Highlights The collapse in oil prices supercharges the geopolitical risks stemming from the global pandemic and recession. Low oil prices should discourage petro-states from waging war, but Iran may be an important exception. Russian…

Highlights The near-term is fraught with risk for US equities and global risk assets. Investors concerned over uncertainty, a slow recovery, and economic aftershocks must also guard against geopolitics. COVID-19 is not a victory for…

Highlights The liquidity-driven rally will soon be followed by an acceleration in global growth. The economic recovery will bump up expectations of long-term profit growth. The dollar has downside, but the euro will not benefit much…

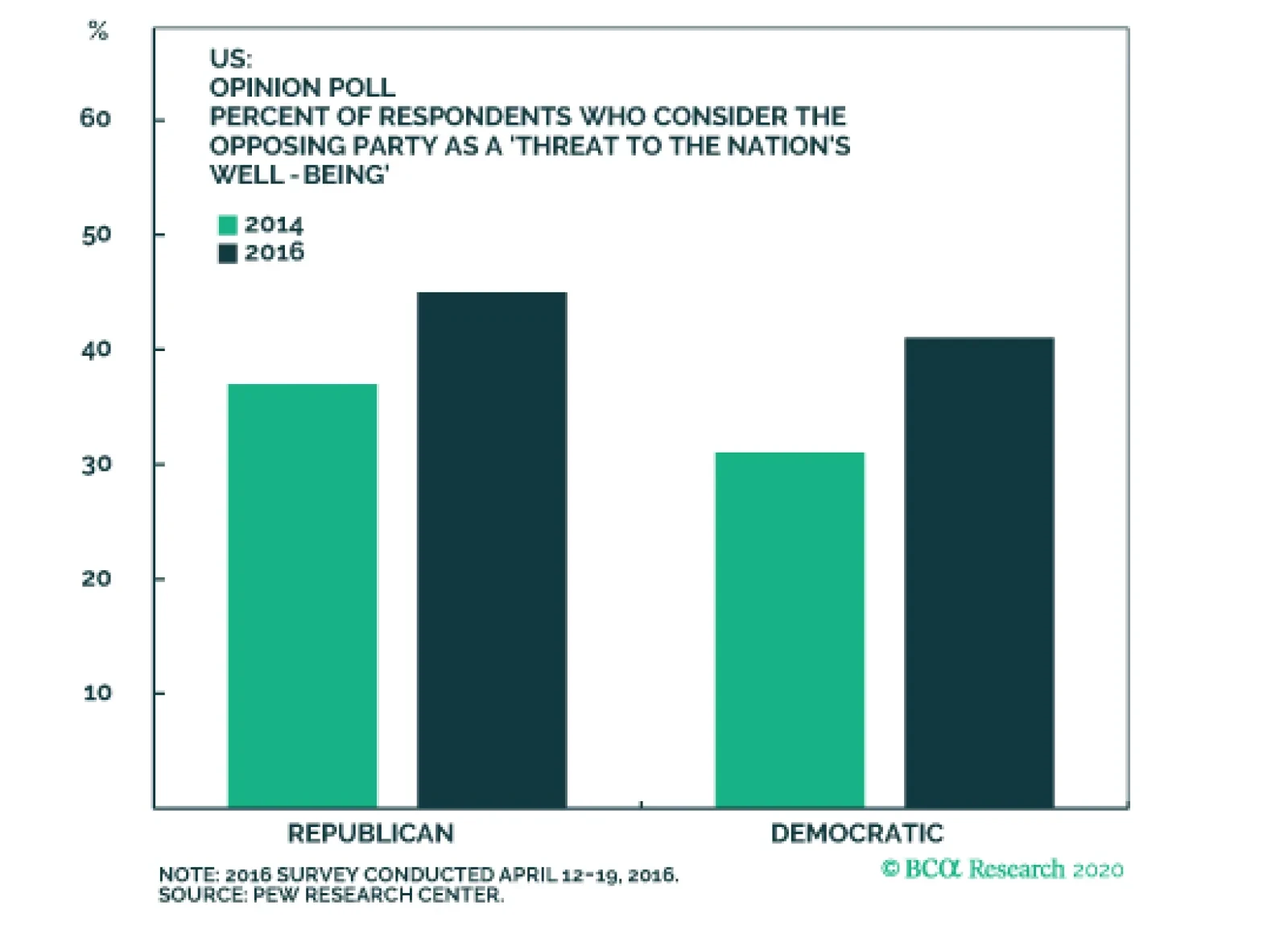

2020 may be a particularly violent year for the US. First, left wing activists may be shocked and angered to learn that Joe Biden is the nominee of the Democratic Party come July. With so much hype behind the progressive…

Highlights Our top five geopolitical “Black Swans” are risks that the market is seriously underpricing. With the “phase one” trade deal signed, Chinese policy could become less accommodative, resulting in a…