In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

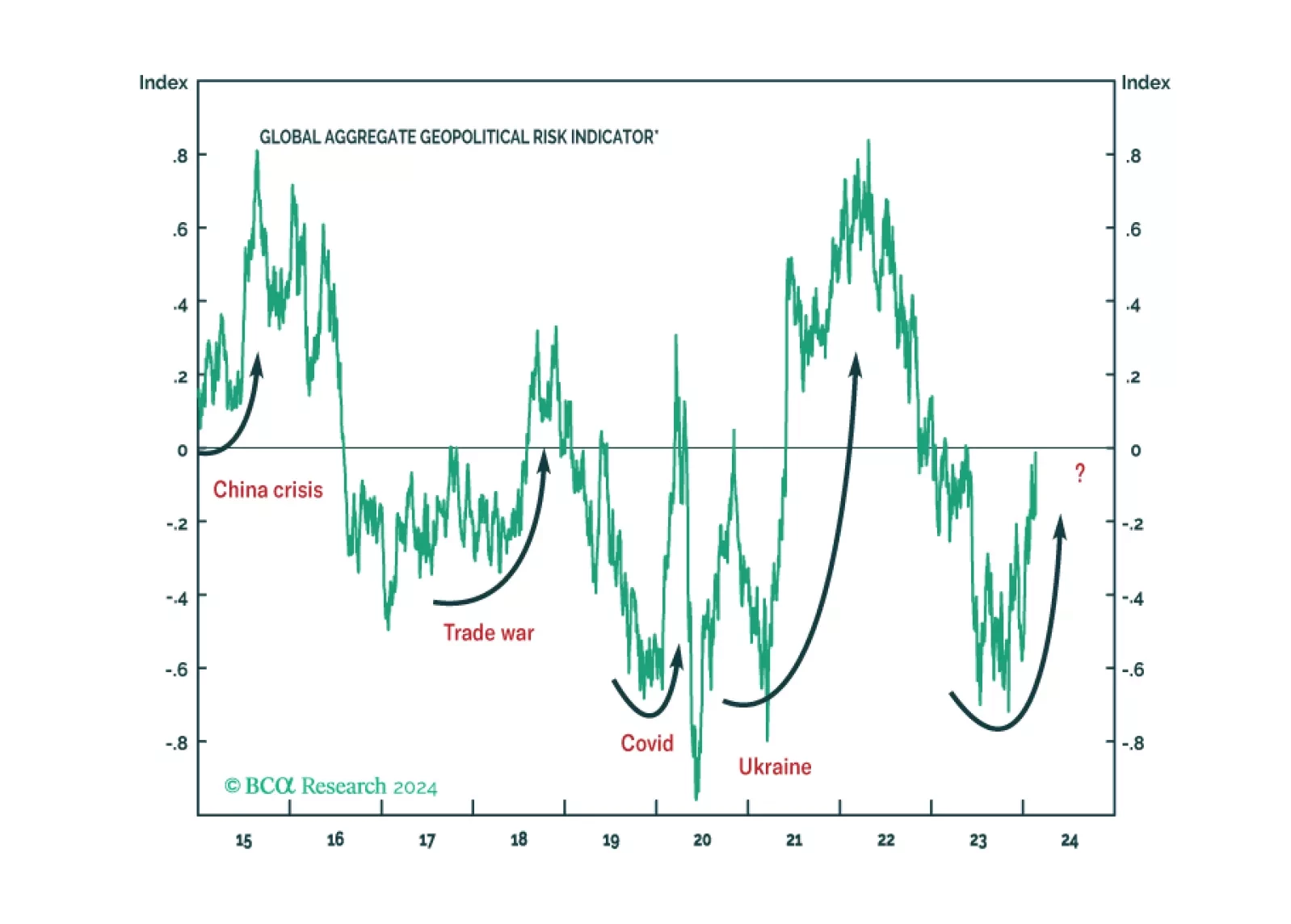

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

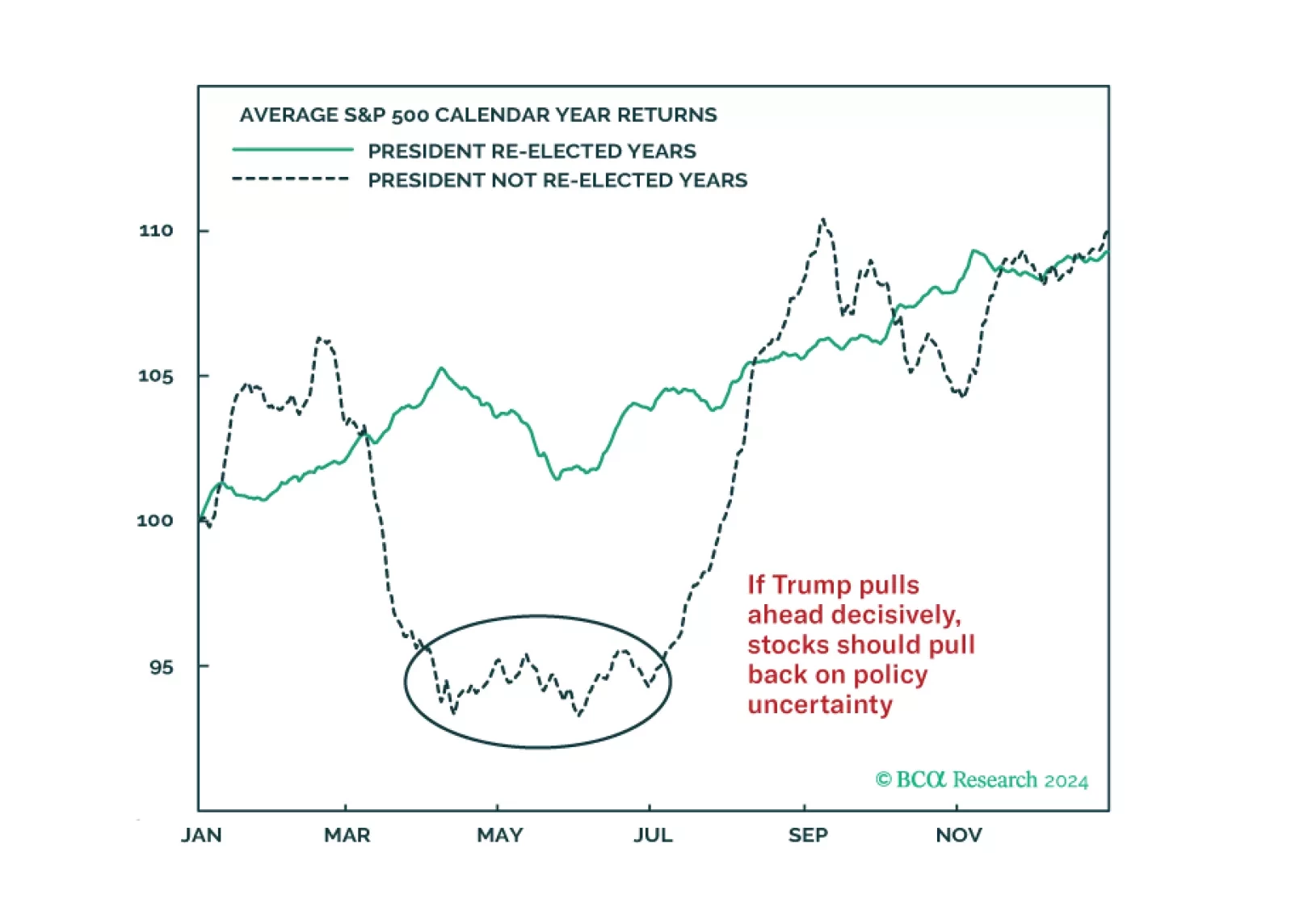

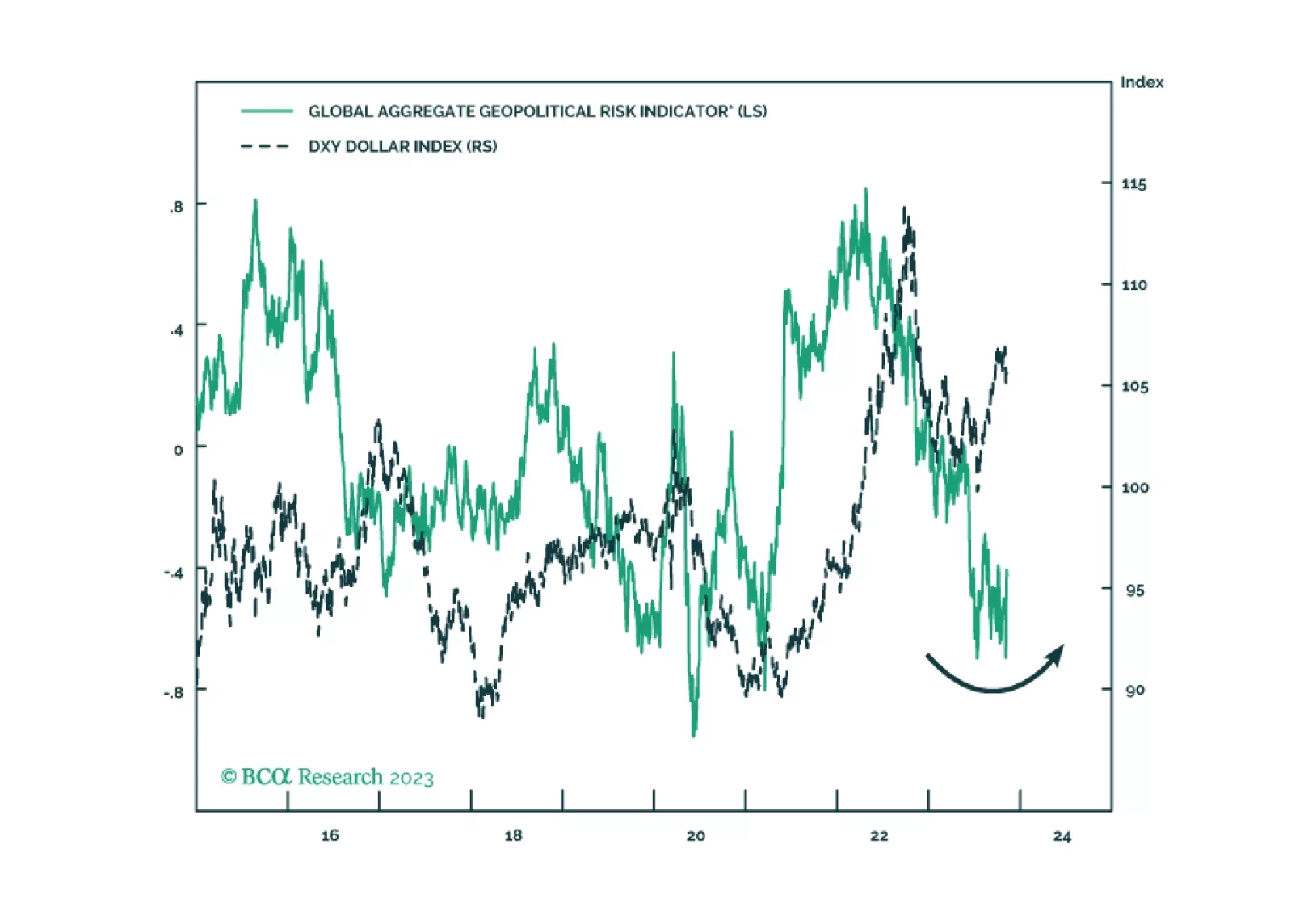

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

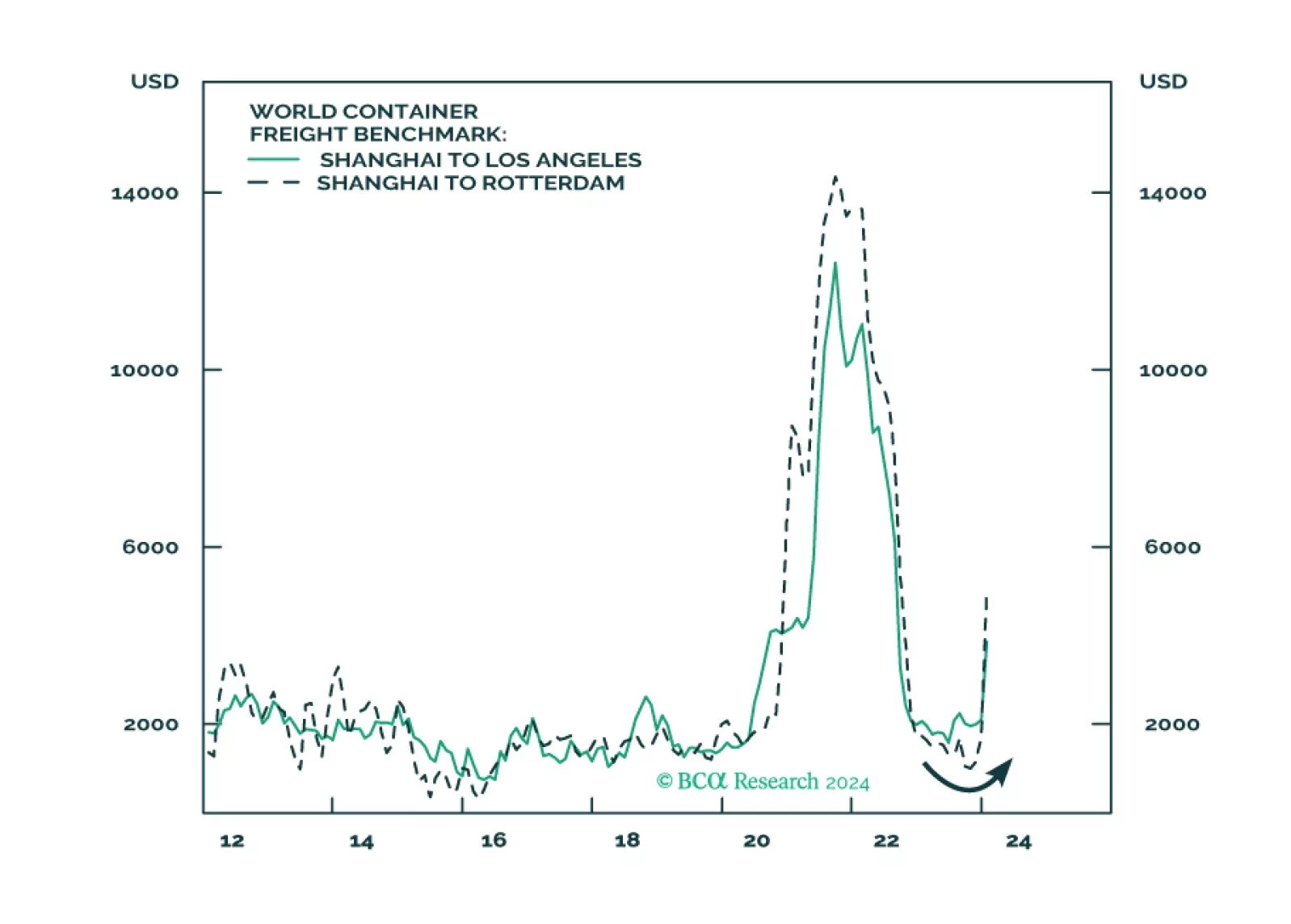

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

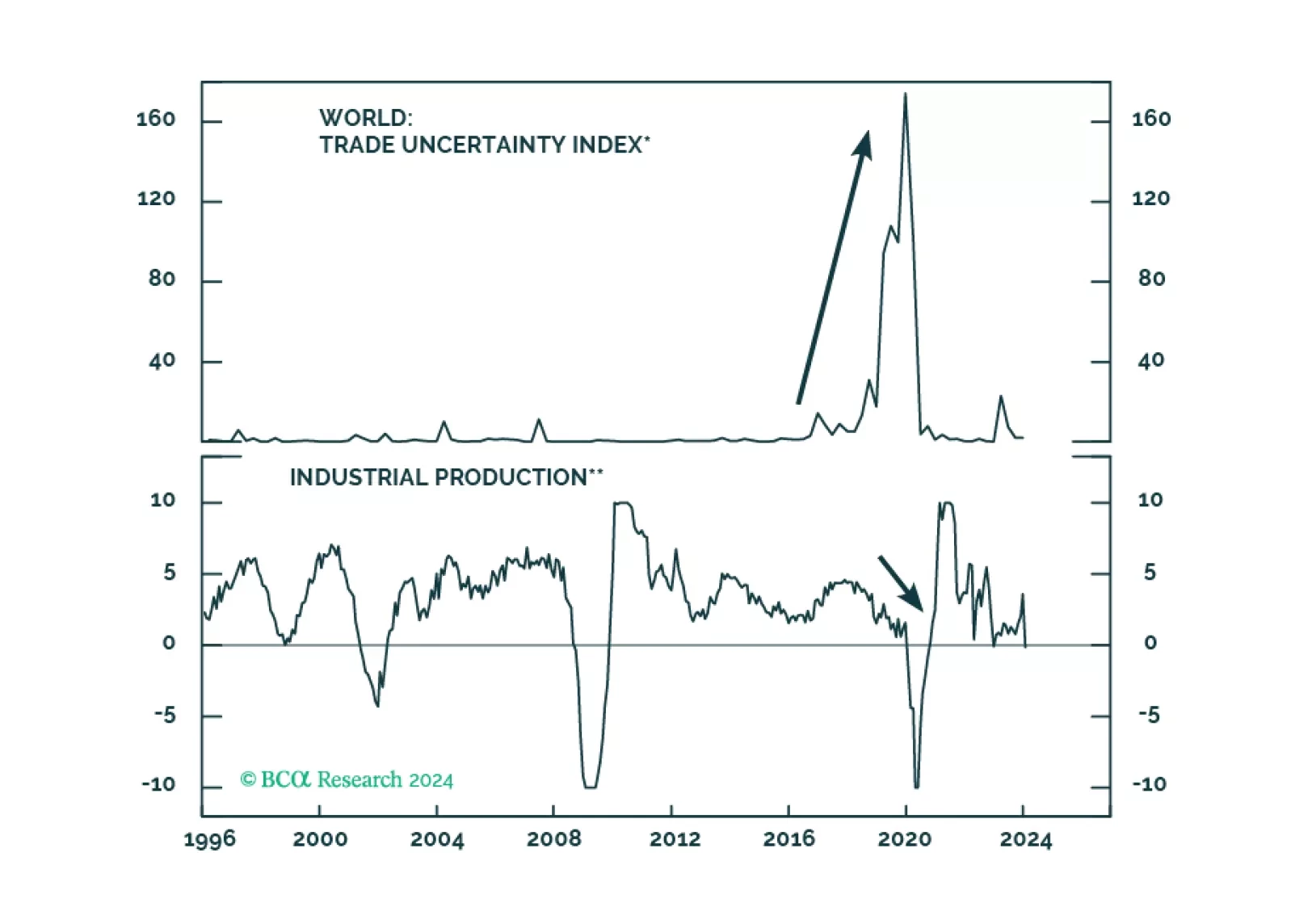

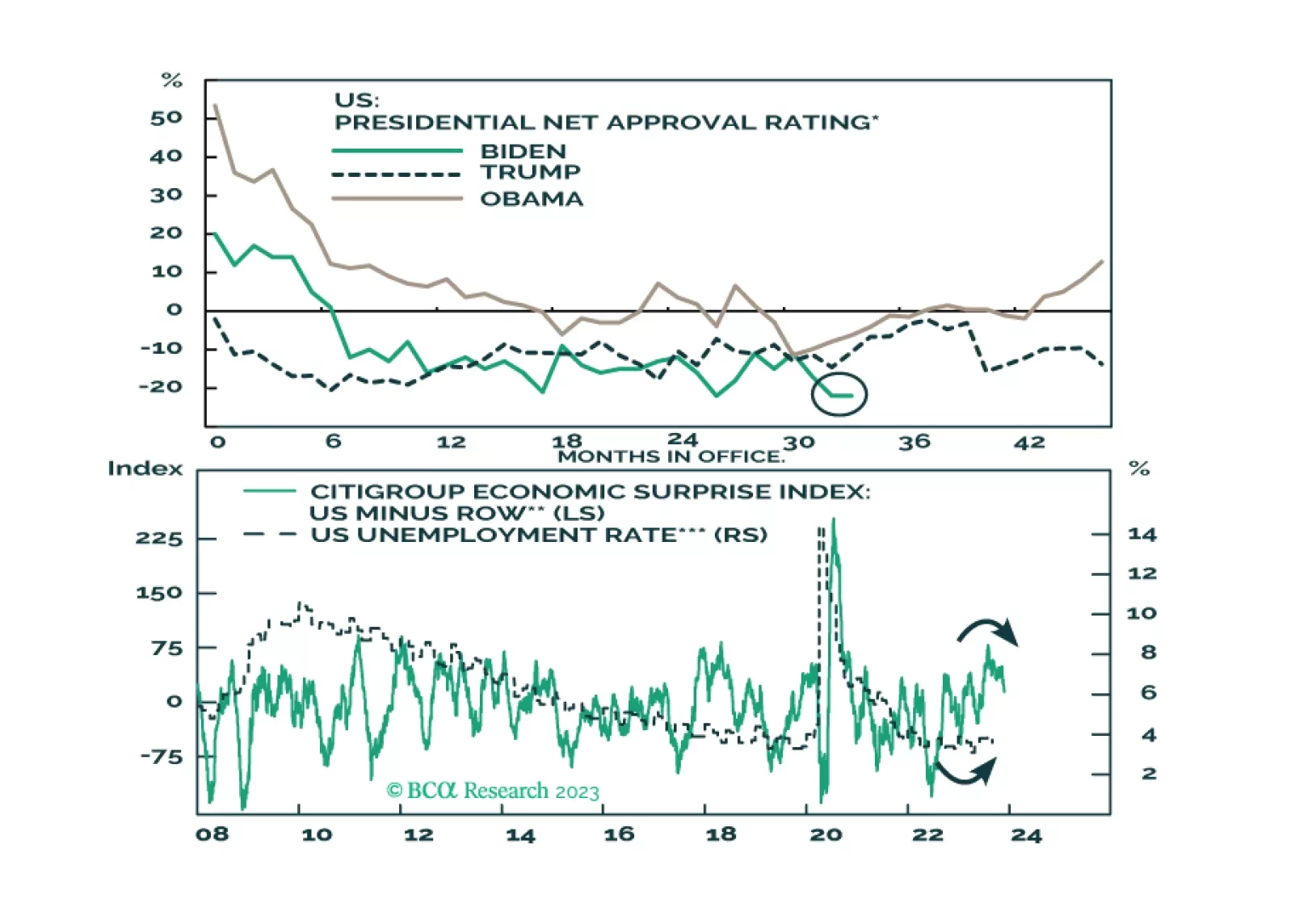

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

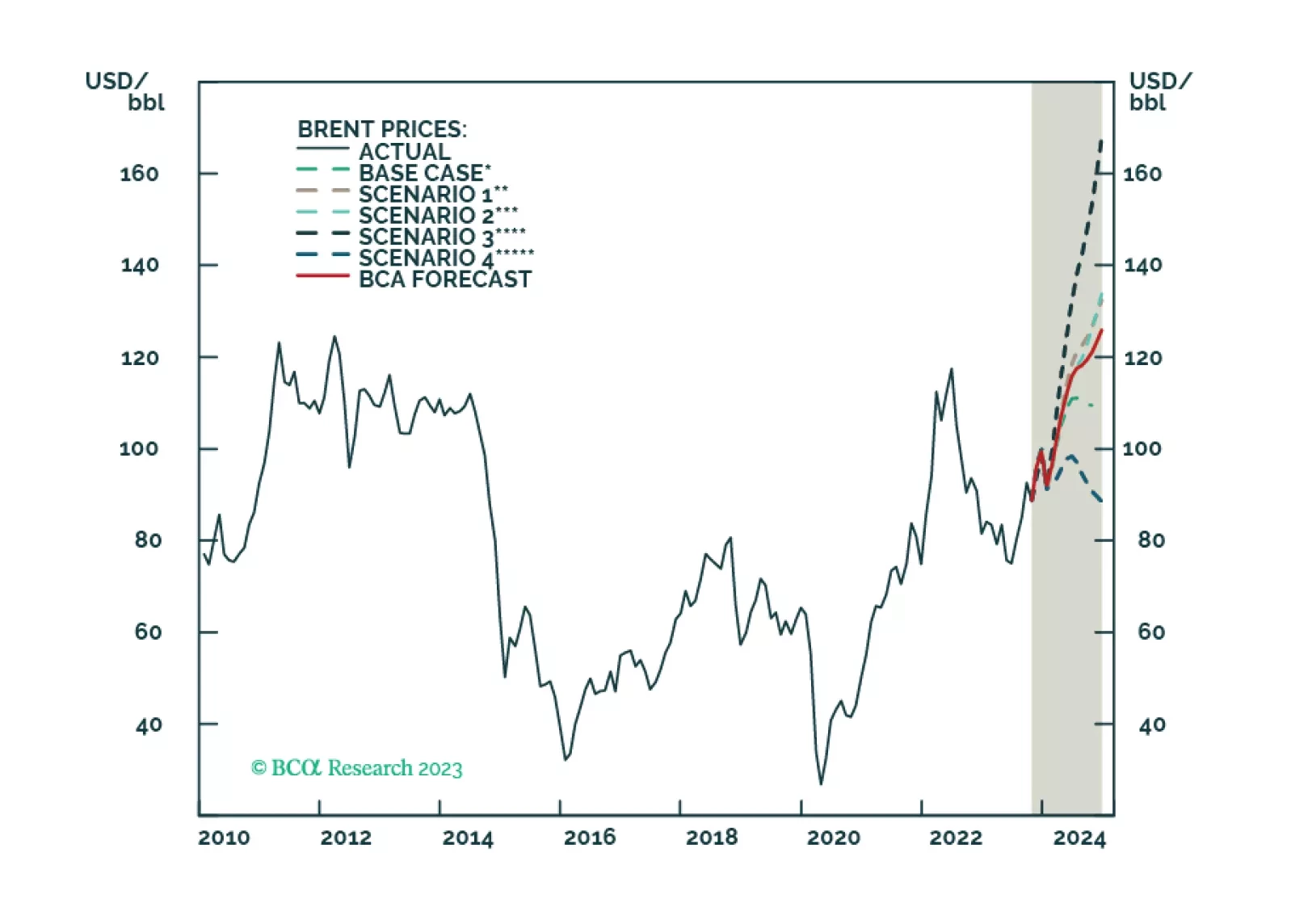

US and Chinese oil-demand strength will offset EU weakness next year. Incremental supply growth from non-OPEC 2.0 producers, coupled with a lower risk of the US enforcing its sanctions on Iranian oil exports, reduces our 2024 Brent…

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…