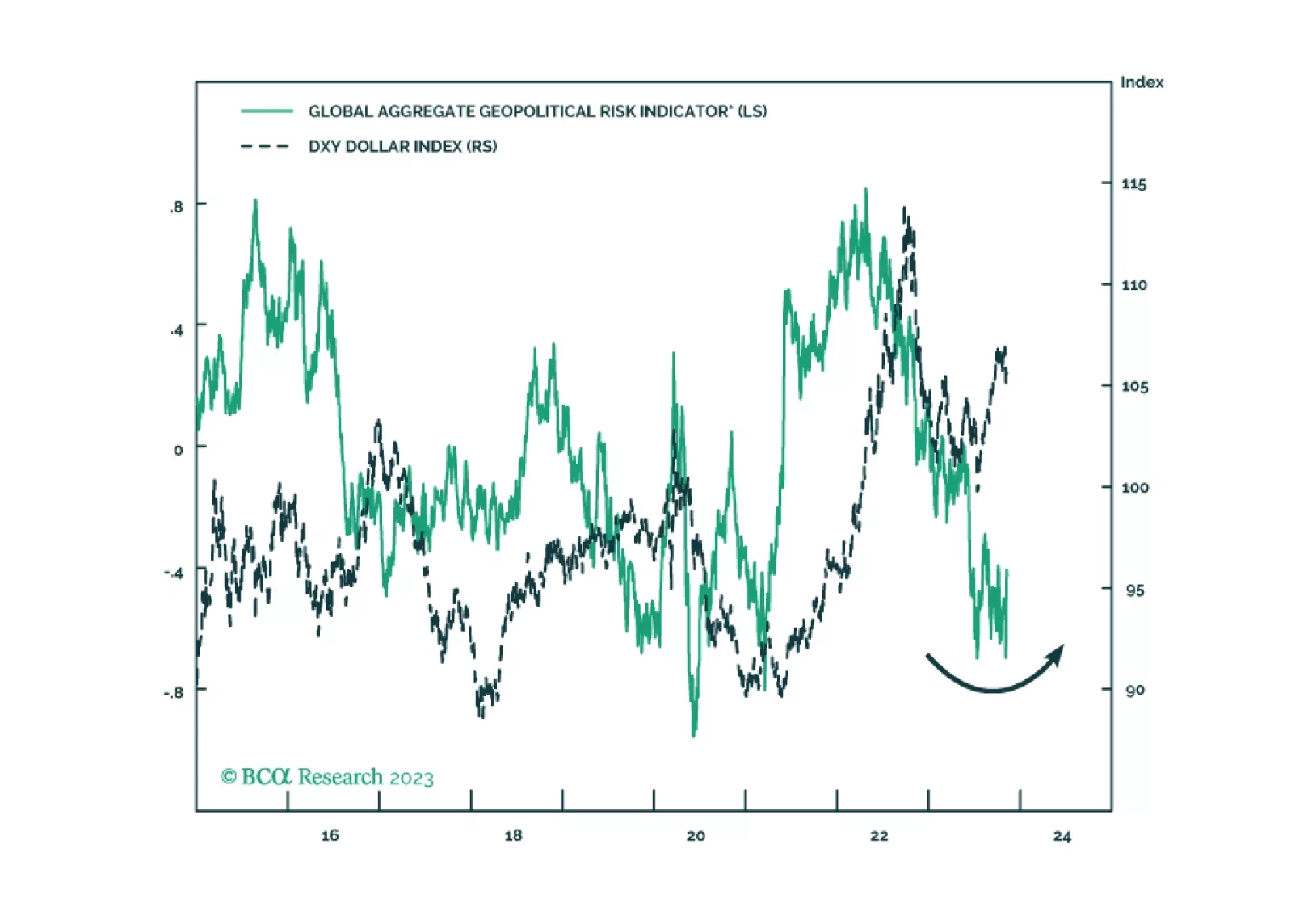

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

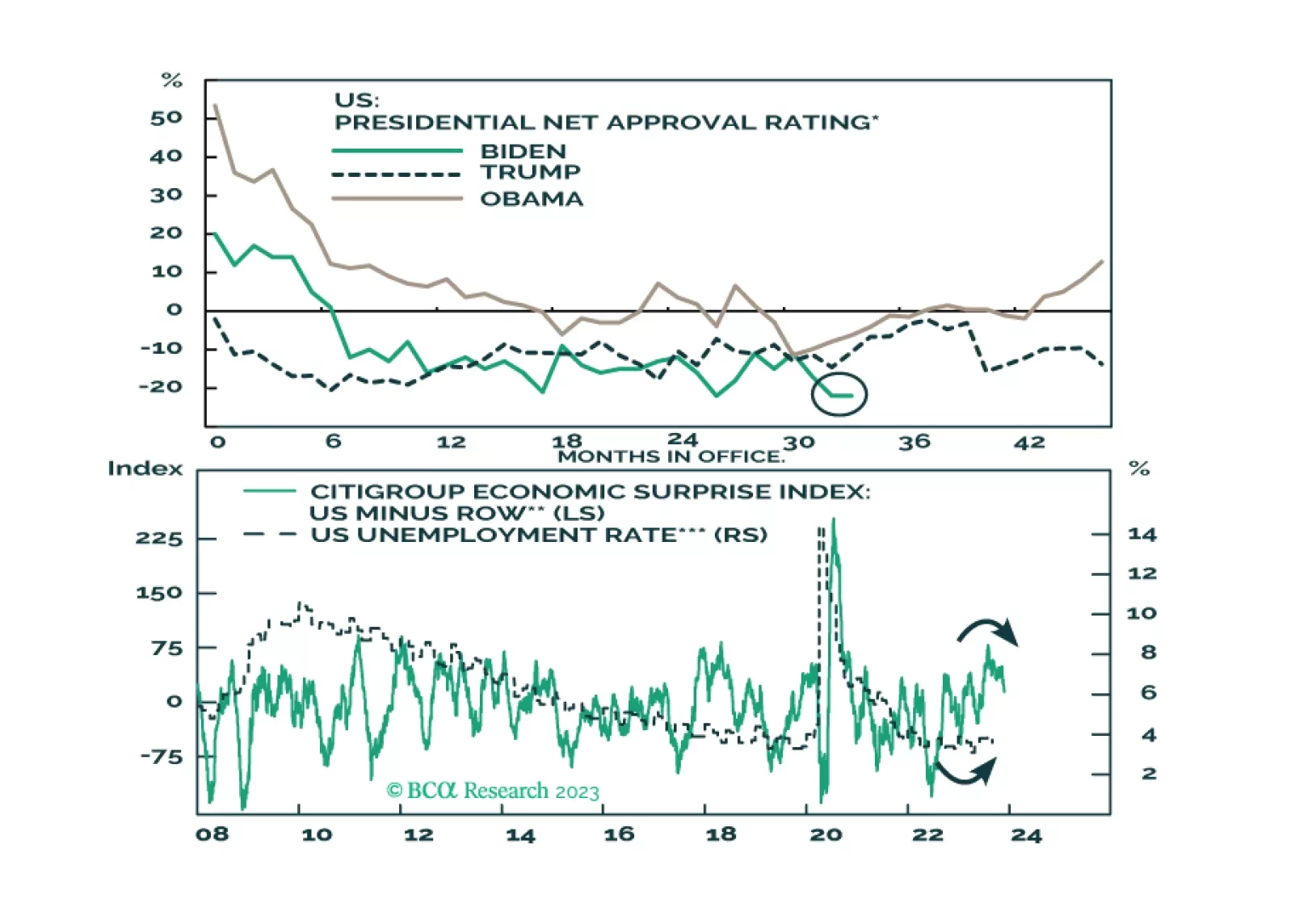

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

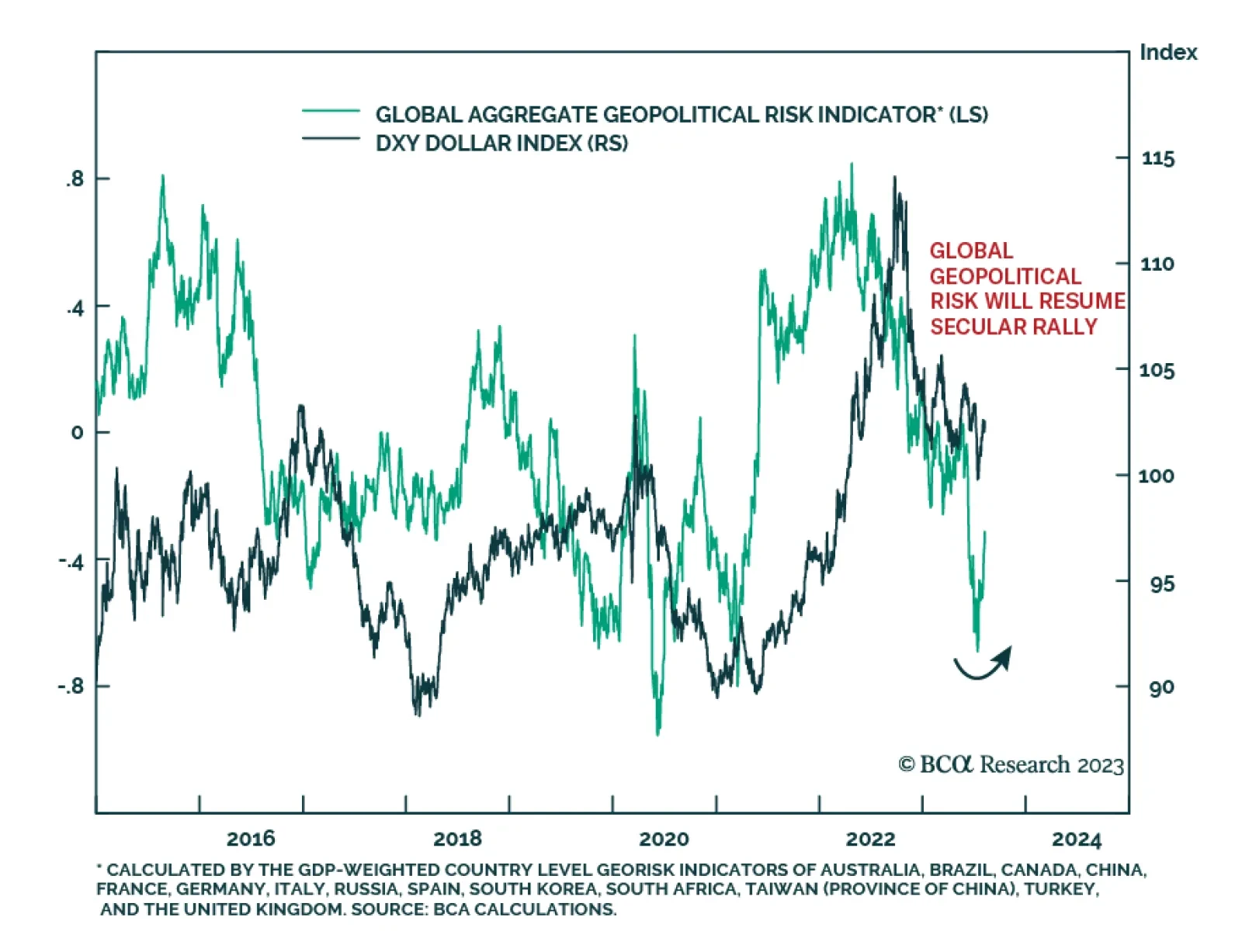

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

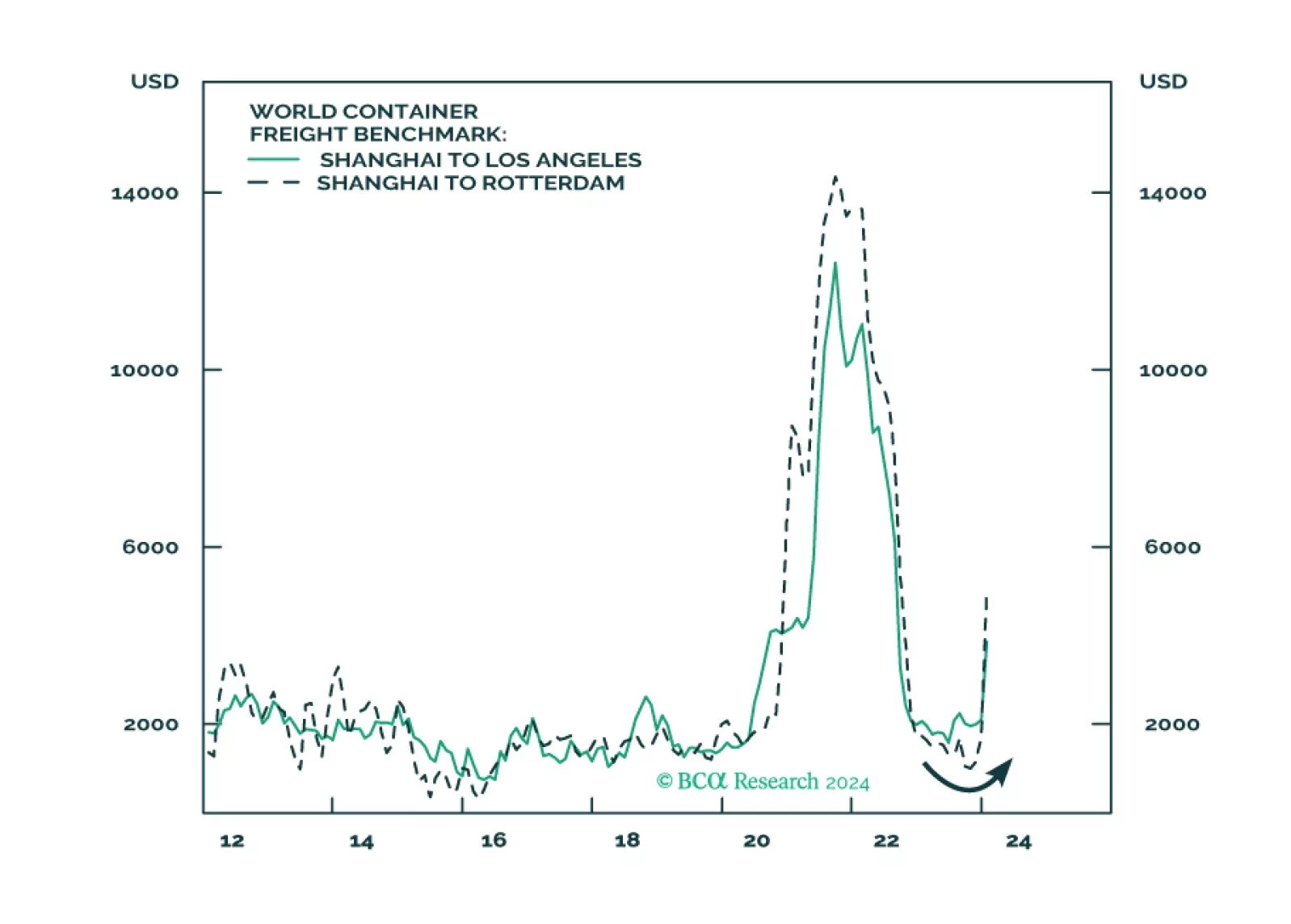

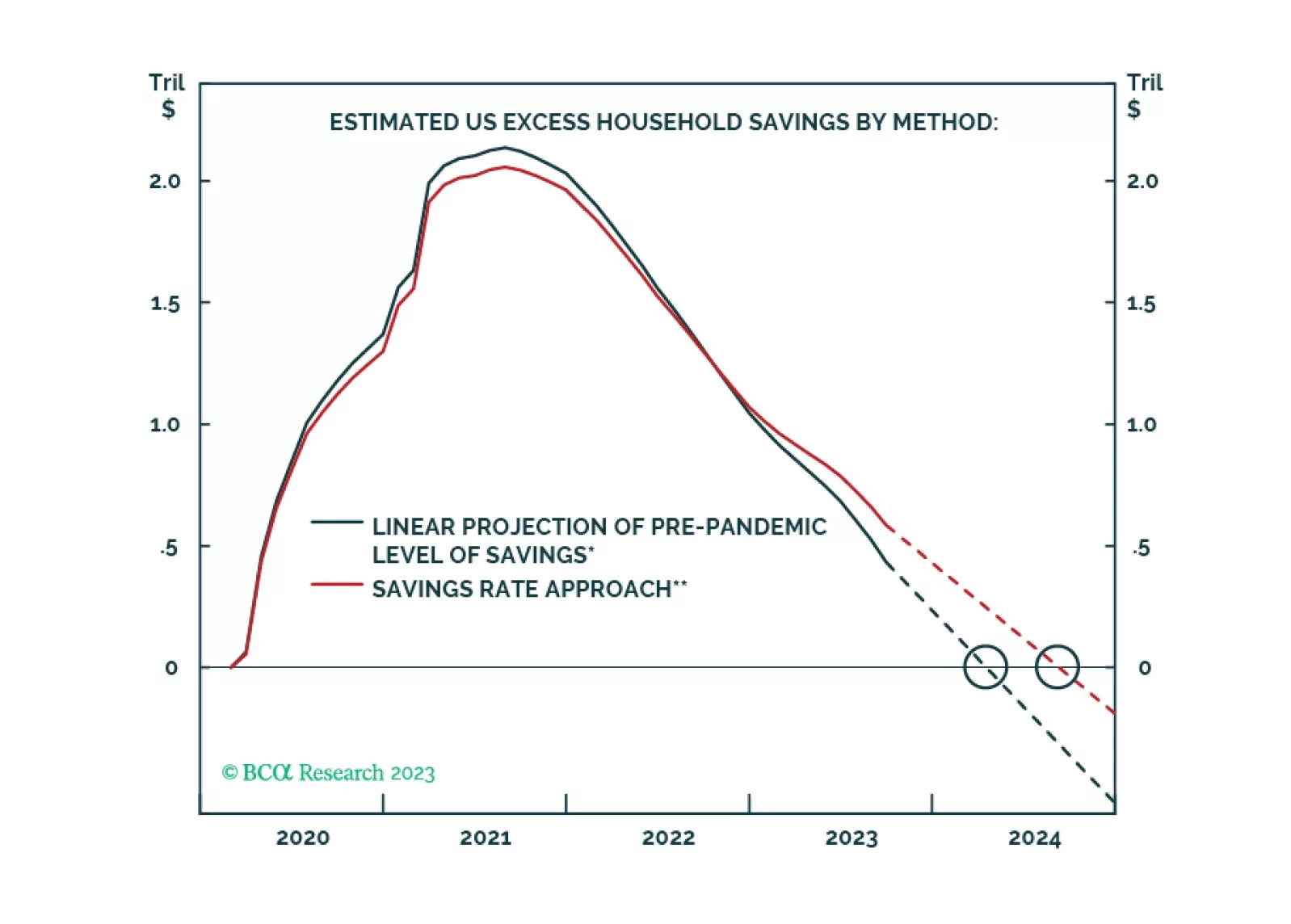

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

According to BCA Research’s Geopolitical Strategy service, investors should stay overweight low-beta assets. Geopolitical risk is likely to stay elevated in Asia Pacific in the coming months. Mainland China faces debt-…