Highlights In the short term, the US stock market price will track the 30-year T-bond price, with every 10 bps move in the yield moving the stock market and bond price by 2.5 percent. We think that the bond market will not allow the…

Dear client, This is our final report for this year. Clients who missed our FX key views report last week can access the link here. We thank you for your continued readership, and wish you happy and healthy holidays. Kind regards…

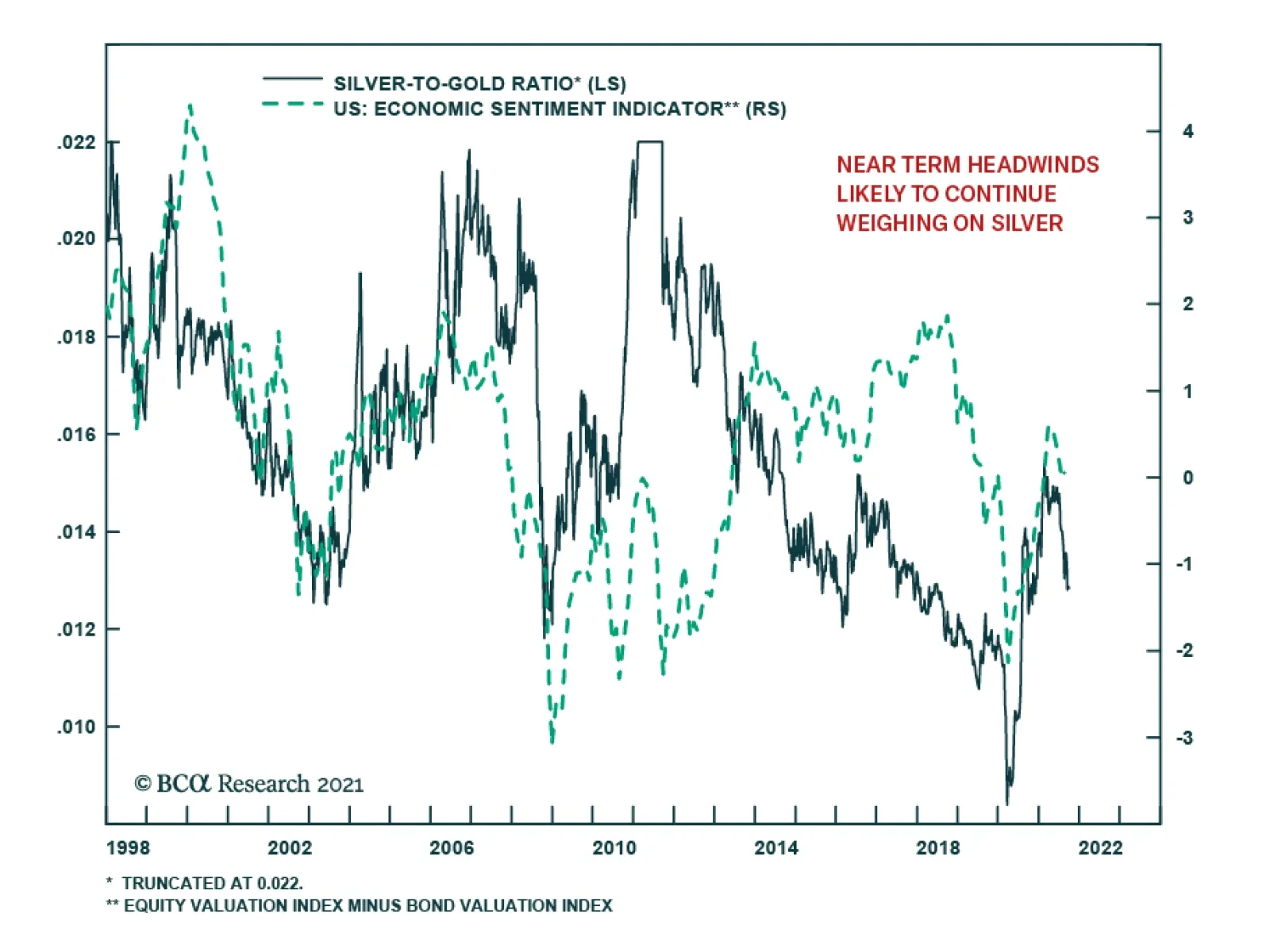

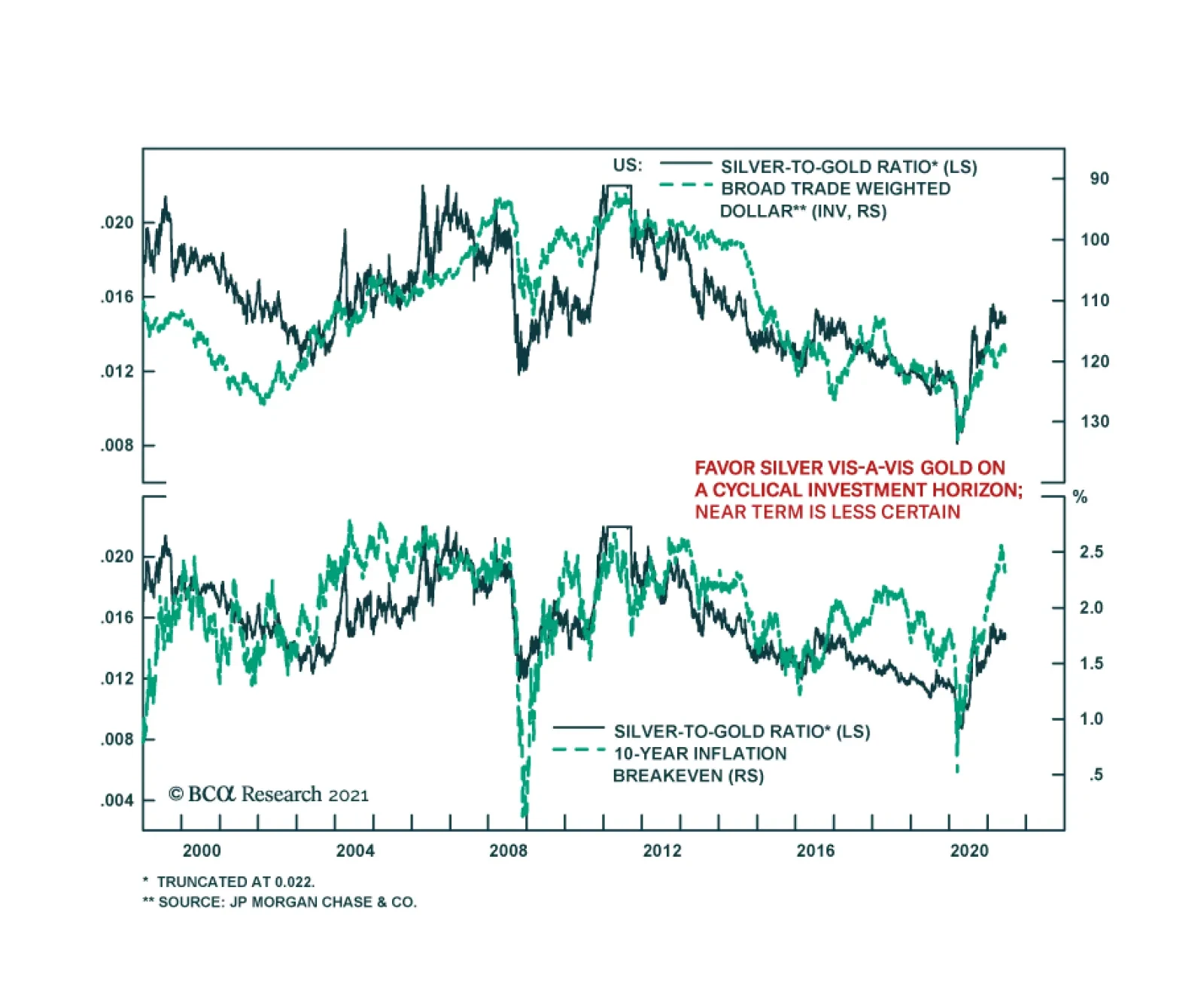

Silver has been among the worst performing financial assets recently. It is down nearly 20% since mid-June and has underperformed gold over this period. Back in June, we noted that the near-term outlook for silver was…

Highlights The rapid spread of the COVID-19 delta variant in Asia will re-focus precious metals markets anew on the possibility of another round of lockdowns and the implications for demand, particularly in Greater China and India,…

Highlights The dollar is fighting a tug of war between two diverging forces: an economic slowdown around the world but plunging real interest rates in the US. The litmus test for determining which force will gain the upper hand is if…

Gold was a major victim of the FOMC’s recent shift to a more hawkish tone. It is down more than 4.8% since Wednesday’s FOMC meeting, taking it to levels last seen at the end of April. Although we remain positive on…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights Rising CO2 emissions on the back of stronger global energy growth this year will keep energy markets focused on expanding ESG risks in the buildout of renewable generation via metals mining (Chart of the Week). …

Dear client, In addition to this week’s abbreviated report, we are also sending you a Special Report on currency hedging, authored by my colleague Xiaoli Tang. Xiaoli’s previous work mapped out a dynamic hedging strategy for…

Highlights For the month of February, our trading model recommends shorting the US dollar versus the euro and Swiss franc. While we agree a barbell strategy makes sense, we would rather hold the yen and the Scandinavian currencies.…