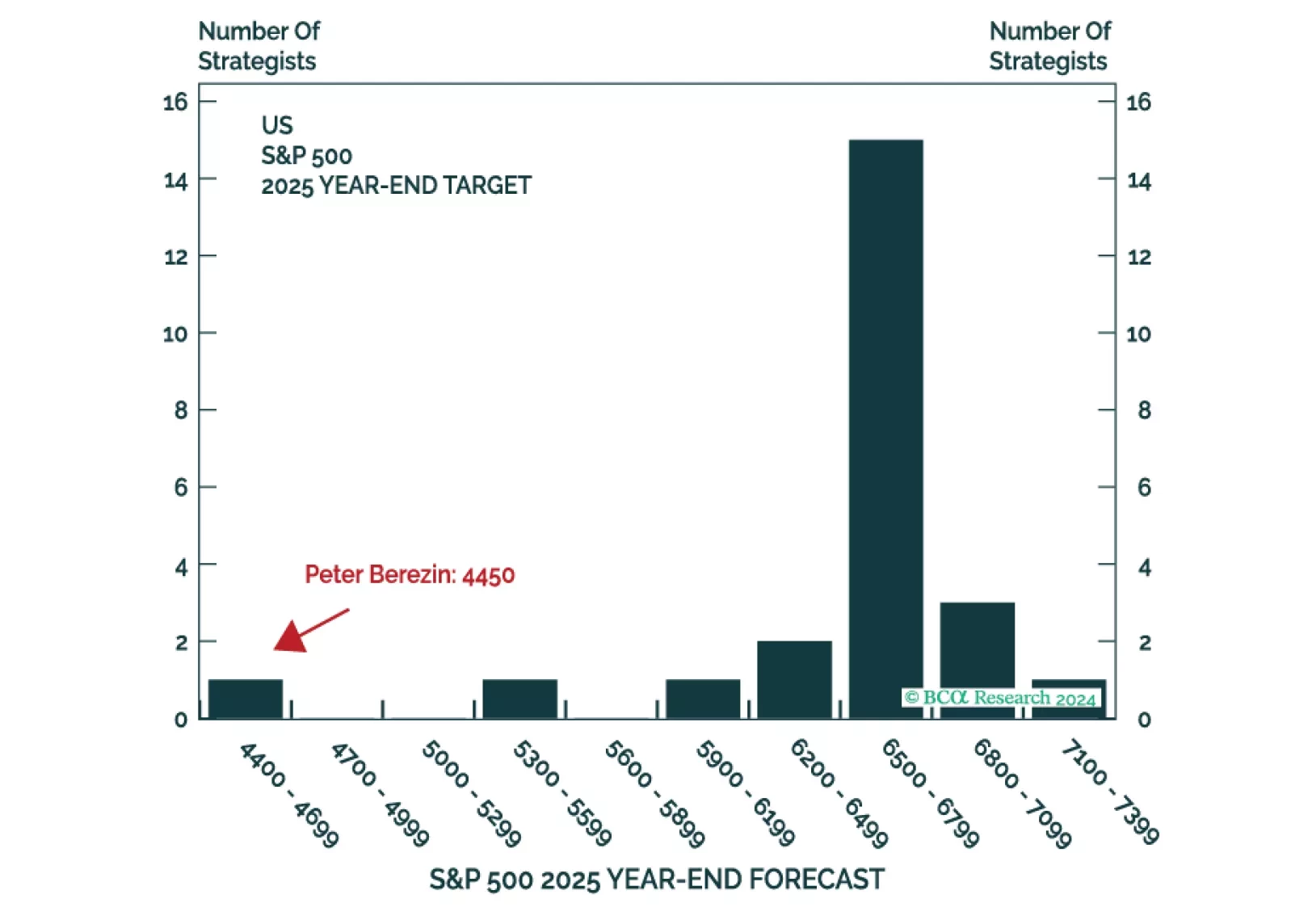

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

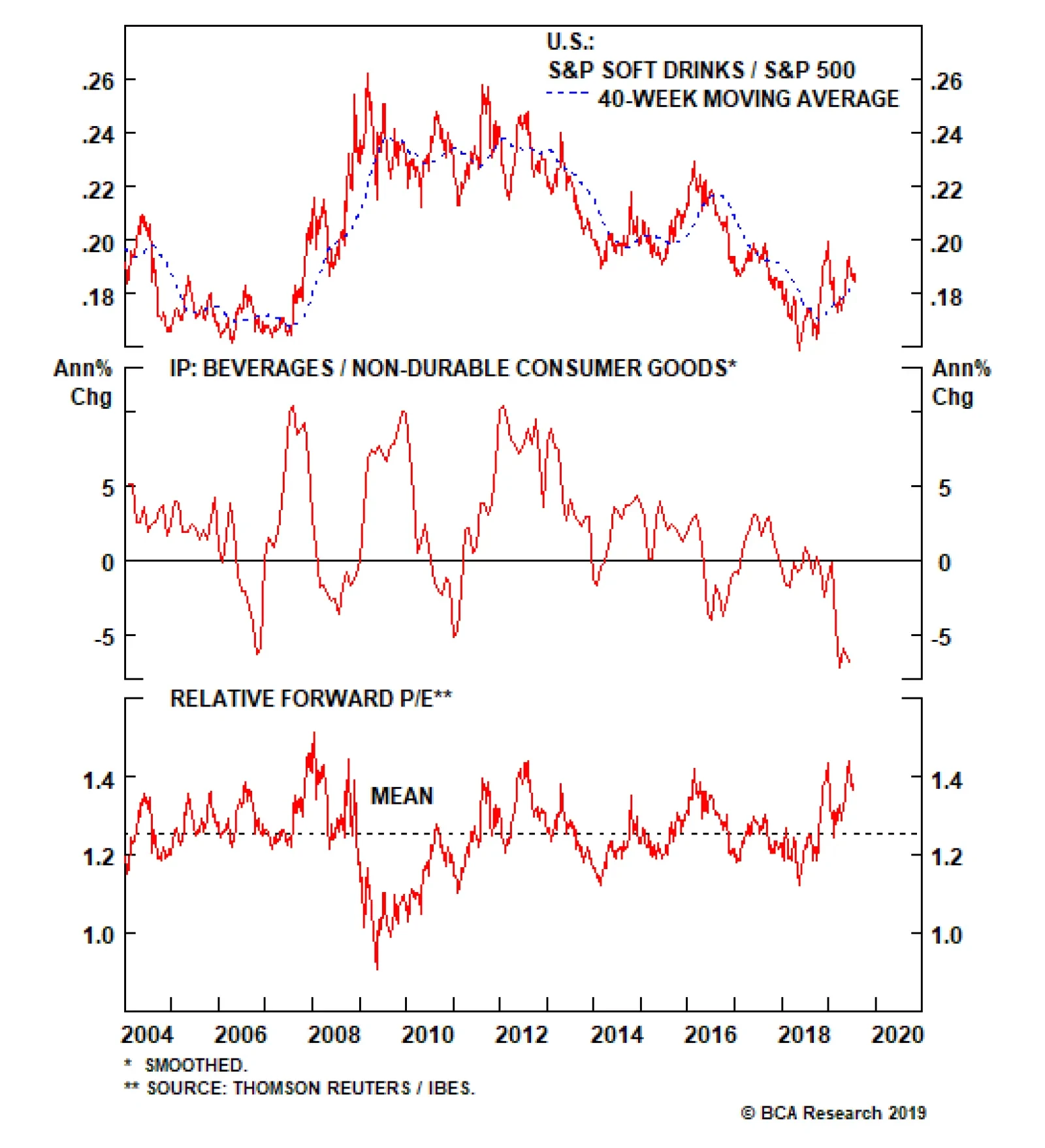

Neutral (Downgrade Alert) Soft drinks have taken a beating recently and we are on the lookout for an oversold bounce before we go underweight this consumer goods sub-group, especially given our short-term cautious outlook.…

Highlights Portfolio Strategy Rising demand for packaging materials, increasing industry pricing power along with compelling relative valuations signal that ignored containers and packaging stocks are a hidden gem within the S&P…

S&P Hypermarkets (Overweight) Upgraded from Neutral S&P Soft Drinks (Neutral) Upgraded from Underweight As a follow up to our yesterday’s Insight where we outlined some of our reasons to go underweight the S…

As our U.S. Equity Strategy team continues to shift its portfolio away from cyclical and toward defensive exposure, it is upgrading the S&P soft drinks index from underweight to neutral. This defensive pure-play consumer…

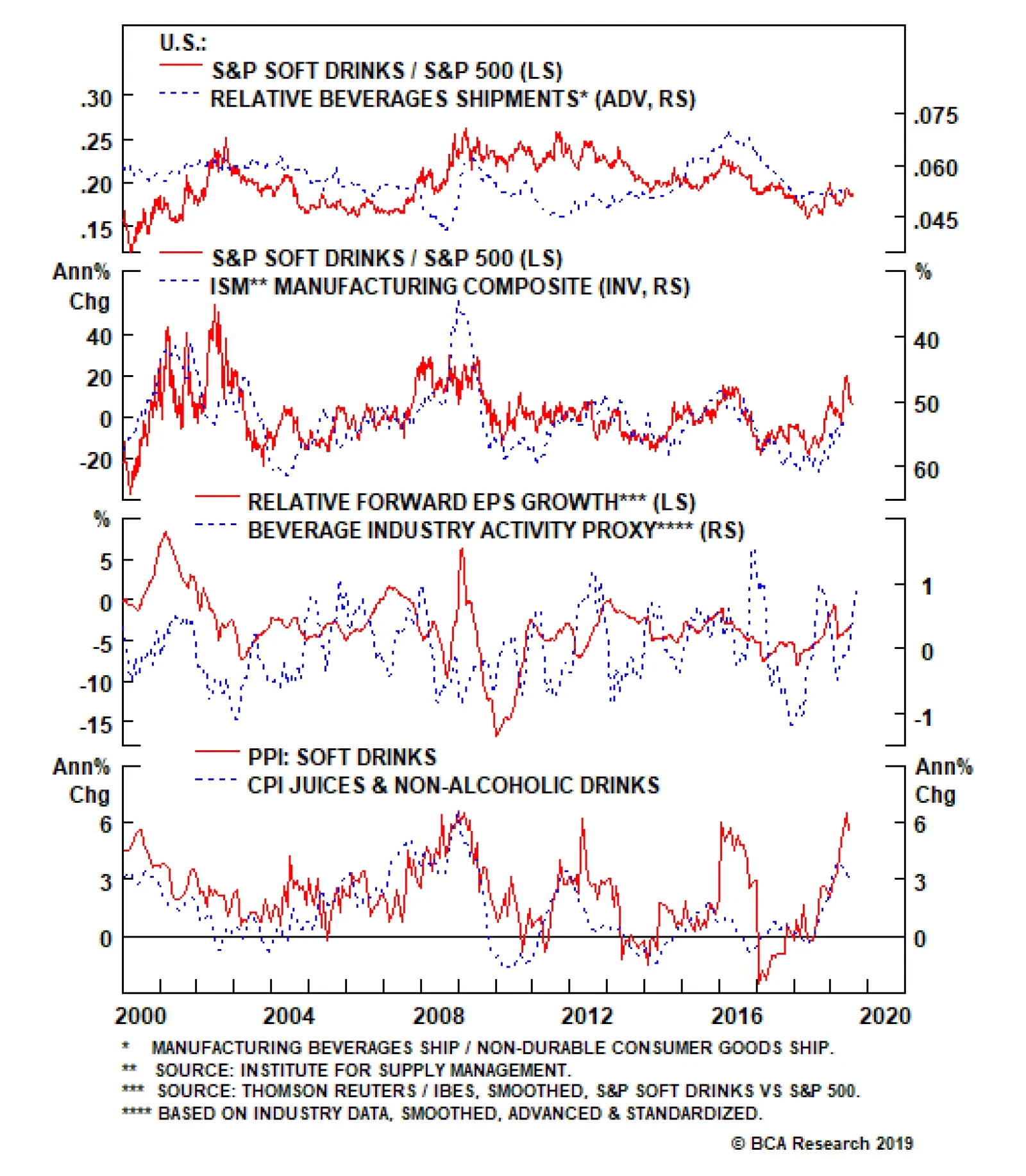

In the previous Insight we highlighted a number of firming beverage industry operating metrics, however, soft drinks industrial production itself is still waving a yellow flag. In fact, relative output is contracting at the…

Neutral While in the previous Insight we highlighted a number of firming beverage industry operating metrics, soft drinks industrial production is still waving a yellow flag. In fact, relative output is contracting at the…

Neutral As we continue shifting our portfolio away from cyclical and toward defensive exposure, we are upgrading the S&P soft drinks index from underweight to neutral, locking in a relative gain of 5.5% since inception…

Underweight S&P soft drinks index heavyweight Coke reported its results last week and though it beat earnings estimates, the stock offered its worst performance in more than a decade. This is despite solid pricing…

Underweight The S&P soft drinks index popped in late October, driven by better than expected Q3 results, mostly at Coke. In truth, pricing power has been staging a fairly steady recovery since falling off a cliff in 2016, though it…