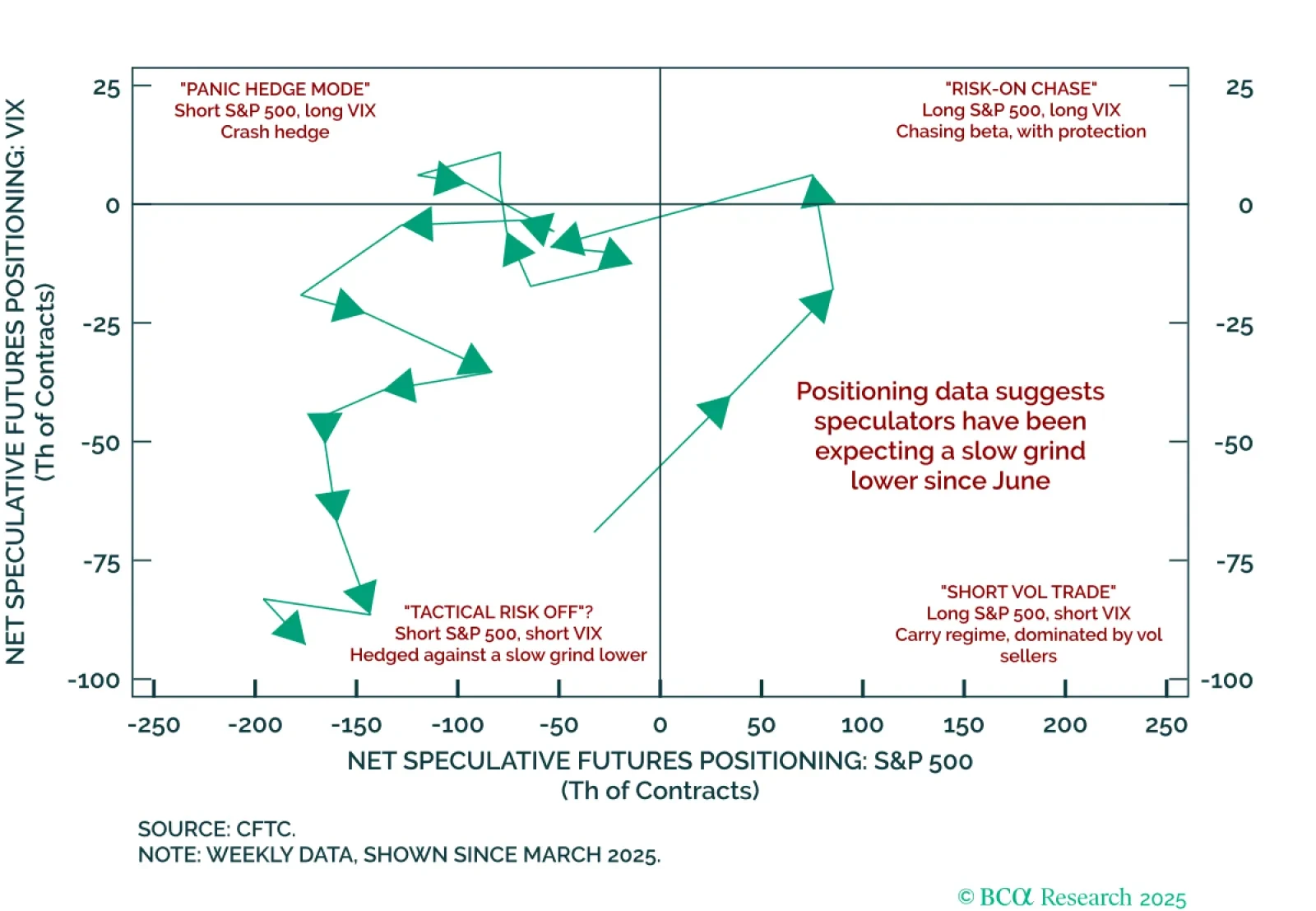

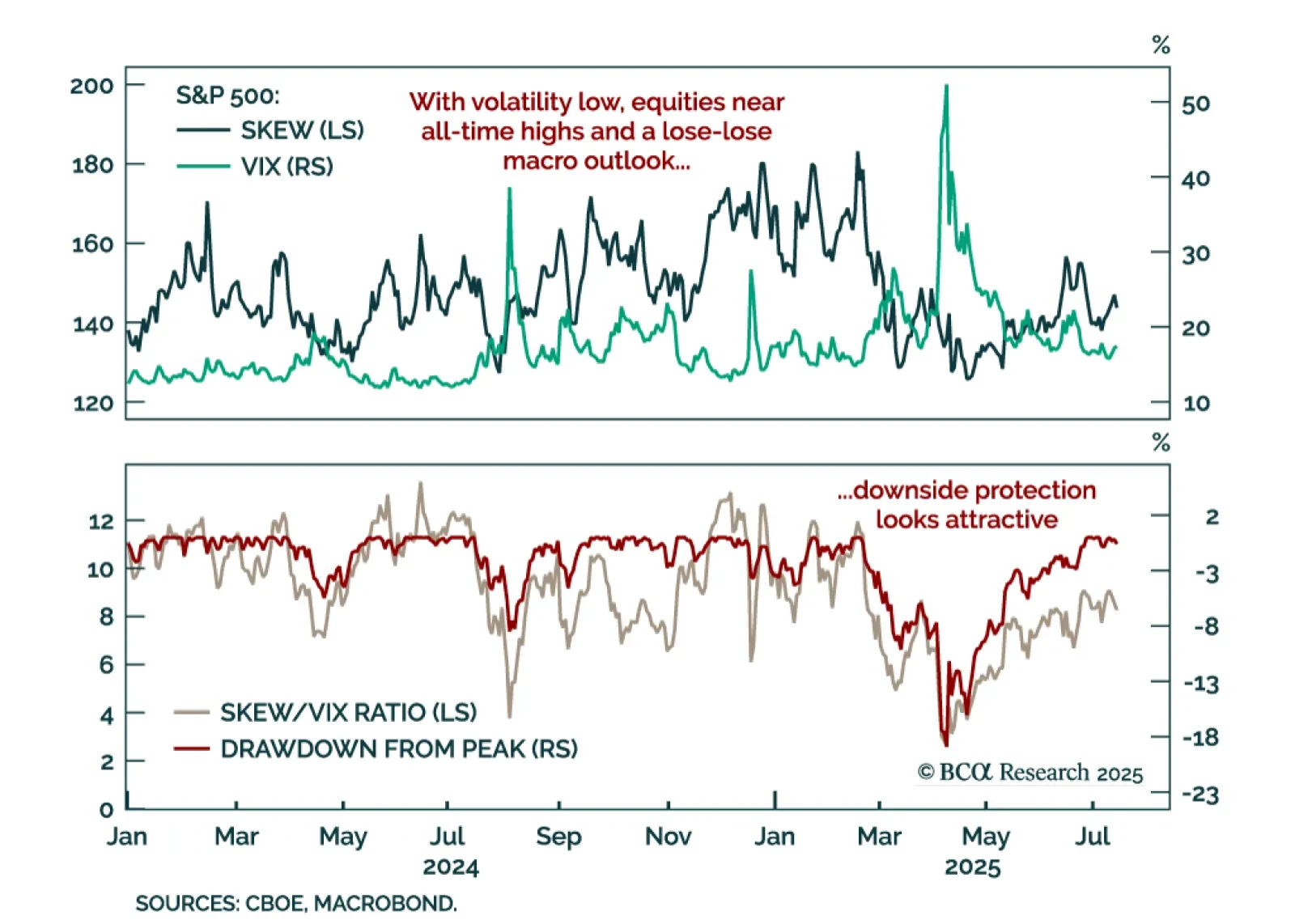

Volatility has fallen to 2025 lows even as positioning data show caution despite the S&P 500’s steady rebound. US equities have climbed back to all-time highs with minimal drawdown, steadily compressing realized…

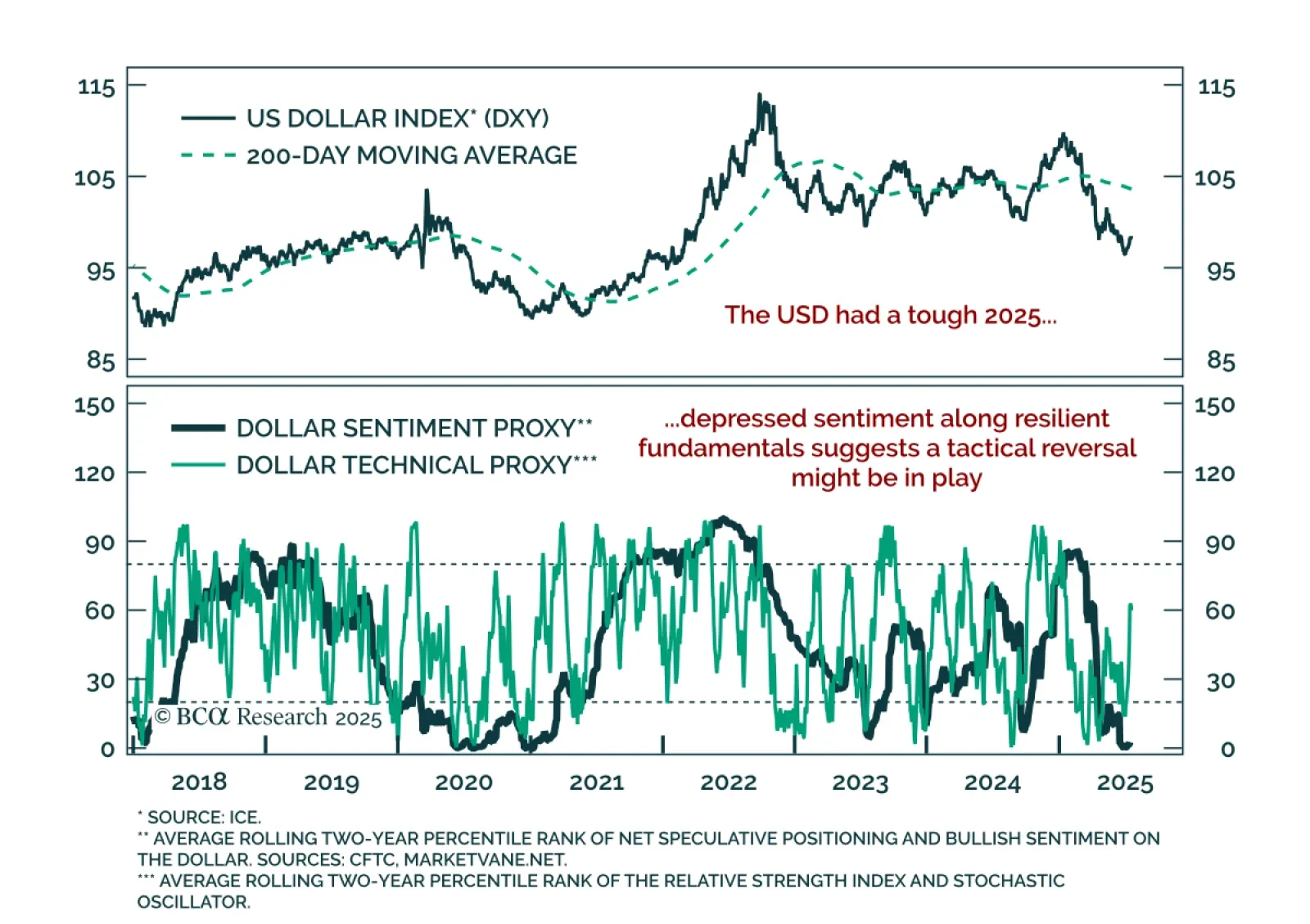

The USD remains structurally challenged, but near-term tactical conditions suggest a temporary bottom is in place. After a sustained selloff and rising concerns around its reserve status, the dollar has decoupled from rate…

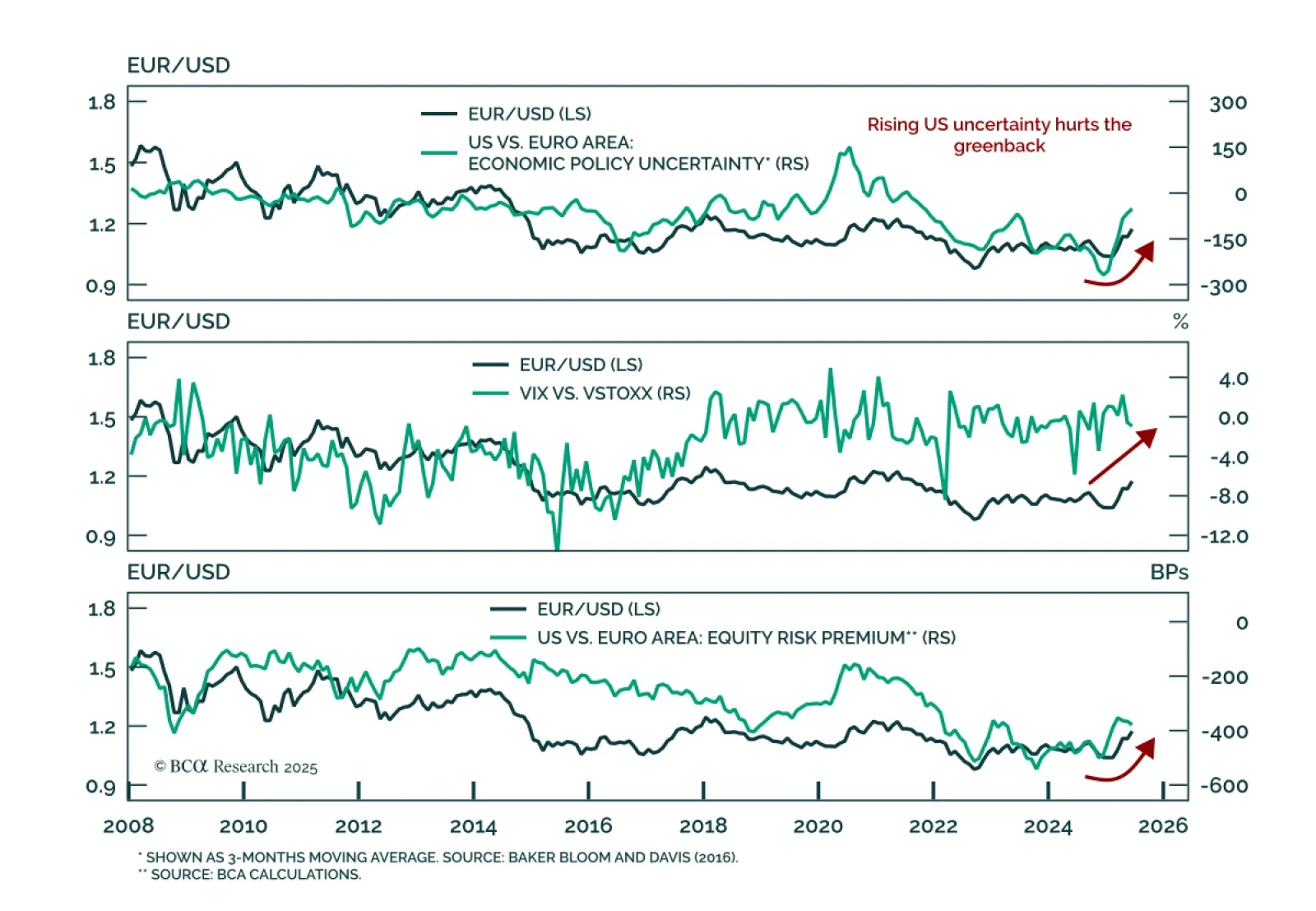

Rising US macro uncertainty and external imbalances are reinforcing euro strength and are supportive of a long-term bullish view on EUR/USD. Our Chart Of The Week comes from Mathieu Savary, Chief Strategist for Developed Markets ex…

The S&P 500 sits near all-time highs, but sentiment and positioning suggest euphoria has not driven this rally. Prices are elevated, yet the SKEW/VIX ratio sits at 8.3, or its 67th percentile. While not at extreme levels…

Hard aggregate macro data series remain solid, but surveys of businesses and consumers continue to worsen and the list of consumer-facing companies lowering earnings estimates gets longer by the week. We believe surging equities are…

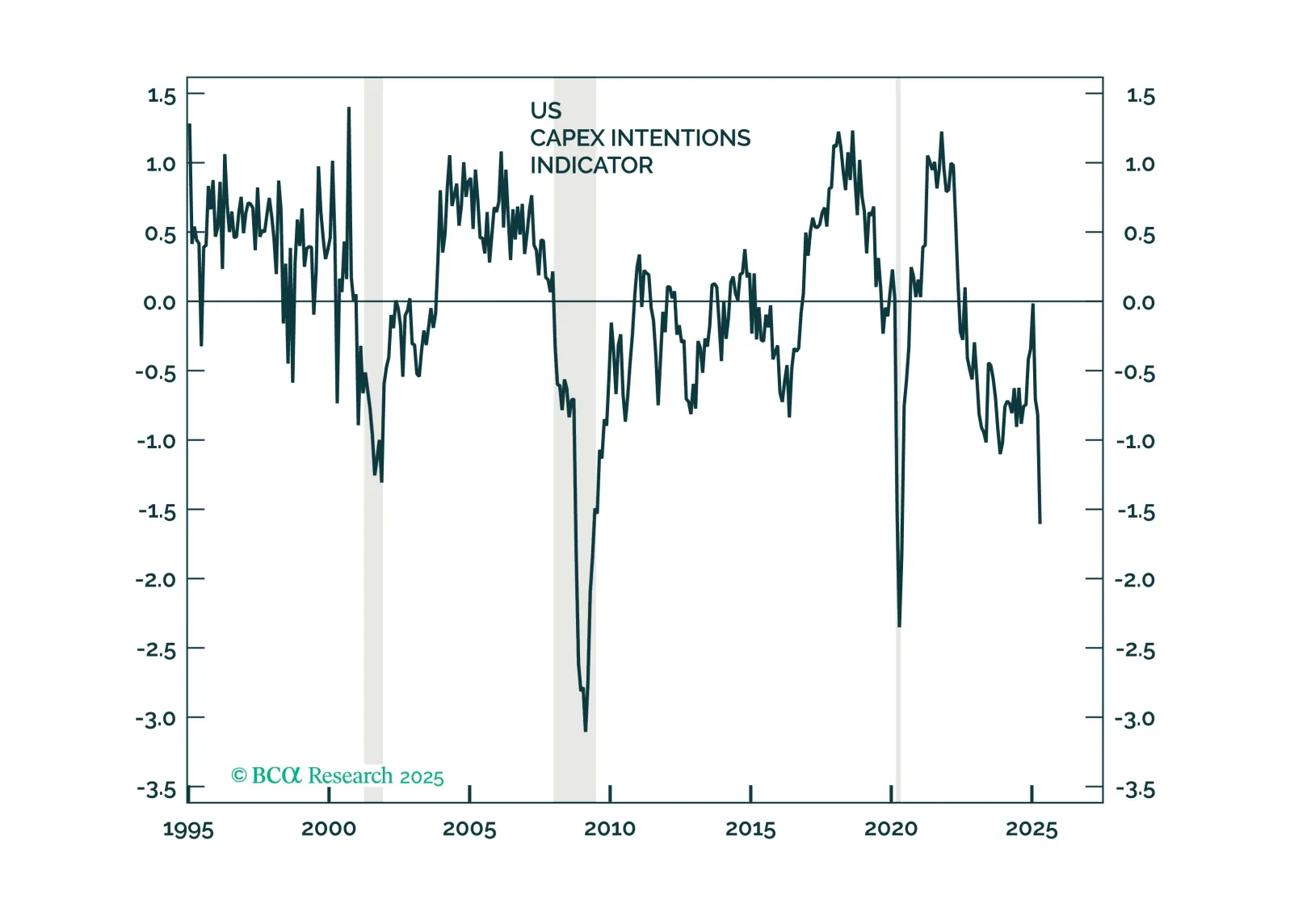

The US economy faces a new investment regime characterized by tighter fiscal and easier monetary policies. The market corrected fast, and a short-lived equity rebound is likely. However, over the long term, US equities face economic…

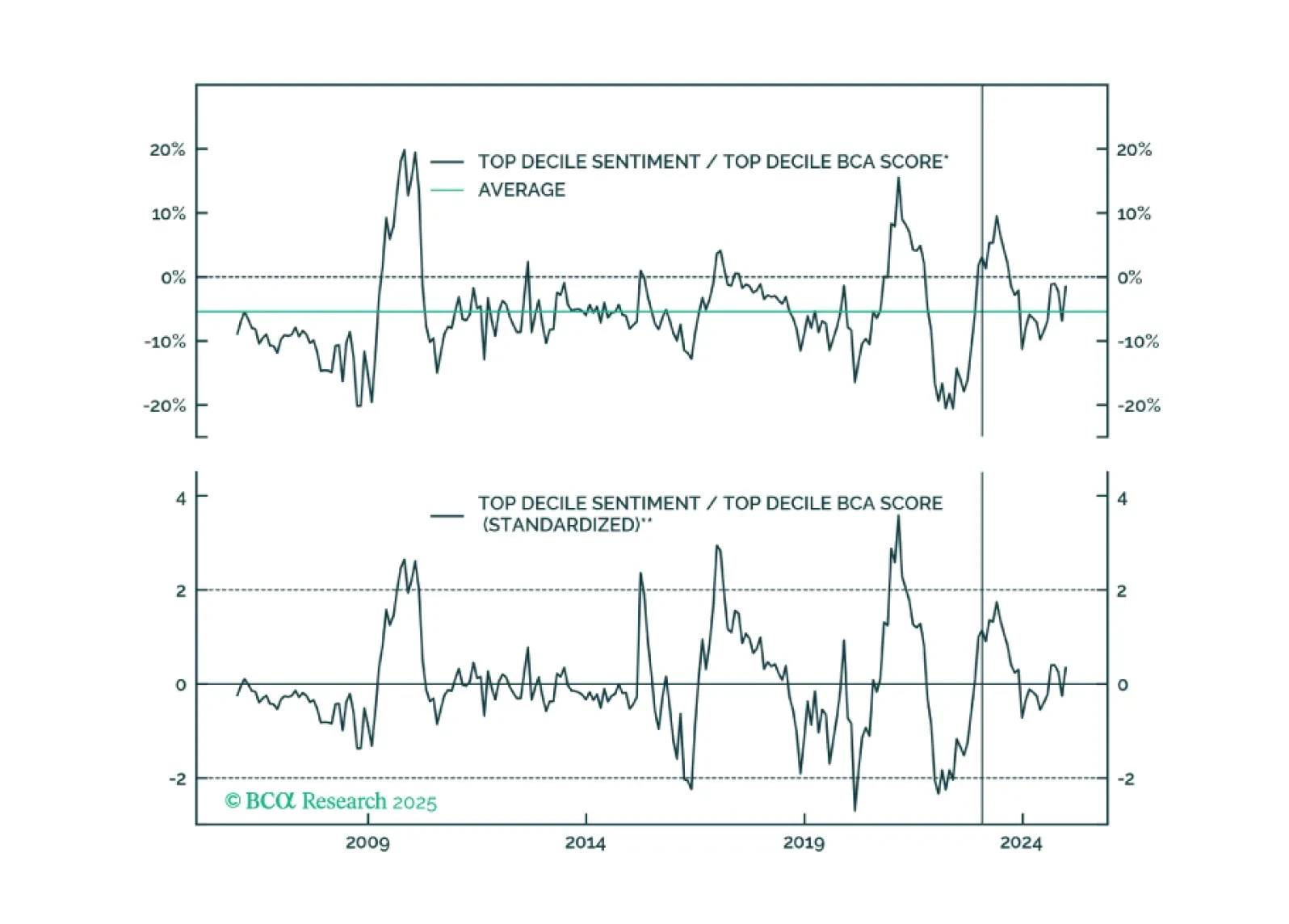

Sentiment will stay positive for now, but downside risks are rising. Investors should proceed cautiously in stock picking and portfolio construction at this juncture, given rising economic and policy uncertainty, which threaten…

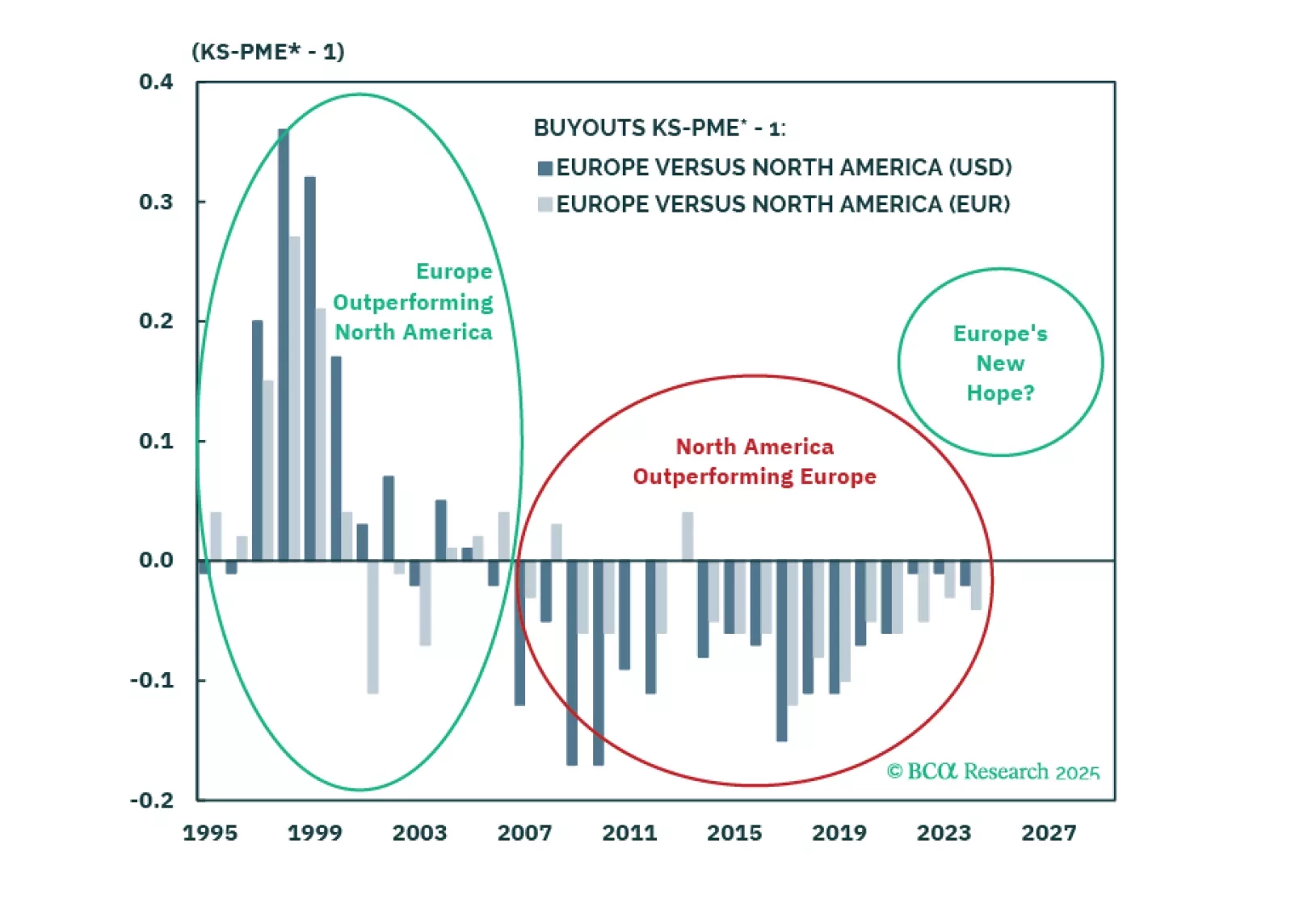

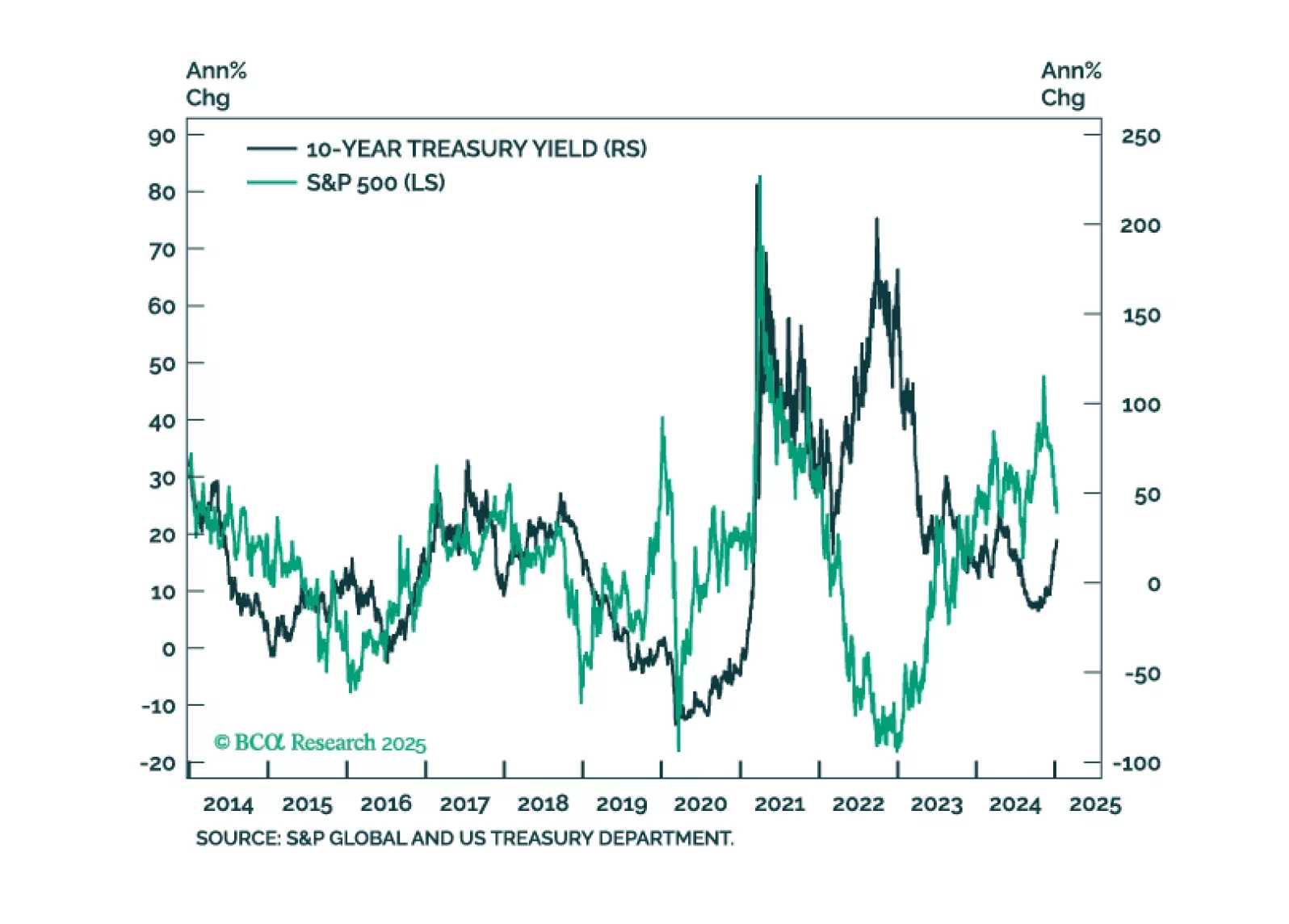

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

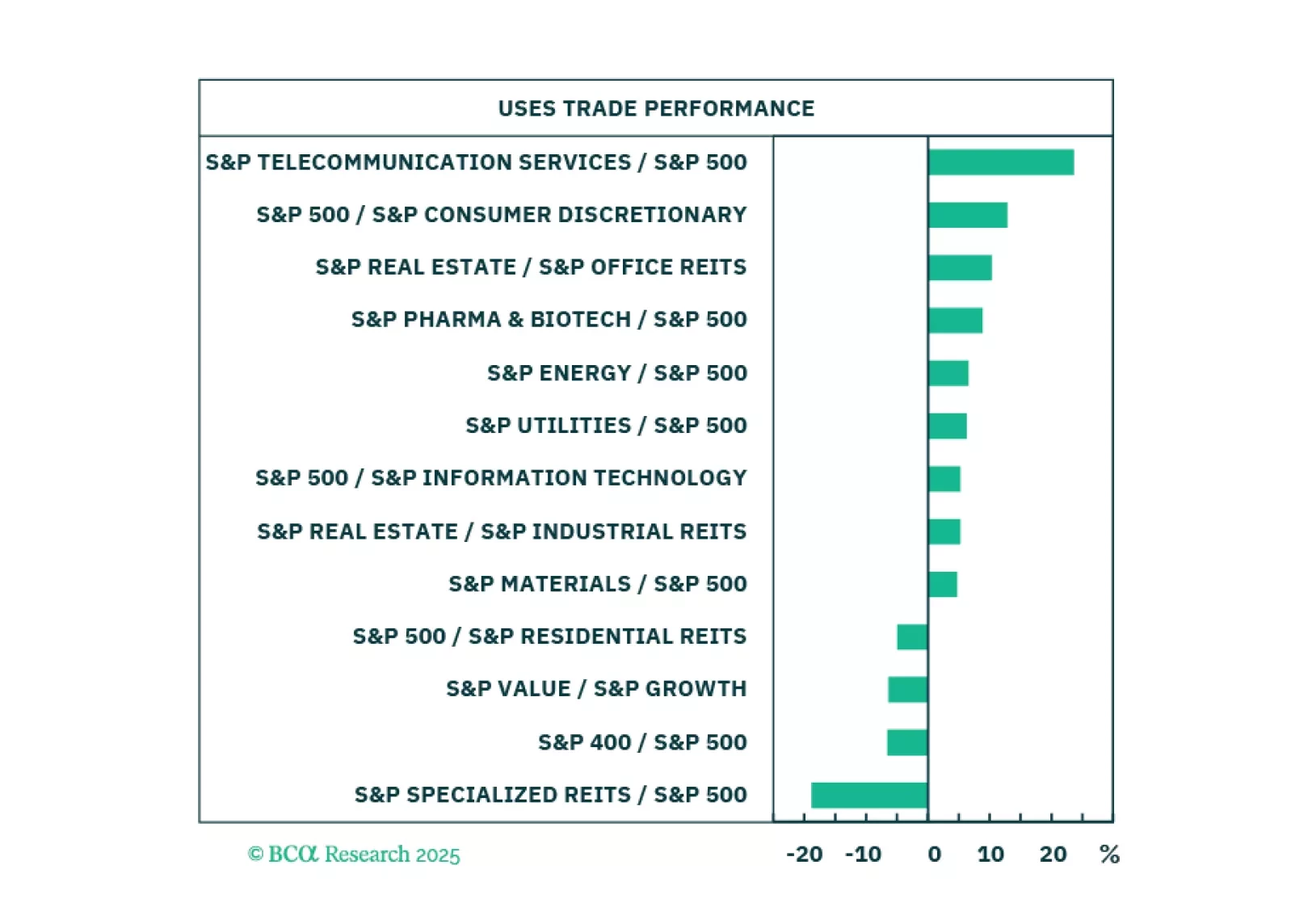

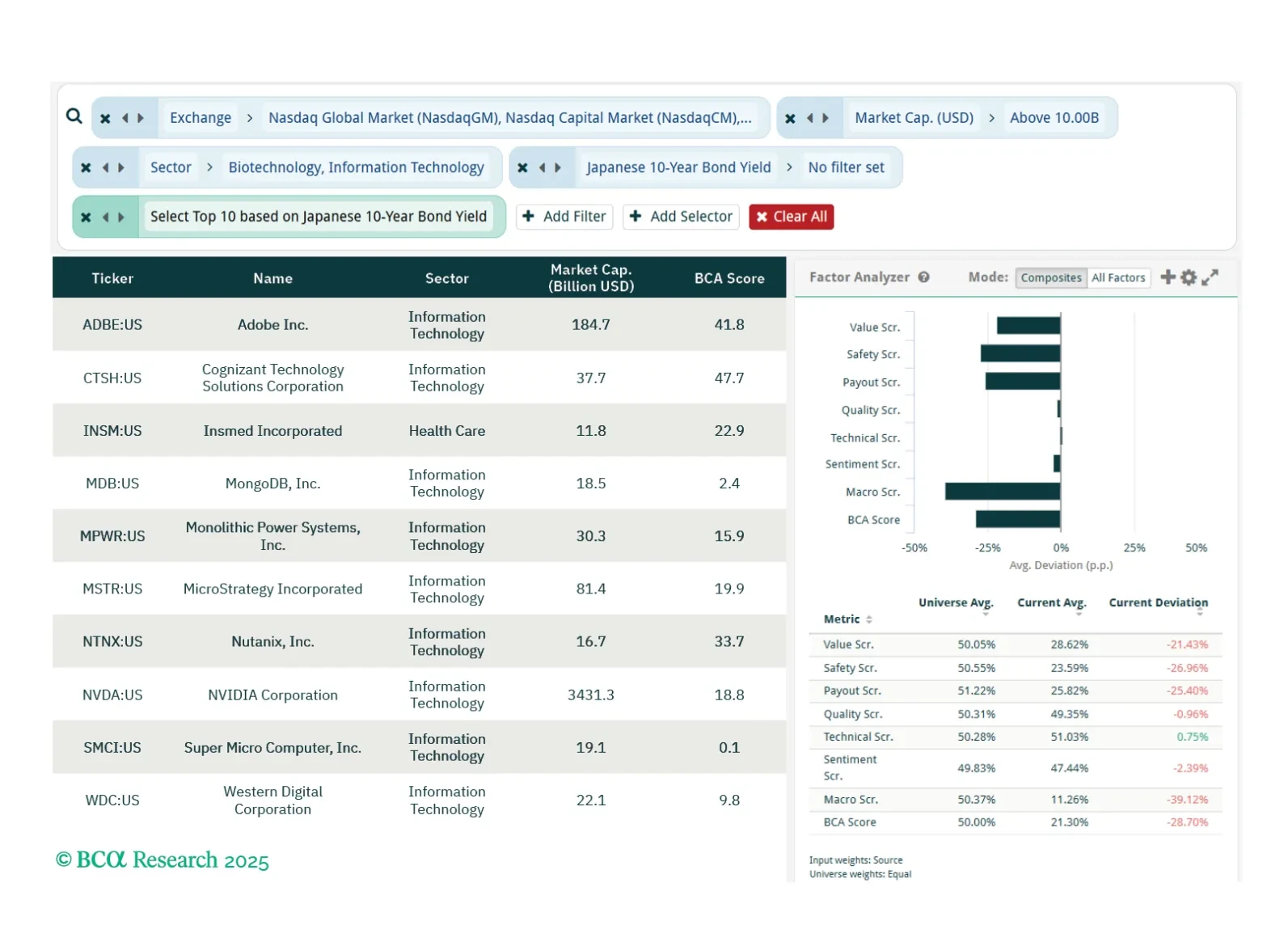

To kick start our new research agenda at Equity Analyzer, we welcome you to our weekly screener report. Each week we will deliver three screeners highlighting stocks exposed to various macro and investment views and themes, that have…