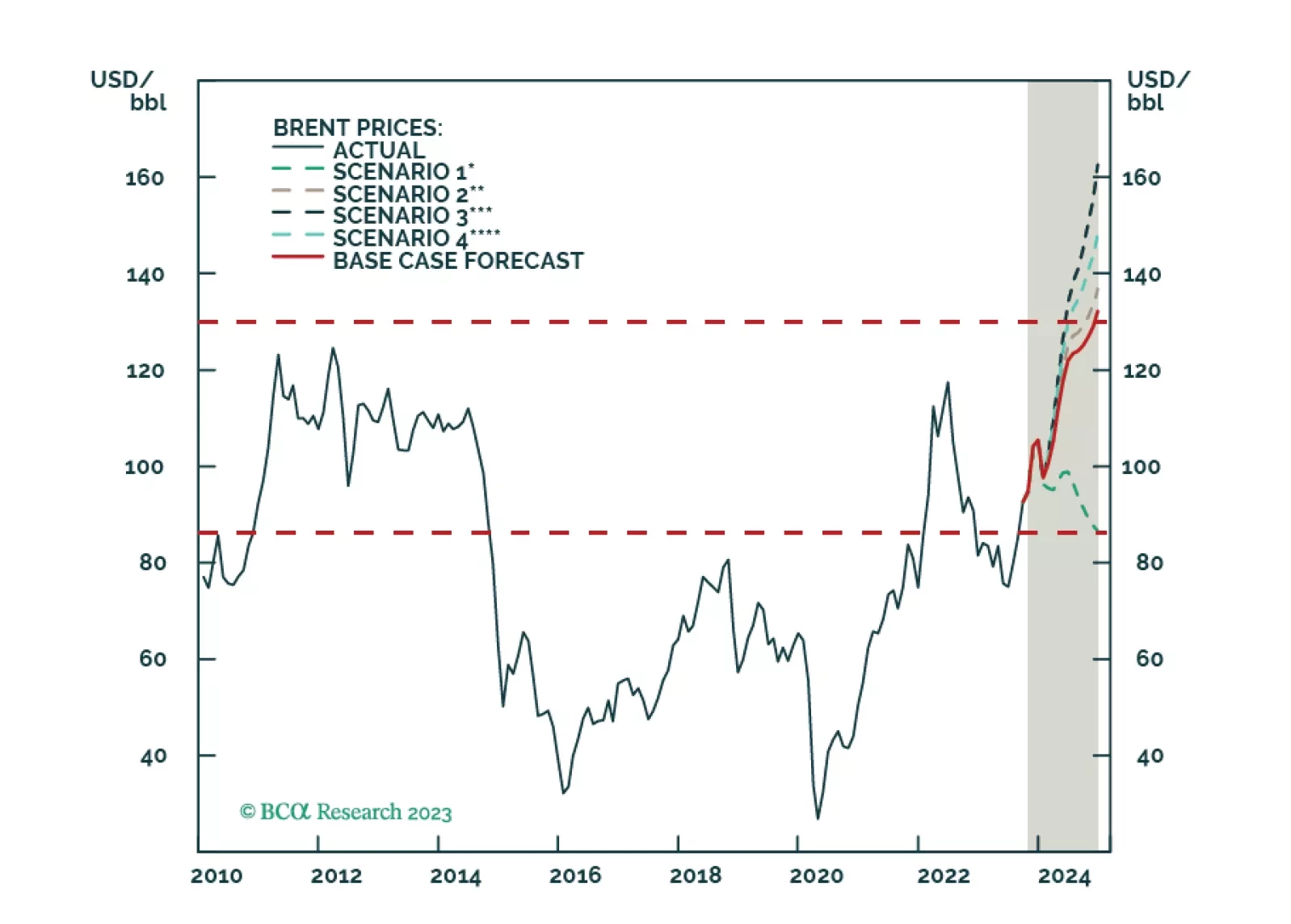

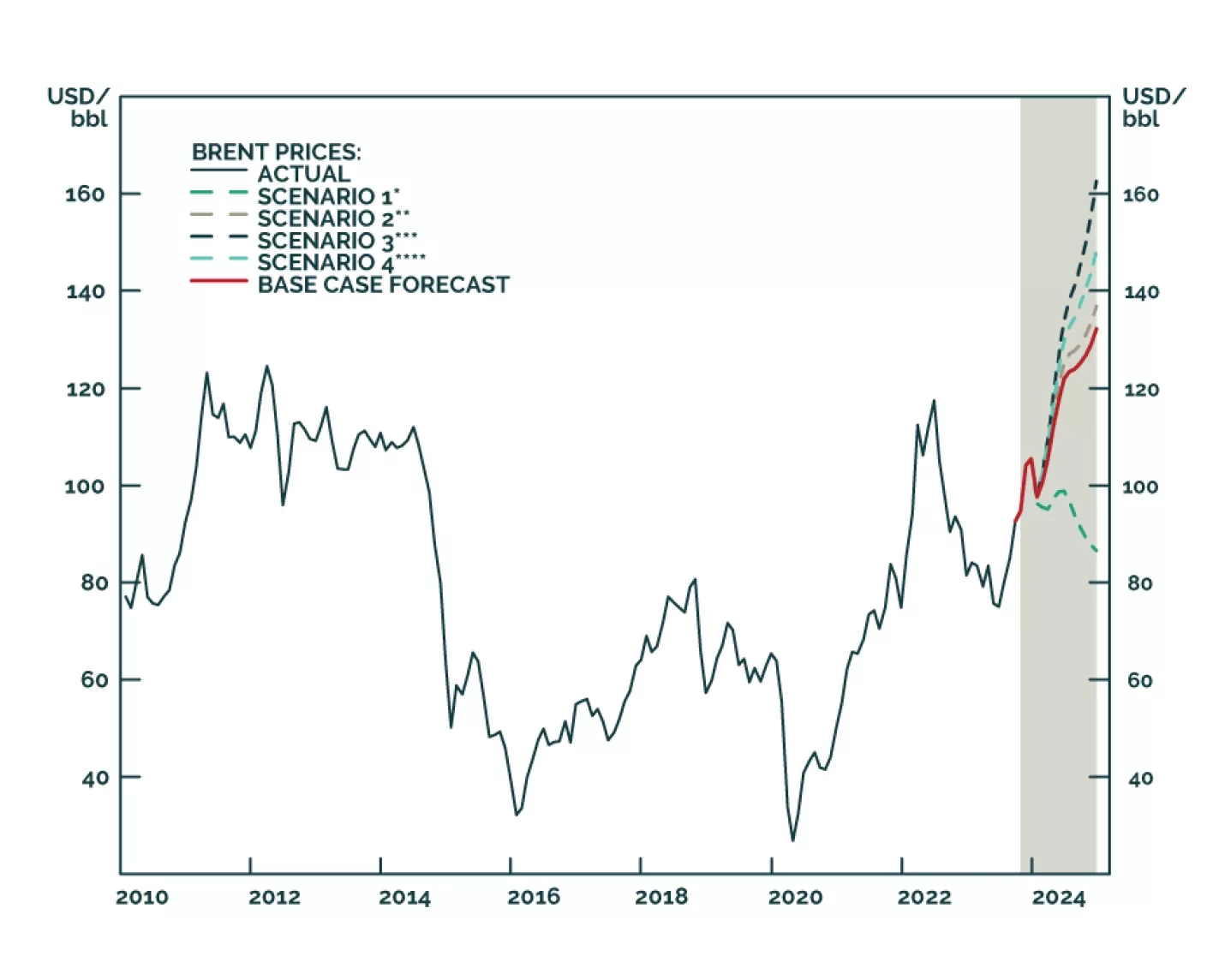

Despite higher uncertainty, our Brent price forecasts remain unchanged at just over $101/bbl for 4Q23 and $118/bbl for next year. We remain long equity exposure to oil and gas producers via the XOP ETF, and commodity exposure via the…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

Global oil demand growth is tracking with our estimate of ~ 1.8mm b/d for this year. Supply discipline is being maintained by OPEC 2.0, where the core (KSA and the UAE) and Russia have reduced production by ~ 240k b/d yoy in 1H23.…

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…