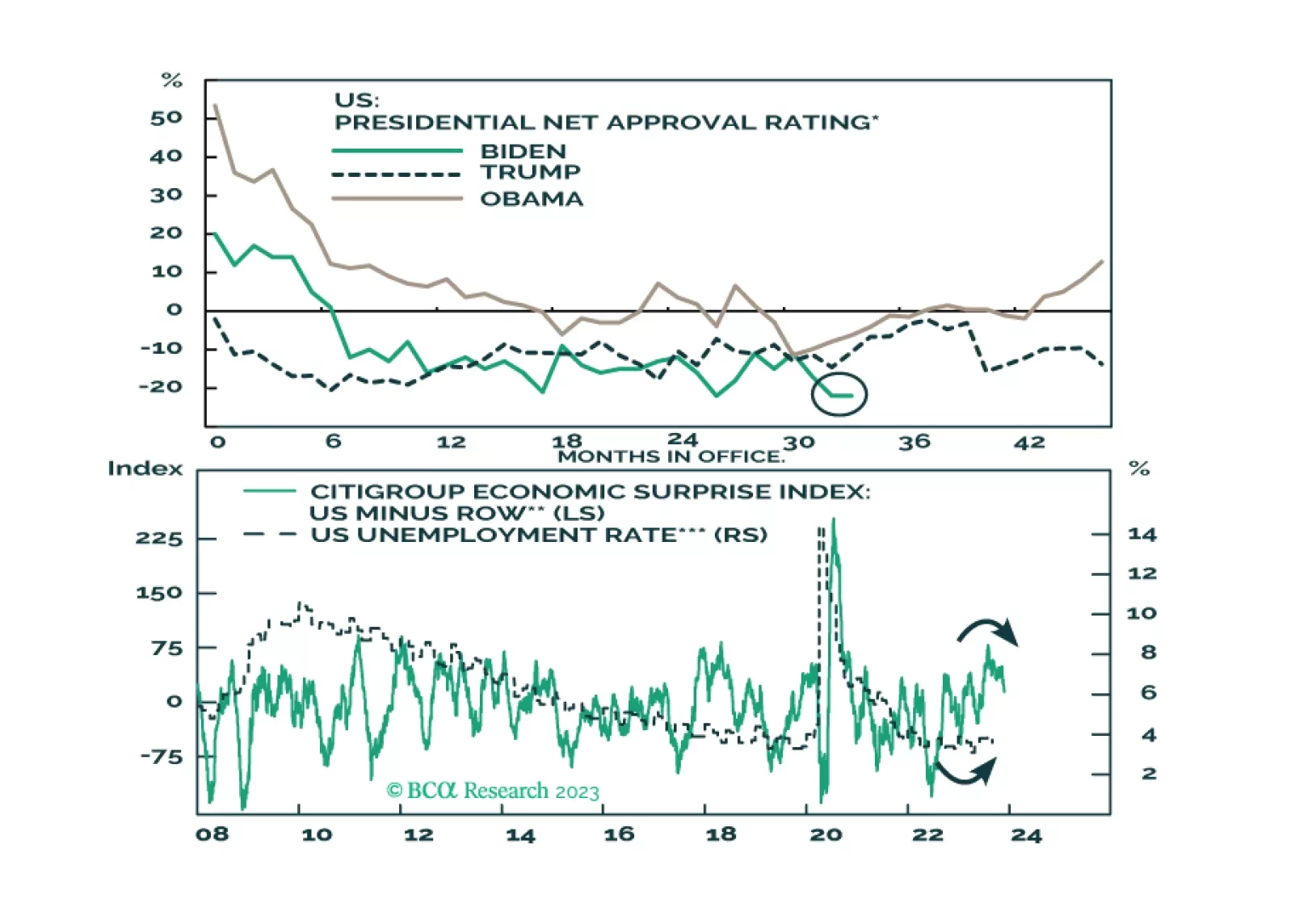

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

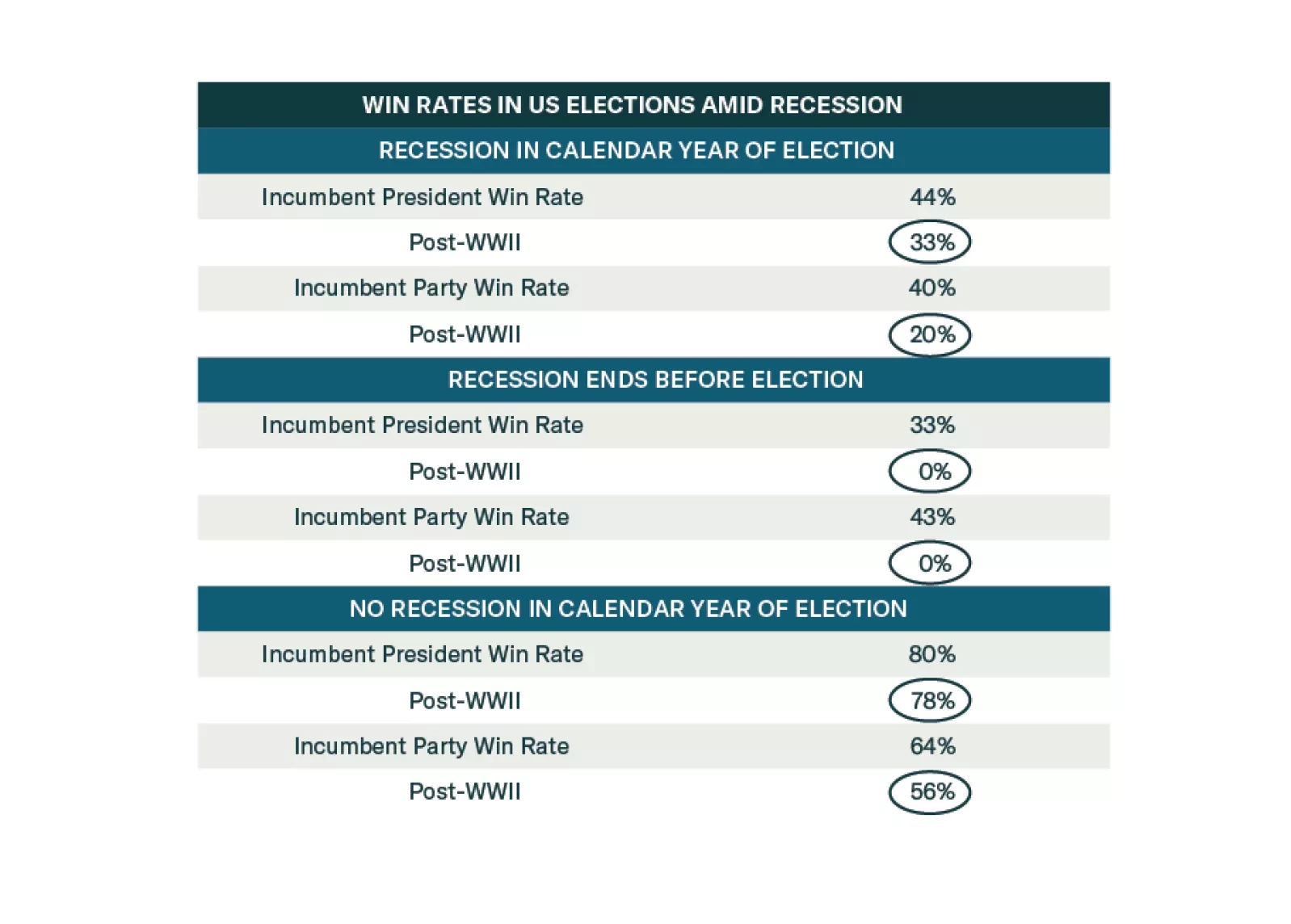

Democrats are favored to win the election until recession materializes. But recession risks are high. Investors should adopt a defensive and conservative strategy in 2024 amid extreme US policy uncertainty.

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

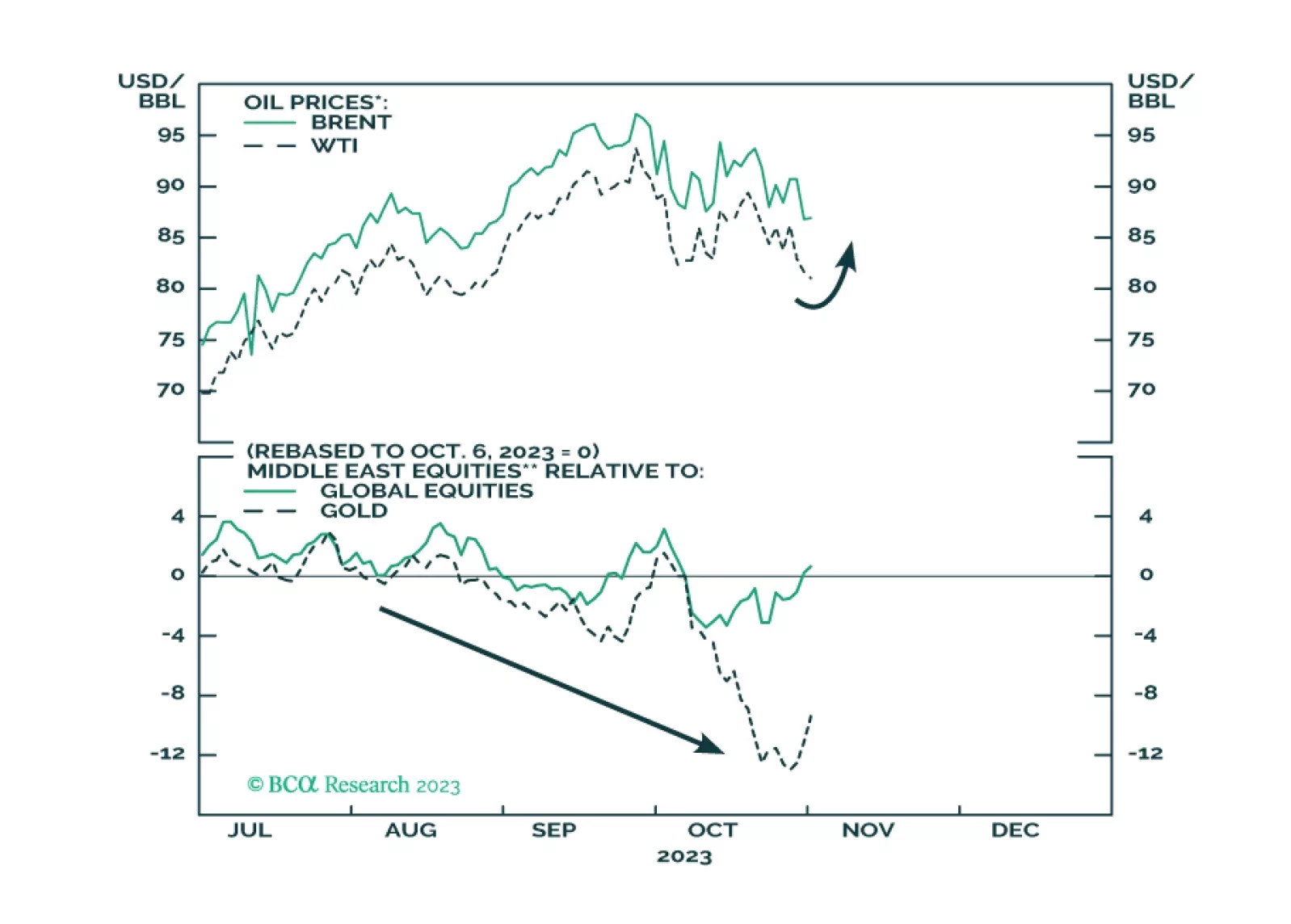

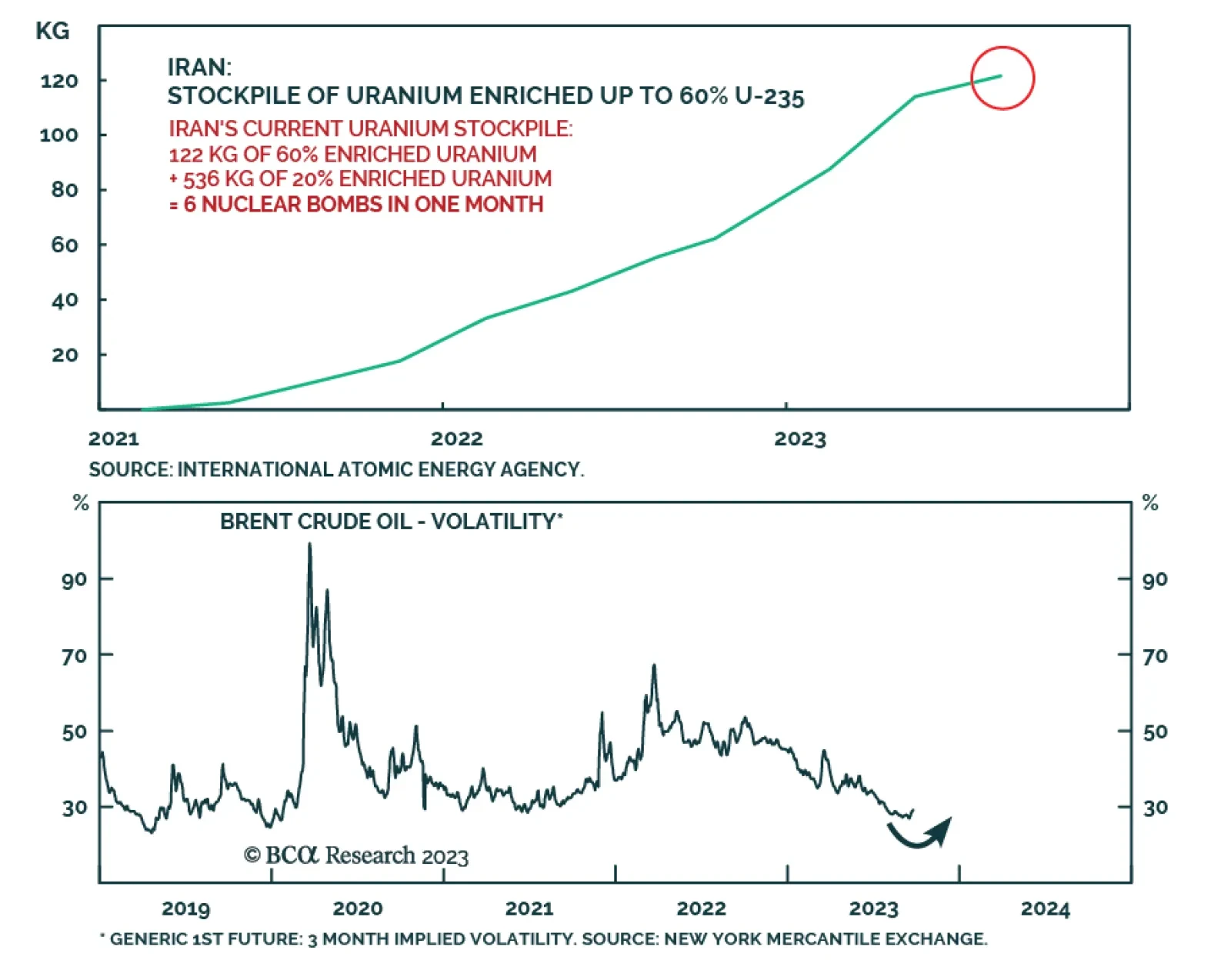

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

According to BCA Research’s Geopolitical Strategy service, volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. Everything depends on whether…

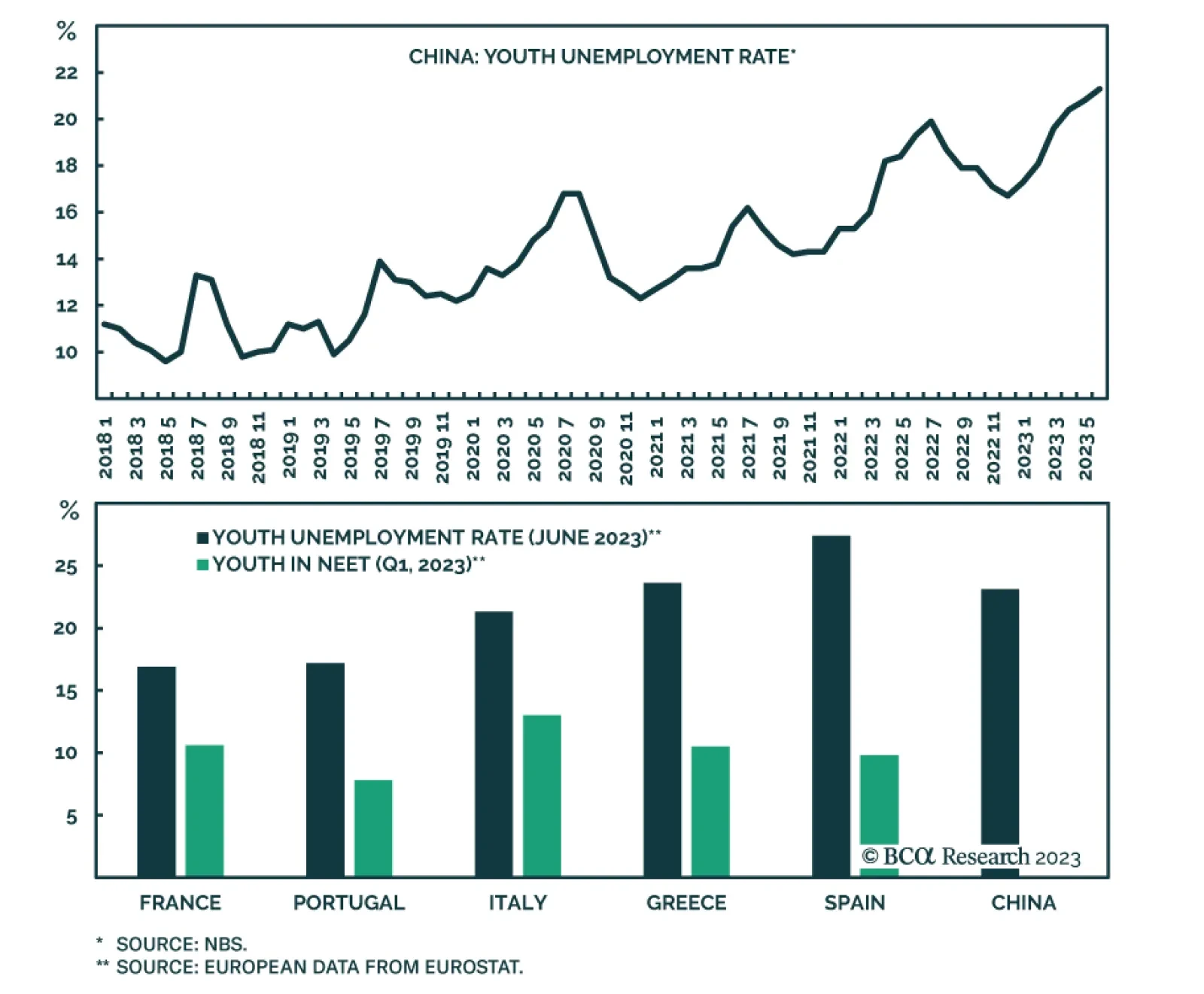

The Chinese government today announced that it is suspending the reporting of urban youth unemployment rate. This rate reached 21.3% in June after climbing since December. While there is an element of seasonality to the data…

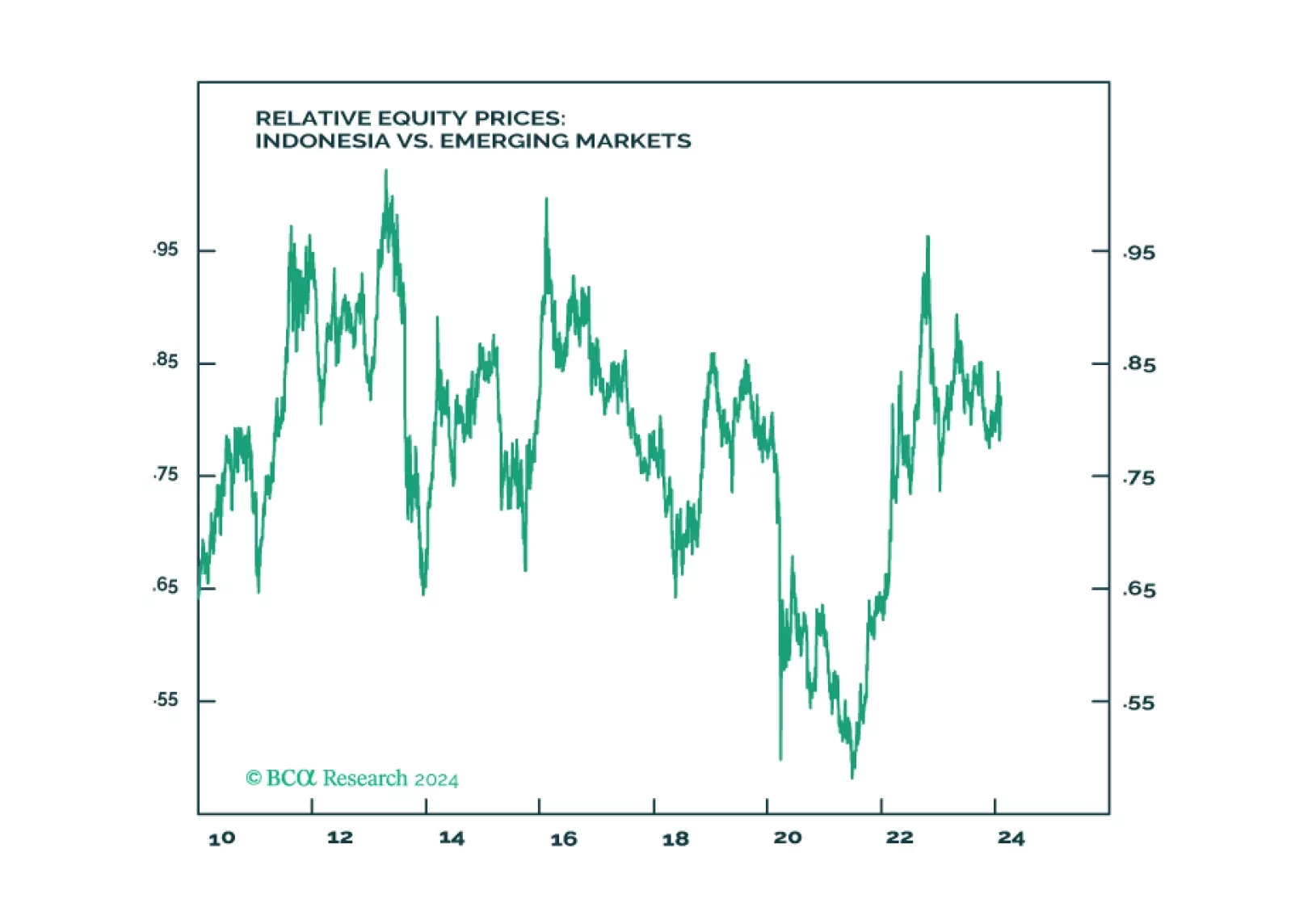

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…