The US High Quality (USHQ) portfolio underperformed its benchmark through July, returning -1.5%, whilst its SPY benchmark returned 0.2%. On a trailing three-month basis, performance was notably weak vs. benchmark, with USHQ…

The S&P 500 recently breached new highs, but narrow leadership and a slowing labor market reinforce caution on risk assets. Equities rebounded from their post-Liberation Day lows, but the rally has been led mostly by the tech…

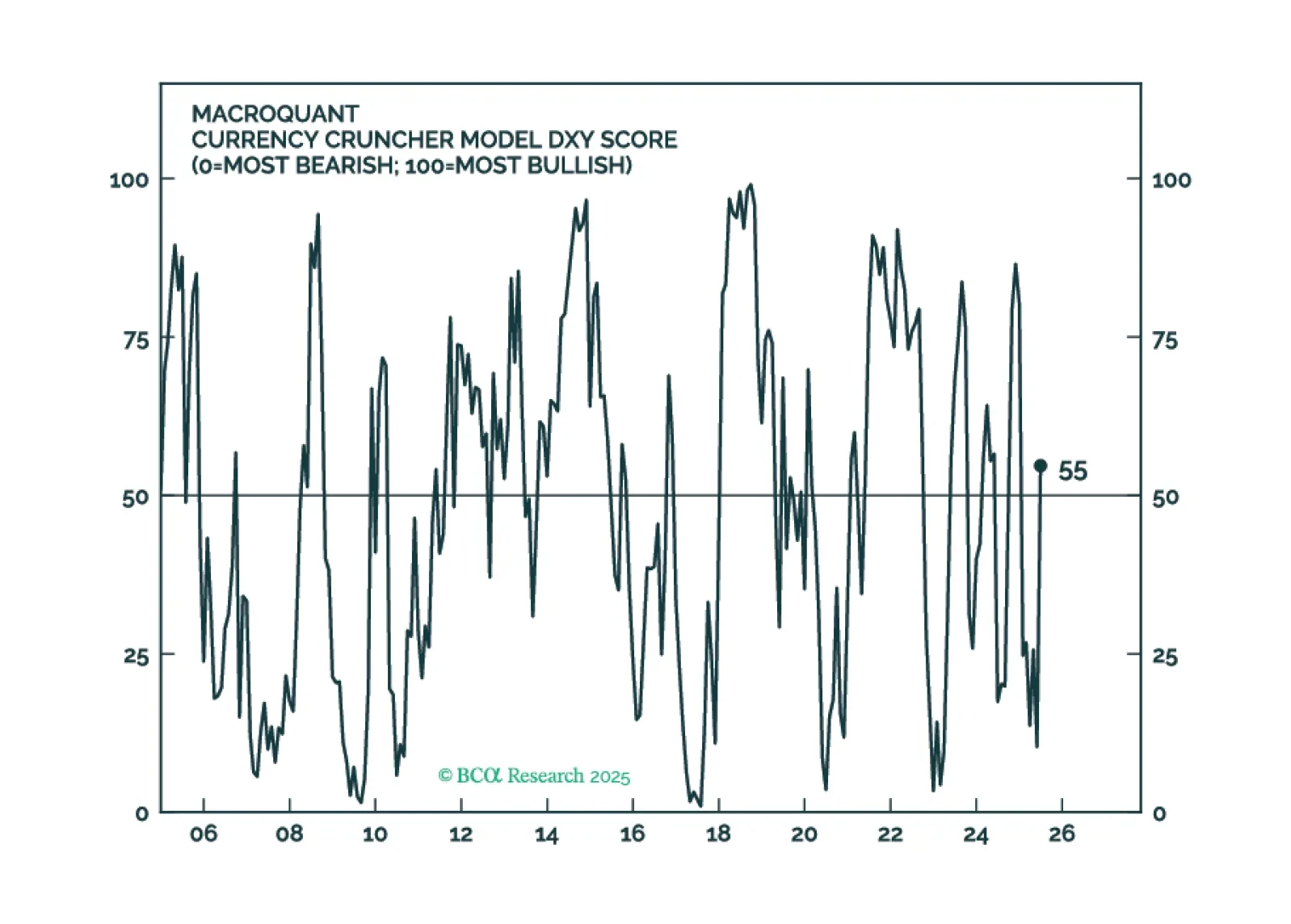

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.

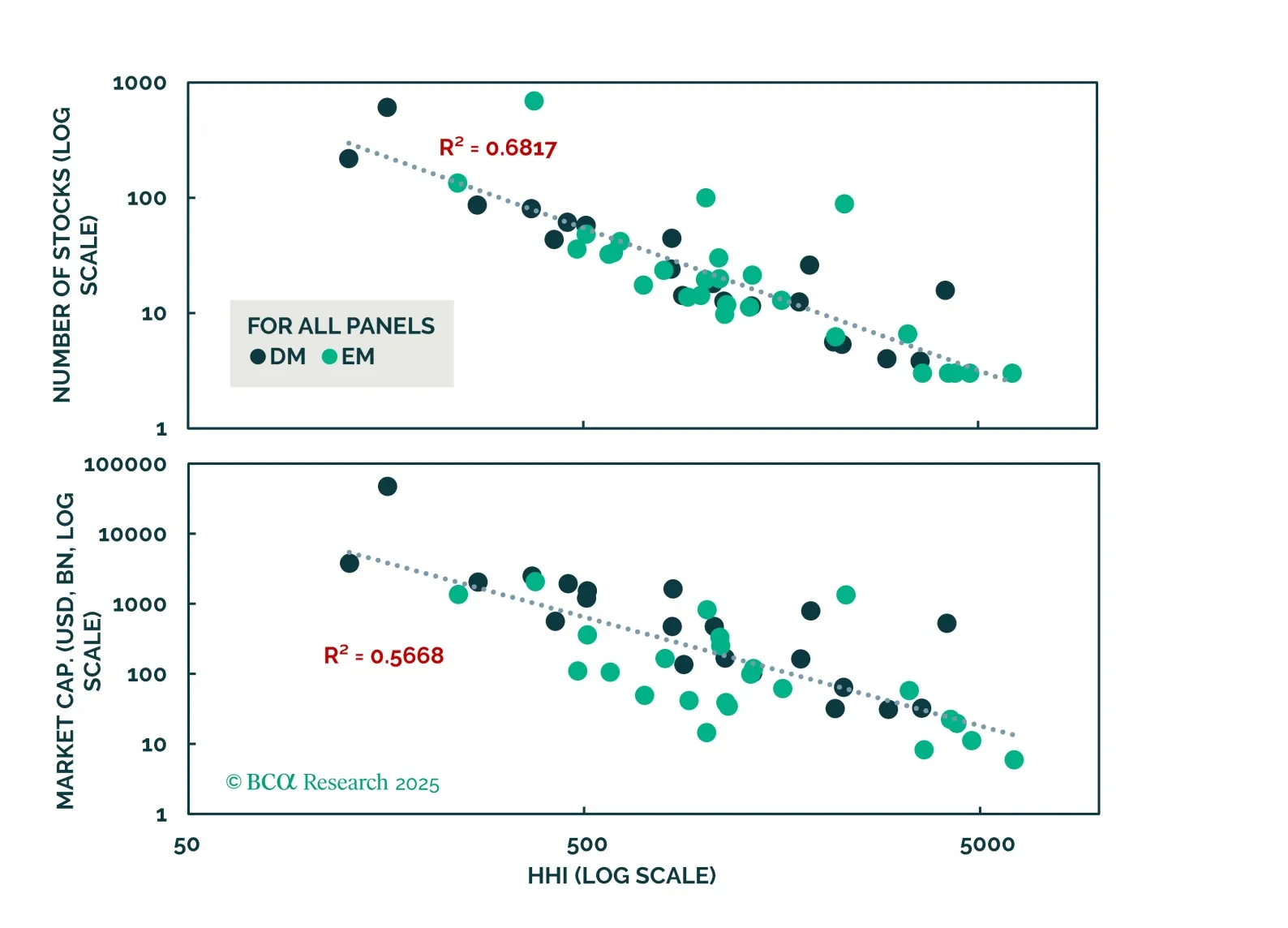

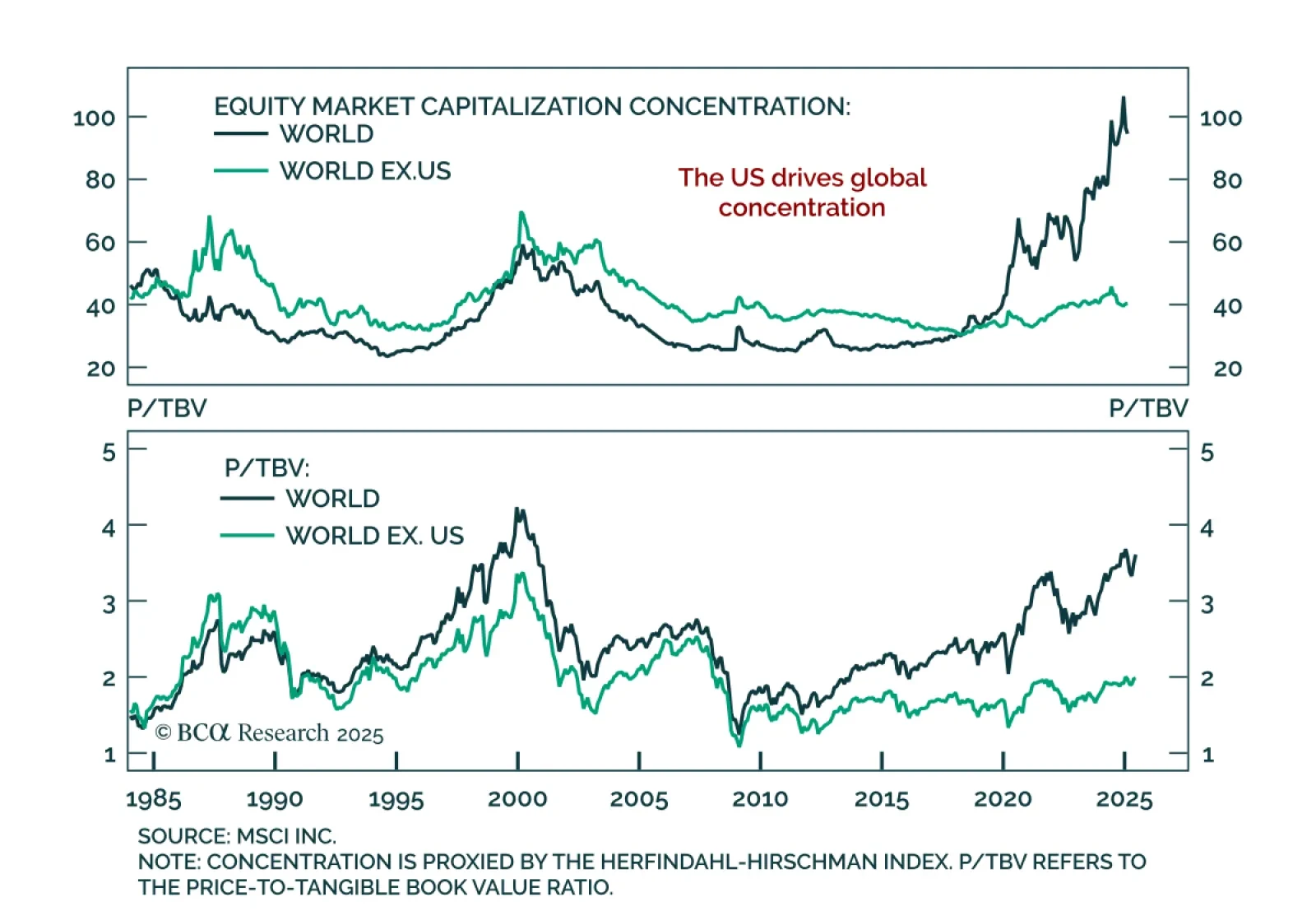

Our Global Asset Allocation strategists argue that equity market concentration is not a meaningful risk factor and does not help forecast returns. Cross-sectional concentration reflects index size, with smaller indices typically…

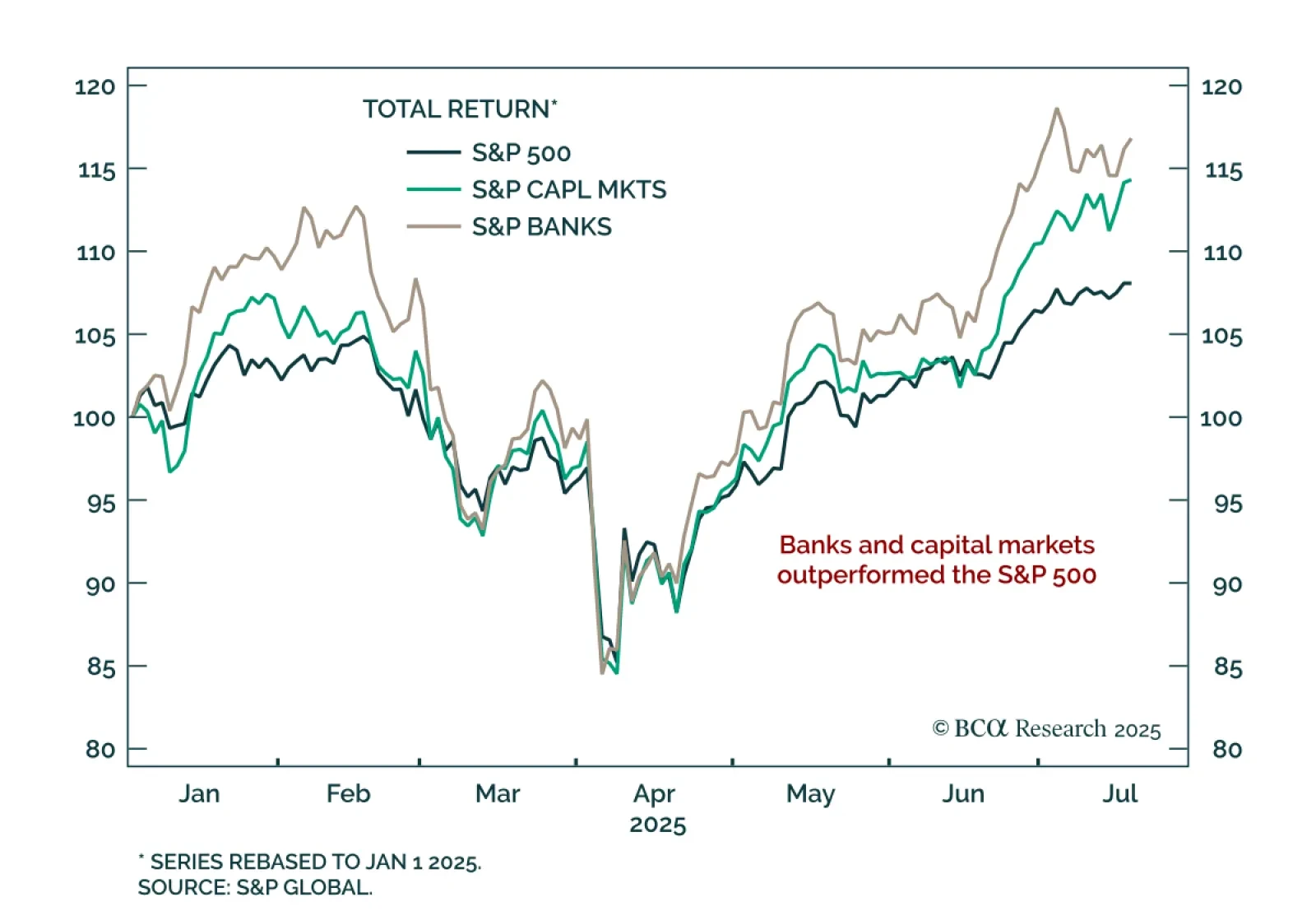

BCA’s US Equity strategists reiterate their overweight stance on Banks and Diversified Financials. Q2 results were solid, with resilient consumer strength and a rebound in capital markets activity. Net interest margins are…

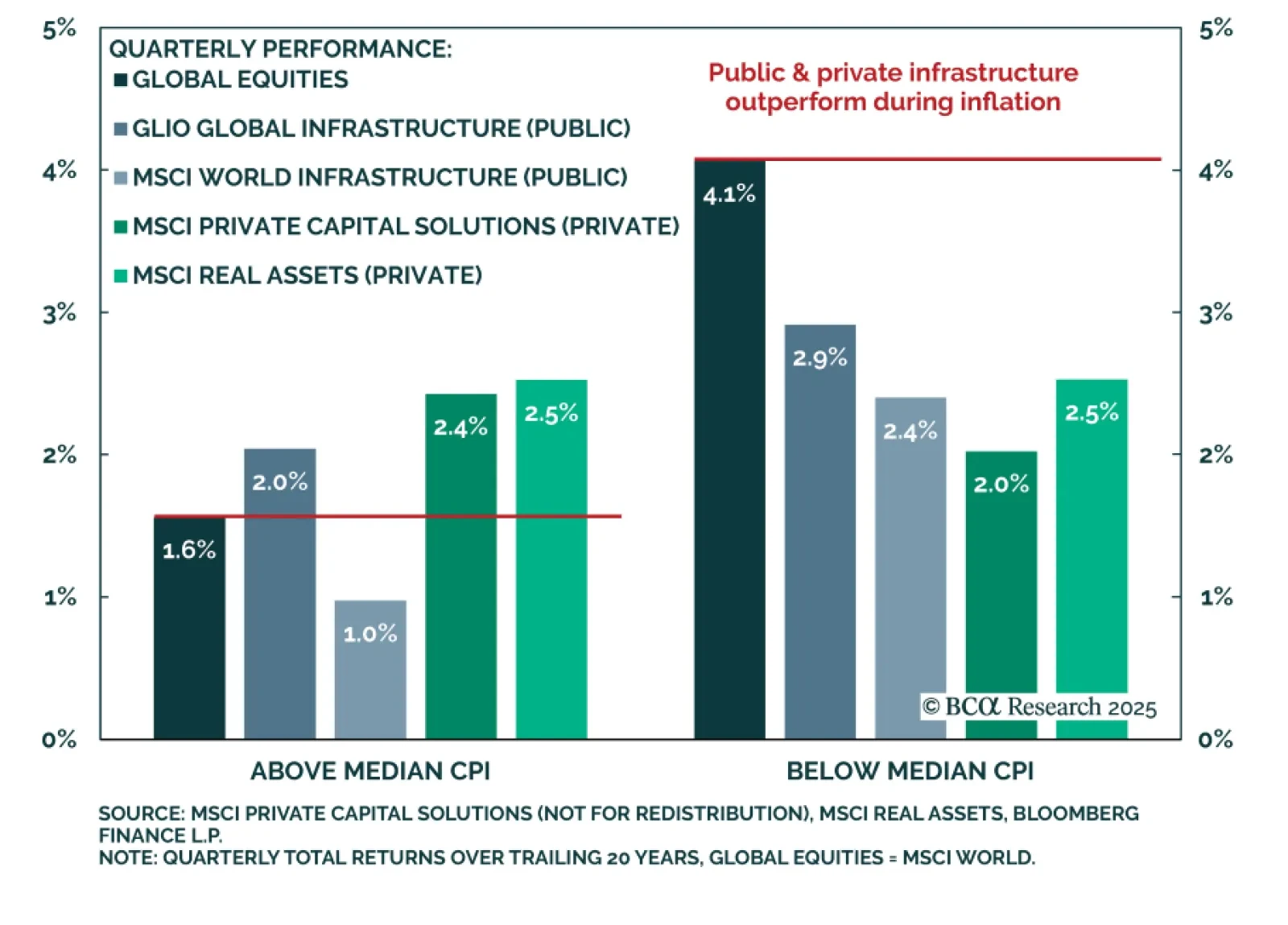

BCA’s Private Markets & Alternatives strategists recommend a balanced allocation across Public and Private Infrastructure, with near-term valuation favoring Public. Structural differences in index construction, sector mix, and…

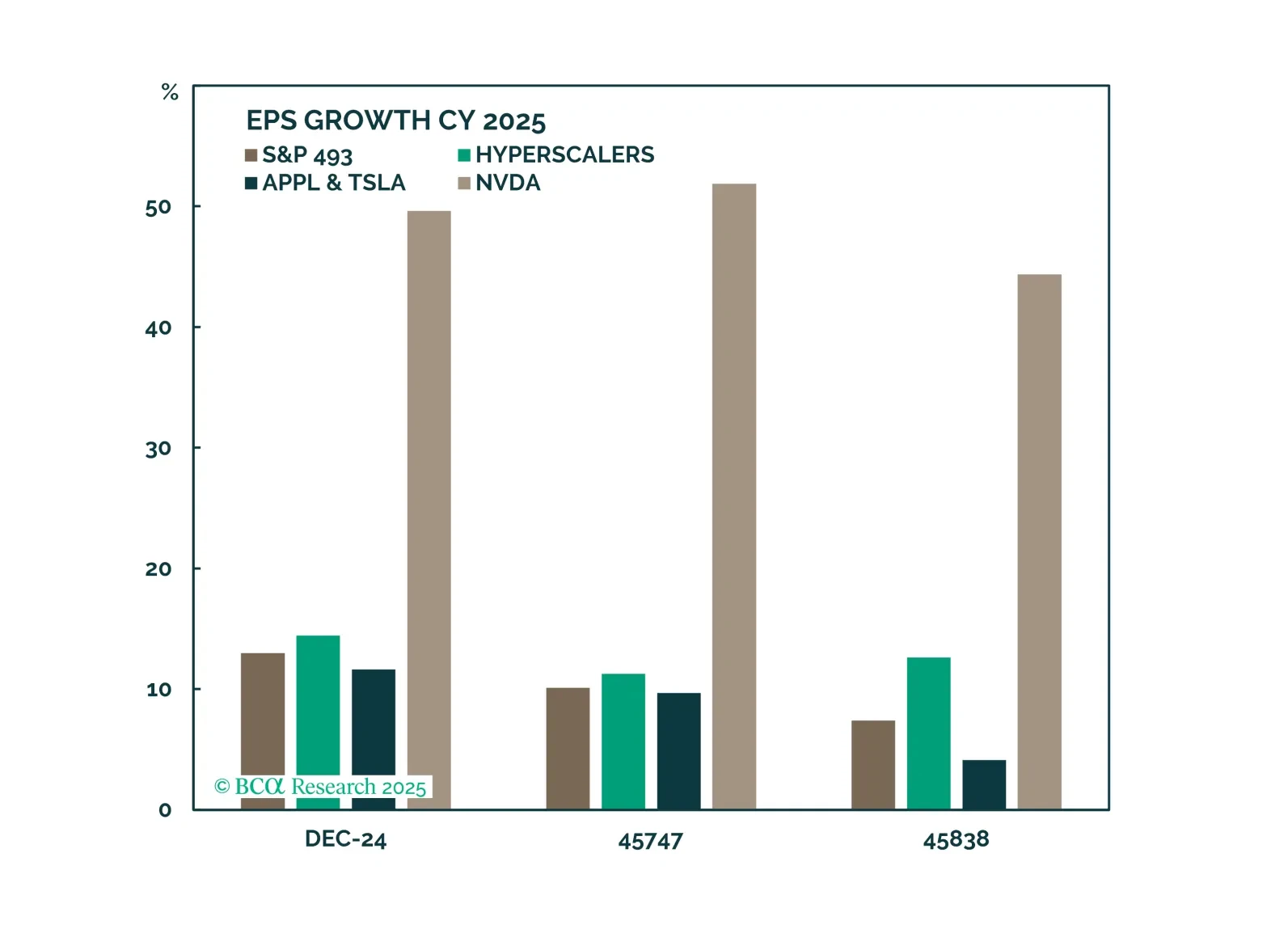

Earnings growth should continue to support equity performance this year. However, after blockbuster gains, some profit-taking is likely. We recommend booking profits and increasing exposure to Defensives.

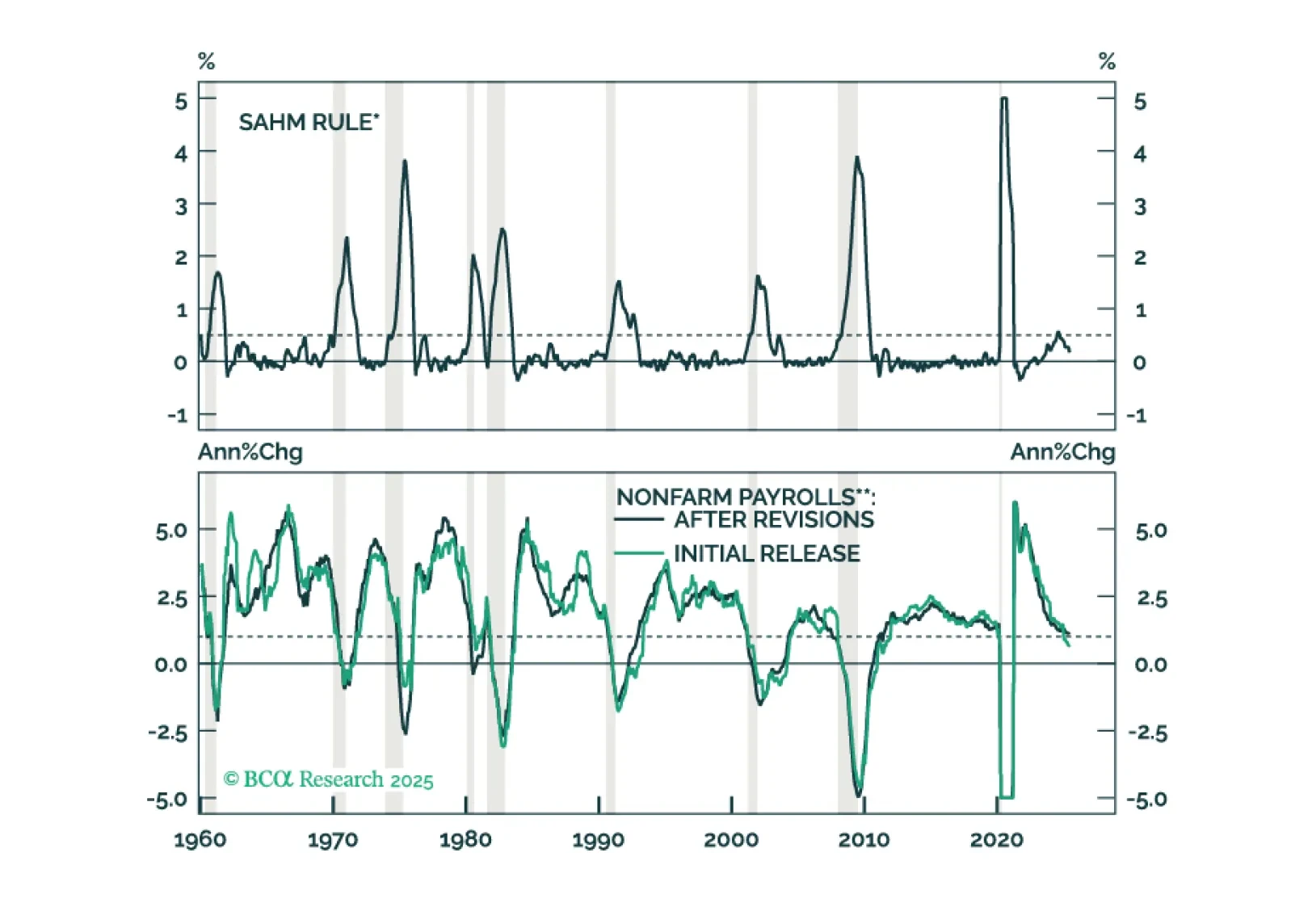

June’s employment report showed a tick down in the unemployment rate, an improvement that rules out a Fed rate cut later this month.