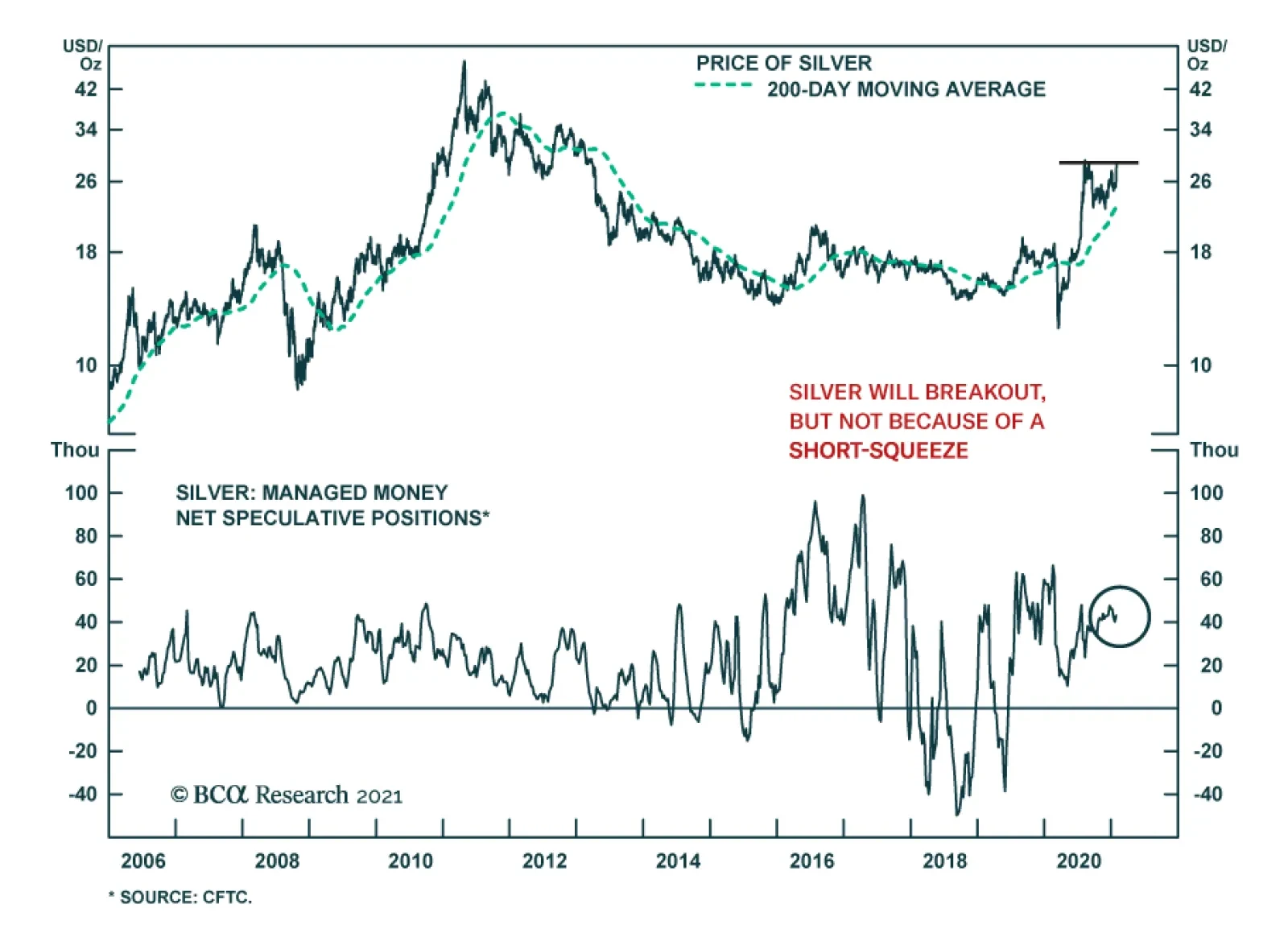

Silver has recently grabbed the headlines, with a rapid move to $30/oz. Silver has significant cyclical upside, but the near-term outlook remains nebulous, and consolidation under the $30/oz resistance is likely. The long…

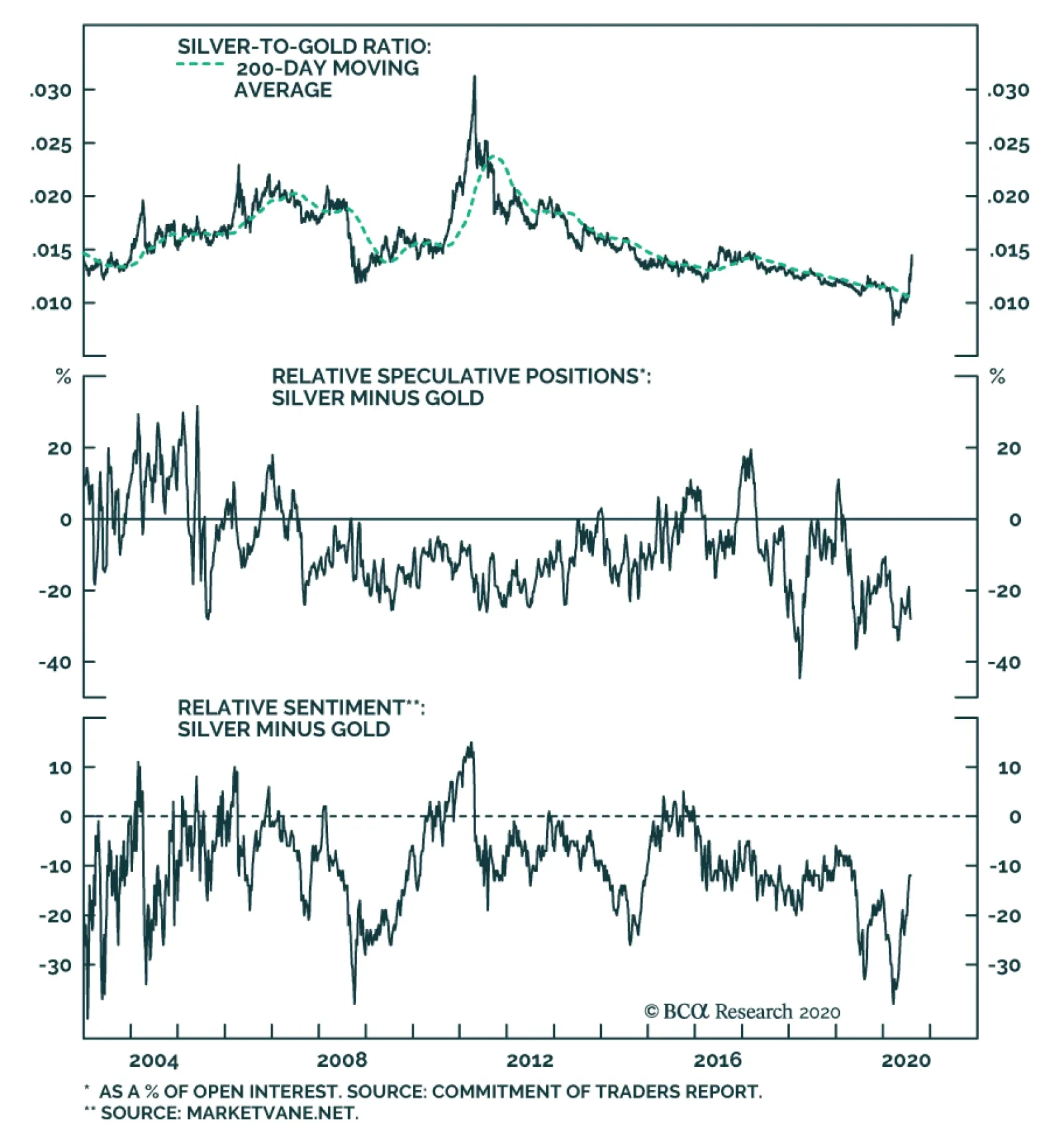

On a long-term basis, silver will further outperform gold, however, it is vulnerable to a short-term pullback. While tactical trader should sell silver, we maintain our cyclical preference for the white metal. Like gold,…

Highlights We remain bearish on the US dollar over the next 12 months. The best vehicle to express this view continues to be the Scandinavian currencies (NOK and SEK). Precious metals remain a buy so long as the dollar faces downside…

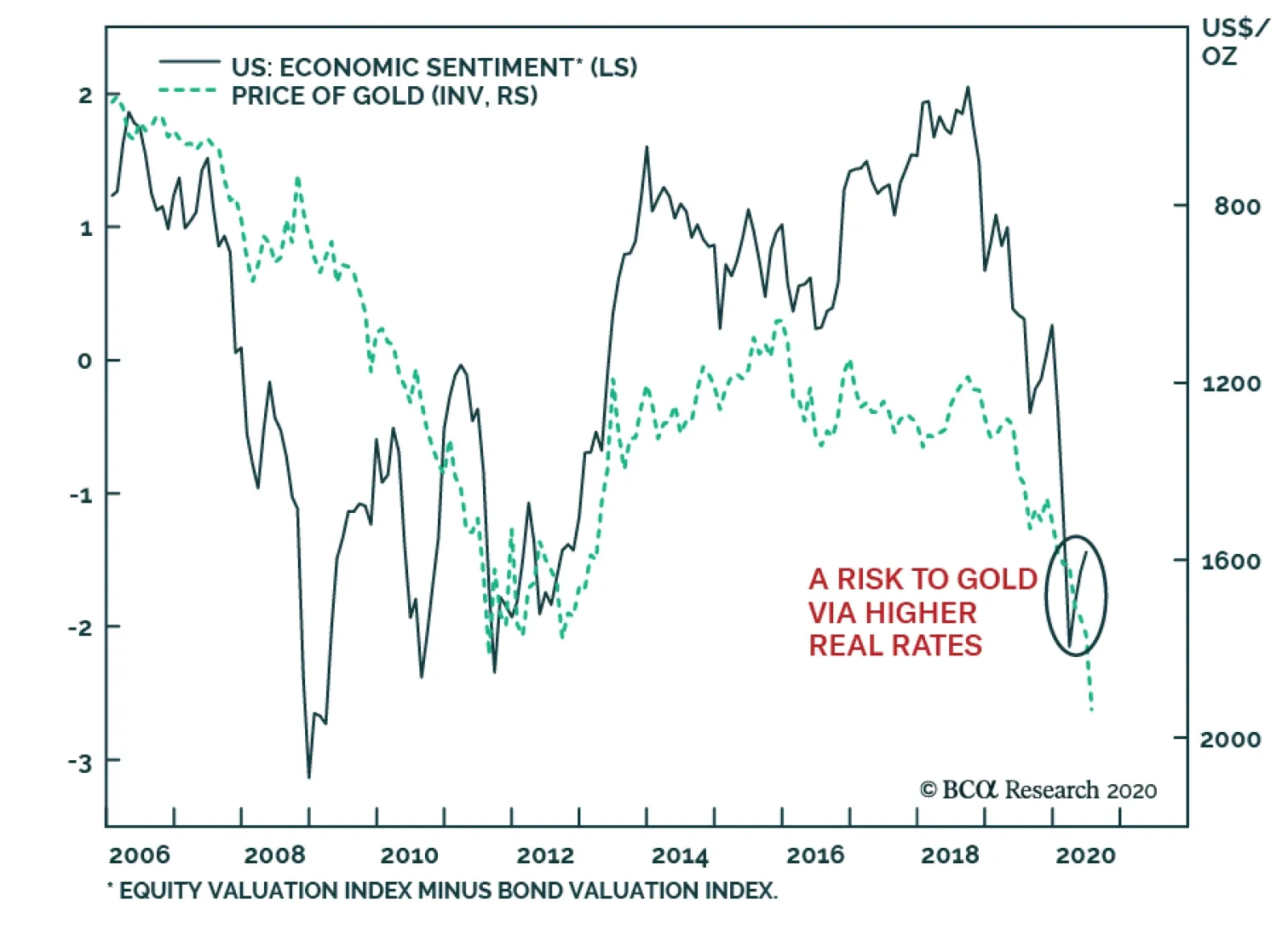

Precious metals saw a spike in volatility on August 11. Silver fell 15%. Gold is down 6% over the past five days. The trigger was probably the deflationary implications of a premature tightening in US fiscal policy, given the…

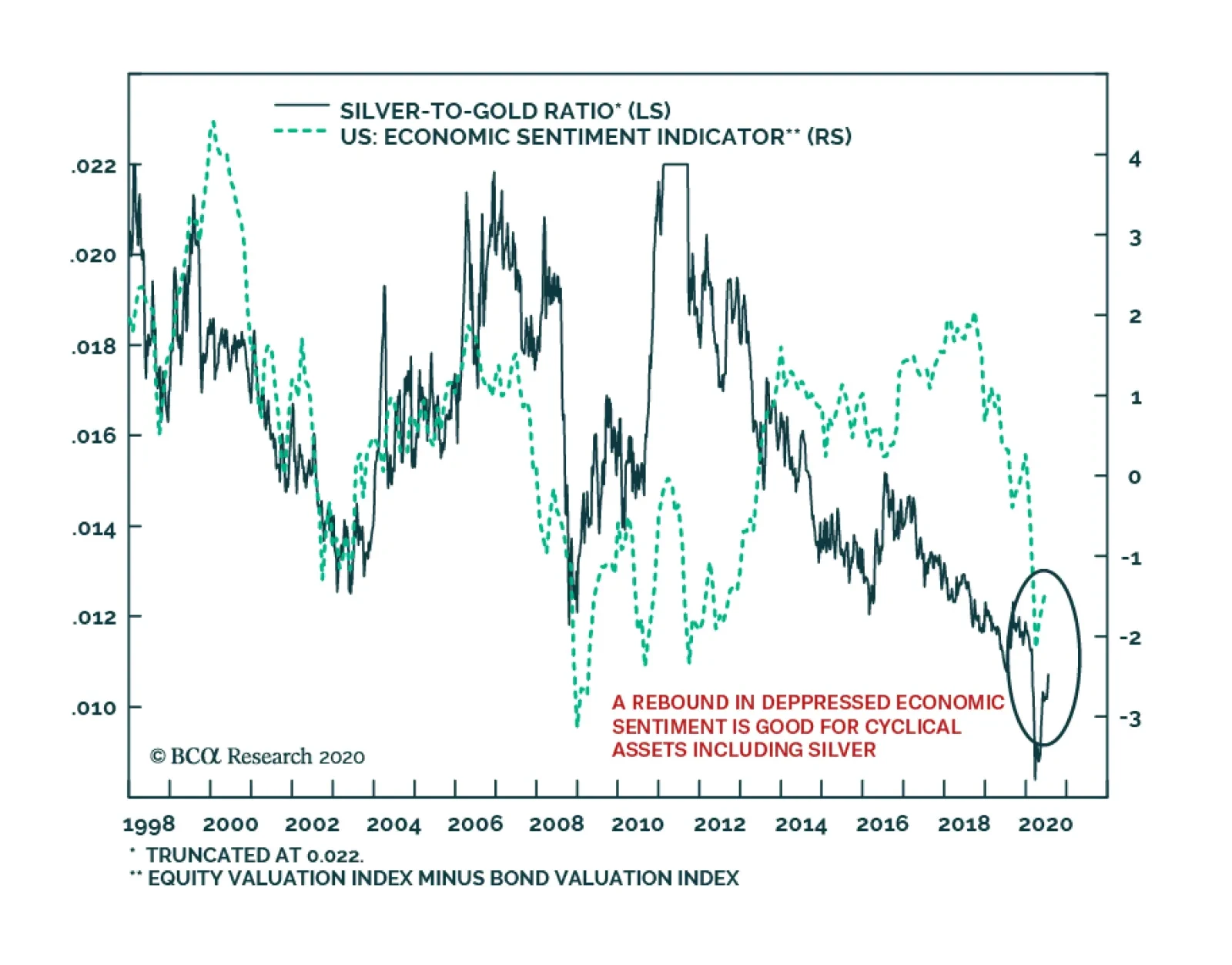

The recent rally in gold prices has happened in conjunction with a marked deterioration in our Economic Sentiment Index. This index reflects the difference between our Valuation Index for stocks relative to that of bonds. When…

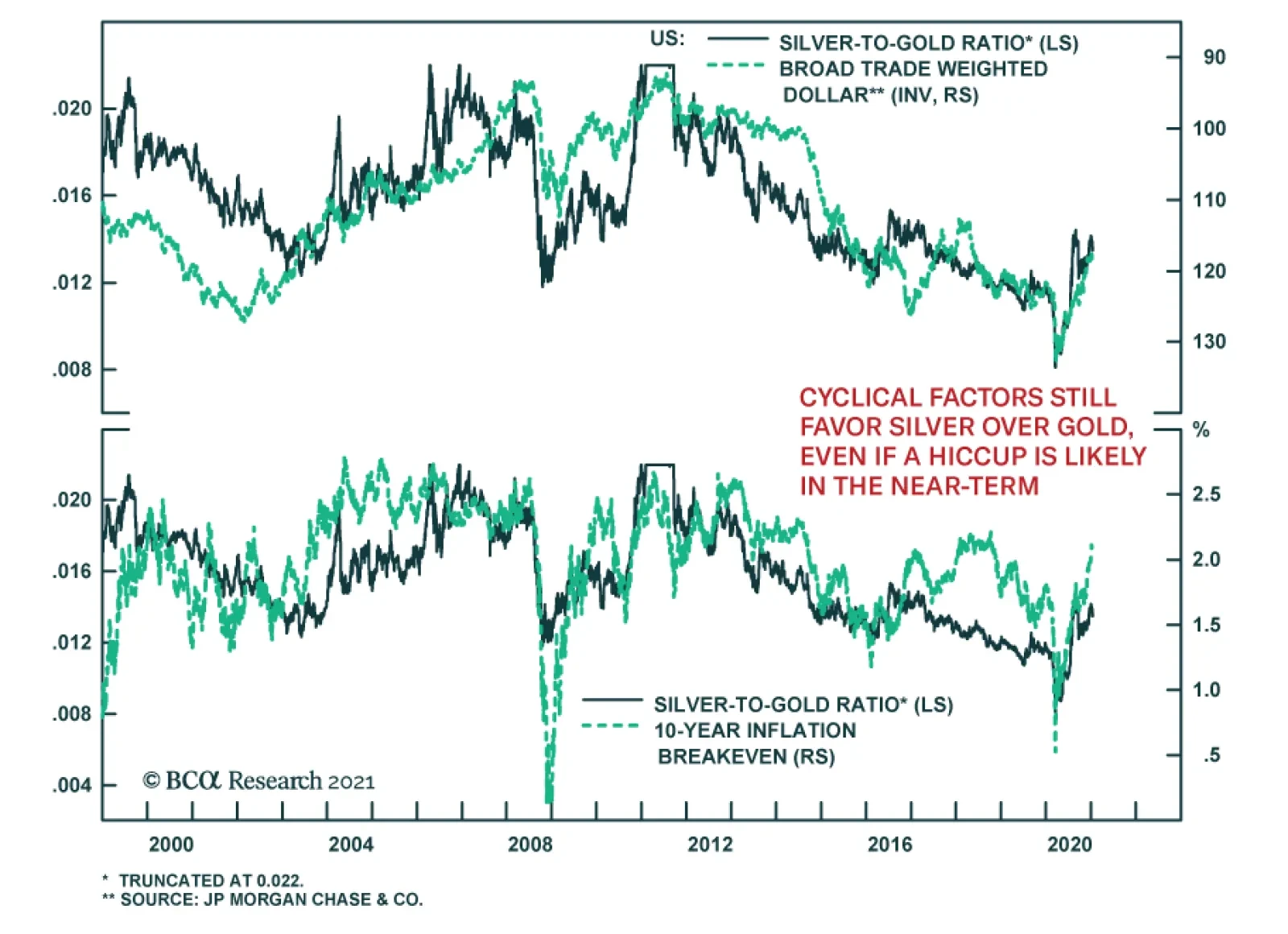

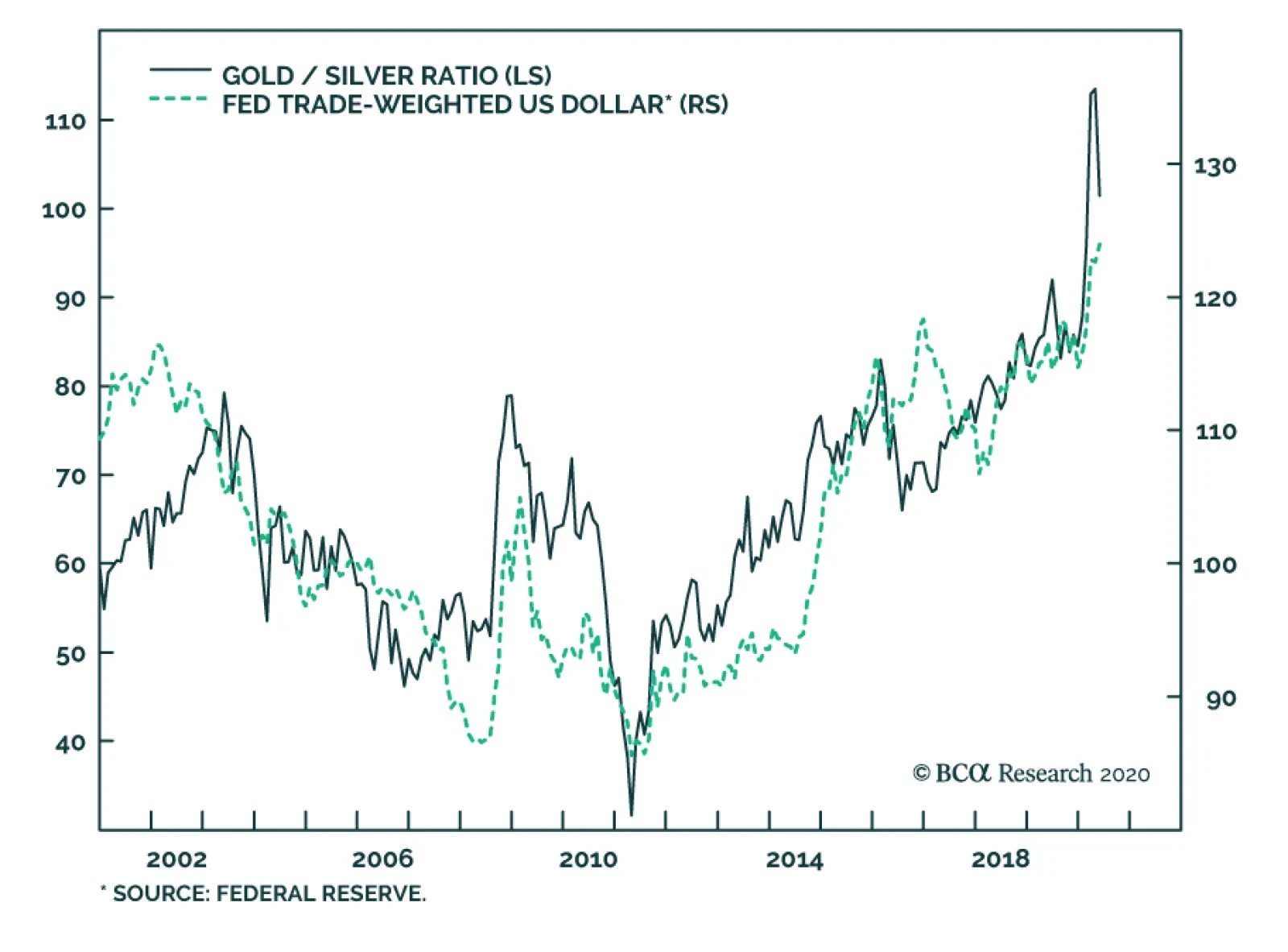

Highlights The dollar is on the verge of a significant breakdown. If the DXY punches through 94, it will likely mark the beginning of a structural bear market. The most recent catalyst – fiscal support in the euro zone –…

Our global growth sentiment indicator remains depressed. This indicator is simply the difference between our equity valuation index and our bond valuation index. Investors pushing equities in overvalued territory relative to…

Highlights Silver will outperform gold in 2H20, as industrial production and consumer-product demand revives on the back of the massive global stimulus deployed to reverse the hit to aggregate demand inflicted by the COVID-19 pandemic…

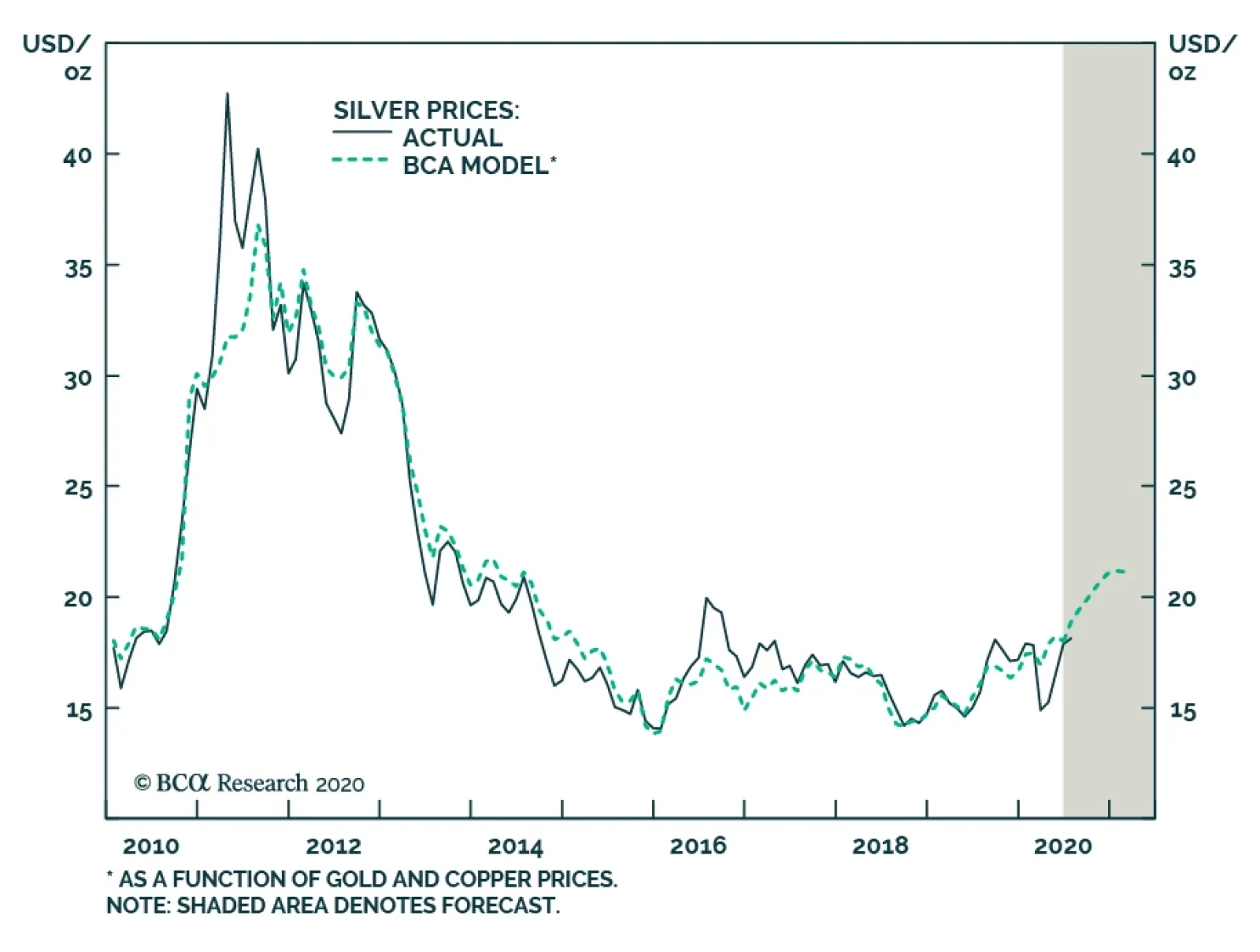

BCA Research's Commodity & Energy Strategy service's model indicates that silver will outperform gold in 2H20. They recommend going long the December 2020 COMEX silver contract. We expect silver to end the year at…

Last Friday, BCA Research's Foreign Exchange Strategy service concluded that a bearish view on the dollar can be expressed via shorting the GSR. With both first- and second-quarter GDP likely to contract severely around…