Dear client, In lieu of our regular weekly report next week, we will hold a webcast on Thursday at 10:00 am ET discussing both tactical and strategic currency considerations. The format will be a short presentation, followed by a Q&…

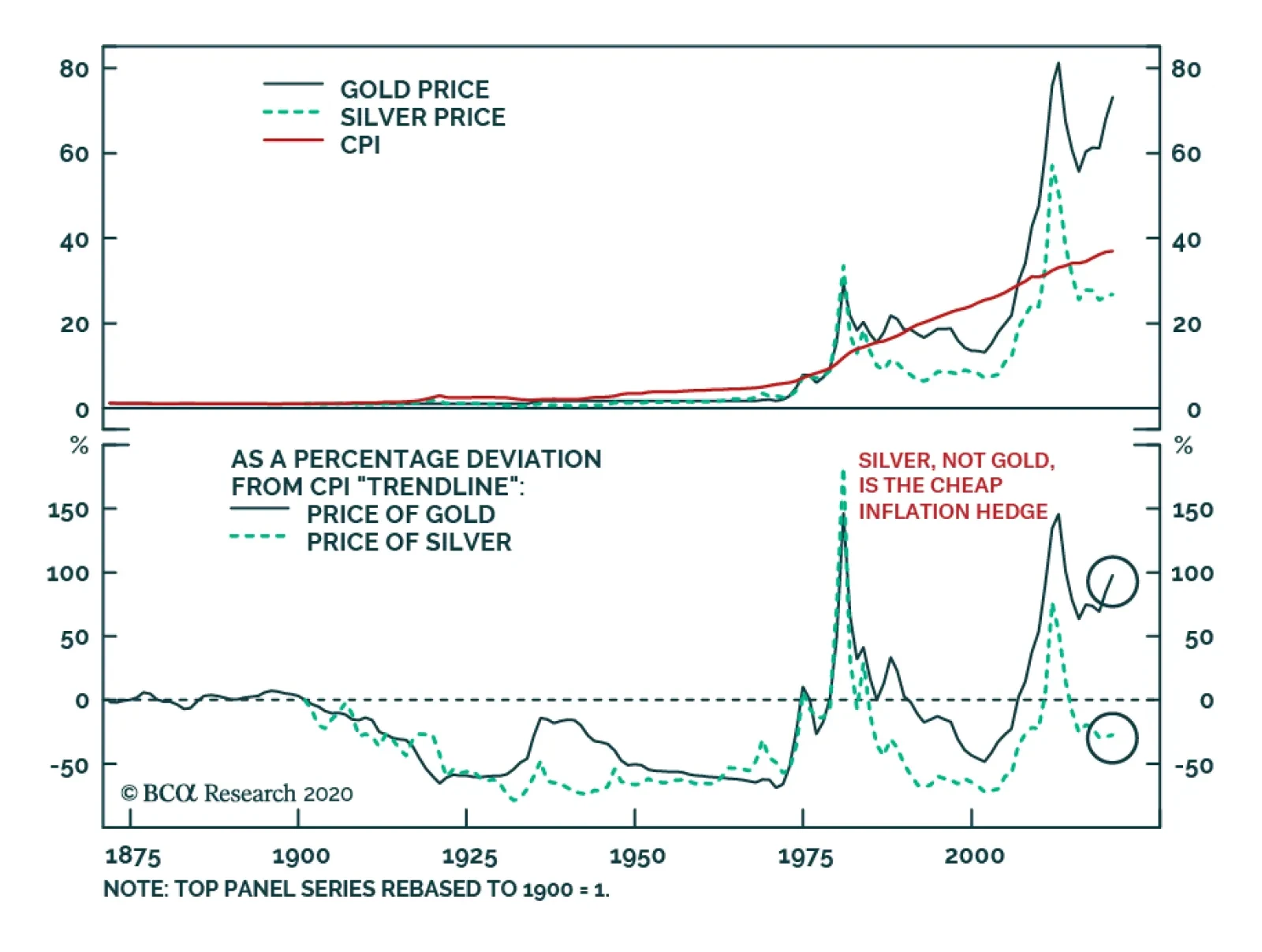

Gold has attracted a lot of attention from investment managers. Gold is perceived as an excellent inflation hedge that will perform well if global central banks try to debase their currencies and monetize the flood of government…

Highlights With interest rates near zero around the world, balance sheet policy will become an important driver for currencies. Should the global economy need another dose of monetary stimulus, yield curve control (YCC) and direct…

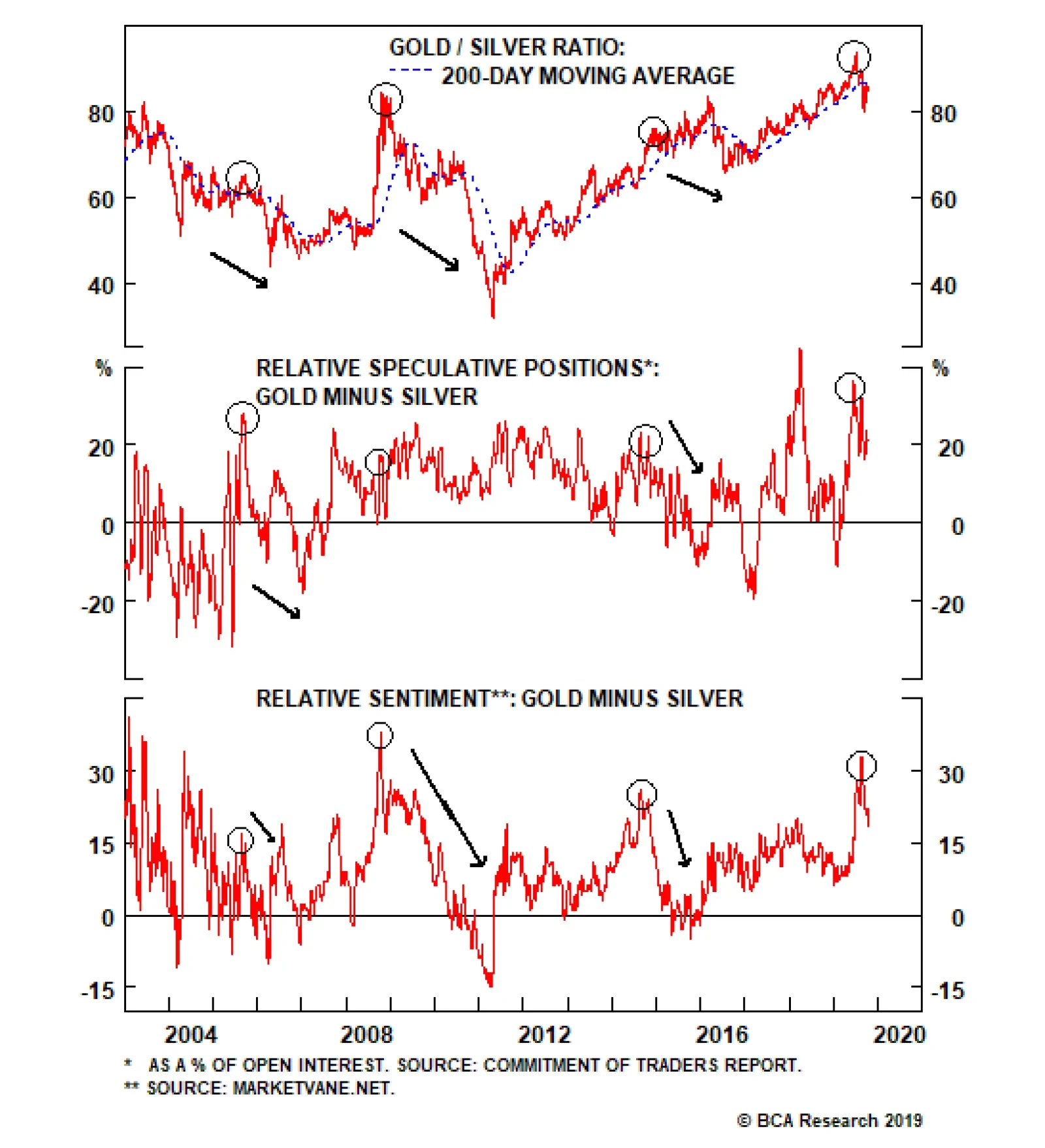

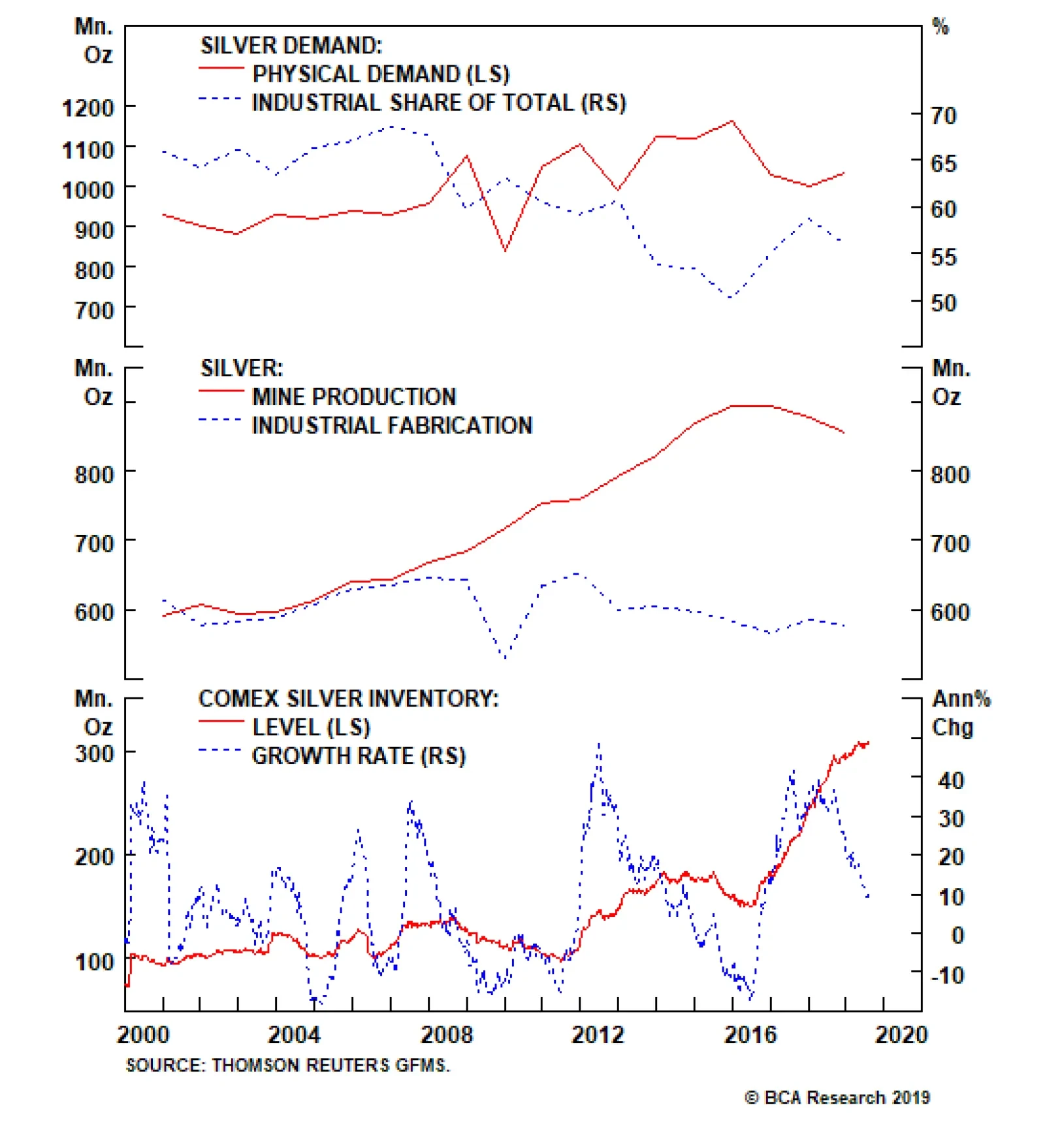

Silver has traveled on a wild rollercoaster. After peaking in April 2011 near $50/oz., it has nearly continuously underperformed gold, and in early March, traded at a record low relative to the yellow metal. At first, the recent…

Highlights Collective market signals suggest a low but non-negligible probability of a dollar spike due to the coronavirus. Stay long the yen as a portfolio hedge. Short CHF/JPY bets also make sense. Our limit sell on the gold/…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

The gold/silver ratio (GSR) was in a race towards a major overhead resistance at 100 this summer, but after hitting a three-decade high of 93.3, it is now showing tentative signs of a reversal. Historically, these reversals tend…

Highlights The world remains mired in a manufacturing recession. This has historically not been bullish for pro-cyclical currencies. The velocity of money in the euro area will need to rise vis-à-vis the U.S. to confirm a…

We expect central banks generally – and the Fed in particular – will err on the side of maintaining monetary accommodation while uncertainty over trade and global growth prospects remains elevated. Fed Chairman Jay…