Positive economic surprises have delayed the onset of recession in the United States. But tighter monetary and fiscal policy, slowing global growth, and a looming rebound in policy uncertainty and geopolitical risk suggest that…

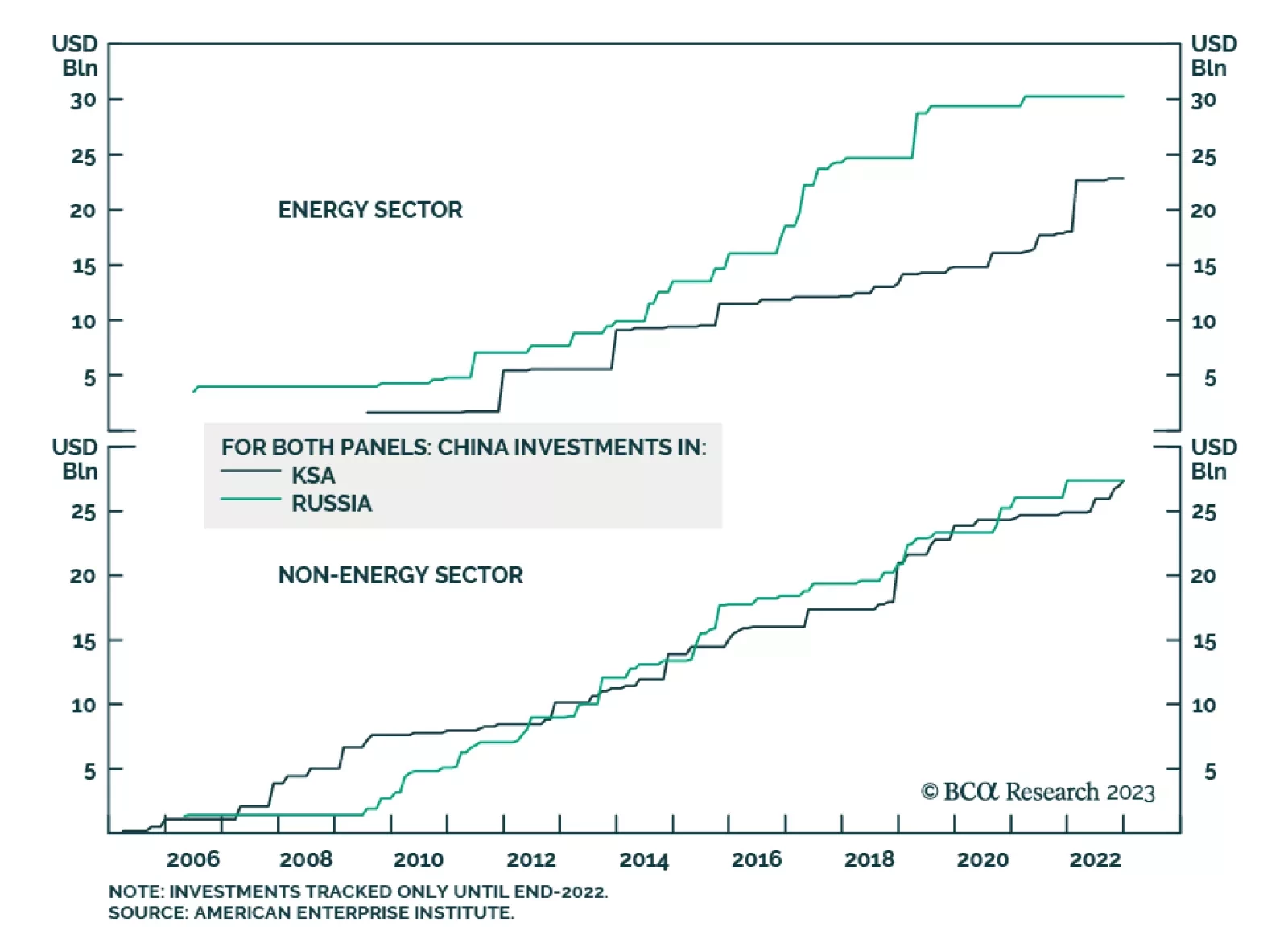

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

China’s economic and diplomatic interests in the GCC region will expand, as will its military presence. Whether or not this stabilizes the region is yet to be determined, particularly if tensions in the South China Sea and other…

The attempted coup in Russia produced subdued short-covering rallies in oil, gas, and grains markets, as markets over time have observed that coups, rarely result in loss of production and exports. Markets await Putin’s next move.…

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

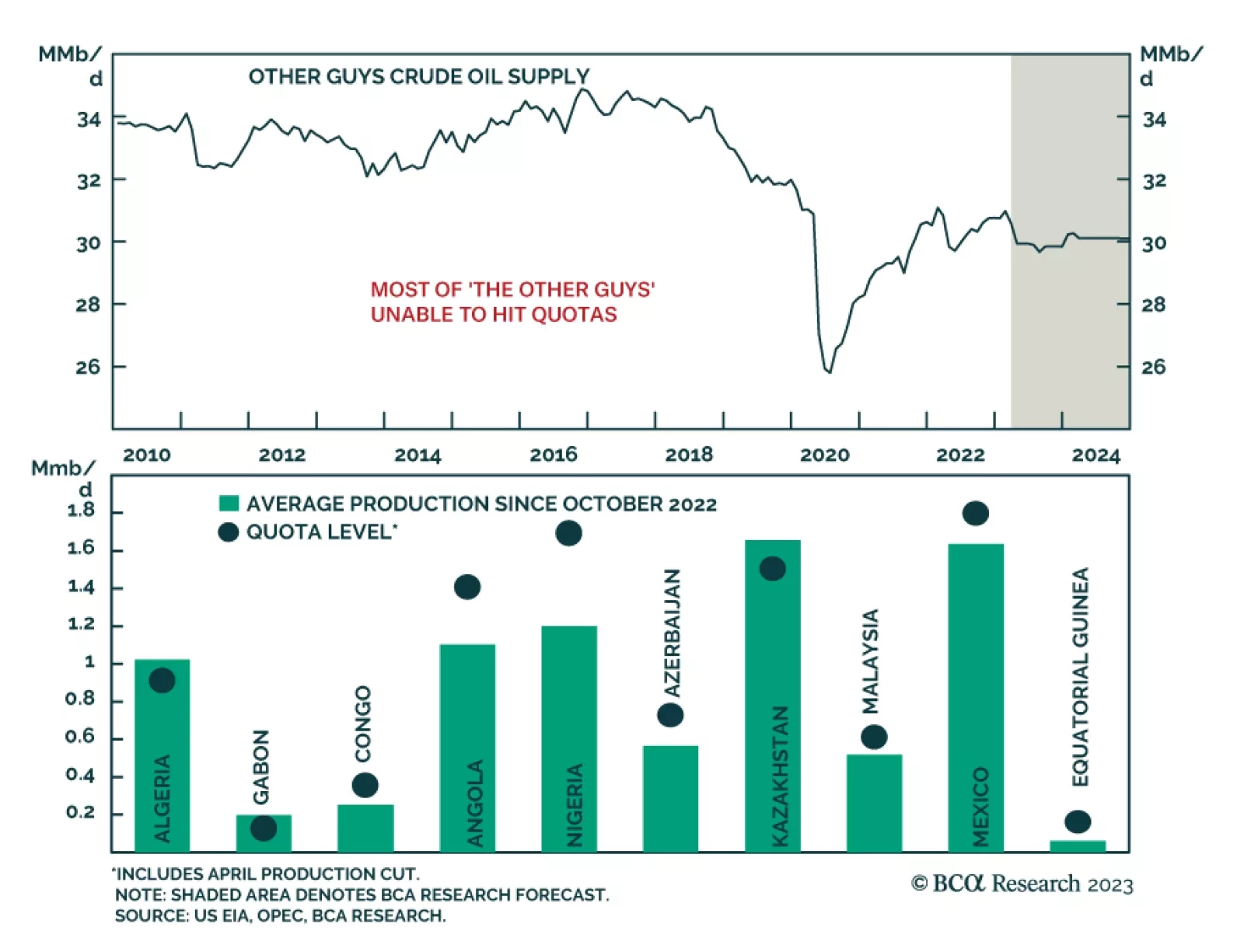

According to BCA Research’s Commodity & Energy Strategy service, oil supply management by OPEC 2.0 and production discipline outside the coalition will be maintained, forcing inventories lower. Russia’s gray…

EM oil demand remains resilient and will continue to be propelled by global growth this year. Supply management by OPEC 2.0 and production discipline outside the coalition will be maintained, forcing inventories lower. Recent price…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.