As the major central banks once again mull their policy options, they face a daunting task. They must phase-transition inflation back to imperceptible, without phase-transitioning unemployment to perceptible. This report explains why…

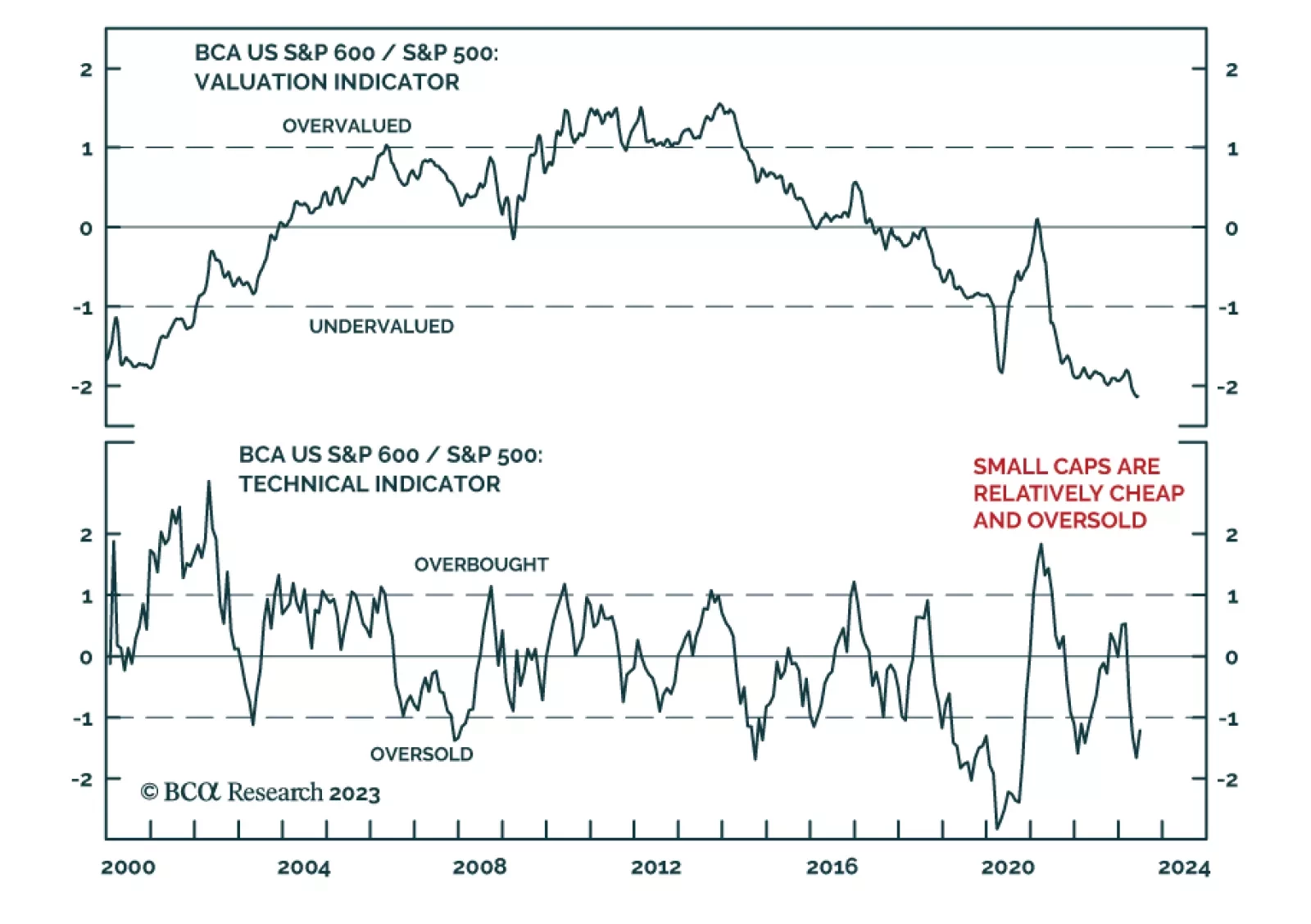

US equity market moves have recently shifted in favor of small caps. After underperforming the S&P 500 by 16% between the start of March and beginning of June, the S&P 600’s recent 6% gain is greater than its large-…

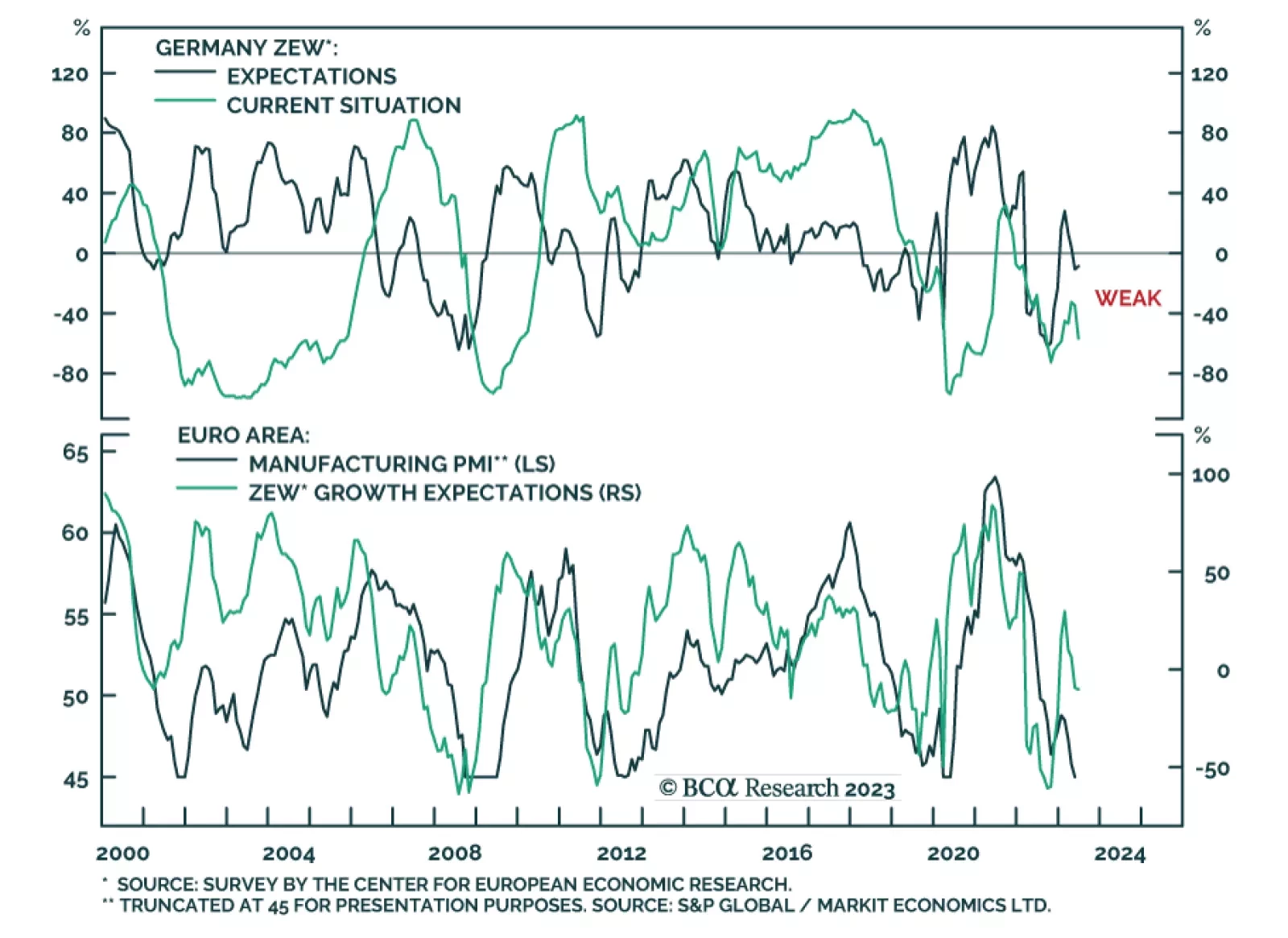

The message from the ZEW economic research institute’s June survey was mixed. On the one hand, the German Indicator of Economic Sentiment unexpectedly ticked up from -10.7 to -8.5. While the negative reading indicates that…

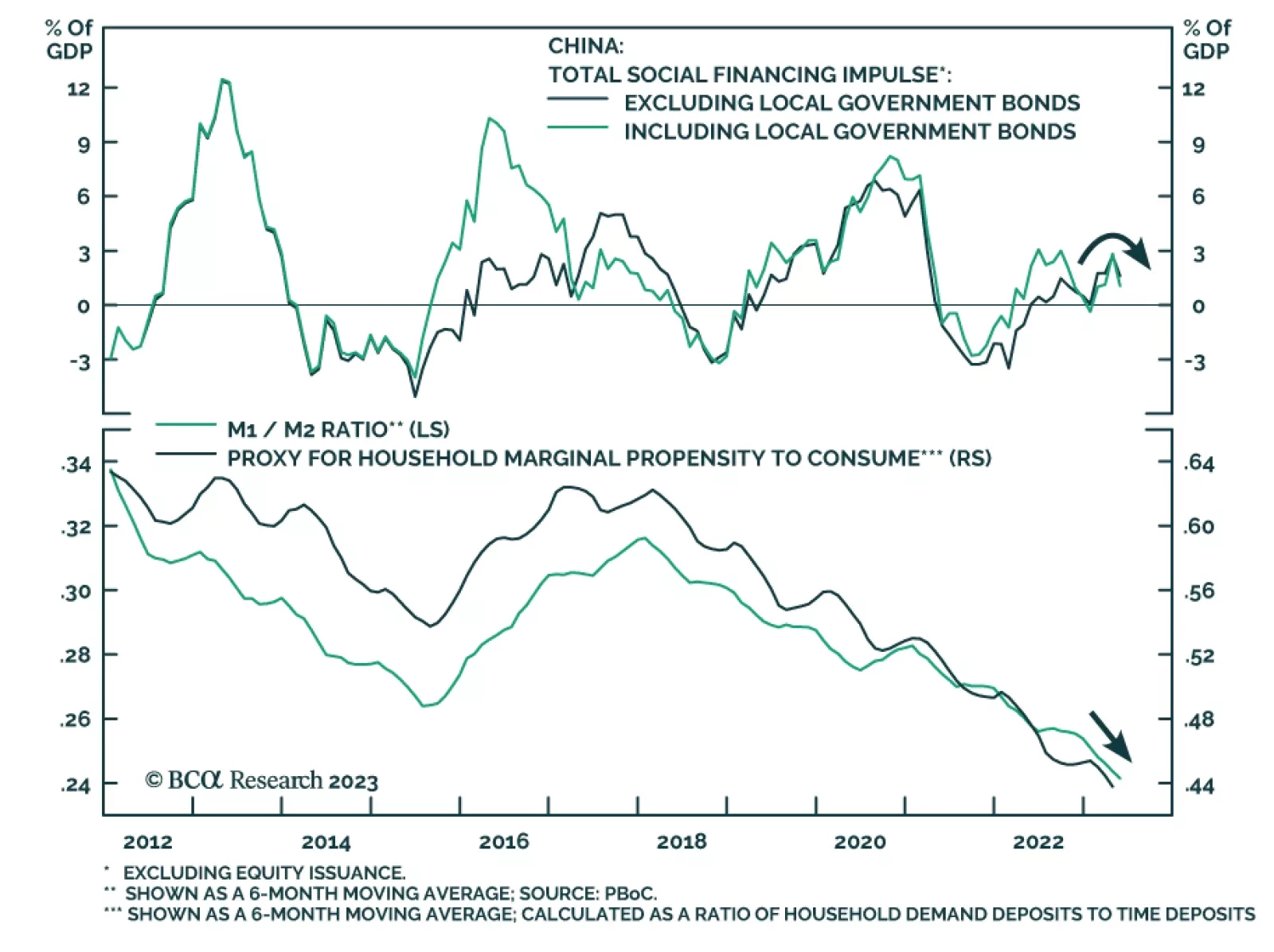

China’s money and credit update for May continues a string of disappointing Chinese data releases. The CNY 1.56 trillion increase in total social financing fell below expectations of a CNY 1.90 trillion rise. Similarly, the…

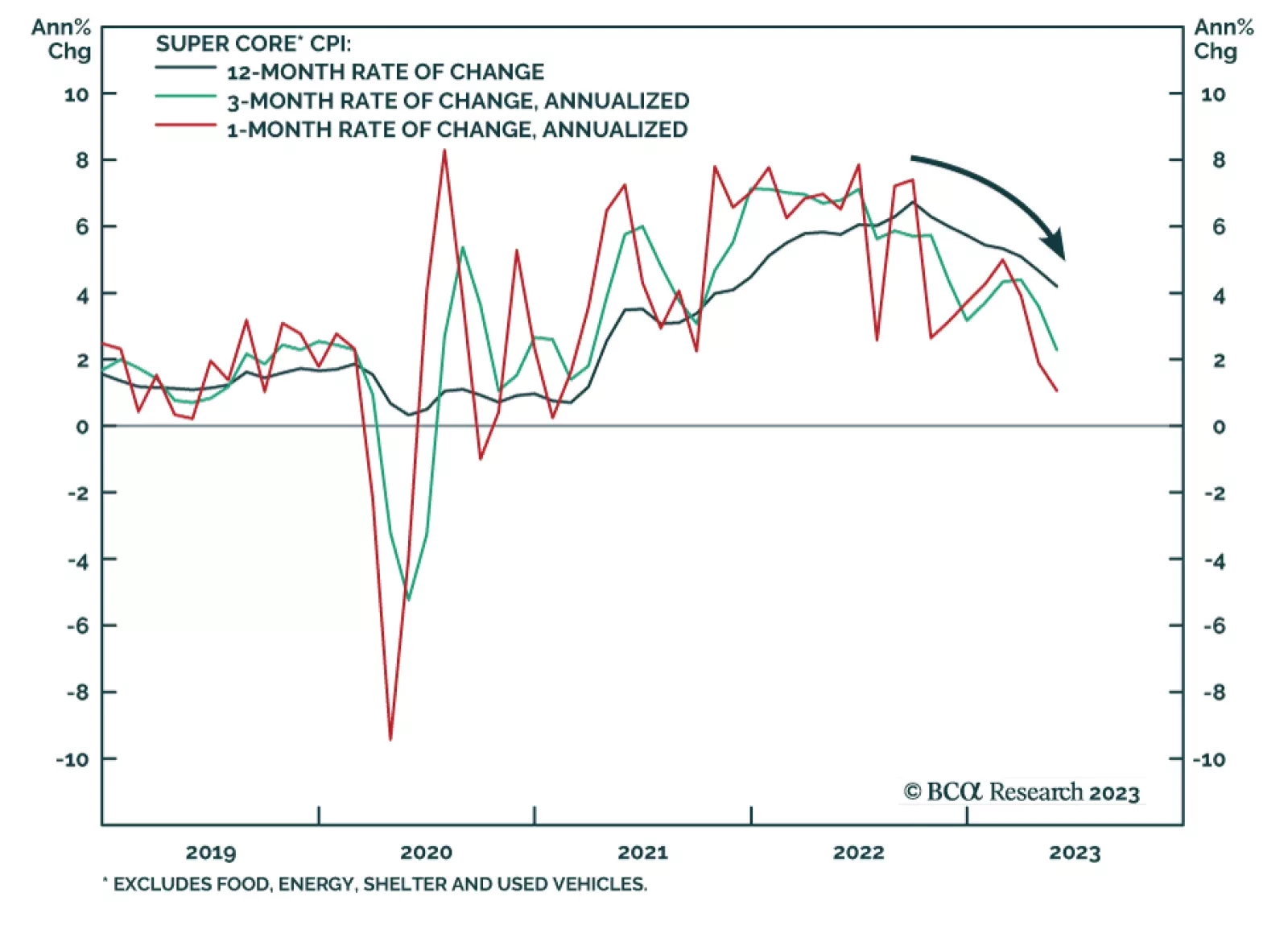

With the 1-year CPI swap rate trading at 2.3%, the market was already priced for a significant drop in inflation heading into yesterday’s May CPI release. The results of the report should only reinforce those expectations…

In response to the first-ever federal indictment of a former President, investors should focus on the state of the economy and not on Trump’s legal trouble. They should also use the current market rally to stock up on protection, as…

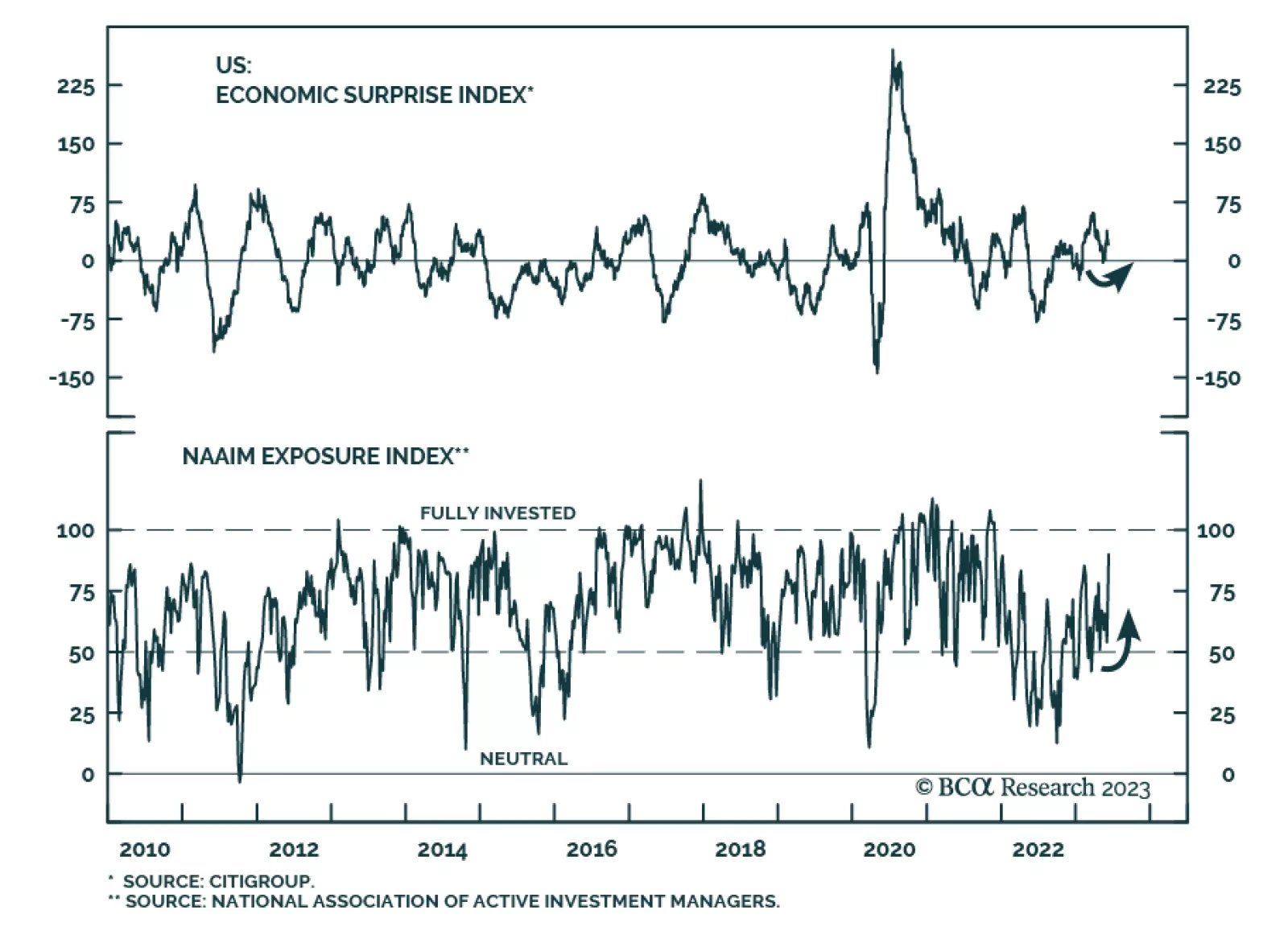

According to the Exposure Index compiled by the National Association of Active Investment Managers (NAAIM), active risk managers are increasing their net exposure to equities. The range of responses to the weekly survey…

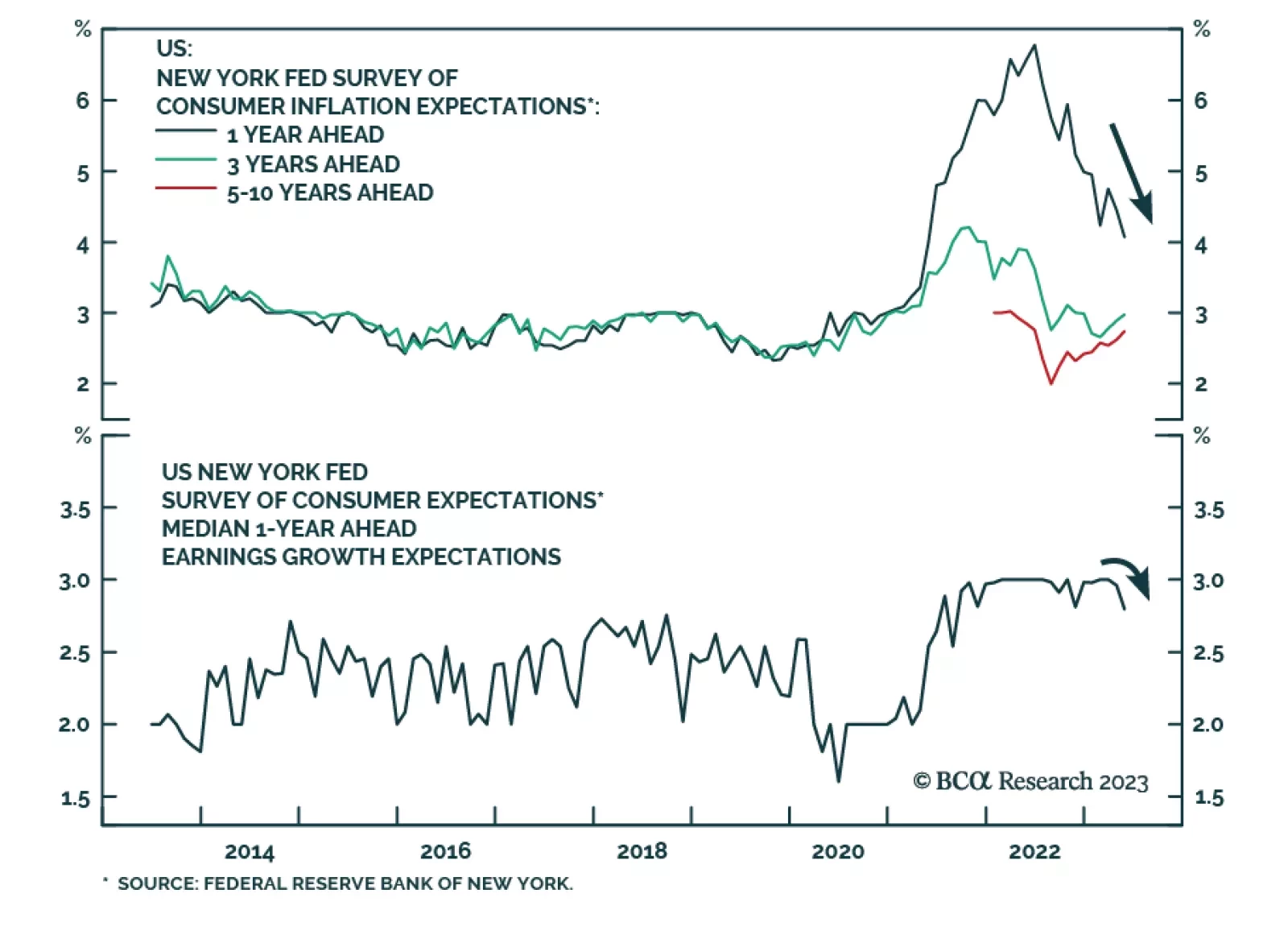

Results of the New York Fed’s Survey of Consumer Expectations sent a positive signal about short-term inflation expectations. Median one-year-ahead inflation expectations dropped by 0.3 percentage point to a two-year low of…

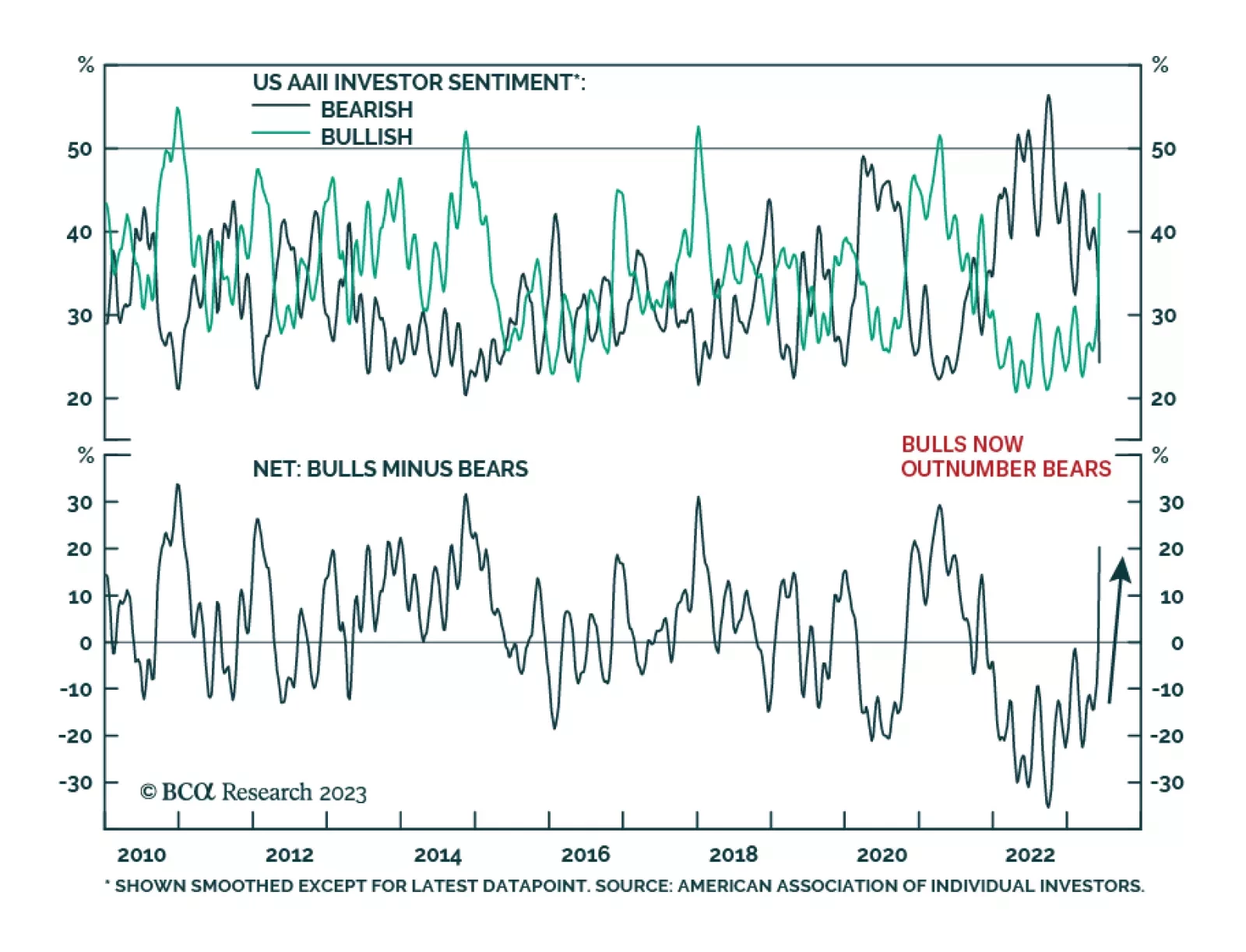

Investor sentiment has improved meaningfully in recent weeks. According to the latest AAII survey, the share of respondents with a bullish outlook jumped from 29.1% to 44.5%. It crossed above the historical average of 37.5% for…

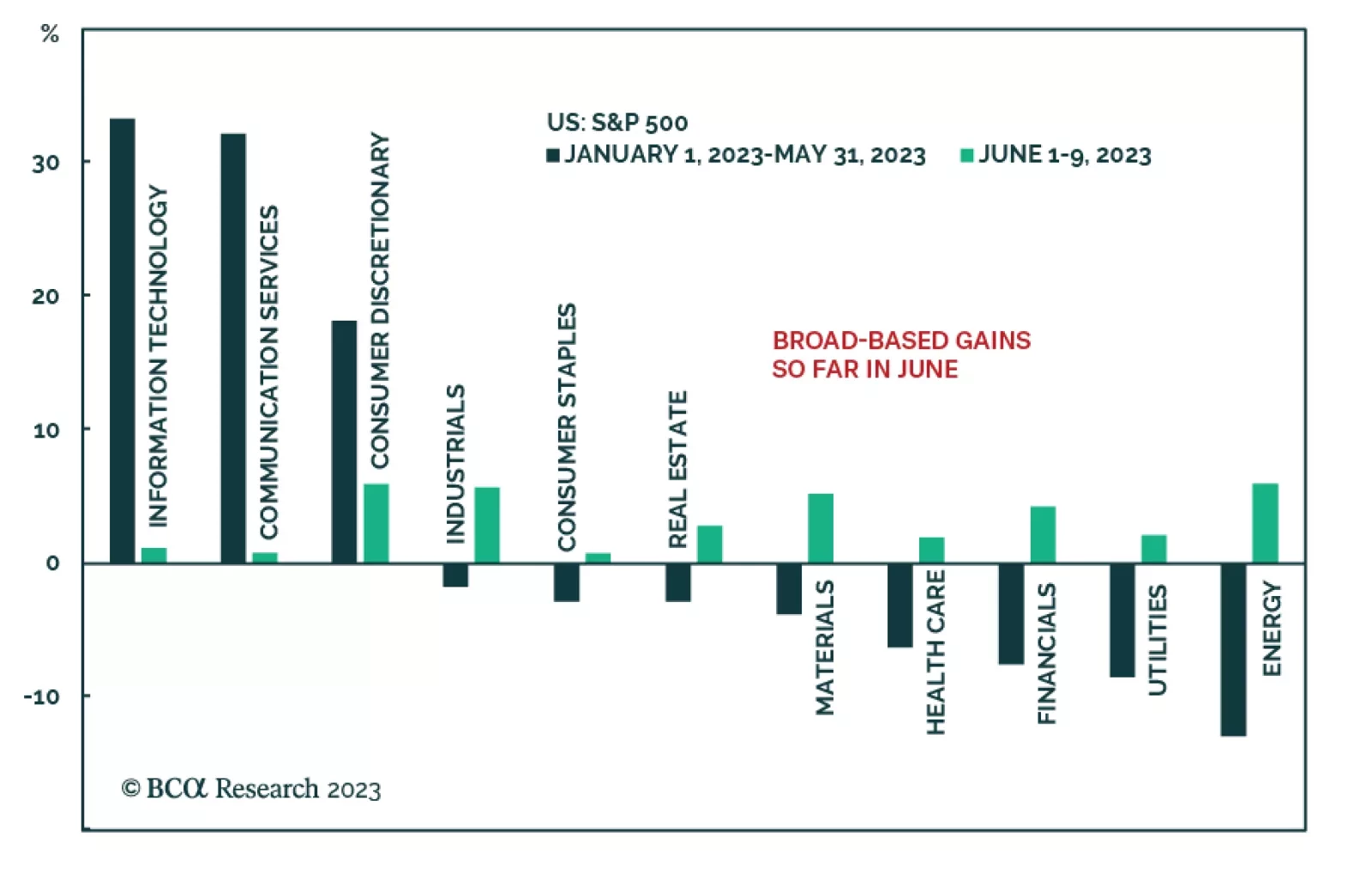

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…