While the broad tech sector is on an even keel with the SPX, software EPS are racing at twice the speed of the broad market, roughly 14%. The software profit juggernaut is intact and our U.S. Equity Strategy team reiterates its…

Highlights Portfolio Strategy Corporate sector selling price inflation is nil while leading wage inflation indicators signal additional labor cost increases in the coming months. The risk is that profit margins have already peaked for…

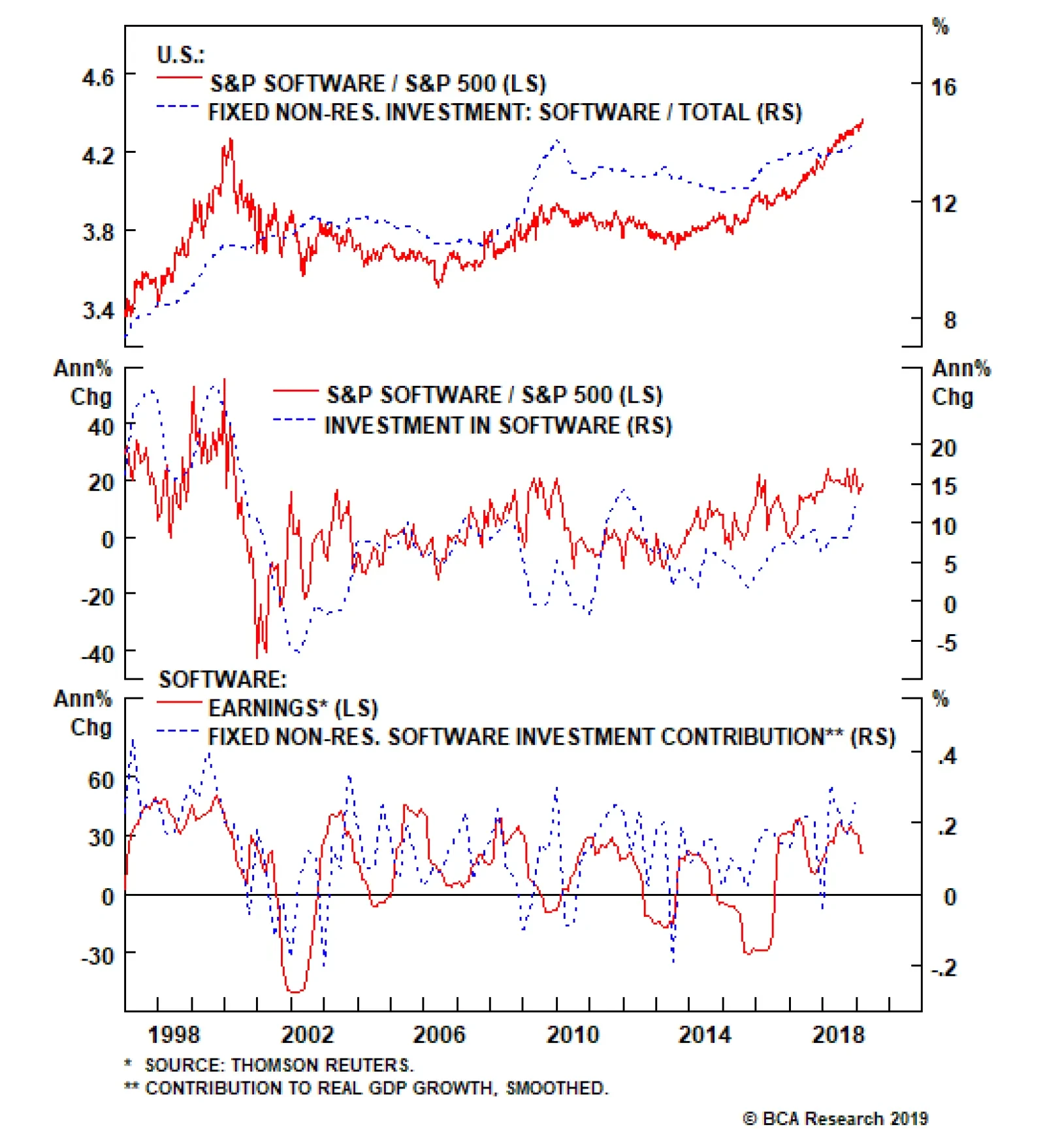

Overweight (High-Conviction) In last week’s GDP report, software was a clear standout. Investment in software as a ratio of total fixed non-residential investment has been on fire for much of the past four years and is…

Overweight (High-Conviction) One of the key themes for 2019 we noted in Monday’s Weekly Report is the later stages of the U.S. capex upcycle; we highlight our high-conviction overweight recommendation on the S&P…

Highlights Portfolio Strategy Higher interest rates, with the Federal Reserve tightening monetary policy three more times in the next seven months, will be the dominant theme next year. All four of our high-conviction underweight…

Inter-industry M&A activity is reaching fever pitch and this frenzy is bidding up premia to stratospheric levels. The push to the cloud, SaaS and even AI has boosted the appeal of software stocks and brought them to the…

Overweight (High-conviction) Despite recent tech stock ills, software stocks continue to defy gravity and remain in a multi-year uptrend, still above the dotcom bubble relative performance highs (top panel). We reiterate our high-…

Highlights Portfolio Strategy Frenzied software M&A activity, the ongoing capex upcycle, firming industry operating metrics and pristine balance sheets suggest that software stocks are a must have for equity portfolios. Rising…

As the SPX and a slew of other indices have vaulted to fresh all-time highs, a deeper dive into profit margins is in order. While the S&P 500's profit margins are benefiting from the one-time fillip of lower corporate taxes in…