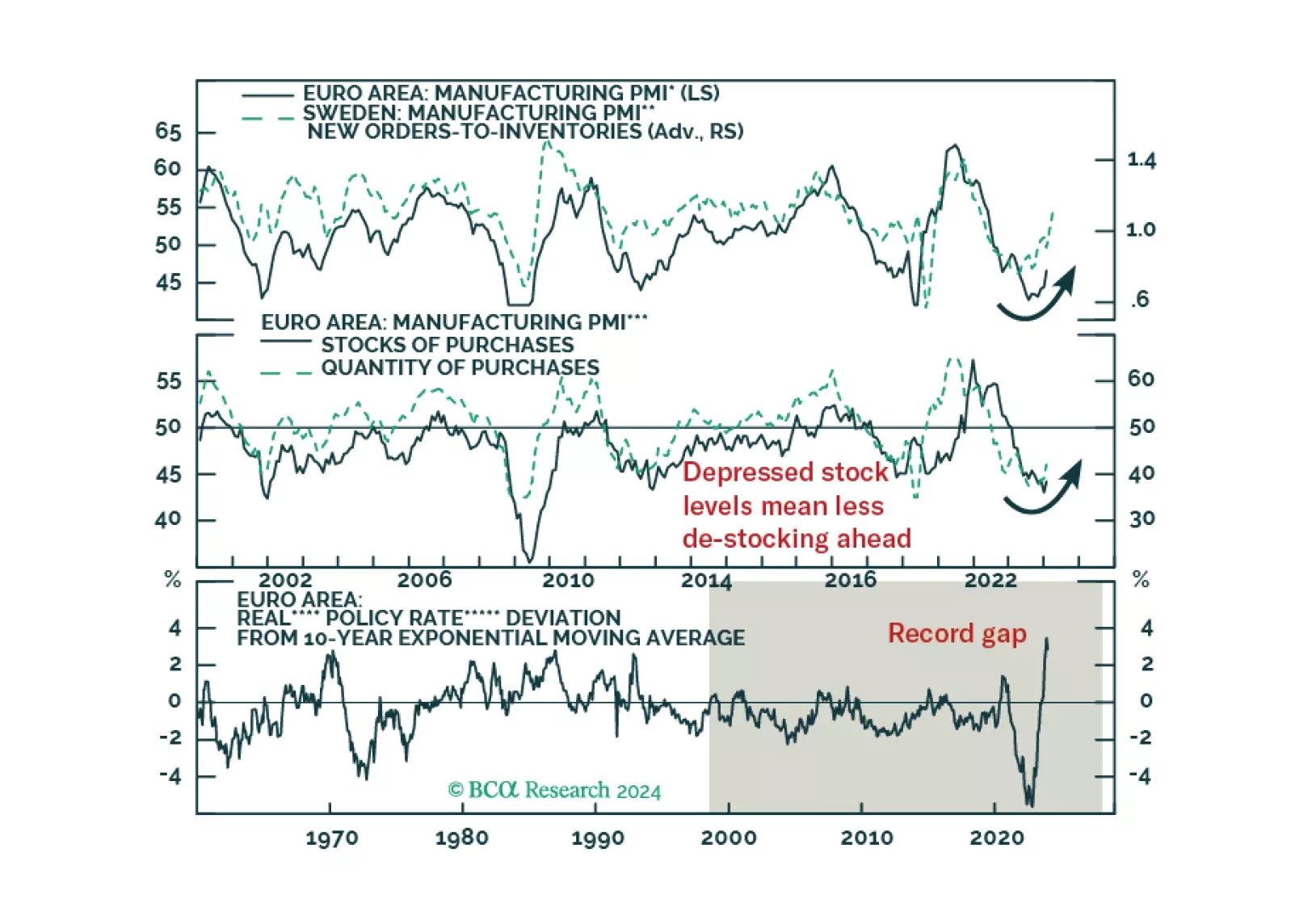

Is the rebound in European PMIs enough to boost the appeal of European risk assets?

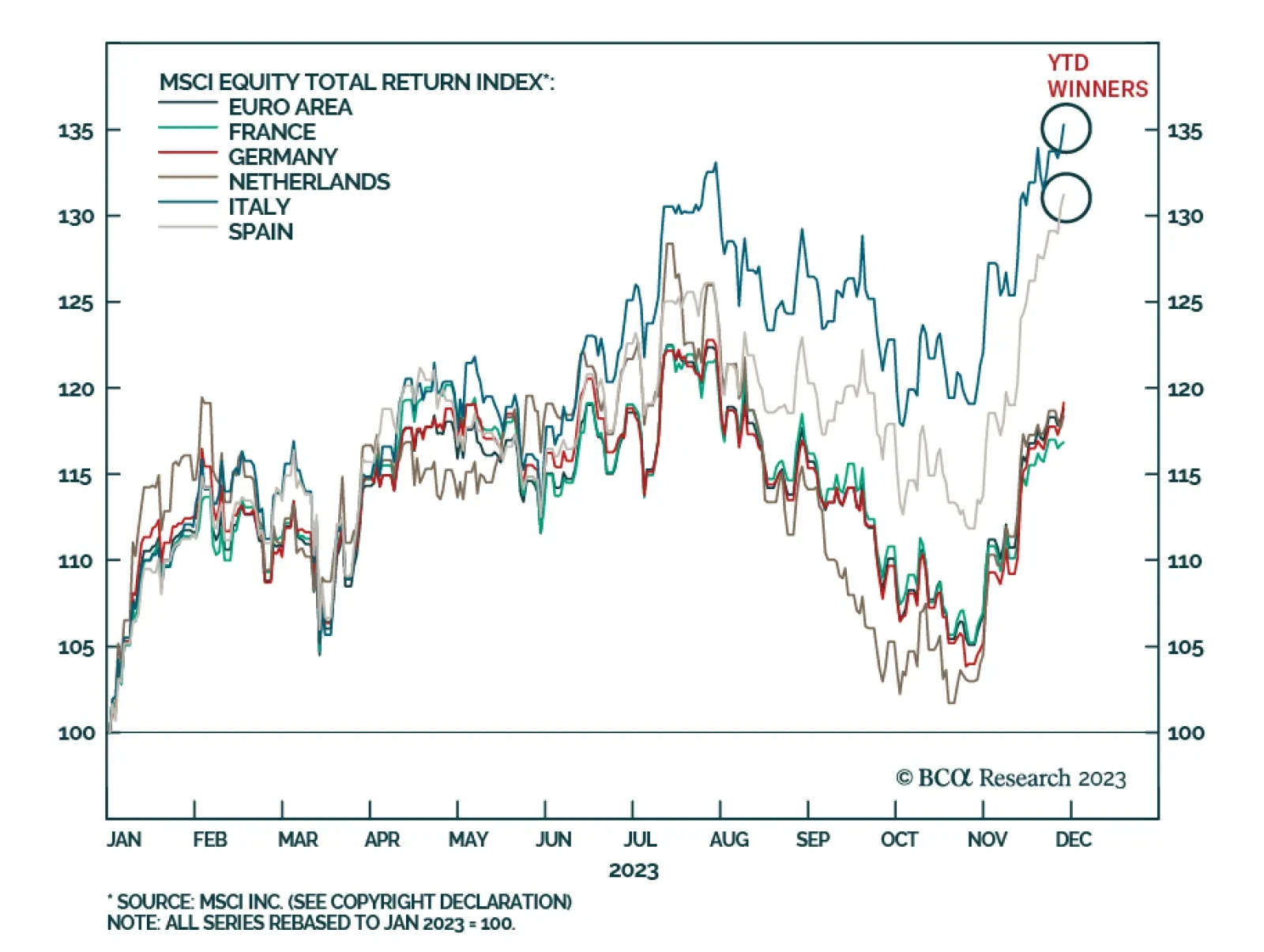

Euro Area stocks have had a strong 2023, rising by 18.8% year-to-date, only slightly behind the 19.1% gain captured by US equities, and outperforming the ACWI’s 14.3% increase. In particular, the Italian index’s 35…

Eurozone economic data sent a positive signal on Monday. Preliminary CPI releases from Germany and Spain show price pressures continue to moderate. In Germany, the harmonized index declined by 0.2% m/m while the annual rate of…

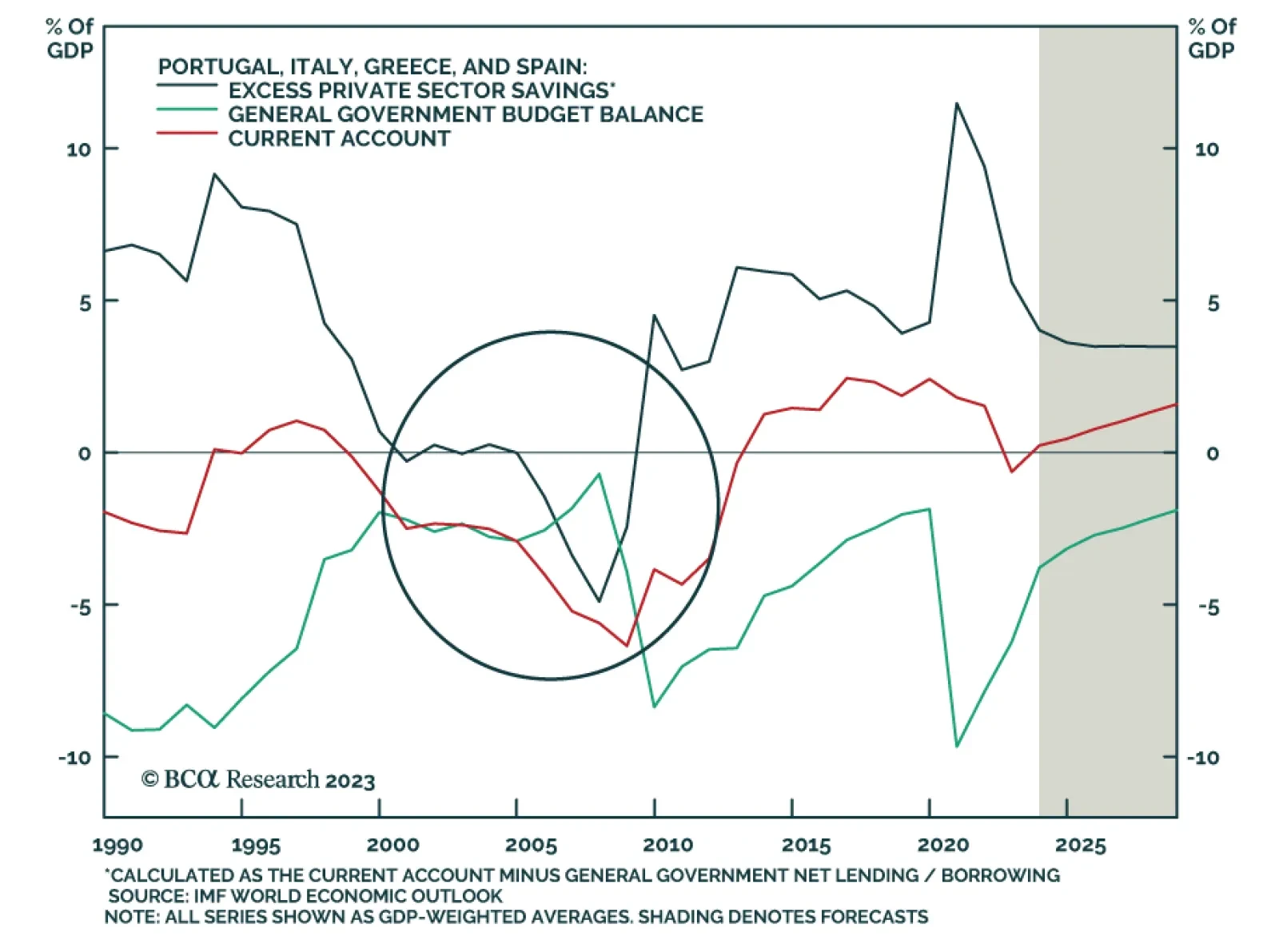

According to BCA Research’s European Investment Strategy service, the Mediterranean bloc’s move from current account deficit to current account surplus nations greatly limits the risk of a new sovereign debt crisis…