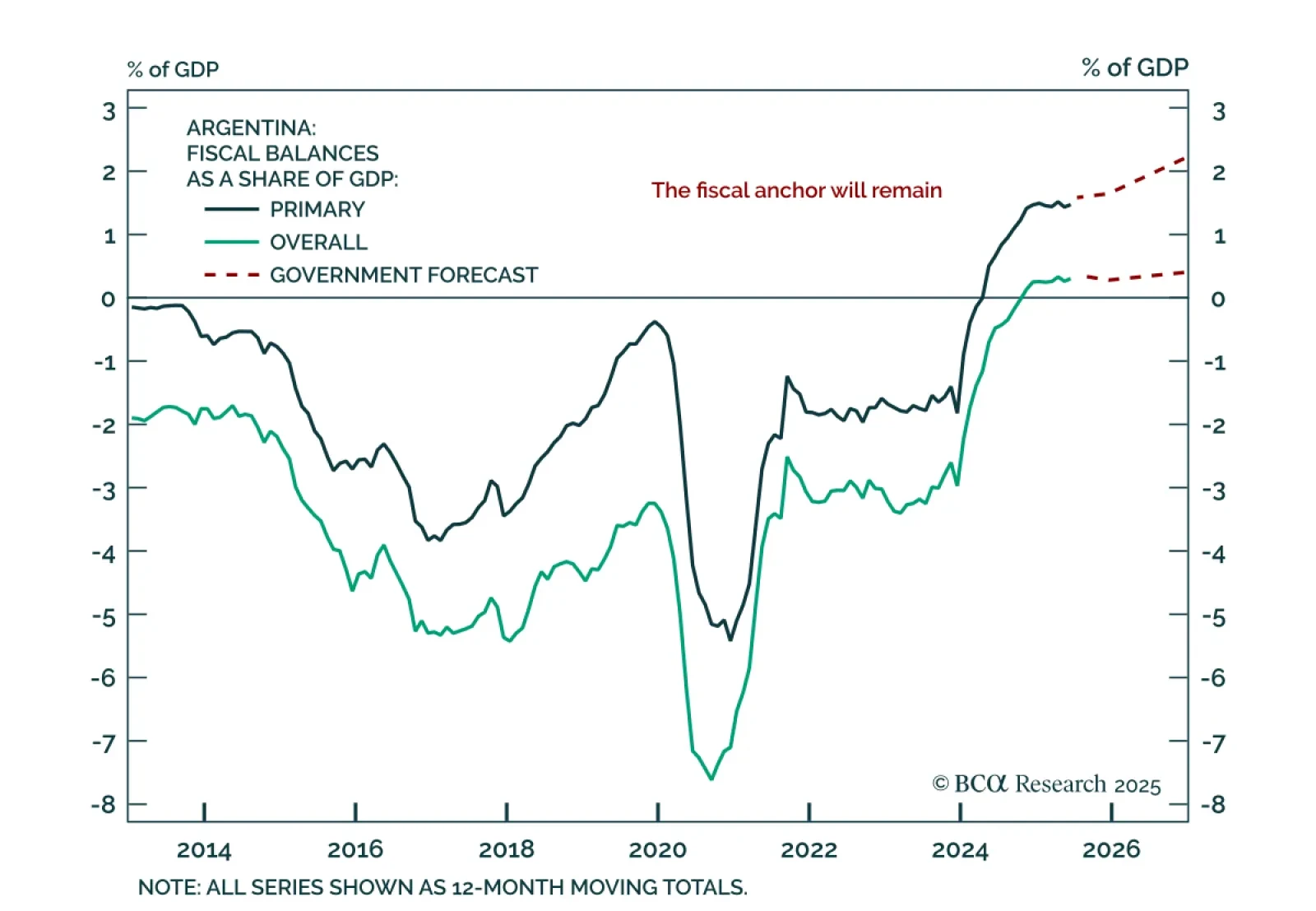

Despite the post-election selloff, investors should continue buying Argentine assets on weakness. Argentine markets sold off sharply after President Milei’s party suffered a crushing defeat in Sunday’s Buenos Aires election.…

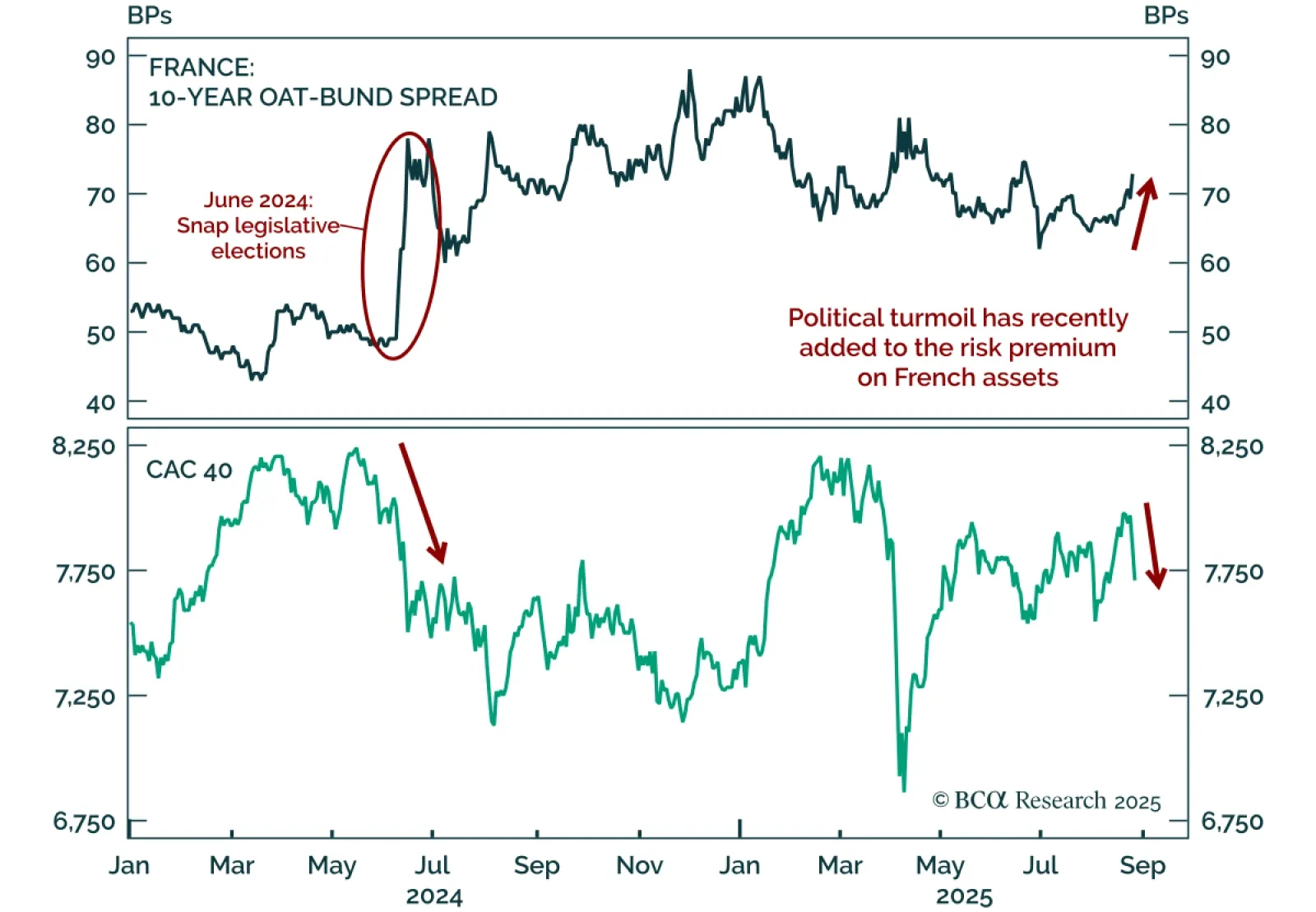

France’s renewed political turmoil highlights fiscal risks for OATs, but creates opportunities to buy French equities on dips. PM Bayrou has called a September 8 confidence vote over his deficit-cutting budget proposals,…

Our Emerging Markets strategists have upgraded Colombian equities, local bonds, and sovereign credit from underweight to neutral relative to EM benchmarks. Markets are caught between optimism about a potential rightward policy shift…

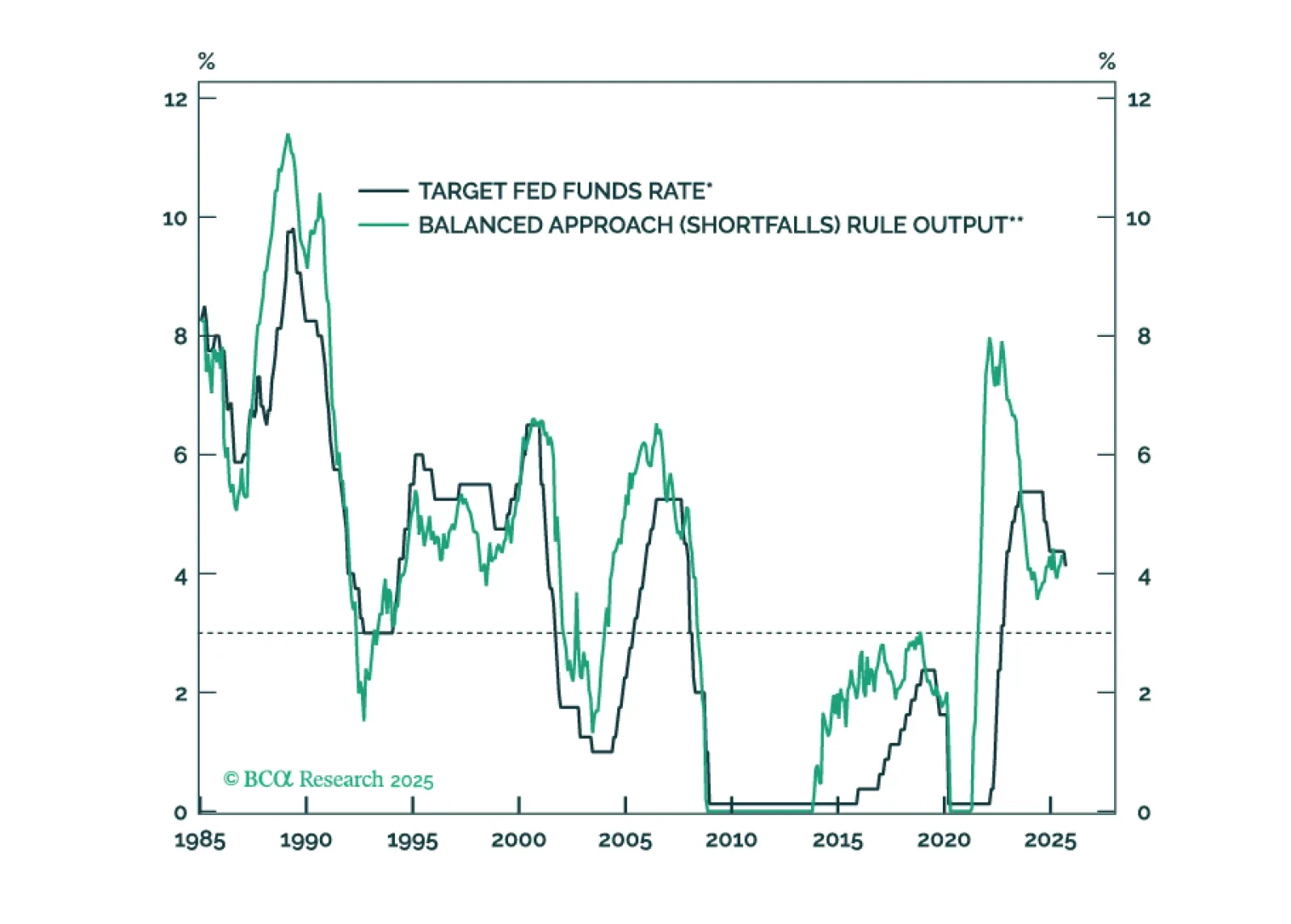

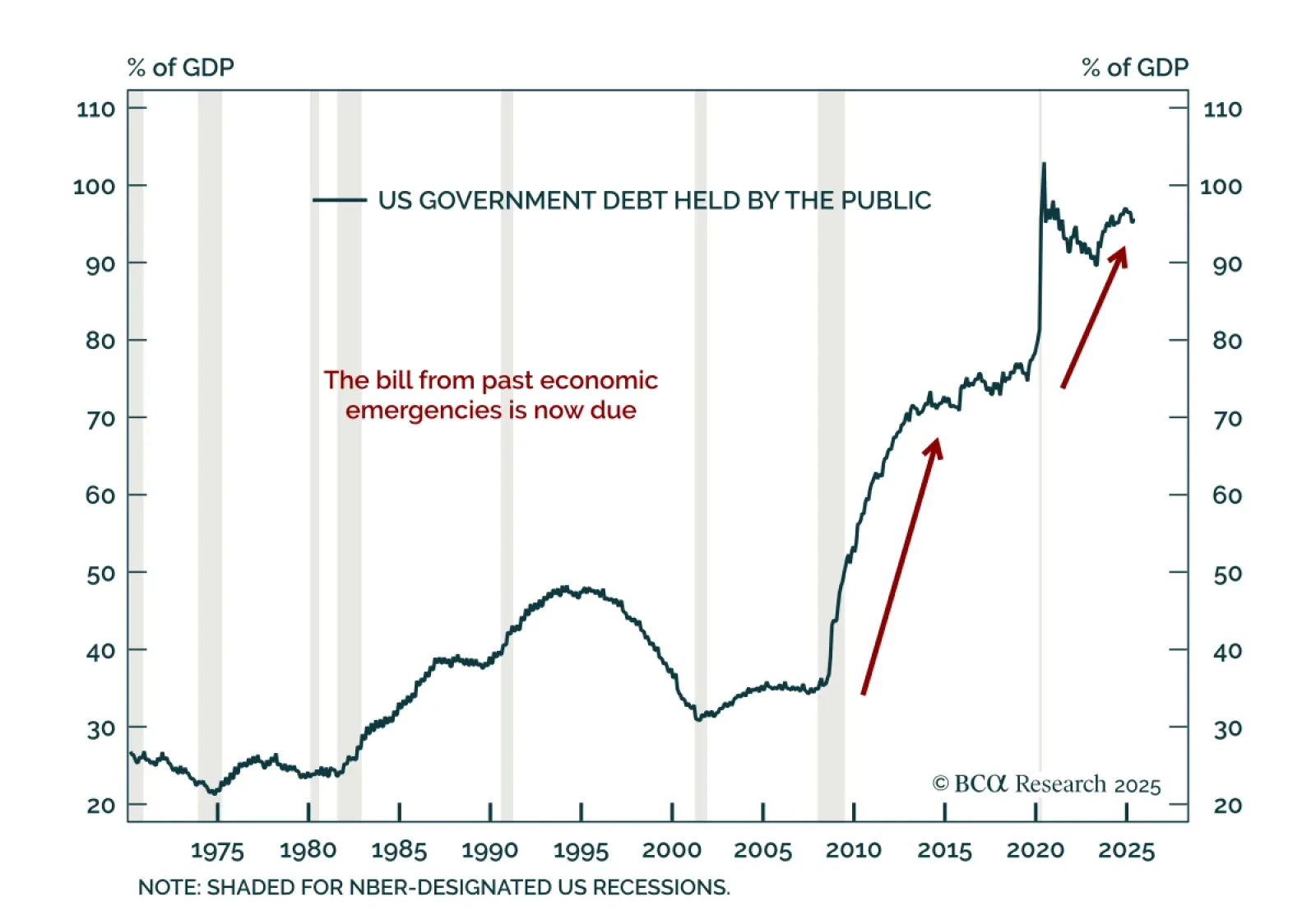

Our Bank Credit Analyst strategists argue that a US fiscal crisis should be treated as a base case over the next decade, not a tail risk. The ballooning US budget deficit reflects higher interest rates, demographic pressures, and the…

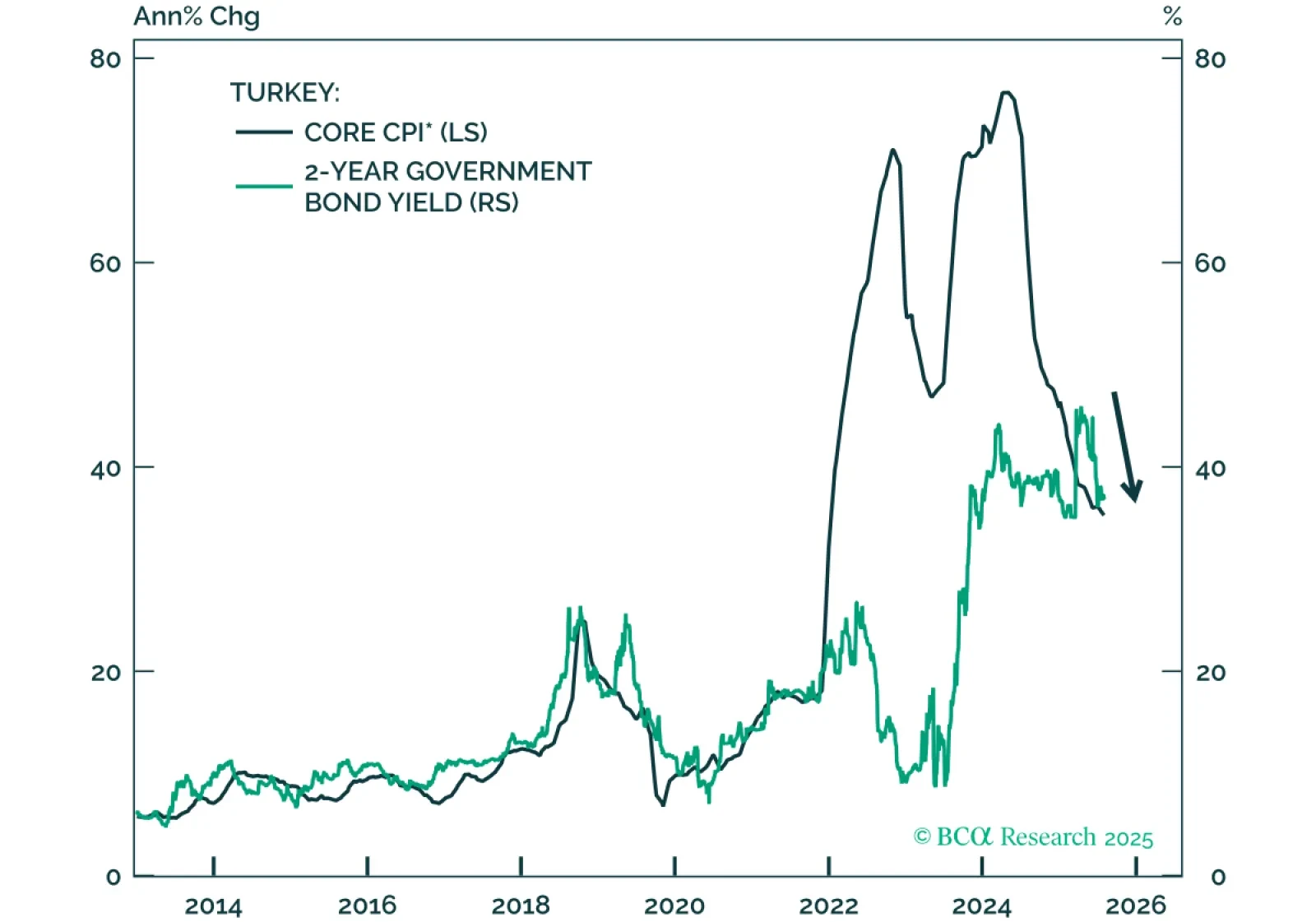

Turkey’s financial policymakers have pursued a disciplined and restrictive policy mix so far, delivering high real interest rates and curbing fiscal expansion even as the economy slows. This commitment to inflation control has paved the…

The SARB cut rates by 25 bps to 7.00%; our EM strategists expect further easing and recommends short ZAR exposure. Real interest rates remain elevated, and high borrowing costs are intensifying debt sustainability concerns, with…

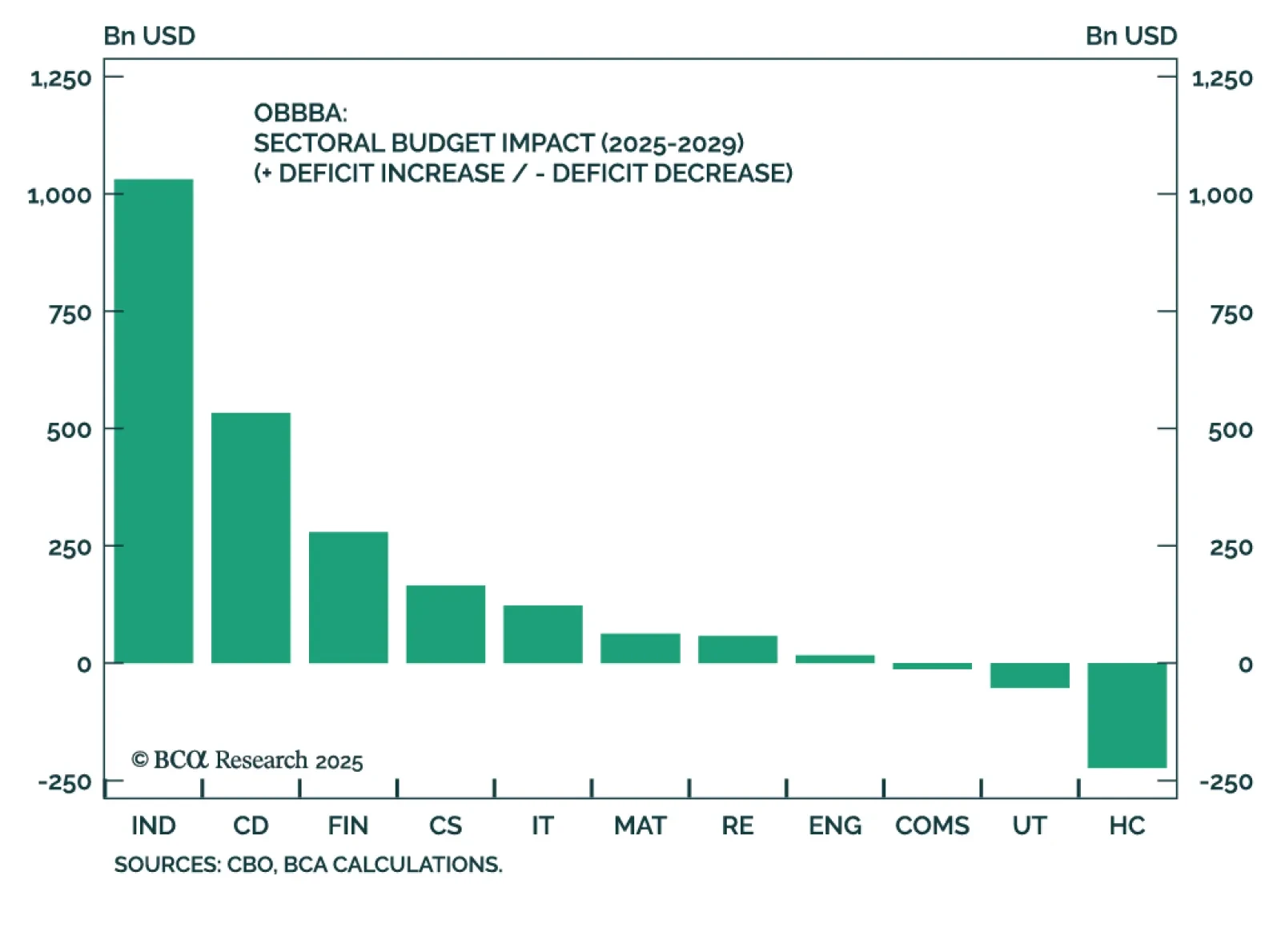

Our Geopolitical and Equity Analyzer teams recommend a Value and Quality-focused equity basket in Industrials, Financials, and Consumer Discretionary to capture OBBBA-driven upside. These sectors are the primary beneficiaries of the…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…