Dear client, Next week, in lieu of our weekly report, I will be hosting a webcast on Thursday, March 25 at 10:00 am EDT and Friday March 26 at 9:00 am HKT. I look forward to your comments and questions during the webcast. Best regards…

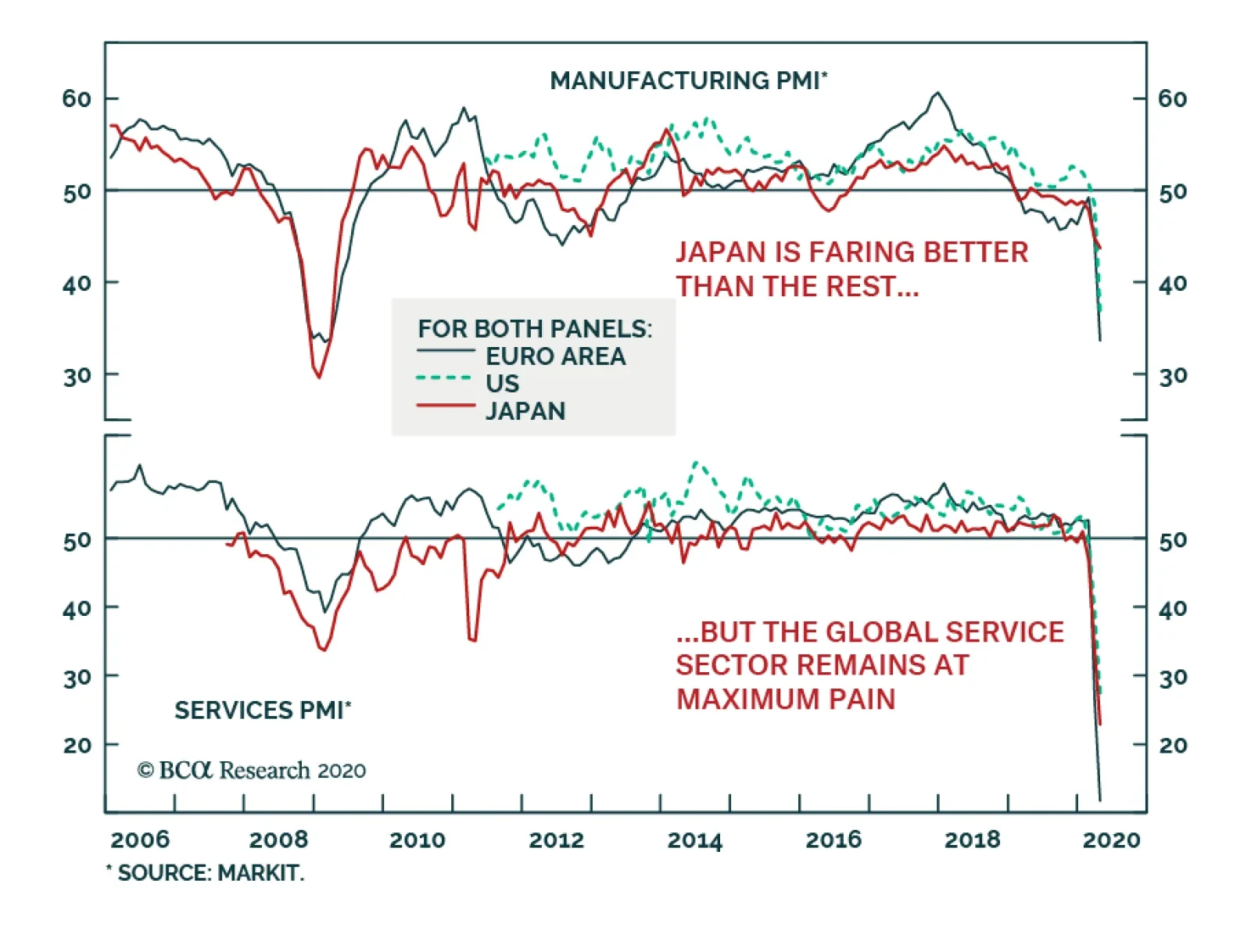

The flash PMIs in April managed to underwhelm already dire expectations. The European manufacturing index collapsed to 33.6 from 44.5, while the services gauge plunged to 11.7. In the US, the manufacturing PMI declined to 36.9…

Dear clients, Over the next couple of weeks, we will be further analyzing China’s coronavirus outbreak, its economic impact, and the likely policy response, as well as the attendant investment recommendations. We will also examine…

Feature The global manufacturing cycle looks dire at the moment. Around the world, manufacturing PMIs have fallen, profit growth has slowed, and capex has been reined back (Chart 1). This is clearly a risky moment for the economic…

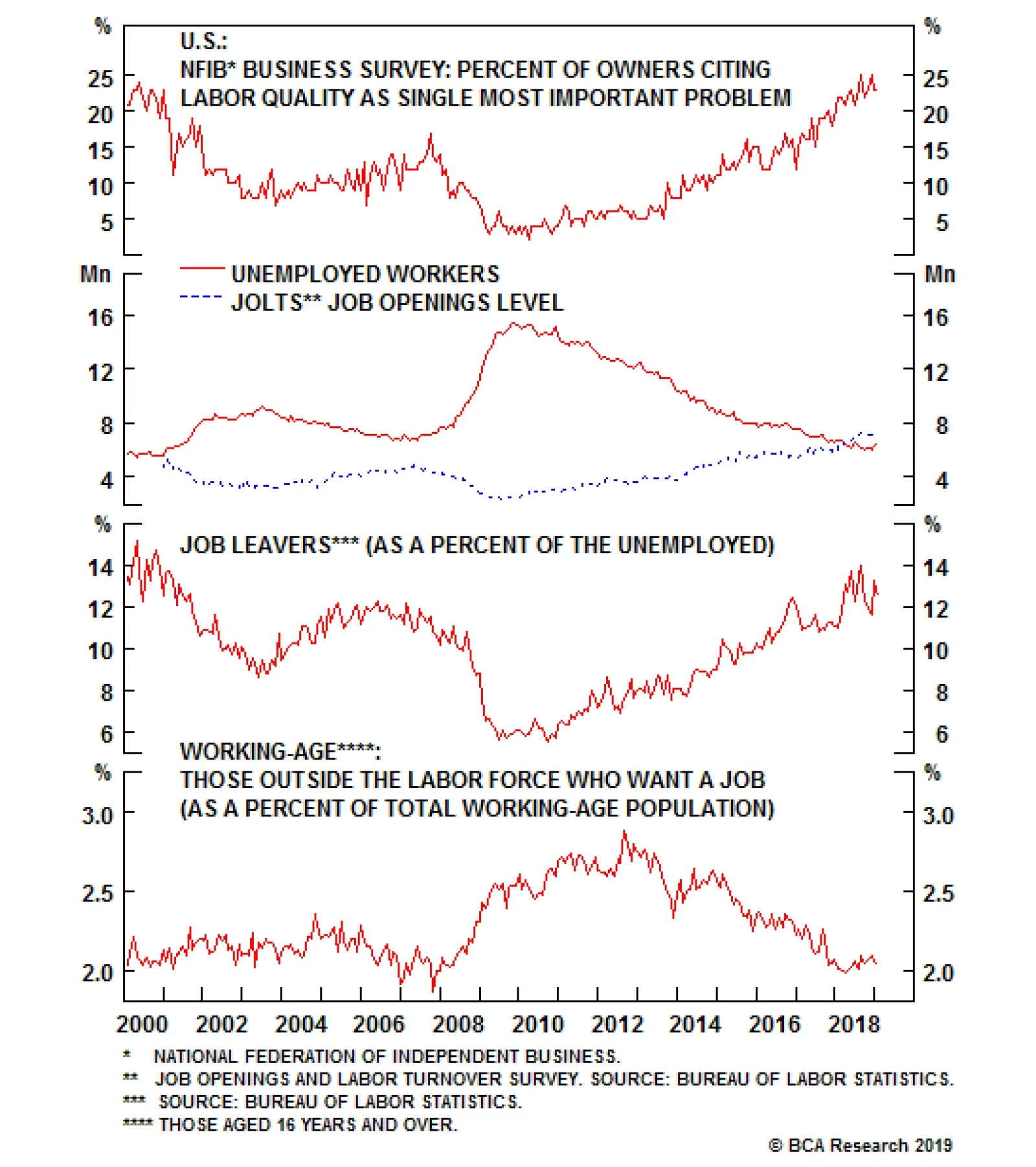

This morning NFIB survey dipped from 104.4 to 101.2, underperforming expectations. However, lengthy government shutdowns, such as the one we just experienced, normally cause this survey to weaken sharply, only to recover once the…

As the world’s second most populous country with an economy projected to grow over 7% annually, India’s potential as a commodity consumer is massive. However, years of distortionary and unfriendly policies have held back the…

Highlights Dear Clients, This is the final publication for the year, in which we recap some of the key developments in 2018. We will resume our regular publishing schedule on January 2, 2019 with a Special Report on urbanization/…

Highlights Neither the weakness in emerging market economies nor political turmoil in Europe are likely to significantly affect the U.S. economy. Although the U.S. economy is increasingly service-oriented, financial markets have…