The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

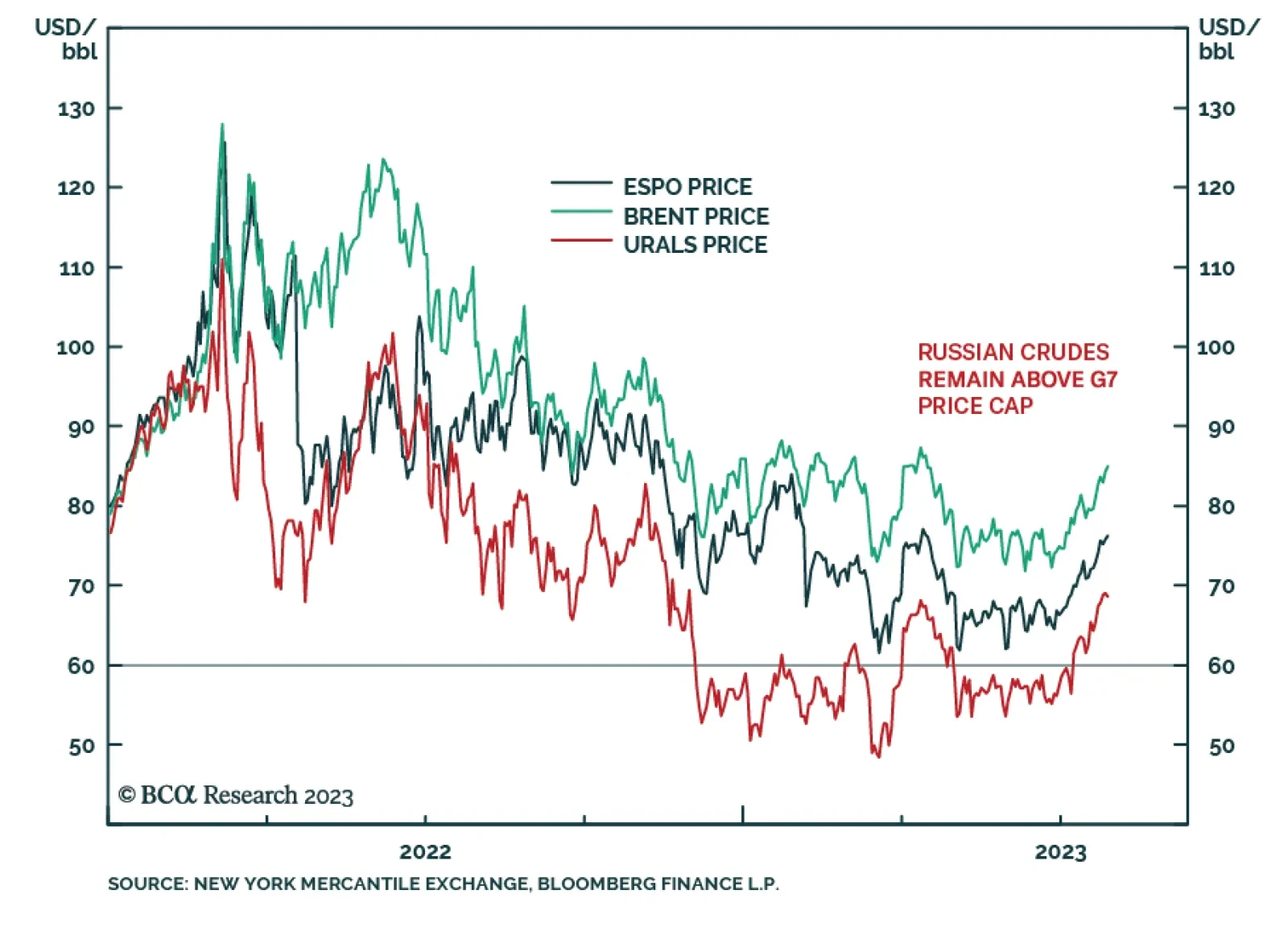

According to BCA Research’s Commodity & Energy Strategy and Geopolitical Strategy services, Russia is likely to cut oil production to pressure the West as a part of its war effort. This cut would push oil prices to…

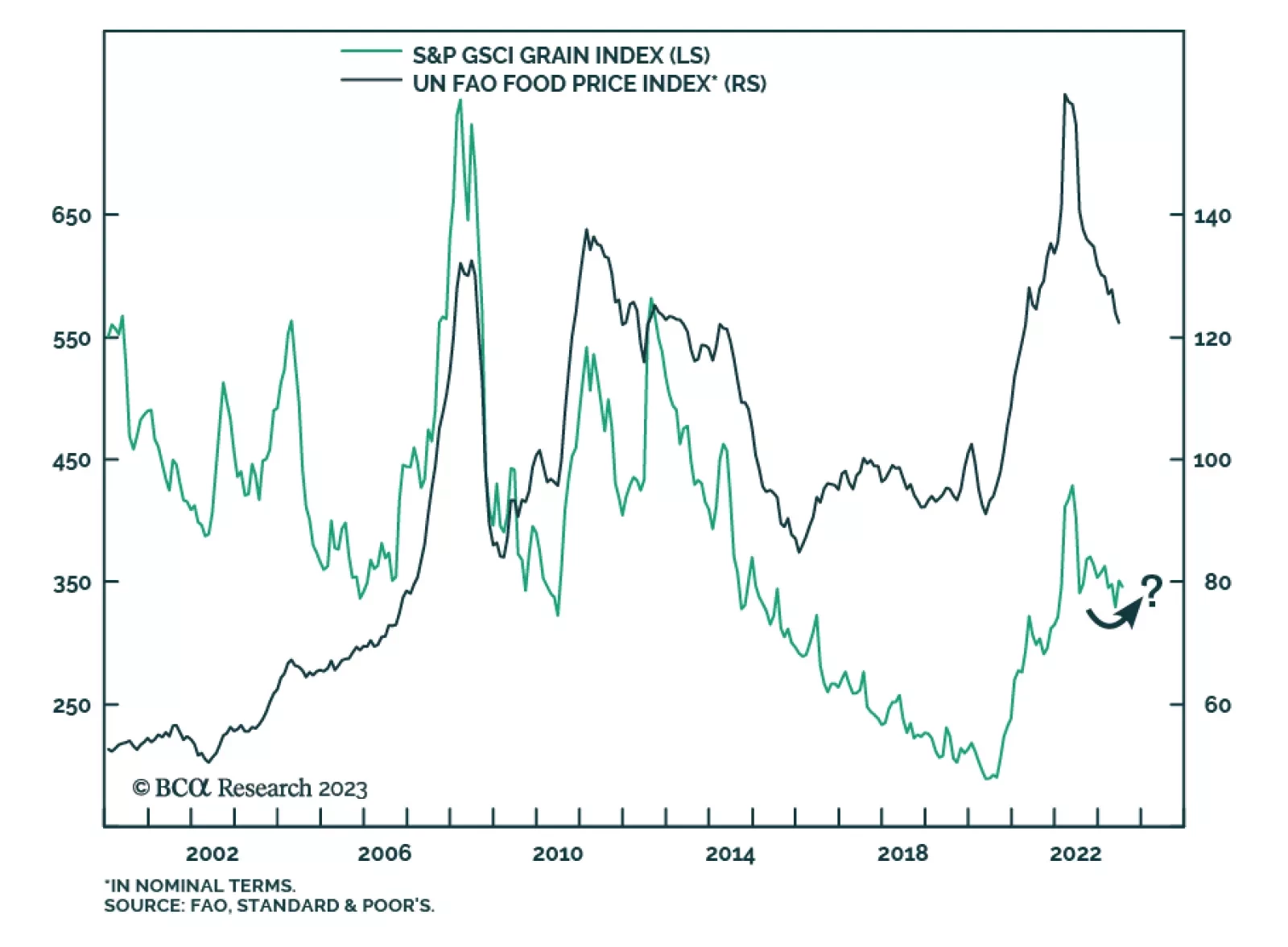

Wheat and corn prices have surged by 16% and 11%, respectively since Russia refused to renew the Black Sea Grain Initiative after it expired on July 17. The deal, which was negotiated with Turkey and the UN, allowed shipments of…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

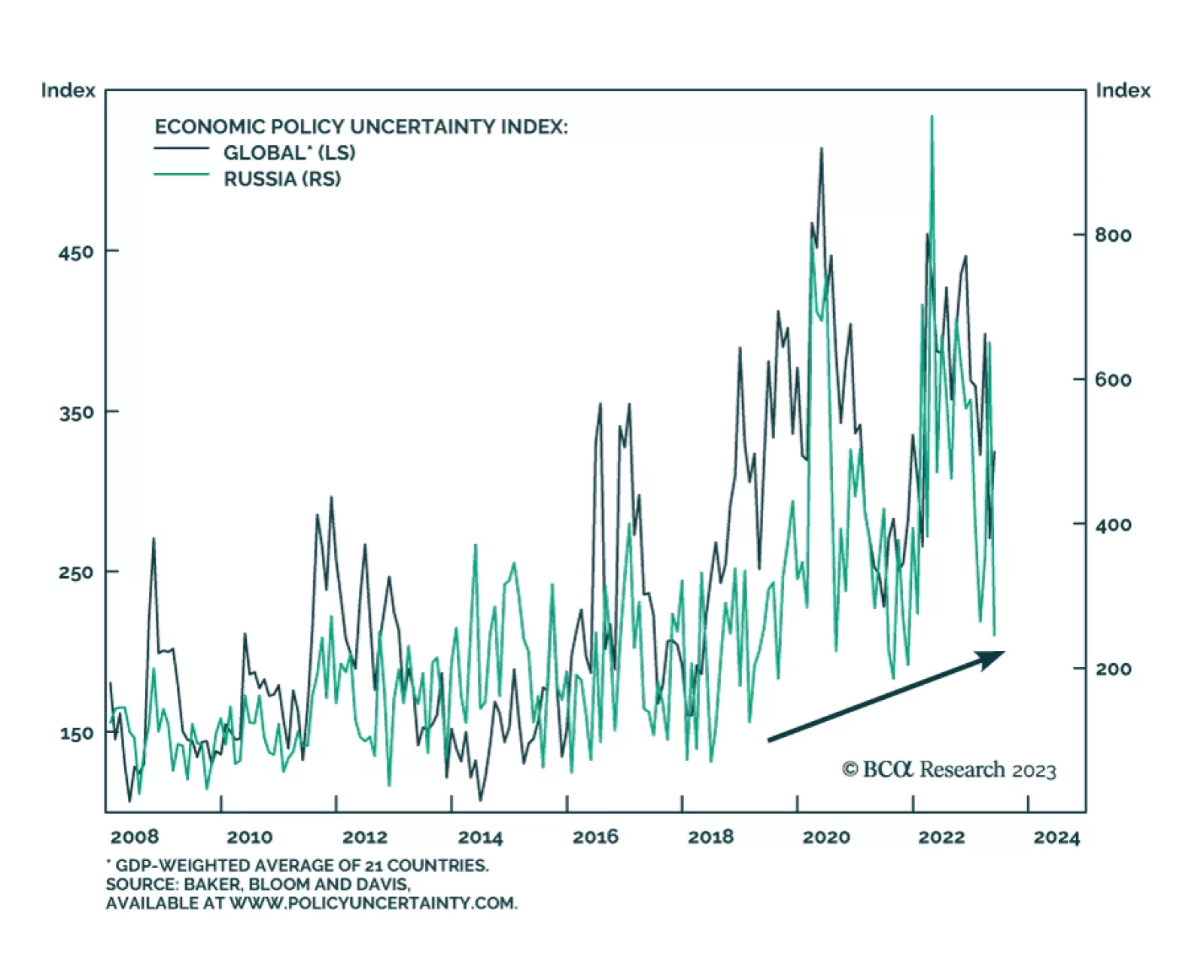

Our Geopolitical Strategy service cautions investors of Russian instability, which will likely push up the global equity risk premium in the next few months. After some developments during the weekend, Vladimir Putin and his…

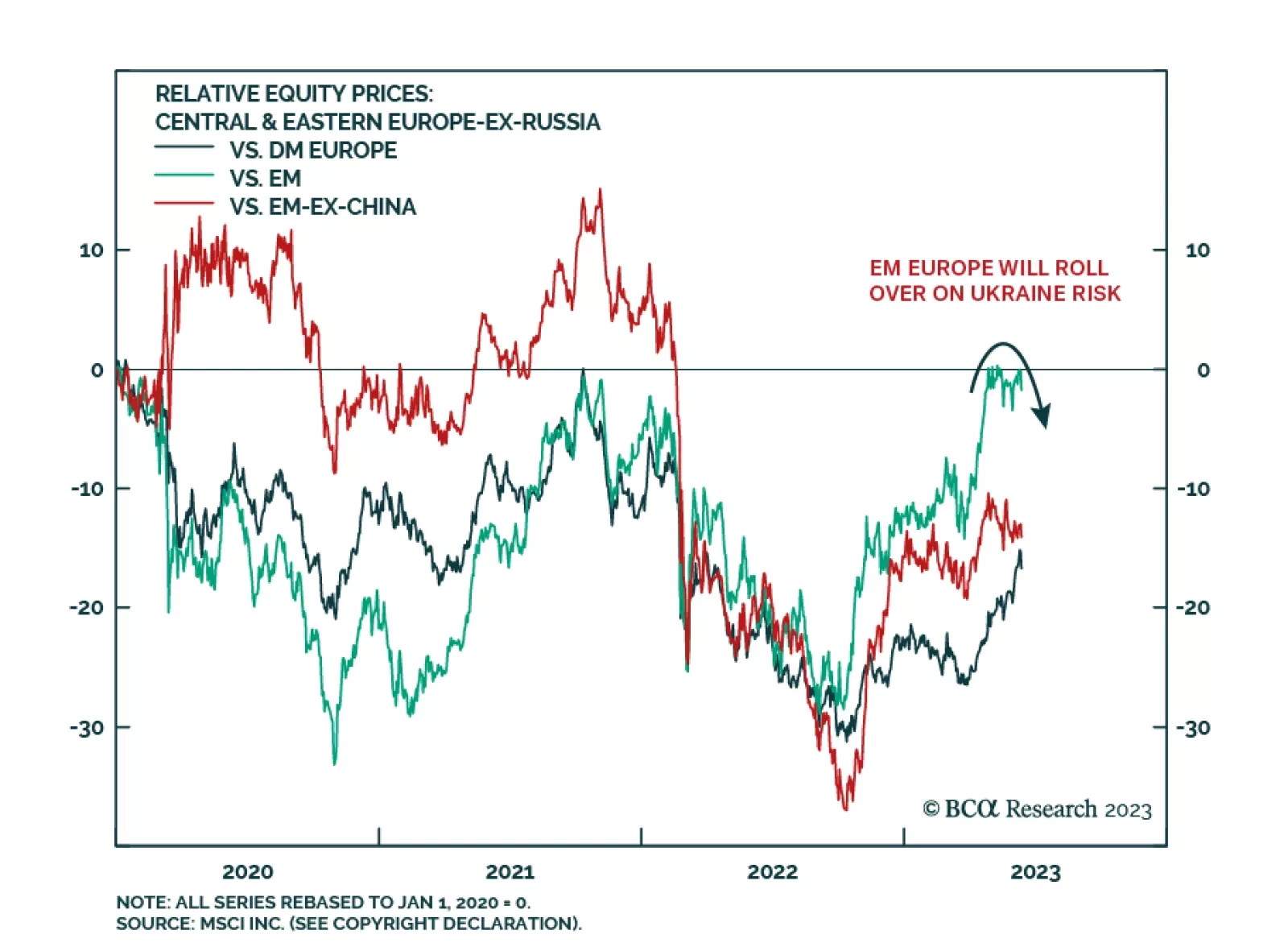

According to BCA Research’s Geopolitical Strategy service, geopolitical risk will rise before the Ukraine war is resolved, punishing eastern European emerging market assets on a relative basis. Ukraine’s…

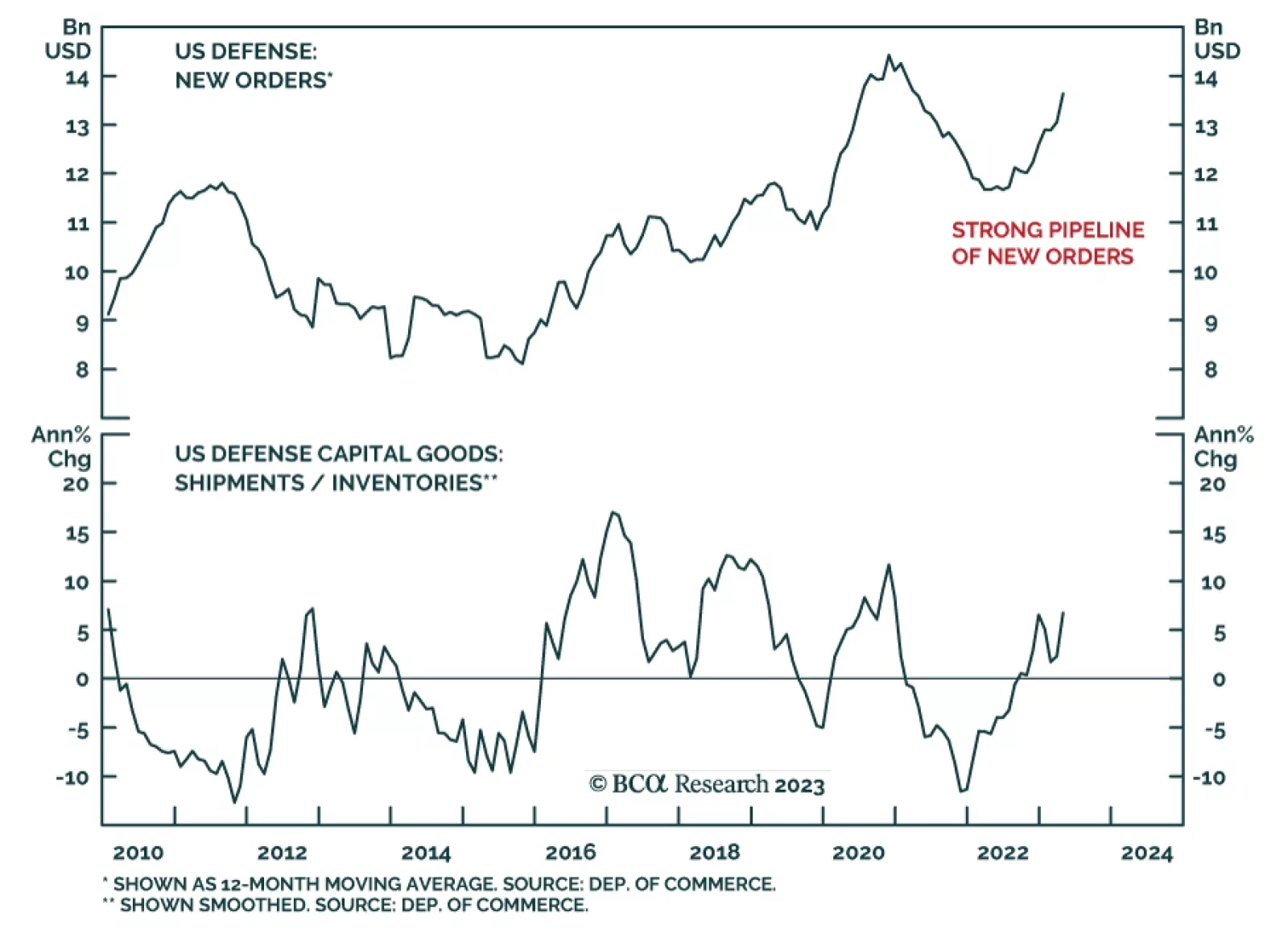

According to BCA Research’s US Equity Strategy service, despite temporary hurdles, the longer-term trends support an overweight in Defense. Global military spending is poised for significant increases as the world system…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.