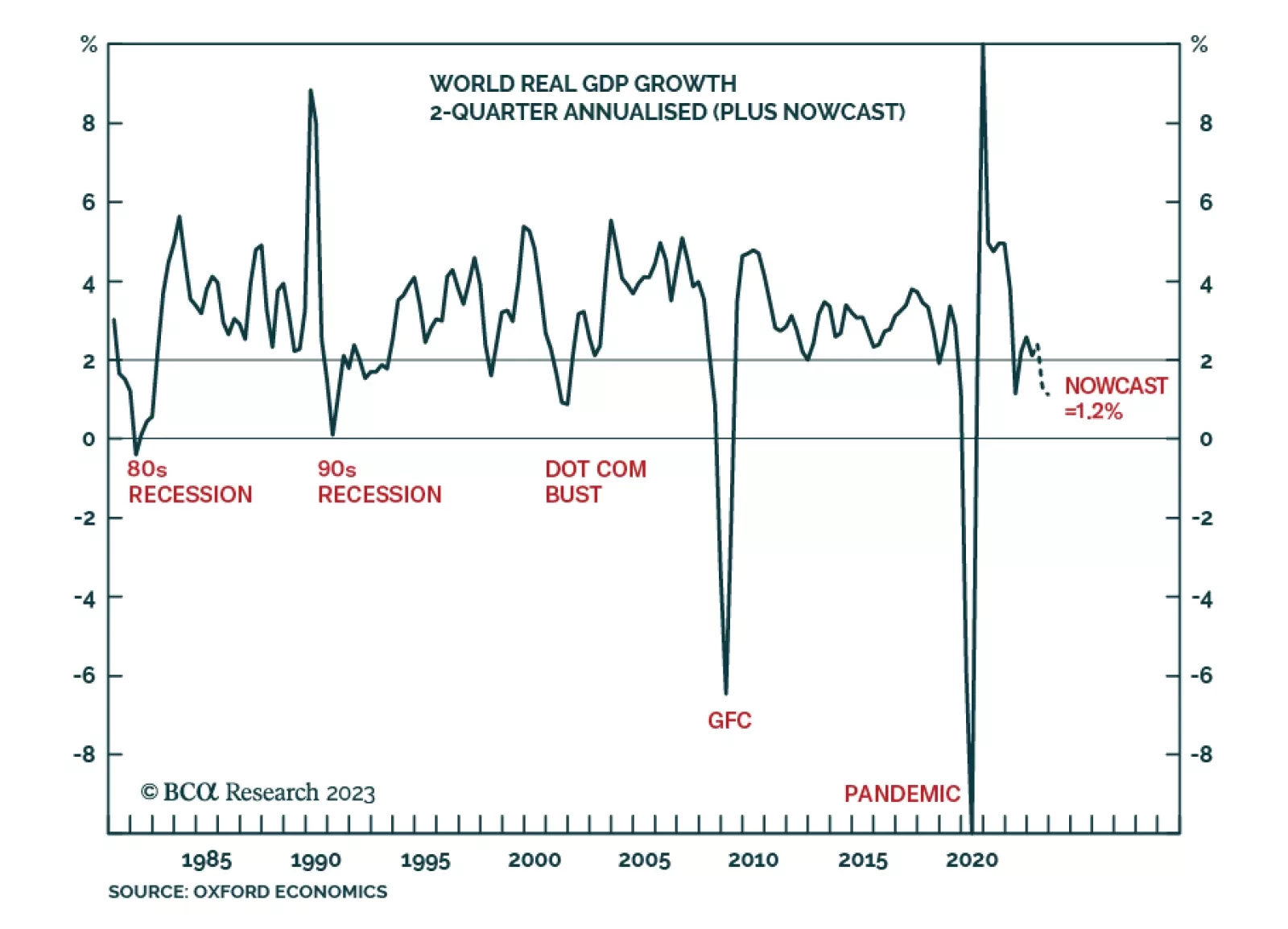

According to our Counterpoint strategy service, latest nowcasts indicate that world growth has likely slowed to sub-2 percent, thereby passing the threshold of a typical world recession as experienced in the early 1970s, early…

Global stocks fell and sovereign bond yields surged on Thursday following the release of stronger-than-anticipated US labor market data. Data released by Challenger, Gray, & Christmas showed job cuts declined to 40,709…

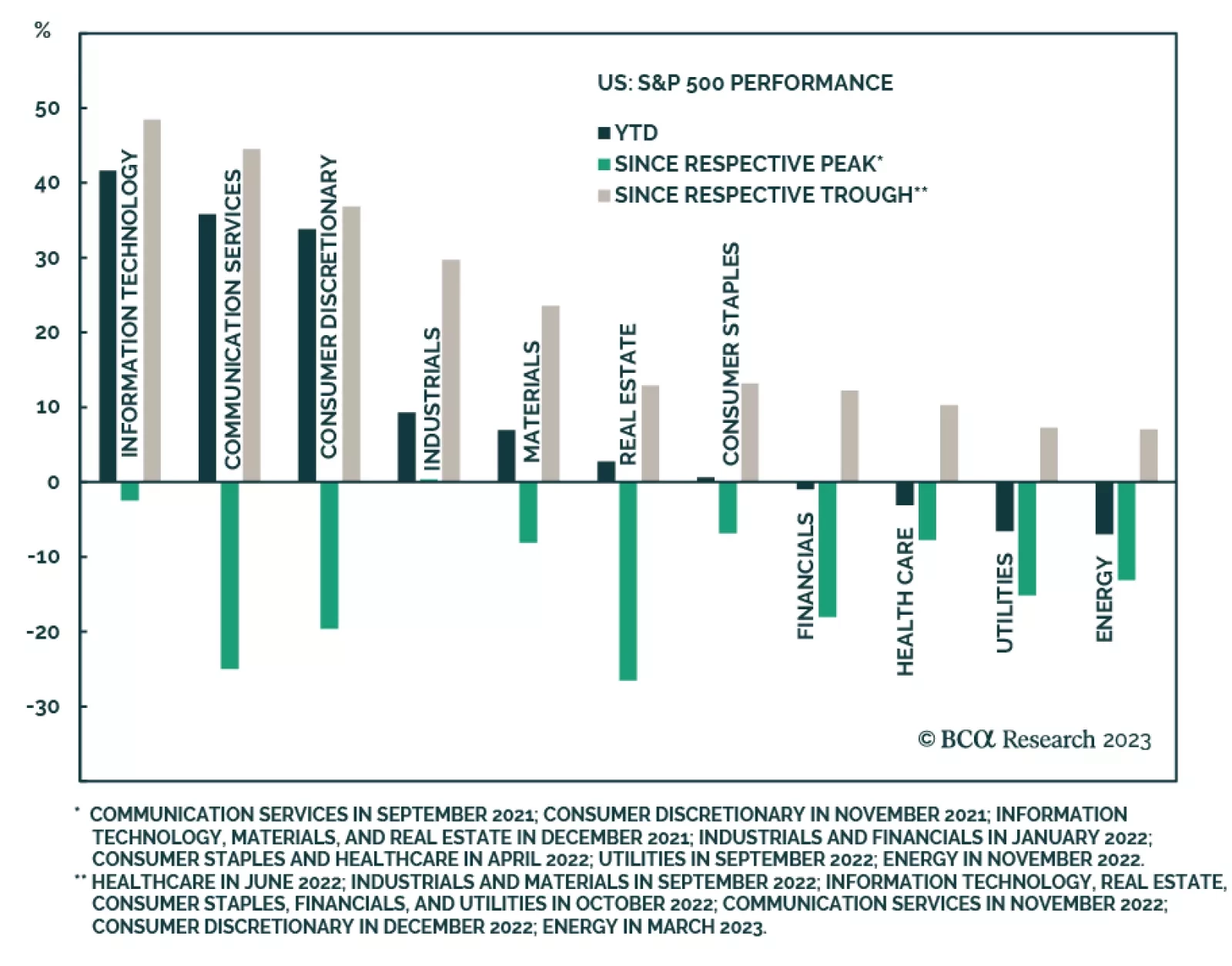

Seven of the 11 S&P 500 equity sectors are in the green on a year-to-date basis, led by those that benefitted from the AI frenzy: Information Technology, Communication Services, and Consumer Discretionary. In fact, the…

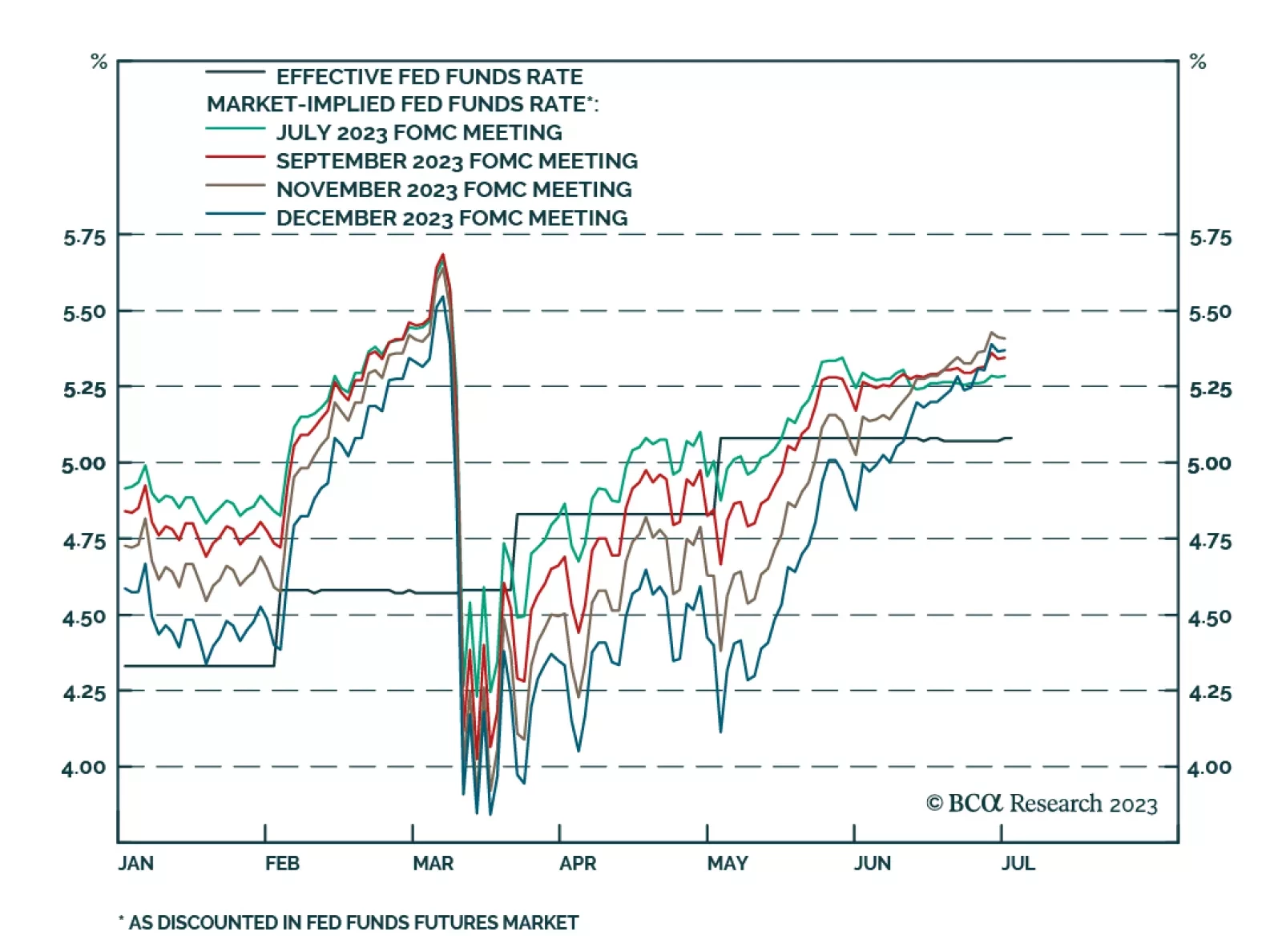

The minutes from the June FOMC meeting didn’t reveal anything that wasn’t already known. They did explicitly say that “some” participants would have preferred a 25 basis point rate hike instead of a pause…

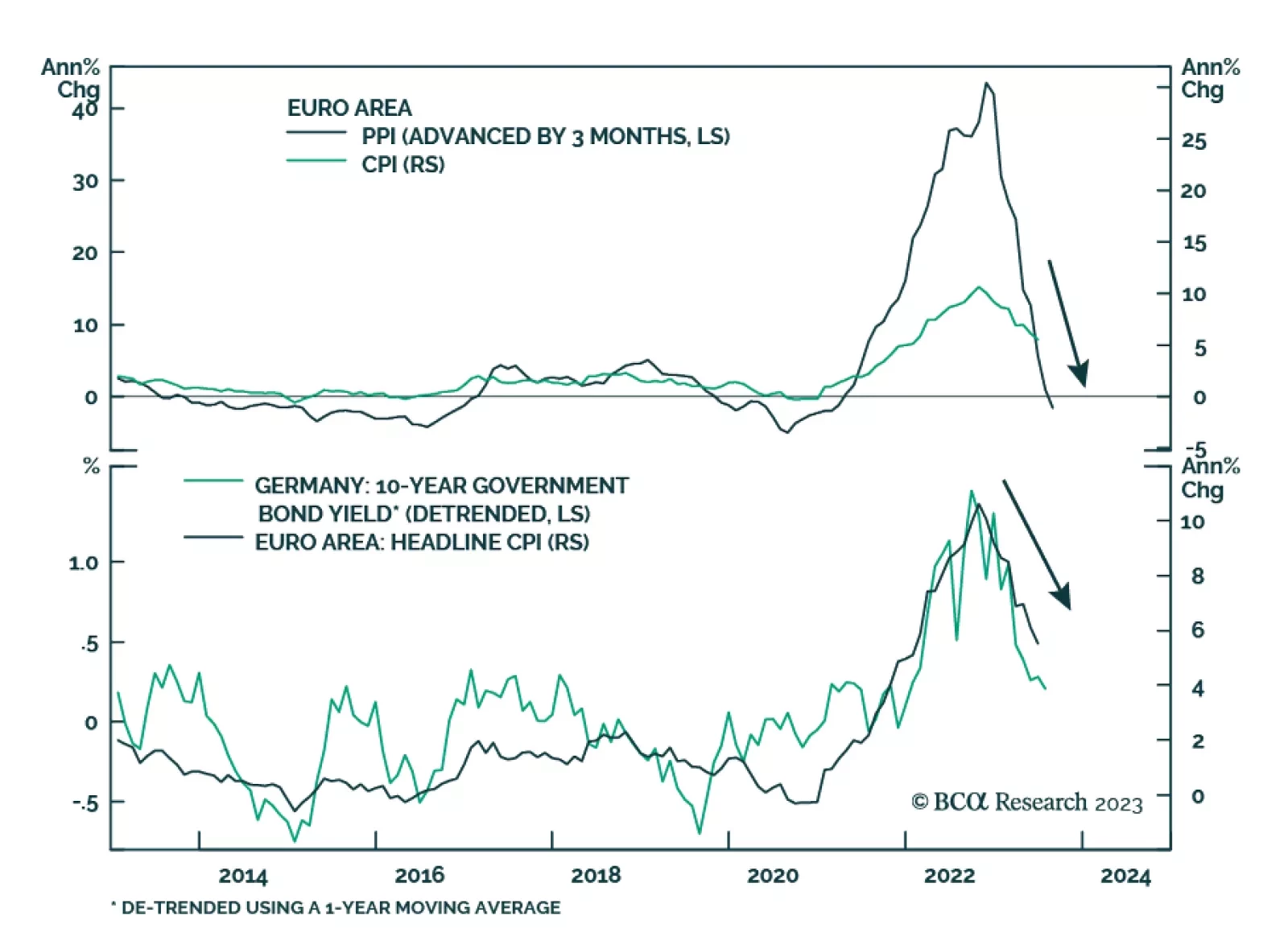

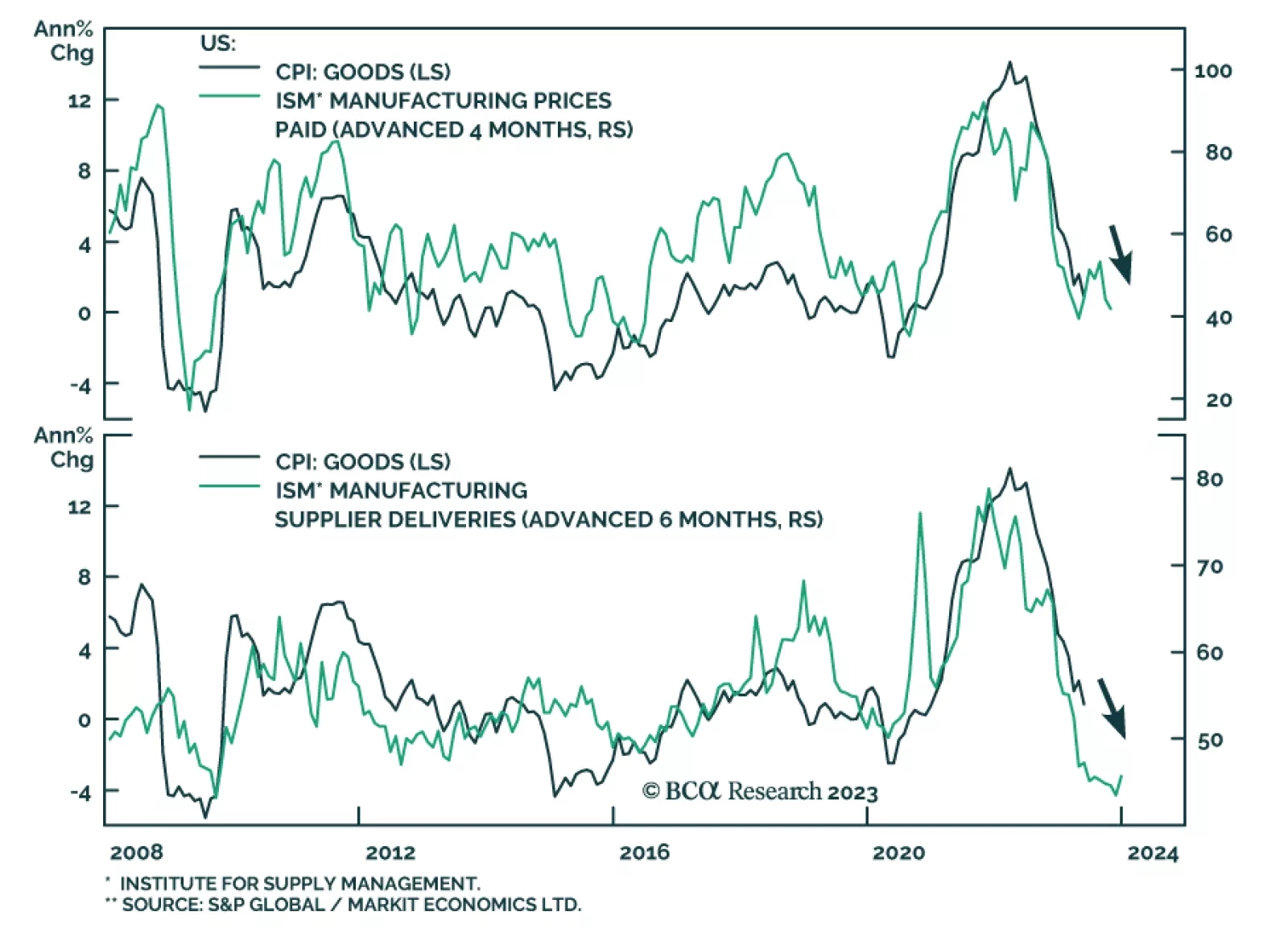

Eurozone producer prices fell by more than anticipated in May. The -1.5% y/y decrease – which marked the first annual drop since December 2020 – was more pronounced than expectations of a -1.3% y/y decline and…

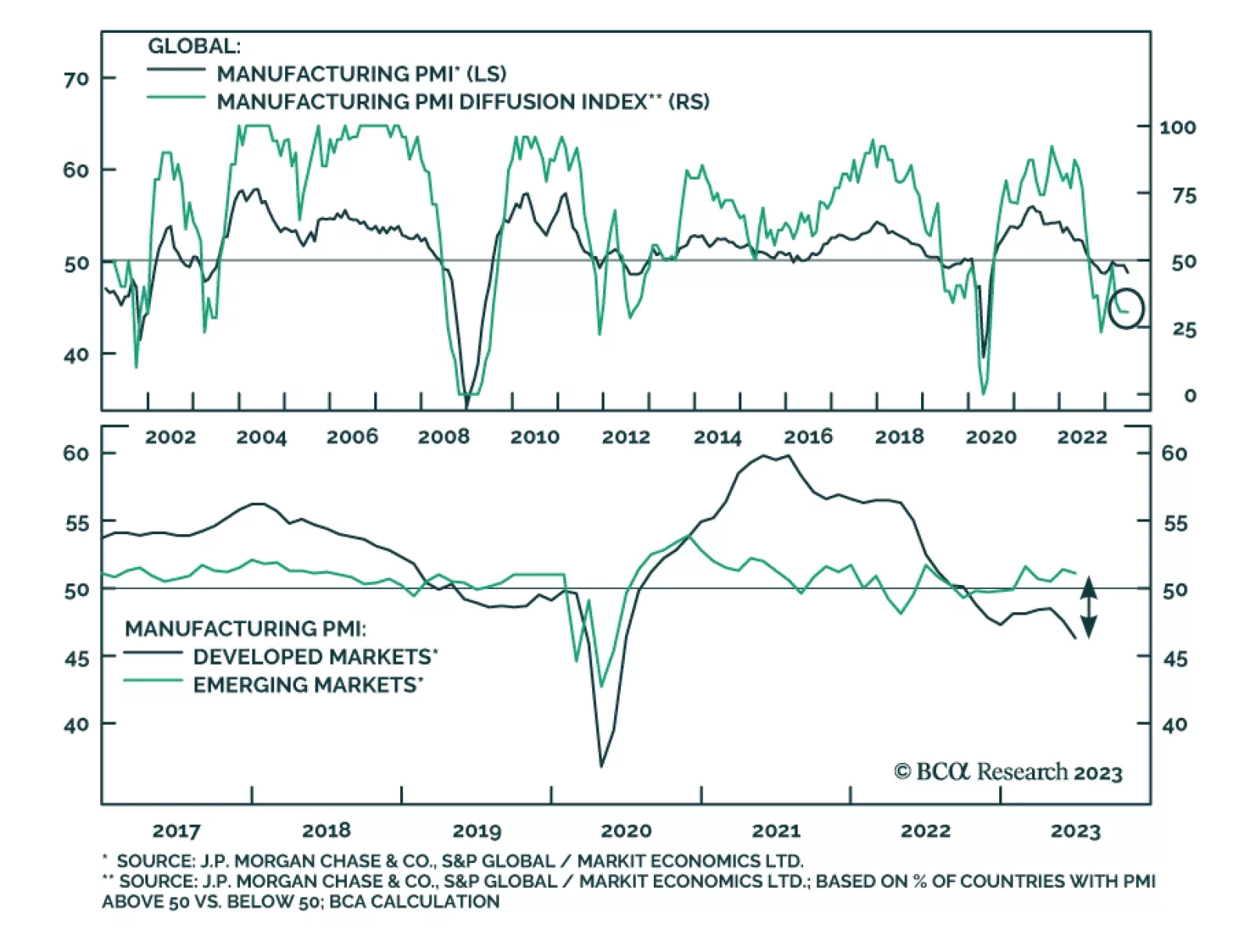

The world economy is likely already in recession, defined as world growth dipping to sub-2 percent. So far, the world recession has been China-led, but in the coming months it will change to being developed economy-led. Hence, while…

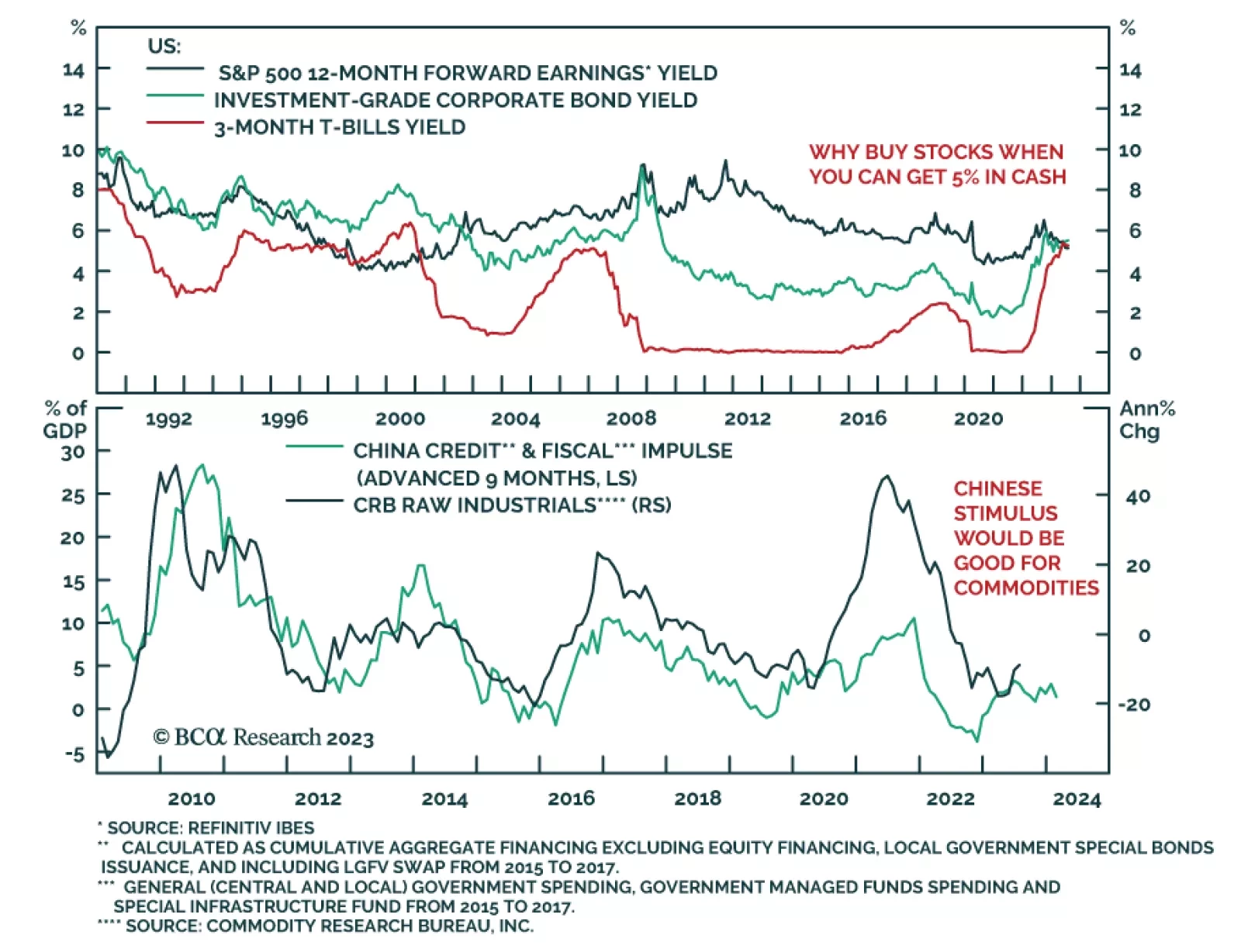

On a 12-month investment horizon, BCA Research’s Global Asset Allocation service recommends a defensive stance: Overweight government bonds, and underweight equities and credit. The US stock market trades on 19x forward…

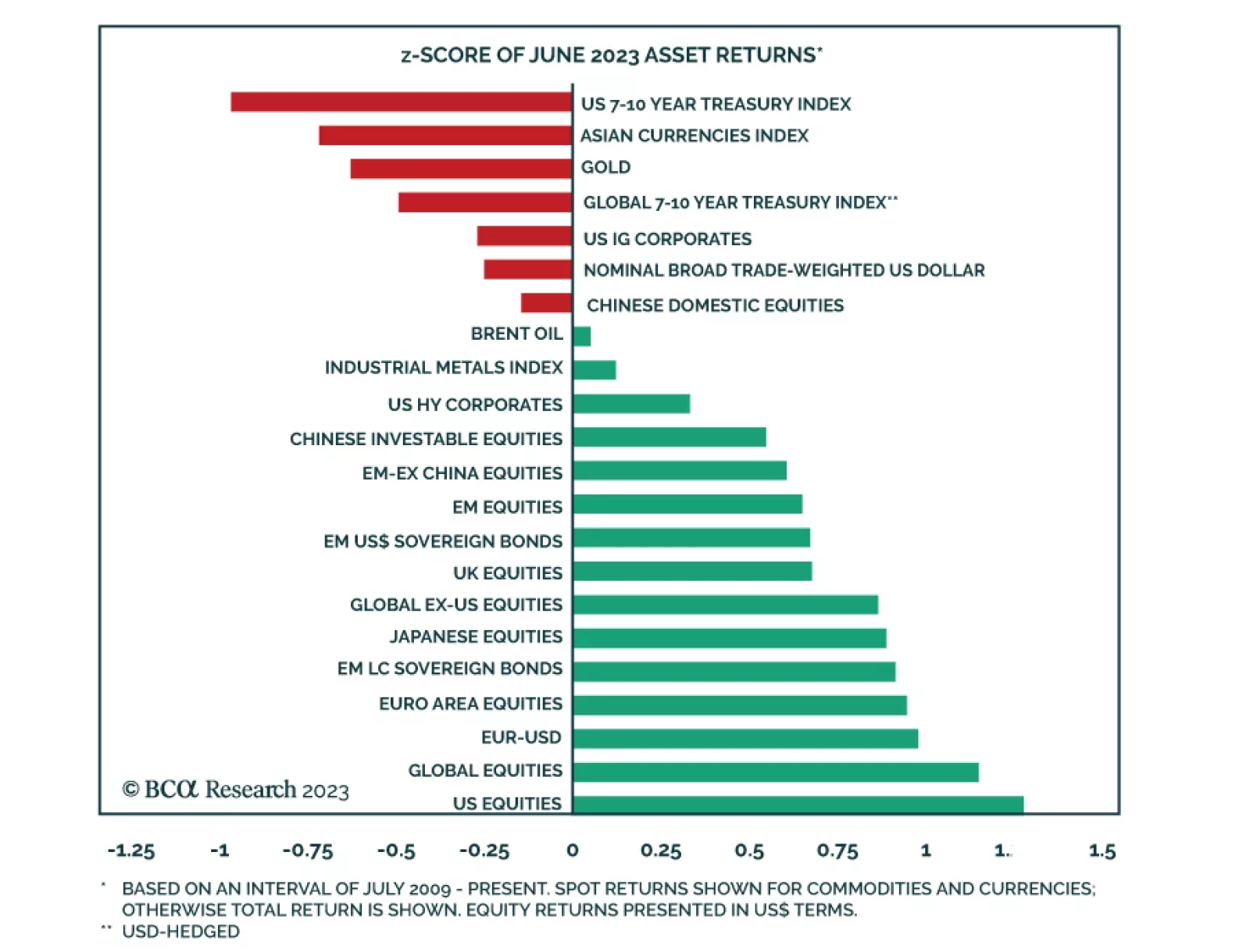

The performance of financial markets continued to improve in June, with most of the major financial assets we track generating positive abnormal returns. The US equity rally – which had been narrowly concentrated among…

The ISM PMI sent a pessimistic signal about US manufacturing conditions in June. The headline index dropped 0.9 points to a 3-year low of 46.0 – it eighth consecutive month below the 50 boom-bust line. This is consistent…

The Global Manufacturing PMI’s 0.8-point decline to a six-month low of 48.8 in June indicates that manufacturing conditions deteriorated at the end of Q2. The forward-looking New Orders and New Export Orders components both…