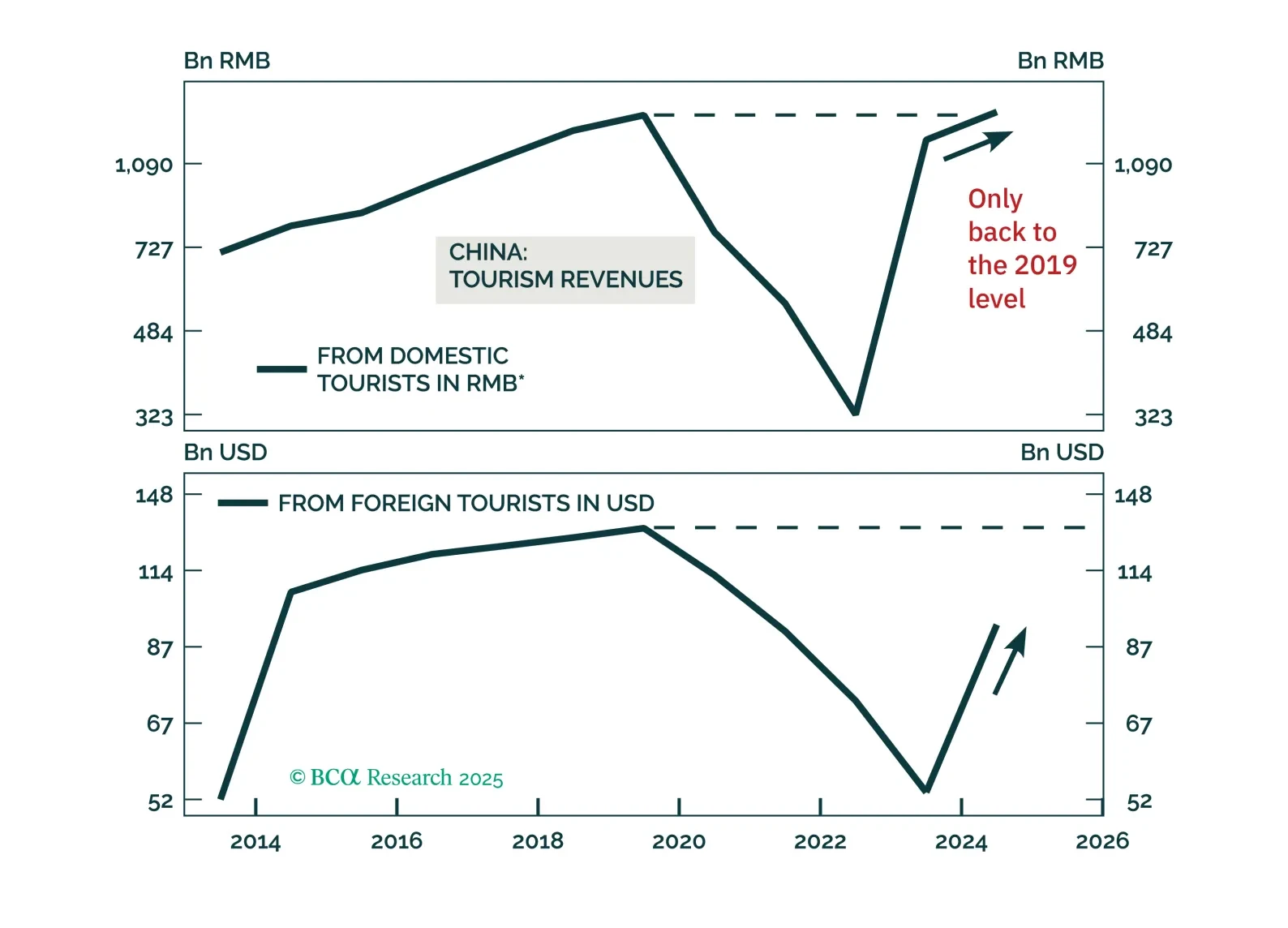

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

Today, we are downgrading the S&P restaurants index from overweight to neutral. Currently, the industry faces a trifecta of challenges: Rising input prices, a stronger dollar, and a shift in consumer spending away from discretionary…

Highlights This is the second part of the publication, in which we provide an in-depth overview of Hotels, Restaurants, and Airlines, or the “travel complex” as we dubbed it. In last week’s report, we provided an…

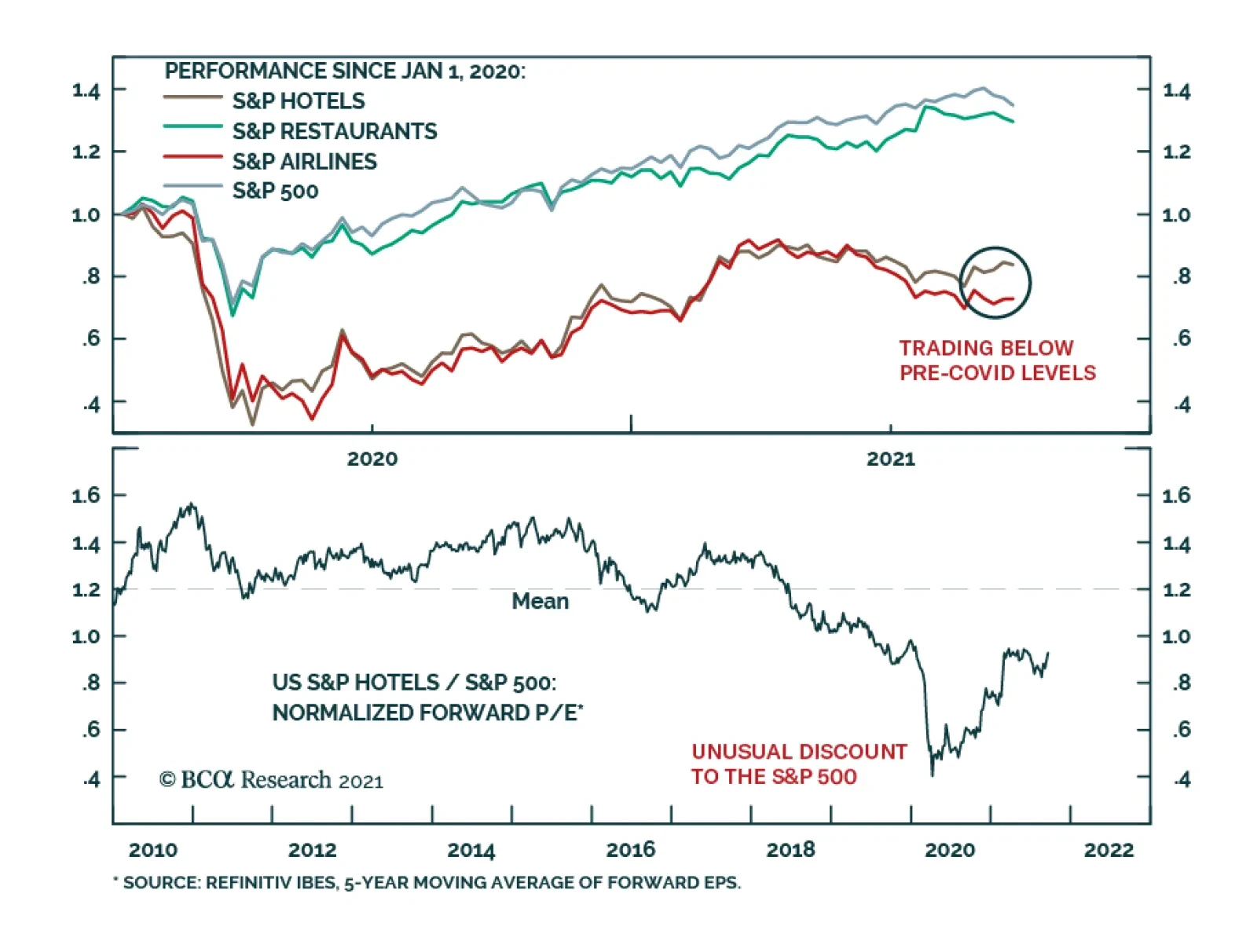

BCA Research’s US Equity Strategy service recommends overweighting the Hotels, Resorts, and Cruise Lines industry. The team summarizes this view as follows: The Delta variant is cresting. Their base case is that herd…

Highlights Covid-19 has wreaked havoc in the markets, but the Hotels, Restaurants & Leisure, and Airline industries have been most affected. These industries constitute what we call the “travel complex” as they share…

Neutral As reopening of the economy will, at the margin, bring back diners (take out mostly) to restaurants, the two heavyweights that comprise 80% of the market cap of the S&P restaurants group are anything but…

Highlights Portfolio Strategy The Fed’s unorthodox monetary policy is aimed at quashing volatility, lifting asset prices and debasing the currency, all of which are equity market bullish. Grim, but backward looking, macro data…

Underweight The S&P restaurants index is often mistakenly used as an early cyclical vehicle to express the “vibrant consumer” theme. However, the name of the index is deceiving as MCD and SBUX comprise ~80% of the index…

Underweight The S&P restaurants index has had an exceptional month, following surprisingly healthy results from both McDonalds and Starbucks, which collectively represent approximately 80% of the index. We think…

Highlights Portfolio Strategy Selling in the S&P cable & satellite index is overdone. Recession type valuations fully reflect the acquirer discount heavyweight CMCSA is still commanding. Lift exposure to neutral. Content…