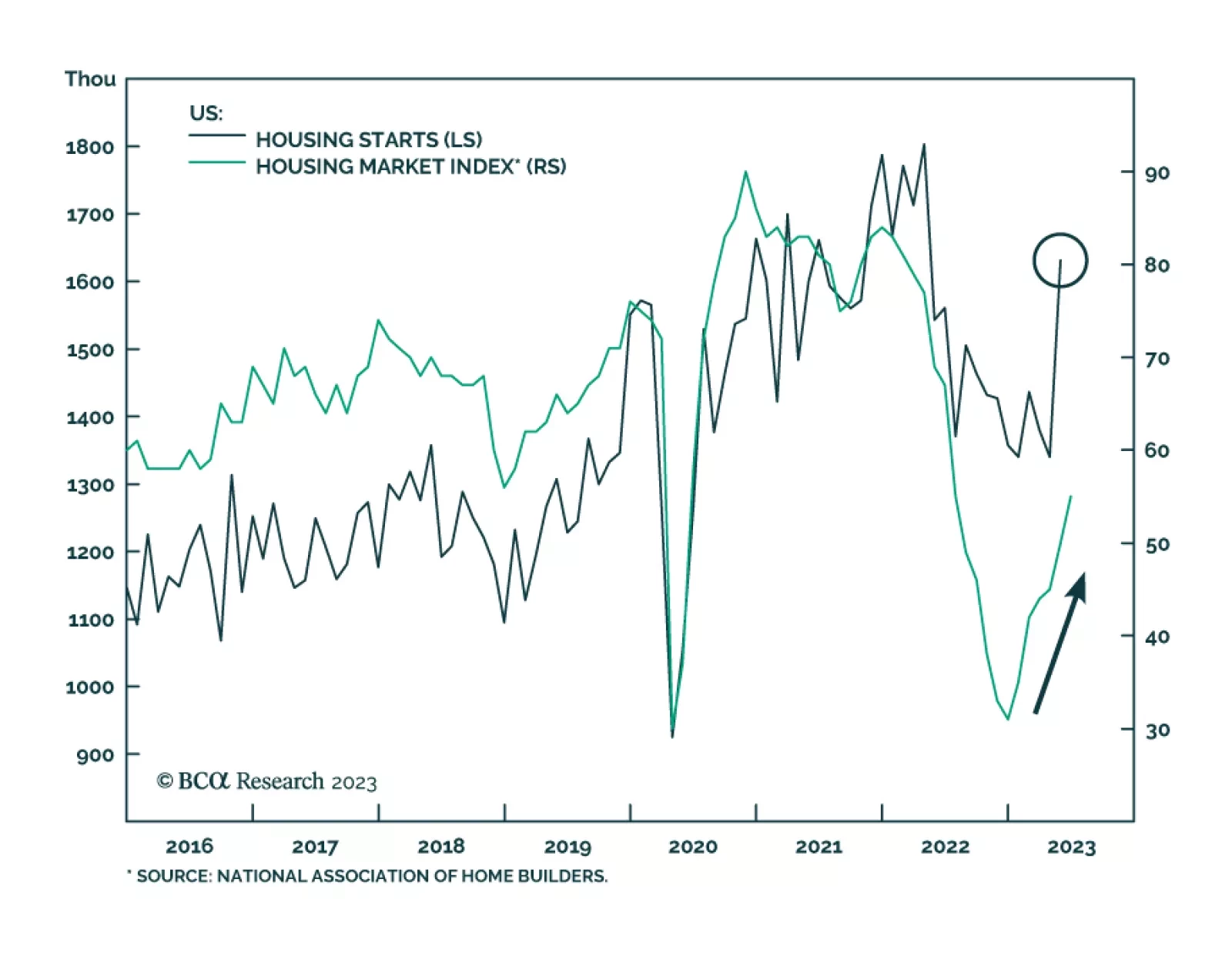

In their just-published update of US housing market conditions, our colleagues at the BCA Bank Credit Analyst focus on whether May’s strong showing in new home starts and sales in May – up 21% and 12%,…

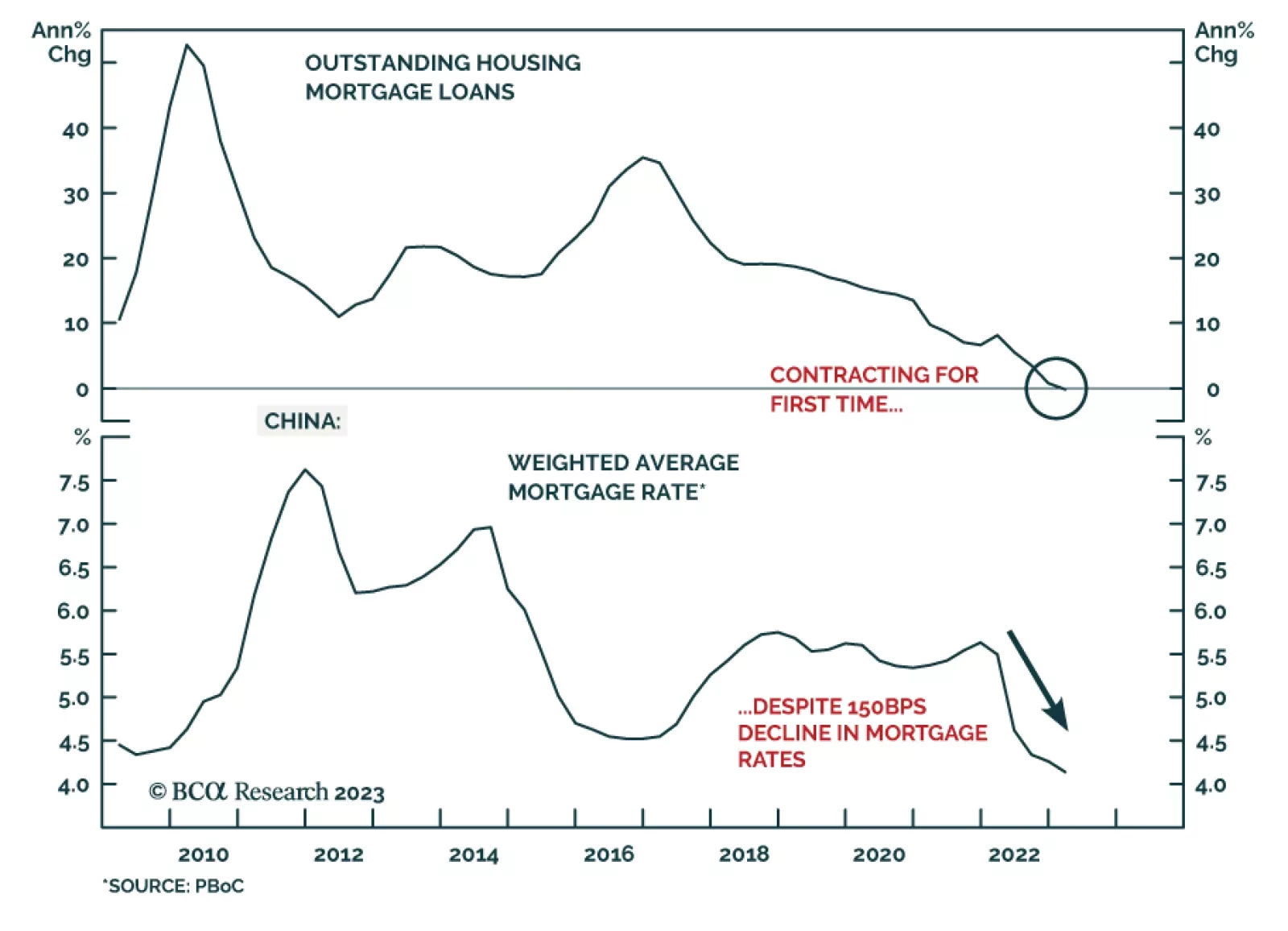

In a recently published report, our China Investment Strategy team revisited the issue of a liquidity trap in China. A liquidity trap is a condition that occurs when lower borrowing costs are unable to boost credit demand and…

In this Strategy Outlook, we present the major investment themes and views we see playing out for the rest of 2023 and beyond.

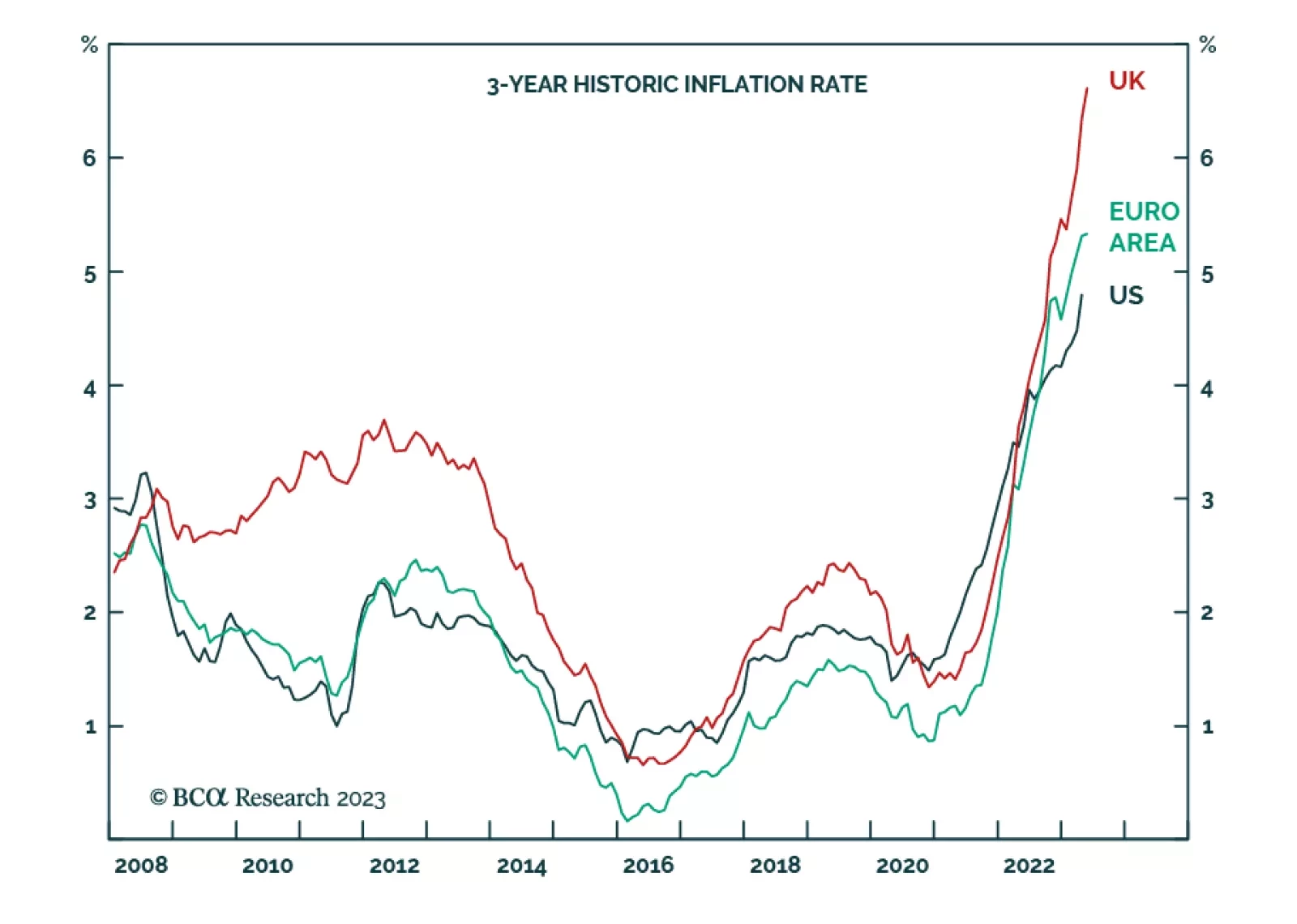

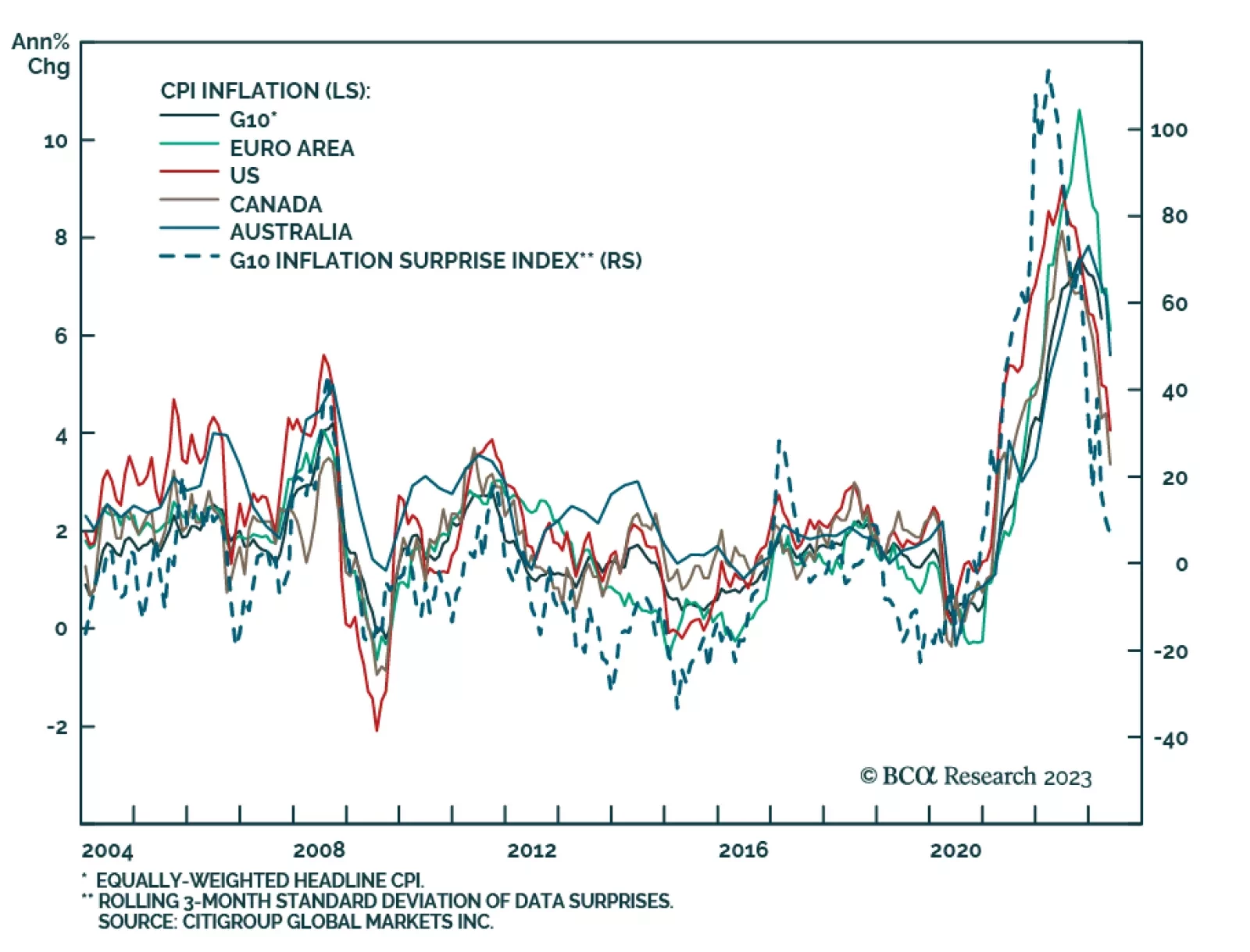

Our Counterpoint service argues that it is not enough that inflation stabilizes at 3 percent for inflation expectations to be anchored and central banks must make inflation undershoot 2 percent for some time to prevent a repeat…

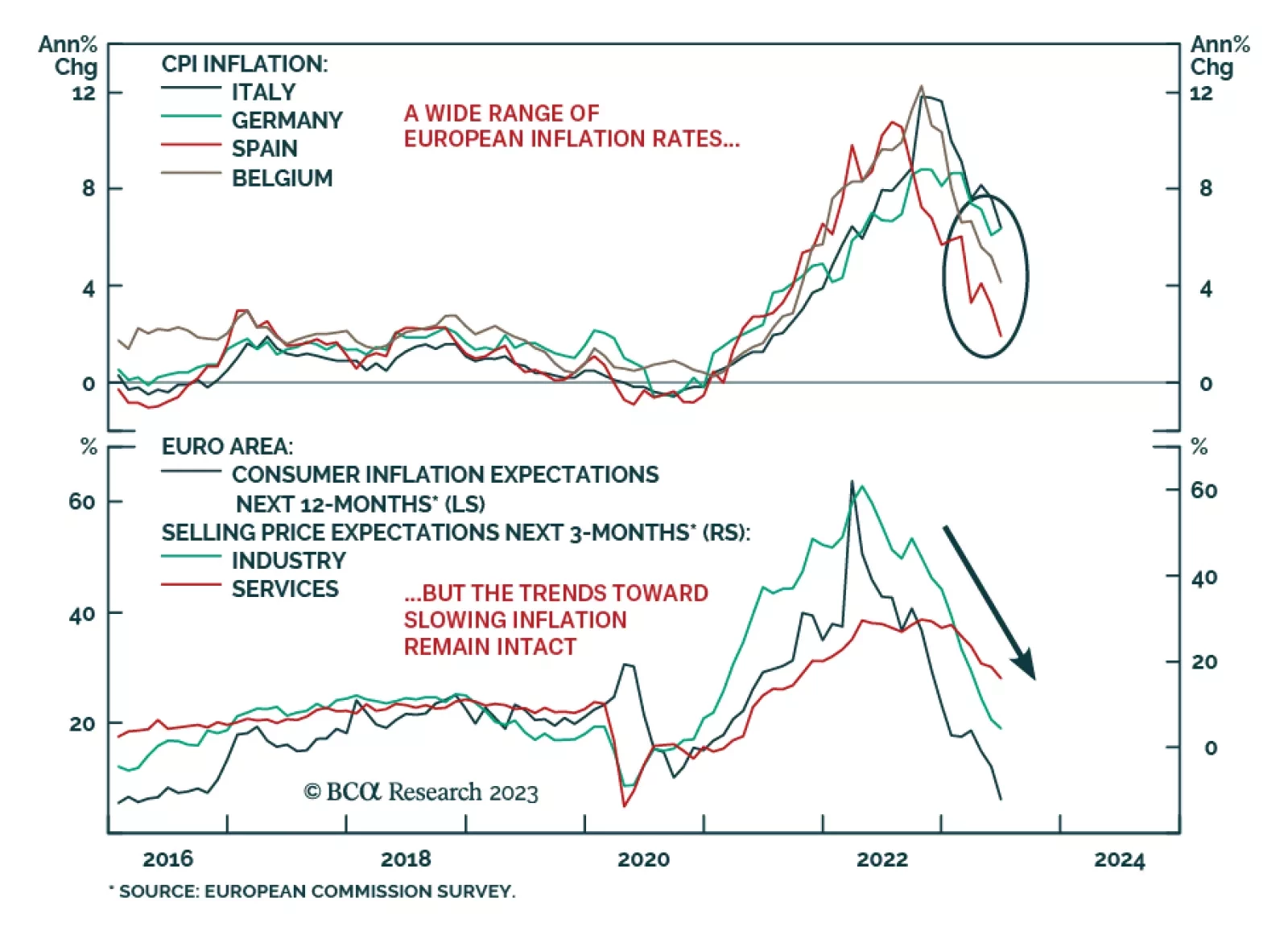

The preliminary inflation prints for June in the major euro area economies highlight a growing divergence in inflation outcomes. There was good news: headline CPI inflation in Italy fell to 6.7% in June from 8.0% in May, while…

In Section I, we reiterate why a soft economic landing remains improbable in the US. Some reasonable estimates of the level of excess savings point to their depletion in a year’s time, but other estimates indicate a much earlier end…

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

There have been big downside surprises to inflation over the last few weeks. Today, the May monthly print of Australian inflation (covers 67% of all items), came in at 5.6%, versus 6.8% the previous month. This followed a…

The market does not grasp the implied depths of recessions that will be needed to prevent inflation expectations from un-anchoring. Among the major economies, the most vulnerable to a deep recession is the UK. We explain why, and…