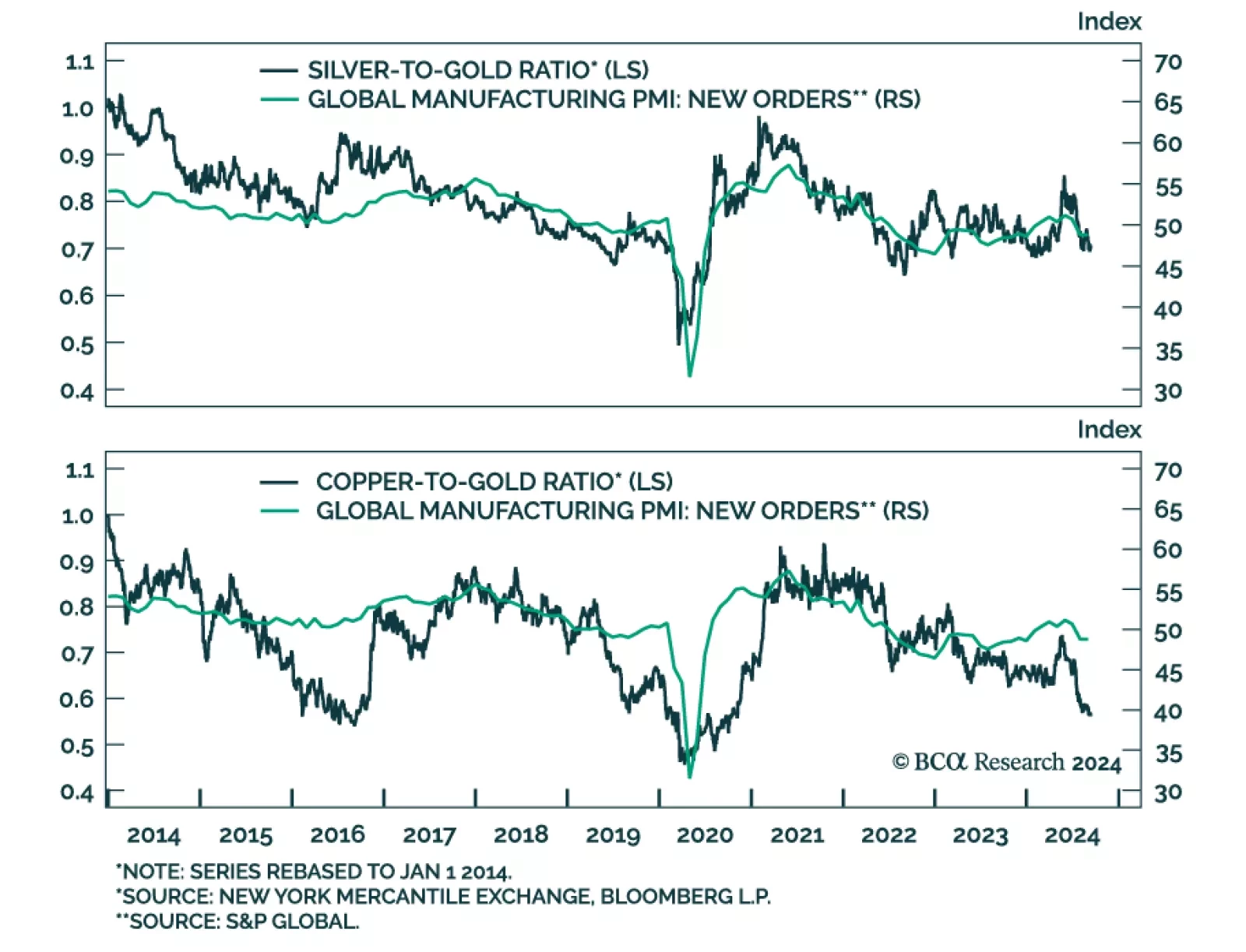

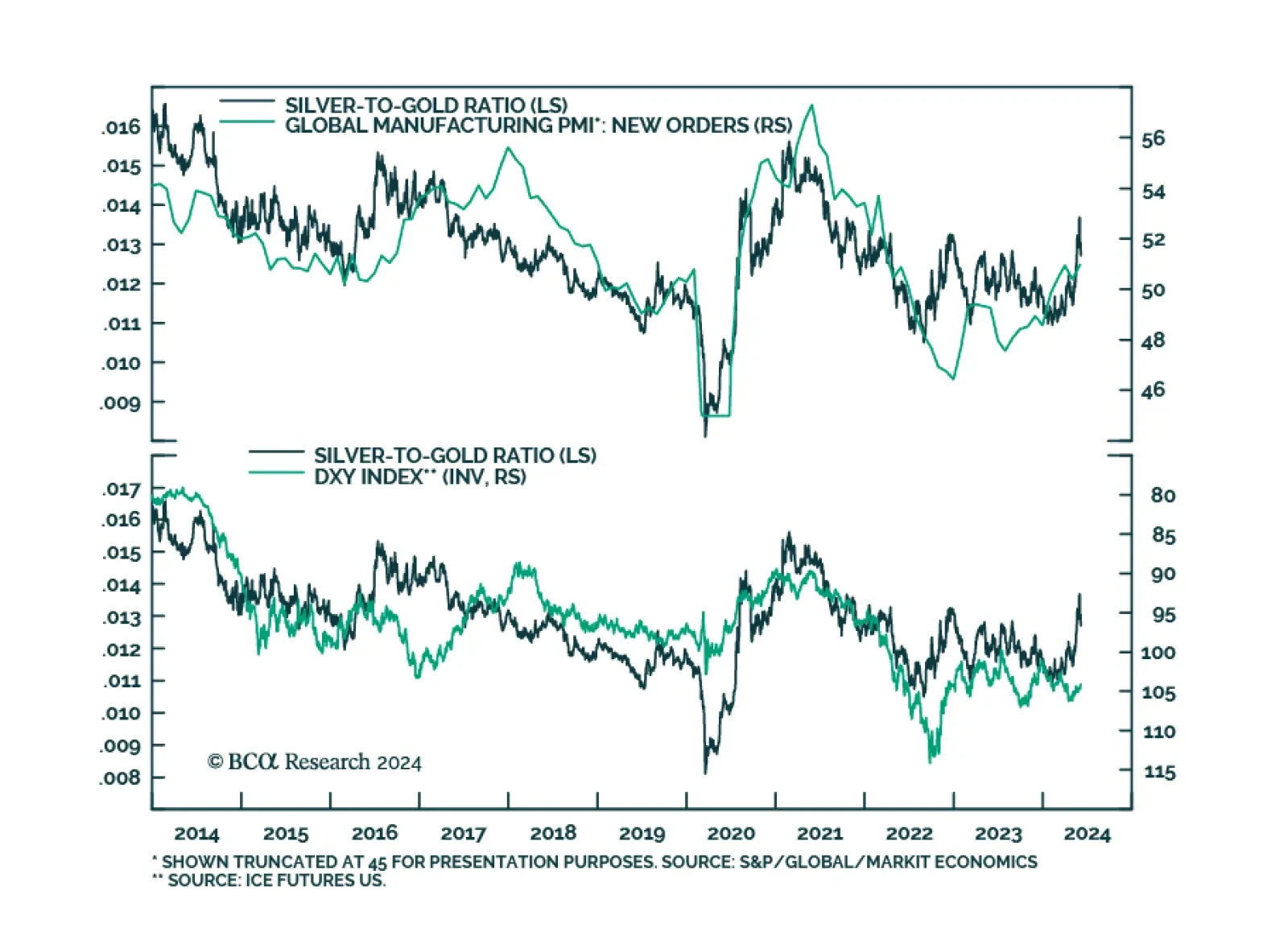

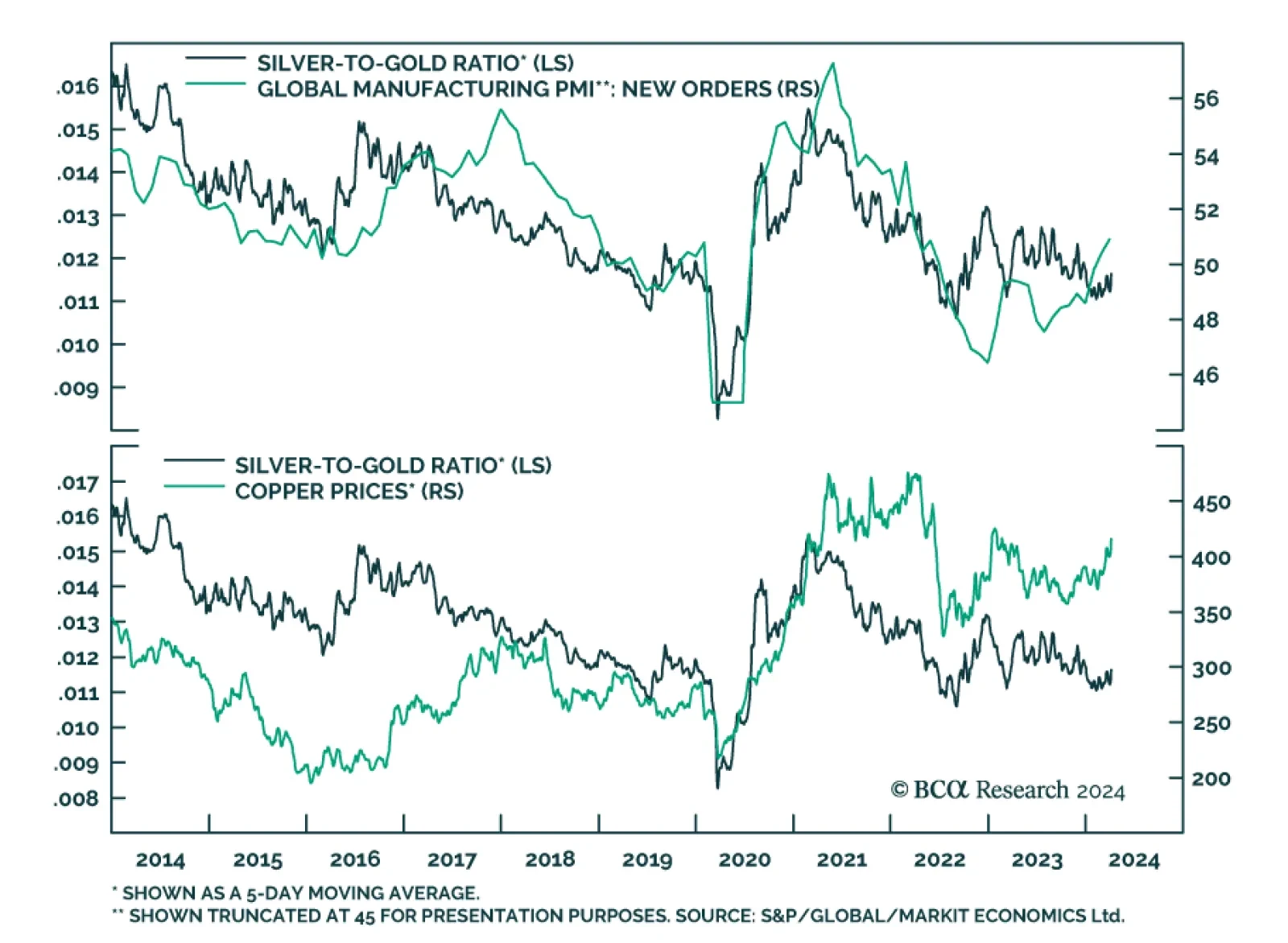

As an industrial metal, copper acts as a barometer of economic activity. Silver and gold are safe-haven assets with inflation-hedging properties, though silver is relatively more sensitive to global growth developments given that…

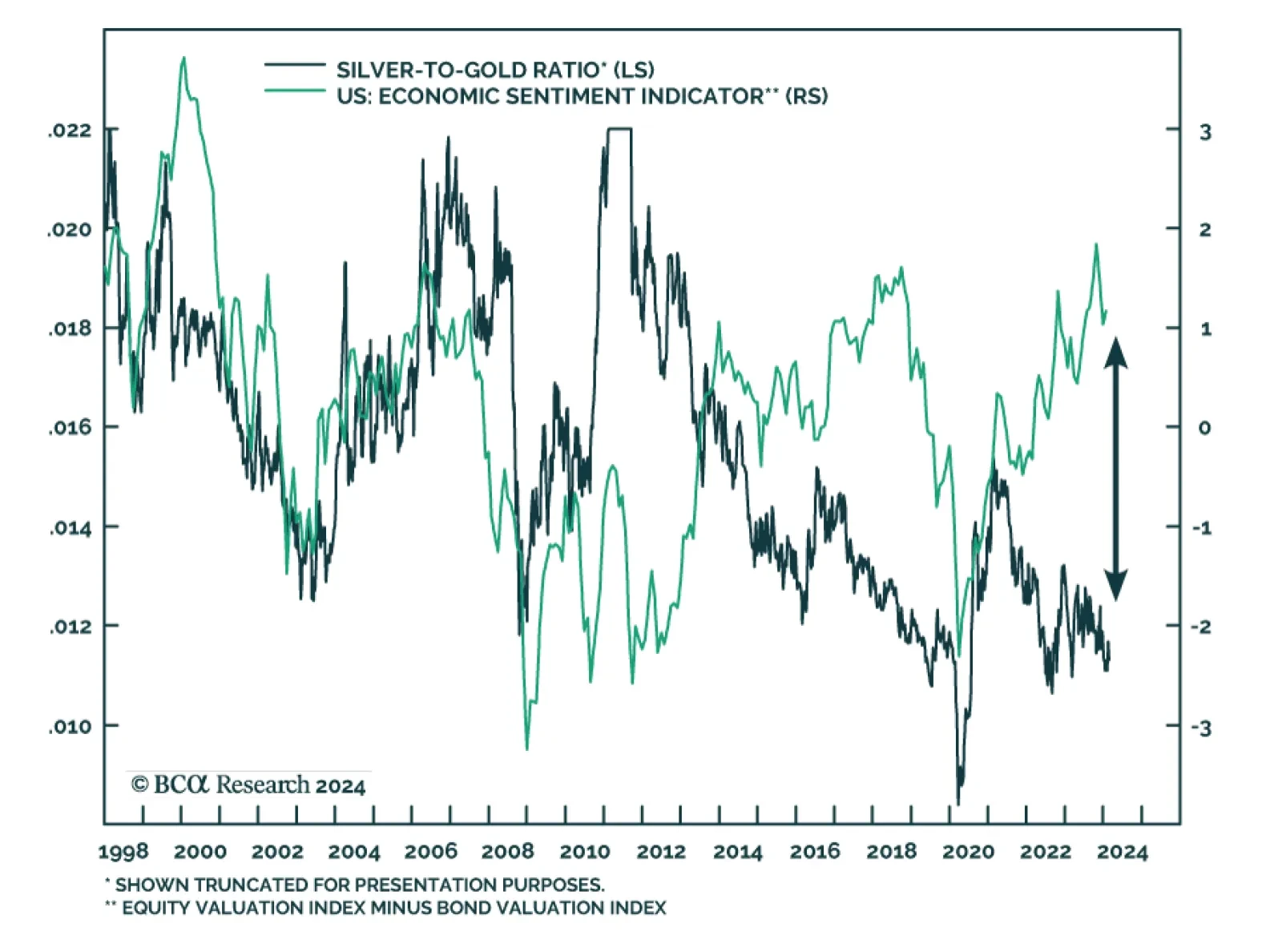

The silver-to-gold ratio has surged close to 10% this year on the back of silver prices catching up to gold. Silver has returned 22% on a YTD basis, against 12% for gold, 13% for industrial metals and 5% for the broad commodity…

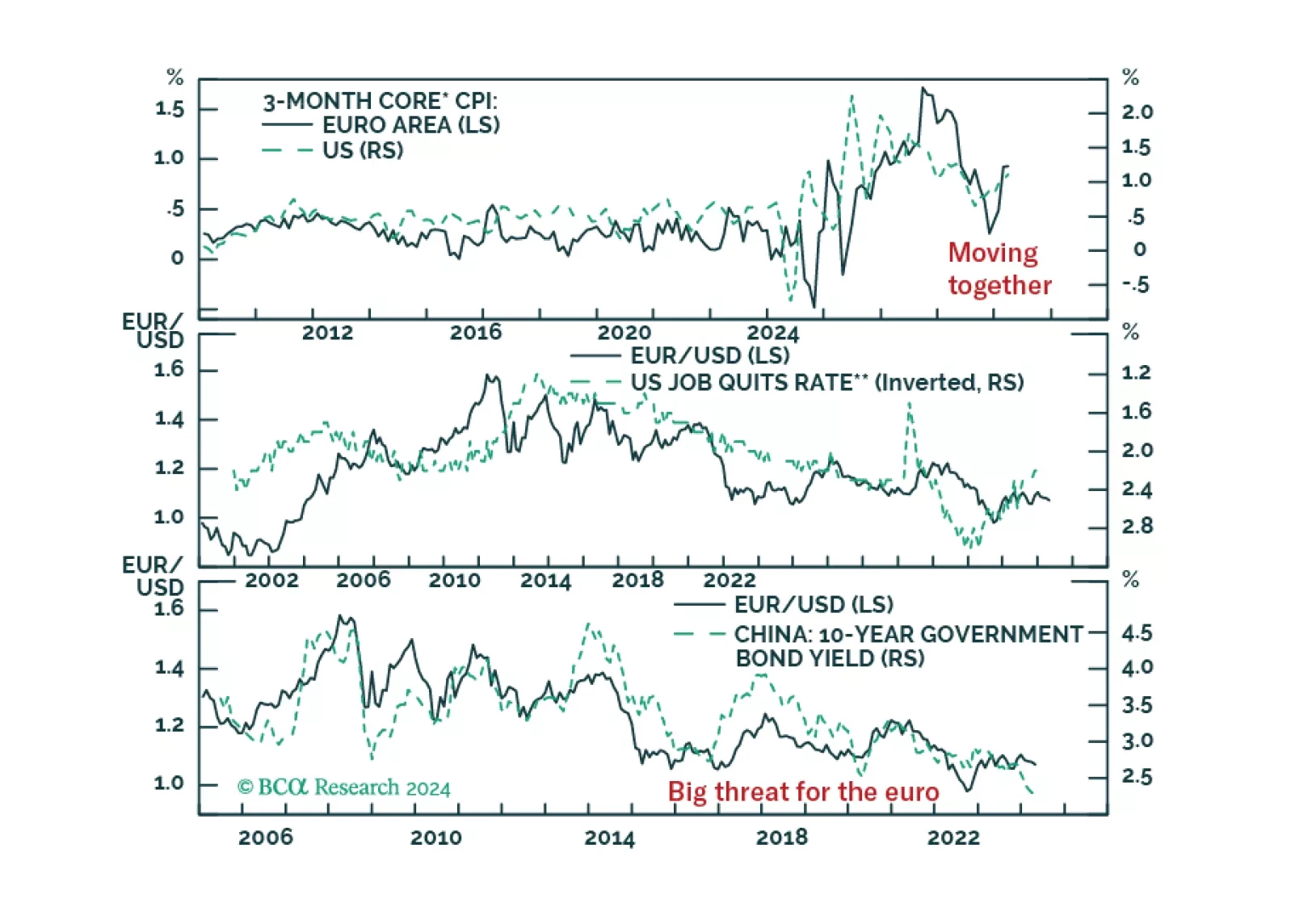

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

Commodities are making headlines with the prices of crude oil, copper, and gold all making sizeable gains since mid-February. Multiple forces have been cited as drivers of the rally across these commodities. Increased…

Our US economic sentiment indicator – which is based on the difference between our equity valuation index and our bond valuation index – remains on an uptrend since its pandemic trough. Investors are pushing US stocks…

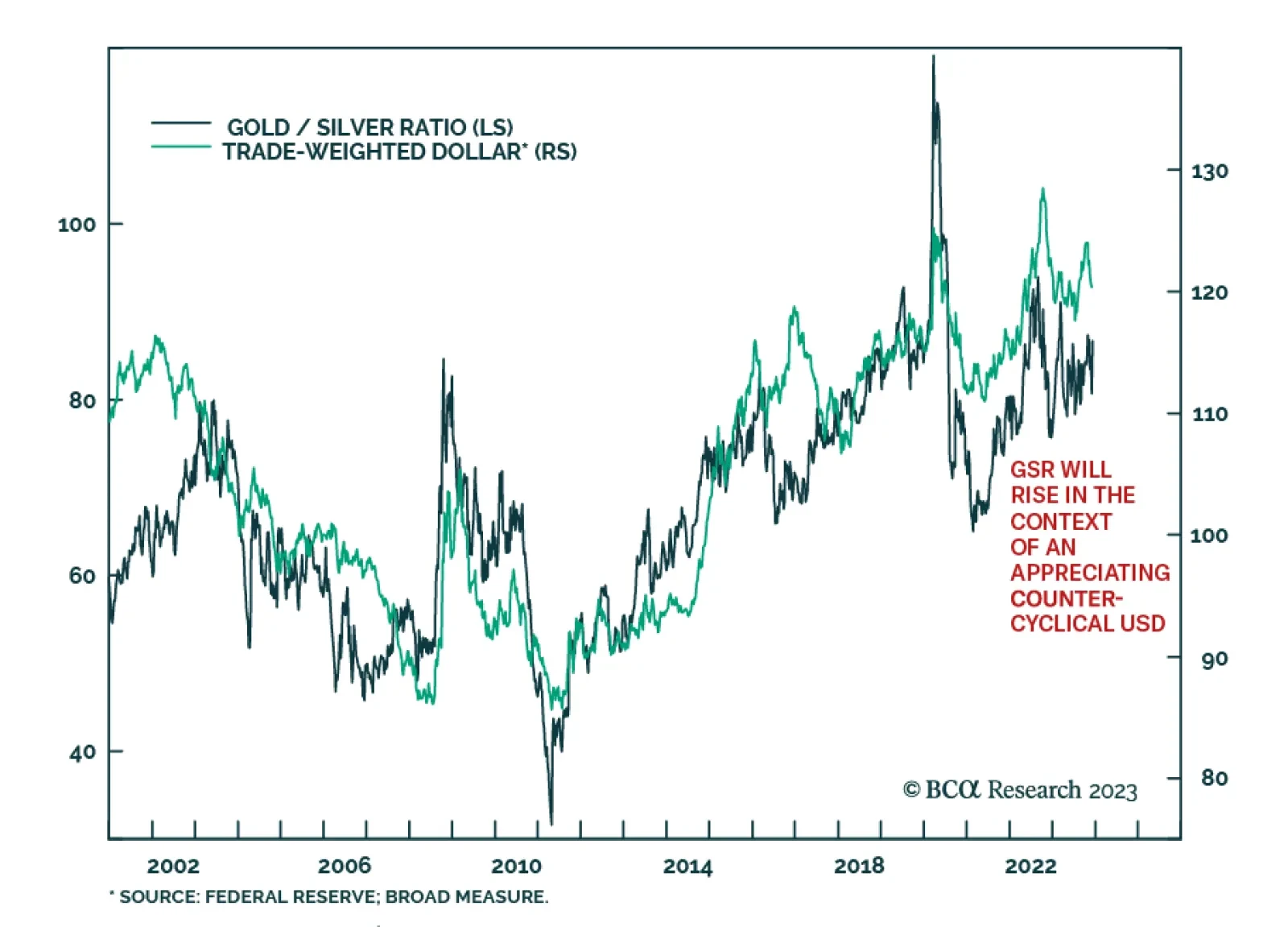

The gold/silver ratio (GSR) confirmed the improvement in global risk sentiment in November. It declined on the back of a 9.2% rally in silver, which outpaced the 1.9% rise in gold. Since then, the GSR has soared amid a more…

In this report, we explore some trading opportunities after a volatile few weeks for FX markets.

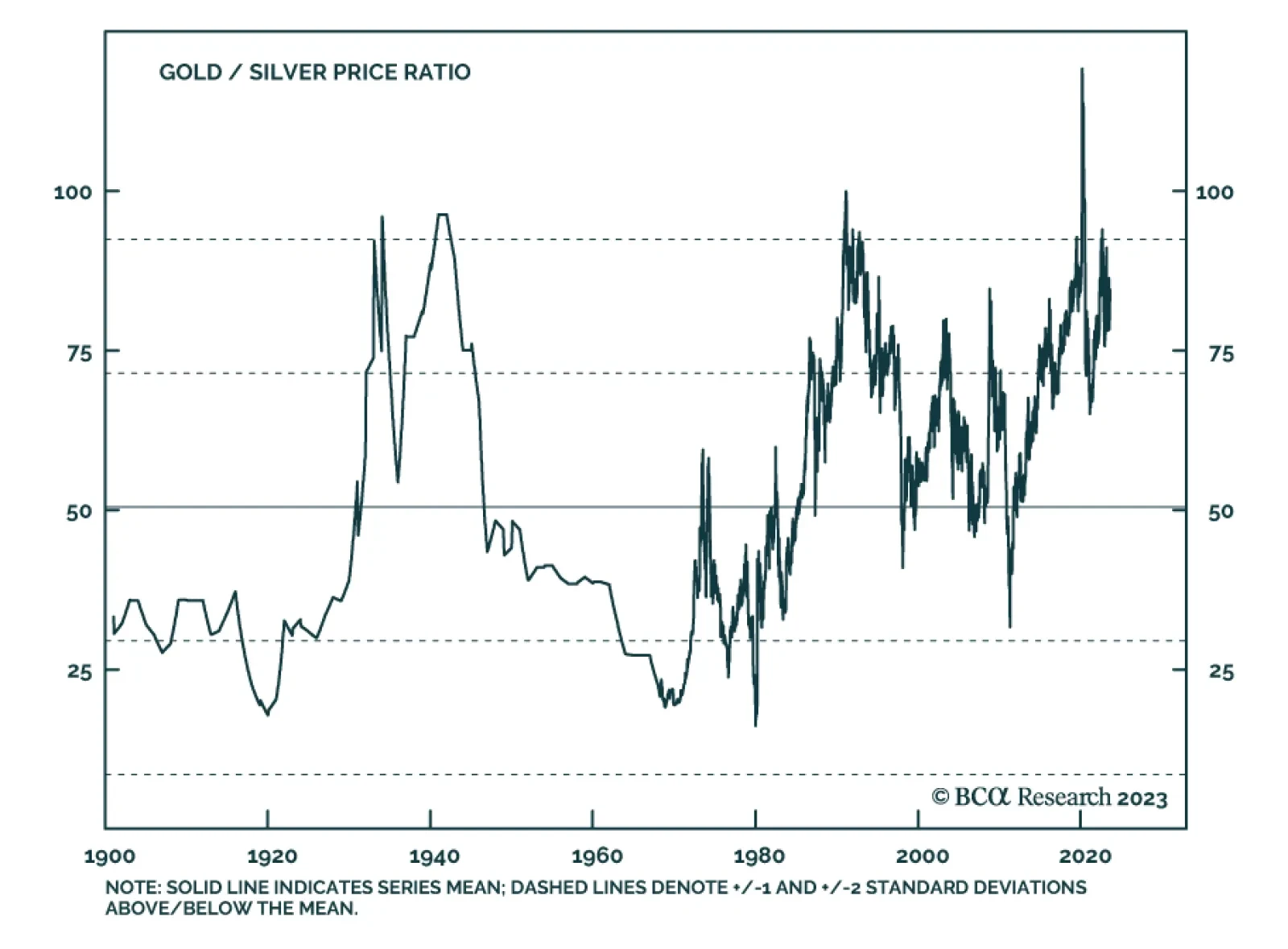

The gold/silver ratio (GSR) entered a well-defined tapered wedge formation with downside support near 80, and an upside breakout around the 90 level. Back in 2020, this ratio was caught up in a race towards major overhead…

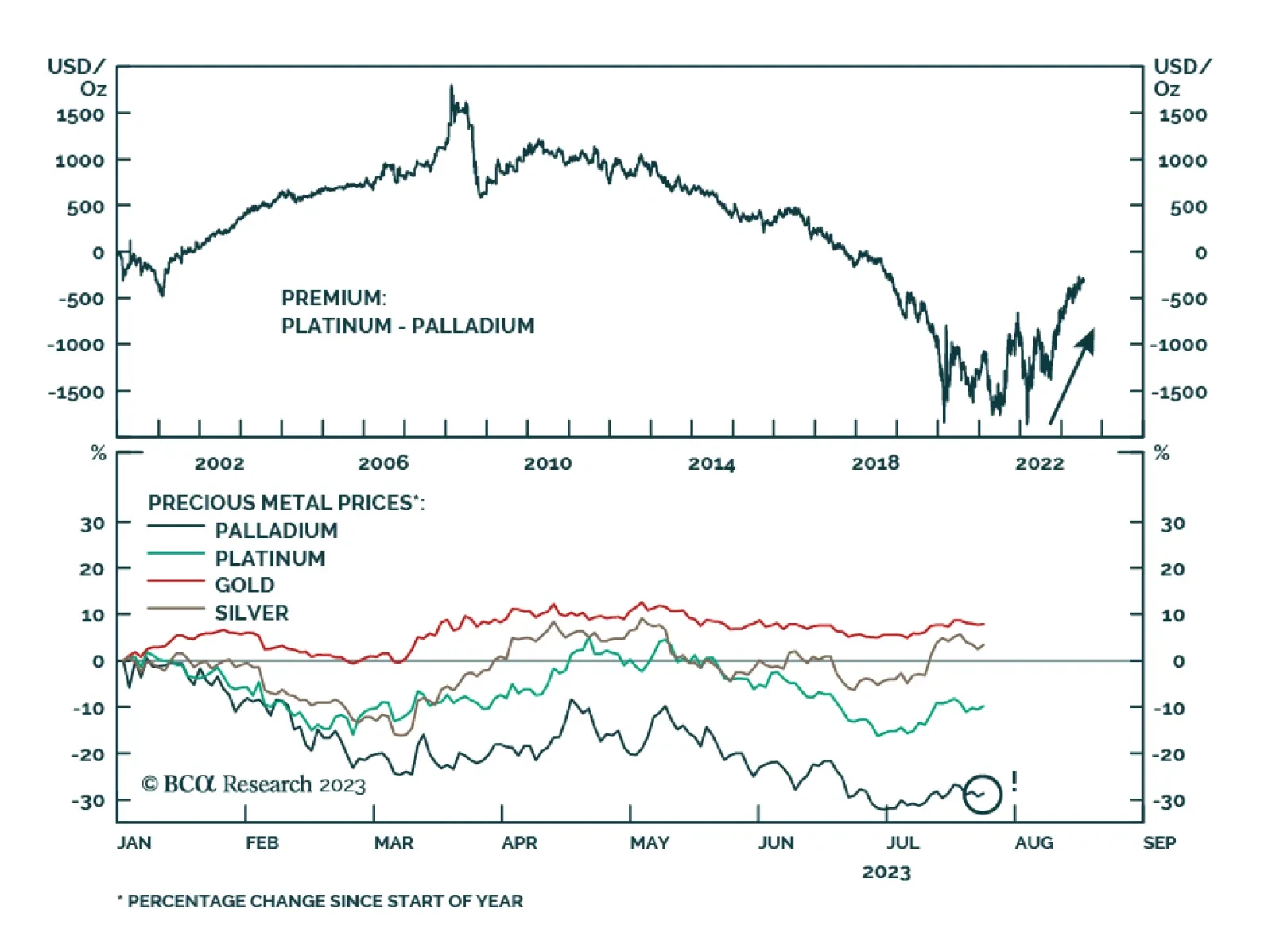

Palladium is by far the worst performing precious metal so far this year. The 30% year-to-date price decline is significantly worse than platinum’s 10% loss and contrasts with higher gold (+8%) and silver (+4%) prices.…

In this short weekly report, we review some of the most common questions clients asked us in the last few weeks.