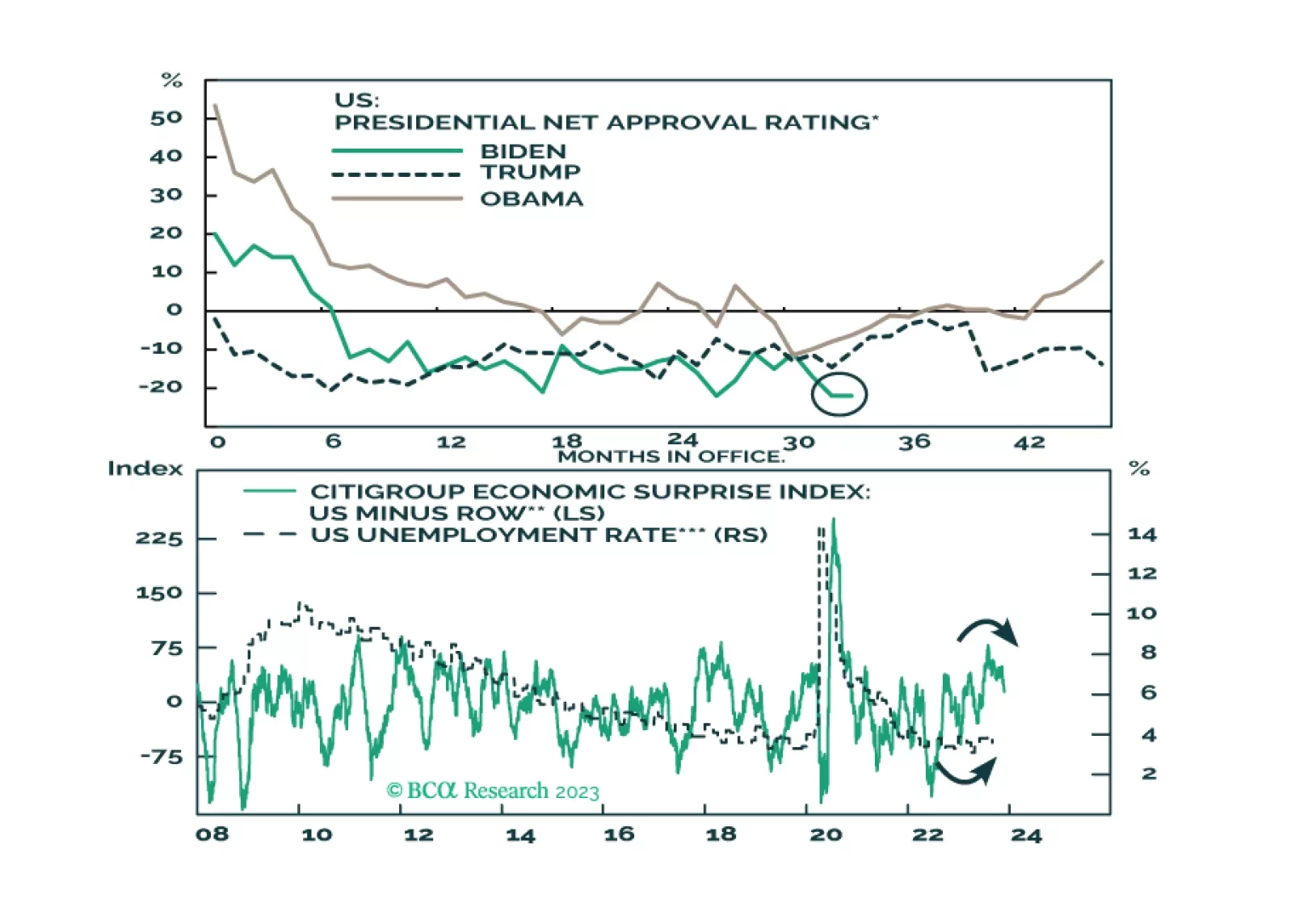

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

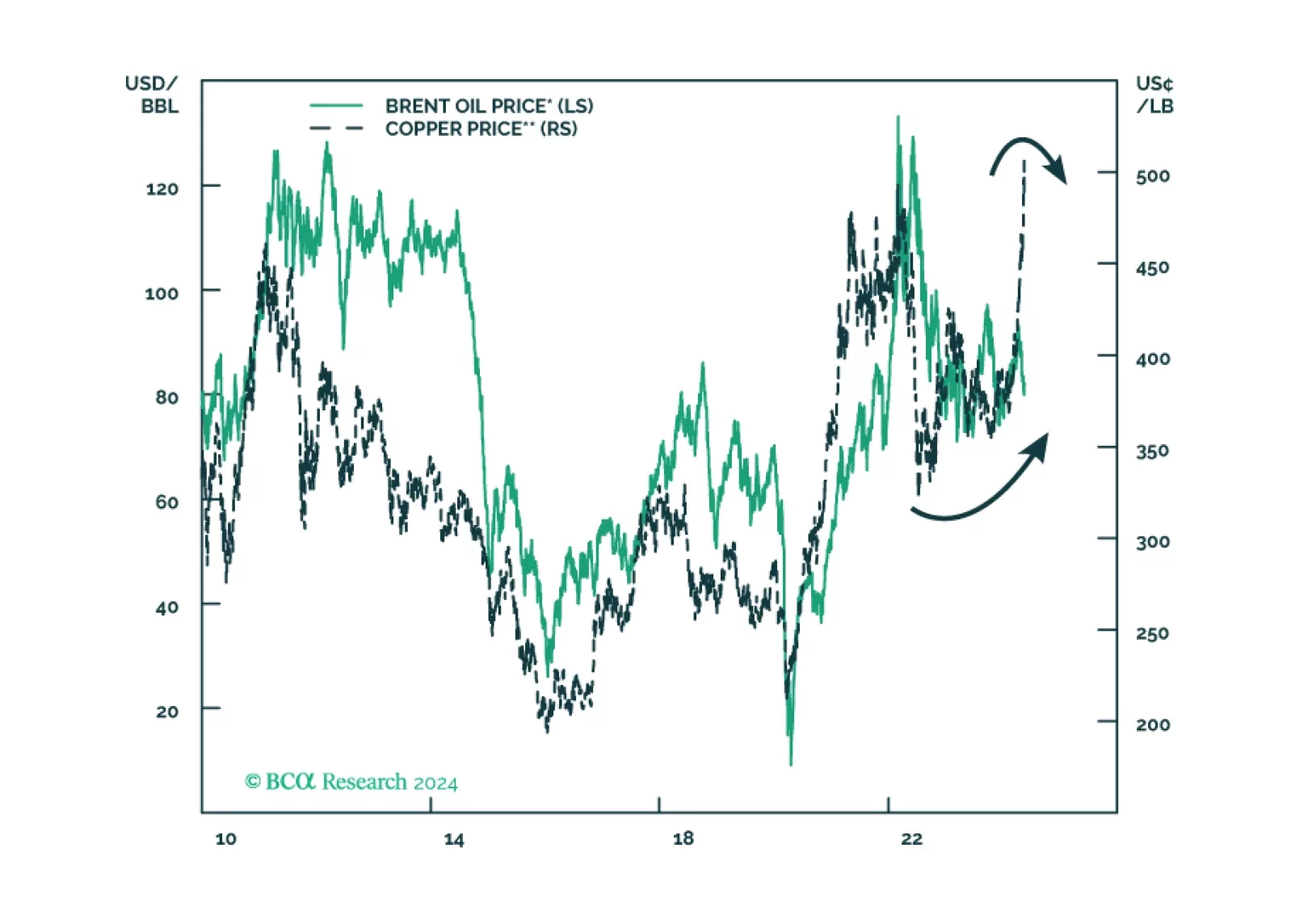

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…

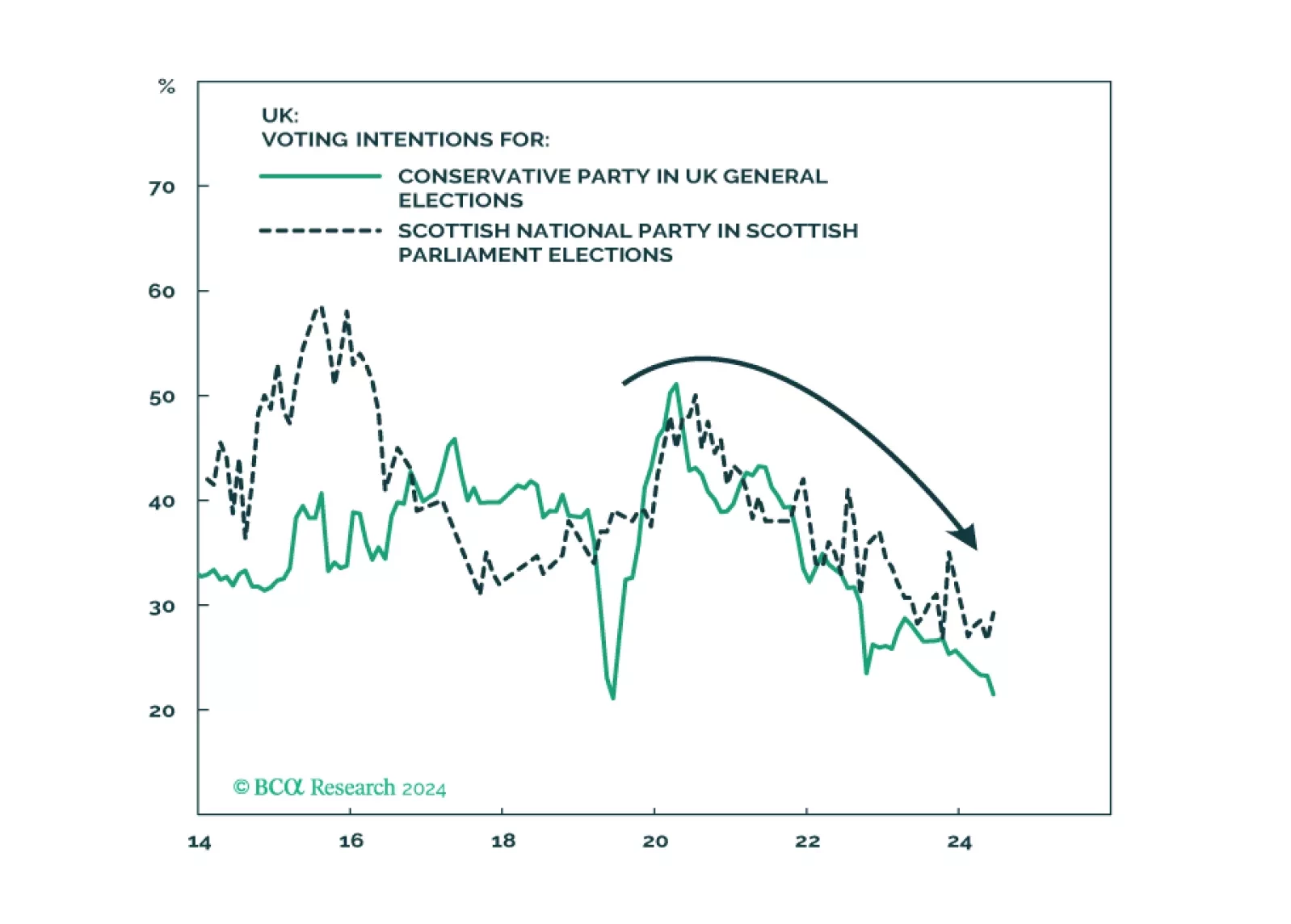

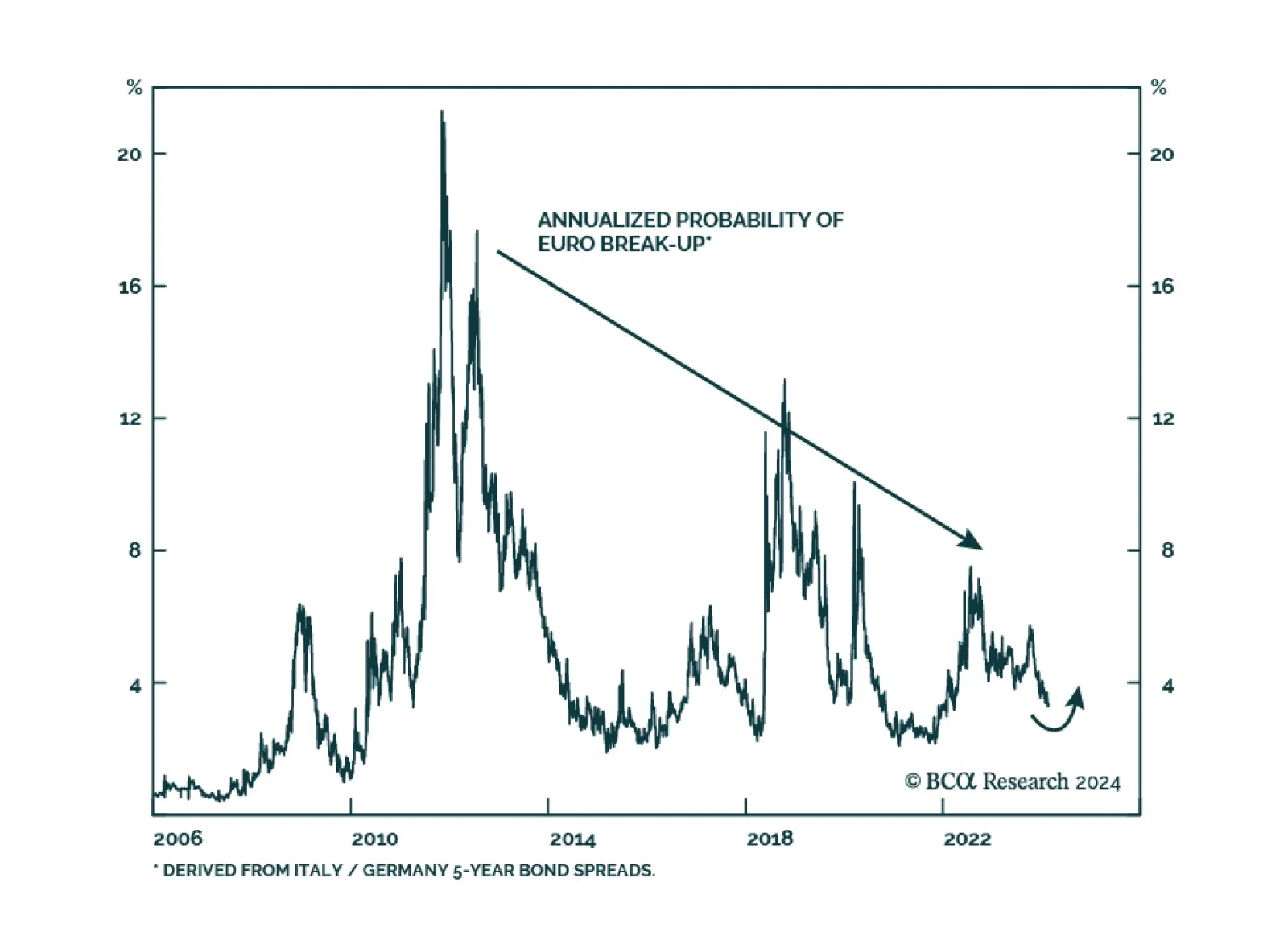

According to BCA Research’s Geopolitical Strategy service, European political risk is turning up again. Increased European political risk is not because of the European parliamentary elections, which will see right-wing…

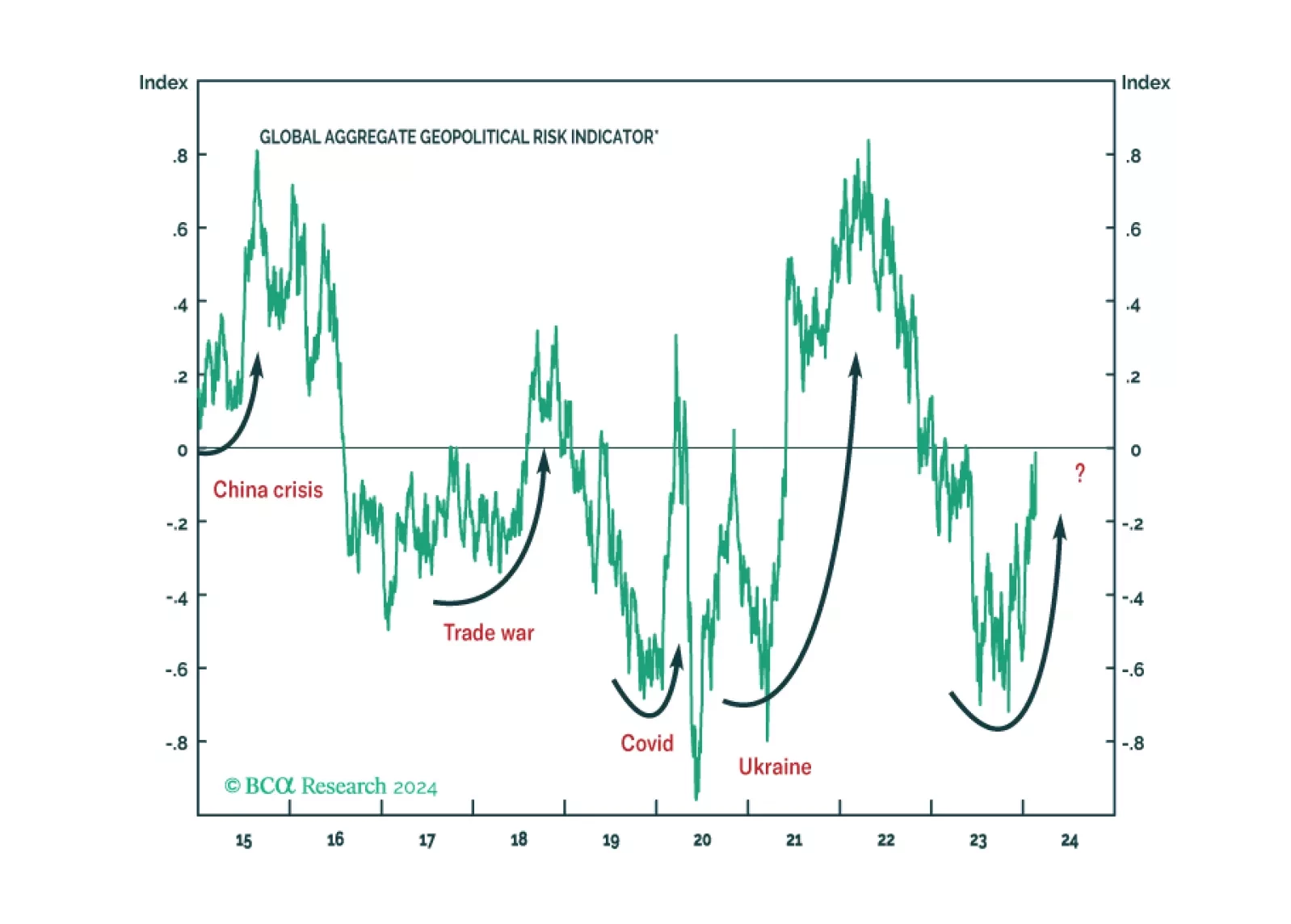

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.