Highlights The global manufacturing cycle is likely to bottom soon, and consumption and services remain robust. The risk of recession over the next 12 months is low. This suggests that equities will continue to outperform bonds. But…

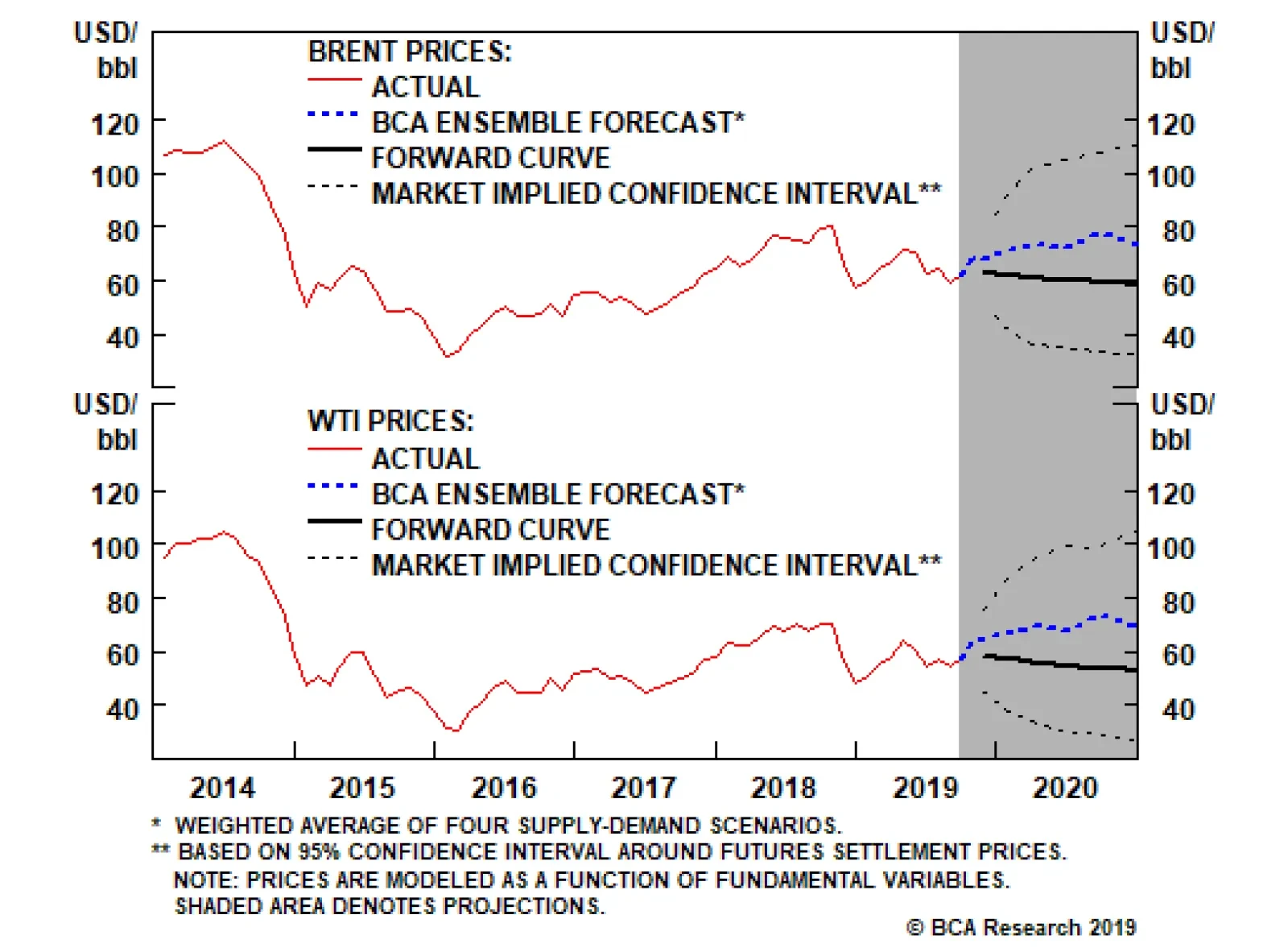

According to KSA officials, repairs to the damaged 7-million-barrel-per-day processing facility at Abqaiq will mostly be completed by month-end. Relative to last month, we are not changing our price forecasts much, with Brent…

Following drone attacks on critical oil infrastructure in the Kingdom of Saudi Arabia (KSA) over the weekend, which removed ~ 5.7mm b/d of output, the U.S. is likely to conduct a limited retaliatory strike. In addition, the U.S. will…

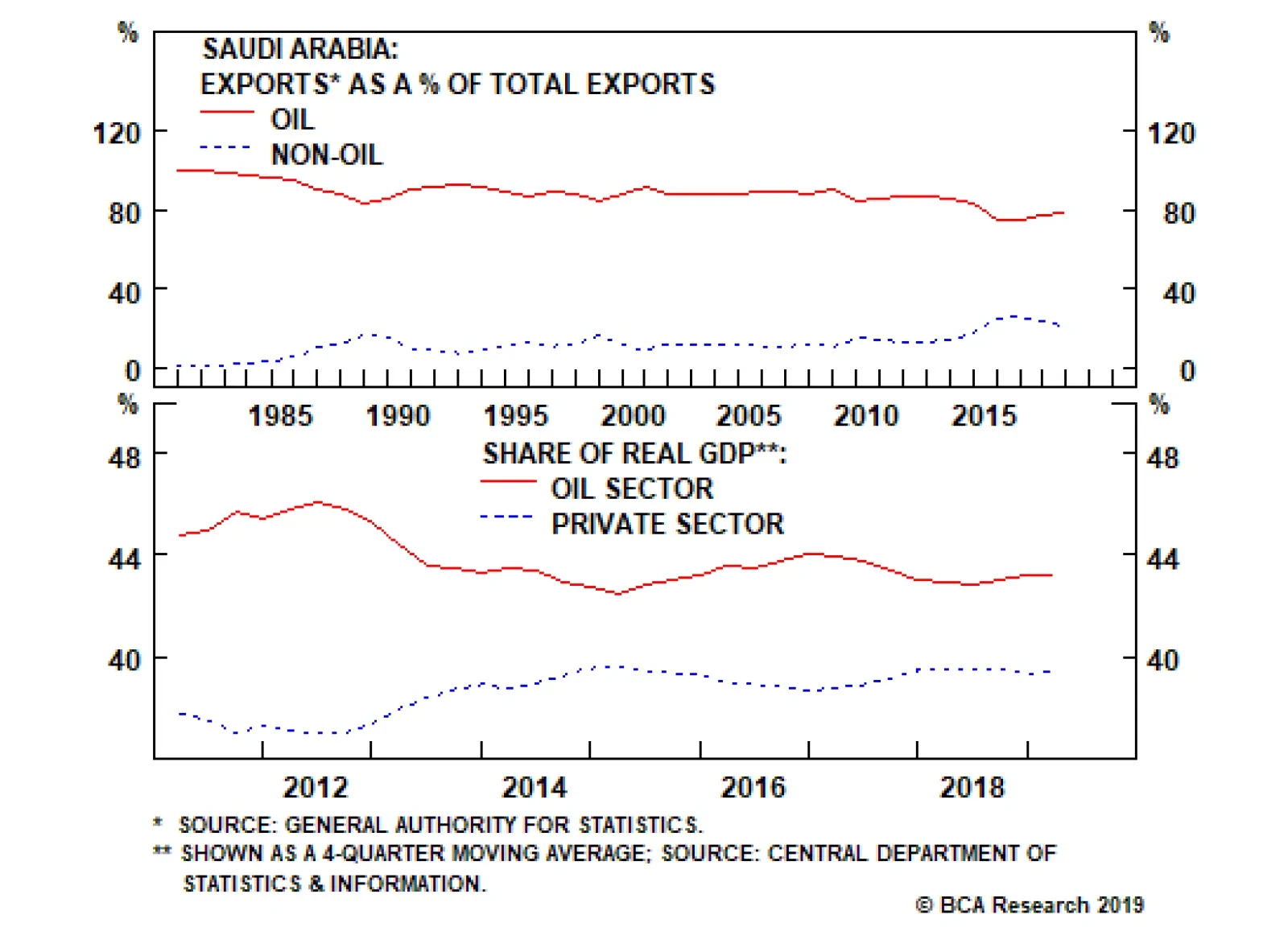

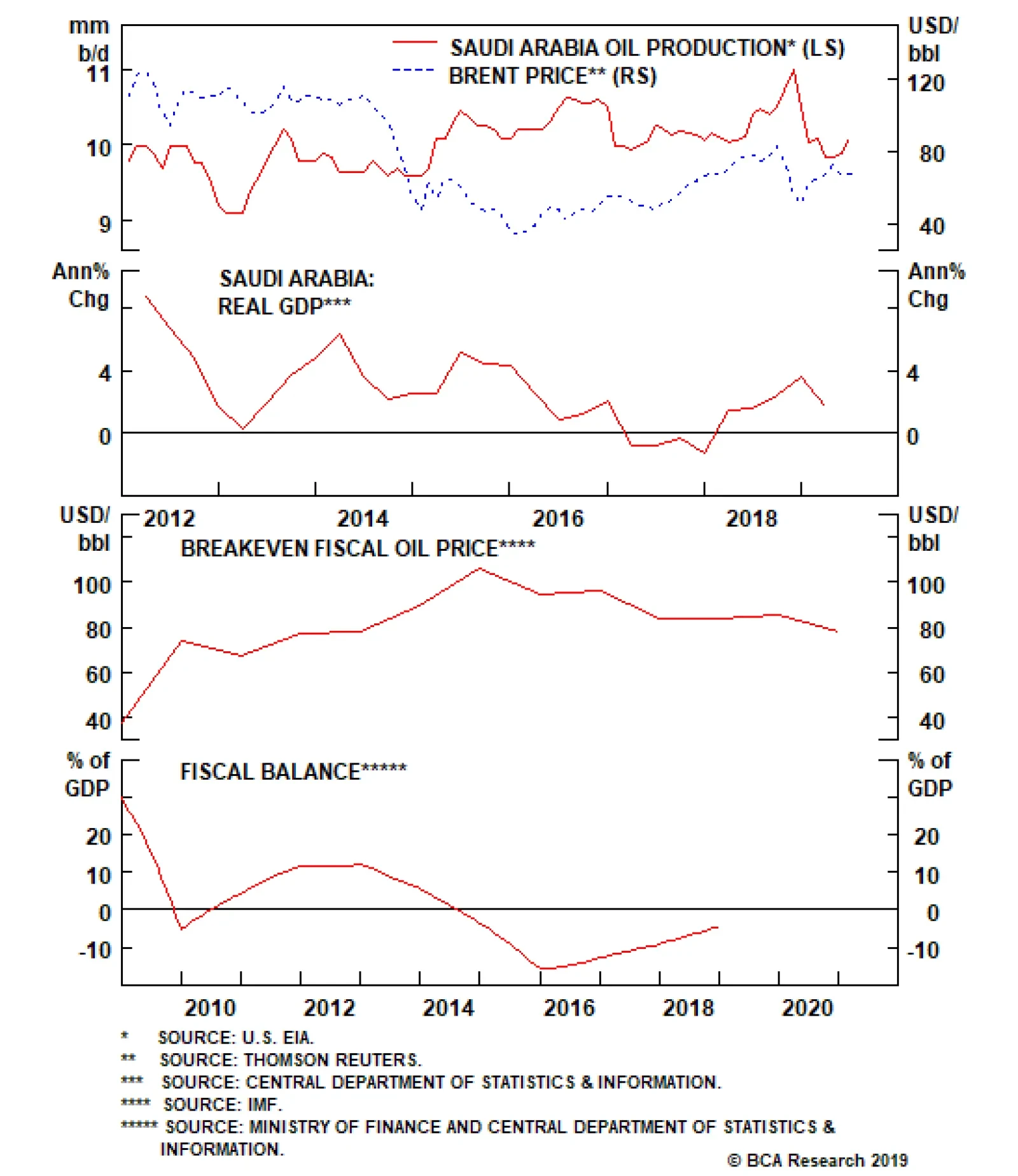

Little progress has been made on this front, despite the fanfare surrounding the Vision 2030 plan. 70% of government revenues were derived from the oil sector last year, an increase from the 64% share from two years prior, and…

From 2014-16, Riyadh attempted to drive U.S. shale producers out of business by cranking up production and running prices down. Since then it has supported prices through OPEC 2.0’s production cuts. Export earnings have…

Highlights The risk premium in crude oil prices is rising again, as policy risk – and the potential for large policy-driven errors – increases (Chart of the Week).1 This is not being fully reflected in options markets, where…

Highlights OPEC 2.0 will meet in June to decide whether to continue its production cuts into 2H19. Once again, the leaders are sending conflicting signals – KSA is subtly indicating OPEC 2.0’s 1.2mm b/d of production cuts…