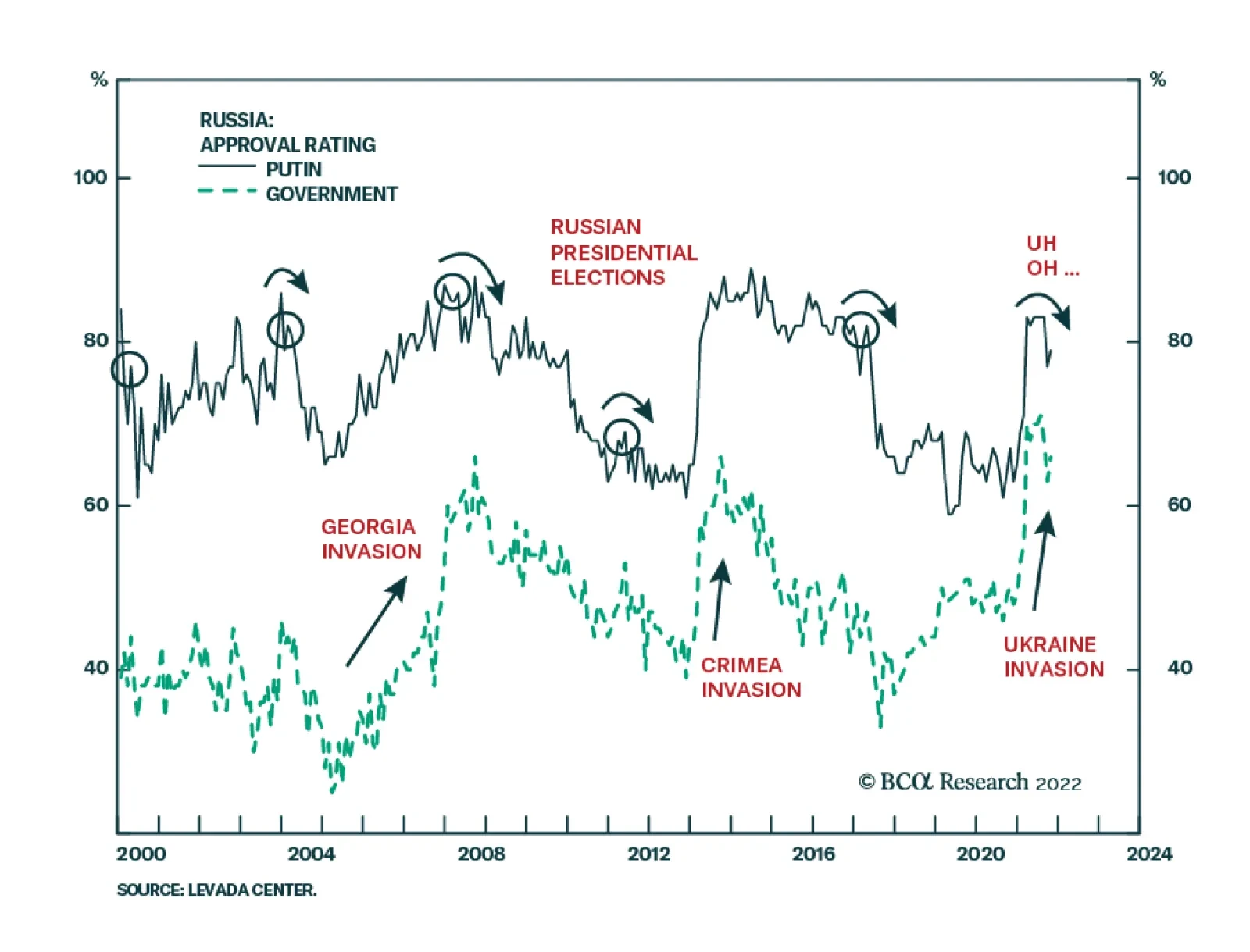

According to BCA Research’s Geopolitical Strategy service, Russia’s presidential election of March 2024 will put pressure on Vladimir Putin to negotiate a ceasefire before that time. Putin faces his fifth…

The Chinese government will repress social unrest, then relax Covid-19 social restrictions to try to stabilize the economy. Russia will be aggressive in the short term but will pursue a ceasefire before March 2024. European and…

OPEC 2.0’s decision to cut 2mm b/d of output beginning in December telescopes the loss of Russian volumes we expect over the course of the coming year. OPEC 2.0 clearly is not playing by the G7’s or the US’s rules. This will keep…

Russia’s conflict with the West will escalate and trigger more bad news for risky assets this fall. Beyond that, stalemate looms. Latin American equities present a potential opportunity once the macro and geopolitical backdrop…

Investors should go long US treasuries and stay overweight defensive versus cyclical sectors, large caps versus small caps, and aerospace/defense stocks. Regionally we favor the US, India, Southeast Asia, and Latin America, while…

Executive Summary EU Metal Industry Under Threat Russia’s threat to cut off all remaining exports of natural gas to the EU via Ukraine will further imperil the bloc’s struggling metals industry, particularly…

Executive Summary The US inflation surprise increases the odds of both congressional gridlock and recession, which increases uncertainty over US leadership past 2024 and reduces the US’s ability to lower tensions with China and…

Executive Summary At the margin, the European Union’s proposed €140 billion “windfall profits” tax on electricity providers not using natural gas to generate power will blunt the message markets are sending to…

Executive Summary Our negative view on the summer rally is coming to fruition, with equities falling back on the negative geopolitical, macro, and monetary environment. China is easing policy ahead of its full return to autocratic…