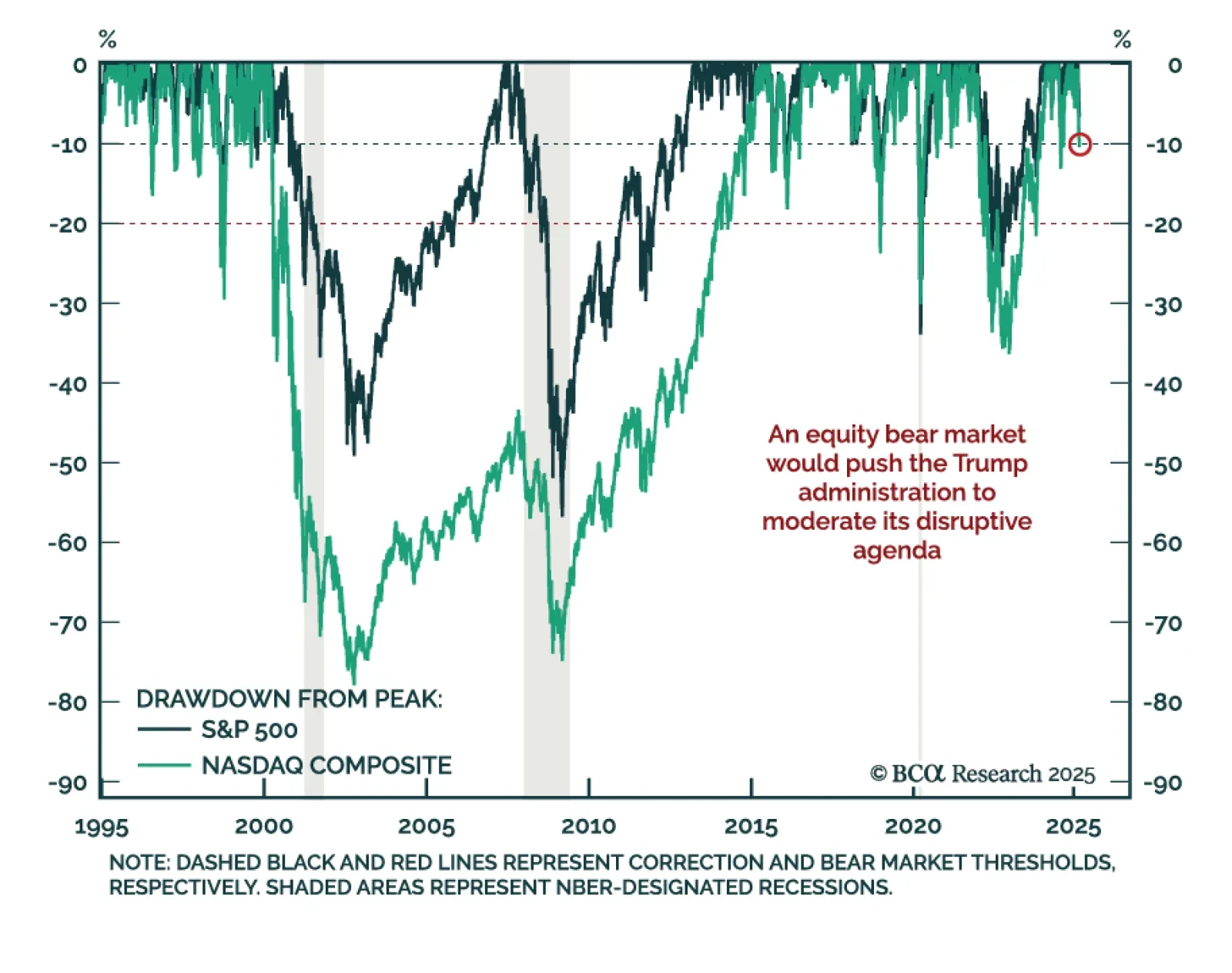

Treasury Secretary Scott Bessent said there is no “Trump put”, and acknowledged the administration’s policy could create short-term pain to achieve long-term gains. The concept of a “market put” implies policymakers would aim to put…

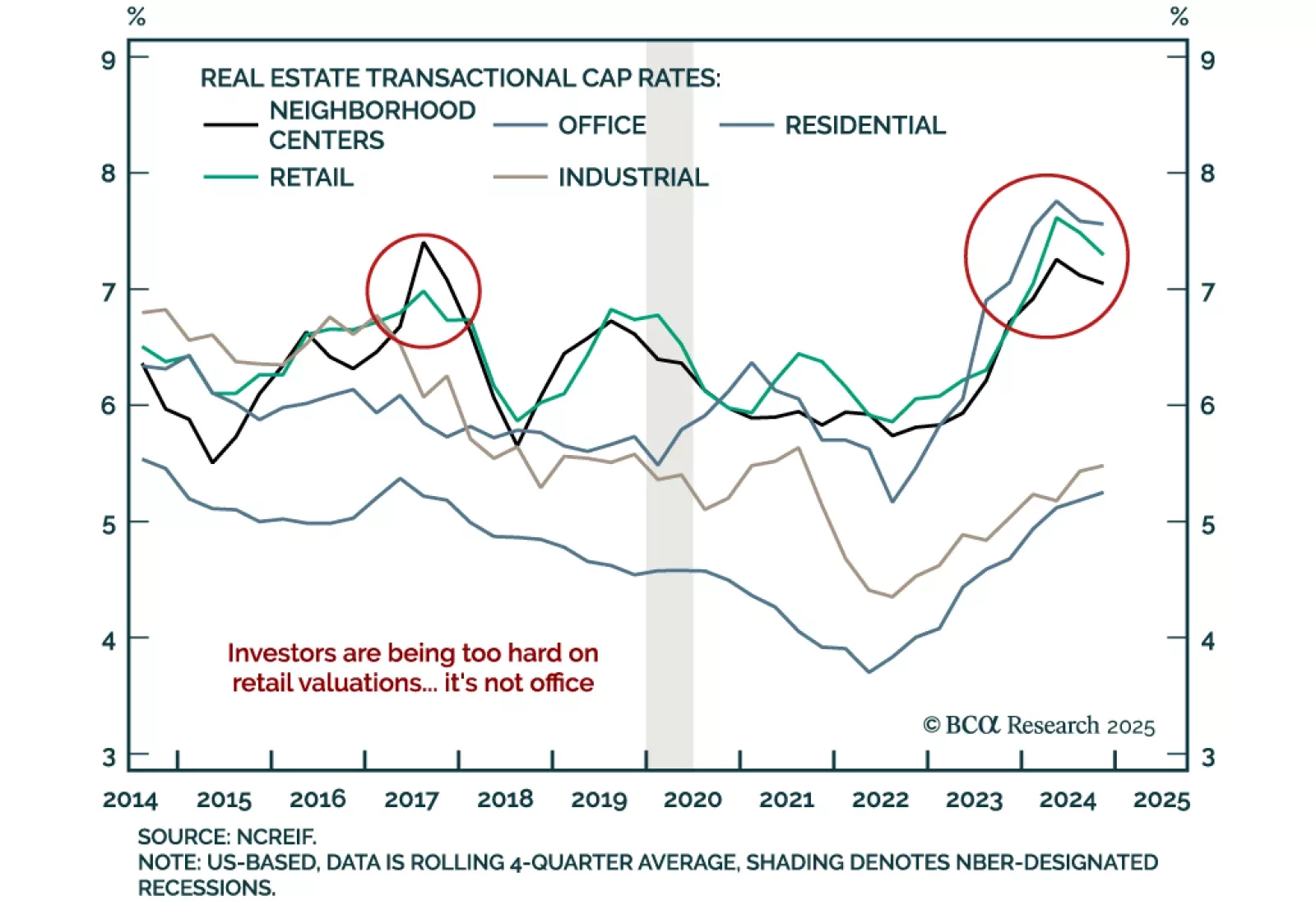

Our Private Markets & Alternatives strategists assessed retail real estate opportunities. Retail Real Estate is a contrarian opportunity, with investor sentiment at rock-bottom levels despite shifting consumption patterns.…

This week we are sending you a sector chart pack. In the front section of the chart pack, we review February’s performance, take stock of the recent macroeconomic developments, and examine whether market rotation will continue. We…

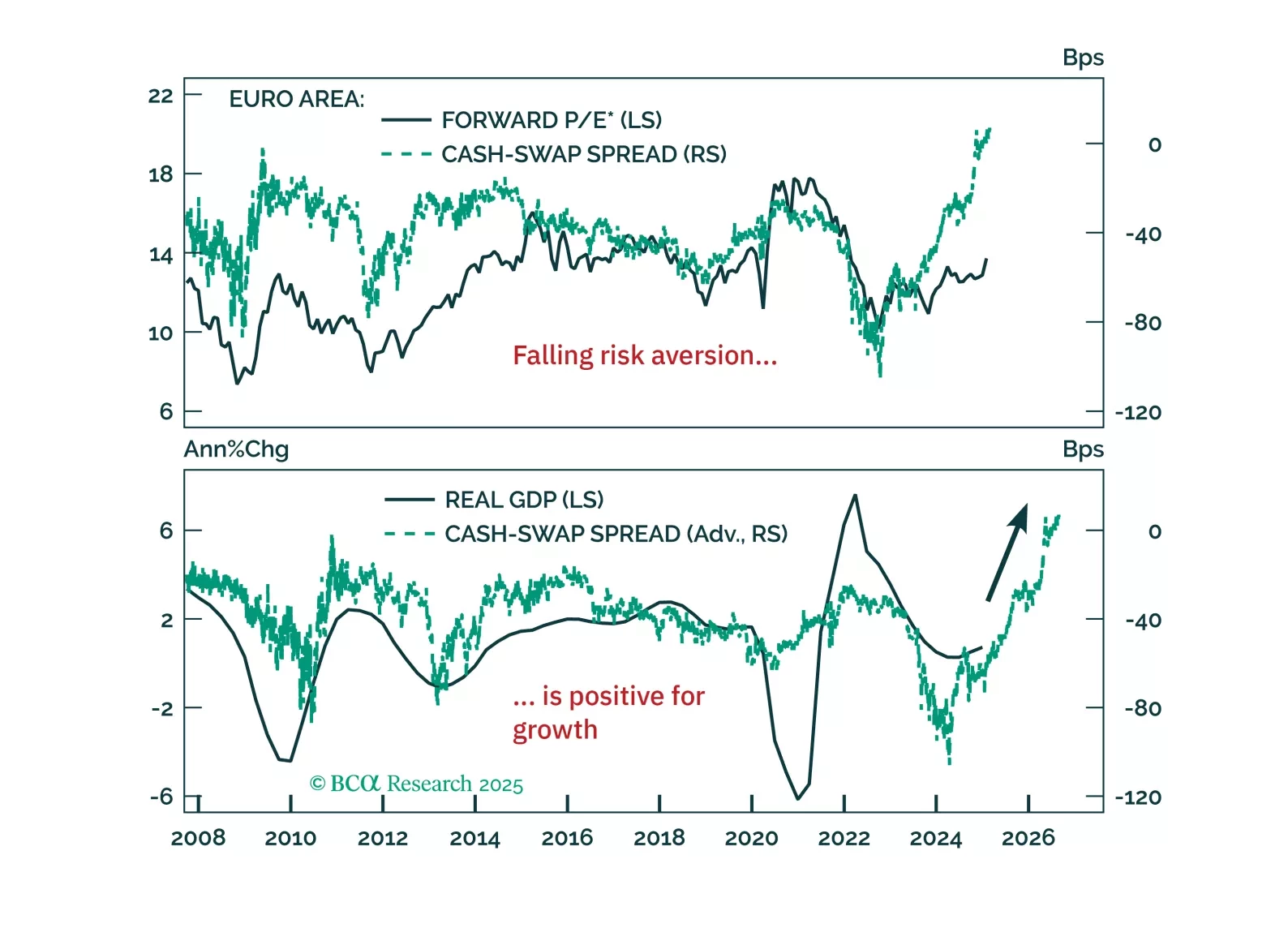

Europe’s resilience to global liquidity deterioration isn’t a fluke—it signals a structural shift. Our latest report explains why the decline in precautionary money demand marks the end of Europe’s liquidity trap and what it means…

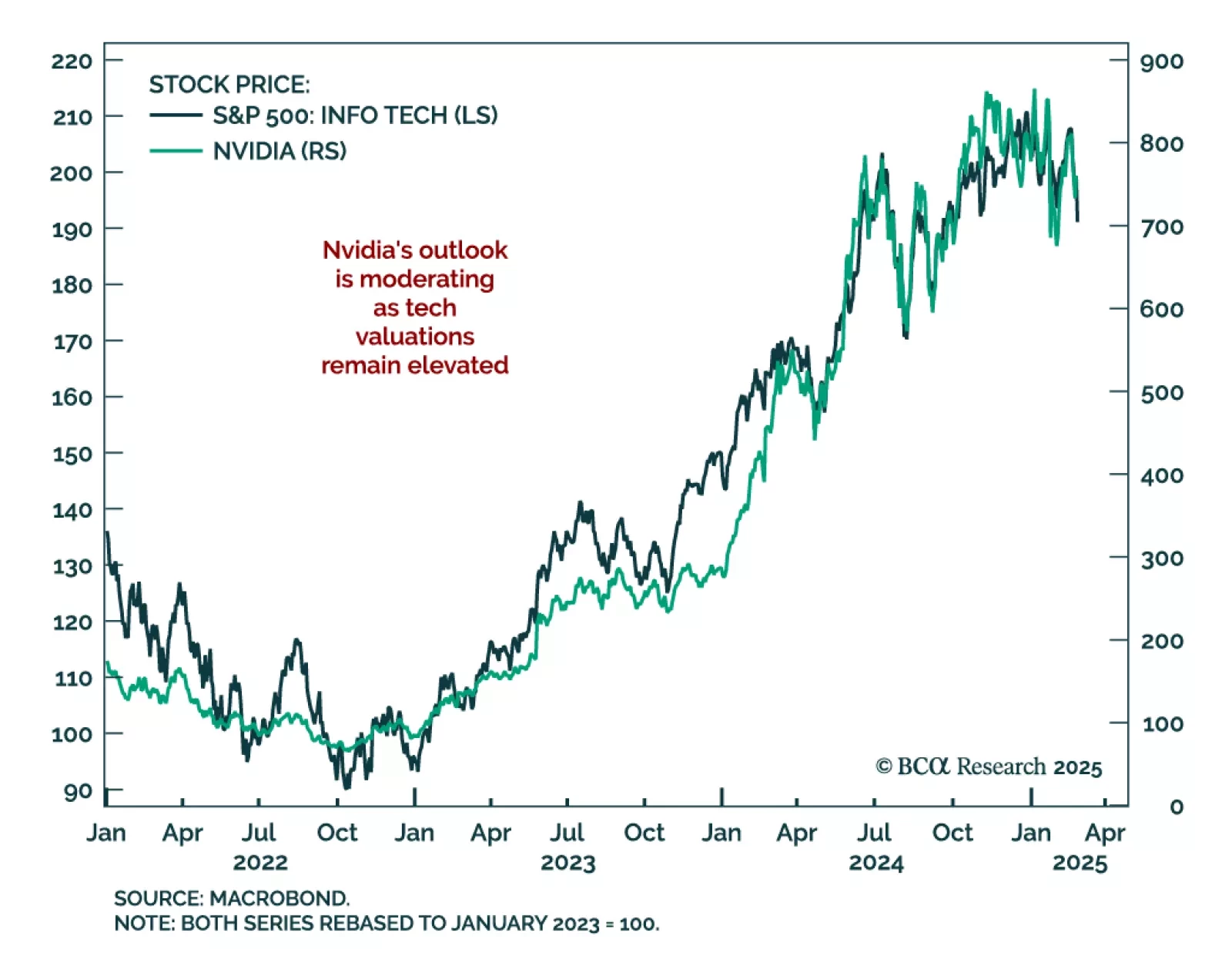

Our Bank Credit Analyst strategists published their latest monthly report, and Section II aims to assess whether AI is leading to a productivity increase. Our colleagues remain unconvinced that Generative AI is a true…

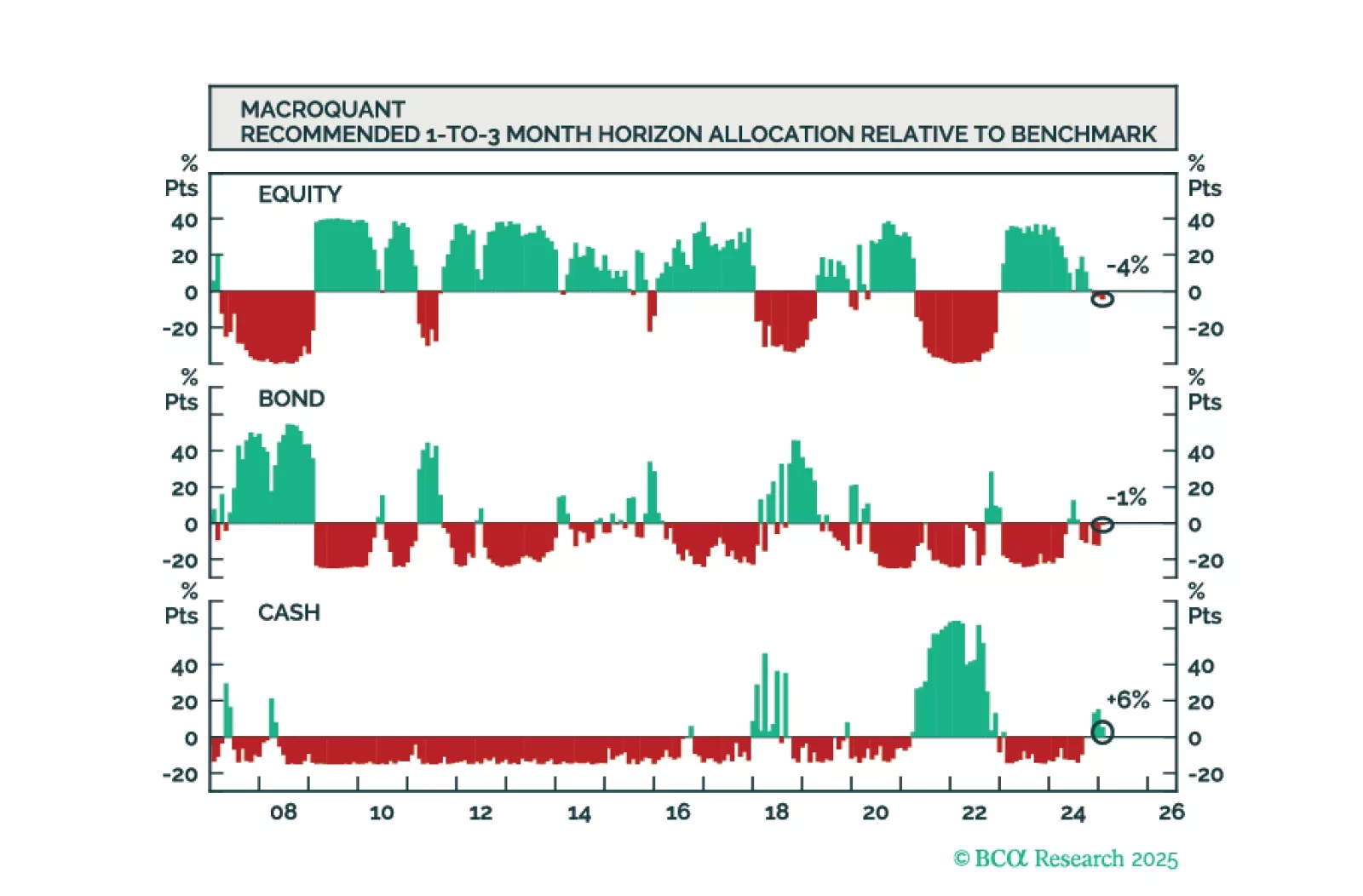

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

The MacroQuant model is no longer bullish on stocks but is not yet prepared to turn underweight. Subjectively, the Global Investment Strategy team is more bearish on equities than the model.

Nvidia announced good results, but Q1 sales guidance fell short of expectations. The numbers point to growth normalization as investors have been accustomed to blowout numbers. Nvidia’s meteoric rise means investors think about…

Our Equity Analyzer team used their platform to find value plays in a richly-valued US stock market. US equities remain in a bull market, but valuations are stretched, with investors heavily concentrated in large, trending…

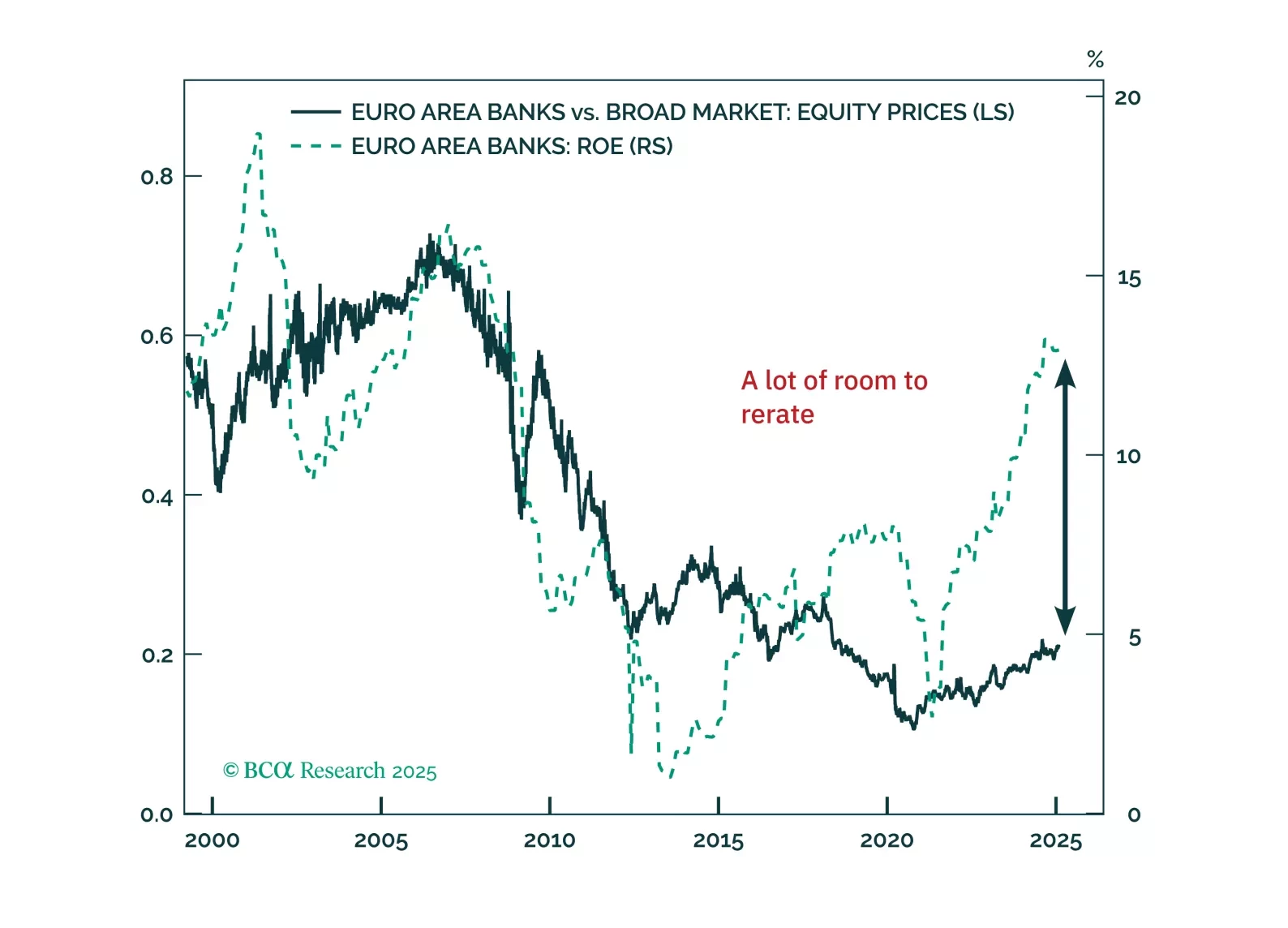

Eurozone banks have quietly outpaced the Magnificent 7—can they keep winning? With strong balance sheets, rising profitability, and structural tailwinds, European lenders still offer value despite short-term risks. Meanwhile, German…