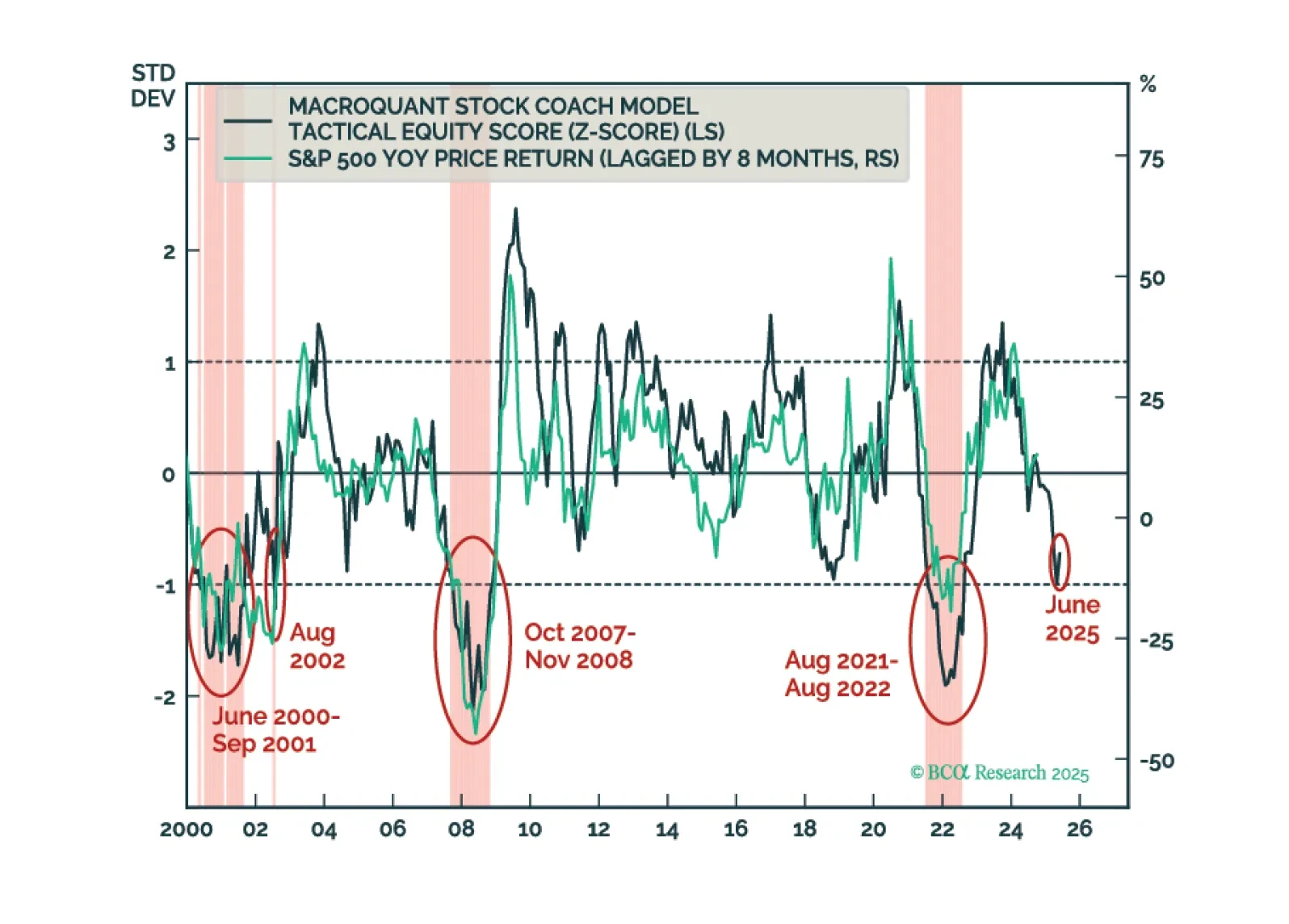

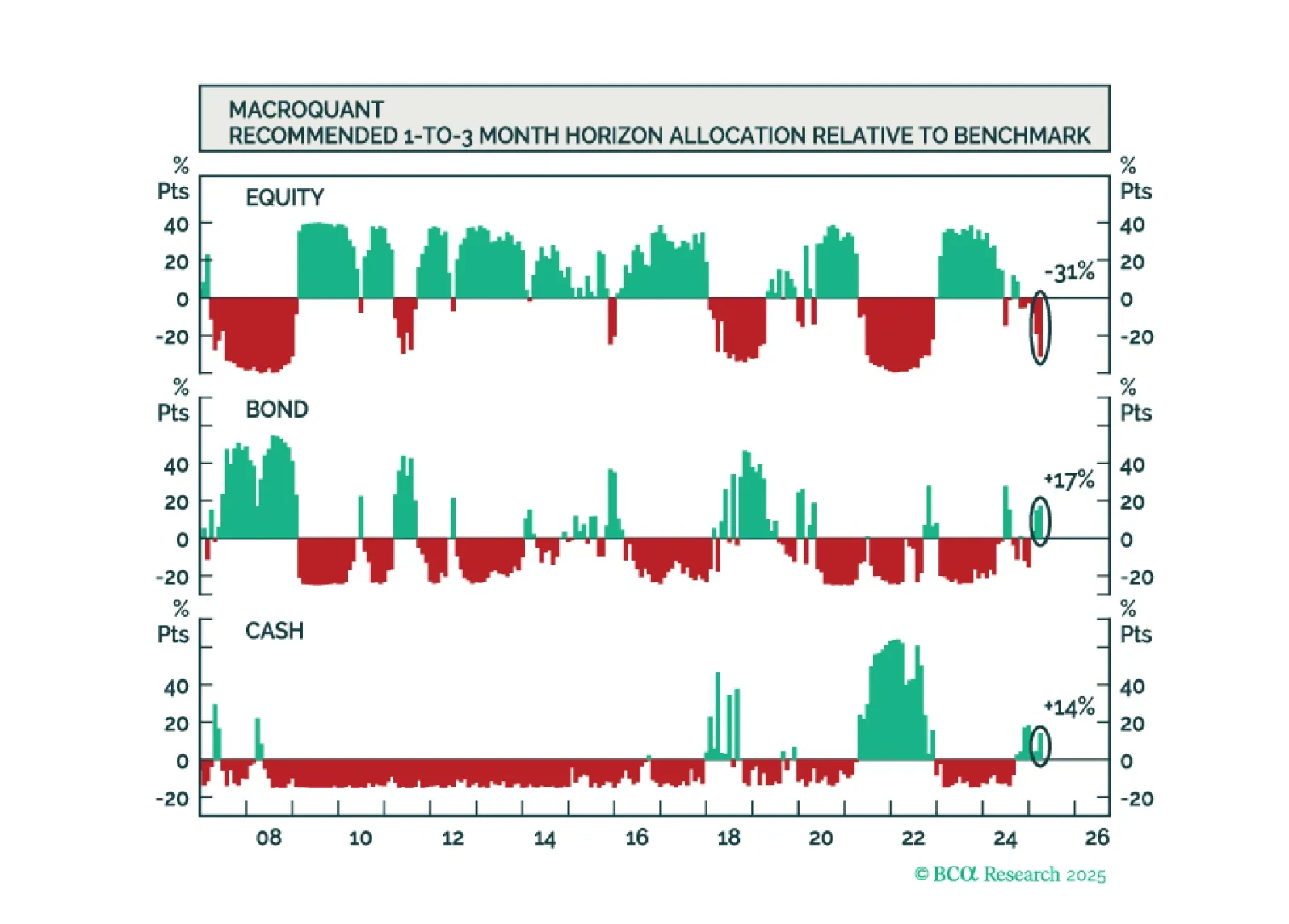

MacroQuant’s US equity z-score is dangerously close to the -1 threshold. Moves below that threshold have reliably coincided with equity bear markets in the past. As such, MacroQuant recommends an underweight on stocks, offset by an…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

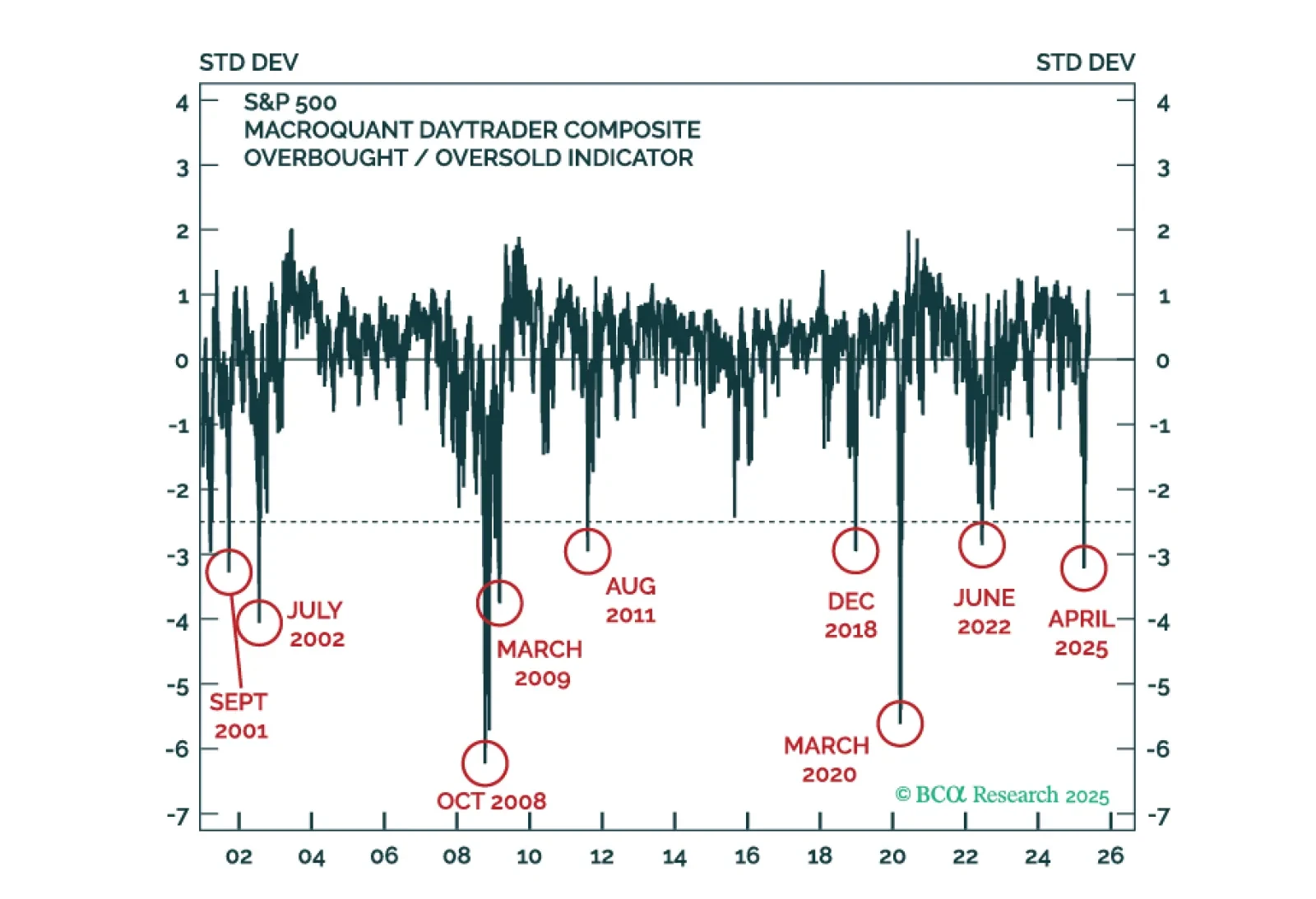

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

MacroQuant warns that US equities are pricing in very little economic risk. The model is shunning equities and recommends a large overweight to cash.

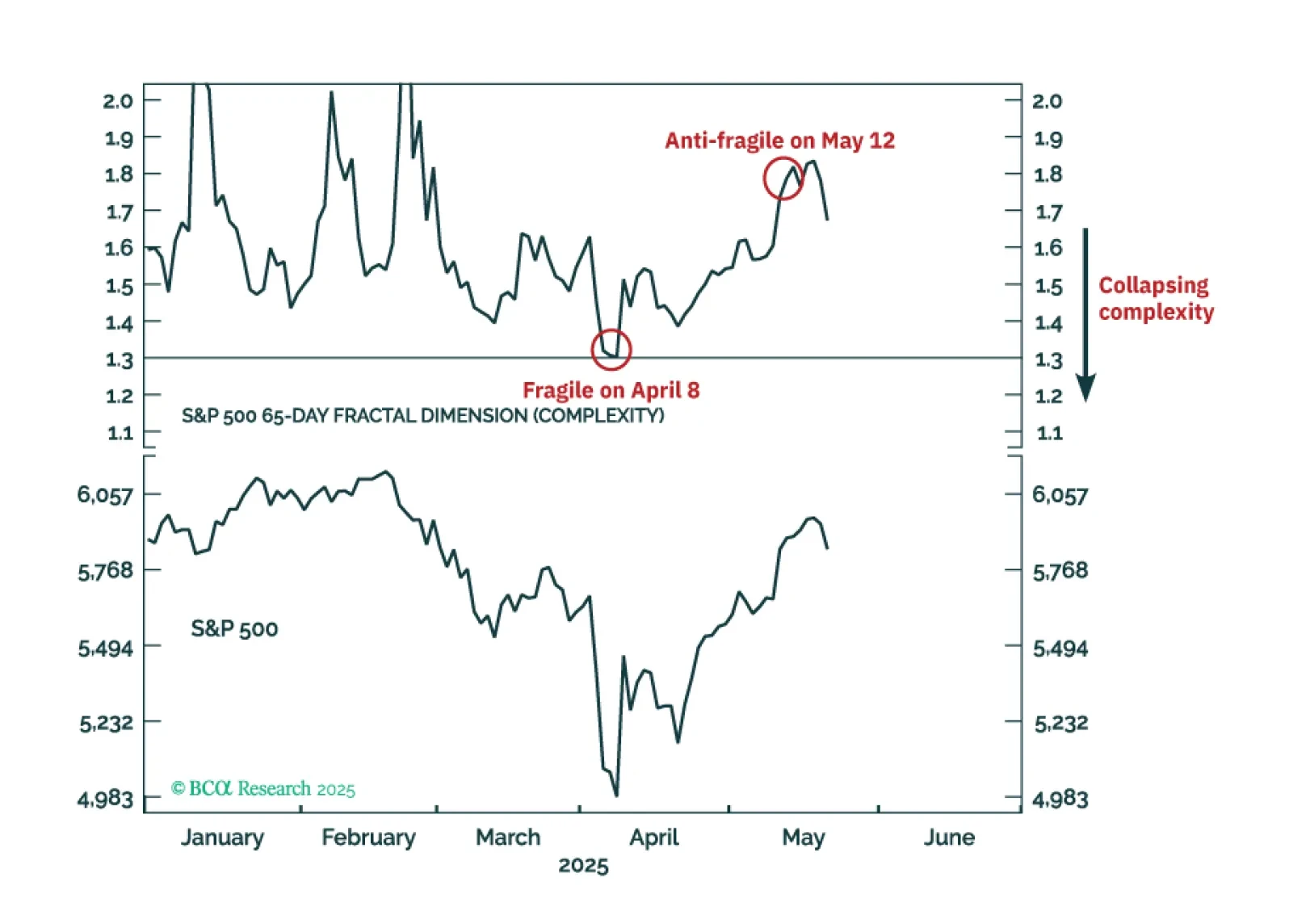

Right now, the major stock and bond markets are more ‘anti-fragile’ than fragile, and the Joshi rule recession indicators signal that a US recession is not imminent. This justifies a neutral, or default, tactical weighting to both…

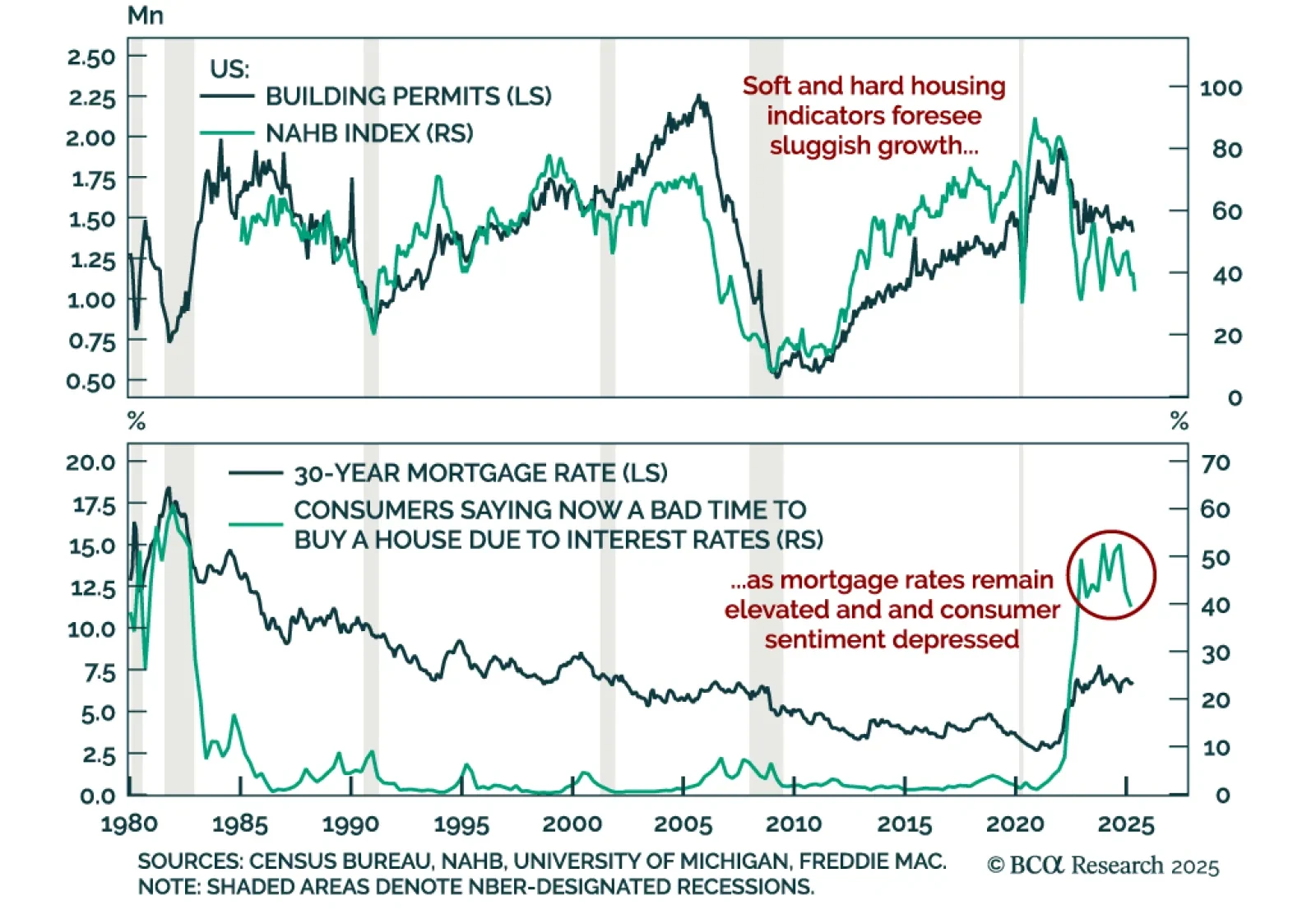

Weak April housing data and deteriorating builder sentiment reinforce our defensive stance, as recession risks remain underpriced. Housing starts rose at a 1.6% m/m annualized rate, missing expectations. Similarly, building permits,…

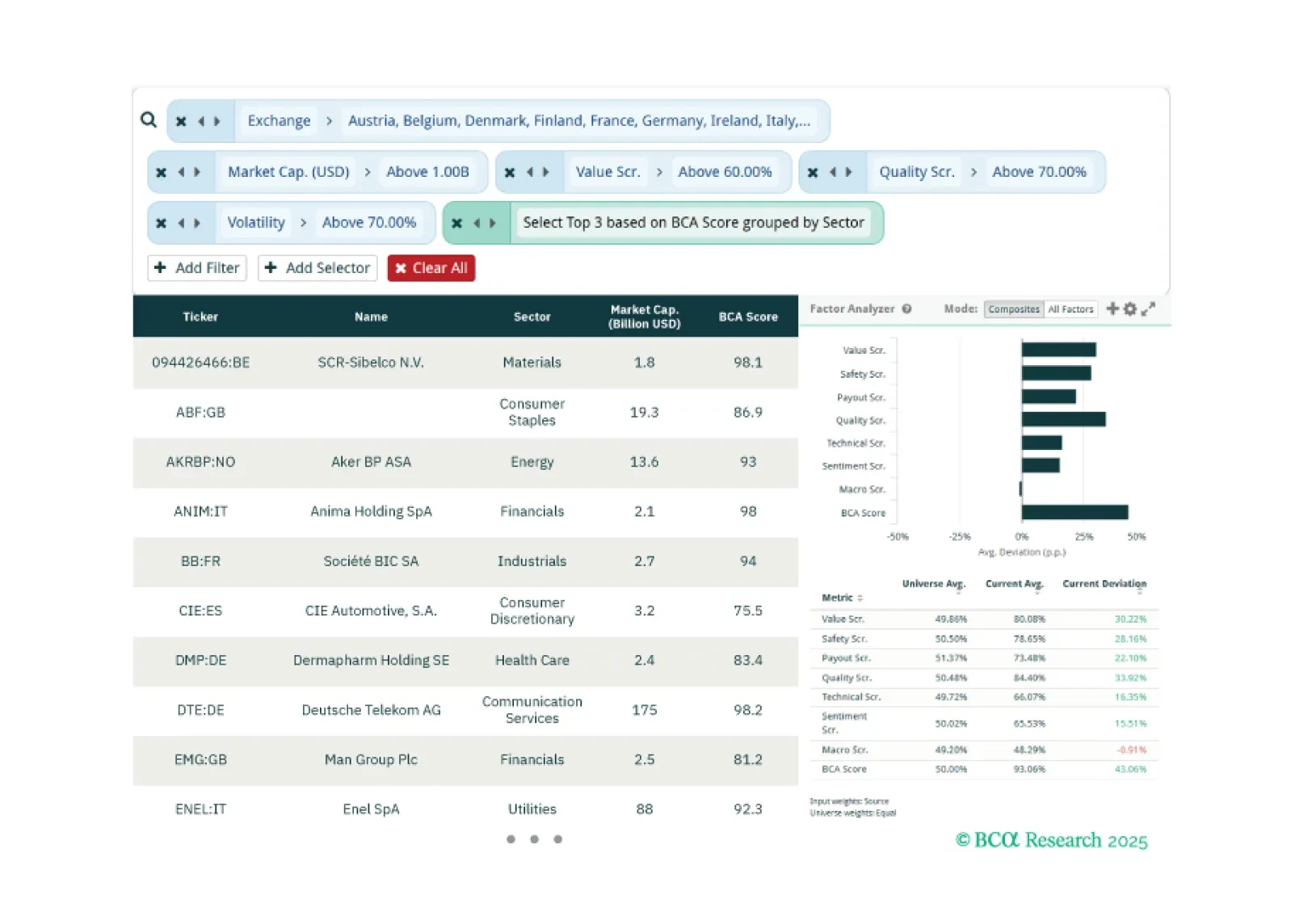

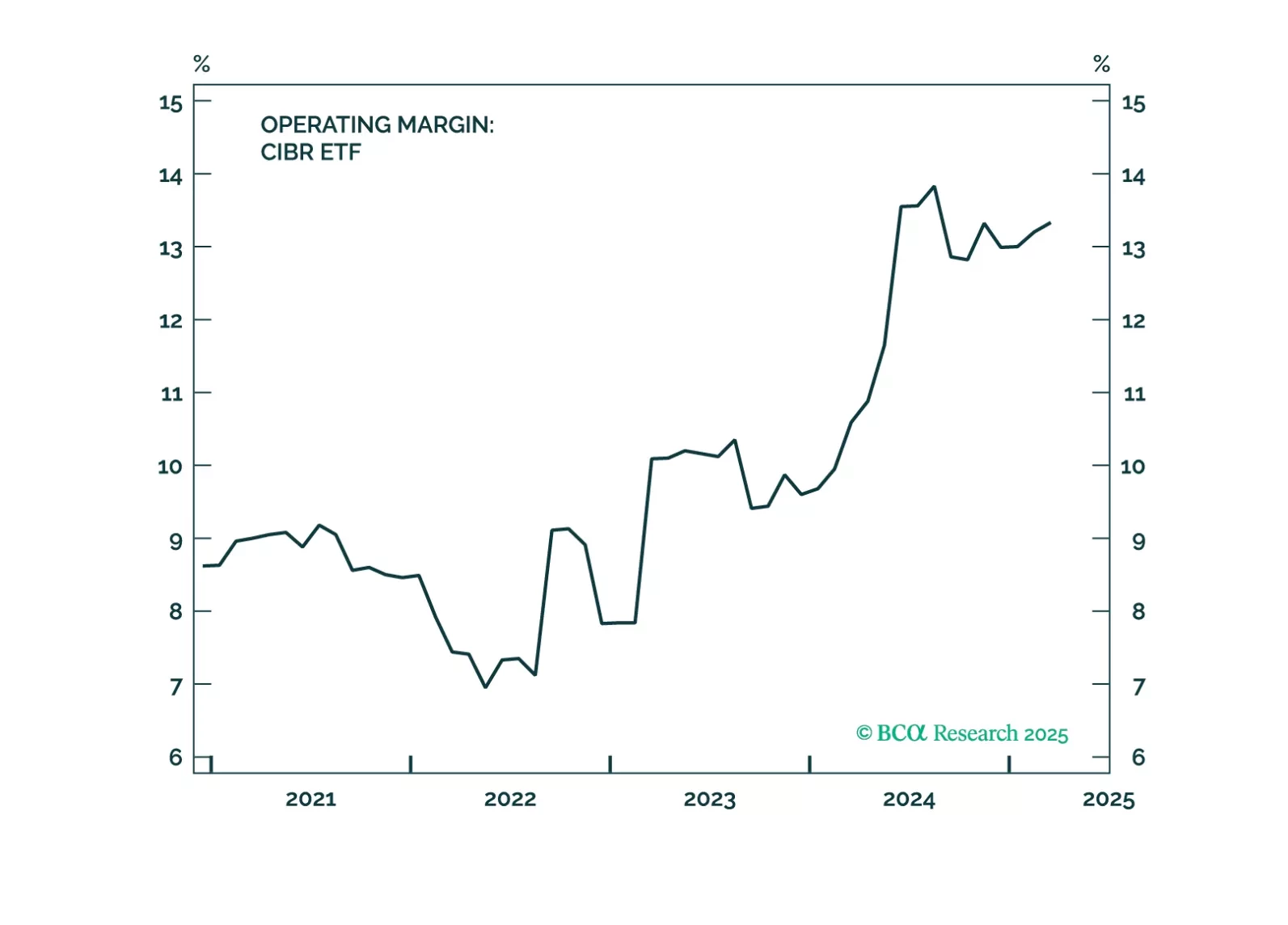

This week, our three screeners cover: Favoring European equities over US equities, cybersecurity stocks, and large caps with large moves in their BCA Score.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.